Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bybit is stepping up its game for institutional investors. The world’s second-largest crypto exchange by trading volume has announced a strategic partnership with Switzerland’s Sygnum Bank to deliver bank-grade, off-exchange custody for crypto assets.

The move brings together Bybit’s deep liquidity and wide product range with Sygnum’s reputation for secure, regulated digital asset banking. For institutions looking for safer ways to trade crypto, this could be a game-changer.

Easy Trading Without Moving Funds

The partnership is centered around Sygnum Protect, a custody platform that lets institutions keep their assets off Bybit’s balance sheet while still trading spot and derivatives on the exchange.

Instead of shifting funds back and forth between the bank and the exchange, clients’ balances are mirrored on Bybit. Trading profits and losses are settled every eight hours, a setup designed to improve transparency and capital efficiency.

Swiss Security Standards at the Core

Sygnum is already the largest bank-operated off-exchange custody platform, supporting over half of global spot and derivatives trading volumes. Assets on the platform are protected under Swiss banking laws and secured by strict governance, independent audits, and advanced hardware and software controls.

Adding Bybit to its roster, which already includes Binance and Deribit, boosts Sygnum’s growing influence in institutional crypto services.

Bybit’s Custody Network Keeps Growing

For Bybit, this deal is part of a larger push to strengthen its custody offerings. The exchange already works with Fireblocks, Copper, and Cactus. With Sygnum on board, it now offers regulated Swiss-level custody within its ecosystem.

“Crypto and stablecoin infrastructure is evolving, and managing counterparty risks is essential for further institutional adoption,” said Yoyee Wang, Head of Bybit’s Business-to-Business Unit. “Our partnership with Sygnum Bank not only gives clients access to Bybit’s industry-leading products and liquidity, but also ensures their assets are safeguarded with the highest standards of Swiss banking.”

Dominic Lohberger, Chief Product Officer at Sygnum, added, “The rapid adoption of Sygnum Protect by institutional clients trading on Binance, Deribit, and now Bybit, demonstrates the urgent need for bank-grade, off-balance sheet custody solutions.”

Exchanges and banks are working closer than ever to make crypto safer for institutions. Bybit’s latest move shows that the demand for regulated, reliable custody is only getting stronger.

Ripple is making strategic moves to maintain the strength and stability of its RLUSD stablecoin, carrying out its largest token burn in weeks.

Meanwhile, RLUSD adoption is picking up, with businesses and banks beginning to use it for payments and other services.

Ripple Executes Largest RLUSD Burn in Weeks

According to data from Ripple Stablecoin Tracker, over 2.71 million RLUSD tokens were burned on September 9, marking the largest single burn in weeks after a series of reductions over the past two weeks.

Ripple Stablecoin Tracker@RL_TrackerSep 09, 2025🔥🔥🔥🔥🔥🔥 2,714,248 #RLUSD burned at RLUSD Treasury.https://t.co/IwILP59jH0

According to the tracker, the company burned 1 million RLUSD twice on September 3 and another million on August 29.

These burns are part of Ripple’s standard process for managing RLUSD. The company issues new tokens when demand rises and removes excess supply through burns when dollars return to its reserves, ensuring that RLUSD remains fully backed and stays close to its one-dollar peg.

RLUSD Trading Volume Spikes

RLUSD is currently trading near $1, with a market capitalization of over $728 million. Its trading volume has surged to $88.51 million, up 88% in the past 24 hours, as per data from Coinmarketcap. RLUSD is also among the top 10 stablecoins by market cap.

VivoPower Adopts RLUSD

VivoPower International recently announced that its electric vehicle subsidiary, Tembo, now accepts payments in RLUSD stablecoin. The company noted that customers in developing markets often face high fees and slow transfers. By integrating RLUSD, Tembo plans to make international payments faster and cheaper.

However, Attorney Bill Morgan notes that it is accepting only RLUSD payments, and not XRP itself. He also noted that although RLUSD exists on both the XRP Ledger and Ethereum, most of its supply is on Ethereum.

Ripple’s European Push

Meanwhile, Ripple is also making big moves in Europe. It has partnered with Spain’s second-largest bank, BBVA, to provide its crypto custody technology, supporting the bank’s new retail crypto trading and storage service for Bitcoin, Ether, and other tokenized assets.

Gemini, the cryptocurrency exchange founded by Cameron and Tyler Winklevoss, is preparing for a major step forward with its upcoming listing in New York. Just before the launch, the company secured Nasdaq as a strategic investor.

Nasdaq is committing $50 million, showing strong confidence in Gemini at a time when digital assets are slowly gaining acceptance in traditional finance. This partnership is not only about funding but also about creating long-term collaboration between the two platforms.

A Strategic Partnership Beyond the IPO

According to Reuters, the agreement between Gemini and Nasdaq goes further than a simple investment. Nasdaq’s clients will soon gain access to Gemini’s custody and staking services. In return, Gemini’s institutional clients will be able to use Nasdaq’s Calypso platform to manage and track collateral. For the crypto industry, which often struggles with security and trust issues, this connection with one of the most respected names in traditional markets is an important milestone.

Gemini’s decision to go public comes at a time when the US stock market is enjoying a strong rebound. Investors are showing renewed interest in new listings, with companies like Circle and Bullish recording impressive first-day performances.

By choosing this moment, Gemini is positioning itself to benefit from the positive mood in the market while also showing that crypto companies are no longer standing on the sidelines.

Gemini’s Current Challenges

While the exchange has made headlines with its growth, it is still working through financial struggles. Gemini reported a net loss of $282.5 million in the first six months of 2025, a steep jump from the year before.

Despite this, the company continues to hold $21 billion in assets and has processed $285 billion in lifetime trading volume. Gemini also runs an over-the-counter trading desk, a US-based credit card, and supports a wide range of digital assets, including Bitcoin, Ether, and stablecoins.

Crypto analyst NickBuzz highlighted that Gemini’s IPO with Nasdaq as a strategic investor marks a step toward legitimizing crypto exchanges in mainstream finance. Meanwhile, the planned $317 million raise and Nasdaq’s $50 million private placement show confidence in Gemini’s future, though questions remain about how much independence the exchange can retain under such close ties.

What It Means for the Crypto Market

If Gemini succeeds in its listing under the ticker GEMI, it will join Coinbase and Bullish as one of the few publicly traded crypto exchanges. This move highlights how digital assets are becoming more integrated into mainstream finance. For the Winklevoss twins, often called the Bitcoin twins, the IPO represents another step in turning early vision into lasting impact.

FAQs

What is the new partnership between Gemini and Nasdaq?Nasdaq is investing $50 million in Gemini and will collaborate on services. Nasdaq clients will access Gemini’s custody and staking, while Gemini’s institutional clients will use Nasdaq’s Calypso platform.

What is Gemini’s stock ticker symbol?Gemini’s stock ticker symbol will be GEMI when it goes public. The exchange has received approval to list on the Nasdaq Global Select Market.

When is the Gemini (GEMI) IPO happening?Gemini’s IPO is upcoming in New York. The exact date is not specified, but it coincides with a strong rebound in the US stock market.

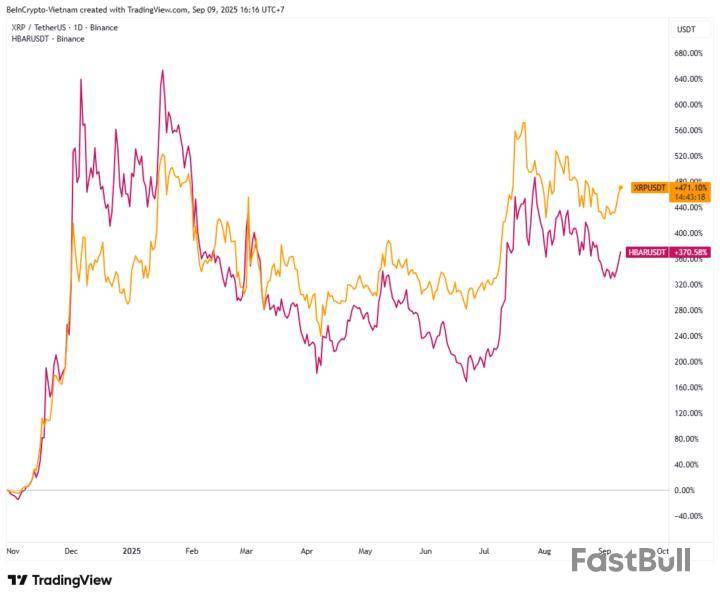

Hedera (HBAR) and XRP are both US-based crypto projects. Over the past year, their price movements have shown a strong correlation. Analysts are asking whether this correlation could reveal a possible scenario by the end of the year.

They expect positive signals from both assets, ranging from technical analysis to fundamental analysis, to push prices higher through year-end.

How are HBAR and XRP correlated?

Hedera is a public distributed ledger platform built on hashgraph consensus and governed by a council of major companies inside and outside the industry.

In contrast, XRP is the native token of the XRP Ledger (XRPL), a decentralized blockchain developed by Ripple to enable fast and efficient cross-border payments.

Studying the correlation between HBAR and XRP is well-founded. Comparing their price charts shows that both have risen and fallen together over the past year.

Correlation data from DefiLlama confirms this. The correlation coefficient between the two altcoins is 0.97 over seven days, 0.93 over one month, and 0.89 over one year.

These high figures reflect strong alignment in investor sentiment for both short-term and long-term horizons. Because of this correlation, technical analysts gain more confidence when predicting price action.

Analyst Steph Is Crypto believes both assets are forming a falling wedge pattern. Prices for both tokens have already reached the end of the pattern, preparing for a breakout in September.

“XRP and HBAR breakout imminent!” Steph Is Crypto said.

The falling wedge is a classic bullish chart pattern. Fibonacci measurements suggest XRP could climb to $4.6, while HBAR could reach $0.4.

Even without focusing on short-term analysis, many investors believe both tokens will maintain long-term growth momentum. They consider them portfolio priorities during bear markets.

“Both are long-term holds in my opinion. You’d be crazy not to hold until the next bull cycle. A lot of these coins gaining traction and utility won’t retrace as much in the bear market compared to previous ones,” investor Dylan Deloach said.

However, some investors argue that HBAR could outperform XRP due to tokenomics. XRP has a total supply of 100 billion tokens, with 60% in circulation. HBAR has a total supply of 50 billion tokens, with more than 84% in circulation.

This means XRP may face prolonged and heavier unlock pressure compared to HBAR.

Meanwhile, each project is pursuing its own path to fuel price momentum. Hedera is actively expanding its ecosystem through events such as Sibos 2025 (SWIFT’s annual FinTech conference) and initiatives involving stablecoins, CBDCs, and DeFi.

Ripple continues to grow partnerships with banks and financial institutions while developing its RLUSD stablecoin. Positive developments in the ongoing legal battle with the SEC have also helped improve investor sentiment.

Binance founder Changpeng Zhao (CZ) has warned the crypto community about the growing security threats in Web2 applications. He stressed that even trusted and open-source software is no longer safe from attackers.

“Web3 will redefine security for Web2,” CZ said on X, urging developers and users to stay alert as hackers become more advanced.

Web3 as the Security Solution

CZ believes Web3 technologies like smart contracts and decentralized applications can fix many of the weaknesses in Web2.

According to him, blockchain can “safeguard digital assets and sensitive data” by removing weak points that attackers often exploit. While he admits Web3 is still at an early stage, he sees it as a long-term solution for stronger online security.

Binance Tests Inheritance Feature

CZ also revealed Binance is testing a new inheritance feature that lets families access the crypto holdings of deceased users.

However, he admitted the feature still needs work:

“Direct feedback (as a user), it sucks. Needs improving,” he tweeted, noting that while the system functions, the user experience is far from ideal.

Community Reacts to CZ’s Warning

CZ’s warning about Web2 security quickly caught attention on crypto Twitter.

Crypto influencer MartyParty agreed, saying open-source repositories must be secured and suggesting that Web2 scripts and code should move on-chain. He even proposed a Web3-powered browser that connects directly to blockchains, removing many of today’s vulnerabilities.

Open Source Debate

Not everyone agreed that open source is the problem. A user known as agentic_t argued that the issue lies in management, not openness.

“The future of secure code lies in reproducible builds, signed releases, hardware-level verification, and strict permission structures,” he said.

This highlights that while Web3 can improve security, best practices in code management are just as important.

Is CZ’s Warning Realistic?

Yes, recent supply chain attacks, such as the one targeting NPM packages, prove that even widely used open-source tools can be hacked.

While open source improves transparency, it doesn’t guarantee safety without verification and strong controls. CZ’s call for Web3-based security reflects the urgent need for new protections as cyberattacks grow more sophisticated.

FAQs

How can Web3 improve security?Web3 uses blockchain, smart contracts, and decentralization to reduce vulnerabilities, safeguard digital assets, and protect sensitive data from exploitation.

What is Binance’s new inheritance feature?It’s a feature in development that allows families to access the crypto holdings of deceased users. CZ admits it still needs a lot of improvement.

Is open-source software the main security problem?Yes, according to CZ, open-source software isn’t safe. Recent supply chain attacks on packages prove that even widely used open-source tools can be hacked.

In a note to clients on Tuesday, analysts at research and brokerage firm Bernstein argued that Robinhood is no longer just a hub for speculative retail traders but an emerging financial "super-app" with vast headroom for expanding market share following its S&P 500 inclusion.

Robinhood was added to the index late Friday alongside AppLovin and EMCOR Group, effective Sept. 22, while Michael Saylor's Strategy was snubbed despite meeting all the criteria. The next rebalancing is scheduled for December.

Bernstein estimates Robinhood controls 12% of the U.S. retail trading revenue market across equities and crypto, up from 7% just two years ago. Its spot equity trading market share has increased from 2.8% in 2023 to 5.5% in 2025, while its equity options dominance has more than doubled since 2023, accounting for 24% of retail volume. Crypto retail trading has become another key driver, with Robinhood's market share surging to around 30% following the collapse of FTX and Binance.US's retreat from the country.

Robinhood's market share in U.S. crypto trading. Image: Bernstein.

The analysts, led by Gautam Chhugani, also highlighted that fears of competition from incumbents like Charles Schwab entering the crypto space have been overstated, with both Coinbase and Robinhood holding their take-rates on advanced traders (55-60 bps), while Robinhood has quietly raised fees in recent quarters. The next frontier, Bernstein argues, is blockchain tokenization — an area where Robinhood could help build a liquid market for securities in the U.S., particularly for private equity.

Beyond trading, Robinhood's biggest opportunity is expanding into wealth management and broader financial services, the analysts said, currently representing just 2.7% of the total broking and advisory market. The company's Gold subscription program now counts 3.5 million members paying $5 per month, with perks including higher savings rates, credit card access, mortgage offers, and private banking-like features. Its Gold credit card, positioned as an aspirational financial club membership, already has 300,000 cards issued, with a waitlist still growing.

With revenues projected to grow from $2.9 billion in 2024 to $6.8 billion in 2026 — at a 51.7% CAGR — Bernstein values Robinhood at $160 per share, implying 36% upside from its $117.28 close on Monday — up 15.8% for the day, according to The Block's HOOD price page.

The analysts praised Robinhood management's "best-in-class product velocity and monetization," while cautioning that regulatory risks around payment for order flow and crypto trading remain an overhang.

HOOD/USD price chart. Image: The Block/TradingView.

Gautam Chhugani maintains long positions in various cryptocurrencies. Certain affiliates of Bernstein act as market makers or liquidity providers in the equity securities of Robinhood and Coinbase.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Biconomy will list JUST under the JUST/USDT trading on September 9th.

JST Info

JUST is a decentralized finance (DeFi) ecosystem on the TRON blockchain, launched in August 2020. It offers a suite of DeFi products, primarily centered around JustStable, a decentralized stablecoin lending platform. The ecosystem aims to provide a comprehensive range of DeFi services, creating a complete DeFi ecosystem on TRON.

JUST’s platform includes various products like JustStable, JustLend, JustSwap, JustLink, and tokenized cross-chain assets. Users can deposit collateral tokens, like TRON (TRX), to mint USDJ, a stablecoin pegged to the US dollar. This process involves creating a collateralized debt position (CDP). JustLend allows for liquidity provision and low-interest loans, JustSwap facilitates trustless token swaps, and JustLink provides decentralized oracle services.

JST is the native governance token of the JUST ecosystem, circulating since May 2020. It serves multiple functions on the platform, including paying interest, maintaining the platform, and participating in governance decisions. These decisions involve setting crucial parameters like interest rates and minimum collateralization ratios. JST plays a central role in the operation and governance of the JUST ecosystem.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up