Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After starting the week with a red Monday, Bitcoin (BTC) has recovered the $100,000 zone, registering a 4% recovery from yesterday’s lows. Following its recovery, some crypto analysts suggested that BTC could be getting ready for a February pump.

Choppy January, Double-Digit February?

On Monday, the crypto market suffered a shakeout generated by the broader sell-off ignited by DeepSeek’s Artificial Intelligence (AI) news. Altcoins like Ethereum (ETH) and Solana (SOL) fell 8.4% and 15%, respectively, while Bitcoin dropped 5%.

The flagship cryptocurrency fell below the $100,000 mark for the first time in over a week, dipping to $98,000 on Monday. However, it has experienced a strong rebound, recovering the crucial support zone as the day ended.

After surging to $102,000 on Tuesday morning, Bitcoin has been unable to reclaim $103,000, moving sideways within the $102,000-$102,990 price range throughout the day.

Trader Daan Crypto noted that Bitcoin continued moving in the mid-zone of its post-election range despite the drop. “Right back into the high-volume area within this range. Doesn’t seem like the $100K mark is left behind so easily just yet,” he wrote.

Daan considers that as long as Bitcoin doesn’t break below or above $90,000 or $108,000, the price will continue with its “decent but choppy” performance. However, he suggested that Bitcoin could have a better price action next month based on its historical performance.

The trader points out that February has been historically BTC’s second-best month, only behind October. In the last 12 years, Bitcoin has seen a green performance during this month 10 times, registering up to 61% monthly return, according to CloinGlass data.

Similarly, Rekt Capital stated that in its post-halving years, Bitcoin saw a double-digit profit in February, with 61% in 2013, 23% in 2017, and 36% in 2021. The analysts added that “8 out of the past 12 February dating back to 2013 have produced double-digit upside.”

Bitcoin Next Leg Up Coming Soon

Rekt Capital also considers that BTC is preparing for its next leg up. The analyst explained that Bitcoin completed its first post-halving Price Discovery Uptrend and first Price Discovery Uptrend Correction.

This suggests that BTC “should be able to embark on its second Price Discovery Uptrend to new highs” in the next two weeks. According to Rekt Capital, the second phase historically starts during week 16 of Bitcoin’s Parabolic Phase, with Bitcoin currently starting the 14th week.

“In Week 14 of the 2017 cycle, Bitcoin was recovering from its first Price Discovery Correction only to make new highs in Week 16 In Week 14 of the 2021 cycle, Bitcoin was still just bottoming on its first Price Discovery Correction only to make new highs in Week 16,” the analyst detailed.

As a result, Rekt Capital suggests investor “Patienlly HODL” for the next two weeks, as “confirmation Of The 2nd Price Discovery Uptrend” is set to start next month.

Moreover, Bitcoin’s Monday close above $101,200 developed a “new early-stage Higher Low,” which could see the price “consolidate further here to as high as the Range High at $106,200” if it continues to hold above this level.

Paradigm co-founder Matt Huang announced that the crypto venture capital firm will donate $1.25 million to support Tornado Cash developer Roman Storm in his legal defense against U.S. prosecution.

“The prosecution’s case threatens to hold software developers criminally liable for the bad acts of third parties, which would have a chilling effect in crypto and beyond,” Huang wrote on social media platform X on Wednesday. “We must stand with [Storm].”

Storm co-founded Ethereum-based crypto mixer Tornado Cash with Roman Semenov, both of whom were charged by the U.S. Department of Justice with alleged money laundering-related charges in 2023.

Prosecutors claimed that Storm "knowingly facilitated” the laundering of over $1 billion in illicit funds on the crypto mixer, including money linked to North Korean cybercrime group Lazarus. The Tornado Cash founders each face up to 45 years in prison.

In Storm’s defense

In an X post on Jan. 23, Storm wrote that the prosecution embodies a “terrifying criminalization of privacy,” as he claims he is being charged for writing open-source code for private transactions in a non-custodial manner.

Earlier this month, a US court ordered the sanctions on Tornado Cash to be reversed — ruling that the crypto mixer should not be seen as “property” that can be sanctioned.

Despite the recent ruling, a New York court denied Storm’s motion to reconsider the legal action against the developer.

“The Court recognized that ‘Mr. Storm argues that the Tornado Cash pool smart contracts were ‘immutable’ after May of 2020,’ but also recognized that ‘the indictment charges … that other aspects of the Tornado Cash service were not similarly free from tinkering,’” the court document said.

Ethereum co-founder Vitalik Buterin, along with other members of the crypto community, called for U.S. President Donald Trump to help lift the charges against Storm after Trump signed an executive order to pardon Silk Road creator Ross Ulbricht.

Storm’s court trial is set for April 14, 2025.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Former U.S. Securities and Exchange Commission Chair Gary Gensler has returned to the Sloan School of Management at Massachusetts Institute of Technology (MIT) as a professor of practice following his departure from the agency.

Gensler's work will center around teaching and researching such topics as financial technology and artificial intelligence (AI).

The former SEC boss said that he was "thrilled" and "honored" to return to the prominent business school.

Gensler left MIT after being nominated and confirmed as the 33rd chair of the SEC.

Given that he previously taught classes on blockchain, some industry members expected him to adopt a friendlier stance toward cryptocurrencies than his predecessor Jay Clayton.

However, Gensler continued Clayton's regulation by enforcement policies, bringing new lawsuits against various prominent cryptocurrency companies, including trading giant Coinbase.

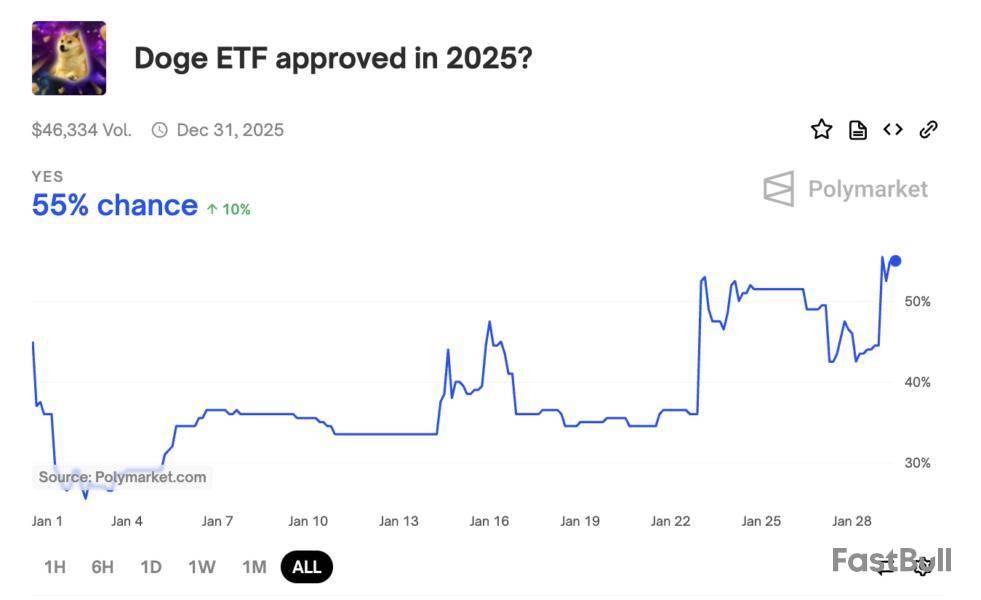

Bitwise Asset Management officially submitted a filing to the US Securities and Exchange Commission (SEC) on Tuesday for a Dogecoin exchange-traded fund (ETF).

This marks the second filing for a Dogecoin ETF, following a similar move by Rex Shares last week.

Bitwise Files for Dogecoin ETF

On January 28, the asset manager submitted an S-1 form with the SEC to launch a Dogecoin ETF. This filing came shortly after its earlier application to establish a Dogecoin ETF through a Delaware trust.

With this move, Bitwise joins Rex Shares, which recently submitted ETF applications for multiple meme coins. These include DOGE, Bonk (BONK), and Donald Trump’s TRUMP token.

Nonetheless, Bitwise’s filing does have a specialty. Eric Balchunas, a senior ETF analyst at Bloomberg, highlighted that the filing was made under the Securities Act of 1933.

“This is the first ‘33 Act (a la $IBIT) doge filing. Rex has on e filed under 40 Act but that isn’t the same true blue physically backed structure,” Balchunas wrote on X.

Notably, this distinction is crucial. ETFs filed under the Securities Act of 1933 are physically backed, which means that they hold the underlying asset—in this case, Dogecoin.

In contrast, ETFs under the Investment Company Act of 1940 have a different structure. Therefore, they do not necessarily involve direct ownership of the asset.

Furthermore, in its filing, Bitwise has designated Coinbase Custody as the proposed custodian for its spot DOGE ETF. However, the S-1 does leave out certain details. This includes the proposed fee, ticker symbol, or the stock exchange on which the ETF would be listed if approved.

Meanwhile, following Bitwise’s Dogecoin ETF filing, betting odds on the prediction platform Polymarket surged to a record high of 56% in favor of approval. At the time of writing, the odds remained steady at 55%.

Bitwise’s move comes amid a rise in cryptocurrency ETF filings. The company has already launched spot Bitcoin and Ethereum ETFs. Moreover, it has also filed applications for Solana and XRP ETFs.

However, the proposal for a Bitwise 10 Crypto Index Fund is still pending review. This fund aims to track the performance of the ten largest cryptocurrencies by market cap. Nevertheless, the SEC has extended its review of the application until March 2025.

TradeCompass: Bitcoin Futures Price Prediction and Analysis for Today (January 29, 2025)

At the time of this Bitcoin futures analysis, Bitcoin futures are trading at 102,400. Below is the comprehensive breakdown of today's bullish and bearish scenarios for Bitcoin futures, following the TradeCompass guidelines.

Bullish Scenario for Bitcoin Futures Today

We will turn bullish above 102,670, positioning us above the highest VWAP level of yesterday and the value area high (VAH) of two days ago. Here are the bullish profit targets:

These levels guide bullish traders on how to manage entries and partial exits effectively, considering the potential for range-bound trading leading up to the FOMC meeting.

Bearish Scenario for Bitcoin Futures Today

We will turn bearish below 101,460, signaling a break under today's VWAP and the POC of two days ago. Bearish profit targets include:

These bearish targets offer a structured approach for managing downside risks in Bitcoin futures, considering key technical levels and potential market reactions to macroeconomic events.

Bitcoin Futures Price Prediction: Key Takeaways

Why These Levels Matter for Today's Bitcoin Futures Analysis

Understanding these levels in today’s Bitcoin futures trading enhances traders' ability to execute high-probability strategies while managing risk effectively.

Market Considerations: FOMC Meeting Impact

With the FOMC meeting on Wednesday, anticipate a tighter trading range as markets await reactions. This event could significantly influence Bitcoin futures, especially regarding the broader risk-on/risk-off sentiment that often correlates with cryptocurrency volatility.

Order Flow Intel: A Broader Look at Bitcoin Futures

Traders should also take note of today's OrderFlow Intel on Bitcoin, which provides an AI-powered deep dive into the daily orderflow data of Bitcoin futures and insights beyond the intraday focus of TradeCompass. While TradeCompass primarily targets intraday movements with potential swing extensions, OrderFlow Intel analyzes the daily order flow mechanics over the last several sessions. This broader perspective can highlight underlying bearishness or weakness, offering an additional layer of analysis on how institutional activity and liquidity shifts influence Bitcoin futures beyond the immediate trade setup.

Bitcoin Futures Trading Disclaimer

Trade Bitcoin futures at your own risk. Visit ForexLive.com for additional perspectives on today’s markets and trading insights.

YZi Labs, the venture capital firm formerly Binance Labs, announced its investment in on-chain token distribution infrastructure provider Sign, its first since the rebrand.

According to Fortune, YZi Labs’ funding round was worth $16 million, with other participants including Altos Ventures, HackVC and Amber Ventures.

Sign, founded in 2021, is a platform that aims to develop a more transparent way for users and AI agents to receive crypto tokens. It offers various services, such as EthSign for signing contracts, TokenTable for managing digital tokens, and Sign Protocol for verifying information on the blockchain.

“Sign’s vision for mass Web3 onboarding aligns with YZi Labs’ commitment to pushing the boundaries of transformative innovation and driving innovation across the Web3 ecosystem and beyond,” said Nicola Wang, Investment Director at YZi Labs, in a press release.

The Block has reached out to YZi Labs for further comments.

CZ's return

Meanwhile, former Binance CEO Changpeng Zhao reportedly rebranded Binance Labs into YZi Labs last week, following the end of his four-month prison sentence in September.

While CZ has stepped down from his position running Binance's centralized exchange, YZi Labs said he will continue to have a “pivotal role” in investment activities.

"Rebranding to YZi Labs is more than a name change—it signifies an expanded vision as we broaden our horizons to include transformative sectors like AI and biotech," CZ said in last week’s announcement of the rebrand.

YZi Labs has over 250 projects in its portfolio, having invested in Sky Mavis, LayerZero, Aptos Labs and Polygon. It manages approximately $10 billion, according to Bloomberg.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Solana started a fresh decline below the $250 support. SOL price is consolidating and might face resistance near the $235 and $242 levels.

Solana Price Dips Below $250

Solana price struggled to clear the $260 resistance and started a fresh decline, like Bitcoin and Ethereum. SOL declined below the $250 and $242 support levels.

It even dived below the $230 level. The recent low was formed at $225 and the price is now consolidating losses. It climbed a few points above the $230 level. It cleared the 23.6% Fib retracement level of the downward move from the $244 swing high to the $225 low.

Solana is now trading below $240 and the 100-hourly simple moving average. On the upside, the price is facing resistance near the $235 level or the 50% Fib retracement level of the downward move from the $244 swing high to the $225 low.

There is also a key bearish trend line forming with resistance at $235 on the hourly chart of the SOL/USD pair. The next major resistance is near the $242 level. The main resistance could be $250. A successful close above the $250 resistance zone could set the pace for another steady increase. The next key resistance is $260. Any more gains might send the price toward the $275 level.

Another Decline in SOL?

If SOL fails to rise above the $235 resistance, it could start another decline. Initial support on the downside is near the $225 zone. The first major support is near the $222 level.

A break below the $222 level might send the price toward the $212 zone. If there is a close below the $212 support, the price could decline toward the $200 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $225 and $222.

Major Resistance Levels – $235 and $242.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up