Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bittensor-focused crypto treasury firm TAO Synergies announced Monday that it entered into a securities purchase agreement to raise $11 million.

The agreement involves the sale of 11,000 shares of the company's newly issued Series E convertible preferred stock, according to the release. Each share has a stated value of $1,000, and is convertible into shares of TAO Synergies' common stock, at a conversion price of $8.

The participants of this purchase agreement include the company's existing investors, its own digital asset strategy advisor James Altucher and a new investor, DCG. The deal is expected to close on or around Oct. 15, 2025, given that the standard closing requirements are met.

"TAO Synergies' latest financing further supports its continuing strategic investments not only in TAO tokens, but also in potential opportunities to earn revenue and accrue additional TAO within the Bittensor ecosystem," said Altucher.

TAO Synergies, formerly biotech firm Synaptogenix, rebranded and changed its ticker to TAOX in June as part of its pivot toward a Bittensor-focused strategy. The firm previously said that it stakes all acquired tokens to earn network rewards on Bittensor.

Bittensor operates at the intersection of AI and cryptocurrency, functioning as a platform designed around incentive mechanisms. Users contribute intelligence to improve AI systems, receiving TAO tokens based on the utility of their input. The platform is open-access, facilitating permissionless coordination of AI development.

According to TAO Treasuries data, TAO Synergies is the largest publicly traded holder of Bittensor, holding 42,111 TAO worth over $18.2 million. There are two other Bittensor treasury companies, xTAO Inc. and Oblong.

While the announcement came after markets closed on Monday, TAO Synergies surged 38.46% on the day to $9.54. The company has a market capitalization of $33.27 million, and its stock has climbed 60% over the past month, according to Google Finance data.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoin price corrected losses and traded above the $114,200 level. BTC is now struggling and might face hurdles near the $116,000 level.

Bitcoin Price Faces Hurdles

Bitcoin price started a recovery wave above the $110,000 pivot level. BTC recovered above the $112,500 and $113,200 resistance levels.

The price climbed above the 50% Fib retracement level of the main drop from the $123,750 swing high to the $100,000 low. The bulls even pushed the price above the $114,000 resistance level. However, there are many hurdles on the upside.

Bitcoin is now trading below $116,000 and the 100 hourly Simple moving average. Besides, there is a bearish trend line forming with resistance at $119,250 on the hourly chart of the BTC/USD pair.

Immediate resistance on the upside is near the $115,000 level. The first key resistance is near the $116,000 level. The next resistance could be $118,150 and the 76.4% Fib retracement level of the main drop from the $123,750 swing high to the $100,000 low.

A close above the $118,150 resistance might send the price further higher. In the stated case, the price could rise and test the $119,250 resistance and the trend line. Any more gains might send the price toward the $120,000 level. The next barrier for the bulls could be $122,500.

Another Drop In BTC?

If Bitcoin fails to rise above the $115,000 resistance zone, it could start a fresh decline. Immediate support is near the $113,600 level. The first major support is near the $112,500 level.

The next support is now near the $111,200 zone. Any more losses might send the price toward the $110,500 support in the near term. The main support sits at $110,000, below which BTC might struggle to recover in the short term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $113,500, followed by $112,500.

Major Resistance Levels – $115,000 and $116,000.

An analyst has revealed the key Bitcoin charts that could be to keep an eye on while Bitcoin is slowly making recovery from its latest crash.

These Bitcoin Charts Could Be Ones To Watch

In a shock to the market, Bitcoin ended last week with a steep crash, falling from above $122,000 to below $110,000. The coin managed to make some recovery on Sunday, and that rebound has held so far into Monday.

However, while BTC appears to be rebuilding its structure, its direction remains unclear, as noted by CryptoQuant community analyst Maartunn in an X thread. Maartunn has shared a few key charts that could determine whether the recovery will hold or fade.

First, the analyst has revealed a chart that points out a similarity between the recent Bitcoin price action and the November 2021 bull market top.

As displayed in the above graph, BTC broke above its weekly resistance with the recent price rally, but immediately fell below the line after the crash. A similar failed breakout also took place back in November 2021. According to Maartunn, such a trend typically signals exhaustion.

On-chain data also suggests the cryptocurrency is currently trapped below a notable resistance level, as the chart for the UPRD shows.

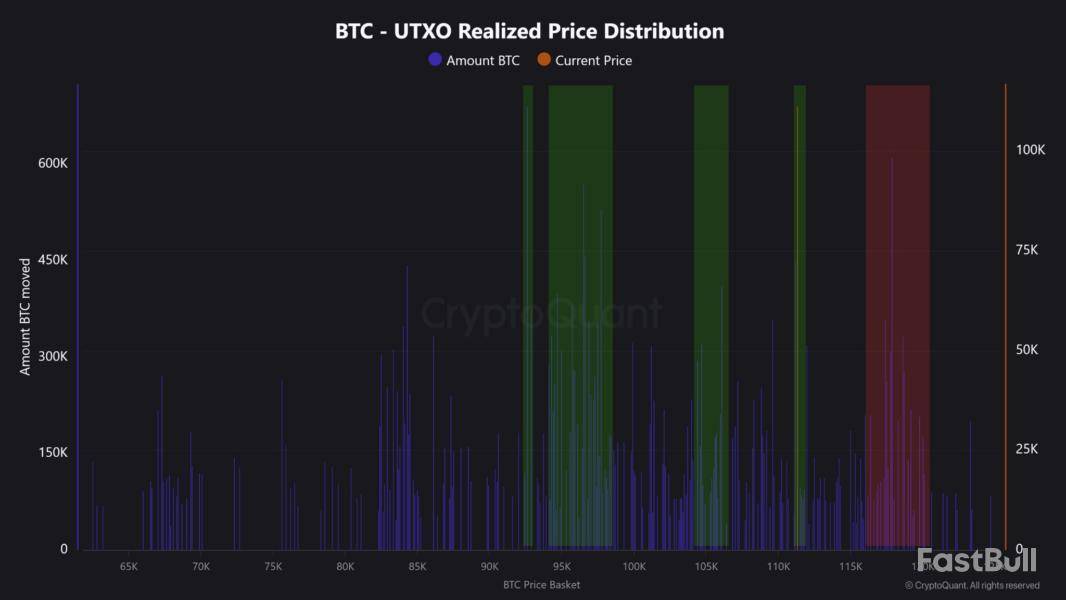

The UTXO Realized Price Distribution (URPD) here is an indicator that tells us about the amount of Bitcoin that was last purchased/transferred at the various price levels that the asset has visited in its history.

From the metric’s chart, it’s visible that a significant amount of supply has its cost basis between $117,500 to $120,000. The holders of these coins would naturally be underwater right now, so there is a chance that if BTC recovers to their break-even level, they might panic sell, fearing going into losses again.

Given the scale of the supply involved, selling pressure of this kind could be notable on a retest of the range, potentially making it a major resistance barrier for the asset.

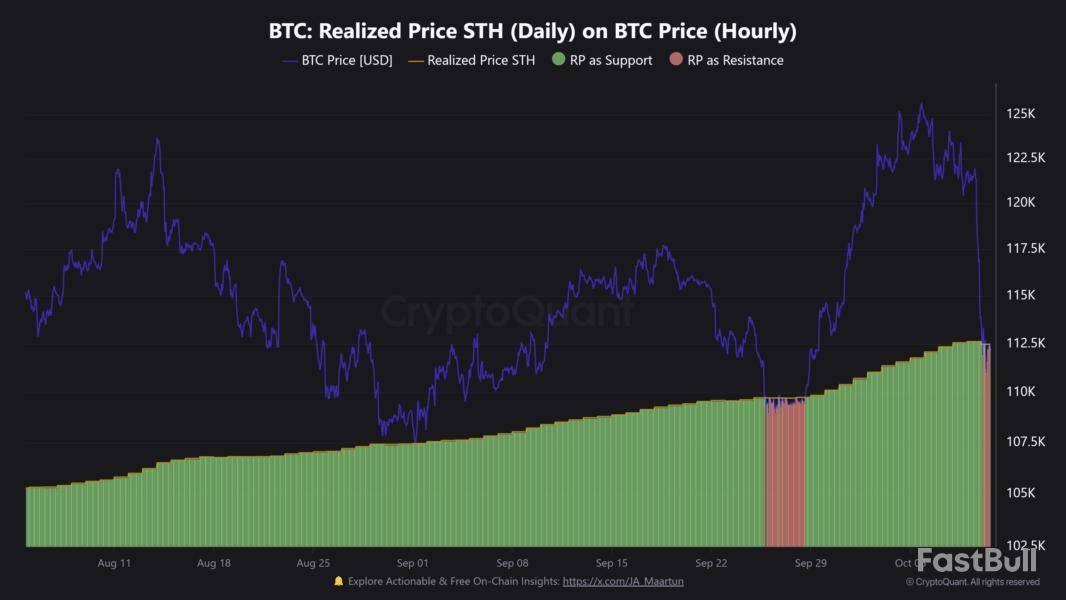

A support level that could be key is the average cost basis or Realized Price of the short-term holders (STHs).

The line has historically helped the asset find a rebound during bullish trends, with three instances of the trend occurring within the last six weeks alone. The analyst has warned, however, that conviction among the cohort is fading.

The Market Value to Realized Value (MVRV) Ratio suggests profitability among the Bitcoin STHs has been following a long-term decline, with the boundary level of 1 again being retested.

“If this level breaks, expect downside. If it holds, it confirms demand — but manage risk accordingly!” noted Maartunn in the thread.

BTC Price

At the time of writing, Bitcoin is floating around $114,100, down over 8% in the last seven days.

Ethereum is showing early signs of recovery after a dramatic sell-off on Friday that sent prices plunging to $3,450. The drop came amid what analysts describe as the largest liquidation event in crypto market history, wiping out billions in leveraged positions across major exchanges. While bulls briefly lost control during the panic, ETH has since begun to stabilize, with renewed buying interest emerging near key demand zones.

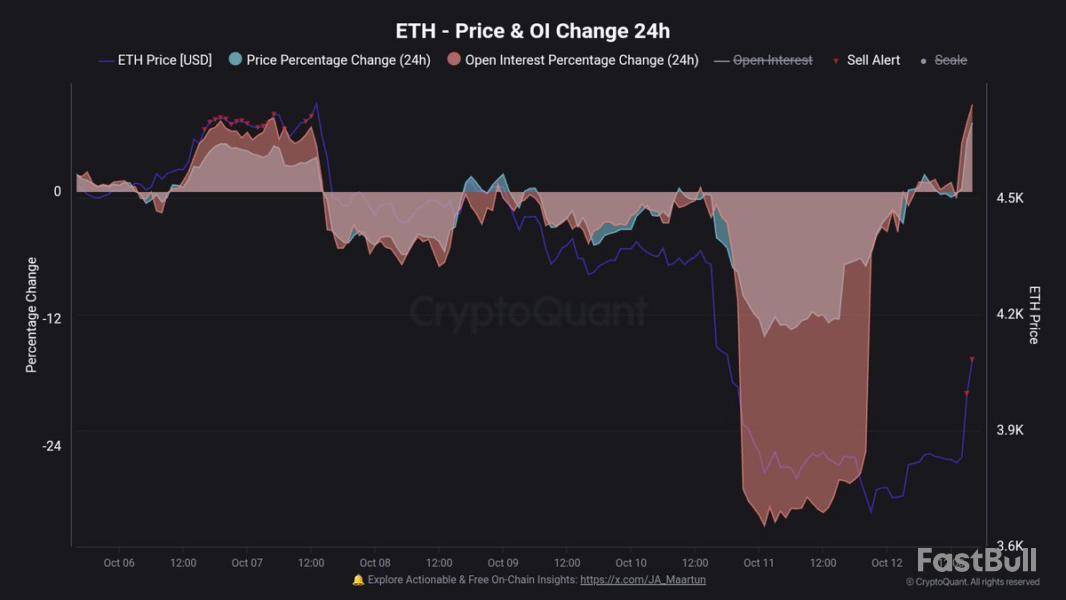

Onchain analyst Maartunn highlighted that leverage is once again building up on Ethereum, signaling that traders are returning to the market following the reset. According to his data, open interest on ETH surged significantly over the past 24 hours — a sign that speculative activity is resuming as volatility cools. This renewed leverage could set the stage for another decisive move, either fueling a short-term relief rally or inviting further liquidations if momentum fades.

The coming days will be crucial for Ethereum, as bulls attempt to reclaim the $4,000 level to confirm a sustainable recovery. Market sentiment remains cautious but optimistic, with onchain data showing large holders and institutions continuing to accumulate ETH despite recent turbulence — a potential signal of long-term confidence in the asset’s resilience.

Leverage Returns to Ethereum: A Risky Revival In Market Activity

According to Maartunn, Ethereum’s Open Interest has surged by +8.2% within the past 24 hours — a clear sign that leverage is flowing back into the market. This rapid rise comes just days after the largest liquidation event in crypto history, where overleveraged traders were wiped out during the sudden crash. Now, it seems many are trying to “trade their money back,” reigniting short-term volatility and speculation across exchanges.

Maartunn notes that while these so-called “revenge pumps” often create strong intraday rallies, they rarely sustain long-term momentum. Historically, around 75% of similar leverage-driven recoveries tend to revert, leading to renewed pullbacks once liquidity and funding rates normalize. Only about 25% manage to extend into lasting uptrends, typically when supported by fresh spot buying or renewed institutional inflows.

This data underscores the precarious balance Ethereum currently faces. The jump in Open Interest signals revived market participation, but also introduces the risk of another wave of forced liquidations if traders overextend their positions. For now, ETH’s short-term recovery remains largely fueled by derivatives activity rather than spot demand.

The next few days will be pivotal in determining Ethereum’s direction. If price holds above the $4,000 region with sustained volume, it could confirm that bulls are regaining control. However, a sudden drop in Open Interest or sharp funding spikes could signal that the rally is overextended — setting the stage for another correction.

Ethereum Rebounds, But Resistance Looms Ahead

Ethereum is showing a solid recovery after last week’s dramatic sell-off that drove prices down to the $3,450 level. The daily chart shows that ETH quickly rebounded from the 200-day moving average (red line), confirming it as a major area of demand. Price is now consolidating near $4,150, attempting to build momentum after a strong bullish candle on high volume — a potential sign that buyers are regaining control.

However, ETH faces immediate resistance near the $4,250–$4,300 zone, which coincides with the 50-day moving average (blue line). This area previously acted as strong support, and reclaiming it would be essential for confirming a shift back into bullish structure. The 100-day moving average (green line) is now flattening, reflecting the market’s cautious sentiment following the massive liquidation event.

If bulls manage to sustain price action above $4,000, the next targets lie near $4,500 and eventually $4,750. Conversely, failure to hold the 200-day MA could open the door to a deeper retest of $3,600 or lower. For now, Ethereum’s recovery remains technically constructive, but it must overcome these resistance levels to confirm that the recent rebound is more than just a short-term reaction to oversold conditions.

Featured image from ChatGPT, chart from TradingView.com

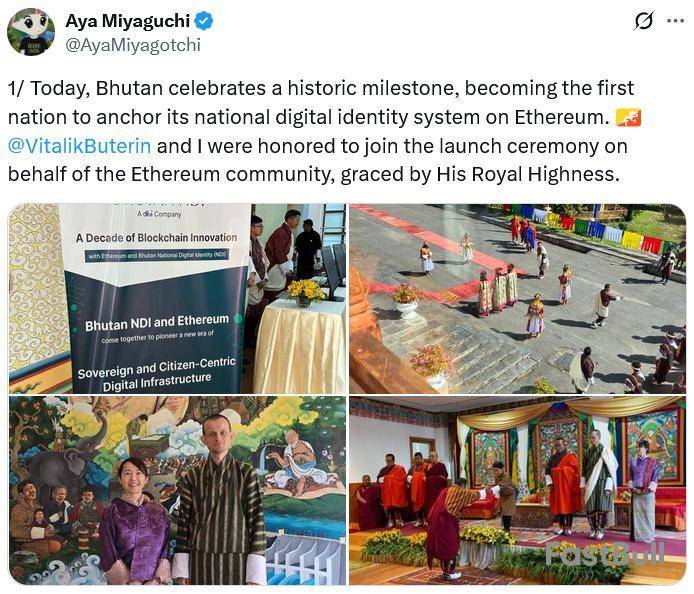

The South Asian nation of Bhutan is migrating its self-sovereign ID system to Ethereum from Polygon, allowing its nearly 800,000 residents to verify their identities and access government services.

The integration with Ethereum has been completed, while the migration of all resident credentials is expected to finish by the first quarter of 2026, according to Ethereum Foundation President Aya Miyaguchi, who joined Ethereum co-founder Vitalik Buterin at the launch ceremony with Bhutan’s Prime Minister, Tshering Tobgay, and Crown Prince, Jigme Namgyel Wangchuk.

“It’s deeply inspiring to see a nation commit to empowering its citizens with self-sovereign identity,” Miyaguchi posted to X on Monday, adding that the Ethereum integration was a world-first.

Integrating a blockchain-based solution into a government’s national ID system has long been touted as a promising crypto use case, due to its immutability, transparency, and privacy features, particularly when zero-knowledge proofs are implemented.

Ethereum is Bhutan’s third blockchain national ID solution

Bhutan previously ran its national ID system on Polygon from August 2024 and Hyperledger Indy before that. Brazil and Vietnam are among the few other countries that have partially integrated blockchain-based self-sovereign identity solutions to date.

Miyaguchi noted that Bhutan’s National Digital Identity and GovTech teams played a crucial role in the Ethereum integration, as well as other contributors in the Bhutan crypto community.

Bhutan has been stacking Bitcoin

Bhutan — a country that measures national progress by Gross National Happiness — has quietly become a leader in crypto adoption in recent years. It is currently the fifth-largest Bitcoin-holding nation-state, having amassed its holdings through mining using renewable energy at its Himalayan hydropower dams.

It currently holds 11,286 Bitcoin worth $1.31 billion, trailing only the US, China, the UK, and Ukraine, BitBo’s Bitcoin Treasuries data shows.

Bhutan may also be exploring other crypto initiatives, having met with former Binance CEO Changpeng Zhao in late September — though the details of their discussions were not disclosed.

XRP has made one of the most spectacular recoveries in recent months, just as traders were preparing for a protracted decline. This move has the potential to completely change the perception of the asset.

After a severe crash last week that destroyed almost 60% of XRP's value in a single day, the token has risen sharply from its lows, regaining important technical levels and surprising market observers who had previously written it off.

Following a flash bottom below $2.00, XRP is currently trading at about $2.55. The strength of this recovery raises the possibility that what at first appeared to be a complete surrender was actually a liquidity flush, a violent shakeout that removed overly leveraged positions and gave the market time to recover. Chart by TradingView">

Since it has acted as both a magnet and a barrier for XRP's price action throughout 2025, the 200-day EMA is currently the site of the most significant technical battle. A retest of the $2.90-$3.00 resistance zone, which is the upper trendline of its descending wedge formation, may be possible if XRP is able to break and hold above the 200 EMA and confirm a midterm bullish reversal.

After several compression stages, these structures typically resolve with a breakout, and XRP's sharp volume spike suggests that momentum might be building. However, there is potential for a rally, but the RSI is cautioning of lingering volatility as it recovers from oversold territory while staying below neutral.

In order to verify that this move is real and not just a short-covering bounce, there must be consistent volume and daily closes above $2. As of right now, the market’s sentiment has changed from one of hopelessness to one of curiosity. If this trend keeps up, XRP's recovery may turn out to be one of the most remarkable and surprising in its history.

Bitcoin in control

Bitcoin has once again demonstrated its control over the cryptocurrency market by easily breaking through the resistance level of $115,000, which used to serve as a psychological ceiling for traders. This action demonstrates Bitcoin’s capacity to bounce back from turbulence and sustain upward pressure, despite the cautious sentiment of the larger market.

After recovering from its 200-day moving average close to $108,000, Bitcoin has demonstrated incredible strength and is currently trading between $114,300 and $115,500. The current rebound highlights the zone’s significance in Bitcoin’s continuous bull structure, as it has historically been a strong support area during medium-term corrections.

The next major obstacle, however, is located only a few thousand dollars higher at about $116,000, where strong liquidity clusters and short-term sell orders start to accumulate, even though there was a clean break above that level. Experts caution that this area might serve as a reversal zone, causing short-term profit-taking before Bitcoin starts to rise more broadly again.

The market structure is still firmly bullish, though. The RSI is still hovering just below overbought levels, suggesting that there is still space for Bitcoin to grow before exhaustion sets in, while the 50-day EMA is curving upward once more, indicating renewed momentum.

The $120,000-$122,000 range, a historically significant zone that has previously sparked aggressive corrections, would be the next logical target if Bitcoin is able to maintain momentum and absorb liquidity above $116,000. Bitcoin may see a fresh push toward its all-time highs if a confirmed close above that level occurs.

Simply put, Bitcoin’s most recent movement serves as a reminder of its tenacity: whereas most assets find it difficult to gain traction, BTC keeps tearing through resistance levels with ease. The $116,000 liquidity wall could be the beginning of Bitcoin’s next significant breakout, or it could just be a temporary pause.

Shiba Inu zero addition canceled

Shiba Inu was on the verge of adding another zero to its price following a violent sell-off that rocked the cryptocurrency market as a whole. This would be a symbolic but psychologically damaging threshold for both retail and institutional holders.

However, for the time being, SHIB seems to have escaped the fatal slip despite the extreme pressure and the cascading liquidations across exchanges. Shiba Inu is now trading at about $0.0000109, having recovered significantly from the intraday low that almost fell below the crucial $0.0000100 threshold. That level is a deep support zone created during the accumulation phase of 2023, in addition to being a technical line in the sand.

Buying activity has historically increased in response to SHIB testing this area, resulting in brief relief rallies. The asset quickly recovered lost ground during the crash, even though it briefly fell into adding-zero territory. This was made possible by traders looking for a rebound and short covering.

More significantly, the volume profile indicates that the majority of participants were hesitant to sell below this range, suggesting deep underlying interest and a brief exhaustion of bearish momentum. The asset continues to trade below all significant moving averages, including the 200-day and 100-day EMAs, indicating that macro resistance is still present.

To test its current stabilization, SHIB may retest lower levels if momentum wanes around $0.0000120-$0.0000130. However, SHIB might hold the line as sentiment gradually returns to normal and the overall market exhibits signs of recovery.

Even after one of the market’s most severe flash crashes, the refusal to add another zero shows resiliency and indicates that the community’s speculative energy is still alive and well. In summary, Shiba Inu is not adding a zero just yet, which is a win in this market.

By Sam Kessler, Shane Shifflett and Caitlin Ostroff | Graphics by Rosie Ettenheim

President Trump's surprise announcement of 100% tariffs against China on Friday triggered a cryptocurrency selloff that wiped out more than $19 billion in leveraged positions. Two accounts that placed bets against the market minutes before the news broke scored a $160 million windfall.

Bitcoin dropped 12%, forcing liquidations that triggered even more selling, pushing prices lower. Less popular tokens saw declines as steep as 80%. CoinGlass, a crypto data platform, noted that the scale of the selloff is likely underreported, as many platforms don't publish liquidation data.

While crypto has fallen before, analysts said the sharp downturn exposed the extreme leverage that had fueled a monthslong rally, which began after the election of an administration seen as friendly to the industry.

Last week's plunge also highlights how closely these markets are now intertwined with geopolitics — and how their prices respond to policy decisions from an administration whose members hold large stakes in the very assets they're affecting. The token for World Liberty Financial, a crypto project backed by President Trump and his three sons, fell by more than 30% on Friday.

Ahead of the selloff, two accounts on Hyperliquid, a decentralized exchange that allows investors to make leveraged bets on future crypto prices, placed massive bets that bitcoin and ether would fall. By day's end Friday, the positions were closed for $160 million in profit.

The timing of the trades — the last of which was placed just a minute before Trump's tariff announcement — sparked speculation on social media that they may have been informed by insider information. However, the bets were placed after Beijing announced new restrictions on the export of rare-earth minerals — a move that ultimately prompted Trump's tariff response.

The identity of the trader or traders remains unknown. Hyperliquid didn't respond to a request for comment.

Write to Sam Kessler at sam.kessler@wsj.com, Shane Shifflett at shane.shifflett@dowjones.com, Caitlin Ostroff at caitlin.ostroff@wsj.com and Rosie Ettenheim at rosie.ettenheim@wsj.com

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up