Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bybit is delisting several coins, including BOB Token and DSRUN, which is set to occur on April 4, 2025. Delistings can cause price drops since they reduce accessibility for trading on a major platform. If a token loses significant trading volume, it can suffer decreased liquidity, making price recovery harder. Traders might sell off these tokens quickly to avoid holding an asset with fewer trading options. Thus, staying updated on follow-up announcements for any further trading support is crucial. For more details, check the source.

Bybit@Bybit_OfficialMar 29, 2025DSRUN, SPARTA, PTU, VEXT, BOB and SEILOR Delisting from #BybitSpot!

The Trading Pairs will be Delisted from the Bybit trading platform effective Apr 4, 8AM UTC and will no longer be supported.

Learn More: https://t.co/tBj06I6rET#TheCryptoArk #BybitListing pic.twitter.com/ADKf76TqjO

The Andromeda Vote for MultiversX (EGLD) is happening until April 7, 2025, following its testnet deployment. This proposal for a protocol upgrade (v1.9) could impact EGLD’s price as such improvements often drive interest and potential price increases. A favorable vote might boost community confidence and attract new investors looking for positive developments. Conversely, resistance or defeat of the proposal might yield the opposite effect. Traders should watch community sentiment during this period. For detailed information, please visit the source.

Multiversᕽ@MultiversXMar 28, 20251/ Andromeda: Testnet + Governance votehttps://t.co/YjfxFJu7gJ

Following the public testnet deployment, the proposal for Andromeda (v1.9) protocol upgrade is live for voting.

Open now to EGLD stakers, between Mar 28 - Apr 07. pic.twitter.com/VSmdP4WhJg

STP’s partnership with Allo for launching the Autonomous Worlds Engine on March 29, 2025, is promising due to its potential to enhance AI-driven applications and economic simulations. This collaboration could lead to advancements in tokenized worlds and onchain economies, possibly increasing STPT’s value through innovation. Such strategic partnerships may attract developers and investors intrigued by AI use in blockchain. However, without clear details on implementation success, the price impact might be speculative initially. To explore more about this partnership, see the source.

STP@STP_NetworkMar 29, 2025STP x Allo

We are proud to announce @allo_xyz as a launch partner for AWE (Autonomous Worlds Engine) to scale AI-driven Autonomous Worlds.

Together, we will explore:

• Running economic simulations around tokenized real-world assets

• Empowering AI Agents to experiment with… pic.twitter.com/rnkITyYHCD

Amid today’s market correction, Chainlink (LINK) has lost its recent gains, falling back to a crucial support level. An analyst suggests a monthly close above its current range could position the cryptocurrency for a 35% surge.

Chainlink Retest Crucial Price Zone

Chainlink has retraced 9.1% in the past 24 hours to retest the key $14 support zone again. The cryptocurrency surged 15.7% from last Friday’s lows to hit an 18-day high of $16 on Wednesday, momentarily recovering 35% from this month’s low.

However, the recent market correction halted the momentum of most cryptocurrencies, with Bitcoin (BTC) falling back to the $83,700 mark and Ethereum (ETH) dipping to the $1,860 support zone.

Today, LINK dropped from $15 to $14.07, losing all its Wednesday gains. Previously, analyst Ali Martinez noted that the cryptocurrency has been in an ascending parallel channel since July 2023.

Chainlink has hovered between the pattern’s upper and lower boundary for the last year and a half, surging to the channel’s upper trendline every time it retested the lower zone before dropping back.

Amid its recent price performance, the cryptocurrency is retesting the channel’s lower boundary, suggesting a bounce to the upper range could come if it holds its current price levels.

Meanwhile, Rekt Capital highlighted that the token is testing its multi-month symmetrical triangle pattern, which could determine the cryptocurrency’s next move.

As the analyst explained, Chainlink consolidated inside a “Macro Triangular market structure” for most of 2024 before breaking out of the pattern during the November market rally.

During the Q4 2024 breakout, the cryptocurrency hit a two-year high of $30.9 but failed to hold this level in the following weeks. As a result, it has been in a downtrend for the past three months, with LINK’s price falling back into the Macro Triangle.

“The main goal for LINK here is to retest the top of the pattern to secure a successful post-breakout retest,” Rekt Capital detailed, adding, “It’s possible this is a volatile post-breakout retest.”

LINK Needs To Hold This Level

Rekt Capital pointed out that, historically, Chainlink has had downside deviations into this price range: “Back in mid-2021, LINK produced a downside deviation into this price area in the form of multiple Monthly downside wicks.”

Nonetheless, the cryptocurrency is downside deviating “but in the form of actual candle-bodies closes rather than downside wicks” this time.

The analyst also highlighted that, like in 2021, LINK is trading within a historical demand area, at around $13-5 and $15.5, testing this zone as support. Based on this, the cryptocurrency must successfully hold this area to “position itself for upside going forward.”

Moreover, the retest is key for reclaiming the top of its triangular market structure. Breaking and recovering that level would “exact a successful post-breakout retest” and enable the price to target the $19 resistance in the future.

The analyst concluded that if LINK closes the month above the triangle top, it “would position price for a successful retest, despite the downside deviation.”

As of this writing, Chainlink trades at $14.09, a 6.9% drop in the monthly timeframe.

Flow is planning its first rollout in March, upgrading the chain with a new recovery mechanism for epoch handovers. The upgrade will occur with zero downtime, facilitating a smooth transition.

FLOW Info

Flow is a fast, decentralized, and developer-friendly blockchain by Dapper Labs, designed as the foundation for a new generation of games, apps, and the digital assets that power them. It is based on a unique, multi-role architecture, and designed to scale without sharding, allowing for massive improvements in speed and throughput while preserving a developer-friendly, ACID-compliant environment.

In contradistinction to Ethereum, which uses a proof-of-work (PoW) model, Flow employs a novel multi-level consensus architecture that enables high throughput without compromising decentralization. This separation allows different nodes in the network to perform distinct functions, thereby improving efficiency.

Flow also provides low-cost interaction for developers and users, making it an ideal blockchain for social and entertainment applications.

Flow (FLOW) is the primary utility token of the Flow blockchain, which can be used for network governance, transaction fee payments within the Flow network, and staking.

Metis Token is scheduled to host the “Metis BUIDL Hour: Seoul” event on April 17th in Seoul. The event is being organized in partnership with CoinEasy, Web3 Simplified, and LazAI.

Refer to the official tweet by METIS:

Metis🌿@MetisL2Mar 27, 2025🦉 Metis BUIDL Hour: Seoul

📅 April 17

📍 시뉴필름 in Seoul, South Korea

Hosted in partnership with @Coiniseasy and LazAI

Register here: https://t.co/vx6i59bt0V pic.twitter.com/xMSBJ8GZ8O

METIS Info

Metis is a Layer 2 Rollup platform built on the Ethereum network that aims to tackle some of the key challenges faced by the main net Ethereum — namely transaction speed, cost, and scalability. It achieves this by offering a framework for simple, rapid deployment of smart contracts within the network, thereby facilitating seamless and efficient operations on the Ethereum blockchain.

At the core of Metis’s offerings are several key features: Metis Oracles, Metis Nodes, and Metis SubGraph. Metis Oracles provide real-time data from external sources, connecting blockchains to external systems and supplying smart contracts with crucial outside information. Metis Nodes, which store a complete copy of the distributed network, enhance security and reliability. Lastly, the Metis SubGraph serves as an indexing protocol for gathering, processing, and storing data for use in the blockchain network, aiming to ease information retrieval through a service known as GraphQL. These combined features position Metis as a significant player in improving the functionality and performance of the Ethereum network.

METIS is an ERC-20 governance token compatible with the Ethereum blockchain network. The main use cases for the METIS token are paying transaction fees on the Metis network and staking.

Bitcoin (BTC) continues to trade above the $84,000 mark despite a slight decline in momentum this week. After briefly touching higher levels of nearly $90,000, the asset has seen a 3.3% decrease over the past day, bringing its current price to roughly $84,222.

While price volatility remains a short-term concern, Bitcoin’s broader trend shows signs of consolidation within this range. Amid the movement from BTC’s price, on-chain analysts are offering insights into Bitcoin’s behavior beyond the surface-level price action.

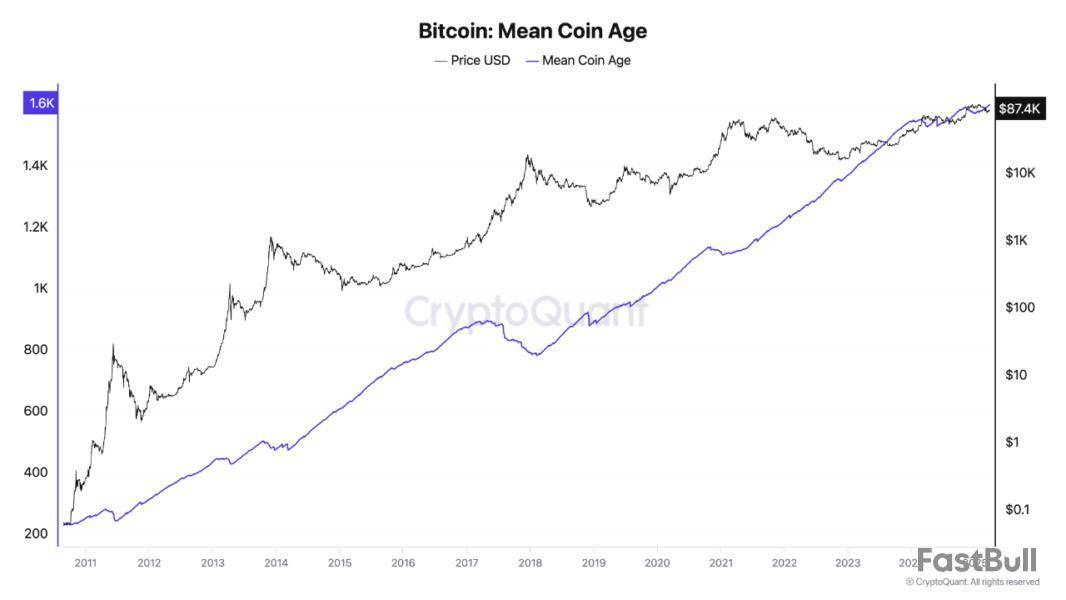

Bitcoin Mean Coin Age and Supply Dynamics in Focus

A recent analysis by CryptoQuant contributor Onchained points to Bitcoin’s Mean Coin Age (MCA) as a crucial metric for understanding current market sentiment. The MCA represents the average age of unspent transaction outputs (UTxOs), which can help reveal the behavior of long-term holders.

According to Onchained, Bitcoin’s recent upward momentum is not a product of short-term speculation or news-driven hype. Rather, it is being influenced by the strategic actions of long-term holders.

These participants typically acquire BTC during market downturns and hold through volatile phases, reducing the available supply and gradually increasing scarcity. This behavior creates conditions in which even moderate increases in demand can lead to stronger price responses due to reduced liquidity in the market.

With Bitcoin’s supply capped at 21 million, the accumulation of coins by long-term holders contributes to a tightening of supply. As these coins become increasingly illiquid, they apply upward pressure on price when demand strengthens.

This mechanism is a core feature of Bitcoin’s market dynamics and is viewed by some analysts as a signal of potential bullish continuation. Onchained wrote:

This illiquidity creates a supply-demand imbalance, contributing to upward pressure on prices when demand increases. As fewer coins are available for trading, the price becomes more sensitive to buy-side pressure, leading to stronger upward price movements.

Monitoring Behavioral Shifts for Market Signals

The analysis also highlights the significance of a sudden drop in MCA, which can indicate long-term holders are beginning to move their coins. Such behavior may signal changing sentiment, profit-taking, or reactions to broader macroeconomic conditions.

According to Onchained, “the movement of these coins from long-term holders can drive short-term volatility and is a signal that market dynamics are changing.”

Onchained emphasized that relying solely on public commentary or high-profile announcements—such as regulatory statements, ETF launches, or tweets from influential figures—may distract from the deeper, data-driven trends that govern Bitcoin’s performance.

Instead, the blockchain itself provides transparent insights into actual investor behavior, offering a clearer view of market conditions. The analyst noted:

The truth lies within the data itself. The blockchain speaks clearly and transparently, and it is through this data that we can understand bitcoin’s true movement. S.N architected Bitcoin to ensure that the financial information we need is open and accessible to all, so we can make informed decisions, not be misled by the stupidity of popular narratives. Let the data guide us, not the whims of outsiders who misunderstand what is truly happening.

Featured image created with DALL-E, Chart from TradingView

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up