Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Ukraine's Defence Minister Says Kyiv And Spacex Working On System To Ensure Only Authorized Starlink Terminals Work In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Europe Has Failed To Defeat Russia In Ukraine

Russian Security Committee's Vice Chairman Medvedev: We Never Found The Two Nuclear Submarines Trump Spoke Of Deploying Closer To Russia

Russian Security Committee's Vice Chairman Medvedev: Victory Will Come 'Soon' In Ukraine But Equally Important To Think Of How To Prevent New Conflicts

Russian Security Committee's Vice Chairman Medvedev: Trump Is An Effective Leader Who Seeks Peace

Russian Security Committee's Vice Chairman Medvedev: Behind The So Called 'Chaos' Of Trump, He Is An Effective And Original USA Leader

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

Iran's Supreme Leader Khamenei: If Americans Start A War This Time, It Will Be A Regional Conflict

Ukraine President Zelenskiy: Ukraine Is Recording Russian Attempts To Disrupt Logistics And Connectivity Between Cities And Communities

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

but later you will

but later you will

but later you will

but later you will

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Digital asset treasury bull Peter Smith, co-founder and CEO of Blockchain.com, sees the trend of publicly-listed companies adopting crypto treasury strategies continuing for some time, although he expects a wave of mergers and acquisitions.

"More and more are going to come, until we run out of management teams or shells. Capitalism is awesome like that," Smith told The Block. "At some point, though, we sort of run out of steam, and then it gets really interesting because then you’ll see a lot of consolidation ... the really good management teams and sponsors will consolidate a lot of the space at a preferential capital stack."

Earlier this week, Vivek Ramaswamy's Bitcoin DAT Strive reached an agreement to acquire Semler fellow Bitcoin treasury Semler Scientific, which will result in a new company that holds nearly 11,000 BTC ( over $1 billion). Benchmark analyst Mark Palmer said smaller firms with meaningful crypto reserves but lower valuations are natural candidates for stock-for-stock tie-ups.

Smith said Blockchain.com has been perhaps one of the busiest firms active in the DAT space. His company has invested over $200 million in about a dozen companies, including Bitcoin-based DAT ProCap Financial, Ethereum treasury BitMine Immersion, and Toncoin DAT Ton Strategy.

The long-time crypto executive said that while taking over small-cap shell companies and giving them a new purpose is nothing new —Smith said biotechs have been using shells and PIPEs (private investments in public equity) for years— the move to use these tactics to accumulate a specific digital asset was inspired by Michael Saylor's Strategy.

Treasuries evolved beyond Bitcoin

Strategy, formerly MicroStrategy, demonstrated that accumulating crypto, specifically Bitcoin in its case, could translate into a major increase in shareholder value. Then, earlier this year, a host of smaller Nasdaq-listed companies decided to follow in Strategy's footsteps and began rebranding as DATs.

The first wave bought bitcoin and ethereum; the next broadened the model with altcoin-based treasury models. Now there are DATs dedicated to stockpiling XRP, Dogecoin, BNB, and others.

Currently, only those crypto treasuries holding either Bitcoin, Ethereum, or Solana, combined, possess over $120 billion in digital assets, according to The Block Data Dashboard. Fresh capital has fueled the growth, with DATs pulling in over $20 billion in VC funding so far this year.

Some have been critical of the DAT explosion. Last month, Komoto CTO Kadan Stadelmann called the trend "self-dealing, dressed up as capital deployment." This week, The Wall Street Journal reported U.S. regulators are investigating potentially suspicious stock trading patterns that occurred before publicly listed DATs announced plans to buy crypto. The inquiries are focused on unusual trading patterns, including abnormally high trading volumes and sharp stock price increases in the short periods preceding public announcements.

Two types of digital asset treasuries

Smith considers there to be two types of DATs.

"There are two reasons to have a DAT and they're distinct. One is a DAT as an investment vehicle and the other is as a replacement for foundations," he said.

In the case of an "investment DAT," Smith said investors buy shares in the hopes the management team behind the publicly-traded treasury will generate more value, thanks to their financing and ability to get tokens at a discount, than an investor could on their own by simply holding a cryptocurrency on spot.

Smith, however, believes "there's probably more risk" in buying shares in a DAT than in "holding spot."

In the case of an "ecosystem DAT," it's about "replacing these foundations with C-Corps that eventually go public," Smith said. "People forget all these Cayman or Swiss foundations that we have in crypto are a direct result of bad regulation."

Smith has been watching crypto evolve for a considerable amount of time, given that Blockchain.com was founded in 2011. The company was also an early success story, raising capital at a $14 billion valuation in 2022.

"We couldn't have a Delaware C-Corp ... that's where most tech startups are ... so the foundation, it was just a regulatory arbitrage," said Smith.

He's confident DATs are here to stay: "It's a sector and a vertical that's going to be here on a permanent basis."

Besides investing in DATs, Smith Blockchain.com is also extremely active in servicing digital asset treasuries by providing custody, trading, and staking services.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

What really is altcoin season?

Altcoin season, often called “altseason,” occurs when a significant portion of altcoins, cryptocurrencies other than Bitcoin, experience rapid price increases that outpace Bitcoin’s performance.

This period is characterized by a shift of investor capital from Bitcoin into assets such as Ether , Solana , Cardano (ADA) and even smaller tokens like Dogecoin or Pudgy Penguins (PENGU).

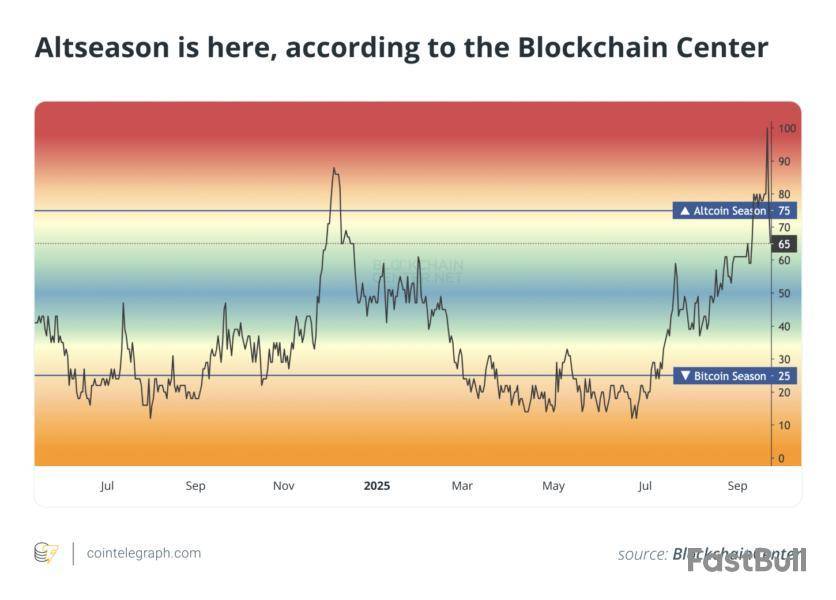

The Altcoin Season Index is frequently used as a benchmark. Per Blockchain Center’s definition, altseason is considered underway when at least 75% of the top 100 altcoins outperform Bitcoin over a 90-day period.

Historically, altcoin seasons have delivered outsized returns. For instance, during the 2021 cycle, large-cap altcoins gained approximately 174%, while Bitcoin advanced only about 2% over the same span.

These episodes raise a central question: What factors consistently drive altcoin season, and why do they matter?

Bitcoin’s price cycle: The catalyst for altcoin rallies

Bitcoin is the crypto market’s bellwether. Its price movements often set the stage for altcoin season. Typically, altseason follows a Bitcoin bull run.

When Bitcoin surges, say, crossing milestones such as $100,000, as it did in late 2024, investors pour capital into the market. Once Bitcoin’s price stabilizes or consolidates, traders often rotate their profits into altcoins, seeking higher returns from more volatile assets.

This pattern is rooted in market psychology. Bitcoin’s rally attracts new capital, boosting overall market confidence. As Bitcoin’s growth slows, investors look for the next big opportunity, and altcoins, with their potential for outsized gains, become the go-to choice. For instance, after Bitcoin’s 124% gain in 2024, 20 of the top 50 altcoins outperformed it, signaling the early stages of an altseason.

A key metric to watch is Bitcoin dominance (BTC.D), which measures Bitcoin’s share of the total crypto market capitalization. When BTC.D drops below 50%-60%, it often signals capital flowing into altcoins. In August 2025, Bitcoin dominance fell to 59% from 65%, hinting at an impending altseason.

Market sentiment and FOMO: The psychological fuel

Altcoin season thrives on human emotion, specifically, the fear of missing out (FOMO). As altcoins like Ether or memecoins like Pepe (PEPE) start posting double- or triple-digit gains, social media platforms like X, Reddit and Telegram light up with hype.

This buzz creates a feedback loop: Rising prices attract more investors, which drives prices higher still. In 2024, memecoins like Dogwifhat (WIF) surged over 1,100%, fueled by community-driven excitement.

Social media trends are a leading indicator of altcoin season. Heightened discussions on platforms like X often precede price rallies, as retail investors jump in to capitalize on the momentum.

For example, in 2025, Google Trends data for “altcoins” shattered records, reaching an all-time high in August, surpassing the May 2021 altseason peak, with search interest entering “price discovery” during Bitcoin’s consolidation above $110,000. This surge reflects exploding retail FOMO, especially for ETH, SOL and memecoins like DOGE, as institutional exchange-traded fund (ETF) inflows (e.g., $4 billion into ETH) rotate capital into altcoins.

Macroeconomic factors: Liquidity and risk appetite

The broader economic landscape plays a massive role in the altcoin season. Macroeconomic conditions like interest rates, inflation and global liquidity significantly influence crypto markets.

When central banks, such as the US Federal Reserve, cut interest rates or increase liquidity through measures like quantitative easing, riskier assets like altcoins tend to thrive. Lower interest rates push investors away from traditional safe havens like bonds and into high-risk, high-reward assets like altcoins.

For instance, analysts are hoping that Fed rate cuts in 2025 could inject liquidity into markets, fueling altcoin momentum. Conversely, tighter monetary policies can suppress altcoin growth by reducing market liquidity. In 2020-2021, aggressive money printing and low interest rates created a perfect storm for altcoins, with the altcoin market cap hitting record highs.

Geopolitical events and regulatory developments also matter. Pro-crypto policies in major markets, such as the US or EU, boost investor confidence and drive capital into altcoins. For example, the 2024 approval of Ether spot ETFs, with inflows reaching nearly $4 billion in August 2025, shows how regulatory clarity sparks altcoin rallies.Technological innovation and new narratives

Altcoin season isn’t just about hype; it’s often driven by technological advancements and emerging narratives. Each altseason tends to have a defining theme.

In 2017, it was the initial coin offering (ICO) boom. In 2021, decentralized finance (DeFi) and non-fungible tokens (NFTs) took center stage. In 2025, analysts point to AI-integrated blockchain projects, tokenization of real-world assets (RWAs) and layer-2 solutions as key drivers.

Platforms like Ethereum, Solana and Avalanche are gaining traction for their scalability and ability to support tokenized securities, from stocks to real estate. These innovations attract institutional capital, which often flows into altcoins before retail investors pile in.

Ethereum, in particular, plays a pivotal role. As the backbone of DeFi, NFTs and layer-2 solutions, Ether’s price surges often signal the start of broader altcoin rallies.

Institutional and retail capital: The money flow

The crypto market has matured, and institutional adoption is now a major driver of altcoin season. Unlike past retail-led booms, in 2025, institutional capital drives altcoin season, with Bitcoin dominance dropping below 59%, echoing 2017 and 2021 pre-altseason trends.

Ether ETFs amassed nearly $4 billion in inflows in August 2025 alone, while Solana and XRP (XRP) ETF reviews signal broader adoption. The US Securities and Exchange Commission’s streamlined ETF listing rules in September boosted over 90 applications, with XRP ETF approval odds at 95%, potentially unlocking $4.3 billion-$8.4 billion.

Solana exchange-traded products saw $1.16 billion year-to-date inflows, and CME’s SOL/XRP futures options launch in October 2025 will draw hedge funds. Retail investors amplify this via FOMO, with memecoins like DOGE ( 10% to $0.28) and presale tokens surging.

CryptoQuant shows altcoin trading volume on Binance Futures hitting $100.7 billion daily in July 2025 (the highest since February), driven by altcoin-to-stablecoin trades, not BTC rotation.

DeFi total value locked (TVL) reached over $140 billion, and the Altcoin Season Index hit 76, with 75% of altcoins outperforming BTC. This $4-trillion market cap growth reflects fresh capital. October’s ETF decisions could trigger over $5 billion of inflows, blending institutional stability with retail hype for sustained altcoin rallies in Q4.

Key metrics to watch: How to spot altcoin season

In the past, analysts have suggested that altcoin season was signaled when Bitcoin dominance fell below 55%, along with an Altcoin Season Index above 75, rising altcoin-to-stablecoin volumes and technical indicators.

To navigate altcoin season, investors rely on several indicators:

Risks and strategies to navigate altcoin season

While altcoin season offers massive opportunities, it’s not without risks. Altcoins are highly volatile, often losing 50%-90% of their value post-peak. Speculative hype, scams and regulatory uncertainty can also derail gains.

To maximize returns, you could consider these strategies:

However, caution is key. The crypto market is unpredictable, and altseason is often only clear in hindsight. By understanding the drivers, such as Bitcoin’s cycle, market sentiment, macro conditions and technological trends, investors can position themselves to ride the wave while managing risks.

TL;DR

Weekly Structure Builds Toward Breakout Zone

XRP has continued to trade within a symmetrical triangle pattern on the weekly chart. The structure has held for nearly a year, with the price now moving close to the upper trendline near $3.44. According to market analyst EGRAG CRYPTO, this level marks a potential breakout point. If cleared, XRP could target a move toward $7.34 based on the range of the formation.

The setup includes multiple Bullish Engulfing candles, which in past cycles have appeared before upward moves. These patterns have been noted in early 2025, with similar formations seen earlier in XRP’s trading history. EGRAG pointed out,

“The next time we see a Bullish Engulfing Candle on the weekly chart, XRP could shoot up to new all-time highs.”

Interestingly, the current weekly chart shows XRP remaining above a key support denoted as the Bull Market Support Band. This support has remained intact in recent weeks, as observed from the chart where it is drawn as a curved ribbon. It must hold for any structure to remain intact.

EGRAG mentioned that price movement inside this band has been stable. Traders have continued to defend the range, with no confirmation yet of a breakdown. This suggests the market remains in a controlled phase while waiting for a clearer signal.Support Levels Below Remain Active

Two levels on the downside have been marked as areas of interest in case of further weakness. One is $2.60, sitting near the center of the triangle. The other is $2.37, which is near the 0.618 retracement level. EGRAG noted this area could offer a final low before any potential rally. They said,

“If we hit $2.37 before the next rise, it’s your chance to buy cheap.”

XRP was priced at $2.72 at press time, reflecting a 3% decline in the past 24 hours and an 11% drop over the last week. Trading volume stands above $9 billion for the same period.Compression Pattern Signals Move Ahead

Sistine Research has also found a tightening price range on the weekly chart. This would be a third compression phase since the last United States election, having all compressed at a higher price level. The present range is the narrowest of all.

Sistine noted that order book liquidity has thinned, and most activity is now centered near the current price. They added,

Expecting a large expansionary move from XRP soon (within months).

As the price action compresses, so does the orderbook, with most liquidity compressing into a tighter and tighter range.

This results in very large gaps in liquidity.

XRP is on its 3rd compression since the… pic.twitter.com/hjRVzeK8wc

— Sistine Research (@sistineresearch) September 24, 2025

The setup mirrors previous cycles in 2017, 2021, and 2025, all of which led to strong price moves.

Bitcoin's pseudonymous creator, Satoshi Nakamoto, is believed to hold an estimated 1.096 million BTC, according to Arkham data. Satoshi's wallet, which made all its holdings from mining the network in its earliest days, has remained untouched since 2010, when it was run on a few laptops.

Satoshi accumulated this Bitcoin, mining over 22,000 blocks between 2009 and 2010. He was one of the first few miners of Bitcoin, with block rewards nearing over 50 BTC at the time.

According to Arkham data, Satoshi Nakamoto's Bitcoin stash is currently worth $119,640,092,296 ($119.64 billion) at a current Bitcoin price of $109,125.

With a current Bitcoin worth of $119.64 billion, Satoshi Nakamoto ranks among the wealthiest individuals on the planet, but none of the BTC has ever been moved.

Satoshi's Bitcoin holdings' fate predicted

Satoshi's Bitcoin holdings, accumulated from early network mining, have been untouched since 2010, but recent concerns about Quantum computing seem to be shifting this narrative.

Charles Edwards@caprioleioSep 26, 2025Satoshi's coins will be market dumped. In 2-8 years Quantum will break Bitcoin. These are scientifically calculated timelines. We must upgrade Bitcoin NOW. We are running out of time.

What are you doing about it?

Come to my @token2049 talk: 10:45am, Wed 1 Oct!

"Thank you for… pic.twitter.com/b4GR3S4Qjc

In light of this, Capriole Fund Founder Charles Edwards speculates on what the fate of Satoshi coins might be: they could be market dumped.

As quantum computing continues to advance, timelines for when a sufficiently powerful quantum computer could crack modern encryption algorithms are emerging.

Edwards gives this timeline to be 2-8 years (which would be from 2027 to 2033), stating this range to be "scientifically calculated timelines."

The timeline of when cryptocurrency encryption standards might be cracked by a sufficiently powerful quantum computer is causing debate among blockchain developers, as well as when migration to quantum-resistant cryptography must occur. Edwards indicated that the time to upgrade Bitcoin is now, as it is running out of time.

The Stellar Network, a blockchain platform built for fast and low-cost cross-border payments, shows optimistic signals even as the XLM token recently corrected.

What are these signals, and are they strong enough to withstand the growing selling pressure across the market at the end of September?

Stellar’s Total Value Locked Reaches New High in September

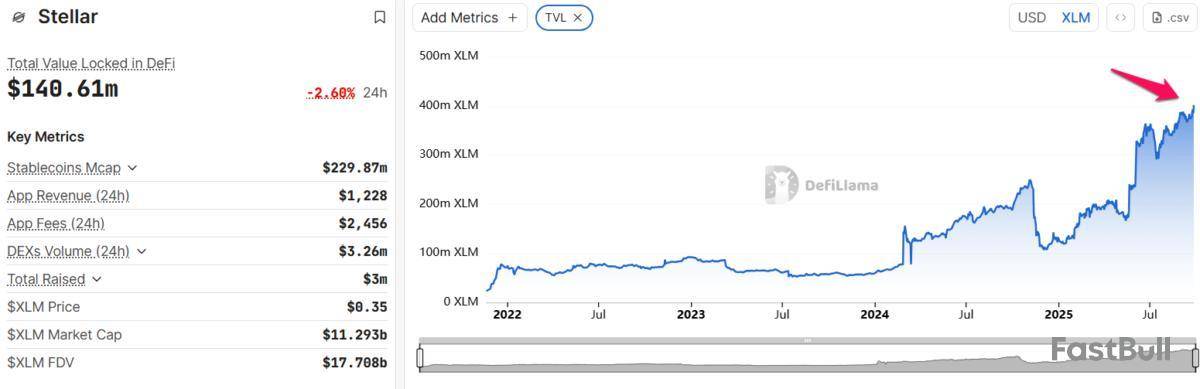

Stellar’s Total Value Locked (TVL) hit a record high in September, with more than 400 million XLM locked in protocols.

Data from DeFiLlama shows that this figure has doubled compared to the previous quarter. The increase reflects the community’s growing confidence in locking XLM within the Stellar ecosystem.

TVL calculated in XLM is more reliable than in USD terms. This is because XLM’s USD price fluctuates sharply due to market factors, which can distort the actual picture of assets locked.

In fact, since the beginning of the quarter, XLM’s price has fallen more than 30%, but USD-based TVL has remained stable at around $140 million. The main reason is that the amount of XLM locked in protocols has continued to grow instead of declining.

TVL in XLM focuses on intrinsic value. It accurately measures the assets users commit to staking, lending, or liquidity provision. Leading protocols attracting capital include Blend, Aquarius Stellar, and Stellar DEX.

However, objectively, Stellar’s TVL remains small compared to other ecosystems, where TVL reaches into the billions of USD.

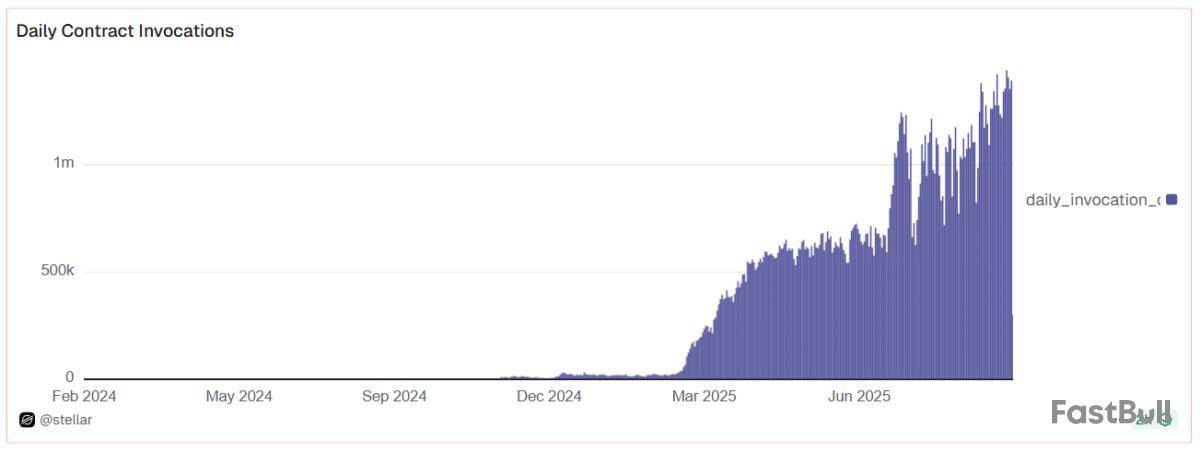

Smart Contract Activity Surged in September

Another highlight for the Stellar network is the sharp increase in smart contract activity.

According to Dune Analytics, smart contract operations surged in September, with more than 1 million daily contract invocations.

This metric measures the average number of successful smart contract calls per day. It helps assess adoption trends and informs decisions on resource allocation and platform development.

The data shows higher transaction volume, greater creativity, and real-world applications from developers. Examples include contracts related to payments, DeFi, or integrations with traditional financial systems.

This surge carries important implications. It proves that Stellar is moving beyond testing phases into real-world adoption. It also strengthens Stellar’s position as a reliable platform for decentralized financial services, attracting more capital and partnerships.

Institutional Interest in Stellar Grew in September

Alongside positive on-chain data, Stellar also expanded its institutional exposure in September.

Mercado Bitcoin, the largest digital asset investment platform in Latin America, recently announced it would issue $200 million worth of tokenized financial assets (stocks and bonds) on the Stellar network.

RedSwan Digital Real Estate also tokenized $100 million of commercial real estate assets (luxury apartments and hotels) on Stellar’s blockchain.

Furthermore, PayPal officially integrated its stablecoin PYUSD on Stellar, enabling fast and low-cost payments.

Notably, the Hashdex Nasdaq Crypto Index US ETF (ticker: NCIQ) filed with the SEC to include NCIQ. The fund consists of five leading crypto assets: Bitcoin , Ethereum , XRP, Solana , and Stellar .

This move is promising after the SEC eased listing standards for crypto ETFs and officially approved the multi-asset Grayscale Digital Large Cap Fund (GDLC).

Despite these positive signals, XLM’s price continues to be heavily affected by bearish market sentiment in late September. Once fear-driven trading subsides, Stellar’s strong fundamentals may have the chance to show their value.

Almost a year into the second term of US President Donald Trump, the Commodity Futures Trading Commission (CFTC) still doesn’t have a permanent head.

Former CFTC Commissioner Brian Quintenz was Trump’s top choice for the role. A confirmation vote was expected by the end of July but was stalled at the request of the White House. Reportedly, the Winklevoss brothers didn’t want Quintenz as chair because he wouldn’t sufficiently protect the cryptocurrency industry.

So, who will it be? In recent weeks, several different names have appeared as possible candidates, including former commissioners and policy experts. The White House has not confirmed its choice, but some names have been floated by insiders.

The crypto industry is playing close attention — especially since the market infrastructure bill making its way through Congress would give the CFTC significant regulatory oversight.

Michael Selig

In a Sept. 19 report citing White House insiders, Bloomberg reported that Michael Selig was under consideration to head the CFTC.

Current role: Selig is chief counsel to the Securities and Exchange Commission’s Crypto Task Force.

Past experience: Selig was a partner at law firm Willkie Farr & Gallagher, where he worked in its crypto and digital assets practice. He was also counsel at Perkins Coie and an associate at Reed Smith.

Thoughts on crypto: Immediately following Trump’s election, Selig said that the next head of the SEC must take a “do no harm” approach to crypto. He also called for an end to “regulation by enforcement” by the SEC.

Tyler Williams

White House sources speaking to Bloomberg also tipped Tyler Williams as a candidate under consideration to lead the CFTC.

Current role: Williams is currently a counselor to the US Treasury Secretary Scott Bessent, advising on digital assets and blockchain technology policy.

Past experience: Williams served as Galaxy Digital’s global head of policy, prior to which he operated his own financial services consulting firm in Washington, D.C. He was also a senior advisor at FS Vector and a senior policy advisor for Republican Virginia Governor Glenn Youngkin’s campaign.

Thoughts on crypto: Williams was one of the lead authors of the White House’s crypto report. In an interview with TRM Labs, Williams stressed the need to give certainty to the crypto industry and provide a “durable framework.”

Jill Sommers

Crypto in America journalist Eleanor Terrett reported on Sept. 25 that former CFTC commissioner Jill Sommers was under consideration to lead the agency.

Current role: According to LinkedIn, Sommers is currently a financial services consultant in the Washington, D.C. area.

Past experience: From 2007 to 2013, Sommers served as a commissioner at the CFTC at the nomination of President Barack Obama. At the CFTC, she was chairman of the Global Markets Advisory Committee and was the commission designee to the Financial Literacy and Education Commission.

After leaving the CFTC, she became chair of the derivatives practice group at Potomak Global Partners and joined the FTX.US board of directors in 2022.

Thoughts on crypto: Sommers has not said much publicly on crypto. When she joined FTX.US, she emphasized working closely with regulators to better form regulations for crypto derivatives.

Kyle Hauptman

Terrett also tipped that Kyle Hauptman is on the White House’s short list for CFTC chair.

Current role: Hauptman is currently the chairman of the National Credit Union Administration (NCUA), nominated by Trump. The NCUA insures credit unions and provides deposit insurance.

Past experience: Prior to serving at the NCUA, Hauptman was a counselor on economic and financial policy to Senator Tom Cotton and was staff director for the Senate Banking Committee’s Subcommittee on Economic Policy. He was also an advisory committee member at the SEC.

Thoughts on crypto: Hauptman hasn’t made public comments regarding crypto specifically. However, he has prioritized avoiding stifling regulation and adopting new technology at the NCUA, suggesting he is at least open to novel concepts like crypto and blockchain.

Josh Stirling

On Sept. 24, Semafor reported that lawyer Josh Stirling was under consideration to run the CFTC, citing sources familiar with the matter.

Current role: Currently, Stirling is a partner at Milbank and a member of its white collar and investigations and derivatives/alternative financial products practices. He also represents the prediction market Kalshi.

Past experience: Stirling previously served as co-chair of the derivatives subcommittee of corporation, finance and law community at the Bar Association of the District of Columbia. He was also a member of the capital markets strategic litigation advisory committee at the US Chamber of Commerce.

Thoughts on crypto: While at the CFTC, Stirling gave a statement on “Supporting Innovation in Digital Asset Products.” He has noted customer protection concerns regarding digital assets and said, “The CFTC itself feel that they have a valuable and constructive role, maybe even a primary role in regulating the digital assets, marketplace, and ecosystem.”

Combining the SEC and CFTC?

One unorthodox proposal has been to combine the CFTC and SEC. According to crypto lawyer Aaron Brogan, some high-level sources are considering consolidating the two agencies, essentially making Paul Atkins, the current SEC chief, head of the CFTC.

Brogan said that the only problems are how it would work or whether it’s legal. The Trump administration has appointed one person to head up multiple agencies, although these aren’t quite the same as the CFTC.

Anne Joseph O’Connell, a law professor and administrative law researcher at Stanford Law School, said, “It is not clear whether he could be both a confirmed member of the Securities Exchange Commission and a confirmed member at the CFTC because there is this [SEC statute] that says no SEC Commissioner can engage in other employment.”

There are also ethical issues. Professor Nick Bednar at the University of Minnesota Law School said, “As a policy matter, the Trump administration’s efforts to consolidate power over multiple agencies in a handful of officials is worrying.”

After all, a person only has so much time in a day, and being spread across multiple agencies “makes it harder to ensure proper management within a given agency. The centralization of control comes with a significant cost to administrative capacity and good governance.”

Regardless of who the White House eventually nominates, they also need to pass the sometimes lengthy nomination process in the Senate. A pro-crypto CFTC chair could still be a long way off.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up