Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A growing number of public firms may begin purchasing Bitcoin in substantial quantities in the next five years, with more than $300 billion potentially entering the cryptocurrency by 2030.

That’s what researchers at Bernstein, an asset manager that monitors corporate appetite for Bitcoin, say in a new report. Their estimates hinge on the assumption that additional firms will follow in the footsteps of Strategy’s tactics of retaining Bitcoin as a central component of their balance sheets.

Strategy Sets The Tone

MicroStrategy, now doing business under the name Strategy, has already made waves with its aggressive Bitcoin buys. The firm now sits with 555,450 BTC. That inventory has cost them approximately $38 billion, with an average of $68,550 per coin. Recently, they purchased another 1,895 BTC for $180 million.

Naeem Aslam@NaeemAslam23May 05, 2025Bernstein projects that corporate treasury investments in #Bitcoin could reach $330 billion by 2029, with Strategy (formerly MicroStrategy) potentially contributing $124 billion of that total. This forecast underscores the growing institutional interest in Bitcoin as a treasury…

Bernstein believes that this strategy gains traction. Its report states companies with sluggish growth and plenty of excess cash could be attracted to Bitcoin as an alternative destination to invest their cash.

Between 2025 and 2030, listed firms alone could steer some $205 billion toward Bitcoin. Adding to that is another $124 billion which could be made by companies following Strategy’s systematic blueprint to investment in the top crypto.

Treasuries Could Fuel Demand

In Bernstein’s words, some movement, no matter how little, would lead to a great impact. This gigantic flow would amount to $190 billion if just 20% of related firms were to transfer 25% of their treasury balance into an investment in Bitcoin. These firms have very low growth and few compelling investment opportunities. That could make Bitcoin simply look good for capital investment for them.

Currently, public companies already possess approximately 720,898 BTC, which is valued at almost $68 billion. That’s a significant increase from the 1.3% of the total supply of Bitcoin that they had in late 2023. Today, it’s 3.4%. Private companies are not far behind, possessing approximately 398,323 BTC, valued at a little over $37 billion.Increasing Interest And Limited Supply

The surge in corporate Bitcoin ownership is occurring alongside evolving regulation and accounting practices. These changes might be facilitating more ease of access for companies to look into Bitcoin with less bureaucratic red tape. Additionally, with fewer coins on the market and easier access to capital, businesses might become the force behind increased demand—and possibly even prices.

Bernstein cites Strategy’s work in this revolution. The company has developed systems and tools that enable it to continue purchasing Bitcoin, even through challenging market periods. Not every company can follow suit, but the framework exists for others to attempt it.

Featured image from Gemini Imagen, chart from TradingView

Bitcoin Core developers plan to remove the long-standing 80-byte size limit on OP_RETURN outputs in an upcoming software release, a move that has sparked disagreement within the development community.

OP_RETURN allows small amounts of data to be embedded into Bitcoin transactions with an unspendable output (UXTO). The concept grew in popularity during the early 2024 ordinals and inscription boom.

According to Bitcoin Core contributor Greg Sanders, the update would completely eliminate the current 80-byte limit and “allow any number of these outputs." In a May 5 GitHub post, Sanders said that the restriction had outlasted its purpose and lifting the cap would encourage less harmful onchain behavior.

“The cap merely channels them into more opaque forms that cause damage to the network,” Sanders wrote, referring to large-data inscriptions and other participants that bypass the 80-byte threshold. “When the polite avenue is blocked, determined users turn to impolite ones. Some use bare multisig or craft fake output public keys that do enter the UTXO set, exactly the outcome OP_RETURN was invented to avoid."

Developers considered three options: keep the cap, raise it, or remove it entirely. The first two were deemed arbitrary and ineffective, while the third option garnered broad — though not unanimous — support, according to the GitHub discussion.

Sanders argued that lifting the cap would help maintain a cleaner UTXO set, reduce transaction burdens, and reaffirm simple, transparent rules within Bitcoin’s protocol.

Not everyone agrees. Critics including JAN3 CEO Samson Mow called the removal an “undesirable change for a number of reasons.” Marty Bent, managing partner at Ten31 Fund, noted on X that the proposal lacks broad consensus. Some community members worry the change could incentivize spam on the Bitcoin network, while others surmised that removing the 80-byte limit was performative and seemingly coercive.

The debate continues across GitHub and social media. Bitcoin Core developers have not set a release date for the proposed update.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Shiba Inu on-chain activity has shot up, and the numbers are too big to ignore, as represented by IntoTheBlock. In just one day, the total transaction volume for SHIB jumped from 1.8 trillion tokens, equal to $22.84 million, to a whopping 7.37 trillion SHIB, which was worth around $93.56 million.

While the price of SHIB did not change much during that same time - it was mostly around $0.000013 - the increase in volume was what got real attention.

If you look at the big picture, this move really stands out compared to the previous week, when the average daily volume was about 2.78 trillion SHIB, which is just over $36 million.

That makes this recent activity more than double the weekly average, and well above the seven-day low recorded on May 1, when volume dipped to 1.09 trillion SHIB, worth just $14.69 million.IntoTheBlock">

Even though the number of transactions went up a great deal, the number of transactions per user did not increase as much.

On May 5, the on-chain count hit 3,940 transactions. Thus, it looks like the surge was not driven by retail traders making lots of small moves. It is more likely that there were fewer but much larger transactions. These were probably tied to whales, internal transfers or pre-structured capital shifts.

It is unclear if this spike is a sign of bigger price movements or just large holders shifting their funds around. Either way, the sudden jump in volume has put Shiba Inu back on the map for those keeping an eye on the early signs in the altcoin market.

Key Takeaways:

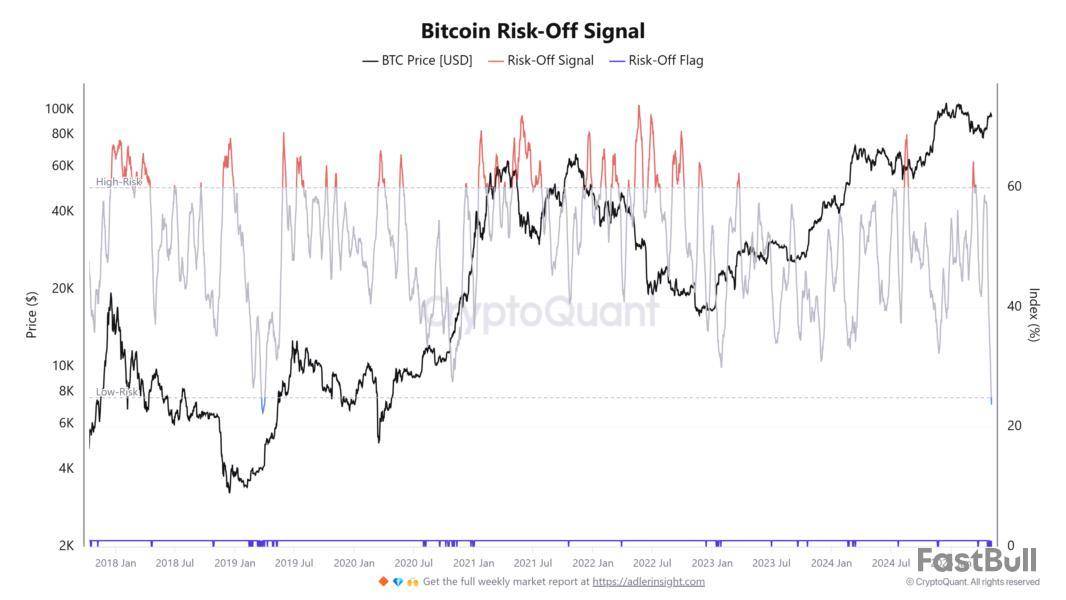

The Bitcoin Risk-Off signal dropped to 23.7, its lowest since March 2019, indicating low correction risk and a high likelihood of a bullish trend developing.

Despite the recent decline in network activity, bullish macro indicators like the Macro Chain Index (MCI) suggest Bitcoin could soon rally above $100,000.

On May 5, the Bitcoin Risk-Off signal, an indicator that uses onchain and exchange data to assess correction risk, dropped to its lowest level (23.7) for the first time since March 27, 2019, when Bitcoin (BTC) traded at $4,000. The signal is currently in the blue zone, which historically suggests low correction risk and a high probability of a bullish trend. When the oscillator rises above 60 or turns red, it implies a high risk of bearish movement.

In 2019, the same signal preceded a staggering 1,550% rally that saw Bitcoin soar above $68,000 in 2021.

Data from CryptoQuant indicates that the Risk-Off signal combines six metrics: downside and upside volatility, exchange inflows, funding rates, futures open interest, and market capitalization. Collectively, they provide a balanced view of correction risk, making the signal a data-oriented gauge for market trends.

The last time the Risk-Off Signal indicated a low-risk investment environment, Bitcoin was valued at $4,000. Several factors can explain the price disparity.

The launch of spot Bitcoin exchange-traded funds (ETFs) in the US in 2024 opened the floodgates to institutional capital, boosting demand and stabilizing prices. In fact, ETFs and public companies now hold 9% of the Bitcoin supply.

Cointelegraph Markets & Research@CointelegraphMTMay 03, 2025🚨LATEST: ETFs and public companies now hold 9% of Bitcoin's supply! Spot ETFs own 5.5% just 1 year after launch, while public firms like Strategy hold 3.5%. Institutional adoption is reshaping $BTC's market—less supply, shifting dynamics. 👀👀

(h/t: @ecoinometrics ) pic.twitter.com/iC892RveP2

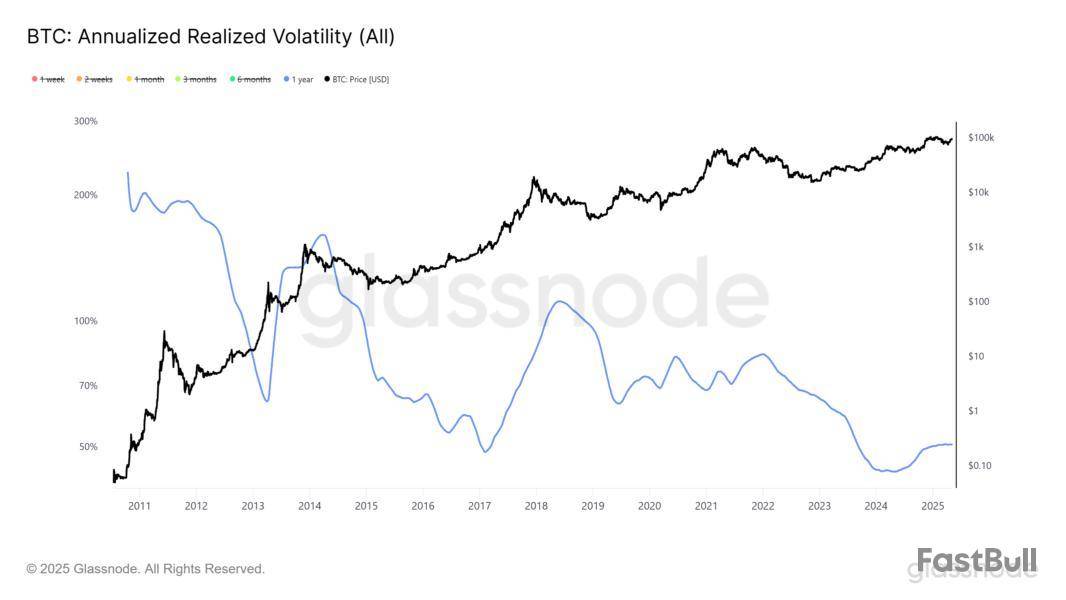

Data from Fidelity Digital Assets noted that Bitcoin’s volatility has decreased three to four times that of equity indexes, down from triple-digit volatility in its early years, as illustrated in the chart below. Between 2019 and 2025, the 1-year annualized realized volatility dropped by more than 80%.

This maturing market absorbs capital inflows with less price disruption. Thus, growing mainstream adoption, regulatory clarity, and Bitcoin’s increasing role as a hedge against inflation have bolstered its value, setting a higher price floor compared to 2019.

Related: Bitcoin price forms two BTC futures gaps after Coinbase premium flips negative

Bitcoin macro indicators flash bullish signals

Cointelegraph recently reported that the Macro Chain Index (MCI), a composite of onchain and macroeconomic metrics, flashed a buy signal for the first time since 2022, when it accurately predicted the market bottom at $15,500.

Historically, MCI’s RSI crossover has preceded massive rallies, such as the more than 500% surge in 2019. Combined with rising futures open interest and favorable funding rates, the MCI suggests Bitcoin could break $100,000 over the coming few weeks.

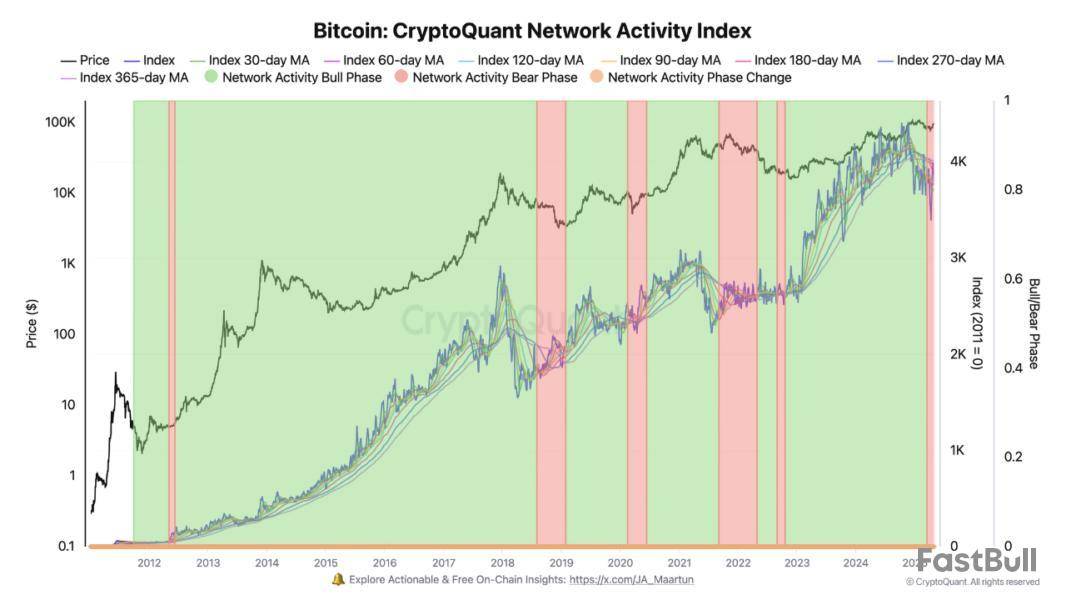

Anonymous crypto analyst Darkfost pointed out that Bitcoin’s network activity index has declined sharply, reflecting reduced transaction volume and fewer daily active addresses since December 2024. The drop in UTXOs further indicates waning demand for block space, a pattern often seen in bear markets.

However, the analyst explained that it doesn’t confirm a bearish outlook. Macro indicators remain strongly bullish, suggesting this lull could be a strategic entry point for long-term investors.

Related: How much Bitcoin can Berkshire Hathaway buy?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The rates of the majority of the coins keep falling, according to CoinStats.CoinStats">

The price of SHIB has dropped by 1.41% over the last day.TradingView">

On the hourly chart, the rate of SHIB has bounced off the local support of $0.00001233.

If bulls can hold the gained initiative, there is a chance to witness a test of the resistance by tomorrow.TradingView">

On the bigger time frame, there are no reversal signals yet. If the daily candle closes near its low, the drop may continue to the nearest support of $0.00001212 by the end of the week.TradingView">

On the weekly chart, the price of SHIB is falling after the previous bearish closure. If nothing changes, traders may expect a test of the $0.00001050-$0.00001150 range soon.

SHIB is trading at $0.00001244 at press time.

The market remains mainly under sellers' influence, according to CoinMarketCap. CoinMarketCap">

The price of DOGE has declined by 2.06% over the last day.TradingView">

On the hourly chart, the rate of DOGE has made a false breakout of the local support of $0.1645.

If the daily bar closes far from that mark, one can expect a test of $0.17 by tomorrow.TradingView">

A bearish picture can also be seen on the bigger time frame. If the daily bar closes below the $0.1667 level and with no long wick, the correction is likely to continue to the $0.16 area.TradingView">

From the midterm point of view, bulls have failed to fix above the $0.18 zone again. If the buyers cannot seize the initiative soon, one can expect a test of the $0.15 range.

DOGE is trading at $0.1669 at press time.

For months, Cointelegraph took part in an investigation centered around a suspected North Korean operative that uncovered a cluster of threat actors attempting to score freelancing gigs in the cryptocurrency industry.

The investigation was led by Heiner Garcia, a cyber threat intelligence expert at Telefónica and a blockchain security researcher. Garcia uncovered how North Korean operatives secured freelance work online even without using a VPN.

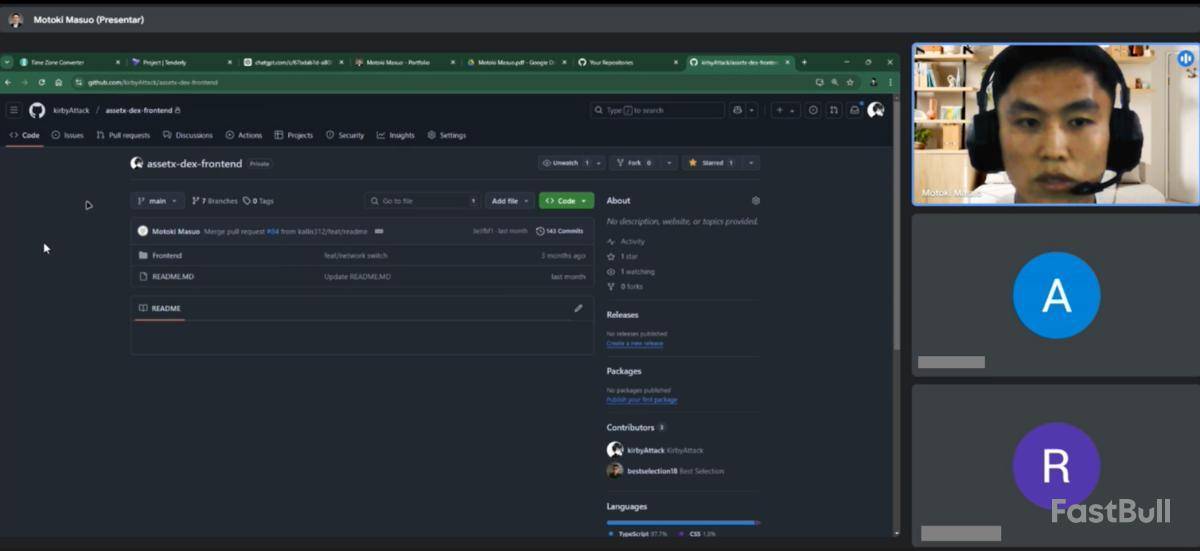

Garcia’s analysis linked the applicant to a network of GitHub accounts and fake Japanese identities believed to be associated with North Korean operations. In February, Garcia invited Cointelegraph to take part in a dummy job interview he had set up with a suspected Democratic People’s Republic of Korea (DPRK) operative who called himself “Motoki.”

Ultimately, Motoki accidentally exposed links to a cluster of North Korean threat actors, then rage-quit the call.

Here’s what happened.

Suspected North Korean crypto spy posed as a Japanese developer

Garcia first encountered Motoki on GitHub in late January while investigating a cluster linked to a suspected DPRK threat actor known as “bestselection18.” This account is widely believed to be operated by an experienced DPRK IT infiltrator. It was part of a broader group of suspected operatives who had infiltrated the crypto gig economy through freelancing platforms such as OnlyDust.

Most North Korean state actors don’t use a human face photo in their accounts, so Motoki’s profile, which had one, hooked Garcia’s attention.

“I went straight to the point and just wrote to him on Telegram,” Garcia told Cointelegraph, explaining how he created an alter ego as a headhunter for a company looking for talent. “It was pretty easy. I didn’t even say the company name.”

On Feb. 24, Garcia invited Cointelegraph’s South Korean reporter to join an upcoming interview for his fake company — with the hope of speaking to the suspected DPRK operative in Korean by the end of the call.

We were intrigued; if we could meet with an operative, we had the opportunity to learn just how effective these tactics were and, hopefully, how they can be counteracted.

On Feb. 25, Garcia and Cointelegraph met Motoki. We kept webcams off, but Motoki did not. During the interview, conducted in English, Motoki often repeated the same responses for different questions, turning the job interview into an awkward and stilted conversation.

Motoki displayed questionable behavior inconsistent with that of a legitimate Japanese developer. For one, he couldn’t speak the language.

We asked Motoki to introduce himself in Japanese. The screenlight reflecting off his face suggested he was frantically searching through tabs and windows to find a script to help him answer.

There was a long, tense silence.

“Jiko shōkai o onegaishimasu,” Cointelegraph repeated the request, this time in Japanese.

Motoki frowned, threw off his headset, and left the interview.

Compared to bestselection18, Motoki was sloppy. He revealed key details by sharing his screen in the interview. Garcia theorized that Motoki is likely a lower-level operative working with bestselection18.

Motoki had two calls with Garcia, one of which was with Cointelegraph. In the two calls, his screenshare revealed access to private GitHub repositories with bestselection18 for what Garcia calls a defunct scam project.

“That’s how we linked the whole operation and the whole cluster… He shared his screen and revealed he was working with [bestselection18] in a private repo,” Garcia said.

Linguistic clues point to North Korean origins

In a 2018 study, researchers observed that Korean males tend to have wider, more prominent facial structures than their East Asian neighbors, while Japanese males typically have longer, narrower faces. While broad generalizations, in this case, Motoki’s appearance aligned more closely with the Korean profile described in the study.

“Okay, so let me introduce myself. So, I am an experienced engineer in blockchain and AI with a focus on developing innovation and impactful products,” Motoki said during the interview, his eyes scanning from left to right as if reading a script.

Motoki’s English pronunciation offered more clues. He frequently pronounced words beginning with “r” as “l,” a substitution common among Korean speakers. Japanese speakers also struggle with this distinction but tend to merge the two sounds into a neutral flap.

He seemed more relaxed during personal questions. Motoki said he was born and raised in Japan, had no wife or children, and claimed native fluency. “I like football,” he smiled, pronouncing it with a strong “p” sound — another hint more typical of Korean-accented English.

Motoki unveils one more North Korean tactic

About a week after the interview with Cointelegraph, Garcia attempted to prolong the charade. He messaged Motoki and claimed that his boss had fired him due to the dubious interview.

That led to three weeks of private message exchanges with Motoki. Garcia continued to play along, pretending Motoki was a Japanese developer.

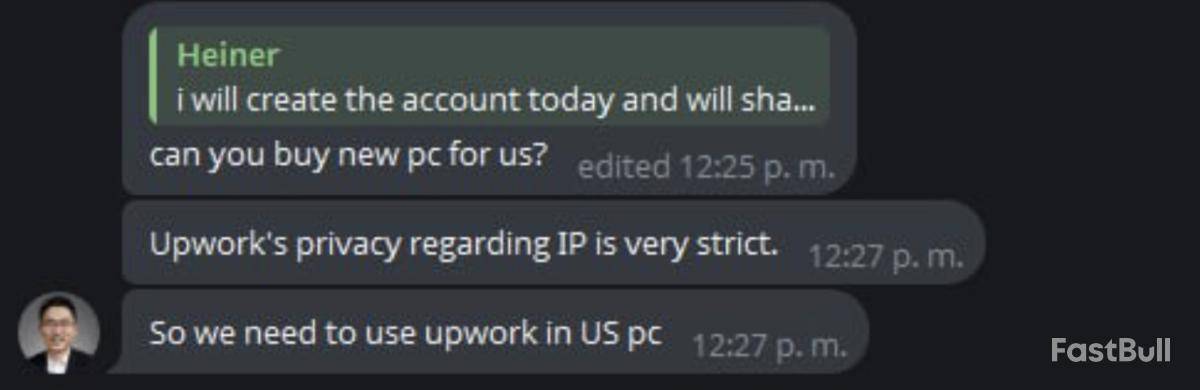

Garcia later asked Motoki for help finding a job. In response, Motoki offered a deal that provided additional insight into some of North Korea’s operational methods.

“They told me they would send me money to buy a computer so they could work through my computer,” Garcia said.

The arrangement would allow the operator to remotely access a machine from another location and carry out tasks without needing a VPN connection, which can trigger issues on popular freelancing platforms.

Garcia and his partner published their findings on the cluster of suspected DPRK operatives tied to bestselection18 on April 16 on open-source investigative platform Ketman.

A few days later, Cointelegraph received a message from Garcia: “The guy we interviewed is gone. All his socials changed. All the chats and everything around him has been deleted.”

Motoki has not been heard from since.

Suspected DPRK operatives have become a recurring problem for recruiters across tech industries. Even major crypto exchanges are targeted. On May 2, Kraken reported it identified a North Korean cyber spy attempting to land a job at the US crypto trading platform.

A United Nations Security Council report estimates that North Korean IT workers generate up to $600 million annually for the regime. These spies are able to funnel consistent wages back to North Korea. The UN believes those funds help finance its weapons program — which, as of January 2024, is thought to include more than 50 nuclear warheads.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up