Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Longtime gold advocate and bitcoin skeptic Peter Schiff is developing a blockchain-based product of his own.

In a recent interview with crypto creator Michael Jerome, who goes by the moniker "Threadguy," Schiff said his company, Schiff Gold, is building an app that will let users buy vaulted metal, tokenize ownership, and transfer it "instantly and verifiably" for payments or redemptions.

Schiff described the system as a way to "carry all your gold around in your phone," enabling users to spend fractions through a debit card or redeem for coins. He argued that gold is "the one thing that actually makes sense to put on a blockchain," framing tokenization as a bridge between traditional stores of value and digital payments.

Binance founder Changpeng "CZ" Zhao, who earlier today received a presidential pardon from Donald Trump, pushed back on X, arguing that tokenized gold isn't truly onchain metal but a promise dependent on middlemen.

"It’s tokenizing that you trust some third party will give you gold later," Zhao wrote. "It's a 'trust-me-bro' token."

Schiff countered that intermediaries are a normal feature of markets, not a flaw. "Counterparties are part of capitalism," he said, pointing to vault providers like Brinks as examples of longstanding custodianship that underpins the gold industry.

Bloomberg Intelligence analyst Eric Balchunas noted that the structure already exists in traditional finance.

"Congratulations, you just invented an ETF," he quipped, citing $AAAU and $OUNZ — gold-backed funds that already allow retail investors to redeem for physical metal. Still, Balchunas added, "99% of people don’t care; they just want to redeem for cash."

Debates aside, tokenized gold assets are continuing to reach new milestones.

The sector's market cap, led by market leaders Tether Gold and PAX Gold, climbed to an all-time high of $4.03 billion on Monday as spot gold hit a record $4,360 per troy ounce, according to The Block's price data. Gold has since slipped back, trading near $4,160 today.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Cryptocurrency use in the United States has grown over the past year, but concerns over fraud and trust continue to dominate. New research from Sumsub, a global verification and anti-fraud firm, shows that one in three Americans have either experienced or know someone affected by crypto-related scams.

Widespread Adoption, Persistent Risk

According to Sumsub’s survey, 36% of U.S. adults used or interacted with cryptocurrency in the past 12 months. Younger users are leading this adoption but also face higher exposure to scams. Nearly half of Gen Z, at 46%, and Millennials, at 49%, reported direct or indirect experience with fraud.

Digital assets meet tradfi in London at the fmls25

The most common schemes include social engineering, Ponzi schemes, and fake giveaways, each cited by about 30% of respondents. Phishing, impersonation, fake airdrops, wallet draining, and rug pulls were also frequently reported. Synthetic identity fraud, often involving AI-generated deepfakes or forged documents, affected 35% of respondents, with nearly one in five personally targeted.

Sumsub’s internal data shows that synthetic identity document fraud in the U.S. increased by more than 300% in the first quarter of 2025 compared to the same period in 2024. Deepfake-related fraud rose by 700% during the same timeframe.

Financial Impact and Accountability

Among those affected by online or crypto scams, the average loss from the most severe incident was about 3,300 dollars. When asked who should be responsible for recovering the funds, 33% said platforms should bear the cost, while 20% believed individuals should absorb the losses themselves.

Declining Trust and Demand for Oversight

Despite growing participation, trust in cryptocurrency platforms remains low compared to traditional financial institutions. Only 26% of respondents expressed greater confidence in crypto services, while 54% said they trust them less, including 41% who said much less.

Most respondents support stronger regulatory measures. Three in five favor government regulation of crypto platforms, including proposed laws such as the GENIUS Act and the Clarity for Payment Stablecoins Act.

Both bills aim to create clear frameworks for stablecoin issuance and enhance consumer protection against fraud. Support for these measures is highest among people who have encountered scams.

AI-Related Concerns

Fraud driven by artificial intelligence has also drawn public attention. About 69% of respondents agreed that companies developing generative AI should be held accountable if their technology is misused to commit fraud. This survey of 2,000 U.S. adults was conducted during the first week of September this year.

By Anita Hamilton

The price of the crypto coin Binance Coin rose 5% Thursday after news that Changpeng Zhao, the founder of the exchange the coin is named after, received a pardon from President Donald Trump.

Zhao pleaded guilty in 2023 to failing to maintain an effective anti-money-laundering program at the crypto exchange. The exchange also agreed to pay $4 billion to resolve Justice Department charges.

Zhao served a four-month jail term in 2024.

"President Trump exercised his constitutional authority by issuing a pardon for Mr. Zhao, who was prosecuted by the Biden Administration in their war on cryptocurrency," White House press secretary Karoline Leavitt said. "The Biden Administration's war on crypto is over."

Write to Anita Hamilton at anita.hamilton@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

Key takeaways:

Ethereum’s triple bottom pattern near $3,750–$3,800 hints at a potential 10% rebound in October.

Mega whales (10,000–100,000 ETH) are quietly accumulating, absorbing supply from smaller holders during the recent price decline.

Ethereum’s native token, Ether , is hinting at a textbook bearish reversal setup after dropping 6.50% so far in October.

Triple bottom rekindles ETH’s $4,000 potential

As of Thursday, Ether’s 4-hour chart shows a triple bottom, a setup that forms when prices hit the same support level three times and fail to break lower each time.

For ETH, that support sits around $3,750–$3,800, where buyers have consistently stepped in to defend the price. Each “bottom” shows sellers losing strength, while buyers quietly build momentum.

Now, Ethereum faces a key hurdle at its neckline resistance near $3,950–$4,000. This area also aligns with the 50-period exponential moving average (50-period EMA, represented by the red wave).

The triple bottom pattern would confirm if Ethereum breaks decisively above the neckline. Doing so may enable ETH to rise toward its potential price target of around $4,280, a 10% increase from current levels, by October or early November.

Trading volumes have been slowly declining during the pattern’s formation, which is typical before a breakout. A noticeable spike in buying volume alongside the breakout will confirm the triple bottom setup.

The bullish reversal setup aligns with trader Kamran Asghar’s analysis, although he presents the $4,800-$ 5,000 area as the main resistance area.

Mega-whales absorb ETH from smaller fish

Onchain data from Glassnode shows a significant reshuffle in Ethereum’s ownership during the recent price decline.

Large wallets holding 10,000–100,000 ETH, often called “mega whales,” have been quietly accumulating at the fastest pace in years, now controlling close to 28 million ETH.

At the same time, smaller whales with 1,000–10,000 ETH saw their balances drop sharply, especially in the past month during Ether’s price correction.

This suggests that as prices fell, some mid-sized holders either sold into the dip, with their coins being absorbed by larger investors, or bought more ETH, pushing themselves into the bigger cohort.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

On November 20, 2025, LayerZero will unlock 25.71 million ZRO tokens, which is about 7.29% of its total released supply. This event can be important for the price of ZRO. A big token unlock usually means more tokens enter the market, and some holders may decide to sell. This can cause the price to drop if there is not enough buying to match. However, if most tokens go to long-term holders who do not sell, the price might not change much. Traders should watch closely. For more details, visit source.

Sonic plans a big mainnet upgrade to become compatible with Pectra on November 3, 2025. This upgrade will bring fee subsidies and better security, which could make the chain more popular and safer for users. Strong mainnet upgrades often show that a crypto project is developing well, and this can attract new users and investors. If the upgrade goes smoothly, the price of S could go up. If there are technical problems, confidence may fall. It is a key event to watch. Learn more at source.

Sonic@SonicLabsOct 22, 2025️ Important Notice

All nodes on Sonic mainnet and testnet must upgrade to 2.1.2 immediately to avoid disconnection.

This release introduces native fee subsidies and critical security improvements, replacing the earlier v2.1 ahead of Sonic’s full mainnet upgrade to Pectra… pic.twitter.com/mS43UqHDq8

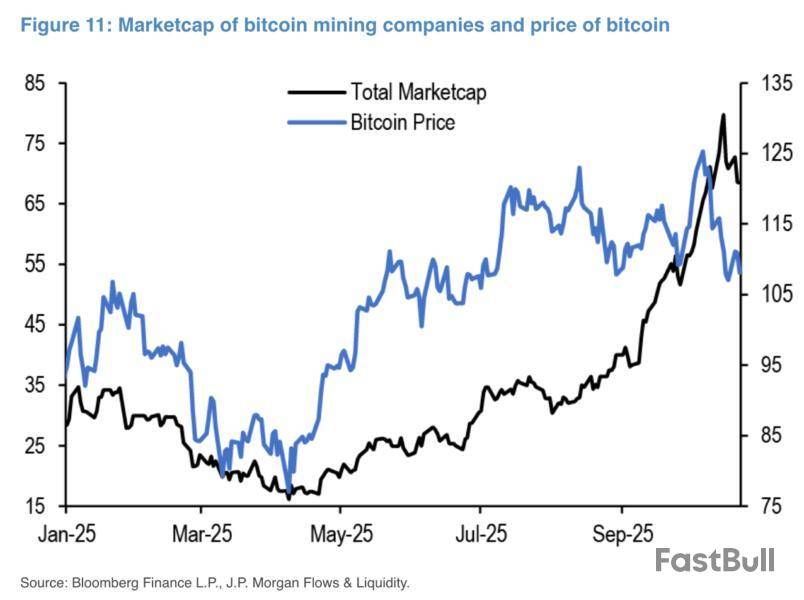

Publicly listed bitcoin mining firms have diverged from bitcoin’s price performance in recent months, with their combined market capitalization climbing sharply since July even as bitcoin has traded sideways, according to JPMorgan analysts.

The shift marks a "clear breakdown" in the correlation between bitcoin mining stocks and the cryptocurrency’s price, JPMorgan analysts led by managing director Nikolaos Panigirtzoglou said in a report on Wednesday.

Mining stocks once moved closely in line with bitcoin and were often viewed as proxies for exposure to the asset before the launch of spot bitcoin exchange-traded funds. Now, with major bitcoin miners pivoting their business toward artificial intelligence infrastructure, their stocks are more driven by the AI theme rather than the bitcoin price, the analysts said.

The move into AI is offering miners more stable and higher-margin revenue streams compared to the more volatile and increasingly less profitable business of bitcoin mining, according to the analysts. As a result, equity markets have started to re-rate these companies based on AI potential rather than their bitcoin exposure, causing decoupling from bitcoin price movements.

The shift comes amid growing pressure on miners’ profitability after the April 2024 bitcoin halving, which cut block rewards in half from 6.25 BTC to 3.125 BTC. The JPMorgan analysts estimate the current average cost to mine one bitcoin is around $92,000, projected to rise to about $180,000 after the next halving in April 2028 — well above the current price of about $109,700. Higher energy and hardware costs, along with power contract renewals, are also expected to keep production costs elevated for bitcoin miners, the analysts said, implying tougher profitability conditions ahead for miners.

As miners allocate more resources to AI computing, the growth in bitcoin’s network hashrate is likely to slow, which could limit further increases in production costs. The trend favors large, well-capitalized miners that can flexibly shift capacity between bitcoin and AI, while smaller firms may struggle to adapt and have begun exploring other areas, including setting up Ethereum and Solana treasuries, such as BitMine and BIT Mining, the analysts said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up