Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

By Callum Keown

Bitcoin, XRP, and other cryptocurrencies edged lower Friday as the recent recovery stalled with stock markets closed for the Good Friday holiday.

The moves in cryptocurrencies have closely followed stocks recently, reacting to global trade developments amid President Donald Trump's tariffs policy. In the absence of any catalysts, the rebound took a pause.

Bitcoin, the world's largest digital asset, was trading at $84,643 early in the day, slightly up over the past 24 hours but below the $85,000 level it reached late Thursday. The cryptocurrency recovered from below $82,000 last week and is up 2.8% so far in April.

XRP, the popular altcoin used to settle transactions on Ripple Labs' payments platform, fell 1.1% to $2.07. Ether, the second-largest crypto, slipped 0.7% to $1,584.

Uncertainty over U.S. trade policy and the developing tensions with China are also keeping crypto investors on edge.

"Bitcoin and cryptocurrency gains are emerging amid signs of a possible de-escalation in the trade conflict between the U.S. and other countries, with negotiations with Japan beginning," XS.com analyst Samer Hasn said Thursday.

However, he added that the comeback could be short-lived. "Conversely, this recovery in Bitcoin comes amid underlying signs of a possible further escalation in the trade conflict with China, coupled with weakening risk appetite among investors and traders."

Write to Callum Keown at callum.keown@dowjones.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

HONG KONG, April 18, 2025 (GLOBE NEWSWIRE) — CoinEx demonstrated its support for financial education by sponsoring the National Finance Summit 2025, held on April 13, 2025, in Quezon City, Philippines. Organized by the Junior Confederation of Finance Associations - Philippines (JCFAP), the event brought together over 1,500 students and professionals from top universities, making it one of the country’s most influential finance gatherings.

With the theme "Driving Sustainable Growth Through Financial Innovation," the summit explored key topics in finance—from traditional banking to cryptocurrency. Attendees gained valuable insights from industry-leading speakers, covering financial trends, investment strategies, and digital assets. The discussions aimed to prepare the next generation for an evolving financial landscape.

As a sponsor, CoinEx enhanced the experience by hosting an interactive booth, where participants received $200 USDT in giveaways and exclusive merchandise. This engagement highlighted CoinEx’s commitment to financial literacy and innovation.

Attendees actively visited the CoinEx exhibition booth

The summit’s success reinforced the importance of collaboration and education in finance. CoinEx remains dedicated to empowering future leaders, ensuring they are equipped to navigate the digital economy. Through initiatives like this, CoinEx continues to drive progress in financial accessibility and knowledge-sharing worldwide.

About CoinEx:

Established in 2017, CoinEx is a global cryptocurrency exchange committed to making trading easier. The platform provides a range of services, including spot trading, swap, automated market maker (AMM), and financial management services for over 10 million users across 200+ countries and regions. Since its establishment, CoinEx has steadfastly adhered to a “user-first” service principle. With the sincere intention of nurturing an equitable, respectful and secure crypto trading environment, CoinEx enables individuals with varying levels of experience to effortlessly access the world of cryptocurrency by offering easy-to-use products.

Contact:

CoinEx

Disclaimer: This content is provided by CoinEx. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining related opportunities involves significant risks, including the potential loss of capital. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector--including cryptocurrency, NFTs, and mining--complete accuracy cannot always be guaranteed. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. Speculate only with funds that you can afford to lose.Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c2642ea7-0df4-4365-a596-e1b85fe7b4c0www.globenewswire.com/Trackerhttps://www.globenewswire.com/NewsRoom/AttachmentNg/425609bf-8044-4715-9c92-fcf6b2276c73

www.globenewswire.com/NewsRoom/AttachmentNg/4fa00d58-0cbc-45f6-8319-1761bbdae9b8

CoinEx Country Lead Dell at the National Finance Summit center stage

CoinEx Country Lead Dell at the National Finance Summit center stage

Attendees actively visited the CoinEx exhibition booth

Attendees actively visited the CoinEx exhibition booth

Arizona's Strategic Digital Assets Reserve Bill, or "SB 1373," passed the House committee on Thursday. It now awaits a third reading and a full floor vote before reaching the governor's desk for final approval.

The SB 1373 bill proposes the creation of a digital assets strategic reserve fund, which would consist of funds appropriated by the legislature and crypto assets seized by authorities.

The bill notes that the state treasurer would be allowed to deposit seized crypto into the fund via a qualified custody solution or a state-registered exchange-traded product, and that the treasurer may loan digital assets from the fund for additional returns.

"The state treasurer may not invest more than ten percent of the total amount of monies deposited in the fund in any given fiscal year," the bill says.

According to SB 1373, the term "digital assets" include virtual currency, virtual coin, and cryptocurrencies, which encompass bitcoin, stablecoins, non-fungible tokens, and other blockchain-based assets that carry economic or access rights.

A separate bill — the Arizona Strategic Bitcoin Reserve Act (SB 1025) — also passed the House on April 1. If enacted, SB 1025 would allow state funds to invest up to 10% in "virtual currency holdings."

However, Arizona's crypto reserve bills may face a significant roadblock in the legislative progress as Governor Katie Hobbs vowed to veto all bills until the legislature passes a disability funding measure.

Several other U.S. states are currently advancing crypto-related legislation. According to data from bitcoin legislation researcher Bitcoin Laws, Arizona has made the furthest progress in passing the digital asset reserve legislation, followed by Texas and New Hampshire.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoinlib, explained

Bitcoinlib is an open-source Python library designed to make Bitcoin development easier.

Think of it as a toolbox for programmers who want to create Bitcoin wallets, manage transactions, or build apps that interact with the Bitcoin blockchain. Since its launch, it’s been downloaded over 1 million times, showing just how widely trusted and used it is in the crypto community.

Here’s what Bitcoinlib does in a nutshell:

For beginners, Bitcoinlib is like a user-friendly bridge to Bitcoin’s complex world. Instead of wrestling with the blockchain’s technical details, developers can use Bitcoinlib’s ready-made functions to get things done quickly. For example, this library automates tricky tasks like generating private keys or signing transactions, saving developers hours of coding.

Bitcoinlib under fire: How PyPI typosquatting put crypto wallets at risk

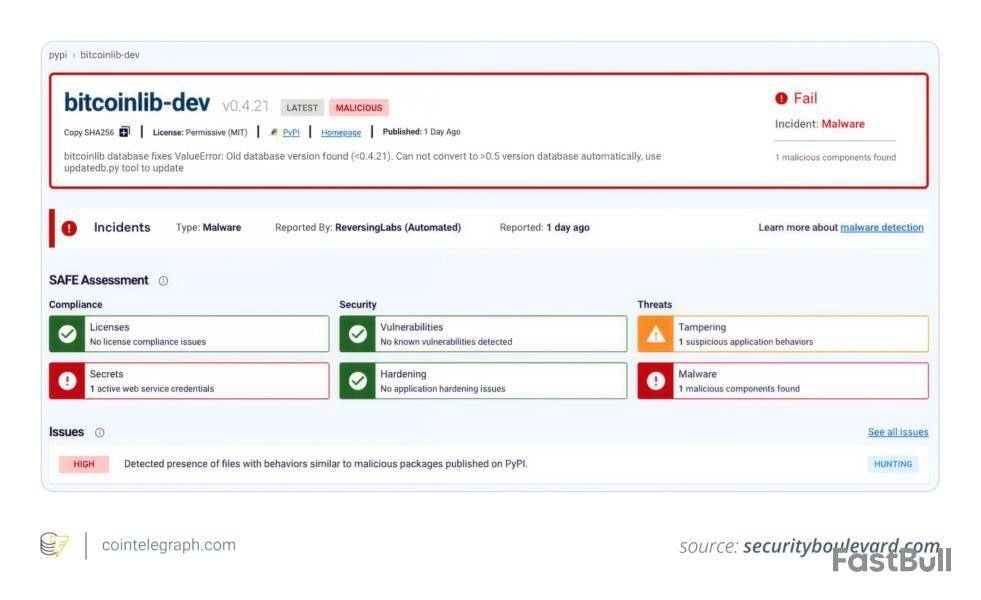

In early April 2025, security researchers raised alarms about a malicious attack targeting Bitcoinlib users. Hackers didn’t attack the Bitcoinlib library itself but instead used a sneaky trick to fool developers into downloading fake versions of the library.

This attack involved uploading malicious packages to PyPI, the platform where developers download Python libraries like Bitcoinlib. For developers and enthusiasts, tools like Bitcoinlib make it easier to interact with Bitcoin’s blockchain, create wallets, and build applications. But with great power comes great responsibility — and unfortunately, great risk.

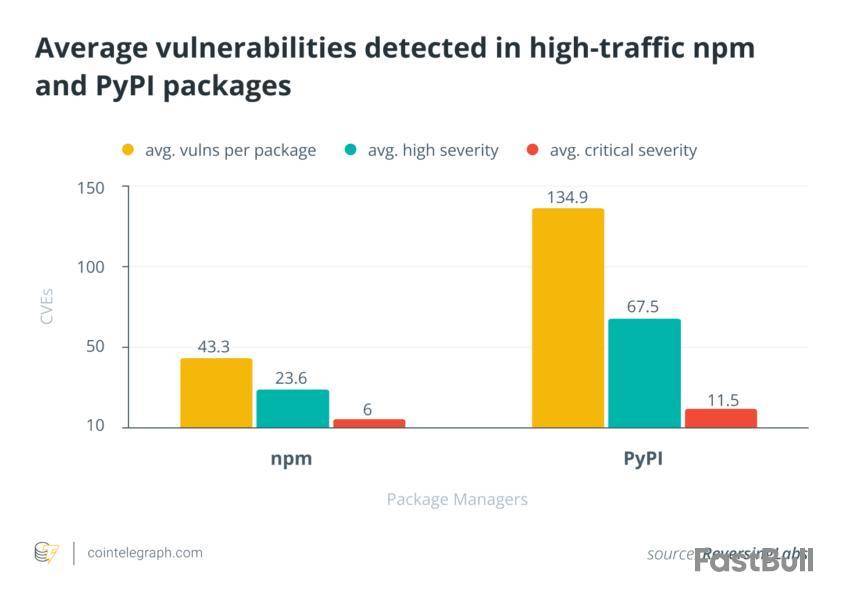

The 2025 Software Supply Chain Security Report by ReversingLabs reveals that software supply chain attacks grew more sophisticated in 2024, with particular intensity around cryptocurrency applications. The report highlights 23 malicious campaigns targeting crypto infrastructure, primarily through open-source repositories like npm and PyPI (Python Package Index).

Attackers employed both basic typosquatting and advanced tactics, such as creating legitimate-looking packages that were later updated with malicious code. Examples include the “aiocpa” package, which initially appeared benign but was later weaponized to compromise wallets, and the attack on Solana’s web3.js library.

ReversingLabs calls cryptocurrency a “canary in the coal mine,” noting that the financial incentives make crypto platforms an attractive target — and a preview of future threats to other industries. The report urges organizations to move beyond trust-based assumptions, especially when dealing with third-party or closed-source binaries.

Let’s break down how it happened and why it’s a big deal.

How hackers targeted Bitcoinlib

Here’s a step-by-step look at the attack:

Thankfully, security researchers used machine learning to spot the malware. By analyzing patterns in the fake packages, they identified the threat and warned the community, helping to limit the damage.

Why does this attack matter?

This hack wasn’t about breaking Bitcoin’s blockchain (which remains secure) but about exploiting human trust. Developers who downloaded the fake packages thought they were getting the real library and ended up with malware that could wipe out their Bitcoin (BTC) savings. It’s a reminder that even trusted platforms like PyPI can be used for scams if you’re not careful.

How typosquatting made the Bitcoinlib attack so effective

The Bitcoinlib attack worked because of a tactic called typosquatting.

This is when hackers create fake package names that look almost identical to the real ones (like “bitcoinlibdbfix” instead of “bitcoinlib”). Developers, especially those in a rush, might not notice the difference. Here’s why this trick was so effective:

The attack also highlights a broader issue: Open-source platforms rely on community oversight, but they can’t catch every bad actor. Hackers know this and use it to their advantage.

New to crypto? Here’s what the Bitcoinlib incident teaches about staying safe

If you’re new to crypto, the Bitcoinlib hack might sound scary, but it’s not a reason to avoid Bitcoin or development tools. Instead, it’s a chance to learn how to stay safe in a space that’s full of opportunities — and risks.

Bitcoinlib is still one of the ways to dip your toes into blockchain development, as long as you take precautions.

Here’s why this matters for you (as a beginner):

Bitcoinlib is a game-changer for developers who want to explore Bitcoin’s potential. It’s easy to use, powerful and backed by a vibrant community. But as the Bitcoinlib attack showed, even the best tools can be targeted by hackers if you’re not careful. By sticking to trusted sources, double-checking package names and keeping security first, you can use Bitcoinlib to build amazing things without worry.

The crypto world is full of surprises — some good, others not so good. The Bitcoinlib hack reminds one to stay curious but cautious. Whether you’re coding your first wallet or just learning about Bitcoin, take it one step at a time, and you’ll be ready to navigate this exciting space like a pro.

Have you used Bitcoinlib before, or are you thinking about trying it?

During your engagement with Bitcoinlib, if you come across anything suspicious, don’t stay silent — spread the word. In a decentralized world, community awareness is one of the strongest defenses.

How to protect yourself from similar crypto hacks

If you’re a developer or crypto user worried about falling for scams like this, don’t panic.

Here are some beginner-friendly tips to stay safe:

Above all, the lesson is clear for Bitcoinlib users: Stick to the official package and verify everything. For the broader crypto world, this attack underscores the need for better security on open-source platforms.

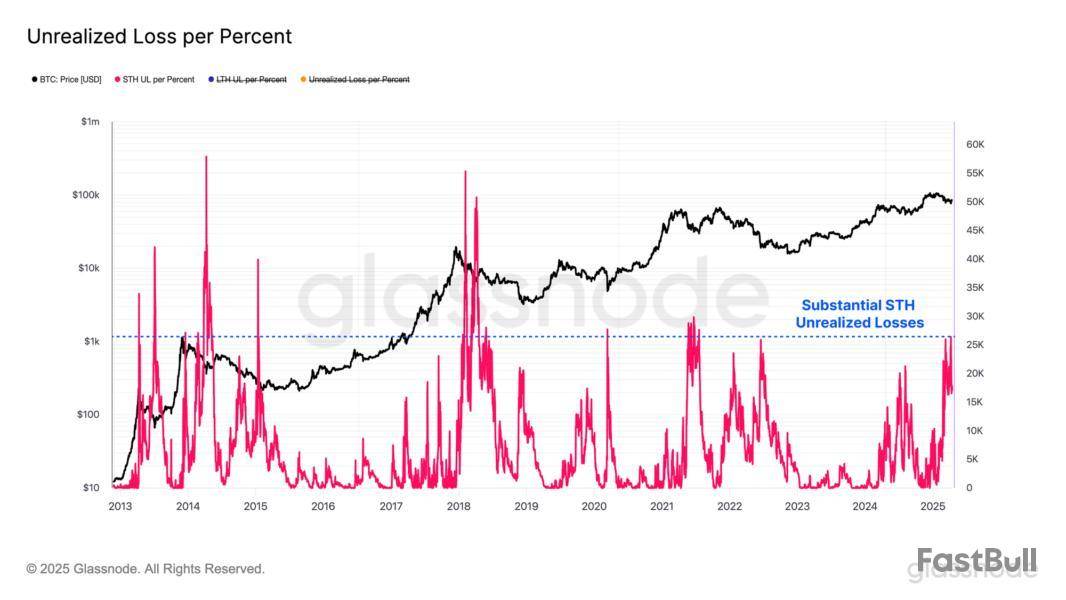

The on-chain analytics firm Glassnode has revealed in a report how this historical bear market confirmation is yet to appear for Bitcoin in the current cycle.

Bitcoin Unrealized Loss Hasn’t Spiked For Long-Term Holders Yet

In its latest weekly report, Glassnode has discussed about the trend in the Unrealized Loss for the two major Bitcoin cohorts. The “Unrealized Loss” is an on-chain indicator that measures the total amount of loss that the BTC addresses as a whole are carrying.

The metric works by going through the transfer history of each coin in circulation to see what price it was last moved at. If this previous trading price is more than the current spot price for any token, then that particular token’s assumed to be holding a net loss.

The indicator takes the difference between the two prices to find the exact measure of this loss. It then adds up this value for all coins part of the circulating supply to find the network total.

In the context of the current topic, the usual version of the Unrealized Loss isn’t the one of interest, but rather a new variant known as the Unrealized Loss per Percent Drawdown. As the analytics firm explains,

As the market continues to contract, it’s reasonable to expect the absolute size of unrealized losses to grow. To account for this and normalize across drawdowns of varying magnitudes, we introduce a new variant of the metric: Unrealized Loss per Percent Drawdown, which expresses losses held in BTC terms relative to the percentage decline from the all-time high.

First, here is a chart that shows the trend in this Bitcoin indicator specifically for the short-term holders:

“Short-term holders” (STHs) refer to the Bitcoin investors who purchased their coins within the past 155 days. BTC is currently trading under the levels that it was at during most of this window, so these holders would majorly be in a state of loss.

The Unrealized Loss per Percent Drawdown showcases this trend, as its value has shot up recently. Interestingly, the indicator is already at a high-enough level to be comparable with values seen during the start of previous bear markets.

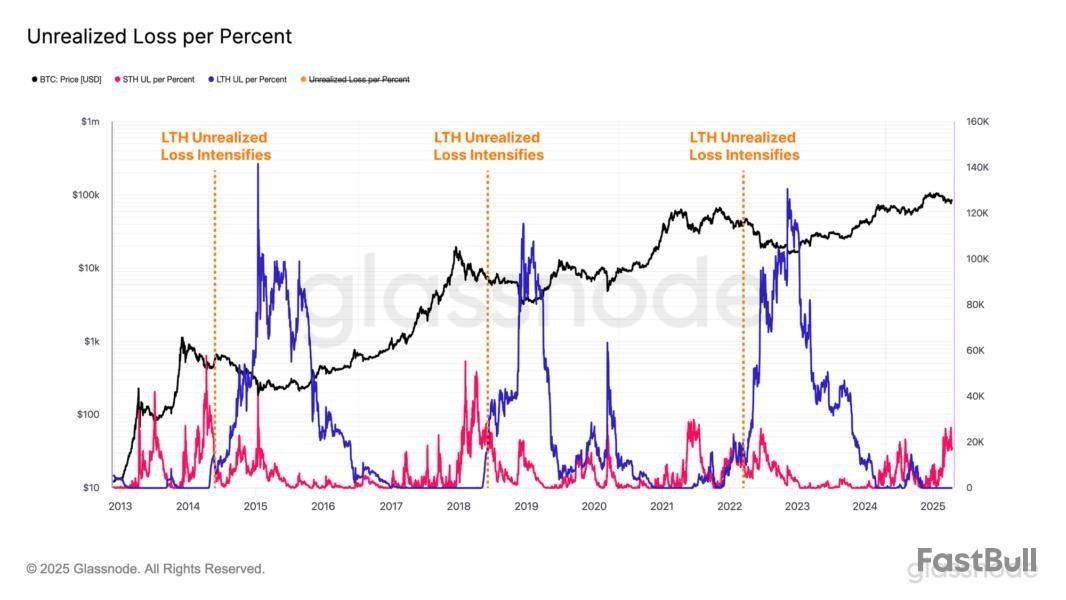

While the STHs are in substantial losses, the same isn’t true for the other side of the market: the “long-term holders” (LTHs).

These investors, who have been holding onto their coins since more than 155 days ago, are carrying no unrealized loss at all right now. In the past, the LTHs have generally seen their loss spike up during the transition to a bear market.

As the report notes,

Historically, substantial expansions in unrealized losses among long-term holders have often marked the confirmation of bear market conditions, albeit with a delay following the market peak.

So far, this signal hasn’t appeared for Bitcoin. Something to keep in mind, though, is the fact that the top buyers will soon promote into the LTHs. Once that happens, the loss among the group is probable to register an increase.

BTC Price

Bitcoin has seen a pause in the recovery rally as its price has taken to sideways movement around $85,000.

HashKey Capital, the investment arm of cryptocurrency infrastructure developer HashKey Group, has announced the launch of the very first tracker fund for the XRP token in Asia.

Ripple, the enterprise blockchain company linked to the token, is seeding the initial investment into the fund.

The product, which is tailored to professional investors, is expected to be a boon for XRP's institutional adoption.

This is the third tracker fund launched by HashKey after the Bitcoin and Ethereum ones. HashKey says that it picked the XRP token due to the fact that institutions and enterprises around the globe are already using it. "XRP is at the forefront of cross-border payments, enabling faster, cheaper, and more efficient transactions than traditional systems like SWIFT…" it said in a statement on social media.

Unlike an ETF, a tracker fund is not traded like a stock throughout a trading session, meaning that its price does not fluctuate in real time. Investors can buy or sell once a day, meaning that its liquidity is substantially lower.

HashKey says that the XRP-based tracker fund could evolve into an ETF with additional regulatory approval. This could happen within the span of one or two years.

Earlier this year, Hashkey Group and Bosera obtained approval to launch the very first tokenized money-market ETFs in the world in Hong Kong.

This comes after Bitcoin and Ethereum ETFs proposed by the local crypto giant were greenlit by Hong Kong's financial regulator in April 2024.

Last year, Hashkey Group predicted that Hong Kong-based crypto ETFs could reach one-fifth of the size of U.S.-based products.

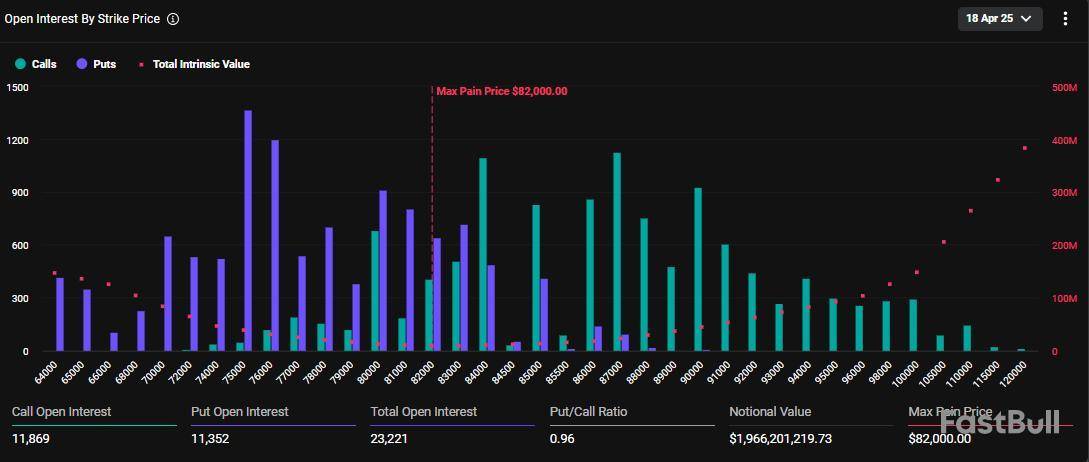

On Good Friday, over $2.2 billion worth of Bitcoin and Ethereum options contracts expire today.

It comes as crypto markets continue to reel from macroeconomic uncertainty. President Donald Trump is pressuring the Federal Reserve (Fed) to cut interest rates, but the chair, Jerome Powell, will not budge.

Over $2.2 Billion Options Expire Today

Today, April 18, amid Good Friday celebrations, 23,221 Bitcoin options contracts will expire. The notional value for this Friday’s tranche of expiring Bitcoin options contracts is $1.966 billion, according to data on Deribit.

The put/call ratio is 0.96, suggesting a prevalence of purchase options (calls) over sales options (puts).

As the Bitcoin options expire, they have a maximum pain or strike price of $82,000; at this point, the asset will cause the greatest number of holders’ financial losses.

Similarly, crypto markets will witness the expiry of 177,130 Ethereum contracts, with a notional value of $279.789 million. The put-to-call ratio for these expiring Ethereum options is 0.84, with a maximum pain of $1,600.

This week’s options expiry event is slightly smaller than what crypto markets witnessed last week on Friday. As BeInCrypto reported, approximately $2.5 billion worth of BTC and ETH options expired then, with short-term dips bringing put demand.

Traders and investors must closely monitor today’s developments as options expiry could lead to price volatility. Nevertheless, put-to-call ratios below 1 for Bitcoin and Ethereum in options trading indicate optimism in the market. It suggests that more traders are betting on price increases.

Meanwhile, analysts at Deribit highlight low volatility and flat skew. While this suggests a calm market, historical data from CoinGlass suggests post-expiry price swings are common, potentially signaling an upcoming move.

“With volatility crushed and skew flat, is the market setting up for a post-expiry move?” they posed.

Blackswan Event Likely, Greeks.live Analysts Say

Analysts at Greeks.live shed light on current market sentiment, echoing the calm outlook. However, they note that the market is predominantly bearish to neutral. Traders expect continued choppy action before potentially revisiting $80,000 to $82,000.

As of this writing, Bitcoin was trading for $84,648, slightly above its strike price of $82,000. Based on the Max Pain theory, prices will likely move toward this strike price as options near expiry.

Citing a mild sentiment, Greek.live analysts ascribe the calm to Trump not putting out a lot of news this week. Nevertheless, they anticipate more trade wars, heightened uncertainty, and volatility.

“We expect the trade and tariff wars to be far from over, and the uncertainty in the market will continue for a long time, as will the volatility in the market,” Greeks.live wrote.

They also ascribe the outlook to Powell’s comments, which created downward pressure as 100 bps rate cut expectations for the year were reduced. This led to crypto correlation with traditional markets.

Against this backdrop, Greeks.live says the probability of a black swan event is higher, where a rare, unexpected event that has a significant and often disruptive impact on the market occurs.

“…it is now a period of pain when the bulls have completely turned to bears, and investor sentiment is relatively low. In this worse market of bulls turning to bears, the probability of a black swan will be significantly higher,” they explained.

They urge traders to buy out-of-the-money (OTM) put options. An option is classified as out-of-the-money when its strike price is less favorable than the current market price of the underlying asset. This means it has no intrinsic value, only time value (the potential for it to become valuable before expiration).

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up