Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The demand for yield-generating strategies around Bitcoin (BTC) is surging, especially from firms seeking liquidity without liquidating their BTC, according to Ryan Chow, co-founder and CEO of Solv Protocol.

During a fireside chat at the Token2049 conference in Dubai on May 1, Chow said institutional interest in Bitcoin yield products has grown exponentially over the past few years.

Initially, generating Bitcoin yield was nearly impossible. However, recent innovations like staking via proof-of-stake (PoS) protocols and delta-neutral trading strategies have made this possible.

Layer-1 and layer-2 advancements, such as Babylon, have made these strategies more viable. Babylon allows BTC holders to earn yield on their assets, which are used to provide security and liquidity for PoS networks.

“Bitcoin as the largest asset class here, you can stake your Bitcoin to secure the network […] that makes us feel like if it is the answer to really bring utility and also use case,” he said.

Lending emerges dominant BTC financial use case

Chow noted that institutions mainly focus on Bitcoin when entering crypto due to its dominance in portfolios. Once they purchase Bitcoin, they lend it out to gain liquidity without selling.

Companies like Coinbase now offer up to $1 million in borrowing against Bitcoin. Platforms like Aave and Compound also enable instant borrowing.

Chow also praised public firms like Strategy (formerly MicroStrategy) for helping normalize BTC as a treasury asset. “MSTR is a very successful derivatives kind of use case based on Bitcoin […] That’s also Bitcoin finance.”

In an April report, crypto fund issuer Bitwise revealed that the amount of Bitcoin held on the books of publicly traded companies rose by 16.1% in the first quarter of 2025.

The company detailed that Bitcoin holdings rose to around 688,000 BTC by the end of Q1, with firms adding 95,431 BTC over the quarter.

The value of the combined Bitcoin stacks rose around 2.2%, reaching a total combined value of $56.7 billion with a price per BTC of $82,445, the firm added.

Looking ahead, Chow said he expects over 100,000 BTC to enter ecosystems like Solana. “There should be more and more use cases come out,” he said.

Solv launches Sharia-compliant yield products

Chow also mentioned the firm’s recently launched Sharia-compliant Bitcoin yield product called SolvBTC.core, which generates yield by securing the Core blockchain network and engaging in onchain DeFi activities while adhering to Islamic finance principles.

“Sharia compliance is something that we prepared for a long time [...] you have to pass it before you really serve them through your platform.”

With over 25,000 BTC already locked in Solv’s protocol — worth more than $2 billion — Chow said the firm is now building infrastructure tailored to institutional needs, with an emphasis on regulatory and cultural requirements.

Ethereum developers are working to improve blockchain interoperability with two new token standards: ERC-7930 and ERC-7828.

“There’s no standard way for wallets, apps, or protocols to interpret or display this information,” decentralized finance (DeFi) ecosystem development organization Wonderland wrote in a May 1 X post. Wallets, decentralized applications (DApps), block explorers and smart contracts follow different rules.

“The result? A messy, inconsistent experience that breaks cross-chain UX,“ Wonderland stated.

Wonderland is a group of developers, researchers and data scientists focused on improving the Ethereum DeFi ecosystem. The organization partnered with multiple DeFi protocols, including Optimism, Aztec, Connext and Yearn.

In the post, the organization shared what was discussed at a recent Ethereum Foundation interoperability working group call. Teddy from Wonderland explained that the current goal is to finalize both token standards within the next two weeks. He added:

Something for people, something for bots

Wonderland explained that “ERC-7930 defines a compact, binary format for interoperable addresses.” This format is machine-friendly and optimized for protocols that require a single representation for all blockchains.

ERC-7828 expands that standard “by adding a human-readable layer, using formats like address@chain, ensuring everything stays clear and simple for users.” Together, the two are designed to enhance the experience of using Ethereum’s inter-blockchain ecosystem.

“Target audience for ERC-7828 is anything that interacts with humans… It’s the text layer,” Teddy said during the call.

Many chains, one address

Put simply, the proposed system would allow the sender to specify the target blockchain when sending a payment address. This would include both a human-readable address@chain format and a machine-readable format for application programming interfaces.

The setup prevents users from sending or receiving assets on the wrong blockchain, which helps prevent crypto losses. Currently, the same address can be used on multiple blockchains within the Ethereum ecosystem, which can lead to confusion.

With the new setup, wallet operation can be blockchain-agnostic, and the address input into the user interface will also determine which blockchain the transaction is directed toward. This would, in turn, reduce friction, as users currently need to switch networks in wallet settings to move from chain to chain.

The Bitcoin price seems to have hit an important make it or break it point that will determine the next course of action. While sellers seem to be running out, there is still enough pressure to keep the bulls at bay. This continuous beating down of the Bitcoin price, as well as its failure to make a notable break above resistance at $95,800 in the last few days, suggests there is more to be done. So, what happens when Bitcoin does make a definite breakout?

Bitcoin Price Could Sweep Liquidity At $93,000

With the Bitcoin price being beaten down, there is the possibility that the cryptocurrency could fall a bit further before resuming its uptrend. This was explained by crypto analyst TehThomas on a TradingView post, mapping out the possible directions of Bitcoin, with both hinging on two major levels.

The first of the major levels mentioned was the resistance at $95,400-$95,800 that has been holding back the Bitcoin price from its campaign for $100,000. The analyst explains that this has become an important level to beat, given the fact that it has rejected the price multiple times already. As a result, there has been the formation of a range just underneath this resistance level as bulls seem to be backing down.

However, regardless of the loss in momentum, the crypto analyst explains that the broader trend structure is still the same. This means that the Bitcoin price is still bullish, especially with a higher timeframe ascending trend line and the formation of higher lows recently.

The one roadblock faced by the Bitcoin price from here is the possibility of it falling to do a liquidity sweep at the $93,000-$93,800 levels. A successful sweep and a rebound from here would see adequate absorption of liquidity, which would be used to fuel a higher price rise. Thomas explains that “This zone is confluenced by the ascending trendline from previous swing lows, offering a clear area for a liquidity sweep.”

Bullish Or Bearish Scenario Next?

In terms of where the Bitcoin price is headed next, it comes down to the liquidity sweep and if resistance is broken. As Thomas explains, a drop to the $93,000-$93,800 level for liquidity is most likely at this point to sweep out late longs and introduce fresh liquidity into the market. “A dip into this level that still respects the trendline would maintain bullish structure despite violating the local higher low.”

On the flip side, if the Bitcoin price were to fall lower than $93,000, then the sweep could be unsuccessful. This would lead to a break in the bull structure and likely cause the price to collapse further. “In the worst case scenario possibly invalidating the breakout thesis temporarily.”

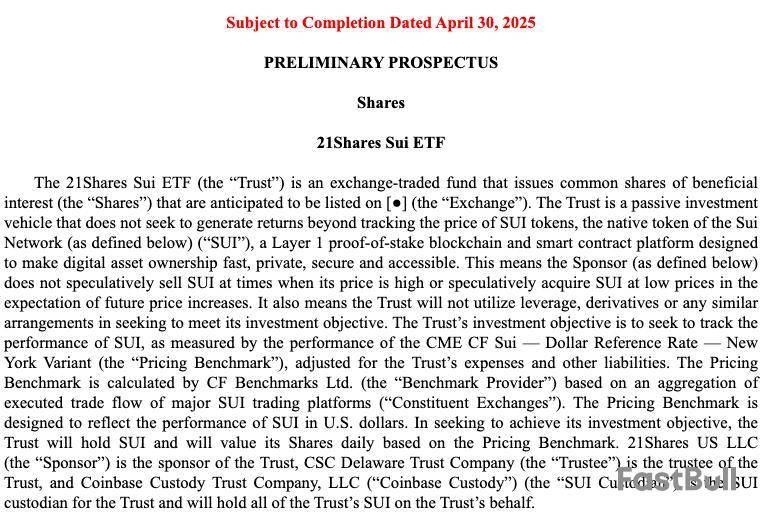

Major European cryptocurrency investment firm 21Shares has filed for a spot Sui exchange-traded fund (ETF) in the United States, marking another step in its expansion to the US market.

21Shares on April 30 submitted the Form S-1 registration for a spot Sui (SUI) ETF to the US Securities and Exchange Commission (SEC).

Called the 21Shares Sui ETF, the proposed ETF will issue common shares of beneficial interest by seeking to track the performance of SUI held by 21Shares’ US subsidiary.

The US filing comes a year after 21Shares started trading the 21Shares Sui Staking exchange-traded product in Europe in July 2024, with its first listings on Euronext Paris and Euronext Amsterdam.

No ticker or planned exchange yet

The 128-page filing does not specify on which US exchange the new SUI ETF is expected to debut trading. The ETF also doesn’t have a ticker symbol yet.

“There is no certainty that there will be liquidity available on the exchange or that the market price will be in line with the NAV [net asset value] or the principal market NAV at any given time,” it states.

The filing highlighted that the ETF aims to provide exposure to SUI by holding the tokens directly, without utilizing leverage, derivatives or engaging in speculative trading.

Canary Capital was the first to file for Sui ETF

21Shares is not the first company to file for a Sui ETF in the US. Canary Capital, a US-based crypto investment firm, filed a Form S-1 registration for a spot Sui ETF on March 17.

Subsequently, Cboe BZX Exchange asked US regulators for clearance to list Canary’s Sui ETF in early April.

Sui-based ETPs have already been trading in Europe, with some of such products including 21Shares Sui staking ETP and VanEck Sui ETP.

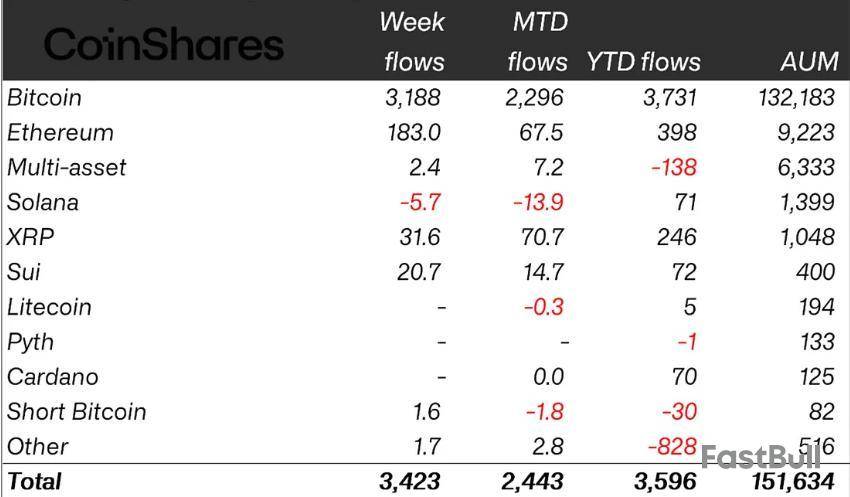

According to the latest CoinShares update, Sui-based ETPs had $400 million in assets under management as of April 25.

Year-to-date, Sui ETPs have seen $72 million of inflows, with a fresh $20.7 million coming in just last week.

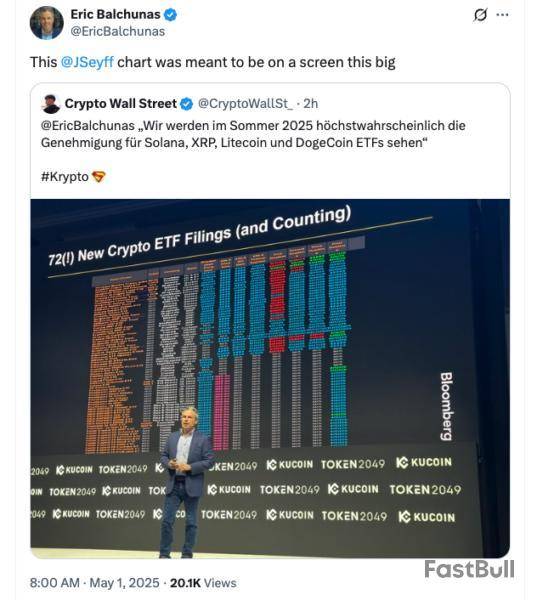

The latest ETF filing by 21Shares is yet another product joining a massive list of crypto ETFs awaiting the SEC’s decision.

According to Bloomberg ETF analysts Eric Balchunas and James Seyffart, there were at least 72 new crypto ETF filings on the SEC’s table as of May 1.

Sky's core governance design team, Atlas Axis, submitted a proposal Wednesday that, if approved, would complete the protocol's upgrade from MKR to SKY. This shift would make SKY the exclusive governance token and enable staking, unlocking USDS rewards for SKY holders.

Sky co-founder Rune Christensen hailed the proposal as a "huge milestone" in a forum post.

"I fully support the proposal from Atlas Axis to finalize the upgrade from MKR to SKY, and it is great to see them taking the lead on proposing larger scale upgrades to the system like this," he said. "Getting past the full upgrade of MKR to SKY is one of the last pieces missing before Sky can transition to zero fixed costs at the end of 2025, which will ensure an even greater portion of the income the protocol generates goes to the benefit of SKY buybacks, or SKY staking rewards."

Formerly known as Maker, the protocol underwent a significant rebranding as part of its "Endgame" strategy, transitioning to Sky in 2024. That introduced new features, including the launch of decentralized stablecoin USDS, a new version of DAI, with a supply now exceeding $7.5 billion, and SKY to replace the MKR governance token.

While USDS and SKY were introduced as upgraded tokens, DAI and MKR remain in circulation, and users have had the option to convert their holdings to the new tokens, allowing for a gradual transition process.

End of an era

If approved, the proposal could be activated within a matter of weeks, making SKY the technical and functional evolution of MKR, with SKY inheriting the governance voting rights previously held by MKR, the Sky team told The Block via email.

Existing MKR holders can upgrade to SKY at a fixed rate of 1 MKR:24,000 SKY. Like MKR, SKY allows holders to vote on Sky ecosystem governance proposals or delegate their votes.

SKY staking would also be enabled, providing holders with sustainable and permanently active USDS rewards based on the income the Sky protocol generates, Christensen explained — accessible via frontends such as Sky.money.

To encourage timely migration, conversions from MKR to SKY starting Sept. 18 will incur a 1% penalty, increasing by 1% every three months thereafter. These penalties, transparently managed by governance, aim to reward early adopters and support long-term stability.

Initially, SKY-backed staking vaults will temporarily disable liquidations to maintain stability. Full functionality will resume as liquidity improves and governance adjusts risk parameters.

Governance authority will migrate to a new contract controlled exclusively by SKY voting, permanently disabling the ability to downgrade from SKY back to MKR. This transition is slated to occur between May 15 and May 19, pending an onchain vote.

"Overall, I think this is a very competent and thoughtful solution to ensure the full upgrade of MKR to SKY, maximizing the chance that exchange liquidity will migrate smoothly while providing the crucial SKY staking feature to SKY holders and MKR holders that will be upgrading," Christensen said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

According to Bloomberg Intelligence, the likelihood of US regulators approving a Solana ETF (exchange-traded fund) is now a whopping 90%.

This is particularly noteworthy because the company’s odds for a $SOL ETF were just 70% back in February, i.e., only a couple of months ago.

Combined with the CME listing Solana-based futures contracts in March, a $SOL ETF will likely rocket Solana to the moon.

Keep reading to find out all the reasons for being bullish on Solana right now. We’ll also point you towards the best altcoins you can buy today to make the most of $SOL’s bright future.

Solana Futures Open Interest Nears All-Time High

While six asset managers await the SEC’s permission to list $SOL ETFs, the crypto’s future open interest reached $5.75B (or $40.5M $SOL). In addition to being a chunky 5% increase from March, this metric is now close to its all-time high. The demand for $SOL derivatives is also 50% higher than $XRP’s.

Moreover, this data is hot off the oven (recorded just a few days ago), so it’s dead accurate and proof of strong institutional interest in the blockchain.

One of the biggest reasons behind the growing adoption of $SOL derivatives is that the crypto held the crucial $140 support level.

With rising DEX volumes and a staggering $9.5B in total value locked (TVL), $SOL can easily surge past $200 well before a potential spot ETF approval on October 10.

What Does $SOL’s Chart Say?

Technical analysis on $SOL’s charts paints a pretty picture, too. The crypto has bounced perfectly from the 10, 20, and 50 EMAs simultaneously on the daily chart, which is a hugely positive signal.

The aforementioned bounce is also at a major support/resistance zone, further proving that the current bullish rally could hold itself nicely.

The only thing left to see is whether $SOL can break and hold itself above the 200 EMA. However, as per the 4-hour chart, it should easily be able to do that, seeing as it’s above all the major EMAs on that time frame.

All in all, Solana is doing really well and could pump soon. If you want to ride its growth, here are three Solana-based coins that could give you the best results in an already-pumping market.

Our top pick, Solaxy, shows the best potential. It’s still in presale, which has turned out to be a massive success thanks to over $30M in early investor funding.

1. Solaxy ($SOLX) – Best Altcoin on Solana, over $32M in Presale Funding

Unlike other coins on Solana, Solaxy ($SOLX) won’t just use the blockchain’s low-cost, high-speed architecture to further its interests. Its goal, in fact, is to improve Solana.

Solana has become too popular for its own good, ironically. A recent massive influx of new investors to the network has overloaded it. As a result, it has been struggling with congestion and scalability issues.

Solaxy will solve Solana’s aforementioned issues by building the first-ever Layer 2 scaling protocol on the network.

It will process some of Solana’s transactions on a sidechain, reducing the burden on its mainnet and increasing transaction speed while lowering traffic congestion. In one word, Solaxy will optimize Solana’s key areas.

The utility-based nature of $SOLX significantly contributes to its uniqueness and makes it one of the best cryptos to buy today. What’s more, Solaxy will also jack up Solana’s affordability by processing multiple transactions simultaneously, i.e., in batches. This will reduce the per-transaction cost, making crypto more affordable to people like you and me.

As mentioned earlier, Solaxy is currently in presale, which is another reason why it’s such a lucrative opportunity. Remember, prices are at their lowest during the presale stage, offering insane risk-to-reward possibilities (like a 29x increase by the end of 2026).

With over $32.6M in presale funding so far, one $SOLX is currently available for just $0.00171. Here’s how to buy it.

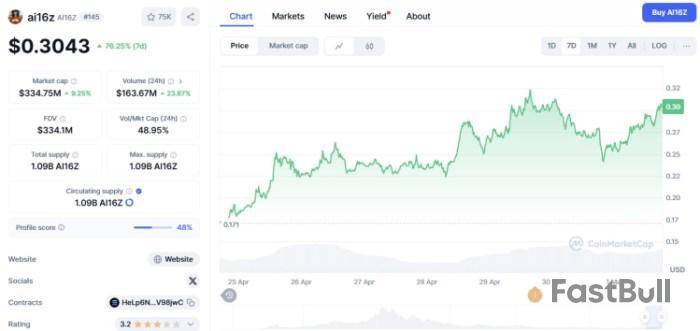

2. ai16z ($AI16Z) – Venture Capital Firm Run by AI Agents

ai16z ($AI16Z) really stands out because it’s the first-ever venture capital firm run solely by AI agents. This crypto project is redefining the possibilities of artificial intelligence in the crypto investment space.

A decentralized trading fund, ai16z uses AI agents to collect and analyze investment-related data, including current community sentiment. This speeds up the entire process of deciding whether a certain company is worth investing in.

Aside from extra speed, AI will also reduce human error. What’s more, these AI agents are also equipped to execute transactions both on-chain and off-chain, further improving flexibility and transaction speed.

As a leader in the AI-powered decentralized trading segment, $AI16Z has unsurprisingly been one of the most successful cryptos of late. It reached a record market cap of around $2.6B in January 2025.

Over the last month or so, the token is up a staggering 60%. It’s also currently one of the top trending cryptos, having jumped 10% in just the last 24 hours. $AI16Z is currently trading at $0.3043.

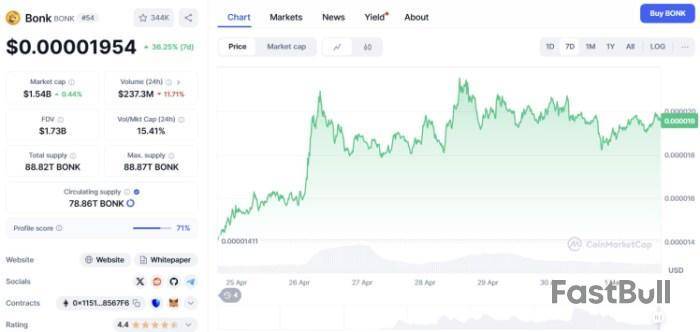

3. Bonk ($BONK) – Biggest Dog Meme Coin on Solana

Often referred to as ‘the dog coin of the people,’ Bonk is the first and the largest dog-themed meme coin on the Solana blockchain.

It’s also the fifth-largest meme coin across the board, with a market capitalization of over $1.5B. Only $TRUMP, $PEPE, $SHIB, and $DOGE are above it.

Launched in December 2022, $BONK currently boasts over 17,000% in lifetime returns, which more than justifies its massive popularity among crypto degens.

After a nearly two-month-long steady decline, the token is climbing once again. It’s up over 36% in the last week and 67% in the last month.

With one of the lowest per-token prices (just $0.00001968 at the time of writing) in the entire meme coin industry, $BONK is certainly one of the best cheap cryptos to buy to benefit from a potential $SOL rally.

Best Altcoins on $SOL – A Golden Buying Opportunity

Just the increased likelihood of a $SOL ETF has put the best altcoins on Solana in green.

Its actual launch, therefore, could be a canon event that sets forth a new future for $SOL and Solana-based cryptos.

That being said, we urge our readers to kindly do their own research and back their intuition with facts. None of the above is financial advice, after all.

Although history should not serve as an indication for future price movements, one cannot help but ask it for advice, especially in times of indecision and lack of a clear trend.

CryptoQuant’s latest analysis shows a promising picture when it comes down to the behavior of short-term holders (those holding their assets for somewhere between a day and a week), which have been growing in the past few weeks – something that was observed ahead of the two significant rallies in 2024.A Glimpse Into the Past

The accumulation trend mentioned by CryptoQuant’s Crypto Dan hints back at the developments that took place in January and October last year. Back then, STHs, which wereabsentfrom the BTC market, at least until recently, went on a buying spree, which was confirmed by the growing number of active addresses.

What followed both times were rather quick price upticks for bitcoin, which soared to a new all-time high in March 2024 after the launch of the ETFs, and a new peak down the line in January 2025 ahead of Trump’s inauguration.

“Now, a similar increase in short-term holder activity is once again being observed, which could signal the beginning of another bullish phase, just like in the past.

Notably, this indicator has historically moved ahead of major price surges, making it a reliable signal of accumulation,” said the CQ analyst.BTC Above $96K

After the April 7 and 9 lows of under $74,000, the primary cryptocurrency went on the offensive hard and exploded by over $20,000 to tap $96,000 last Friday. Its run, even though quite impressive, was stopped there, and the asset spent the following week or so in a tight range between $93,000 and $95,000.

The lower boundary wastestedon a couple of occasions, including yesterday, but it managed to hold. As such, BTC bounced off and spiked above the upper one earlier today. As of now, the cryptocurrency trades close to $96,500, which is the highest price since February 23.

Aside from the STHs’ behavior, there are a few more bullish signals on the BTC front, including whale and institutional accumulation. We published another report as well about the most probable scenarios for BTC for 2025, which you can check here.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up