Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin is poised to grow in price and adoption regardless of the macroeconomic scenarios that will unfold in the coming years and decades, as the global financial system heads for a Fourth Turning-style reset, according to market analyst Jordi Visser.

Visser told Anthony Pompliano that the average person has lost confidence in all legacy institutions, which should drive investment into BTC — a neutral, permissionless, global asset not tied to governments or traditional organizations.

The Fourth Turning is a reference to a book written by William Strauss and Neil Howe that describes the cyclical rise and fall of nations due to predictable intergenerational patterns.

“Bitcoin is a trustless thing. It was set up first to deal with the fact that I don't trust the banks. Well, now we're past the banks,” Visser said. He then added:

The comments came amid lowered consumer confidence, geopolitical tensions, and record-high government debt, which is devaluing the average individual’s purchasing power and creating the need for an alternative financial system based on incorruptible hard money.

Consumer confidence craters as most people are stuck at the bottom of a K-shaped economy

“The growing number of people on the bottom end of the K do not feel like they're part of the system, and this is part of the Fourth Turning,” Visser said.

A K-shaped economy refers to a financial system in which different segments of the population experience different rates of economic prosperity and recovery.

Those at the top of the K, who hold assets, experience growing wealth, while those at the bottom of the K experience downside pressure due to currency inflation.

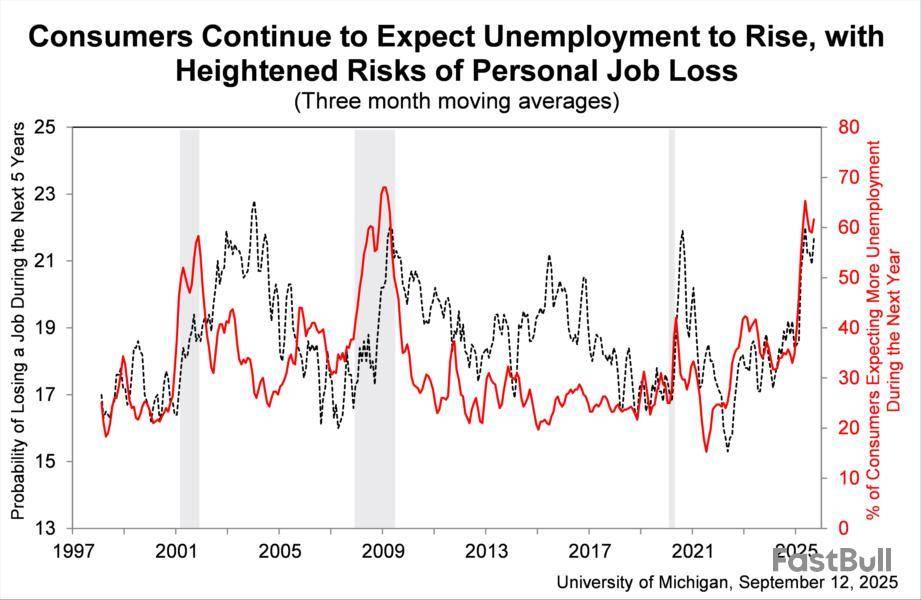

Visser cited the recent University of Michigan consumer sentiment report, which found that only 24% of respondents expect their spending habits to remain the same in 2026, with many expecting the price of goods to go up due to inflation and trade tariffs in the US.

A majority of respondents also expect unemployment to rise in 2026. Over 60% of those surveyed by the University of Michigan indicated that they expect higher unemployment.

The latest survey reflects a sharp rise since the beginning of 2025, when about 30% of respondents expected deteriorating job numbers.

In his latest update, CryptoWzrd observed that Litecoin closed the day on a bearish note, moving in line with Bitcoin’s broader trend. He stressed that the LTC/BTC chart remains within a falling wedge formation. CryptoWzrd added that he will be keeping a close watch on the intraday action over the weekend to scout for quick scalp opportunities, particularly if Bitcoin lends further confirmation to the setup.

Falling Wedge Formation Holds The Key

CryptoWzrd highlighted that both Litecoin’s daily chart and the LTC/BTC pair closed on a bearish note. Despite this short-term weakness, he pointed out that LTC/BTC continues to maintain a falling wedge formation, a structure that historically favors bullish reversals when broken to the upside.

He explained that a healthy breakout from this wedge could trigger a strong upside rally, with Litecoin likely to follow suit and reflect the broader market sentiment. Such a move would mark a significant shift in momentum, particularly after the recent bearish closes, and could attract renewed buying pressure into the market.

CryptoWzrd noted that Litecoin, although trading bearish, is still holding firmly above the $112 level. He emphasized that this zone is crucial, as a single strong bullish daily candle from this area could serve as confirmation for buyers and set the stage for the next leg higher.

Looking ahead, he identified $140 as the next key resistance target, a level that would need to be overcome for Litecoin to confirm a sustained rally. Should the price manage to close above $140, CryptoWzrd believes the altcoin could extend gains toward $170 and potentially open the door for a broader bullish continuation.

Litecoin Intraday Volatility Picks Up

Conclusively, the analyst noted that Litecoin’s intraday chart showed noticeable volatility today, a sign that price movements could remain sharp in the near term. He suggested that traders should anticipate more swings from this location, as the market attempts to establish a clearer direction.

The expert emphasized that for Litecoin to shift into a more positive stance, it must hold above the $115.50 intraday resistance. A successful move above this level could provide the momentum needed to push higher, with $123 standing out as the next resistance target on the upside.

For now, his focus remains on lower time frame charts to identify quick scalp opportunities. Given that trading conditions tend to be thinner and less predictable over the weekend, he added that his expectations will remain measured, preferring to wait for a healthy setup before committing to new positions.

The price of Bitcoin has had a mixed performance over the past week, falling beneath the $115,000 mark at the start of the period. While the premier cryptocurrency made a play for $118,000 following the Federal Reserve’s decision to cut interest rates, the BTC price is now back to around where it started the week. However, the latest on-chain data suggests that a stronger price performance is not too far in Bitcoin’s future.

On-Chain Transactions On The Rise

In a Quicktake post on the CryptoQuant platform, market analyst CryptoOnchain published that there has been a notable uptick in activity on the Bitcoin network. The on-chain pundit shared that this recent surge in network activity could have significant effects on the price trajectory of the world’s largest cryptocurrency.

CryptoOnchain based this report on the Transaction Count metric, which tracks the number of confirmed transactions on a blockchain network (Bitcoin, in this case) at a given time. According to the analyst, the 14-day Simple Moving Average (SMA-14) of the cryptocurrency’s transaction count surged to as high as 540,000, marking a peak level for the year 2025.

As highlighted by CryptOnchain, a surge in a network’s transaction count typically suggests a significant increase in the fundamental demand and network usage. The pundit also explained that this demand may have been amplified by protocols such as Bitcoin Ordinals and Runes.

Network Demand Meets Bullish Momentum

According to CryptoOnchain, the notable thing about this on-chain development is the bullish convergence between the metric and Bitcoin’s price since July.

The online pundit pointed out that, unlike previous periods of divergence, the current broader price rally is supported by a spike in network activity. Because of this aforementioned “bullish convergence”, the credibility of an uptrend can be further strengthened, as it is not just a result of pure speculation.

If anything is to be expected in the days to come, it is that Bitcoin’s price action will reflect a strong bullish momentum. With important advice as a parting note, CryptoOnchain explained that further price momentum hinges on the sustenance of the currently high on-chain activity. As a result, the on-chain activity should be closely watched when making decisions in the market.

As of this writing, Bitcoin is valued at about $115,744, reflecting an over 1% decline in the past 24 hours. While the market leader seems to be under a slight bearish pressure, a broader look shows that BTC is only stuck in a consolidation range. According to data from CoinGecko, the flagship cryptocurrency has barely changed in the past week.

Flora Growth, a Nasdaq-listed firm that works in the cannabis industry, is set to secure $401 million in cash-and-token financing in a private placement as it pivots to become the first publicly traded company to hold 0G, the native token of forthcoming crypto-AI blockchain Zero Gravity (0G).

The offering is led by DeFi Development Corp., the Solana treasury firm which holds around $480 million worth of SOL, alongside Hexstone Capital, and Carlsberg SE Asia PTE Ltd. The deal consists of $35 million in cash and $366 million in in-kind digital assets, principally 0G, valued at a price of $3 per token.

0G is set to list on major exchanges following an airdrop on Monday, and would have an implied fully diluted valuation (FDV) of $3 billion at the $3 price. As part of the deal with DeFi Development Corp, Flora "will be holding a small portion of its treasury holdings in SOL tokens," per a statement.

Flora plans to rebrand to ZeroStack following shareholder approval of the deal, though it will keep its FLGC ticker on Nasdaq. The deal is expected to close on Friday, Sept. 26, and had additional participation from firms such as Dao5, Abstract Ventures, Dispersion Capital, Blockchain Builders Fund, and Salt. Some buyers receive pre-funded warrants exercisable after shareholder approval, per the company.

Amid a rise in digital asset treasuries, the Flora deal is notable given the 0G token has yet to launch, though Zero Gravity Labs (0G Labs), the firm behind the blockchain, has already secured $75 million in seed funding and a $250 million token purchase agreement from the 0G Foundation, the independent governing body for the 0G protocol. A $3 billion FDV would value the project similarly to Pudgy Penguins and Trump-backed World Liberty Financial, at current prices.

0G Labs is building a decentralized operating system that will allow for distributed training of advanced AI models, currently in testnet. The firm has "successfully [trained] a 107 billion parameter model using distributed clusters over low-throughput internet connections," according to the statement. The firm has not disclosed a date for the launch of its mainnet, though Michael Heinrich, told The Block in November of last year that the mainnet is expected to launch around the same time as the token.

"This treasury strategy offers institutional investors equity-based exposure to the foundational infrastructure enabling transparent, verifiable, large-scale, cost-efficient, and privacy-first AI development," incoming Flora Growth CEO Daniel Reis-Faria said.

The price of FLGC has increased by 69% in after-hours trading following the announcement of the deal, according to Yahoo Finance data, reversing its 32% year-to-date decline.

It is unclear if 0G Labs or 0G Foundation contributed to the deal; The Block could not immediately reach either organization, or Flora, for comment.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

BlackRock has quietly turned its early foray into crypto into a lucrative venture, earning more than $260 million in annual revenue from digital asset products in less than two years.

The windfall stems largely from the rapid success of its spot Bitcoin and Ethereum exchange-traded funds (ETFs), which dominate their respective markets and now rank among the most profitable products in the firm’s portfolio.

How BlackRock Quietly Built One of Its Most Profitable Businesses Through Crypto ETFs

According to Dragonfly partner Omar Kanji’s data, BlackRock’s iShares Bitcoin Trust (IBIT) generated about $218 million in fees at a 0.25% commission rate during its first year. Its Ethereum fund, ETHA, added another $42 million under the same fee structure.

Kanji emphasized that the milestone is striking not only because of the size of the revenue. He noted that achieving it within a year of launch underscores how quickly BlackRock has entrenched itself in crypto finance.

The success of these funds reflects a broader trend: investors are paying significantly more to access crypto products compared with traditional ETFs.

While IBIT and ETHA charge 0.25% in annual fees, most of BlackRock’s established ETFs—including its flagship IVV fund—charge between 0.03% and 0.1%.

This disparity highlights how institutional demand for Bitcoin and Ethereum exposure has translated into premium pricing power for the asset manager.

Meanwhile, that strategy has coincided with investor enthusiasm for the market class.

Launched in January 2024, IBIT has grown into the largest crypto ETF globally and now ranks as the 22nd largest ETF overall by assets, according to VettaFi.

Additionally, SoSo Value data shows IBIT has attracted $60.6 billion in net inflows, representing nearly three-quarters of all US Bitcoin ETF flows. Today, it manages more than $88 billion in assets, cementing its role as the industry’s flagship product.

On the other hand, BlackRock’s Ethereum product, ETHA, has also become a force in its category.

Since its July 2024 debut, ETHA has drawn $13.4 billion in net inflows, giving it a commanding 72.5% share of all US ETH ETF flows.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up