Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin price started a fresh surge above the $102,000 zone. BTC is rising and might aim for a move toward the $107,500 resistance.

Bitcoin Price Aims More Gains

Bitcoin price started a fresh increase from the $96,500 support zone. BTC formed a base and was able to clear the $98,800 resistance zone. The bulls even pushed the price above $102,000.

The pair spiked above $104,500 and tested $105,000. A high is formed at $104,943 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $95,825 swing low to the $104,943 high.

Bitcoin is now trading above $103,500 and the 100 hourly Simple moving average. There is also a new connecting bullish trend line forming with support at $103,500 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $104,500 level. The first key resistance is near the $105,000 level. The next key resistance could be $105,500. A close above the $105,500 resistance might send the price further higher. In the stated case, the price could rise and test the $106,200 resistance level. Any more gains might send the price toward the $108,000 level.

Are Dips Supported In BTC?

If Bitcoin fails to rise above the $104,500 resistance zone, it could start another downside correction. Immediate support on the downside is near the $103,500 level and the trend line. The first major support is near the $102,800 level.

The next support is now near the $100,500 zone and the 50% Fib retracement level of the upward move from the $95,825 swing low to the $104,943 high. Any more losses might send the price toward the $98,800 support in the near term. The main support sits at $97,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $103,500, followed by $102,800.

Major Resistance Levels – $104,500 and $105,000.

Crypto media with the report:

---

BTC update, such flows helping to underpin the price:

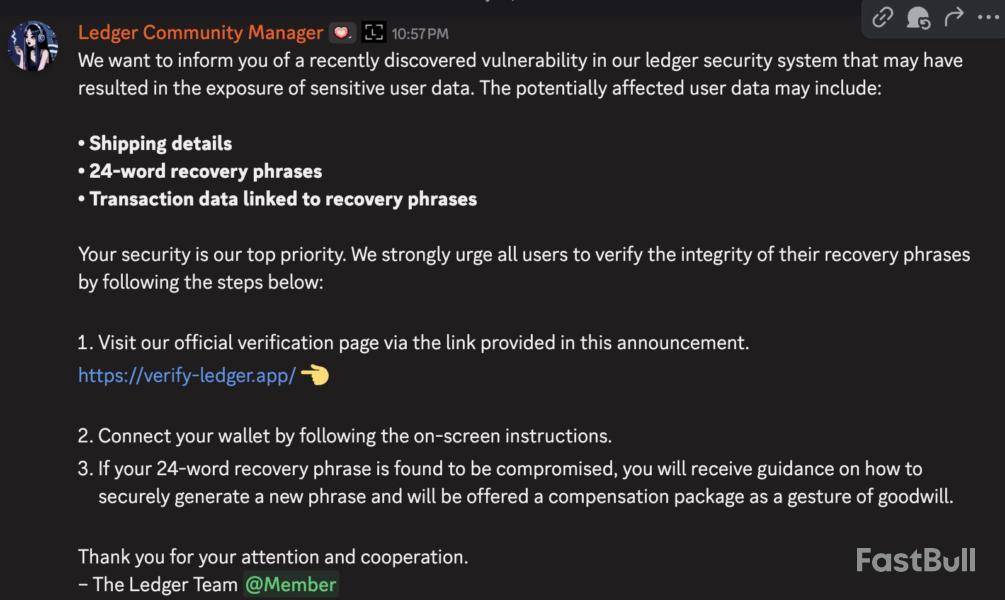

Hardware wallet provider Ledger has confirmed its Discord server is secure again after an attacker compromised a moderator’s account to post scam links on May 11 to trick users into revealing their seed phrases on a third-party website.

“One of our contracted moderators had their account compromised, which allowed a malicious bot to post scam links in one channel,” Ledger team member Quintin Boatwright wrote on the Ledger Discord server.

Some members in Ledger’s Discord channel claimed the attacker abused moderator privileges to ban and mute them as they tried to report the breach, possibly slowing Ledger’s reaction.

Boatwright said the security breach was an isolated incident and that Ledger has taken additional measures to strengthen its security on Discord, a chat platform many crypto projects use to share protocol developments and engage with their community.

Using the compromised Ledger community manager account, the hacker told Ledger Discord members that there was a recently discovered vulnerability in the firm’s security systems and strongly urged all users to verify their recovery phrases with a scam link, according to several screenshots shared on X.

Ledger users were asked to connect their wallets and follow on-screen instructions.

It isn’t clear whether anyone was affected by the security breach. Cointelegraph has reached out to Ledger for comment.

Ledger scammers were sending physical letters last month

In April, scammers were mailing physical letters to owners of Ledger hardware wallets, asking them to validate their private seed phrases in a bid to access and empty the wallets.

The letter used Ledger’s logo, business address and a reference number to feign legitimacy and asked users to scan a QR code and enter the wallet’s recovery phrase.

One Ledger user who received the letter speculated whether scammers were sending letters to Ledger customers whose data was leaked in July 2020.

That incident saw a hacker breach Ledger’s database and dump the personal information of over 270,000 of its customers online, which included names, phone numbers and home addresses.

The following year, several Ledger users claimed to have been mailed fake Ledger devices that were tampered with and designed to install malware upon use, Bleeping Computer reported at the time.

With its recent surge and breakout above the descending wedge pattern that has restrained price action since the beginning of 2025, XRP has been attracting the attention of the market. A confluence of resistances including the 50-day and 100-day exponential moving averages was eventually overcome by the digital asset after weeks of accumulation and sideways consolidation, paving the way for what appears to be a long-term surge.

A more aggressive bullish leg begins when the breakout above the wedge is confirmed by a close above $2.40. Prior to a minor decline, which is completely typical considering the recent moves, vertical character XRP reached $2.1. All of the major EMAs are currently above the price, including the 200-day moving average at $2.01, which serves as strong long-term support. Chart by TradingView">

RSI and other momentum indicators are still high but not extreme, indicating that there is still potential for further growth, particularly if XRP settles in the $2.30-$2.40 range prior to the subsequent leg up. A retest of levels of resistance that have been broken could supply the liquidity required for another push, and the volume has been robust. In order to reach the psychological and technical target of $3, XRP would most likely continue to grind higher.

Following the wedge breakout, this level is consistent with Fibonacci extension projections and previous local highs. Technically speaking, there isn't much substantial opposition until that $3 threshold. A bullish outlook is also supported by on-chain data, which shows enormous wallet activity and a surge in payment volume.

Shiba Inu breaks in

Shiba Inu just gave traders a classic market fake out by breaking above the 200 EMA and then quickly reversing course to return to its prior trading range. SHIB was able to briefly break through the crucial resistance zone on the daily chart close to the $0.000016 level, which corresponds to the 200-day exponential moving average, before reversing course and losing roughly 6.3% in a single daily candle.

Weak hands are often shaken out by this type of price action, which can also surprise breakout traders, particularly those who enter on FOMO without confirmation. A full-bodied red candle after a wick above the 200 EMA indicates that the market, at least for the time being, rejected the breakout attempt. That being said, the bullish momentum of SHIB is still alive.

The key short-term moving averages (20 and 50 EMAs) of the token are sloping upward, and it continues to maintain a structure of higher lows. Support is still present between $0.00001400 and $0.00001380, and another test of the 200 EMA is probably in order if SHIB can create a strong base here.

The pullback's volume was lower than the breakout volume, indicating that there might not be much strength behind the sell-off. Even after this shakeout, the RSI is still above 55, suggesting that the bullish bias is still present. SHIB must hold the $0.000014 zone going forward in order to sustain any upward momentum.

A period of consolidation between $0.000014 and $0.000016 may be required to withstand selling pressure prior to a successful breakout attempt. In summary, this wasn't the real thing, but it also wasn't the end. Better outcomes could come from a different strategy aimed at the 200 EMA if SHIB builds the volume and base to support it. Keep an eye out because this dog may retaliate.

Ethereum finally back

After an exhausting 145-day decline, Ethereum has finally turned things around. Since the beginning of May, ETH has risen 44%, breaking through significant technical barriers from about $1,800 to a peak just above $2,600. On May 8, after a protracted consolidation range, the rally started to pick up significant traction.

Ethereum was able to breach the 50 EMA, 100 EMA and even the psychologically significant 200 EMA in a matter of days, indicating a total reversal in the sentiment of the short- to midterm market. Supported by robust volume, this explosive move suggested that there was organic buying interest rather than speculative pumps. However, there is a catch to the joy: ETH is currently exhibiting indications of a possible short-term reversal after reaching a local high close to $2,650.

The formation of the first red daily candle in this rally along with increased sell volume indicates that some profit-taking is taking place. Furthermore, above 79, which is frequently a sign of cooling-off periods, the Relative Strength Index (RSI) has entered overbought territory. This in no way negates the overall bullish trend.

It is evident that the trend has shifted, and a successful retest of broken EMAs, especially the 200 EMA at about $2,430, could solidify support and pave the way for a move toward $3,000. But without confirmation, it could be dangerous to jump in aggressively at the current levels. Before the subsequent leg higher, Ethereum might be moving into a consolidation or pullback zone.

An appropriate retracement in this case would be a possible launching pad for further growth rather than an indication of weakness. Though short-term caution is still necessary, ETH bulls finally have something to fight for after almost five months of constant bleeding.

Ethereum staking protocol Lido remains "fully secure and operational" after an attacker compromised one of its protocol reporting oracles, draining nearly 1.5 ETH and sparking an emergency DAO vote to rotate the oracle's address.

Chorus One, which operates the oracle, said the attack appears to be an "isolated incident" without further threats to the protocol. "We have thoroughly audited our entire infrastructure and found no evidence of any broader compromise," Chorus One wrote on X.

The attacker drained 1.46 ETH worth about $3,800 from the compromised address, blockchain data shows. "Investigation on all fronts is still ongoing; we will share a full postmortem after we conclude the investigation," Chorus One added on Lido's governance forum. "Activity of the exploiter points towards an automated system, rather than a targeted attack."

Though the attacker was able to drain the oracle address's ETH balance (which was purposely held at a low level, Chorus One said), the attack didn't threaten Lido's operations, as its protocol reporting oracles require a 5-of-9 consensus.

"In the worst case, [compromised oracles] may mean something like stETH rebases (whether positive or negative) take longer to materialize, which will affect stETH holders but mostly in a negligible manner apart from those who may be using stETH in a leveraged manner in DeFi," wrote Lido head of validators Izzy on X.

The Lido DAO vote to rotate the compromised address currently has unanimous support, though it has not yet reached quorum. "Oracles are complex and vary in their usage across DeFi," Izzy wrote. "In Lido, they're a carefully considered part of the protocol, and possible negative impact is meaningfully mitigated through effective decentralization, segregation of duties, and multiple layers of checks."Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

RATO will be listed on AscendEX, opening trading with RATO/USDT. New exchange listings usually help with price discovery and increase awareness. RATO is a meme coin, and AscendEX is a well-known platform, so excitement could bring attention and new buyers. If the community supports this event, the price may go higher. Still, meme coins are risky and can move up or down quickly. Low interest after the first hype could bring fast drops. Careful trading is suggested. Find extra information at the source.

AscendEX@AscendEX_May 11, 2025#AscendEX is thrilled to announce the @RatoTheRatCoin (#RATO) listing under the trading pair #RATO/USDT. Details are as follows:

Deposit: Opened

Trading: May 11, 12:00 PM UTC

Withdrawal: May 12, 12:00 PM UTC

More Detailshttps://t.co/Ef5SKga8M6

Trade Now… pic.twitter.com/fQK2x82aAj

Nightmare Axies is a new, limited collection in the Axie Infinity game. A supply cap can often make people interested and may push demand higher. Players or collectors who want rare NFT items could buy more AXS or SLP to get these new Axies. If the collection is popular, it may bring fresh players, which is positive for price. However, if interest stays low or if only old players care, the price effect might be small. Close attention on community reaction is important. For more info, see the source.

Axie Infinity@AxieInfinityMay 11, 2025Nightmare axies: a new collection born from ancient magic

Survivors of the Nightmare Realm

Nightmare axies were once regular axies — until they were transformed by the Nightmarescape.

This supply-capped collection is full of dark magic and surprises.

We not recommend… pic.twitter.com/Q88IIz2EMz

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up