Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Opinion by: Przemysław Kral, CEO of zondacrypto

The football transfer market has long been seen as a world of discrete backroom deals and negotiations. The transfer window brings immense excitement to supporters wanting to see how clubs prepare for the season ahead.

It’s not always smooth sailing, given the huge capital requirements and tight deadlines the clubs face to complete the deals. There is an option that could overcome these issues.The answer has come to the fore in recent years, and the football industry is beginning to embrace it.

Football has become a great partner to the crypto industry, with a rapid increase in sponsorship deals with football clubs making up 43% of all crypto sports sponsorships in the last year, roughly valued at $213 million, according to SportQuake.

There is an opportunity for clubs to take these partnerships even further by integrating blockchain technology into their financial systems to increase transparency and democratize access to the transfer market.

Football clubs have already proven that blockchain works

This isn’t an entirely foreign concept in football transfers. In 2018, cryptocurrency was first used for a transfer when Ömer Faruk Kiroğlu was bought by Harunustaspor for a fee partially paid in Bitcoin. Several transfers have since been completed by major clubs worldwide, including Inter de Madrid, São Paulo FC and Raków Częstochowa.

These transfers were all completed with reduced settlement times and bypassed numerous cross-border payments that could have stunted the transactions. The process is becoming simpler with the development of more efficient and regulated crypto-native payment rails.

The advantages don’t only apply to clubs — governing bodies, including UEFA, could also leverage regulated crypto payment rails to automate the release of performance-based rewards should clubs qualify for the Champions League.

Overcoming turbulent markets

Player transfers require vast amounts of capital; not only are the initial fees and add-ons in the multi-millions, but the settlement and transaction fees for cross-border payments often mean that lower league clubs struggle with access to the global market.

An early example was when São Paulo FC wanted to buy Giuliano Galoppo from Argentine side Banfield Athletic Club. Still, the sale was in trouble due to the turbulent Argentine FX market. This necessitated stablecoins, which São Paulo FC used to complete the transfer for a fee valued between $6 and $8 million in USDC.

While the transfer was later subject to Argentine export regulation, leading to the advantage gained by using crypto being negated, the example highlights the potential for blockchain technology to provide a fixed and reliable value amid turbulent financial markets.

As the economic world of football continues to expand globally, systematic modernization through a regulated, blockchain-powered framework could be the key to ensuring all clubs, regardless of size, market and location, have an equal opportunity to participate in the transfer market.

Winning deadline day

“Deadline Day” is the term used for the final day of the football transfer window, where clubs frantically attempt to finalize deals, often at the mercy of technology and bureaucracy. In 2015, a faulty fax machine thwarted former Manchester United goalkeeper David De Gea’s move to Real Madrid.

Cross-border payments between teams in different countries can take days (or sometimes weeks) to settle, creating a bottleneck that can hinder a transfer or risk clubs missing crucial deadlines. Bringing regulated crypto rails into play can allow transactions to be completed in minutes, highlighting the potential to de-escalate the hectic nature of deadline day.

The implications of introducing blockchain technology to the football transfer market go beyond beating the deadline day clock. Smaller clubs in emerging markets could benefit by democratizing access to faster, cheaper and more efficient rails. The worries of elongated settled times that risk jeopardizing crucial deals are minimized significantly, empowering teams to participate effectively in the global market and attract key talent.

The financial fair play ledger

Beyond democratizing access, crypto and blockchain could have a positive role in profit and sustainability rules or financial fair play. These rules aim to level the playing field in the transfer market but the penalties clubs face, such as point deductions, can be devastating to their seasons and supporters.

Blockchain technology could help boost transparency and make football transfers more equitable and seamless. By creating a so-called “Financial Fair Play Ledger” with all transfers and relevant financials onchain, transparency would be increased exponentially, and clubs would avoid falling prey to these rules and unnecessary penalties.

Crypto provides multiple solutions

Those cases are incidental, though; there’s a much wider field of opportunity here. Crypto payment rails can solve the most significant issues affecting the football transfer market by creating an overarching, regulated transfer market onchain. This could ensure clubs adhere to profit and sustainability rules more efficiently, enable smaller clubs to access the broader transfer market by slashing cross-border exchange fees, and overcome deadline day chaos by reducing transfer settlement times.

With more clubs embracing crypto sponsorship, there’s a significant opportunity for governing bodies to officially endorse blockchain technology and join them onchain. There is real potential for blockchain technology and cryptocurrencies to be leveraged as tools for more efficient (and cheaper) cross-border football transfers, leading to a positive, industry-wide impact on club finances, income sources and spending activities. For now, crypto is making its mark in the world of football and sport, through sponsorship, but also, increasingly, one lightning-fast transaction at a time.

Opinion by: Przemysław Kral, CEO of zondacrypto.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Coinbase's XRP has fallen almost 90% in just three months, according to new information from XRPWallets. At the beginning of the summer, the leading U.S. crypto exchange held around 970 million XRP in 52 cold wallets. Ten of these held 26.8 million coins each, and the rest held another 16.8 million combined. This made Coinbase one of the largest visible holders of XRP in the market.

But then something switched, and now, by the middle of September, only six cold wallets are still active, each with about 16.5 million XRP, leaving the total close to 99 million, a level not seen in years.

This is an 89.79% drop from June, which happened against the background of consistent transfers between Coinbase and unknown wallets all summer.

Whale Alert@whale_alertSep 13, 2025🚨 🚨 🚨 16,508,780 #XRP (51,425,879 USD) transferred from unknown wallet to #Coinbasehttps://t.co/kcZ7kaJTHc

One of those, like the 16.5 million XRP worth $51.4 million that moved into Coinbase, happened just this weekend, sparking further debate among traders.

Where XRP going?

Some may think that big companies and institutions like BlackRock might be buying XRP through Coinbase for their own customers, but nothing is known for sure.

The on-chain data only shows balances leaving the exchange, not where the coins go after they leave cold storage or how they might be used later.

Amid all this, XRP remains the third largest cryptocurrency after Bitcoin and Ethereum, with a market value of around $183 billion.

This makes it even more surprising that Coinbase's role in storing XRP becomes much smaller, as it raises questions about whether coins are being moved into new custody solutions, private vaults, or alternative trading routes.

Dogecoin is back on the radar, with a new price prediction by Ali Martinez suggesting the biggest meme coin is heading as high "up north" as $0.45, which would mean a nearly 50% jump from the price of DOGE right now.

DOGE is at around $0.292, which is already more than 6% up from yesterday. But what really matters is that the meme cryptocurrency finally broke above the $0.27 level that was stopping rallies all summer.

DOGE is consolidating above the breakout zone before climbing toward $0.39, $0.43-$0.45. Given that Dogecoin tends to surge quickly once key resistances turn into support, and with retail demand picking up again amid brand new Dogecoin ETF launch, it seems likely that the chart is set for another boost.

Ali@ali_chartsSep 14, 2025Dogecoin $DOGE may consolidate for a bit, then expect the next leg up toward $0.45! pic.twitter.com/uynq9IF4wd

Should Dogecoin ascend to $0.45, it will be back to where it was at the end of 2021. But this time, it will be coming off a longer base at around $0.20-$0.25, not a sudden spike, which makes the price behavior look more mature.

Bottom line

The thing that gives bulls confidence is holding the current floor, because past rallies often collapsed when DOGE failed to keep freshly conquered territory intact.

The idea is that the DOGE price will stay above $0.27, but if it dips back down, it will lose steam and probably return to previous years' range. For now, the bias is higher, and traders are keeping a close eye on September as the month that could set up the biggest meme coin's next big move.

The steady appreciation in the Ethereum price continues to mirror how resilient the cryptocurrency has become in the market. Despite the waves of skepticism experienced in the past, there seems to have been a recent major shift in investor behavior, which shows a level of optimism in the potential growth of the Ether token.

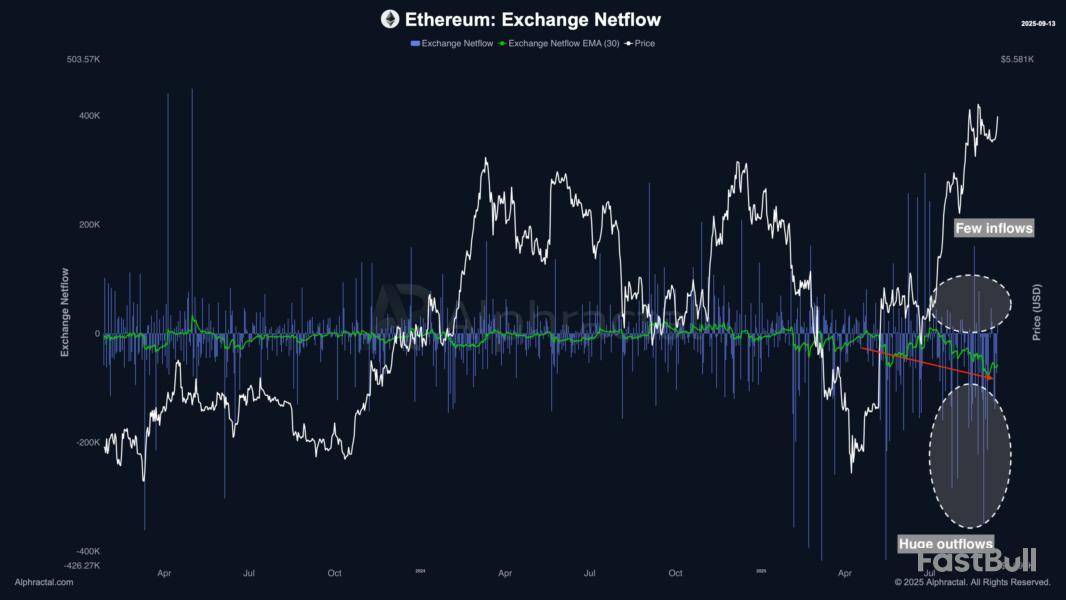

Ethereum Netflow Across Exchanges Consistently Negative

In a September 13 post on social media platform X, on-chain analyst Darkfost revealed how Ethereum’s investors have been acting behind the scenes over the past few months.

According to Darkfost, there has been a major shift in investor behavior since Ethereum’s last price drop from $4,000 to $1,500. At the time, the prevailing investor mood was fear, uncertainty, and doubt (FUD) — emotions which did not play so much of a role in affecting the long-term activity of investors.

Darkfost reported that the netflow across all exchanges has been “consistently negative” since the major Ethereum price drop; this means that more ETH is leaving exchanges than they are being deposited.

According to the on-chain analyst, around 56,000 ETH is being withdrawn daily over an average of 30 days. Interestingly, this figure has not been seen since the depths of the last bear market.

Recently, there have been days when more than 400,000 ETH were withdrawn. What is more interesting is that the exchange netflows have not turned positive since July.

As earlier inferred, this trend of token movement represents a shift in the holding behavior of Ethereum investors, as they move their assets off trading platforms to non-custodial wallets for long-term storage. Ultimately, this suggests that holders are becoming increasingly confident in the ETH’s long-term promise.

As of this writing, the Ether token is valued at around $4,660, reflecting no significant price change in the past 24 hours. According to data from CoinGecko, the price of Ethereum has increased by almost 10% in the past seven days.

BTC And ETH Reserves Drop 23% And 20% Respectively

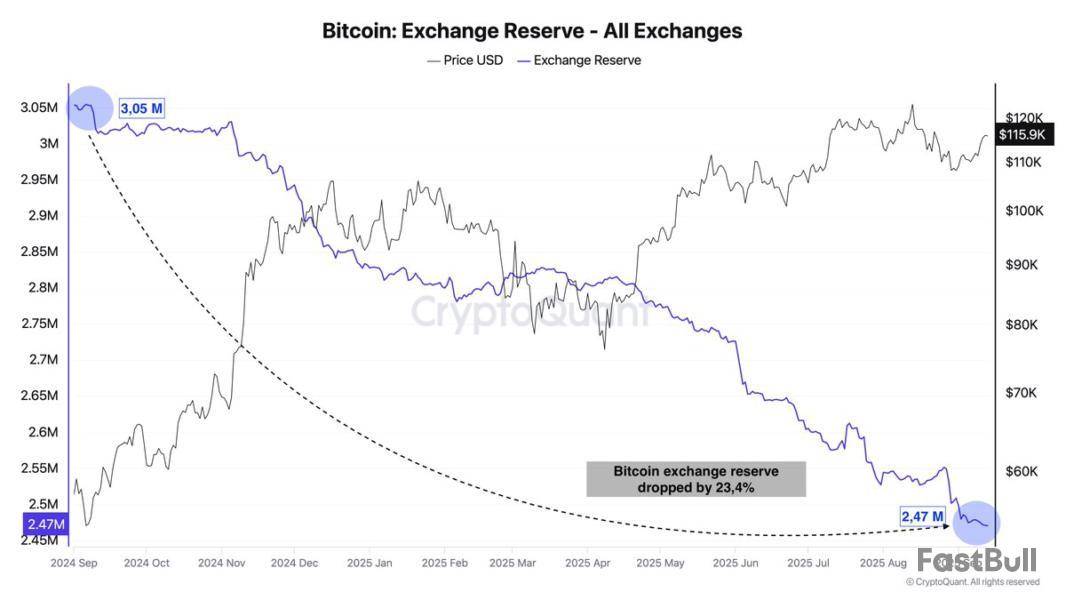

In a separate post, Darkfost analyzed the Bitcoin and Ethereum Exchange Reserve metrics across all exchanges and estimated how much of these cryptocurrencies have left exchanges in 2025.

According to the online pundit, Bitcoin reserves across all exchanges have dropped by almost a quarter of their total holdings since the year’s beginning. The BTC exchange reserves have dipped by 23% to about 2.47 million BTC from 3.05 million BTC as of January 1, 2025.

Ethereum exchange reserves, on the other hand, did not immediately start to decline until the month of May. As mentioned in the earlier post, ETH supply on exchanges began to fall following a reversal triggered by its fall to below $1,500. Over the last four months, Ethereum reserves have fallen to 17.1 million from 20.6 million, representing a 20% decline.

A significant decline in exchange reserves is often interpreted as a sign of accumulation among investors. This trend could be a bullish catalyst for the two largest cryptocurrencies, especially Ethereum, considering that the coin movement started more recently.

US President Donald Trump’s escalating attacks on the independence of the Federal Reserve are worrying investors. From pressuring Chair Jerome Powell to cut interest rates to firing Governor Lisa Cook, these measures have shaken investor confidence in American institutions and the US dollar.

According to Bitget, Jelly Labs, WeFi, and ZIGChain representatives, Trump’s moves represent historically uncharted territory in US monetary policy. They also believe that, while gold has always been around to soften the blow during times of uncertainty, investors may also begin to turn toward Bitcoin to safeguard their portfolios from government-controlled currencies.

Escalating Political Pressure on the Federal Reserve

Since assuming office, President Trump has carried out a series of attacks against the Federal Reserve over what he views as inadequate monetary policy.

Even before his inauguration, Trump had made a series of public comments urging Chairman Jerome Powell to lower interest rates and stimulate economic growth. In different social media posts, the President referred to Powell as “Mr. Too Late” and a “total and complete moron.”

These pressures on the central bank’s political independence have reached new heights recently. Last month, Trump announced the firing of Federal Reserve Governor Lisa Cook over mortgage fraud allegations.

Cook later filed a lawsuit against Trump, citing an illegal attempt to undermine the Fed’s independence. Two days ago, a US District Judge sided with Cook, temporarily blocking the administration from removing her. Trump has since appealed the decision.

Why This Time Is Different

History has shown that this isn’t the first time the US government has pressured the Federal Reserve over differences between the former’s political agenda and the latter’s monetary policy.

Former President Richard Nixon, for example, was determined to avoid the economic downturn in his 1972 re-election campaign that he believed cost him the 1960 election. Nixon’s conversations, later revealed in the Nixon tapes, show him urging then-Chairman Arthur Burns to lower interest rates and increase the money supply to stimulate the economy.

More famously, former President Lyndon B. Johnson physically shoved then-Chairman William McChesney Martin Jr. against a wall over the Fed’s decision to raise interest rates in the midst of the Vietnam War.

However, experts agree that the current level of intervention is unprecedented.

“In its 112-year history, no sitting US President has tried to remove a Federal Reserve Governor or the Chairman. The situation with Lisa Cook is highly polarizing as a US Judge has now blocked the President from removing the Fed Governor. The Trump administration is not known to back down from legal hurdles, and the country might not have seen the last of the Lisa Cook removal,” Bitget COO Vugar Usi Zade told BeInCrypto.

If the Trump administration wins its appeal, it would undermine the legal foundation of Fed independence, potentially causing the central bank to be perceived as a political tool.

Witnessing these developments, investors are asking a crucial question: What is the best investment strategy now?

How Is the Market Reacting to Attacks on Fed Independence?

Maksym Sakharov, CEO of WeFI, finds the recent attacks on the central bank particularly alarming because, instead of discreetly expressing dissatisfaction, the President is openly attacking the institution on social media for the world to see.

Investors have already taken note of this.

“For investors, this is a completely different ballgame because in the past, the market could largely dismiss political noise as just that— noise. But today the threats look credible, and markets are starting to price the risk of a compromised Fed,” Sakharov said.

Meanwhile, diminishing investor confidence in the US government will inevitably cause the dollar to suffer. If this contentious environment continues, the American economy will experience significant instability.

“If policymakers fail to take fiscal steps that restore confidence and instead continue policies that erode it, the consequences could be significant. We would likely see persistent inflation, rising bond yields as investors demand higher risk premiums, and growing pressure on the dollar’s status as the world’s reserve currency,” Jelly Labs Managing Director Santiago Sabater, said, adding, “This erosion of confidence will… widen wealth inequality, and deepen social and political polarization — potentially leading to periods of instability until the system resets.”

In fact, data is already showing that investors are reevaluating their trust in the US dollar.

The Global Shift Away from the US Dollar

Different market indicators have begun to show a growing trend among investors to reallocate their assets and diversify away from those tied to the United States.

Earlier this week, gold prices surged past $3,600 an ounce, setting a new record. As a traditional “safe haven” asset, this price increase demonstrates growing investor anxiety over economic and geopolitical instability.

Meanwhile, the bond market has also intensified this feeling of anxiety.

“We are already seeing a deeply inverted yield curve, which signals that the market expects economic stress ahead. If this is followed by rising long-term bond yields despite fiscal or monetary intervention, it would indicate a real loss of confidence in the Fed’s ability to control inflation,” Sabater said.

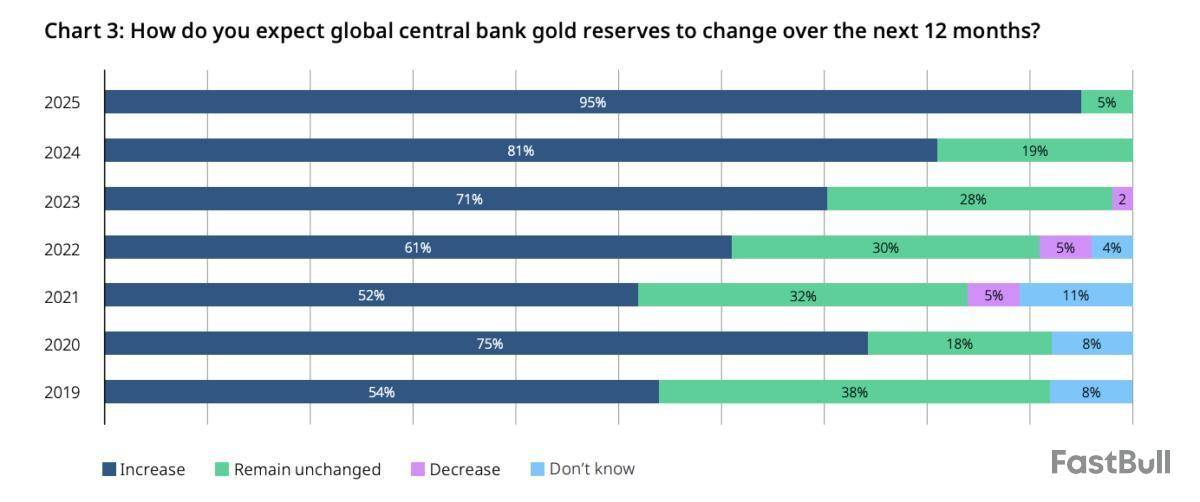

Central banks worldwide are on a significant gold-buying spree. A mid-2025 World Gold Council survey indicated that most central banks plan to increase their reserves.

In fact, for the first time since 1996, global central bank gold holdings have surpassed their US Treasury holdings. A key factor driving this trend is a strategic effort to reduce their dependence on the US dollar as the world’s primary reserve currency.

On a more personal level, investors have also begun to diversify their portfolios.

A New Monetary Era?

According to Sakharov, these recent developments could finally end the world’s “addiction” to the US dollar.

“For decades, the world has relied on the dollar as the global reserve currency. However, events of the past few years have shown this model lacks sustainability. The US has abused its position by printing trillions of dollars and using the dollar as a political weapon,” he said, adding, “I believe we might be on the cusp of a new monetary era— where the world is no longer reliant on a single currency, but on a basket of currencies and assets.”

Gold’s 5,000-year history as a vital hedge against risk is unparalleled. But now, a new and powerful alternative has emerged: Bitcoin.

Bitcoin and Gold: A Modern-Day Portfolio Diversifier

Experts are divided on whether Bitcoin will eventually replace or coexist with gold. However, they generally agree that Bitcoin possesses unique and valuable characteristics that no other asset can fully replicate.

“Gold is rising at the moment, underlining its role as a trusted hedge in uncertain times. Bitcoin adds a digital layer: it is decentralized, portable, and increasingly treated as ‘digital gold.’ Together, they represent a dual hedge– gold with centuries of credibility, and Bitcoin with the technology and infrastructure that align with how global finance is evolving,” ZIGChain Co-Founder Abdul Rafay Gadit told BeInCrypto.

He believes investors will undoubtedly consider these inherent benefits over the long term.

“Structural diversification is likely– less reliance on the dollar and greater adoption of tokenized, transparentfinancial infrastructure. Catalyst events and policy shifts will keep swinging sentiment between ‘pro-crypto’ optimism and caution, with the strongest flows concentrating in assets seen as safe havens, like Bitcoin and gold, rather than more speculative tokens,” Rafay Gadit added.

According to Sakharov, stablecoins will be the crucial link between traditional finance and digital assets.

“On the crypto side, track stablecoin inflows— price-pegged digital tokens that serve as a cash bridge into crypto. A sharp rise suggests money seeking shelter outside the banking system; from there, reallocating into Bitcoin is a short step,” he said.

These parallel trends suggest the rise of a new investor mindset.

Will the World Move Beyond the Dollar?

While economic crises and market instability are nothing new, the unprecedented speed of technological advancement is. These changes inevitably offer new ways to reimagine long-standing monetary systems.

Slowly but surely, Bitcoin’s properties have risen to the occasion, providing people an alternative way to manage their money—especially in contexts where instability reigns.

“It’s the only asset that is completely decentralized, global, and neutral. It’s the money of the people, for the people. When you can’t trust the people in charge, that becomes a very powerful thing,” Sakharov concluded.

The growing political and economic uncertainty in the United States could encourage a new approach to global finance that doesn’t depend on a single reserve currency. Although it’s still early, things seem to be moving in that direction.

In terms of revenue, Tron has surpassed almost all other blockchains, generating an incredible $1.142 million in a single day. To put this in perspective, Ethereum made $174,677, while Solana, which came in second, only made $175,708. Tron's revenue over the past 30 days has been $49.2 million more than three times Ethereum's $14.78 million and 10 times Solana's $4.61 million. Dominance is not a coincidence.

Tron's market dominance

A significant amount of stablecoin supply is hosted on Tron, which has emerged as the foundation of the USDT (Tether) ecosystem. Large volumes of transactions are driven by this one factor throughout the Tron network, which directly results in high fees and steady income. Because stablecoin transfers keep Tron's transaction throughput consistently high, it differs from most other chains in that activity only spikes during speculative rallies.DefiLIama">

Tron is not only surviving the current crypto cycle but flourishing, as evidenced by its on-chain traction. While Solana's speed draws developers and Ethereum remains the leader in smart contract innovation, Tron has established a distinct market niche by controlling stablecoin settlements. This dominance builds a strong moat against rivals and guarantees steady inflows. In terms of price, TRX has fared better than the larger altcoin market.

Massive revenue stream

The asset exhibits consistent strength while trading close to local highs, avoiding the sharp volatility observed in other tokens. Tron's valuation is supported by a favorable environment created by network adoption, consistent USDT inflows and high on-chain revenue. Ultimately, Tron has shown that usefulness and steady income are more important than marketing.

Tron is in a strong position to continue being one of the most lucrative and significant networks in the market as USDT solidifies its position as the most popular stablecoin in the world.

In early 2021, global remittance giant MoneyGram ended its high-profile partnership with Ripple Labs, citing challenges tied to the U.S. Securities and Exchange Commission’s (SEC) lawsuit against Ripple. The lawsuit, filed in December 2020, alleged that Ripple had conducted unregistered securities offerings through its sale of XRP.

At the time, MoneyGram had been one of Ripple’s most prominent partners, using RippleNet and XRP-based solutions for cross-border settlements. However, regulatory uncertainty made it impossible to continue.

𝗕𝗮𝗻𝗸XRP@BankXRPSep 12, 2025MoneyGram CEO Alexander Holmes on choosing Stellar: “Ripple’s product was very different.” The SEC lawsuit against Ripple was the main reason for ending the partnership, Stellar and Ripple can still complement each other in unique ways. pic.twitter.com/kVb8WBkkYR

“We had a great experience with Ripple,” said MoneyGram CEO Alexander Holmes in an interview with CoinDesk. “But with the changes and the challenge that the SEC put forward, it was very difficult for us to continue in that relationship. We both agreed to move on.”

Why Stellar Was the Next Choice

MoneyGram later turned to Stellar , a blockchain co-founded by Jed McCaleb, who was also one of Ripple’s original founders. According to Holmes, Stellar’s offering was fundamentally different from Ripple’s, with a focus on consumer-facing solutions and stablecoin integration.

“Ripple product was very different,” Holmes explained. “Ripple tends to focus on the back-end, cross-border funds flow through RippleNet. Stellar approached us with a front-end consumer model — the ability to operate between fiat and stablecoins. It was a great idea, and we wanted to be proactive and progressive in blockchain innovation.”

This shift allowed MoneyGram to pilot on/off-ramp services for USDC stablecoin, making it easier for consumers to convert between digital assets and fiat currencies across multiple countries.

“Stellar and Ripple can complement each other in unique ways,” Holmes said. “They both have strengths in bridging the gap between traditional finance and blockchain.”

XRP Growth Drivers Post-Lawsuit

After years of courtroom battles, the long-running Ripple vs. SEC lawsuit officially ended in August 2025. The resolution marked a turning point for the crypto industry and immediately lifted market sentiment.

With legal uncertainty finally behind it, Ripple is focusing on real-world adoption. Current growth is being fueled by:

The end of the lawsuit also removed a major source of selling pressure and chart manipulation, giving XRP more room to trade based on market demand and utility.

Price Performance

XRP has shown strength since the ruling. The token broke out from its previous range near $2.80 and climbed above $3.20. Meanwhile, Ripple continues to build momentum on the business front. The company recently extended its digital asset custody partnership with BBVA, adding a new retail service in Spain.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up