Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin proxy Strategy continues to scale up its BTC exposure. The company said Monday it had acquired another 1,895 BTC between April 28 and May 4, boosting its holdings to 555,450 BTC, or 2.6% of the total Bitcoin supply.

According to a new SEC filing , the purchase was funded through the sale of Strategy’s Class A common stock (MSTR) and Series A preferred stock (STRK). Last week, the company sold 353,825 MSTR shares and 575,392 million STRK shares, generating net proceeds of approximately $180 million.

This latest purchase marks the fourth consecutive week Strategy has added more Bitcoin to its portfolio. Last Monday, the firm revealed it had bought $1.4 billion worth of BTC during the week ending April 27.

Bitcoin is currently trading at around $94,000, down 1.5% in the last 24 hours, according to CoinMarketCap. Prices may face more volatility as markets turn their attention to the upcoming FOMC meeting, where the Fed is expected to announce its latest interest rate decision.

While President Trump has repeatedly urged the Federal Reserve to reduce interest rates, the central bank has shown no signs of shifting course. No rate cut is expected at this week’s policy meeting.

While President Trump has repeatedly urged the Federal Reserve to reduce interest rates, the central bank has shown no signs of shifting course. No rate cut is expected at this week’s policy meeting.

Regardless of the recent pullback, Strategy’s BTC holdings still reflect about $14 billion in unrealized gains, data from its portfolio tracker shows. The company has also made it clear that it has no intention of backing off its aggressive accumulation strategy, despite a Q1 earnings miss.

Last week, the Michael Saylor-led firm reported a $4.2 billion net loss for the first quarter of 2025, primarily due to a $5.9 billion unrealized markdown under the new fair value accounting rules.

Nevertheless, the company announced plans to raise another $21 billion to continue expanding its Bitcoin acquisition strategy. It also aims to boost its BTC yield target to 25% and its BTC dollar gain target to $15 billion.

With several impressive milestones, the TRON network continues to assert its dominance in the stablecoin payment sector. Recently, the amount of USDT (Tether) circulating on TRON reached a new all-time high.

Meanwhile, the number of long-term holders on TRON has exceeded 2.66 million addresses. This reflects retail investors’ strong confidence and long-term commitment to this layer-1 blockchain.

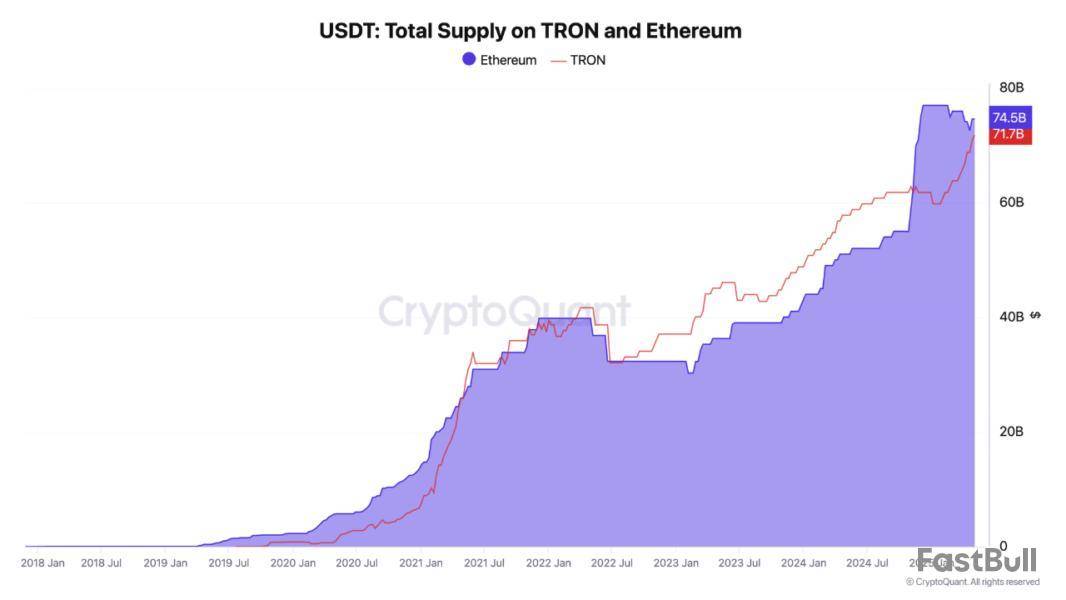

Can USDT Supply on TRON Surpass Ethereum?

Data from CryptoQuant shows that the USDT supply of TRON has grown steadily over recent years. Currently, the market cap of USDT on TRON has hit a record high, with over $71 billion USDT in circulation.

Meanwhile, Ethereum hosts $74.5 billion USDT in circulation. TRON is narrowing the gap with ETH in terms of traders’ USDT usage.

“This milestone cements TRON’s position as one of the major blockchains in the DeFi space, and it may even surpass the adoption of some major chain competitors in the future,” Analyst Darkfost commented.

For context, the total stablecoin market capitalization is $242 billion, and Tether alone accounts for $149 billion. That means TRON facilitates smooth transactions for 29% of the stablecoin market cap and 47% of USDT’s market cap.

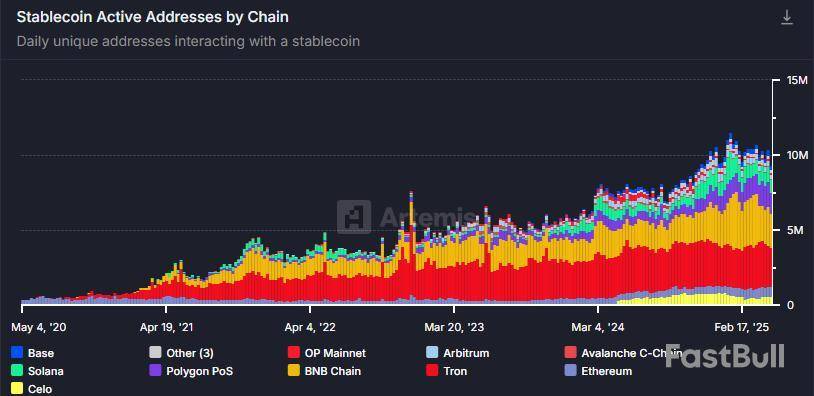

Additionally, data from Artemis shows that TRON accounts for 28% of all active stablecoin wallet addresses, more than any other blockchain tracked. This makes TRON the top chain in terms of fee revenue.

A recent report from BeInCrypto reveals that experts predict stablecoins will attract strong VC interest in the future. The number of issuers could grow tenfold. New issuers may choose TRON, which would benefit a blockchain capable of handling $150 billion in weekly stablecoin transaction volume.

Tron (TRX) Backed by Loyal Long-Term Holders

CryptoQuant also reports that 2.66 million TRX addresses have held their tokens for over one year without spending them. These wallets maintain balances of at least 10 TRX. While 10 TRX is worth only a few dollars, many retail investors choose to hold TRON long-term, even with small amounts of capital.

Analyst Crazzyblockk believes this metric indicates strong user loyalty and sustained engagement, which can support TRX’s price in the long run.

“Increased long-term holding is often linked to higher confidence in the underlying network and potential for liquidity resilience,” Crazzyblockk said.

However, some investors argue that TRON’s vitality relies too heavily on USDT transactions. Data from Dune shows over 3 million TRON wallets are active daily, but most only transact USDT. Therefore, any strategic changes in the TRON–Tether relationship could significantly impact the network and the price of TRX.

This dependency highlights TRON’s weak utility outside the USDT space. For example, TRON lags far behind Solana in meme coin deployment and is significantly behind other chains in decentralized exchange (DEX) trading volume. Moreover, TRON appears nearly absent from the real-world asset (RWA) market share.

At the time of writing, TRX is trading around $0.25, showing little movement after falling from a high of $0.45 late last year.

Business intelligence firm Strategy has acquired an additional 1,895 Bitcoins for roughly $180 million, according to a Monday announcement.

In a now-familiar pattern, Executive Chairman Michael Saylor hinted at the purchase on Sunday with a social media post.

According to CoinGecko data, Bitcoin is currently changing hands slightly above the $94,000 level after dipping below 1.5% over the past 24 hours.

Meanwhile, Strategy shares are down 3% in pre-market trading after adding more than 3% on Thursday.

As reported by U.Today, the largest corporate Bitcoin holder announced a $1.4 billion purchase on Monday. The firm spends its entire $21 billion at-the-money (ATM) offering within mere months.

Last week, Strategy moved to double the amount of capital that it intends to raise for buying Bitcoin to an eye-popping $84 billion.

The company registered another $21 billion equity offering program after exhausting the previous one. The company has also doubled its debt purchase program to a whopping $42 billion, with $14.6 billion still being available.

The biggest threat to Strategy

Last month, Matthew Siegel, head of digital research at VanEck, stated that a collapsing premium poses the biggest threat to Strategy and its copycats.

"As long as the shares are trading at a premium…then they should be able to issue equity and buy Bitcoin in a way that creates this Bitcoin yield," he said.

However, if the shares of such companies start trading at a discount, this will break the Bitcoin yield engine since financing new BTC purchases would be value-destructive for shareholders.

Crypto market analytics platform CryptoQuant has highlighted a trend among Ethereum holders in the last few weeks. These investors refuse to sell their ETH holdings, even with the shortfall in the price of the second-largest cryptocurrency by market capitalization.

Ethereum holders endure price plunge

In a Monday X post, CryptoQuant reported that some holders strongly believe in Ethereum. Investors have proven by their actions that they are optimistic about the project and its ecosystem. Analyst Carmelo Aleman cited how long-term holders of ETH have calmly endured a consistent price drop from $4,107 in December 2024.

However, the market took another turn on March 10 when the ETH price went below $2,000, and accumulating addresses moved into unrealized loss territory in return.

Accumulating addresses in ETH, which are usually Ethereum whales, consistently receive ETH without significant selling. Their balance often remains stable or may increase over time, regardless of whether they belong to large or small holders.

CryptoQuant.com@cryptoquant_comMay 05, 2025ETH Holders Refuse to Sell: Accumulating Addresses Lower Their Cost Basis

“On March 10 they held 15.5356M ETH, and by May 3 this rose to 19.0378M ETH, a 22.54% increase. Behavior reflects structural conviction & clear expectations of short-term appreciation.” – By @oro_crypto pic.twitter.com/yx12tC7N0O

So far, cost basis has plunged, with accumulating addresses moving their Realized Price from $2,026 to $1,980 as of May 3. This reflects a 2.32% decrease since March 10. At press time, the Ethereum price traded at $1,810.63 after losing 0.94% of its 24-hour gain, per CoinMarketCap data.

Ethereum holders' on-chain behaviors reflect their structural conviction and clear expectations of short-term appreciation, which aligns with Ethereum’s broader evolution.

Market watchers are eager to see whether this positive sentiment from ETH holders will drive the coin's price to new levels.

Catalysts for potential Ethereum price growth

A number of events in the coming weeks could also fuel the rally in the price of ETH. Ethereum Pectra Upgrade is officially scheduled to launch on May 7.

One of the promises tied to the Pectra Upgrade is that staking will become even better, in addition to a few scalability and usability boosts in the bargain. On this premise, the price of the coin can record some uptick in favor of the accumulating addresses.

Also, Ethereum ETF flows are improving, marking a potential shift in sentiment. If sustained, the price could also feel the ripple effect.

A decisive moment has arrived for Litecoin (LTC) holders, as the United States Securities and Exchange Commission (SEC) faces a key deadline for a potential Litecoin spot ETF.

According to Bloomberg ETF analyst James Seyffart, the SEC is expected to decide on Canary Funds’ application for a Litecoin exchange-traded fund (ETF) by today, May 5.

Wu Blockchain@WuBlockchainMay 04, 2025Bloomberg analyst James Seyffart noted that the SEC is expected to decide on Canary Funds’ proposed Litecoin ETF by May 5. While the SEC has already delayed several filings early, this one was not included. Seyffart believes Litecoin may have a chance at early approval, though he…

Following the successful launch of Bitcoin and Ethereum ETFs, asset managers have filed dozens of applications for altcoin ETFs.The SEC has, however, delayed making decisions on the filings, creating anticipation in the crypto community.

In late April, the SEC delayed decisions on whether to allow the trading of altcoin spot ETFs, which would give investors exposure to Dogecoin and XRP. The regulator said it would wait until June to decide on the next steps for the Bitwise Dogecoin ETF and the Franklin XRP Fund.

While the SEC has already delayed several filings, the Litecoin application was not included, according to Seyffart, which leaves open the possibility of an early decision.

Bloomberg ETF analysts predict a 90% possibility that the U.S. securities regulator will approve a spot Litecoin ETF before the end of the year.

Bloomberg analyst shares expectations

Given that the Litecoin ETF filing has not yet faced a delay, Bloomberg ETF analyst James Seyffart believes Litecoin may have a chance at early approval, though he personally expects a delay.

"The Canary Funds Litecoin ETF filing is due for a decision (possibly a delay) by Monday 5/5. SEC went early & delayed a bunch of filings but not this. If any asset has a chance of early approval it's Litecoin IMO. Personally think a delay is more likely but definitely something to watch," Seyffart stated, noting the fact that the filing has not been pushed back yet sets it apart from others in the crypto ETF queue.

If approved, the ETF would mark a significant milestone for Litecoin, giving the cryptocurrency increased visibility and potentially broader institutional access, similar to the optimism seen in Bitcoin following its ETF launch.

The XRP Ledger (XRPL) community has long wondered what happened to the first 32,569 ledger entries. With permanent record-keeping only starting at ledger 32,570, those early blocks have been missing from public view for years — and critics have not let that go unnoticed.

For some, the missing data has fueled claims that Ripple, a crypto company which leverages XRP in its operations, or the XRPL development team, may have deliberately wiped early transactions, possibly to hide activity or gain an advantage. It is often cited in arguments that XRP is not truly decentralized and that Ripple has too much control over the network.

Now, Ripple CTO and XRPL co-creator David Schwartz has stepped in to clear things up. According to Schwartz, the missing ledgers date back to XRPL’s earliest development and testing days.

Multiple ledger streams were being created as the software was taking shape, and a bug in one of those streams caused about 10 days’ worth of ledgers to be lost. Recovery efforts brought back everything except those first 32,569 blocks.

David 'JoelKatz' Schwartz@JoelKatzMay 05, 2025We created many ledger streams in the process of testing and developing the software. In one of many streams, a software bug caused some ledgers (about ten days) to be lost. All but the first 32k or so were recovered. We expected the next ledger reset to make the issue…

At the time, the team expected to reset the ledger again soon, which would have made the lost history irrelevant. But that reset never happened. They thought about wiping the ledger to clean things up, but that would have deleted even more history, so they left it as is.

It looks like the mystery of the missing blocks is finally solved. The loss was not intentional, and it did not involve any kind of manipulation. It was a one-time thing, related to the experimental stage of XRPL's launch.

Changpeng Zhao, the cofounder of the Binance exchange and its former CEO, frequently known simply as CZ to crypto fans, has taken to the X platform (formerly known as Twitter) to share an important post.

CZ proposes BNB and BTC as basis for Kyrgyzstan’s crypto reserve

CZ revealed that during his recent visit to Kyrgyzstan, he had proposed that the government make Binance Coin (BNB) and Bitcoin the basis for its Strategic Cryptocurrency Reserve.

CZ 🔶 BNB@cz_binanceMay 05, 2025Not my car, but ❤️ the plate. Kyrgyzstan🇰🇬🙏

Among other things, also gave my advice to make #BNB and #BTC as the two starting crypto for the National Crypto Reserve. https://t.co/ZhbGs2pWQu pic.twitter.com/ZewpPqZdQc

Notably, a month ago, CZ accepted the invitation of the Kyrgyz President Sadyr Japarov to become a member of the country’s National Crypto Committee.

Now, CZ has helped to sign a partnership between Kyrgyzstan and Binance to help the country launch internal cryptocurrency payments.

Many countries are now considering the launch of their own Strategic Crypto Reserve, following the example of the U.S., which already has 200,000 Bitcoins for it.

Thanks to CZ’s role as an intermediary, Binance has signed a memorandum of understanding with Kyrgyzstan, and is now getting ready not only to launch crypto payments but also educational programs about blockchain and crypto in the country. The latter will be achieved by Binance Academy.

CZ 🔶 BNB@cz_binanceMay 04, 2025Honored to be invited by Mr. President Sadyr Japarov of Kyrgyzstan to join the National Crypto Council.🇰🇬

Also learned so much about the unique cultures of Kyrgyzstan. Truly amazing place.

Let's grow the industry together. 🤝 https://t.co/xCQUXQfTur

The memo was signed on April 3, according to CZ's earlier X post. CZ accepted the official invitation to join the crypto committee in Kyrgyzstan on Sunday.

CZ shares his view on gold vs. Bitcoin

Over the weekend, CZ, who is a well-known long-term supporter of crypto, Bitcoin and BNB in particular, took to social media to share his take on gold as an asset. As a crypto proponent, it looked as if he indirectly opposed Bitcoin to gold without naming BTC but naming its key feature instead — scarcity.

On May 3, CZ tweeted: “Not against gold, but it’s not a limited supply asset.” This tweet ignited Bitcoin fans among his followers, who started touting BTC as an asset with a capped supply of 21 million.

When it comes to crypto holdings, Zhao once tweeted that he only holds Bitcoin and BNB, and for this reason he in unable to buy any BTC dips — he is 100% in crypto. BNB is currently changing hands at $593, and Bitcoin is trading slightly above $94,000.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up