Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitget said it will upgrade its exchange token, BGB, to the native asset of the Ethereum Layer 2 blockchain, Morph, where it will serve as both gas and governance, while preserving all existing exchange utilities, such as fee discounts and Launchpool access.

The “exclusive strategic partnership” aims to push BGB on-chain and broaden its role beyond the exchange. Morph, meanwhile, highlighted Bitget and Bitget Wallet’s combined 120 million users as a distribution channel while promising performance upgrades, faster settlement, and a push into consumer “PayFi” use cases.

Morph touts itself as a consumer-oriented Layer 2 network designed to lower costs and speed settlement for retail-style dApps. As of today, Morph holds roughly $18 million in total value locked, according to DefiLlama.

As part of the shift, 440 million BGB, worth approximately $2.3 billion and governed by Bitget, was transferred to the Morph Foundation. Of that amount, 220 million was destroyed immediately, and the remaining 220 million is locked with a 2% monthly unlock for liquidity, ecosystem, and education initiatives, the crypto exchange said on X.

The Morph Foundation will also revise BGB’s burn mechanics to link reductions to onchain activity with a long-term target of shrinking total supply from 1.1 billion to 100 million. Trading on Bitget and in Bitget Wallet will continue to support BGB through the transition, the team added.

Karry Cheung, CEO of Bitget Wallet, also said to expect more collaborations between both projects over the next year. "Over the next 12 months, we will see an acceleration of BGB migration onto Morph Layer and deeper partnerships between Morph and Bitget Wallet."

Bitget describes BGB as a utility token launched on Ethereum in 2021 that powers trading fee discounts, Launchpool access, and staking programs. The exchange has previously executed large burns and adopted a recurring buyback-and-burn policy tied to activity, promising to cut total supply by 40% with quarterly burns.

Price reaction was positive following the Morpho partnership news. BGB rose about 15% intraday after the announcement, according to The Block’s price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

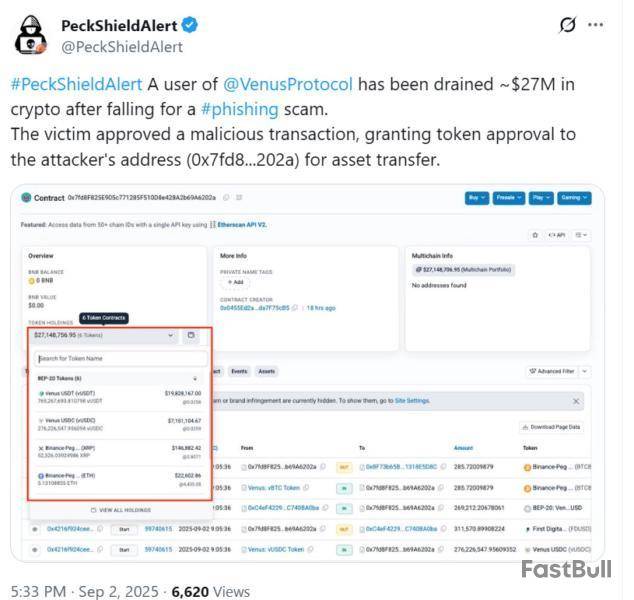

A decentralized finance (DeFi) trader lost $27 million in crypto after falling victim to a phishing scam, according to blockchain security firm PeckShield.

PeckShield reported on Tuesday that a user of the DeFi lending platform Venus Protocol saw crypto assets worth $27 million disappear in a phishing attack.

A phishing attack is a type of scam where attackers trick victims into granting malicious permissions or revealing sensitive information by pretending to be a legitimate source. In this incident, the user approved a malicious transaction, allowing the attacker to drain stablecoins and wrapped assets from its balance.

Onchain data suggests that the compromised wallet held about $19.8 million in Venus USDT (vUSDT) and $7.15 million in Venus USDC (vUSDC), which were siphoned after the user signed the malicious approval.

Venus Protocol pauses protocol to investigate

Venus Protocol’s official social media account responded to community concerns in an X thread, confirming there was no flaw in its smart contracts.

When a user asked if this was due to the user’s mistake, Venus said it was likely the case. However, Venus said that as a precautionary measure, it would pause the protocol to conduct security reviews.

“Right now, yes, that appears to be the case. We will keep everyone updated as we investigate,” Venus Protocol wrote. “Protocol is paused while security reviews are underway.”

Hackers ramp up attacks as September starts

The recent phishing attack adds to a list of criminal efforts to steal crypto at the start of September. On Tuesday, World Liberty Financial’s (WLFI) governance tokenholders were hit by a known phishing wallet exploit, according to SlowMist founder Yu Xian.

On the same day, decentralized exchange (DEX) Bunni paused all its smart contract functions in response to a security exploit in its Ethereum-based smart contracts. Security company BlockSec Phalcon estimated that the protocol lost about $2.3 million in the attack.

The attacks that started at the beginning of September follow millions in losses the previous month. In August, crypto attacks led to over $163 million in losses across 16 attacks. Kronos Research CEO Hank Huang told Cointelegraph that crypto exploits often increase as prices rise.

Amplify Investments has filed with the U.S. SEC to launch the first-ever XRP Spot Income ETF. If it gets approved, this fund could let regular investors earn money from XRP without ever buying the coin directly.

So what is it, how does it work, and is it safe? Let’s break it down.

What Exactly Is This ETF?

Think of it as a shortcut. Instead of buying XRP yourself, this fund would track XRP’s price and also pay you income on top. According to the filing, 80% of the fund will be tied to XRP’s value. But here’s the twist: it won’t hold the coin directly. Instead, it will use products linked to XRP, like exchange-traded products and options.

bill morgan@Belisarius2020Sep 02, 2025This is my take on the spot income XRP ETF application filed by Amplify this week and why it matters (if approved).

Who is Amplify

This is an investment management firm that has launched more than 70 ETFs in the USA and has $12.6 billion worth of assets in its suite of ETFs.… pic.twitter.com/4NxG0u8HDU

Crypto lawyer Bill Morgan summed it up well: “As I understand the product, it does not require Amplify to acquire and custody XRP itself but provides for 80% of the portfolio to be of assets tied to XRP’s value, such as options or derivatives.”

Where the “Income” Comes In

The secret sauce is a covered call strategy. In simple terms, the fund bets on XRP’s movements and earns premiums by selling options. Those premiums are then passed on to investors as income.

So instead of just riding XRP’s roller coaster, holders of the ETF could receive a steady stream of returns, even if the token’s price is choppy. The trade-off is that upside potential gets capped if XRP surges, but the income cushion helps soften the blows during quieter periods.

When Could It Launch?

Amplify wants to list the ETF on the Cboe BZX Exchange, possibly as early as November 2025. But nothing is certain until the SEC signs off. The SEC’s full review process can last up to 240 days to make a final decision on cryptocurrency ETF applications, starting from the initial filing date.

Right now, the Commission is also reviewing applications for Solana, Dogecoin, XRP, and others from big names like Grayscale, 21Shares, and CoinShares.

FAQs

What is the Amplify XRP Spot Income ETF?It’s a fund that would let investors gain exposure to XRP’s price and earn income through a covered call strategy, all without directly owning the token.

How does the ETF generate income?The fund uses a covered call strategy, selling options on products linked to XRP. It then passes the premiums earned from these sales to investors as income.

When could the ETF launch?If approved by the SEC, it could list on Cboe BZX by November 2025. The SEC’s review process may take up to 240 days from filing.

How does this differ from other crypto ETFs?It focuses on income generation via options, not just price tracking. It also avoids direct crypto custody, using derivatives for regulatory simplicity.

Delysium (AGI) will soon show its new community governance plan. When a crypto project gives more power and voice to holders, it can create strong trust and attention. Good governance usually attracts long-term buyers and can help price grow. But if the plan is not clear or lacks good ideas, prices may drop. Investors will watch the details closely, looking for positive changes or special rewards for those who help the community. This event is important, but price impact depends on how strong and clear the new plan is. source

Delysium - $AGI@The_DelysiumSep 01, 2025Delysium September Calendar

What’s Scheduled:

Sep 2 – Trip Cost‑Optimizer Agent use case goes live on https://t.co/oWebq2Tzl7

Sep 9 – Governance DAO Agent use case goes live on https://t.co/oWebq2Tzl7

Sep 16 – Trend Finder Agent use case goes live on… pic.twitter.com/u2IoC5by6L

When Kraken lists a new token like Quack AI (Q), many traders get interested. Kraken is a big, trusted crypto exchange, so a new listing often makes price move up. It can bring more users and money to Quack AI. With more buyers able to trade Q easily, there might be strong demand, especially if Quack AI is popular or new. But price moves depend on market feeling and general crypto trends. Not all new listings lead to lasting gains, so traders should be careful and watch the launch closely. source

Kraken@krakenfxSep 01, 2025Coming soon to Kraken: $Q

AI meets governance powered by @quackai_ai

Deposit today ️ https://t.co/optcwJJPU3

️ Trading starts September 2 at ~8AM UTC

*Geographic restrictions apply pic.twitter.com/beIWuNUZaD

Quack AI (Q) will also be listed on Gate.io, a top trading platform. Listings on major exchanges often bring more attention and new traders. This can help make trading Q easier and sometimes moves the price up strongly, thanks to extra liquidity and buy interest. Since this Gate.io listing happens the same day as the Kraken launch, price swings could be even bigger. But if too many people try to sell at once, gains may not last. As always, price depends on market excitement and long-term faith in Quack AI. source

Gate@GateSep 01, 2025Gate New Listing: $Q @QuackAI_AI

Trading Starts: 08:00 AM, September 2nd (UTC)

Trade: https://t.co/Gf8YWyiJQN

One of the biggest mysteries in finance is not just who Satoshi Nakamoto is—it’s why the anonymous creator of Bitcoin, who sits on one of the largest personal fortunes in history, doesn’t appear on any billionaire rankings.

Forbes, the publication that made “The World’s Billionaires” list a cultural touchstone, has quietly drawn a line in the sand—and it may say more about them than it does about Satoshi Nakamoto.

Forbes’ Billionaire Rankings Cling to Old Rules of Identity and Paperwork

As of this writing, Bitcoin is trading for $110,302. Therefore, Satoshi Nakamoto’s dormant stash of 1.1 million BTC is worth more than $121 billion, almost enough to rival the fortunes of Elon Musk and Bernard Arnault.

Yet, Satoshi’s name is absent from Forbes’ billionaire rankings. The reason?

“Forbes does not include Satoshi Nakamoto on our Billionaire rankings because we have not been able to verify whether he or she is a living person, or one person vs. a collective group of people,” the magazine told BeInCrypto.

That explanation reveals the central flaw in how wealth is measured today. In an age where assets can be provably tracked on-chain, Forbes clings to a framework rooted in identity, legal structures, and corporate filings.

Satoshi is not excluded because the wealth isn’t real. Rather, because the wealth does not fit the story Forbes is used to telling.

Satoshi’s Ghost Fortune Exposes the Cracks Amid the Identity Trap

Forbes is not anti-crypto. Its rankings regularly include exchange founders such as Changpeng Zhao (CZ), token billionaires like Justin Sun, and institutional players.

“Forbes factors in known crypto holdings in all wealth valuations. Forbes treats crypto like any other asset: If a person owns a crypto business, we value the business. If he or she has personal crypto holdings, we value those based on their market prices,” the magazine added.

However, Forbes’ methodology is still tethered to a 20th-century assumption, where wealth must be tied to a face and a filing cabinet.

Offshore trusts, shell companies, and anonymous corporate structures do not prevent billionaires from being ranked because there is ultimately a legal entity to which they are tied.

With Satoshi, there is no name, passport, or paper trail; only a set of keys on a blockchain. The assets are more transparent than most fortunes in the Forbes list, yet somehow, they are treated as less legitimate.

Previous attempts to reveal the identity of the pseudonymous Bitcoin creator have flopped. This includes theories from an HBO documentary, which proved very controversial. Individuals like Nick Szabo, Peter Todd, and Craig Wright also presented as likely candidates.

Justified or Outdated? Experts Debate Forbes’ Stance

Not everyone believes Forbes is wrong. Bryan Trepanier, Founder & President of On-Demand Trading, argues that exclusion is simply common sense.

“It is justified. An anonymous figure with dormant wallets cannot be fairly compared to an individual who actively exercises wealth,” Trepanier told BeInCrypto.

According to Trepanier, a better approach would be for Forbes to create a list of the largest wallets and their holdings. He says this would give recognition without misrepresenting ownership.

For Trepanier, the fact that Satoshi’s wallets have been frozen in time for more than a decade undermines the claim that this is usable wealth.

“Wealth isn’t just about what is held, it’s about what is exercised. Unless and until those coins move, Satoshi’s holdings are more a symbol of crypto’s origins than an active fortune in the real world,” he stated.

That argument resonates with those who see billionaire rankings as more about economic power than raw account balances.

Yet others see Forbes’ position as increasingly untenable. Mete Al, Co-founder of ICB Labs, says the refusal to acknowledge Satoshi reflects a blind spot.

“Forbes is still working within the framework of traditional finance (TradFi), where wealth is tied to a legal entity, a name, or a bank account. But blockchain has changed that reality. Excluding Satoshi highlights the gap between how media outlets measure wealth and how value is actually stored and proven today,” Mete Al told BeInCrypto.

Mete Al points out the irony that many billionaires hide wealth behind opaque legal structures and offshore accounts, yet still make the Forbes list.

By contrast, Satoshi’s coins are visible to anyone with a blockchain explorer.

“Why should Satoshi be treated differently?” he posed.

Elsewhere, Ray Youssef, CEO of NoOnes, says that Forbes’ methodology goes beyond missing the point.

According to Youssef, Forbes’ approach risks irrelevance because wealth today is no longer just tied to traditionally recognized assets

“With the rise of the digital age and decentralized economy, wealth can now exist pseudonymously on-chain and be fully verifiable. Satoshi Nakamoto’s story illustrates the fundamental change that the decentralized era brought into existence,” Youssef said in a statement to BeInCrypto.

Youssef warns that by refusing to adapt, legacy outlets risk ceding credibility to Web3-native media that already track digital wealth with nuance.

Measuring Power in the Digital Era

Satoshi’s absence also conceals just how much influence pseudonymous wealth already exerts. A single transaction from Nakamoto’s wallets would dominate headlines and rattle markets in a way few corporate announcements could.

According to Mete Al, ignoring them doesn’t make their influence disappear. Rather, it blinds mainstream audiences to how much power crypto represents today.

Web3 expert and BestChange ambassador Nikita Zuborev echoed the sentiment in a statement to BeInCrypto.

“Forbes’ choice makes sense if you stick to the traditional rules: their billionaire lists are all about identifiable individuals, and with Satoshi, we just don’t know if it’s one person or a whole team. But it also shows how old-school ideas of wealth don’t always match the digital world,” Zuborev explained.

So what comes next? Even skeptics like Trepanier suggest Forbes could publish supplemental lists of the largest wallets and balances.

Some propose sidestepping the identity issue while acknowledging the scale of digital wealth.

Beyond satisfying crypto’s demands for recognition, that hybrid approach would bring transparency to a growing asset class and help the mainstream understand just how much value circulates outside traditional systems.

“They either evolve or risk new institutions coming in to create rivaling methodologies that would factor in the growing nature of wealth in the digital era,” Youssef warned.

Why It Matters

At first glance, Satoshi’s exclusion seems like a quirk of methodology. However, looking closer, it becomes a symbol of the battle between two definitions of wealth.

Forbes’ rankings are built on identity, documentation, and legacy finance. Bitcoin and Satoshi’s ghost fortune are built on math, transparency, and the absence of identity.

By leaving Nakamoto off the list, Forbes goes beyond making a technical call, signaling that the rules of the old world still define the billionaire class.

Whether that stance holds is an open question as crypto reshapes financial reality.

Nevertheless, ignoring Satoshi does not make them disappear. Rather, it only highlights the limits of billionaire rankings in an age when one of the richest entities alive may remain forever nameless.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up