Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The greatly anticipated meeting at the highest levels between the presidents of the United States and Russia failed to reach a conclusion regarding a ceasefire between Ukraine and the world’s largest country by landmass.

Nevertheless, Trump said both parties made some good progress on a few points, while Putin categorized the meeting as a “starting point.”

This was the first time in almost a decade that the Russian leader set foot on US soil when he attended the UN General Assembly in New York City and met then-President Obama.

“There were many, many points that we agreed on … I would say a couple of big ones that we haven’t quite got there, but we’ve made some headway,” Trump said at a joint press conference.

Putin said the relationship between the two Great Powers has deteriorated to the “lowest point since the Cold War,” but noted that these talks can be considered a “starting point” for improving it.

Before the meeting, Ukrainian President Volodymyr Zelenskyy expressed disappointment that his country would not be represented, as many feared that a potential deal could compromise its sovereignty.

“Ukraine is ready to work as productively as possible to bring the war to an end, and we count on a strong position from America … A meeting of leaders is needed – at the very least, Ukraine, America, and the Russian side.”

Given the potential significance of the meeting, many expertsanticipated a volatile crypto market, especially since it took place after Wall Street had closed for the day.

However, this wasn’t the case. Bitcoin’s price had slipped ahead of the meeting to just under $117,000 but stopped its nosedive even as both parties failed to reach a peace conclusion. As of press time, BTC has neared $118,000 once again.

The cryptocurrency was impacted a lot more by the hot PPI data that came out the day before, as itdroppedfrom itsall-time high of $124,500to under $118,000 within hours.

Lemmy The Bat will get listed on XT.COM, a global crypto exchange. New listings often bring in new buyers, which can push the LBAI price up, at least for a short time. If there is strong interest from XT.COM’s users, the price may jump in the first hours or days. However, after the first excitement, prices may drop if traders sell for quick profit. Listings are usually big news for smaller tokens. Watch trading volume closely. More info here: source.

XT Exchange #BeyondTrade@XTexchangeAug 16, 2025New Listing #XTListing @lbai_lemmy

#XT will list $LBAI (Lemmy The Bat).

Deposit: 12:00 on August 16, 2025 (UTC)

Trading: 12:00 on August 17, 2025 (UTC)

Withdrawal: 12:00 on August 18, 2025 (UTC)

Get ready for trading ️https://t.co/NK8mgwoj07 pic.twitter.com/BQU3IyOTXM

Rice AI is having its Token Generation Event (TGE) on PancakeSwap. This event may raise the price of RICE because PancakeSwap is a very popular place for trading new tokens. Only users with Binance Alpha Points can join, which may limit supply and create more demand at first. Early trading often brings strong price moves, but prices may drop after the event if early users sell their tokens fast. Traders should watch the price closely after launch for sudden changes. More here: source.

Binance Wallet@BinanceWalletAug 15, 2025Join the 34th Exclusive TGE on #Binance Wallet with @realRiceAI (RICE) via @PancakeSwap!

️ Subscription: Aug 18th, 2025, from 8AM to 10AM (UTC)

Eligible users need to use Binance Alpha Points to participate

Additional 40,000,000 RICE for upcoming campaigns — details… pic.twitter.com/hXQz6bmNEE

Flare is launching FAssets V1.2 after finishing a strong security check. Updates like this can help the price go up, because they show trust and growth. If the new version works well, more developers and users may use Flare. However, during the upgrade, some features will stop for about 8 hours, which could cause short-term worries. If the upgrade goes without problems, the price could move higher. But if there are bugs, some traders may lose trust. Read more here: source.

Flare ️@FlareNetworksAug 15, 2025We are preparing to launch FAssets v1.2 on Songbird next week.

This launch is part of our multi-layered security process. We've completed the @zellic_io audit and have high confidence in the code's robustness based on internal reviews. The final Zellic audit report is…

Ethereum had a difficult beginning to the year. From January to late April, the coin lost more than half its value, falling to around $1,300. However, according to Eric Jackson, founder of EMJ Capital, that sharp decline actually set the stage for Ethereum’s rebound. He explained that the drop showed “seller exhaustion,” as many traders were heavily shorting ETH while staying long on Bitcoin. Once that pressure eased, Ethereum started climbing again and has since regained strength.

The Big Catalyst: Ethereum ETFs With Staking

Jackson’s prediction is strongly tied to the possibility of Ethereum exchange-traded funds (ETFs) with staking being approved in the United States. BlackRock, the world’s largest asset manager, has been pushing regulators to allow this. If approved, investors would be able to earn yield through these ETFs, something Jackson says could open the floodgates for institutional money flowing into ETH. A decision from the SEC is expected by October.

Ethereum as the Financial Rails of the Future

Beyond ETFs, Jackson reflected on Ethereum’s growing role in powering the digital economy. Stablecoins like USDC are built on its network, and big companies including Shopify, Coinbase, and Robinhood are adopting Ethereum-based solutions. He argues that Ethereum is not just “digital oil” but the financial infrastructure, or rails, on which future global payments and digital assets will run.

Long-Term Price Targets

Jackson sees strong upside for ETH in both the short and long term. His near-term forecast suggests Ethereum could reach $15,000 in the next cycle. Looking further ahead, he projects ETH could one day hit $1.5 million per coin if adoption continues to grow globally.

At the time of writing, Ethereum is down by more than 4% and is trading at $4,400.

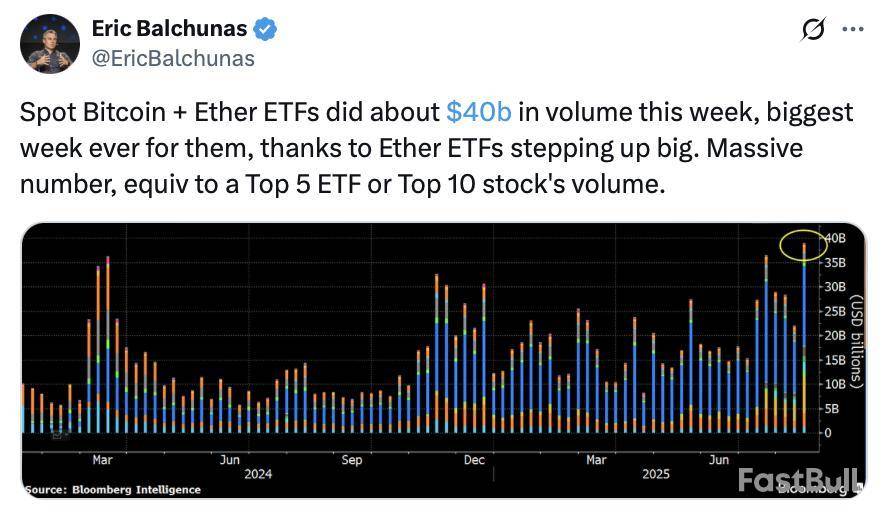

US-based spot Bitcoin and Ether exchange-traded funds (ETFs) just logged their strongest week of trading volume yet, according to an ETF analyst.

“Biggest week ever for them, thanks to Ether ETFs stepping up big,” ETF analyst Eric Balchunas said in an X post on Friday.

Ether “was asleep” for 11 months, says Balchunas

“Ether ETFs’ weekly volume was about $17b, blowing away record, man did it wake up in July,” Balchunas said.

It came the same week Bitcoin (BTC) reached a new all-time high of $124,000 on Thursday, while Ether (ETH) came close to reclaiming its November 2021 high of $4,878 on the same day, reaching $4,784 — just 1.94% below — according to CoinMarketCap.

Since Thursday, Bitcoin has fallen 5.52% from its all-time high, trading at $117,659, while Ether has dropped 6.20% from its Thursday high, trading at $4,486.

However, MN Trading Capital founder Michael van de Poppe said, “There's way more to come for this cycle.”

Ether ETFs take a sharp turn

On Monday, spot Ether ETFs recorded their biggest day of net inflows ever, with flows across all funds totalling $1.01 billion. Across the first two weeks of August, spot Ether ETFs recorded more than $3 billion in net inflows marking their second-strongest monthly performance to date.

Balchunas said it was almost as if Ether ETFs were “asleep” for the past 11 months and “then crammed” one year’s worth of activity into six weeks.

While there was excitement ahead of their July 2024 launch, Ether ETFs initially saw lackluster demand, sparking speculation that Wall Street had yet to find a clear use case for the asset.

Meanwhile, Bitcoin ETFs reached new highs of $73,679 just two months after launching in January 2024.

Analysts are now drawing parallels between Ether’s recent price surge and Bitcoin’s post-ETF rally.

“This move is comparable to the BTC ETF launch, when Bitcoin continued to rally upward,” van de Poppe said, adding, “The ETFs have a massive impact and there’s a lot to come for Altcoins.”

However, some analysts warn that investors must be patient before Ether reaches a new all-time high.

Nansen analyst Jake Kennis said in comments shared with Cointelegraph that a new all-time high for Ether may be weeks or months away, despite ETH currently sitting only a few hundred dollars off a new record price.

Magazine: Altcoin season 2025 is almost here… but the rules have changed

XRP is testing a technical level at the 26-day EMA, which could decide whether a deeper pullback is likely or if the recent uptrend can be sustained. A clean rebound is less likely given the current circumstances, even though the 26 EMA has historically served as a springboard for continuation. The price action has been consolidating following a strong rally earlier this month.

Since the last local low, there has been a sharp upward trendline, but its steep angle indicates limited sustainability. A quick breakdown toward lower supports frequently results from such aggressive slope lines failing under selling pressure. The trendline will probably also be broken if the 26 EMA does not hold, which would allow for faster downward movement. There are not any significant tailwinds for XRP in the larger market context. Chart by TradingView">

Trading volumes have been tapering off, and it looks like the recent rally has lost steam. In the absence of fresh buying interest, the price runs the risk of falling below the EMA support, which might draw technical sellers into the market. In the event that XRP drops this level significantly, the first important support is located close to the 50-day EMA at $2.89.

Failure there would reveal $2.70 as the next important zone, which was crucial as support during the consolidation in July. In order to reopen the path toward recent highs and restore bullish confidence, a significant rebound from the 26 EMA and a break above $3.20 would be required.

Stakes on Ethereum increase

In recent sessions, the volume of Ethereum trades has increased by over 300%. As ETH stays close to the $4,600 mark, the surge shows that market activity around Ether is still through the roof from both retail and institutional sides. The volume increase can indicate a possible turning point around here and hint at increasing volatility.

Technically, ETH's Relative Strength Index (RSI) is not at extreme levels, but it is situated just above the overbought threshold. According to historical data, this reading may indicate that the market may experience consolidation or slight pullbacks before regaining its bearings. Ethereum is still technically stretched, though, given its sharp increase from the $3,000 range only a few weeks ago, regardless of the RSI's position.

A robust uptrend has been driving the sustained momentum, with ETH trading significantly above important moving averages. The trend structure is still in place as of right now, and the price has continuously respected the 26 EMA as dynamic support. However, the rally's steepness raises the possibility of fatigue.

These kinds of overheated conditions frequently lead to corrective phases, particularly if volume spikes start to align with profit-taking. If Ethereum retreats, the first significant support — which corresponds to recent levels of consolidation — is located close to $4,000. The $3,500 range below that is a more advantageous one where buyers may reenter.

Bitcoin's breakthrough attempt

The recent price action of Bitcoin is displaying warning indicators following an unsuccessful attempt to break above the $121,000 resistance level. At first, the move appeared promising, with Bitcoin surpassing a crucial level. However, the inability to maintain momentum has resulted in a significant decline. Failed breakouts like this one have typically indicated weakness in the past and can lead to additional downside pressure as traders unwind long positions.

The significant increase in trading volume during this decline only serves to heighten the worry. Expanding volume during a downward price movement typically indicates more selling activity and insufficient buying support to counteract the pressure. This dynamic makes deeper reversals more likely. With its current flat position, the 26-day EMA provides little directional guidance.

At this point, it cannot function as a trustworthy trend-support indicator in the absence of a strong angle. Before oversold conditions are reached, there is still plenty of opportunity for further downward movement, as indicated by the RSI's hovering around the neutral 50 level. The first significant support, which is in line with recent consolidation and near the 50-day EMA, is located close to $115,000 if the bearish trend persists.

The level of $110,000, a crucial level that has served as a significant pivot in previous cycles, would come into focus if there was a breakdown here. A drop of $110,000 might increase selling pressure and allow Bitcoin to move closer to $102,500, which is the 200-day EMA, a historically important long-term support level.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up