Investing.com – Canada stocks were higher after the close on Wednesday, as gains in the Materials, Energy and IT sectors led shares higher.

At the close in Toronto, the S&P/TSX Composite added 0.24% to hit a new all time high.

The best performers of the session on the S&P/TSX Composite were Energy Fuels Inc. (TSX:EFR), which rose 14.48% or 4.75 points to trade at 37.55 at the close. Meanwhile, Denison Mines Corp (TSX:DML) added 8.97% or 0.48 points to end at 5.83 and NexGen Energy Ltd. (TSX:NXE) was up 8.53% or 1.48 points to 18.84 in late trade.

The worst performers of the session were Aritzia Inc (TSX:ATZ), which fell 6.21% or 7.15 points to trade at 107.94 at the close. Curaleaf Holdings Inc (TSX:CURA) declined 5.99% or 0.20 points to end at 3.14 and Lithium Americas Corp (TSX:LAC) was down 4.69% or 0.40 points to 8.13.

Rising stocks outnumbered declining ones on the Toronto Stock Exchange by 491 to 475 and 76 ended unchanged.

Shares in Energy Fuels Inc. (TSX:EFR) rose to 5-year highs; gaining 14.48% or 4.75 to 37.55. Shares in Denison Mines Corp (TSX:DML) rose to 5-year highs; rising 8.97% or 0.48 to 5.83. Shares in NexGen Energy Ltd. (TSX:NXE) rose to all time highs; up 8.53% or 1.48 to 18.84.

The S&P/TSX 60 VIX, which measures the implied volatility of S&P/TSX Composite options, was down 2.36% to 14.90.

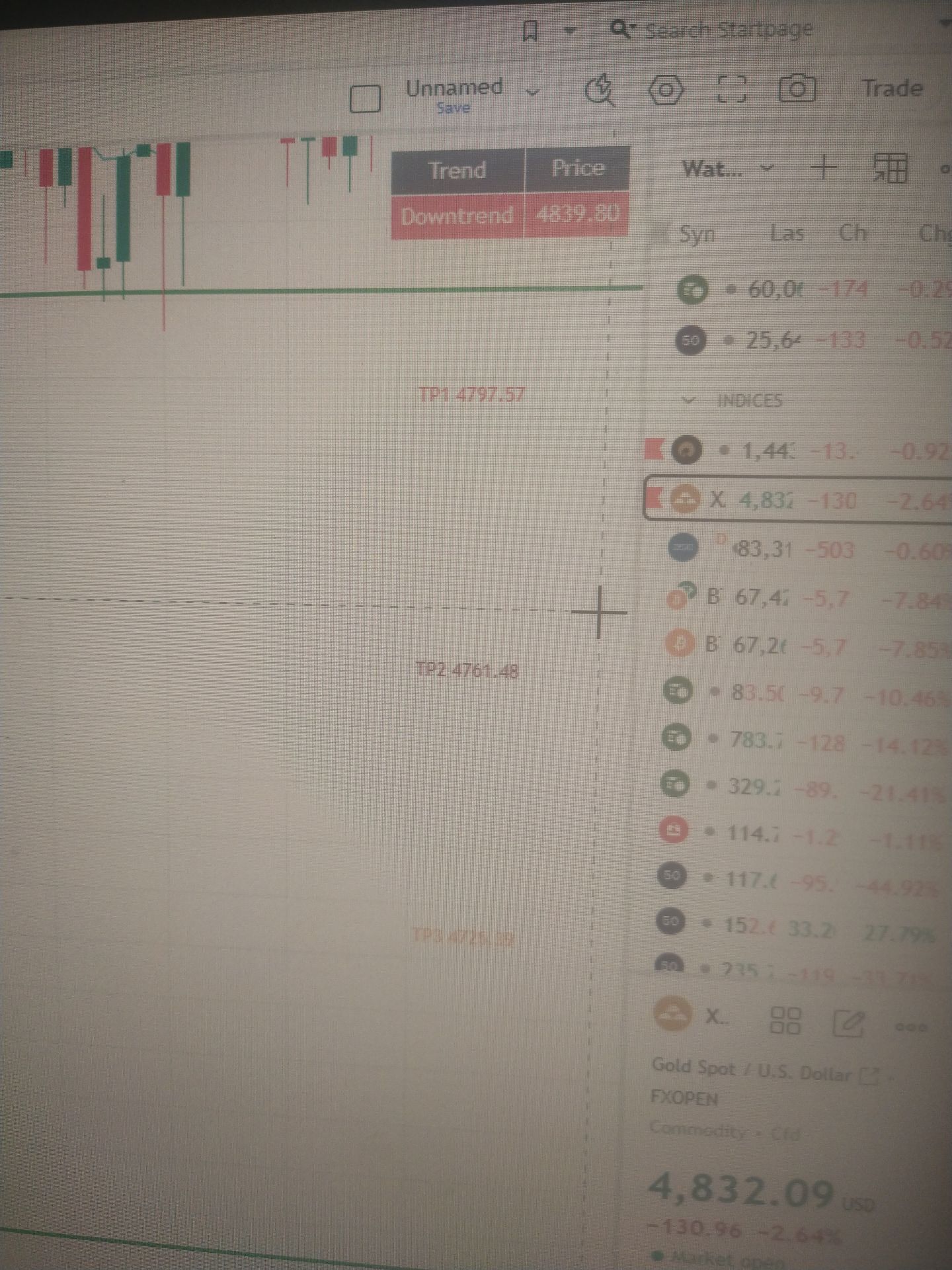

Gold Futures for April delivery was up 5.75% or 294.24 to $5,414.84 a troy ounce. Elsewhere in commodities trading, Crude oil for delivery in March rose 1.80% or 1.12 to hit $63.51 a barrel, while the April Brent oil contract rose 1.53% or 1.02 to trade at $67.61 a barrel.

CAD/USD was unchanged 0.23% to 0.74, while CAD/EUR rose 0.99% to 0.62.

The US Dollar Index Futures was up 0.14% at 96.19.