Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

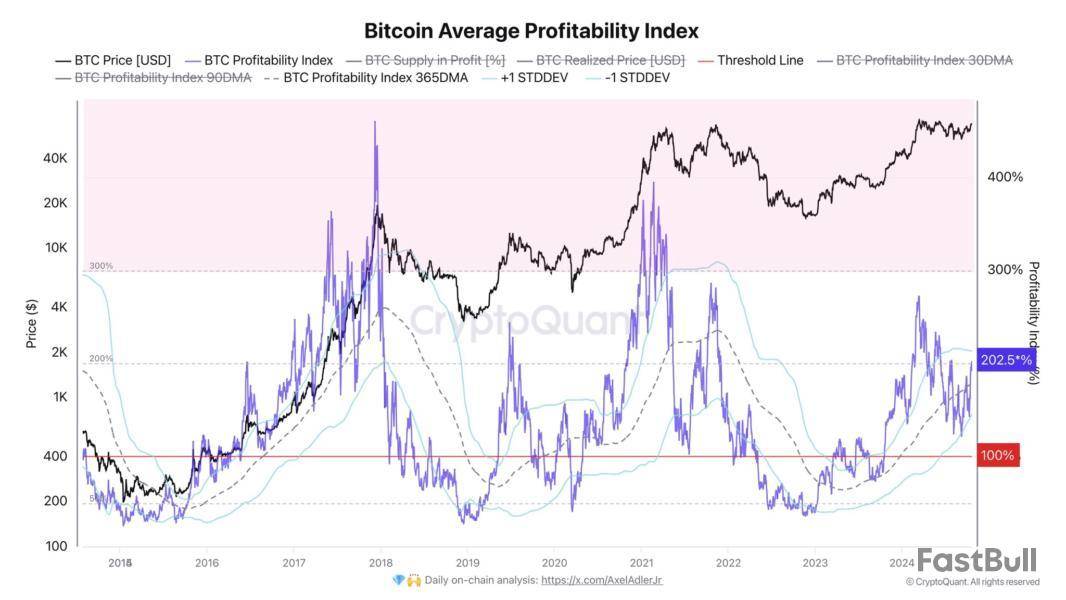

On-chain data shows the Bitcoin Profitability Index is at 202% right now. Here’s how this compares with past bull runs of the asset.

Bitcoin Average Profitability Index Has Been Rising Recently

In a new post on X, CryptoQuant author Axel Adler Jr. discussed the latest trend in the Average Profitability Index of Bitcoin. The “Average Profitability Index” is an on-chain indicator that tells us about how the spot price of the asset compares against its realized price.

The “realized price” here is a measure of the cost basis of the average investor or address on the Bitcoin network. The Average Profitability Index is calculated as a percentage, with the 100% mark corresponding to the spot price being equal to the realized price.

When the value of this indicator is greater than 100%, it means the asset is currently trading above the cost basis of the average investor, so the overall market could be assumed to be in a state of profit. On the other hand, it being under this cutoff suggests the holders as a whole are carrying their coins at a net unrealized loss.

Now, here is a chart that shows the trend in the Bitcoin Average Profitability Index over the past decade:

As displayed in the above graph, the Bitcoin Average Profitability Index has been above 100% since last year, which suggests the investors as a whole have been enjoying profits.

The indicator’s value had spiked to particularly high values earlier in this year when the rally towards the new all-time high (ATH) had occurred. With the latest recovery run that the coin has seen, the indicator has been picking up once again, although it’s still a notable distance away from the level seen during the ATH.

At present, the BTC Average Profitability Index is floating around 202%, which implies the spot price is double that of the realized price. Historically, the indicator reaching extreme levels has generally led to tops for the asset.

This is because the investors’ temptation to participate in profit-taking increases the larger their gains. “When the index rises above 300%, investors are likely to start taking profits actively,” notes the analyst.

The chart shows that the last two times that the Bitcoin Average Profitability Index surpassed this 300% mark was during the heights of the 2017 and 2021 bull runs.

Thus, according to this historical pattern, Bitcoin’s current bullish period may not end until the indicator enters the zone above 300%.

BTC Price

At the time of writing, Bitcoin is trading at around $67,400, up 1% over the last seven days.

Tokenization is poised to revolutionize industries such as finance, commodities, intellectual property, and real estate by converting asset rights into digital tokens on blockchain platforms. This transformation is expected to create a market worth up to $16 trillion by 2030. Despite its immense potential, the widespread adoption of full on-chain issuance and value transfer has been hindered by challenges in scalability, customization, confidentiality, security, and interoperability.

The Elastic Chain, developed by ZKsync, addresses these challenges by offering a scalable, multi-chain network designed for institutional-grade tokenization. Its architecture dynamically adds new ZK Chains to handle increasing transaction volumes without compromising performance, effectively solving scalability issues. By allowing enterprises to tailor blockchain components to meet specific needs across various asset classes, it provides the necessary customization for different industries.

To ensure confidentiality, the Elastic Chain keeps sensitive transaction data off public networks while maintaining regulatory compliance. It enhances security by anchoring to Ethereum utilizing zero-knowledge proofs (ZKPs), offering robust protection without exposing sensitive information. Additionally, the Elastic Chain enables seamless asset movement across networks through shared ecosystem contracts and trustless communication, thus addressing interoperability concerns.

Several financial institutions have begun utilizing ZKsync’s technology. Tradeable is tokenizing over $500 million in private credit assets. Fidelity International, Sygnum, and Chainlink have partnered to tokenize $50 million of a money market fund. Deutsche Bank is developing an asset tokenization and fund management platform using this technology. Furthermore, the Buenos Aires government is implementing a decentralized digital identity protocol powered by QuarkID.

The comprehensive approach of the Elastic Chain positions it as a catalyst for the widespread adoption of fully on-chain tokenization. By overcoming technological and enterprise readiness barriers, it enables institutions to transition smoothly to blockchain-based asset management, positioning them to capitalize on the evolving regulatory landscape.”

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ethereum layer-2 network Scroll launched its SCR token in a highly anticipated airdrop conducted on October 22. However, widespread dissatisfaction among recipients, who complained about the small amounts of SCR they received, has put significant selling pressure on the token.

Currently trading at $1.04, SCR has seen a 19% decline in the past 24 hours. As bearish sentiment continues to grow, the token’s price may face further losses. Here’s why.

Scroll’s Airdrop is the Cause Of Its Problems

According to a blog post from the team, Scroll’s airdrop distributed 5.5% of the total SCR supply—55 million out of 1 billion tokens—to early contributors within the ecosystem.

Of this amount, 40 million SCR was allocated to on-chain participants who earned 200 or more Scroll Marks, the platform’s reward points for engaging with the layer-2 scaling network. An additional 1% of the supply was evenly distributed across eligible wallets, while 0.5% was reserved as a “bonus” for users who met specific criteria.

Another user claimed to have dumped the tokens they received via the airdrop and bridged all their assets off the chain.

SCR Holders Sell Off Holdings

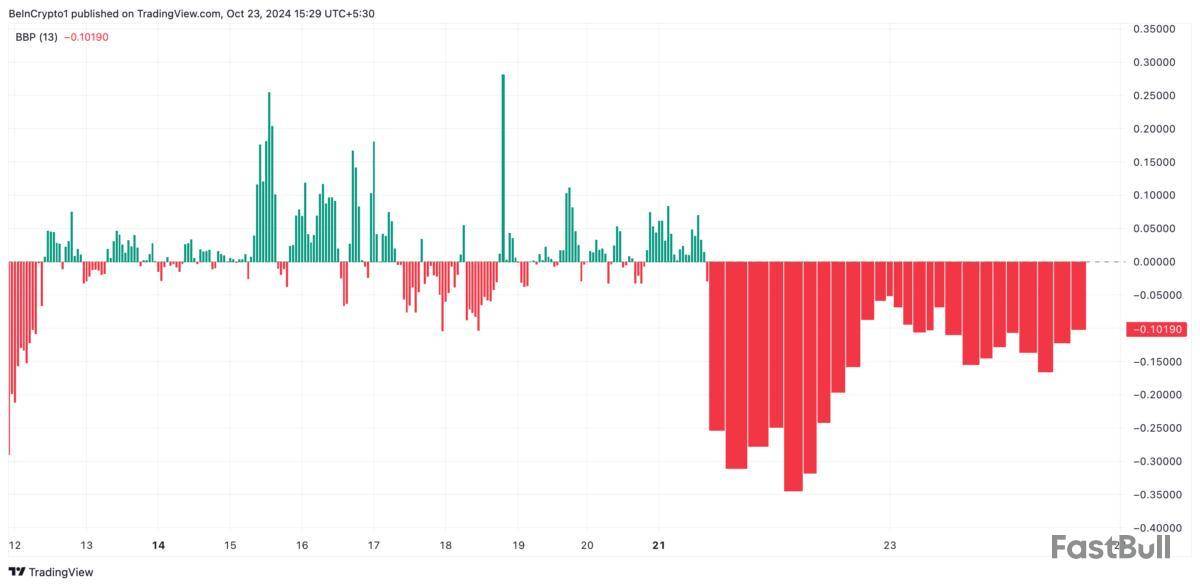

This surge in SCR’s selling pressure since its launch has caused its value to plummet by double digits. BeInCrypto’s assessment of its technical setup on an hourly chart signals the possibility of an extended decline.

For one, the bearish sentiment trailing the altcoin continues to grow, as evidenced by the negative value of its Bull Bear Power (BBP), which stands at -0.10 as of this writing.

This indicator measures the strength of buyers and sellers in the market. A negative BBP reading signals that sellers are in control and the market is experiencing downward pressure.

Furthermore, SCR’s price trades near the lower band of its Bollinger Band (BB) indicator which measures its market volatility. Trading near this level usually indicates that the market is in a downtrend or facing selling pressure. This lower band usually serves as a support level, but if the price continues hugging this band, it reflects sustained bearish momentum.

SCR Price Prediction: Coin Risks Dropping to New Lows

SCR currently trades at $1.04, just above support formed at $0.99, representing its all-time low since it launched. Sustained selloffs amongst market participants will push SCR’s price below this level in the near term.

Read more: What are Crypto Airdrops?

However, if market sentiment changes from bearish to bullish and SCR witnesses a resurgence in demand, its price will initiate an uptrend and climb toward resistance at $1.55. A successful break above this level will make it rally toward the next resistance level at $1.72.

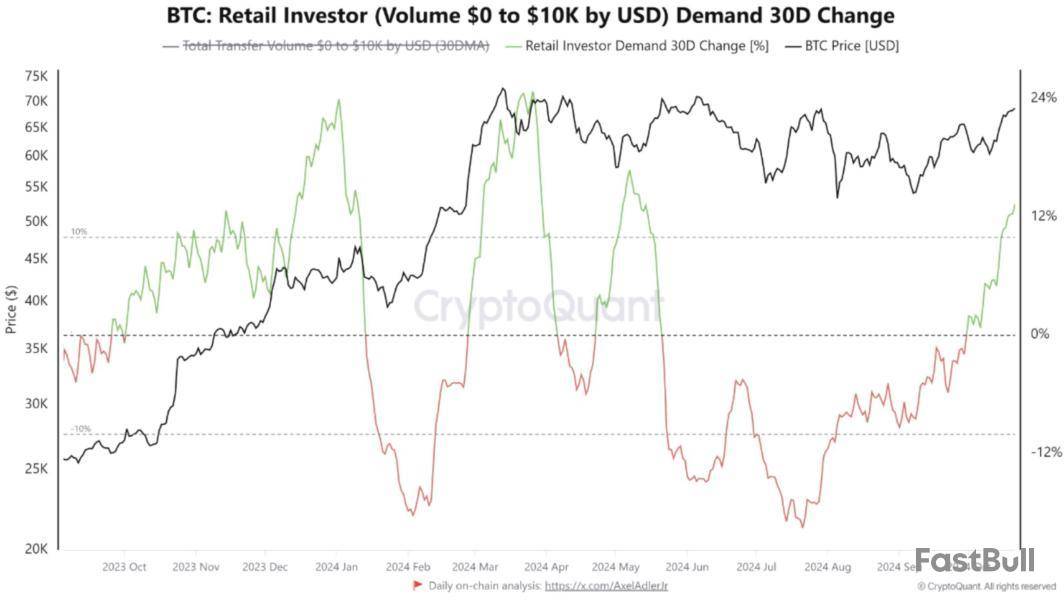

The Bitcoin price is struggling to gain momentum despite growing institutional and retail demand for the world’s first cryptocurrency.

Retail demand for Bitcoin grew to an over six-month high, last seen during March 2024, when Bitcoin recorded a new all-time high of above $73,600.

Retail demand saw a significant uptick during the past 30 days, according to onchain intelligence firm CryptoQuant, which wrote in an Oct. 22 X post:

Despite growing retail investor interest, Bitcoin price fell over 1.5% during the past 24 hours to change hands at $66,432 as of 12:22 pm UTC on Oct. 23, according to Cointelegraph data.

Although both institutional and retail interest in Bitcoin is growing, the cryptocurrency has been unable to surpass the $70,000 psychological barrier since July 29.

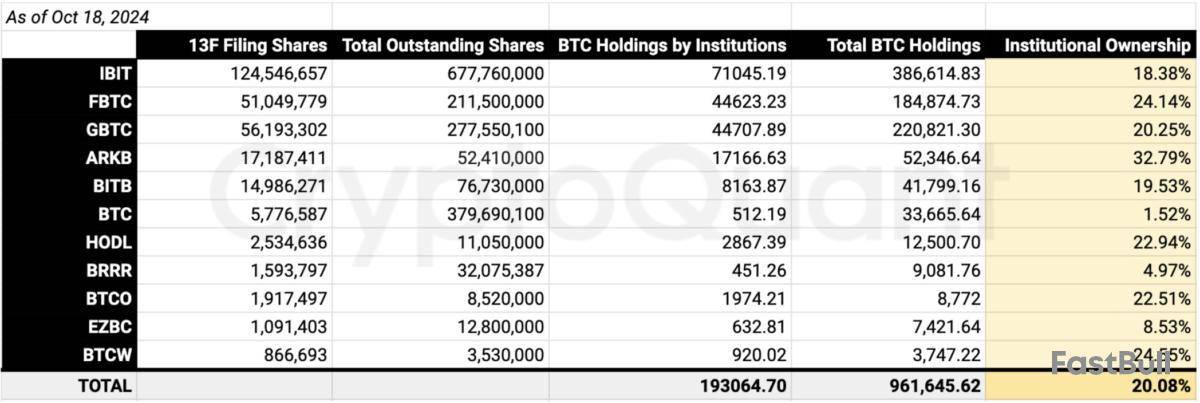

Institutions own over 20% of US Bitcoin ETFs

Institutional ownership of United States-based spot Bitcoin exchange-traded funds (ETFs) is also on the rise, sparking further optimism for the BTC price.

Institutions own approximately 20% of US Bitcoin ETFs, according to Form 13F filings with the US Securities and Exchange Commission, as of Oct. 18, according to Ki Young Ju, the founder and CEO of CryptoQuant, who wrote in an X post:

More than 1,179 new institutions have invested in Bitcoin in the past 10 months since the launch of Bitcoin ETFs, Ju added.

Continued institutional ETF adoption could significantly bolster Bitcoin’s price since institutions hold large amounts of capital that can move crypto markets. Bitcoin may need continued institutional adoption to reach new all-time highs.

Can ETF inflows nudge a weekly Bitcoin close above $66,400?

Bitcoin ETF inflows turned negative on Oct. 22, following seven days of cumulative net positive inflows.

Bitcoin ETF inflows turned negative on Oct. 22 after seven consecutive days of cumulative net positive inflows, according to data from Farside Investors.

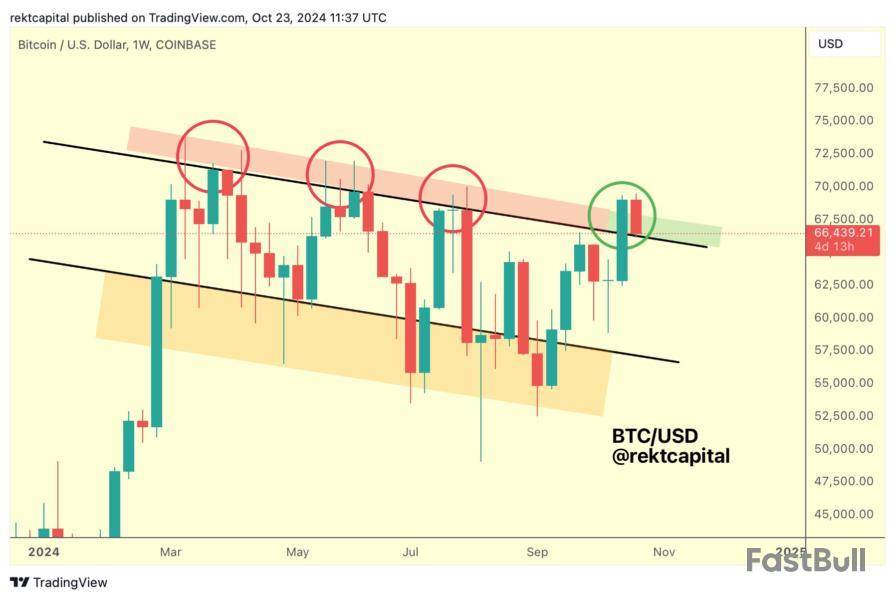

To confirm a potential price breakout, Bitcoin price needs a weekly close above $66,400, the popular crypto analyst Rekt Capital wrote in an Oct. 23 X post:

To achieve a bullish weekly close, Bitcoin may require continued ETF inflows. A month after their launch, US BTC ETFs accounted for about 75% of new Bitcoin investments, helping push the price above $50,000.

In a recently published tweet, Ripple CTO David Schwartz, known on the X social media network as @JoelKatz commented on an X post by another user and added his comment which most likely refers to the legal overreach of the US Securities and Exchange Commission regarding crypto and “unregistered securities.”

The XRP army supported Schwartz in trolling the SEC and its chairman Gary Gensler.

"Accepting an offer of a contract?"

X user @jeremyjudkins_ posted a photo of himself holding a branding iron with a Tesla logo on it. He tweeted that he would brand his backside with that if the post collected 100,000 likes.

This triggered a response from David Schwartz, who wondered if his like was to be considered a security and he accepted “an offer of a contract by liking this post.” That seems like a clear reference to the SEC and their branding altcoins as securities over the past few years while taking various cryptocurrency platforms to court over that.

The XRP army responded supporting Schwartz and adding more oil into the fire with comments like: “this offer looks like a security to me…”, “Is this a physical NFT?” and “Gary will see this lol.”

This tweet came out after it became known on Tuesday that the SEC intends to put stronger focus on crypto and companies working with it and offering trading, staking, and investment services in 2025.

Besides, David Schwartz knows about SEC’s overreach in the crypto space not by hearsay – his company Ripple fought in court against the regulator since 2020 and only in 2023 and then again this year it scored two major victories. One of them was about the court ruling that XRP was not a security when sold in secondary markets.

However, the SEC has recently filed an appeal.

SEC eyes stricter scrutiny for crypto

Fox Business’s journalist Eleanor Terrett spread the word on her X account that the Securities and Exchange Commission has included crypto in its list of 2025 exam priorities, even though no major crypto-focused company has registered with the SEC this year.

Since Bitcoin and Ethereum are the only cryptocurrencies that SEC believes not to be securities, Terrett assumed that the regulator might be focused on them and companies that work with BTC and ETH, which the SEC officially considers to be commodities.

Participants at the Blockchain Life event in Dubai expressed different opinions on who should be responsible for safety and security within the crypto space.

In a Cointelegraph interview, Vugar Usi Zade, the chief operating officer of the Bitget crypto exchange, argued that platforms should not put matters concerning security and safety on their users’ shoulders:

The Bitget executive explained that exchanges such as Bitget have many ways to help consumers with security.

How exchange platforms can enhance security

According to Zade, Bitget implemented a feature called delayed payments. With this, the exchange can delay or cancel transactions before they happen. This means that if a transaction is suspicious, the exchange can prevent the transaction from occurring.

Zade added that Bitget also implements anti-phishing codes. He told Cointelegraph:

Zade said if scammers have already been flagged before, they can notify customers before transferring funds to certain addresses. “We are trying our best on our end to prevent any sort of scam happening,” Zade added.

Security falls on many “layers”

Meanwhile, in a panel discussion moderated by Cointelegraph, Jason Jiang, the chief business officer of blockchain security firm CertiK, said the crypto industry comprises multiple layers, which must be responsible for different security-related matters. He said:

Jiang also noted that regulators are responsible for putting proper policies in place and enforcing the law, with law enforcement also having a role to play in investigating where the funds went.

“It goes to many layers. And it takes all of us to get this space secure,” Jiang added.

Peter Todd, the Bitcoin developer alleged to be Satoshi Nakamoto, the network’s pseudonymous creator in the hyped HBO documentary, Money Electric: The Bitcoin Mystery, has reportedly gone into hiding, per Wired.

Todd was revealed as Nakamoto in the documentary shot by Cullen Hoback, who previously identified the face behind the QAnon conspiracy. Todd, however, denied being Nakamoto in an email to CoinDesk.

Hoback’s supposed evidence for Todd being Nakamoto was his interest in cryptography from a young age, his relationship with Adam Back (who actually emailed Nakamoto), his technical ability and British linguistics.

The documentary provided its strongest clue through a 2010 public forum exchange where Todd inadvertently seemed to reply to a post as himself instead of the mysterious Bitcoin creator, suggesting a potential slip-up in identity. Hoback posited this as evidence that Todd might be Nakamoto, although the documentary stopped short of making a definitive claim.

The Bitcoin community has largely brushed off Hoback’s findings. Hoback, however, continues to believe that Todd is indeed Nakamoto.

But the allegations have a serious real world impact.

Todd told Wired that the fallout from the documentary has forced him into hiding. His email has become inundated with requests for financial help - but there’s a threat of “continued harassment by crazy people.”

Personal safety is the number one concern for Todd now in case criminals do believe in him being Nakamoto: Wallets belonging to Nakamoto hold over 1 million BTC worth more than $67 billion at current prices. That puts the unknown persona on a list of the 25 wealthiest people in the world.

“Falsely claiming that ordinary people of ordinary wealth are extraordinarily rich exposes them to threats like robbery and kidnapping,” Todd told Wired. “Not only is the question dumb, it's dangerous. Satoshi obviously didn't want to be found, for good reasons, and no one should help people trying to find Satoshi.”

Todd remains active online on his X account.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up