Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The big question on everyone’s mind right now: When will the XRP ETF be approved? On prediction platform Polymarket, traders are putting the odds at around 86%. The hype is growing, and insiders say the pieces are finally lining up for XRP to join Bitcoin and Ethereum in the ETF market.

Why Everyone’s Talking About It

According to Bloomberg’s ETF analysts, the SEC is reviewing what’s called a “generic listing standard.” That’s basically a set of rules that could make it easier for crypto ETFs to get approved. The rule of thumb? If a coin already has futures listed on a big exchange like Coinbase, chances are good it could get an ETF as soon as 2025.

Steven McClurg from Canary Capital recently shared his thoughts, admitting that regulators hold the final say but pointing out that XRP looks like one of the stronger candidates.

In an interview with Paul Barron, he said, “If I had to guess I would guess that XRP would probably be this year along with Litecoin, possibly HBAR, Solana. Those are the ones that I do believe will occur in 2025.”

What an Approval Could Mean

If an XRP ETF gets the green light, it could open the floodgates for traditional investors who don’t want to deal with wallets, exchanges, or private keys. Instead, they could just buy XRP exposure through their regular brokerage account. That type of access has the potential to bring in billions in institutional money.

The focus, McClurg said, is on “American-made crypto.” Several protocols are now bringing their treasuries back to the United States after years overseas. Under the current administration, U.S.-based cryptocurrencies and blockchains are expected to thrive, with possible tax benefits adding to the shift. The proposed fund would track an index of projects created, mined, or primarily operated in the U.S., with qualifications set by the index provider.

For now, the most likely timeline looks like 2025, but the mood in the industry is more bullish than ever. After years of waiting, XRP holders finally feel that the long-discussed ETF might actually be around the corner.

John E. Deaton, a cryptocurrency-focused lawyer who ran against Elizabeth Warren for a Senate seat in Massachusetts, believes XRP ETFs will attract substantial inflows once these products are greenlighted by the US Securities and Exchange Commission.

The number of active applications continues to grow, with the most recent one aiming to launch a Monthly Option Income ETF focused on Ripple’s native token.

15 is a lot. Whether people hate it or not, I predict the inflows will surprise many. https://t.co/CMi0ZQPqQP

— John E Deaton (@JohnEDeaton1) August 30, 2025

A Lot of Filings

Deaton’s comments came in response to the Wolf of All Streets’ remarks that the total number of applications for spot Ripple ETFs has grown to 15. However, that information is a bit dated as another filing reached the US SEC desks this week.

Asreportedyesterday, Amplify ETFs filed for an XRP Monthly Option Income ETF, which will work differently from a spot one. It doesn’t rely so much on big gains for the underlying asset. Instead, it uses trading strategies to generate steady, predictable, but capped monthly income for its investors.

Despite the increasing number of applications, the US regulator continues todelaymaking a decision on almost all of them. The next major deadlines are scheduled for October, following the SEC’s request for comments from issuers, which has led to recentfiling updates.Inflows Will Indeed Surprise You?

Although Deaton wasn’t specific whether the inflows will surprise investors in a positive manner, it’s safe to assume so, given his history with the XRP Army. After all, he was among the most prominent attorneys representing XRP holders in the legal battle between the SEC and Ripple.

Obviously, that’s up for debate since the ETFs are not officially approved. However, there has indeed been notable demand for XRP, which was evident from the futures ETFs as well as the recent record for the asset on CME futures.

So far, we have seen only two cryptocurrencies with spot exchange-traded funds tracking their performance. The market leader started with massive inflows since theBTC ETFs’inception in January 2024. In contrast, the ETH ETFs had a sluggish start, and they picked up the pace almost a year later.

For now, the XRP Army is left with having to wait for an official SEC decision, but the crowd seems to be quite optimistic with odds on Polymarket surging to 87% for an approval by the end of the year.

ATTO will join an AMA (ask me anything) with XT Exchange on September 2. These talks are good for new attention and can lead to higher trade, especially as there is a big giveaway in $ATTO tokens. Sometimes, new users join or buy after hearing directly from the project’s founder. If the AMA gives good news or strong development plans, price can go up. If not, price may not change much. Still, big marketing and reward events often bring short-term interest, so watch what is said. source

XT Exchange #BeyondTrade@XTexchangeAug 31, 2025XT & ATTO X Space: Atto: Feeless, Instant L1 for Real-World Payments

09:00 on Sep 2 (UTC)

13,517,213 $ATTO Giveaway:

Follow @XTexchange & @AttoCash

Like & RT with hashtags #XT #XTSpace #ATTO & Tag 3 friends

Leave your questions for… pic.twitter.com/SfVr6SsxBx

BOOP will be integrated with a new feature or service on September 1. Integration news can be very important if it brings more users or use-cases. Sometimes, price grows when integrations mean more people will use or know the project. The exact details are not clear yet, so the price move may depend on how big the new partner or service is. If traders are happy with the news, price often rises after such updates. If it is a small change, price may not move much. source

Electroneum is preparing for a big launch later this year. On September 2, there will be an announcement that could share new information or updates. Early news before a larger project launch sometimes pushes price up, because traders get excited about future growth or changes. But, if the announcement does not give clear details or strong news, price impact can stay small and short-term. Still, this event is important as it shows the team is active, which helps trader confidence. Watch for more signs of what’s coming next. source

electroneum@electroneumAug 30, 2025The next step drops on Tuesday.

It's one of many moves leading to our major autumn/winter launch.

Big journeys start with small steps. pic.twitter.com/ylWAAztTPa

Skepticism over Bitcoin’s ability to rise further has followed the asset for years, and will likely continue even if the price reaches into the millions, according to a Bitcoin adviser.

“I think it’s going to be that way for a very long time,” The Bitcoin Adviser’s Luke Broyles told Natalie Brunell on the Coin Stories podcast on Friday.

“I think Bitcoin will be at $5 million, $10 million or more, and people will still be saying, Yeah, well it’s 8% of world assets now. It can’t go any higher, right?” he added.

Skepticism has followed Bitcoin (BTC) at every price milestone. Each time the asset has reached a new all-time high, critics have questioned its ability to climb further. During price corrections, many skeptics assumed it would never recover.

It may be an “exceedingly long period of time” before change

This year, Bitcoin reached several new all-time highs. Most recently, Bitcoin reached $124,100 on July 14, according to CoinMarketCap. Since then, it has pulled back to $108,978 at the time of publication.

However, Broyles argued that Bitcoin’s biggest hurdle isn’t technical but psychological, as most people still don’t believe it can improve their everyday lives. “Unfortunately, I don’t think a lot of people will make that switch until they see that,” he said.

“I think it is going to be an exceedingly long period of time,” he added.

Broyles suggested that Bitcoin merging with real estate loans will do much more for adoption than convincing Bitcoin skeptics to invest small amounts over time.

Bitcoin mortgages could push adoption faster than DCA

“Like, is it going to be harder to convince somebody who’s more skeptical of Bitcoin, hey, you should buy $1,000 of Bitcoin for the next 200 months. Or is it going to be "Hey, you can refinance your home and convert this equity into Bitcoin, right?” Broyles said.

“I think that is going to blow people’s minds,” he said.

A lack of understanding is still one of the biggest obstacles to crypto adoption. According to an August 2024 survey conducted by Australian crypto exchange Swyftx, 43% of 2,229 respondents said they hadn’t used the tech because they were unsure how it works.

Top Stories of The Week

Ether ETFs hit $13.7B as inflows surge and corporate treasuries grow

Ether spot exchange-traded funds (ETFs) have seen steady growth since their US debut in July 2024, while corporate treasuries tied to the token are also on the rise.

Inflows into Ether funds climbed 44% this month, rising from $9.5 billion on Aug. 1 to $13.7 billion on Aug. 28, according to cryptocurrency research platform SoSoValue. Market participants say renewed institutional demand is fueling the momentum.

After an extended period of underperformance relative to Bitcoin and a souring investor sentiment, Ethereum has recently experienced a significant revival in the recognition of both its adoption rate and value proposition, Sygnum Chief Investment Officer Fabian Dori told Cointelegraph.

Crypto market to unlock $4.5B in tokens in September

Crypto projects are set to unlock about $4.5 billion in vested tokens in September, according to data tracker Tokenomist.

Tokenomist data shows that about $1.17 billion will come from cliff unlocks, while $3.36 billion will be released through linear unlocks. About $4.5 billion in tokens will become available to investors, project teams and other stakeholders as vesting agreements expire.

Cliff unlocks are typically larger, one-time token releases that happen at the end of a specified lockup period. This often affects the market more due to supply shocks. On the other hand, linear unlocks distribute tokens over time, which helps smooth out the impact on the supply.

Elon Musks lawyer to chair $200M Dogecoin treasury: Report

Elon Musks attorney Alex Spiro is set to chair a new public company that aims to raise $200 million to invest in Dogecoin, according to a Fortune report citing six people familiar with the deal.

The initiative is being pitched to investors as a Dogecoin treasury vehicle with the endorsement of House of Doge, the corporate entity launched in early 2025 by the Dogecoin Foundation and headquartered in Miami, Fortune reported Friday.

The company seeks to raise at least $200 million as a public vehicle to hold Dogecoin on its balance sheet, giving investors stock-market exposure to the token without direct ownership.

The effort remains at the pitch stage, with details on its structure or launch timing not yet disclosed.

Strategy Bitcoin lawsuit dismissed as investors withdraw case

Lead plaintiffs and an investor have voluntarily dismissed their lawsuit against Bitcoin treasury company Strategy, permanently ending the case, according to a court filing obtained by Cointelegraph. The move represents a potential win for crypto treasury companies, with Strategy standing as the industrys largest player.

According to a Thursday court filing, two lead plaintiffs, Michelle Clarity and Mehmet Cihan Unlusoy, and an investor representing other shareholders, submitted the stipulation for dismissal.

The dismissal with respect to Co-Lead Plaintiffs claims and Anas Hamzas claims, but not absent class members claims, is with prejudice, the court document reads. In addition, the Action has not been certified as a class action.

Trump has 11 on his Fed chair list, 3 may be crypto-friendly

The Trump administration is considering at least 11 candidates to replace Jerome Powell when his term as Federal Reserve chair expires in May. At least three of them have taken positive stances toward crypto.

Treasury Secretary Scott Bessent told Fox News on Wednesday that there are 11 very strong candidates for Fed chair, which hell begin to vet and shortlist starting next month.

The list of candidates, as CNBC reported on Aug. 13, citing two administration officials, includes Dallas Fed President Lorie Logan, former St. Louis Fed President James Bullard, Fed Vice Chair Philip Jefferson, Fed Governor Christopher Waller, Fed Vice Supervision Chair Michelle Bowman and former Fed Governor Larry Lindsey.

The list also includes Bush administration economic adviser Marc Sumerlin, investment bank Jefferies chief market strategist David Zervos and BlackRocks chief investment officer for global fixed income Rick Rieder.

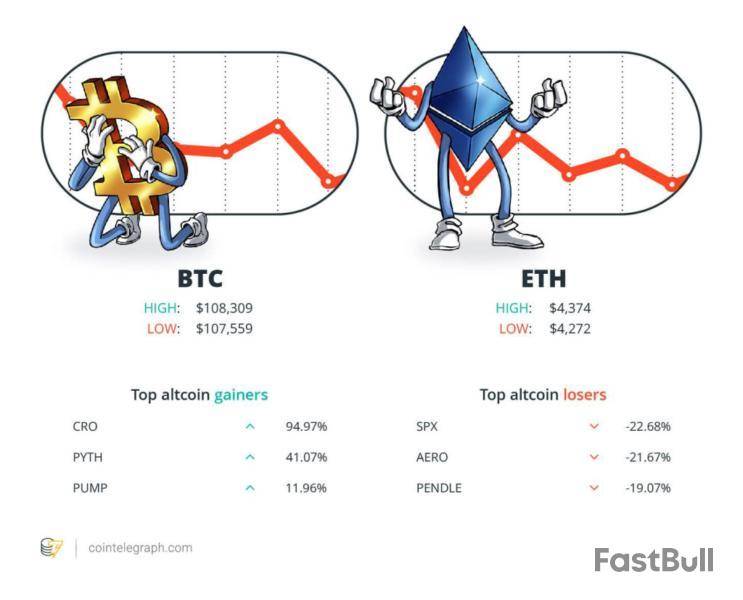

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $108,309, Ether (ETH) at $4,374 and XRP at $2.82. The total market cap is at $3.77 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Cronos (CRO) at 94.97%, Pyth Network (PYTH) at 41.07% and Pump.fun (PUMP) at 11.96%.

The top three altcoin losers of the week are SPX6900 (SPX) at 22.68%, Aerodrome Finance (AERO) at 21.67% and Pendle (PENDLE) at 19.07%.

For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Most Memorable Quotations

Let’s say that your protocol or layer 1 blockchain becomes more secure. Then they may target human beings behind it. The people who have the private key and so on.

Ronghui Gu, co-founder of CertiK

There are other currencies that will come up as flashes in the pan but I think overall, were in a major trend toward Bitcoin.

Tim Draper, founding partner at Draper Associates

This whole system was weaponized against them, no different than it had been weaponized against us for different reasons.

Eric Trump, son of US President Donald Trump

Crypto gets pretty sketchy below the top 10, certainly below the top 20.

Greg King, founder and CEO of REX Financial

We have to go through the tough liquidation days so that we can go up.

Bobby Ong, co-founder of CoinGecko

Timeline bearish and calling for the bear market. Time to go max long.

James Wynn, millionaire leverage trader

Top Prediction of The Week

XRP distribution phase doesnt change $20 price target: Analyst

XRPs price fell 22% to $2.72 from its multi-year high of $3.66 reached on July 18, before recovering to current levels around $3.

Has the popular altcoin finally topped out, or is there a stronger rally in the cards?

XRP price action reveals a consolidation within a symmetrical triangle on the daily chart, suggesting that the altcoin may be preparing another bullish impulse, according to analyst XForceGlobal.

Read also Features Is measuring blockchain transactions per second (TPS) stupid in 2024? Big Questions Features Make sure Ethereum wins Steve Newcomb reveals zkSyncs prime directiveXRP price at $20 remains the primary cycle target, the pseudonymous analyst said in an X post on Wednesday.

Although the price still faces strong resistance around the $4 psychological level, this does not alter the overall bullish outlook on the macro, the analyst said, adding that XRP could now follow two possible scenarios.

Top FUD of The Week

US banks moved $312B in dirty money, but critics still blame crypto

US banks were responsible for moving $312 billion for Chinese money launderers between 2020 and 2024, according to a new report.

In a US Financial Crimes Enforcement Network (FinCEN) advisory on Thursday, the watchdog analyzed over 137,000 Bank Secrecy Act reports from 2020 to 2024.

It found that over $62 billion per year on average has gone through the US banking system from Chinese money launderers.

Chinese money-laundering networks have formed a symbiotic relationship with Mexico-based drug cartels. The cartels need to launder US dollar drug proceeds, while Chinese gangs want US dollars to circumvent Chinas currency control laws, it reported.

These networks launder proceeds for Mexico-based drug cartels and are involved in other significant, underground money movement schemes within the United States and around the world, said FinCEN Director Andrea Gacki.

Kanye Wests YZY token: 51,000 traders lost $74M, while 11 netted $1M

More than 51,000 traders incurred losses on Kanye Wests recently launched memecoin, highlighting the potential risks of trading celebrity-endorsed tokens with no intrinsic technological utility.

The Kanye West-linked YZY token was launched on the Solana blockchain on Aug. 21. It rallied 1,400% within the first hour before losing over 80% of its value.

Of the 70,200 traders who invested in the celebrity-endorsed token, more than 51,800 realized losses, with three traders losing over $1 million, according to blockchain data platform Bubblemaps.

Meanwhile, 11 wallets made $1M+, wrote Bubblemaps in a Wednesday X post.

Amid large-scale losses from the majority of the tokens traders, only 11 out of 70,000 wallets generated over $1 million in profit, while 99 generated over $100,000, highlighting the financial risks of celebrity-endorsed meme tokens with a lack of blockchain utility.

Fenwick denies allegations that it was key to multibillion-dollar FTX fraud

Law firm Fenwick & West denied allegations from an updated class-action lawsuit claiming it was central to crypto exchange FTXs fraud and eventual collapse.

Earlier this month, FTX users asked to update their suit against Fenwick, first filed in 2023, claiming new information from a bankruptcy and criminal case shared evidence that the law firm played a key and crucial role in the most important aspects of why and how the FTX fraud was accomplished.

Read also Columns Socios boss goal? To knock crypto out of the park Features Tornado Cash 2.0: The race to build safe and legal coin mixersFenwick told a Florida federal judge in a filing on Monday that the court should deny FTX users request to update the suit against the firm, arguing their theory that it helped the exchange carry out fraud is as facile as it is flawed.

Fenwick is not liable for aiding and abetting a fraud it knew nothing about, based solely on allegations that Fenwick did what law firms do every day provide routine and lawful legal services to their clients, it said.

Top Magazine Stories of The Week

The one thing these 6 global crypto hubs all have in common

Nations around the world are competing to become the most popular global crypto hubs. Here are some of the best.

BTS Jungkooks hacker, Ripple backs Singapore payments firm: Asia Express

BTS Jung-kooks identity thief tied to international crypto scam ring, Ripple and Circle bet on Singapore fintech, and more.

3 people who unexpectedly became crypto millionaires and one who didnt

Three real-life tales of people who became hilariously rich with crypto could you be next?

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up