Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin’s price is currently sitting at a crucial level that could shape market direction in the coming weeks. Buyers and sellers are locked in a tight battle, and the market appears to be standing on the edge of a potential breakdown.BTC Price Technical Side

By ShayanThe Daily Chart

On the daily chart, Bitcoin has recently slipped below the large ascending channel that had been driving its uptrend over the past few months. The failure to hold above $120K is a bearish signal, and with the $110K support and the 100-day moving average now at risk of breaking, the market could be heading for a sharp drop toward the $100K zone, where the 200-day moving average also resides.

The RSI is holding below 50, further confirming bearish momentum and strengthening the case for continued downside. At this stage, only a strong wave of buying pressure could prevent a deeper decline and stabilize the market.

The 4-hour chart shows a clear fake breakout and rejection around the $116K resistance, signaling that even the anticipation of lower interest rates has not been enough to spark a new rally. This is a bearish sign, as markets failing to react positively to good news often suggest underlying weakness.

Currently, the $111K support is breaking down, which could pave the way for a swift decline toward the critical $100K zone. While the previous accumulation between $105K and $110K may generate some buying interest and temporary support, the overall market structure points to a higher probability of further downside.

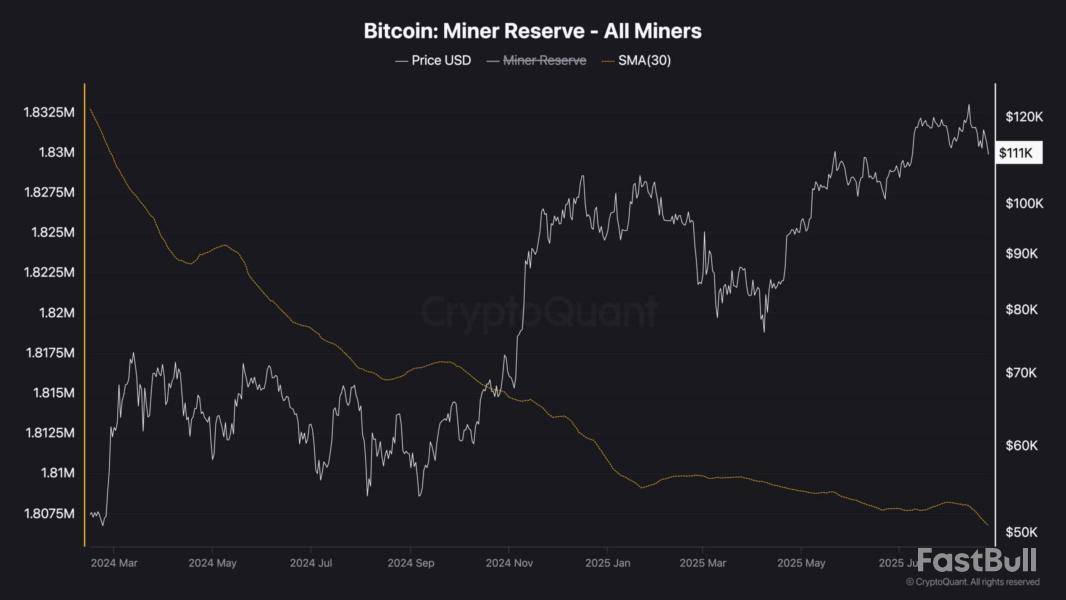

Bitcoin miners have been consistently selling their holdings over the past couple of years, mainly to cover operational costs. While expected, this steady outflow adds extra selling pressure to the market, which can weigh on price performance.

In recent days, the decline in miner reserves has accelerated, signaling an increase in selling activity. This surge in supply is likely one of the factors contributing to the recent downturn following Bitcoin’s new all-time high a few weeks ago. If this trend continues and demand fails to absorb the additional supply, the market could face deeper downside pressure.

TL;DR

Ethereum Price Action

Ethereum surged to a new all-time high of $4,950 on August 24 before losing momentum. The token has since pulled back to around $4,550, down 4.5% over the past 24 hours, though still up 8% on the week. Since early August, ETH has climbed 26% and remains more than 220% above its yearly low.

Meanwhile, the reversal came during a wave ofliquidationsacross the market. More than $720 million in positions were wiped out in the last day, with nearly $500 million tied to Bitcoin and Ethereum longs. The rejection near $4,950 triggered much of the flush.Liquidity Grab and Support Levels

Analyst Lennaert Snyder said Ethereum “took liquidity above $4,880 and flushed leveraged longs.” He added that ETH is “currently testing ~$4,500 support, but it doesn’t look strong.”

Snyder pointed to $4,693 as the key range low for bulls to reclaim quickly. Arecoveryabove that level could open another move toward $4,880. If $4,500 fails, the chart suggests ETH could slide to $4,300, which marked the start of its last impulse higher.

$ETH took liquidity above $4,880 and flushed leveraged longs.

Currently testing ~$4,500 support, but is doesn’t look strong.

Best case scenario for the bulls is to reclaim $4,693 rangelow asap.

If we lose here, Ethereum will probably retest the $4,300 start impulse. pic.twitter.com/Mkl4BtFizy

— Lennaert Snyder (@LennaertSnyder) August 25, 2025

The $4,880 zone now acts as immediate resistance, while $4,500 remains under pressure.Whale Buying and Institutional Flows

Large players have been active in recent sessions. Wise Crypto noted that whales added more than $1.6 billion worth of ETH this week, even as volatility increased. They described $4,590–$4,760 as a demand area that aligns with the 0.5 Fibonacci retracement at $4,780.

Wise Crypto highlighted $4,950 (0.618 Fib) as the resistance to clear. A break above that line could set a path toward $5,500, with checkpoints at $5,190 and $5,500.

At the same time, CryptoQuant analyst Darkfost pointed to continued whale accumulation on Binance.

“Since July, we have seen a significant increase in demand coming from Binance whales,” they wrote.

According to the analyst, their activity shows a preference for building positions after explicit trend confirmation, which could provide extra support if ETH attempts another push toward $5,000.

Ethereum’s rally in August has been strong, but historical trends indicate that September often brings corrections after a profitable August. Data from CoinGlass suggests the same could apply this year.

For now, ETH sits between critical levels: $4,690 on the upside and $4,500–$4,300 on the downside. A reclaim could reignite momentum toward $5,000, while failure may reinforce seasonal weakness.

Opinion by: Sasha Shilina, founder of Episteme and researcher at Paradigm Research Institute

In 2024, Nature reported a record-breaking number of scientific paper retractions: over 10,000 papers pulled from journals due to fraud, duplication or flawed methodology. Peer review, the long-revered backbone of academic legitimacy, is under siege. It’s too slow, too opaque and too easily gamed.

Meanwhile, artificial intelligence models trained on this flawed data set generate confident but nonsensical output. Papers cite nonexistent studies. Research decisions are guided by influence, not inference. The internet, once hailed as a democratizing force for knowledge, is now a battleground of misinformation, clickbait and manipulated metrics.

We are living in an epistemic crisis.

And yet, buried in the unlikely corners of Crypto X and decentralized autonomous organization (DAO) forums, a new architecture is forming. Not for transferring value, but for verifying truth.

A layer 2 for knowledge

In the crypto world, layer 2s address the scalability issue. They help Ethereum process more transactions faster and cheaper. But what if the real scalability bottleneck isn’t financial — it’s epistemological?

Science isn’t scaling. Reputation hierarchies, legacy journals and funding gatekeepers bottleneck it. Brilliant hypotheses die in grant purgatory. Replications go unrewarded. Errors take years to correct, if ever.

What does a “layer 2 for truth” actually look like? This system transforms scientific hypotheses into onchain objects, public, persistent and open to scrutiny. Instead of broadcasting belief on social media, participants stake it, putting skin in the game and exposing their convictions to real risk. Resolution becomes a hybrid process: AI models parse and score evidence, human validators contest or affirm outcomes, and decentralized oracles record the result transparently. Crucially, incentives shift away from prestige and toward precision, rewarding those who are right, not just well-positioned.

This is not decentralized finance (DeFi). It’s not even decentralized science (DeSci). It’s agentic, decentralized science (DeScAI). More radically, however, it’s epistemic finance: Markets built not around coins but claims.

Betting on reality

This isn’t just science gambling. It’s a structural inversion. Today, the academic economy rewards being interesting, not correct. Flashy papers get media attention and grant renewals, whether or not their findings replicate. Meanwhile, replication studies, null results and quiet work often vanish.

Prediction markets can flip the script. They pay you to be right. Not to be loud, famous or institutionally blessed, but simply correct about the world. If a biotech researcher predicts that a particular compound will reduce tumor growth by 20% in mice, and they’re right, they win. If they’re wrong, they lose. Simple. Transparent. Brutally honest.

In this model, belief becomes a measurable asset. Knowledge becomes liquid. The marketplace doesn’t just trade tokens; it trades epistemic confidence.

The oracle problem reimagined

In crypto, the “oracle problem” is getting real-world data onto the blockchain trustlessly. In this epistemic architecture, the oracle isn’t just a price feed. It mediates what is accepted as truth.

This raises uncomfortable questions: Who gets to decide what’s true? Can AI serve as a reliable resolver? What happens when markets are wrong?

The answer is that there’s no singular oracle. There’s a protocol. Resolution becomes a process: part-automated, part-contested and part-historical. Participants challenge, update and refine claims. Truth becomes iterative, open-source and adversarial, like code.

Yes, this opens the door to epistemic volatility. In a world where even Nobel laureates get it wrong, isn’t volatility better than stagnation?

From publishing to protocols

The internet disrupted publishing. Blockchains disrupted finance. Now, a third disruption is underway: the protocolization of knowledge.

In this emerging paradigm, the architecture of knowledge itself is being reimagined. Papers are no longer static PDFs but dynamic contracts embedded with predictive weight, designed to inform and be tested. Citations become more than scholarly gestures; they’re transformed into onchain links annotated with confidence scores and traceable influence. Once a closed gatekeeping ritual, peer review evolves into an open, adversarial verification market where claims can be challenged, revised and resolved in public view.

In this model, science stops being a static archive and becomes an economic, dynamic and plural living system.

Truth is the next asset class

We’ve priced money, time and attention. We’ve never truly priced belief. Not until now.

A new kind of market emerges, one that doesn’t reward speculation but verification — a civic instrument for aligning incentives around truth in an age of noise. The question isn’t whether these markets are risky. All markets are. The question is: Can we afford not to try?

If crypto is a new internet, we need more than memes, memecoins and monkey JPEGs. We need infrastructure for the next epistemic era: for validating what matters, when it matters, in public.

The next big layer isn’t for money. It’s for the truth.

Opinion by: Sasha Shilina, founder of Episteme and researcher at Paradigm Research Institute.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Global central bank digital currency (CBDC) efforts are threatening to give financial institutions more control over the money supply and personal savings, as the transatlantic divide between the US and Europe widens in terms of financial technology.

CBDCs are digital versions of fiat money issued on a permissioned, private blockchain, usually controlled by a central bank, as opposed to decentralized blockchain networks.

“Not all digital currencies are the same,” said Susie Violet Ward, financial analyst, co-founder and CEO of think tank Bitcoin Policy UK, warning that CBDCs represent the "weaponization of money in its purest form.”

This new form of programmable money threatens increased central bank control over spending, including a potential “expiry date” on personal savings, Ward said during Cointelegraph’s Chain Reaction daily X spaces show on Thursday, adding:

“Even George Orwell did not predict that programmable money might come into this. That almost closes the 1984 loop perfectly,” she added, referring to Orwell’s dystopian novel, which depicts a world where an oppressive central government controls major aspects of human life, including public opinion and free speech.

Cointelegraph@CointelegraphAug 21, 2025Escaping the Death of Privacy with Bitcoin #CHAINREACTION https://t.co/nNncxdfFaj

Europe pushes ahead with digital euro after Trump bans US CBDC

The transatlantic divide between Europe and the US is growing, with the former pushing ahead with digital euro plans while the latter is doubling down on stablecoin innovation and banning the creation of CBDCs.

On Friday, the US House added a provision banning the Federal Reserve from issuing a CBDC into an almost 1,300-page bill setting the country’s defense policy for the 2026 fiscal year, Cointelegraph reported.

The provision in the defense policy bill would ban the Fed from issuing any digital currency or asset and stop the central bank from offering financial products or services directly to individuals.

The House passed a similar Republican-backed bill, the Anti-CBDC Surveillance State Act, in July with a slim majority of 219 to 210, which is now awaiting a Senate vote.

On Jan. 23, US President Donald Trump signed an executive order that prohibits the establishment, issuance, circulation or use of CBDCs, citing concerns over their potential to threaten financial system stability, individual privacy and national sovereignty.

Still, the European Union is pushing ahead with its digital euro plans, reportedly exploring major public blockchains like Ethereum for its CBDC, rather than a private one, where data is limited to authorized entities.

The digital euro is expected to roll out in October 2025, European Central Bank President Christine Lagarde said during a news conference, emphasizing that the CBDC will coexist with cash and offer privacy protections to address government overreach concerns.

While CBDCs have been praised for their potential to increase financial inclusion, critics have raised concerns about their surveillance capabilities.

In July 2023, Brazil’s central bank published the source code for its CBDC pilot, and it took just four days for people to notice the surveillance and control mechanisms embedded within its code, allowing the central bank to freeze or reduce user funds within CBDC wallets.

Strategy, the business intelligence firm, has again bought a massive amount of the flagship cryptocurrency, Bitcoin . The aggressive Bitcoin accumulator has acquired an additional 3,081 BTC at approximately $356.9 million at an average price of $115,829.

Strategy’s Bitcoin holdings now exceed 632,000 BTC

According to an update shared by Michael Saylor, executive chairman of Strategy, the firm’s total assets currently stand at 632,457 BTC. The total cost of this holding comes to $6.50 billion at an average purchase price of $73,527 per Bitcoin.

According to Saylor, Strategy has now achieved a BTC yield of 25.4% year-to-date in 2025. This highlights the firm’s aggressive approach to Bitcoin accumulation, given the unrealized gains in investment.

Michael Saylor@saylorAug 25, 2025Strategy has acquired 3,081 BTC for ~$356.9 million at ~$115,829 per bitcoin and has achieved BTC Yield of 25.4% YTD 2025. As of 8/24/2025, we hodl 632,457 $BTC acquired for ~$46.50 billion at ~$73,527 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/KCrM0ffClo

Notably, Strategy has decided to buy the dip following Bitcoin’s crash below $120,000. The asset, according to predictions, is likely to surge toward $150,000 in its next major rally. Hence, many consider this move as an opportunistic move to hedge its portfolio. This new purchase keeps the firm on track as it steadily chases the one million BTC milestone.

The asset has, however, suffered a crash from a daily high of $114,853.46, as a Bitcoin whale dumped on the market. As of press time, Bitcoin is changing hands at $111,148.29, representing a 3.07% decline in the last 24 hours.

Despite the plunge, trading volume has spiked by 51.67% to $80.84 billion. This development suggests that investors are emulating Strategy and taking advantage of the dip in price to accumulate more coins.

Market concerns over Strategy’s growing Bitcoin influence

However, some on the broader cryptocurrency market have expressed concerns over the power that Strategy might have over the ecosystem in the future. Pro-Strategy players in the space counter that it is a free market, and anyone can buy Bitcoin.

This week remains critical for the flagship crypto asset and might decide how Bitcoin performs in the next couple of months. Once the broader market uncertainty phases out, BTC might soar high.

XRP lost its support at $3 for a second time in the past seven days. Will bears aim for $2.7 next or can the asset recover?Ripple (XRP) Price Predictions: Analysis

Key Support levels: $2.7

Key Resistance levels: $3, $3.6, $41. Key Support Lost

Last Friday, XRP had a solid attempt to reclaim the $3 support level, but failed to hold it despite surging to $3.1 briefly. In the days that followed, and especially this Monday, sellers returned to take the asset under this key level. If bears manage to turn $3 into a resistance, then the next key support level will be found at $2.7.2. Momentum Turning Bearish

With clear lower highs, this cryptocurrency is looking bearish at the time of this post. The price action is also forming a descending triangle with a base at the $2.7 support. Should that level be retested later and fail to stop sellers, then XRP will continue its correction.3. MACD Bearish Cross

The 3-day MACD also supports a bearish bias because in the past week it crossed to the negative side. Moreover, the moving averages have been falling and gained speed in the past few days. This shows selling is intensifying, and this puts bears in control of the price action. Hopefully, the key support at $2.7 will halt this correction.

By Barbara Kollmeyer

Bitcoin's post-Powell surge is disappearing fast

Bitcoin is in the throes of a post-Jackson Hole struggle.

A whale appears to have spoiled the party for bitcoin, with the No. 1 cryptocurrency losing its steam and dragging down related investments seen in the wake of comments by Federal Reserve Chair Jerome Powell.

Dropping to a level not seen since early in July, the price of bitcoin (BTCUSD) fell over 1% to $111,178. That was after persistent weekend selling that knocked it down from a high of $117,411 seen on Friday, as perceived riskier assets rose on hopes of Fed interest rate cuts.

Sunday was a dramatic day for bitcoin, with the price slumping from $114,000 to around $112,157 within roughly 20 minutes.

The sharp price reaction has been blamed on a large bitcoin holder, often referred to as a whale, given how they can influence price action.

"This entity liquidated their entire 24k balance, sending all of it to Hyperunite," trading platform, said a post on X by the founder of Timechainindex, known as Sani late Sunday. "They transferred 12k just today and are still actively selling, which is likely contributing to the ongoing price drop."

The bitcoin selloff has coincided with Ether's (ETHUSD) rally for August, with that crypto up 21% versus a 5.9% drop for bitcoin. Ether reached a new closing high of $4,845 on Friday for a 14% gain, its biggest percentage gain since May 8. CoinMarketCap reported that the price surged to over $4,900 on Sunday.

Ether has been in the grips of a catch-up trade, with bitcoin breaking all-time highs several times in 2025, but Monday saw it also give up gains, down 3.6% to $4,611. Cardano was down nearly 5%, and in the equity space Strategy (MSTR), a software firm that is also a large bitcoin holder, fell over 4%.

Alex Kuptsikevich, FxPro chief market analyst, said that bitcoin's surge on Friday, "seems to have attracted new sellers, pushing the coin below its 50-day average.

"So far, it looks like liquidity is being transferred from BTC to ETH or other altcoins, such as SOL. However, we cannot rule out the possibility that all processes are starting in bitcoin, and a similar shift to selling on growth is just around the corner in altcoins," Kuptsikevich told clients in a note.

The analyst added that companies appear to be buying less bitcoin on a daily basis.

Some suggested bitcoin's reversal could also be a forewarning for stocks. Spurred on by Powell, on Friday, the Dow industrials DJIA reach its first record high of the year, after multiple records for the S&P 500 SPX and Nasdaq Composite COMP. Stock futures indicated a modest pullback was in store for Monday.

-Barbara Kollmeyer

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up