Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Flightradar24: Airspace In Southeastern Poland Has Once Again Been Closed For The Past Few Hours

[Ethereum Surges Above $2,100, Up 10.9% In 24 Hours] February 7Th, According To Htx Market Data, Ethereum Has Rebounded And Broken Through $2100, Currently Trading At $2114, A 24-Hour Increase Of 10.9%

Booz Allen Hamilton Maintains Its Fiscal Year Guidance After Treasury Cancels Contracts And Trump Sues IRS For $10 Billion. Consulting Giant Booz Allen Hamilton Confirmed Its Fiscal Year Guidance Remains Unchanged, Expecting The Treasury Department's Contract Cancellations By President Trump To Have An Impact Of Less Than 1.0% On Overall Revenue For The Fiscal Year (the 12 Months Ending March 31, 2027). In Late January, The U.S. Treasury Announced The Cancellation Of 31 Contracts With The Company—with Total Annual Expenses Of $4.8 Million

US Plans Initial Payment Towards Billions Owed To UN In A Matter Of Weeks - Washington's UN Envoy Mike Waltz Tells Reuters

[Bitcoin Touched $71,751 This Morning, Rebounding Nearly 20% From The Low.] February 7Th, According To Htx Market Data, Bitcoin Rebounded This Morning To Touch $71,751, A 19.58% Increase From The Intraday Low Of $60,000, Making It The Day With The Highest Single-Day Price Increase During This Bull-Bear Cycle

In The Week Ending February 6, The US Stock Market's "interest Rate Cut Winners" Index Rose 4.41% Cumulatively. The "Trump Tariff Losers" Index Rose 4.03% Cumulatively, And The "Trump Financial Index" Rose 2.46% Cumulatively. The Retail Investor-heavy Stock Index/meme Stock Index Fell 3.35% Cumulatively

US Defense Secretary Hegseth: His Dept Is Formally Ending All Professional Military Education, Fellowships, And Certificate Programs With Harvard University

[Deutsche Bank: Large-Cap Tech Stocks Fall To Bottom Of 10-Year Trend Channel Relative To S&P 500] Deutsche Bank Strategists, Including Parag Thatte, Wrote In A Research Report That On Thursday, Large-cap And Tech Stocks Rebounded From The Bottom Of A 10-year Trend Channel Relative To The Rest Of The S&P 500, And Continued Their Rally On Friday. The Strategists Stated That Historically, This Group Has Typically Seen A Rally After Hitting The Bottom Of The Channel, Especially Against A Backdrop Of Rising Earnings. The Report Noted That This Year's Performance "is Entirely Driven By Changes In Valuation Multiples, Rather Than Adjustments In Earnings Expectations, A Stark Contrast To Last Year When It Was Entirely Driven By Upward Revisions In Earnings Expectations."

[German Industrial Output Shrinks For Fourth Consecutive Year] Data Released By The Federal Statistical Office Of Germany On February 6 Showed That, Affected By Factors Such As Weak Production In The Automotive Industry, German Industrial Output Will Decline By 1.1% In 2025 Compared To The Previous Year, Marking The Fourth Consecutive Year Of Decline. Statistics Show That, Excluding The Construction And Energy Sectors, Output In Other German Industrial Sectors Will Decline By 1.3% In 2025. Among Them, Key Sectors Such As The Automotive Industry And Machinery Manufacturing Saw The Most Significant Declines, Falling By 1.7% And 2.6% Respectively

India Repo Rate

India Repo RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

No matching data

View All

No data

Fund managers still reluctant on crypto, BofA survey shows

The survey, conducted in September, revealed that 67% of fund managers have zero allocation to digital assets such as bitcoin (BTC-USD), ether (ETH-USD), ripple (XRP-USD), and tether (USDT-USD). This underscores that, for many institutional investors, crypto remains outside the bounds of traditional portfolio construction.

While a majority remain absent, a small minority have dipped a toe into the market. Just 3% of respondents reported a 2% allocation, another 3% hold 4%, and only 1% have exposure at 8% or more.

Weighted exposure tiny:

Structural hesitation:

Broader context

The findings come at a time when crypto adoption continues to expand in retail markets, regulatory frameworks are slowly maturing, and a growing number of products — such as spot bitcoin exchange-traded funds (ETFs) — are offering investors regulated ways to access digital assets. Yet institutional skepticism lingers, centered on volatility, regulatory uncertainty, and questions about crypto’s role in diversified portfolios.

For now, Bank of America’s survey highlights a wide gap: while crypto markets trade in the trillions, professional fund managers remain largely on the sidelines.

For traders, if you like checking out positioning as a guide to likely market moves this is an information riish post!

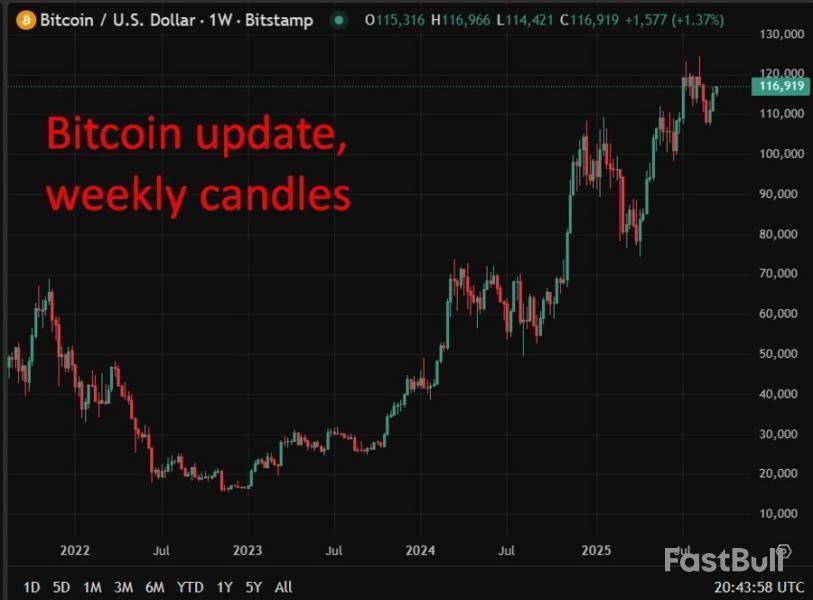

Bitcoin update:

This article was written by Eamonn Sheridan at investinglive.com.

CoinDesk Bitcoin Price Index is up $1501.78 today or 1.30% to $116824.28

Note: CoinDesk Bitcoin Price Index (XBX) at 4 p.m. ET close

Data compiled by Dow Jones Market Data

VivoPower International (ticker VVPR) said Tuesday its mining arm Caret Digital will expand operations and swap mined tokens into XRP, a move it claims will give the company exposure at an effective 65% discount.

The company did not specify how much XRP it expects to acquire or which mined tokens will be exchanged. Caret Digital currently mines Bitcoin, Litecoin, and Dogecoin, according to its website. XRP is the third-largest crypto asset, with about $182 billion in circulation, according to The Block's price page.

VivoPower first unveiled its XRP treasury strategy in May, backed by a $121 million private placement led by His Royal Highness Prince Abdulaziz bin Turki bin Talal Al Saud, chairman of Eleventh Holding Company in Saudi Arabia. Adam Traidman, a former Ripple board member, also participated and joined VivoPower’s advisory board as chairman.

In June, the company said it would use BitGo as its exclusive custodian and over-the-counter trading partner to acquire XRP. Around the same time, it partnered with Layer 1 blockchain developer Flare, which is backed by Ripple Labs, to generate yield on its holdings. VivoPower said the program would begin with a $100 million capital allocation with plans to reinvest income directly into its XRP reserves.

Last month, VivoPower announced additional plans to acquire $100 million of privately held Ripple Labs shares through "definitive" agreements with current shareholders, subject to final approval from Ripple’s executive management. VivoPower said that deal would give it exposure equivalent to 211 million XRP at an implied $0.47 per token — an 86% discount to market prices at the time.

VivoPower says its XRP treasury strategy is dual-pronged: combining token swaps from mining activities with Ripple equity purchases to lower average acquisition costs while building deeper exposure to the XRP ecosystem.

In recent weeks, the company has also expanded into other parts of the XRP ecosystem. Its electric vehicle unit Tembo will accept Ripple’s RLUSD stablecoin for payments, and it partnered with Doppler Finance to deploy $30 million of XRP into institutional yield programs, with proceeds reinvested into reserves.

VivoPower’s shares were down about 0.5% Tuesday at $5, giving the company a market capitalization of roughly $50 million.

XRP is trading over $3, up 1.7% in the past 24 hours, with a market capitalization of about $182 billion, according to The Block’s XRP price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Google has unveiled its open-source payment standard that makes it possible for artificial intelligence (AI) agents to settle monetary transactions via traditional trails as well as stablecoins, Fortune reports.

The tech giant aims to standardize the rails for future AI-to-AI commerce before it becomes a reality.

Broad collaboration

For implementing this initiative, the tech behemoth has collaborated with Coinbase, the Ethereum Foundation (EF), as well as roughly 60 payment and commerce firms, including American Express and Salesforce.

The collaboration between Coinbase and Google was meant to ensure the interoperability of payments.

The protocol, which is known as Agent Payments Protocol (AP2), is an open protocol that is meant to serve as an extension of Google’s April Agent2Agent (A2A), the protocol that enables communication between agents.

Essentially, the idea is that AI agents will be able to pay bills or buy things on a user's behalf, and Google is working on a universal payments protocol. AI agents could potentially gain the ability to pay each other automatically.

Analysts have forecasted that Solana (SOL) treasury companies might outshine Bitcoin (BTC) and Ether (ETH) in 2025.

Galaxy’s Michael Marcantonio outlined various reasons why SOL is the superior choice for such companies, including its higher staging yield and throughput.Expert Backs SOL as High-Yield Reserve Asset

Marcantonio shared his views in a September 15 X post, where he argued that SOL offers treasury firms unique advantages compared to its larger competitors. He explained that SOL has a gross staking yield of about 7–8%, compared with just 3–4% for ETH. Reinvesting these rewards allows a treasury’s net asset value (NAV) to grow faster, creating a steady income stream.

He gave the example of a $9 billion ETH treasury that could produce around $300 million per year, noting that SOL’s higher rate gives it an even stronger position. On the other hand, BTC does not provide any yield, so companies holding it as a reserve asset cannot generate the same kind of returns.

The expert also talked about SOL’s strong transaction throughput, noting that despite its market cap being five to six times smaller than ETH’s, it handles more transactions and reaches more users. He explained that this level of network activity gives firms that accumulate the former greater upside. This is because their NAV per share can grow from treasury mechanics, and the possibility of SOL being valued higher when compared with ETH.

The 38-year-old also looked at volatility and growth. He noted that SOL has historically been more volatile than its counterparts, with levels around 80% compared to 40% for BTC and 65% for ETH. This difference makes financing tools such as convertible bonds, warrants, and structured deals cheaper for companies that have SOL in their treasuries, and helps them accumulate tokens at a faster pace.

He added that this kind of dilution increases the number of tokens per share more quickly, which boosts net asset value.SOL Gains Ground in Corporate Stockpiles

Marcantonio further explained that ETH is already widely used by institutions, while SOL is still in its growth stage. That means reserve companies linked to the latter can benefit from its financial characteristics and expanding adoption.

BTC and ETH remain the dominant assets in corporate treasuries, with over 130 publicly traded firms holding the former and more than 40 accumulating the latter as strategic reserves.

Flagship companies like Strategy and Metaplanet continue tobuildtheir positions in BTC, while others, such as BitMine Immersion Technologies and SharpLink Gaming,accumulateETH. However, a new wave of treasury firms is also turning to SOL.

In the lead is Upexi Inc., holding over 2 million of the cryptocurrency, followed by DeFi Development Corp., which reported nearly 1 million SOL in its treasury, and Sol Strategies Inc., which has 260,000 SOL on its books.

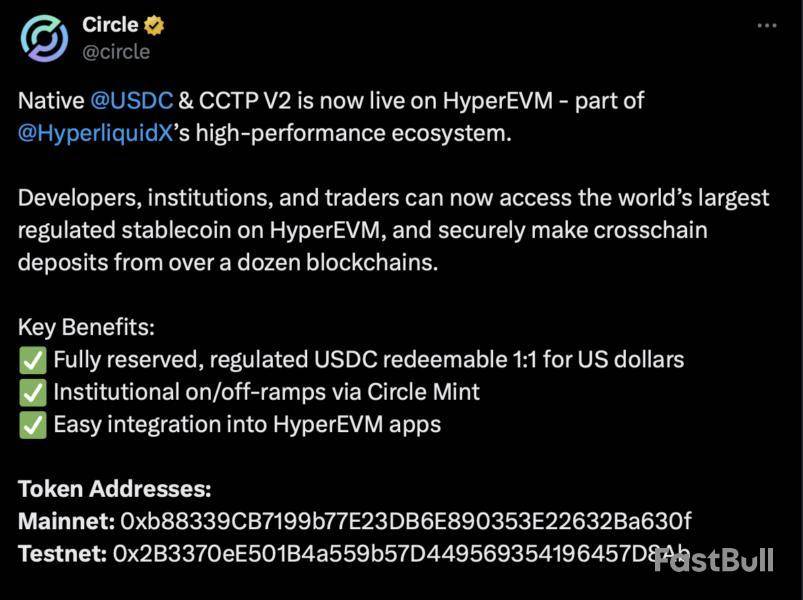

Stablecoin issuer Circle is expanding into Hyperliquid with an investment and the launch of native USD Coin on the protocol, as stablecoin competition on the network intensifies.

According to a Tuesday announcement, Circle is now a stakeholder in the Hyperliquid ecosystem, directly holding its native cryptocurrency Hyperliquid (HYPE). Circle is also considering becoming a validator for the protocol.

The company, which went public on June 5, is behind the USDC (USDC) stablecoin, a digital asset redeemable 1:1 for US dollars. The token will be natively deployed on HyperEVM, Hyperliquid’s smart contract layer.

“This launch is the first step toward enabling USDC deposits into Hyperliquid’s spot and perpetuals exchange on HyperCore,” Circle said on X.

Circle announced plans to expand into the Hyperliquid ecosystem in July. “Today’s launch is simply delivering on that roadmap,” a company spokesperson told Cointelegraph.

Hyperliquid is a decentralized finance ecosystem that specializes in derivatives trading. In July, the protocol hit $330 billion in trading volume nearly a year after launching its layer-1 network.

The protocol announced in September a competition to select a partner to develop its own stablecoin, drawing bids from major stablecoin issuers and crypto firms including Paxos, Frax, Sky, Agora, Ethena, OpenEden, BitGo and Native Markets.

On Sunday, the protocol said its validator community had chosen Native Markets to issue Hyperliquid’s upcoming native stablecoin, USDH.

Validators on Hyperliquid are HYPE holders who stake their tokens to help secure the blockchain, validate transactions and take part in governance. The top 21 by stake make up the active validator set, which is responsible for proposing and confirming blocks on the network.

Currently, about 430 million HYPE tokens are staked on the network. Top validators include Galaxy Digital, Flowdex and the Hyper Foundation, which supports Hyperliquid’s development.

DeFi rises in 2025

Decentralized finance (DeFi) has continued to expand in 2025, with real-world asset tokenization and digital asset treasuries driving financial assets onchain.

According to DefiLlama, total value locked across all protocols has risen to $158 billion as of Tuesday, up from $117 billion in December, representing a rise of 35% in about nine months.

Memecoin trading, once left for dead, has seen a comeback with Pump.fun’s daily volume crossing $1 billion on Monday.

Analyst Austin Hilton has sounded a major XRP warning even as the price continues to consolidate. He declared that this is the last chance to get into the altcoin before its price goes on a parabolic run.

Last Chance To Get In On XRP Before Its Q4 Bull Run

In a YouTube video, Austin Hilton warned that this is the last chance for investors to accumulate XRP before its major bull run in the last quarter of this year. He noted that September was expected to be a slow month with little action from the altcoin, especially as investors wait on a Fed rate cut.

The analyst further remarked that the altcoin has even outperformed expectations this month, considering that it was able to reclaim the psychological $3 level and has held well above support levels. However, Austin Hilton predicts that a greater run lies ahead for the altcoin, with liquidity set to return in the fourth quarter from both retail and institutional investors.

Another bullish fundamental he alluded to is the fact that XRP is being taken off exchanges, which indicates that crypto whales are actively accumulating the token. This could lead to a supply shock, which could serve as a catalyst for higher prices. Bitcoinist reported that Coinbase’s reserves have crashed by 90% as whales move tokens off the exchange to hold for the long term.

Meanwhile, four major crypto exchanges, including Binance, saw massive demand earlier in the month, leading them to add 1.2 million coins to meet this demand. The CryptoQuant analysis that pointed this out noted that the demand might have been coordinated and might have come from institutions. This comes ahead of the potential XRP ETFs launch, which is bullish for the altcoin’s price.

Institutions Set To Flow Into The Altcoin With ETF Launch

Institutions are set to inject new capital into the ecosystem with the launch of the first spot XRP ETF, which is happening this week. REX Shares confirmed that its REX-Osprey XRP ETF (XRPR) is coming this week. It noted that this will be the first U.S. ETF to deliver investors spot exposure to XRP.

Bloomberg analyst James Seyffart stated that the REX-Osprey XRP ETF isn’t a “pure” spot ETF. He explained that it will hold spot directly and other spot XRP ETFs from around the world to get its exposure. The analyst also noted that the fund’s prospectus includes language that would allow it to invest in derivatives for exposure if needed. However, that won’t be the primary exposure method.

The spot XRP ETFs could get a SEC approval in October, which is another factor that could serve as a catalyst for higher prices for the cryptocurrency heading into the fourth quarter. Seven fund issuers are currently awaiting the SEC’s approval to offer a 100% spot XRP ETF.

At the time of writing, the XRP price is trading at around $2.97, down over 2% in the last 24 hours, according to data from CoinMarketCap.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up