Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Crypto market analysts are eyeing one more Bitcoin flush near $104,000 before the crypto bull market will have a chance to restart, based on historical patterns.

Bitcoin’s long-term support technical indicator is the 50-week simple moving average, and that currently stands at around $102,500 according to TradingView.

It has served as solid support four times since the bull market began in mid-2023 and is likely to be revisited again, analysts said.

There is still a lot of leverage in the market and a large liquidity cluster around $104,000, observed analyst ‘Sykodelic’ on Thursday.

“The market always feels the worst right before it reverses,” the analyst added before observing that the last two times Bitcoin markets hit the indicator were in April 2025, when it fell to $74,000 and August 2024, when it crashed to $49,000.

“Both times, sentiment was absolutely fried, just like it is now. And then each time, it reversed hard after tagging that level.”

Final phases of correction

Other analysts, such as ‘Negentropic’, shared the bearish sentiment, stating that this will be the final flush.

The analyst added that the current setup “opens the door to $102,000,” and we are very close now to a larger reversal.

“Bitcoin may retrace to $104,000 as part of a healthy market correction, driven by profit-taking and macroeconomic uncertainties. However, the underlying fundamentals and institutional interest remain robust, setting the stage for a strong resumption of the bull market,” director at LVRG Research Nick Ruck told Cointelegraph.

Fellow analyst ‘Daan Crypto Trades’ identified the 200-day exponential moving average as a key area of support during most of this cycle. “There has been some chop around it during uncertain times, but in the end price never lost the trend for more than a month,” he said.

BTC facing resistance

Bitcoin has remained relatively stable over the past 24 hours, hovering around the $108,000 level, which is a key support-turned-resistance zone.

It briefly spiked to $113,000 on Tuesday but quickly fell back to $107,000 before settling at the resistance level, where it has started to consolidate.

Despite recent bearish movements, Shiba Inu (SHIB) continues to defy market pessimism, showcasing one of the strongest community-driven displays of conviction in the crypto space.

Even with an 18% monthly decline and ongoing selling pressure, more than 1.54 million wallets now hold SHIB, according to the latest data from Etherscan. This steady rise in wallet count shows growing investor interest even as the token struggles to stay above the $0.00001 level.

Shiba Inu Investor Confidence Remains Strong as Wallet Count Grows

The rise in holders, though modest, reflects continued confidence in Shiba Inu’s long-term prospects. On-chain analyst Etherscan_SHIB described the trend as “strong momentum,” noting that new investors continue entering the ecosystem even amid volatility.

Currently, Shiba Inu (SHIB) trades near $0.00000985 with a market capitalization of about $5.86 billion, down over 47% year-over-year. Nonetheless, the community’s ability to expand during a bearish cycle underscores the meme coin’s enduring cultural and retail appeal.

Exchange Inflows Raise Short-Term Concerns

Despite strong community participation, short-term risks remain elevated. Data from CryptoQuant revealed that Shiba Inu exchange reserves rose by over 56.6 billion SHIB within 24 hours, suggesting increased selling intent.

The movement of tokens from self-custody to exchanges typically signals short-term profit-taking or fear of further downside.

Analysts also point to a descending triangle formation on SHIB’s chart, a bearish technical pattern that often precedes breakdowns. The base support around $0.00001052 has been tested multiple times since April, and a confirmed breach could push prices toward $0.000006.

Nevertheless, Shiba Inu’s ability to avoid “adding another zero” to its price this week has been celebrated as a small but meaningful psychological victory for holders.

Can Token Burns and Shibarium Drive the 2025 Rebound?

Analysts remain divided on whether SHIB can mount a strong comeback in 2025. Optimists cite the growing Shibarium layer-2 adoption and an active token burn mechanism as potential catalysts for a long-term rebound.

These mechanisms aim to reduce SHIB’s massive 589 trillion supply, which critics argue is the biggest barrier to significant price appreciation.

Bullish forecasts suggest that if burns accelerate and network utility grows, SHIB could retest $0.000025–$0.00005 in a favorable 2025 market. However, others warn that sustained gains will depend on Shiba Inu delivering on its DeFi, metaverse, and NFT marketplace promises.

For now, while the price action remains fragile, the loyalty of its 1.5 million holders emphasizes one undeniable truth, the Shiba Inu community isn’t giving up its fight for a comeback.

Cover image from ChatGPT, SHIBUSD chart from Tradingview

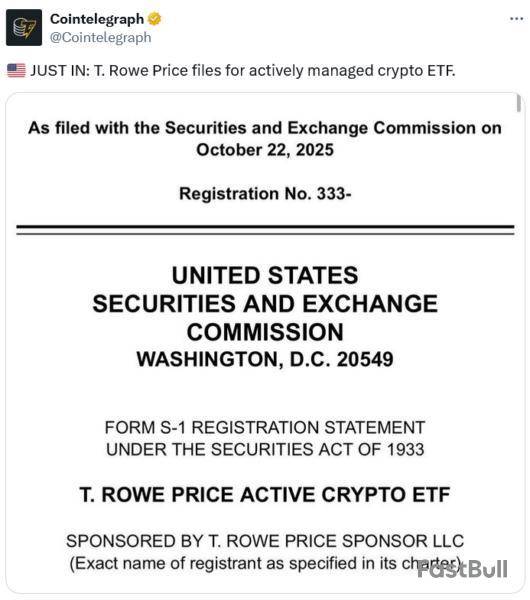

One of the more conservative trillion-dollar asset managers, T. Rowe Price, has surprised analysts after filing to list an actively managed crypto exchange-traded fund in the US.

T. Rowe’s S-1 registration statement to launch an Active Crypto ETF could shake up its largely mutual fund-focused offerings — an asset class that has bled tens of billions of dollars in outflows over the last month.

The filing submitted to the Securities and Exchange Commission on Wednesday states the fund is expected to hold 5 to 15 cryptocurrencies that are eligible under the SEC’s generic listing standards, which include Bitcoin (BTC), Ether (ETH), Solana (SOL), and XRP (XRP).

President of NovaDius Wealth Management, Nate Geraci, referred to the filing as “left field” while suggesting that “legacy asset managers” like T. Rowe that missed out on the first crypto ETF wave are now rushing to find their market fit.

Bloomberg ETF analyst Eric Balchunas similarly described the filing as a “SEMI-SHOCK,” noting that T. Rowe, a near $1.8 trillion asset manager, has focused heavily on mutual funds across its 87-year history.

Weighting of assets won’t be purely based on market size

T. Rowe’s proposed fund seeks to beat the returns of the FTSE Crypto US Listed Index, with the weighting of assets to be based on fundamentals, valuation, and momentum, the filing states.

Among the other cryptocurrencies eligible for inclusion into T. Rowe’s fund is Cardano (ADA), Avalanche (AVAX), Litecoin (LTC), Dogecoin (DOGE), Hedera (HBAR), Bitcoin Cash (BCH), Chainlink (LINK), Stellar (XLM) and Shiba Inu (SHIB).

T. Rowe’s Active Crypto ETF varies from a plethora of single-coin ETF applications in line for SEC approval.

However, every one of those applications, including ones for LTC, SOL and XRP, has been held up by the US government shutdown, which is now in its 22nd day.

One of US President Donald Trump’s economic advisers, Kevin Hassett, said on Monday that the shutdown is “likely to end sometime this week.”

T. Rowe shrugged off crypto in 2021 but didn’t entirely rule it out

More than four and a half years ago, T. Rowe’s former CEO William Stromberg said crypto was still in its “early days” when asked whether the asset manager would invest in crypto.

“It really truly is early, early days here so I would expect this to move at a good pace but take years to really unfold," Stromberg said at the time.

Analysts say XRP’s long-awaited ETF could draw strong demand, but warn that much of the expected price boost may already be reflected in the market.

Talk around an XRP Exchange-Traded Fund (ETF) has grown as large financial firms prepare for potential approval. The product would allow institutions to gain direct exposure to XRP, similar to Bitcoin and Ethereum ETFs.

Analyst Lewis Jackson said that many institutions started buying XRP months ago, anticipating ETF approval. These early purchases helped create the current price strength. “By the time most ETFs launch, about 75% of the price move is already baked in,” he explained.

What to Expect From XRP’s Price

Jackson expects XRP’s short-term price move to be limited once the ETF is approved. In his view, around 75% of the ETF-related gains are already reflected in the price.

If demand grows after launch, he sees XRP moving between $9 and $11. He compared it to Ethereum’s ETF, which saw slow but steady inflows after an initial quiet start. Bitcoin’s ETF, by contrast, triggered heavy buying early on. XRP, he said, could follow a middle path, a short rally followed by gradual gains.

The Bearish Take: Overhyped or Underestimated?

Not everyone is convinced. The XRP ETF narrative might be overblown, pointing out that Ripple’s token has historically struggled to maintain momentum after big announcements.

Others say that while XRP’s technology and liquidity appeal to institutions, it still faces competition from faster-growing ecosystems like Solana and Ethereum, which continue to dominate decentralized finance and tokenized asset markets.

The Bullish Case: Institutional Era Could Redefine XRP

On the flip side, ETF approval could mark a turning point for XRP’s institutional adoption. With large asset managers seeking exposure to diverse digital assets beyond Bitcoin and Ethereum, XRP’s established network and regulatory clarity could make it a top choice.

“If demand hits, XRP could easily test double-digit prices,” said Jackson. “It all depends on how fast and how deep institutional interest runs once these ETFs start trading.”

Hyperliquid Strategies filed an S-1 statement with the U.S. Securities and Exchange Commission for a public offering to raise up to $1 billion.

According to the Wednesday filing, the company plans to offer up to 160 million shares of its common stock for the raise. Chardan Capital Markets is serving as its financial advisor for the offering.

Hyperliquid Strategies is a pending merger entity formed by Nasdaq-listed biotech firm Sonnet BioTherapeutics and special purpose acquisition company Rorschach I LLC, with an aim to establish a crypto treasury company focused on the Hyperliquid ecosystem. Sonnet announced the merger in July, and it is expected to close within this year.

The merged entity will trade on Nasdaq under a new undisclosed ticker, led by Chairman Bob Diamond, the former CEO of Barclays, and CEO David Schamis.

Hyperliquid Strategies plans to use the proceeds for general corporate purposes, including the acquisition of Hyperliquid's HYPE tokens to expand its treasury. The company currently holds 12.6 million HYPE and 305 million in cash.

"[The company] aims to deploy its HYPE token holdings selectively, primarily through staking substantially all of its HYPE holdings, which Pubco expects will generate ongoing staking rewards," the company said in the filing, adding that it may also pursue other non-staking DeFi-related activities within the ecosystem following internal reviews.

Hyperliquid is a high-performance decentralized perpetual futures exchange that has processed over $1.5 trillion in total trading volume since launch in 2023.

Last year, Hyperliquid launched its native token HYPE, with a supply of 1 billion tokens, of which around 38% is allocated for community rewards. According to The Block's price page, HYPE rose 7.67% in the past day to trade at $37.73.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Decentralized exchange Bunni has announced that it is shutting down operations, citing financial constraints following a recent $8.4 million exploit.

In a Wednesday post on X, Bunni said that it does not have enough resources to fund a secure relaunch.

"The recent exploit has forced Bunni's growth to a halt, and in order to securely relaunch we'd need to pay 6-7 figures in audit and monitoring expenses alone – requiring capital that we simply don't have," the team said.

Bunni added that it would take months of business development effort to restore operations, which the project can't afford. "Thus, we have decided it's best to shut down Bunni," the team said.

The platform suffered an exploit last month that resulted in $8.4 million in losses. Its post-mortem revealed that attackers exploited a rounding error in its smart contract withdrawal function.

With the protocol ceasing operations, Bunni said users will still be able to withdraw assets on its website until further notice. The team plans to distribute remaining treasury assets to holders of BUNNI, LIT, and veBUNNI based on a snapshot, pending legal validation. Team members will be excluded from the distribution, according to the post.

Despite winding down the exchange, Bunni noted that it has relicensed its V2 smart contracts from Business Source License to the less-restrictive MIT license, allowing other developers to use its innovations such as liquidity distribution functions, surge fees, and autonomous rebalancing mechanisms.

Bunni said it is cooperating with law enforcement to pursue recovery of the stolen assets. According to Bunni's post-mortem report, the $8.4 million worth of stolen assets have already been laundered through Tornado Cash. The team offers the attacker a 10% bounty to return the remaining funds.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

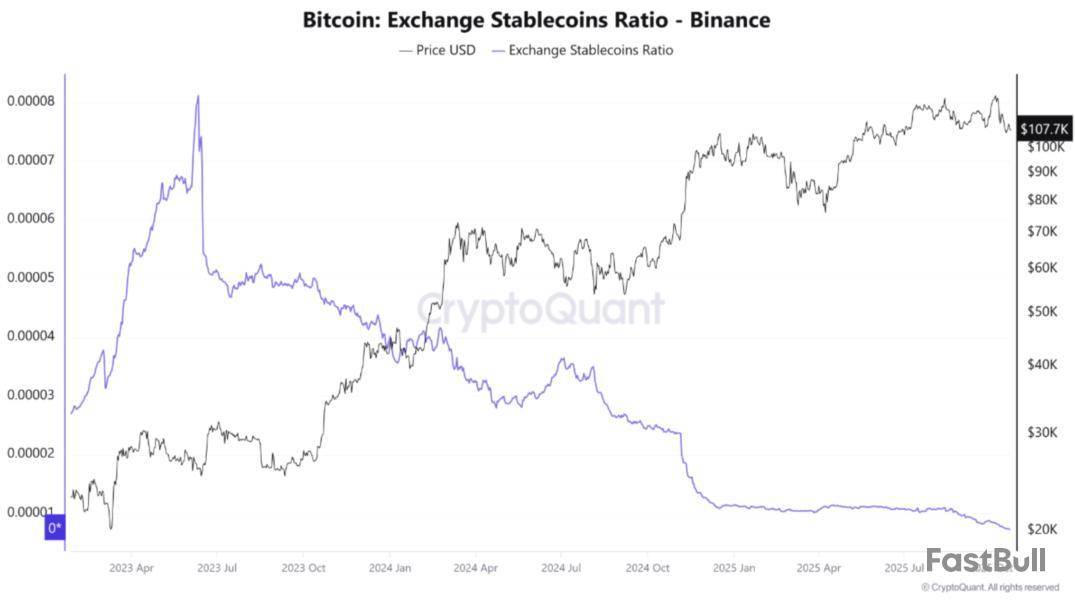

As Bitcoin (BTC) continues to trade in the high $100,000 range following the October 9 crypto market crash, some bullish signs are starting to emerge. Notably, stablecoin reserves on leading crypto exchanges like Binance are entering all-time high (ATH) territory, hinting at a potential rally for BTC.

Stablecoin Reserves Rise – Will Bitcoin Benefit?

According to a CryptoQuant Quicktake post by contributor PelinayPA, Binance stablecoin reserves are approaching ATH levels, indicating that investors are ready to deploy funds to accumulate BTC at current or lower levels.

The CryptoQuant analyst highlighted the rapidly falling Bitcoin-Stablecoin Ratio (ESR). For the uninitiated, the ESR measures the proportion of Bitcoin reserves to stablecoin reserves on exchanges like Binance.

The ratio also gives hints about the market’s potential buying power and selling pressure. Past data shows that whenever the ESR falls sharply during market volatility, BTC’s price tends to surge.

Essentially, a declining ESR means that stablecoin reserves are growing in comparison to BTC reserves on exchanges. This shows an increase in available “dry powder” on exchanges, which can quickly be used to buy more BTC and initiate another bull rally.

Conversely, when the ESR rises, it means that stablecoin reserves are falling while BTC supply on exchanges is increasing. This points toward an increase in short-term selling pressure as traders deposit BTC to exchanges to sell.

Currently, the ESR has fallen to historically low levels, implying that Binance holds relatively large stablecoin reserves compared to BTC reserves. According to PelinayPA, such a setup can have two interpretations:

In a positive scenario, the abundance of stablecoins suggests significant latent buying power. If market confidence returns, this could trigger a strong wave of buying pressure and mark the start of a new bullish phase.

Meanwhile, the negative scenario assumes that this liquidity would remain inactive, reflecting investor hesitation and a market in standby mode after the recent bloodbath that resulted in liquidations worth $19 billion.

Will The Gold Rotation Help BTC?

Following the crypto market crash earlier this month, which sent BTC from an ATH of more than $126,000 all the way down to $102,000, several whales faced liquidations. Despite the crash, some analysts are confident that the BTC top is not in yet.

One of the factors that can significantly benefit BTC in the near term is the capital rotation from gold to the digital asset. In a new report, Bitwise predicted that capital rotation from gold into BTC could propel it to $242,000.

That said, veteran trader Peter Brandt recently forecasted that BTC could crash 50% from current price levels. At press time, BTC trades at $108,268, down 0.3% in the past 24 hours.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up