Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

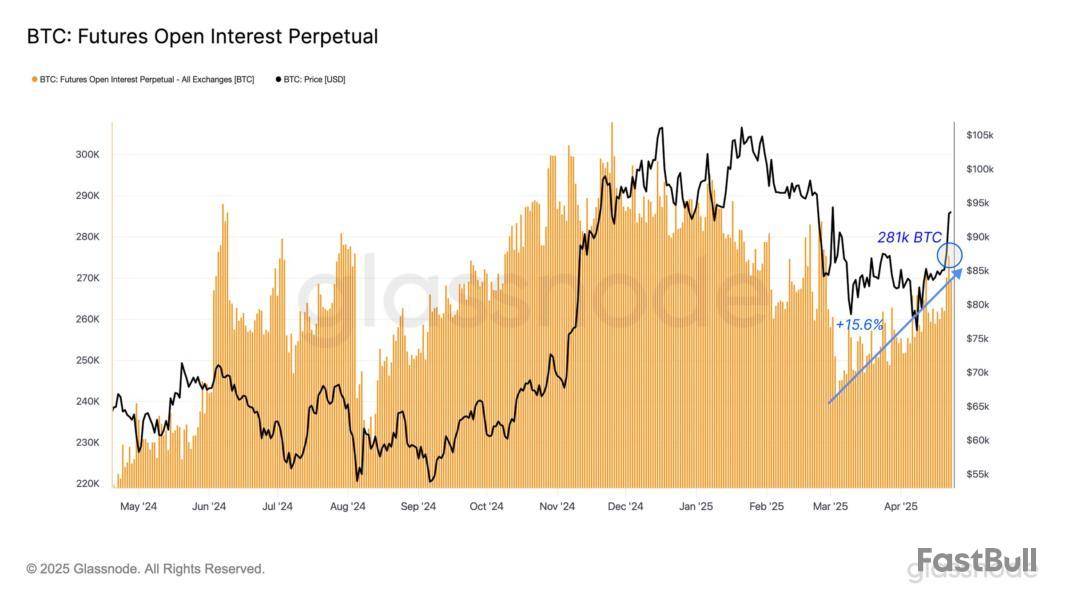

The Bitcoin market saw another rebound in the past week as prices leaped by over 12% to hit a local peak of $95,600. Amid the ongoing market euphoria, prominent blockchain analytics company Glassnode has shared some important developments in the Bitcoin derivative markets.

Bitcoin Short Bets Rise Despite Price Rally, Setting Stage For Volatility

Despite a bullish trading week, derivative traders are approaching the Bitcoin market with skepticism, as evidenced by a build-up of leveraged short positions.

In a recent X post on April 25, Glassnode reported that Open Interest (OI) in Bitcoin perpetual swaps climbed to 218,000 BTC, marking a 15.6% increase from early March. In line with market activity, this rise in Open Interest aligns with increased leverage, introducing the potential for market volatility via liquidations or stop-outs.

Generally, a rise in Open Interest amidst a price rally is expected to signal long-term market confidence. However, Glassnode’s findings have revealed an opposite scenario. Despite Bitcoin’s bullish strides in the past week, short market positions appear to be dominating the perpetual futures markets.This concerning development is indicated by a decline in the average funding rate, which has now slipped into negative territory to sit around -0.023%. The perpetual funding rate is a periodic payment between long and short traders aimed at keeping the contract price in line with the underlying spot price.

A negative funding rate indicates short traders pay long traders as Bitcoin’s perpetual contract price is trading below the spot price. This is caused by a higher number of short positions as traders are largely bearish about Bitcoin, even despite recent gains.

Furthermore, the 7-day moving average (7DMA) of long-side funding premiums has dropped to $88,000 per hour, reinforcing this short-dominant sentiment. This downtrend indicates a waning demand for long positions, as traders exhibit a short bias.

However, Glassnode presents a bullish note stating that the present combination of rising leverage and short positions paves the way for a potential short squeeze, where an unexpected upward price move forces short-sellers to close their positions, thereby driving prices even higher.

Bitcoin Price Overview

At the time of writing, Bitcoin trades at $94,629 following a 1.01% retracement from its local peak price on April 25. Despite creeping developments in the perpetual futures market, the BTC market remains highly bullish, indicated by gains of 1.02%, 11.12%, and 8.32% in the last one, seven, and thirty days, respectively. With a market cap of $1.88 trillion, the premier cryptocurrency ranks as the largest digital asset and fifth-largest asset in the world.

Related Reading: Ethereum To Hit $5k Before Its 10th Birthday, Justin Sun Says

The Arbitrum Foundation, the muscle behind the Ethereum Layer 2 blockchain network by the same name, said it withdrew from an Nvidia-backed accelerator program after the latter company, the world's largest chipmaker, said it didn't want to be mentioned in any public announcements.

Earlier reporting indicated that Nvidia pulled the plug on the arrangement, which would've seen Arbitrum become the exclusive Ethereum partner for the Nvidia- and Tribe-backed Ignition AI Accelerator program. The program would have provided the network with AI development guidance and cloud credits.

However, the Arbitrum Foundation said, Nvidia changed its tune in recent weeks, saying it was willing to partner with Arbitrum, as long as the chipmaker wasn't mentioned in any public-facing crypto-related announcements.

"Arbitrum was not removed from the AI Ignition Accelerator — the team made the decision to disengage after Nvidia asked to remove its brand from crypto-related announcements, signaling a lack of long-term commitment," a Foundation spokesperson told The Block.

The Ignition Accelerator said in a statement that an embargoed press release provided to CoinDesk, which reported that Nvidia "still explicitly exclude[s] crypto-related projects," had incorrect information. "Arbitrum Foundation has kindly requested to pull out from this partnership with the Ignition AI Accelerator," the statement reads.

Other crypto firms have inked partnerships with the Ignition AI accelerator, such as the Aptos Foundation, which supports the Layer 1 Aptos blockchain.

"Ultimately, disengaging from participating in the AI Ignition Accelerator was a sound business decision for The Arbitrum Foundation, as it is committed to collaborating with partners who are positioned to support the acceleration of blockchain innovation," the Foundation said.

Arbitrum is up about 1.8% in price over the past 24 hours, according to The Block's ARB Price page. Nvidia didn't immediately respond to a request for comment.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

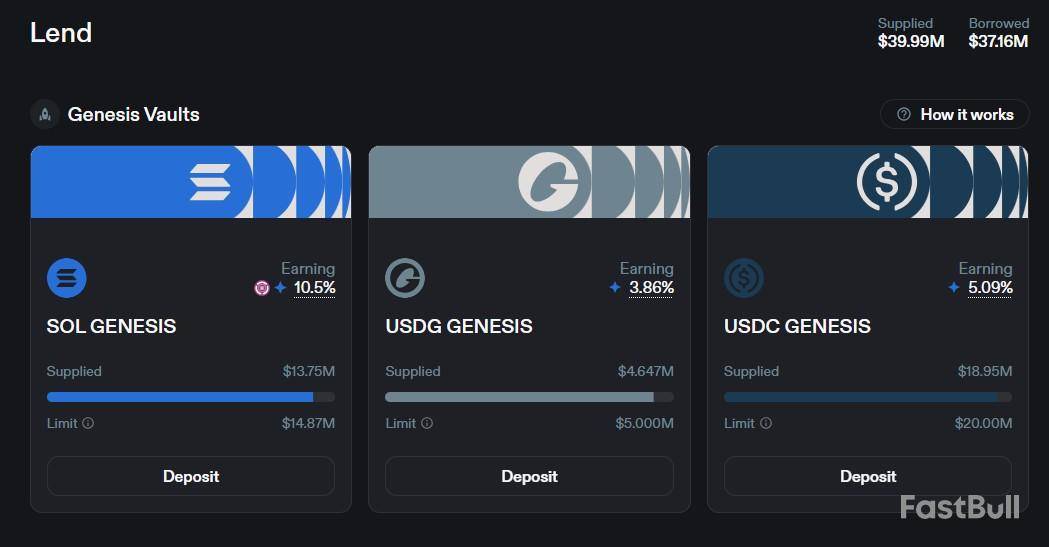

Solana decentralized finance (DeFi) protocol Loopscale has temporarily halted its lending markets after suffering an approximately $5.8 million exploit.

On April 26, a hacker siphoned approximately 5.7 million USDC and 1200 Solana from the lending protocol after taking out a “series of undercollateralized loans”, Loopscale co-founder Mary Gooneratne said in an X post.

The exploit only impacted Loopscale’s USDC and SOL vaults and the losses represent around 12% of Loopscale’s total value locked (TVL), Gooneratne added.

Loopscale is “working to resume repayment functionality as soon as possible to mitigate unforeseen liquidations,” its said in an X post.

“Our team is fully mobilized to investigate, recover funds, and ensure users are protected,” Gooneratne said.

In the first quarter of 2025, hackers stole more than $1.6 billion worth of crypto from exchanges and on-chain smart contracts, blockchain security firm PeckShield said in an April report.

More than 90% of those losses are attributable to a $1.5 billion attack on ByBit, a centralized cryptocurrency exchange, by North Korean hacking outfit Lazarus Group.

Unique DeFi lending model

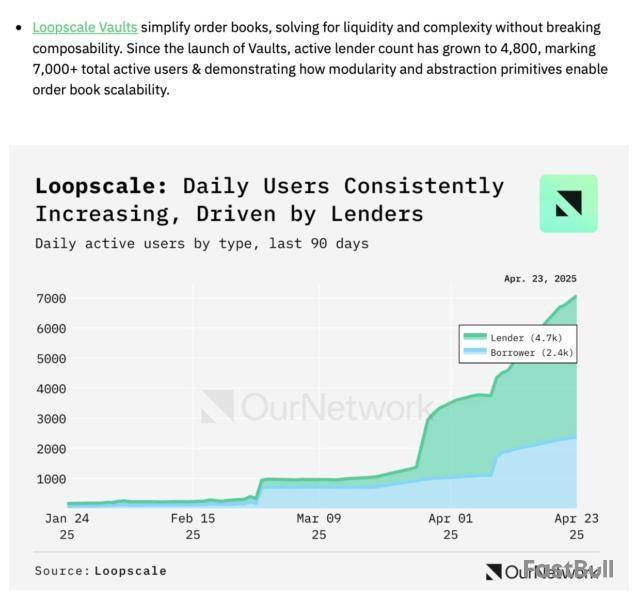

Launched on April 10 after a six-month closed beta, Loopscale is a DeFi lending protocol designed to enhance capital efficiency by directly matching lenders and borrowers.

It also supports specialized lending markets, such as “structured credit, receivables financing, and undercollateralized lending,” Loopscale said in an April announcement shared with Cointelegraph.

Loopscale’s order book model distinguishes it from DeFi lending peers such as Aave that aggregate cryptocurrency deposits into liquidity pools.

Loopscale’s main USDC and SOL vaults yield APRs exceeding 5% and 10%, respectively. It also supports lending markets for tokens such as JitoSOL and BONK (BONK) and looping strategies for upwards of 40 different token pairs.

The DeFi protocol has approximately $40 million in TVL and has attracted upwards of 7,000 lenders, according to researcher OurNetwork.

According to recently shared data by CryptoQuant, the biggest cryptocurrency trading platform in the U.S. jurisdiction, Coinbase, has been stunned with a cumulative withdrawal worth roughly half a billion dollars.

An analyst of the aforementioned on-chain data company shared his take on what this withdrawal could mean for the crypto market.

$500 million in Bitcoin on move

CryptoQuant has noticed that the U.S. largest cryptocurrency exchange by trading volume, Coinbase, has seen cumulative withdrawals of more than 7,000 Bitcoins. This happened on April 25, according to the chart. This amount of crypto is worth approximately $500,000,000.

CryptoQuant.com@cryptoquant_comApr 26, 2025Over 7,000 Bitcoin withdrawn from Coinbase

“Over $500 million worth of BTC was moved out of exchanges, suggesting whales are withdrawing Bitcoin for long-term holding or off-platform use (e.g., DeFi, cold storage).” – By Amr Taha

Link ⤵️https://t.co/lpgH7Bwwu2 pic.twitter.com/DdVLGA6JYK

On April 22, the amount of withdrawals came very close to $1.5 billion worth of Bitcoin. While the chart just shows withdrawals and deposits to exchanges, the CryptoQuant analyst Amr Taha names only Coinbase as the platform that suffered the mammoth withdrawals of BTC.

The analyst explains these gargantuan withdrawals by several possibilities, but all of them come down to one thing — accumulation. It could be financial institutions scooping up Bitcoin, especially since institutions in the U.S. primarily prefer to use Coinbase. “Such large outflows often indicate long-term holding intentions,” the analyst stresses.

Besides, these purchases could be related to spot Bitcoin ETFs and indicate “significant underlying demand.” Potentially, Amr Taha says, this could be signaling bullish investor sentiment.

Bitcoin ETFs welcome $477.93 million in daily netflows

Meanwhile, spot Bitcoin exchange-traded funds continue to score large inflows. According to a recent tweet published by analytics account @lookonchain, on Friday, April 25, ETFs witnessed impressive total inflows of $477.93 million.

Lookonchain@lookonchainApr 25, 2025Apr 25 Update:

10 #Bitcoin ETFs

NetFlow: +5,037 $BTC(+$477.93M)🟢#iShares(Blackrock) inflows 3,500 $BTC($332.07M) and currently holds 586,164 $BTC($55.62B).

9 #Ethereum ETFs

NetFlow: +31,199 $ETH(+$55.5M)🟢#iShares(Blackrock) inflows 22,704 $ETH($40.39M) and currently holds… pic.twitter.com/MBsZZNo9rC

The largest one was registered by BlackRock giant. It inhaled 3,500 Bitcoins worth $332.07 million in fiat. Over the past week, it has drawn in 12,977 BTC valued at $1,224,183,088.9. This wealth management behemoth now holds a total of 586,164 Bitcoins worth $55.62 billion.

The second biggest inflows were recorded by 21 ArkShares, which scooped up 1,037 BTC ($97,800,579) on Friday and 6,665 BTC over the past week — $628,583,281.5. Grayscale Mini Bitcoin Trust bought 319 BTC, while Bitwise got itself 109 BTC.

These inflows came on Friday, when Bitcoin surpassed $95,000 and came really close to breaching the $96,000 price level.

Ethereum is now holding above critical support levels after a volatile few weeks, but it continues to struggle with reclaiming key resistance zones. Bulls have managed to regain some momentum, helping ETH stabilize above the $1,700 level. However, to confirm a true bullish structure and shift sentiment decisively, Ethereum must reclaim and hold higher ground in the coming days.

Top analyst Daan shared a technical setup highlighting a promising development: Ethereum is flipping a previous horizontal level back into support. According to Daan, this marks a meaningful change in ETH’s market dynamics, as it’s something the asset has failed to do for months. Instead of consistently rejecting resistance and making lower lows, ETH is now showing early signs of strength by defending critical zones.

Still, the battle isn’t over. Global macro uncertainty and tensions between the US and China continue to pressure all risk assets, including crypto. For Ethereum, a daily close above key resistance could open the door to a more decisive move higher, while failure to do so could leave it vulnerable to another round of consolidation or downside.

Ethereum Faces A Critical Test After Strong Recovery

Ethereum has staged an impressive recovery, gaining over 32% from its local low of $1,383. Now trading firmly above $1,700, ETH faces a crucial test: holding current levels to shift its longer-term bearish price structure into a more bullish trend. After months of relentless selling pressure, this stabilization could mark the start of a larger reversal if momentum is sustained.

However, broader macroeconomic risks still loom. The ongoing conflict between the US and China continues to pressure financial markets, with growing concerns that a prolonged negotiation process could disrupt global supply chains. If no resolution is reached in the coming weeks, risk assets like Ethereum could struggle to maintain their recent gains. A breakthrough deal, however, could quickly shift investor appetite back toward risk-on assets, fueling a stronger rally.

Daan’s technical analysis highlights a major shift in ETH’s behavior. For the first time in months, Ethereum is flipping a previous horizontal resistance zone back into support—a sign of strengthening market dynamics. Daan suggests closely monitoring the $1,750–$2,100 range, as a firm hold above this area would signal a significant improvement in ETH’s structure.

A daily close above $1,750 and gradual consolidation within this key range would position Ethereum for a potential breakout toward higher levels in the coming months.

ETH Price Holds Above Key Support, But Challenges Remain

Ethereum is currently trading at $1,790, maintaining its position above the critical 4-hour 200 EMA. This technical level has acted as strong support in recent days, providing bulls with a foundation to build momentum. Holding above $1,700 is crucial to maintain the bullish structure that has started to form after weeks of volatility and selling pressure.

To confirm a strong recovery and shift into a sustained uptrend, ETH must reclaim the $2,000 psychological level. A decisive break and hold above $2,000 would likely attract renewed buying interest and could open the door for a move toward higher resistance zones. However, without a strong catalyst, bulls could struggle to maintain upward pressure in the short term.

On the downside, losing the $1,700 support would signal growing weakness and likely invite further selling. A break below this zone could send Ethereum back into the $1,500 region, reigniting concerns of a prolonged consolidation or deeper correction. For now, the market remains cautiously optimistic, but all eyes are on whether bulls can build enough momentum to reclaim higher ground soon.

Featured image from Dall-E, chart from TradingView

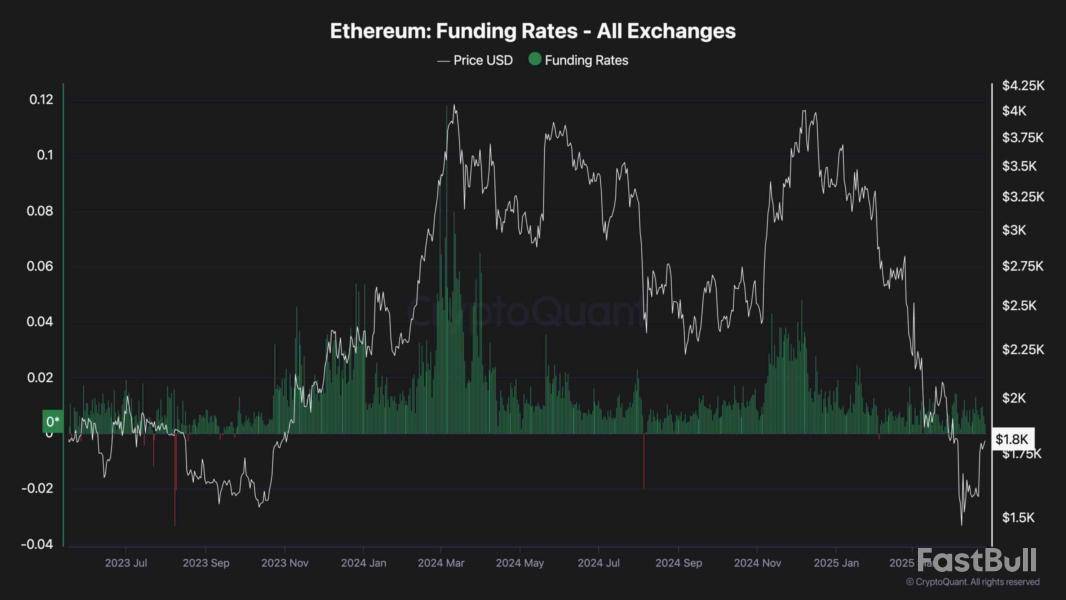

Ethereum faced a notable increase in buying pressure, leading to a bullish rebound at the crucial $1.5K support. The price faces a decisive resistance range at $1.8K, expected to enter a short-term consolidation before breaking above it.Technical Analysis

By ShayanThe Daily Chart

After a period of muted price action and market inactivity around the decisive $1.5K long-term support region, Ethereum eventually experienced a surge in buying pressure, triggering a bullish rebound. This wave of demand has pushed the price toward the significant $1.8K resistance zone. This area coincides with an important order block, where smart money typically places orders, reinforcing its significance.

The price action at this level is critical; a successful breakout above $1.8K would likely confirm a bullish reversal scenario, opening the path toward the $2.1K target. However, short-term consolidation around this resistance is probable before a decisive move unfolds.

On the lower timeframe, ETH’s previous tight-range consolidation was broken by a notable influx of buyers, resulting in an impulsive breakout above the descending channel. This breakout was accompanied by strong bullish momentum, driving the price toward the key $1.8K resistance zone.

This region aligns with Ethereum’s prior swing lows, making it a robust supply area. As a result, short-term consolidation is expected at this level until demand or supply pressure determines the next move. A bullish breakout above $1.8K would set the $2.1K range as the next likely target for buyers.

By Shayan

The funding rates metric is a crucial indicator of sentiment in the futures markets. Analysing its recent behaviour provides important insights into Ethereum’s latest surge. Typically, healthy and sustainable bullish trends are accompanied by rising funding rates, signalling an influx of buyers in both the perpetual futures and spot markets.

Currently, however, funding rates are consolidating and showing no significant increase. This suggests that Ethereum’s recent price surge has primarily been driven by spot market buying rather than futures market speculation. For this bullish trend to be validated and gain persistence, the funding rates metric needs to start rising, reflecting growing confidence and aggressive buying in the futures market as well.

Crypto analyst Daniel has revealed that the Bitcoin price has confirmed its imminent breakout to $106,000. He explained how the technicals and fundamentals support this bullish prediction and currently align for this BTC rally to the $106,000 target.

Analyst Predicts Bitcoin Price Breakout To $106,000

In a TradingView post, Daniel stated that the Bitcoin price now appears poised to reach the next significant resistance zone around $106,000, which also aligns with a big resistance level. The analyst noted that the market is now following through with a solid bullish impulse, pushing past intermediate resistance and confirming the continuation of the ascending channel structure.

He further remarked that the Bitcoin price could reach this $106,000 target with buyers stepping in aggressively and the price respecting the bullish market structure. The flagship crypto has already displayed strong bullish momentum, having broken above $90,000 earlier this week and rallying to $95,000 for the first time in two months.

Daniel noted that this breakout occurred after a well-defined double bottom formed around the major support zone near $74,000. He added that the inability to create a new low and the sharp rejection from that zone confirmed strong buyer presence and marked a clear exhaustion of sellers.

Fundamentals Also Support This BTC Rally

Daniel also explained that the fundamentals support this Bitcoin price rally to $106,000. He remarked that BTC is gaining strength due to several key macroeconomic shifts. These macro shifts include Donald Trump’s tariffs, which have brought about market uncertainty and led investors to seek alternatives outside the stock and bond markets.

The analyst highlighted the fact that the Bitcoin price has thrived during such periods of instability, with investors viewing it as a hedge against the dollar’s instability. He added that global central banks continue tightening monetary policy, increasing fears of a recession. With inflation and recession fears on the rise, investors look poised to diversify their assets into assets like BTC with limited supply.

Daniel also affirmed that the deepening institutional interest is providing a strong foundation for the sustained Bitcoin price movement toward $106,000. He remarked that institutional adoption continues to climb, with spot market activity increasing and institutional funds seeing massive inflows.

The analyst reiterated that the convergence of powerful technical patterns, particularly the confirmed breakout and continuation within the ascending channel, suggests a likely continuation of the upward momentum for the Bitcoin price. The strong macro and institutional adoption also supports a sustained bullish momentum for BTC.

Daniel urged market participants to closely monitor confirmation signals, such as bullish volume surges, strong candle closures above the $90,000 breakout level, and continuation patterns forming on lower timeframes to validate the $106,000 target.

At the time of writing, the Bitcoin price is trading at around $94,660, up in the last 24 hours, according to data from CoinMarketCap.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up