Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

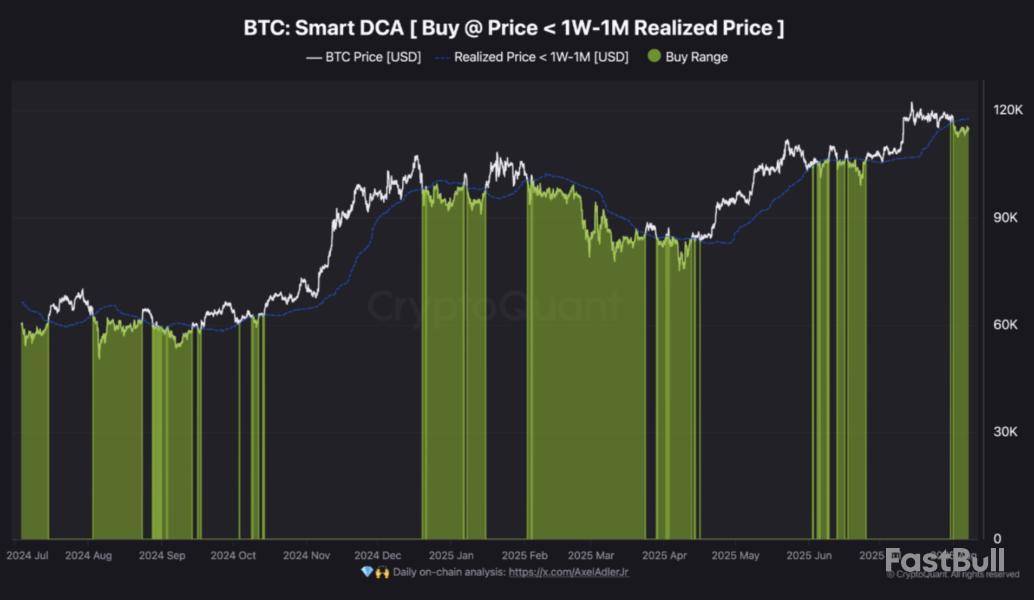

Following a brief dip to $112,200, Bitcoin (BTC) has recovered slightly, trading around the $116,300 level at the time of writing. While concerns remain about BTC’s inability to decisively break the $120,000 resistance level, on-chain data suggests the asset may be in an accumulation phase – potentially gearing up for its next breakout toward a new all-time high (ATH).

Bitcoin Currently In Accumulation Phase, Analyst Says

According to a CryptoQuant Quicktake post by contributor BorisVest, a strategy called Smart Dollar-Cost Averaging (DCA) may help Bitcoin investors accumulate the asset more strategically and improve long-term performance.

In his analysis, BorisVest noted that investors often struggle to time their entries into BTC. Many tend to buy during local tops due to fear of missing out (FOMO) and avoid entering the market during bottoms out of fear of further declines.

Smart DCA offers a way to bypass these emotion-driven decisions. The strategy recommends accumulating BTC when its market price falls below the 1-week to 1-month realized price – a period during which short-term holders are often in loss, resulting in heightened sell-off. BorisVest explained:

At these levels, short-term holders are usually underwater, leading to increased sell pressure. Smart DCA activates hourly purchases during such periods, helping to bring the BTC and USD cost basis closer together.

Currently, the 1-week to 1-month realized price stands at approximately $117,700. As long as BTC trades below this level, Smart DCA continues to flash an accumulation signal. Once BTC climbs above this threshold, the strategy advises gradually selling previously accumulated coins.

With Bitcoin now trading near $116,000, the analyst suggests that the asset is still in an accumulation phase – though it’s approaching the realized threshold. According to data from CoinGecko, BTC remains about 5.2% below its ATH of $122,838, recorded on July 14.

Is BTC Unlikely To Hit A New ATH?

Despite holding steady around $115,000, some analysts warn that Bitcoin’s realized price is slowly beginning to show signs of fragility. A drop below the $105,000 mark could lead to increased downside momentum, potentially triggering a larger sell-off.

Notably, Binance’s net taker volume has slipped back into negative territory, raising concerns about a near-term correction. Additionally, rising Bitcoin ETF outflows have shown signs of weakness, adding another layer of uncertainty.

Still, not all indicators are bearish. Some on-chain metrics suggest BTC may simply be entering a cooling-off period after a brief overheated phase. At press time, BTC trades at $116,316, up 2.1% in the past 24 hours.

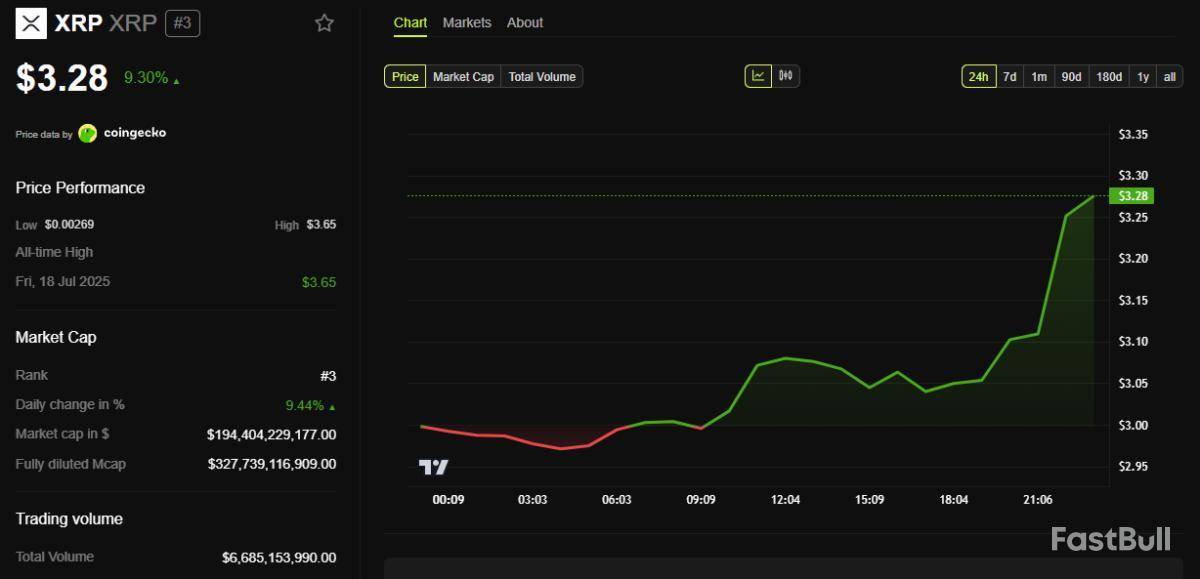

XRP painting early signs of a possible bullrun investors should exercise caution as there is currently insufficient confirmation. Right now the asset is above the 26 EMA, a crucial short-term support level that frequently denotes bullish momentum. A sustained upward trend or a complete market reversal are not however assured by a single indicator.

XRP has shown resilience in recent weeks recovering from a steep correction from the $3.60 range to a local low near $2.80. Buying activity around the 50 EMA was strong supporting this rebound and suggesting that mid-term bulls are still active. At the moment XRP is trading at about $3.07 a level that requires careful attention. Chart by TradingView">

In order to confirm a proper bullrun XRP needs to surpass and stay above $3.30 which served as a local resistance during the previous decline. If it breaks above that level it may be possible to retest the 2025 high which is still about 25% off at $3.80. Support levels on the downside are $2.80 and $2.60 which correspond to the 50 and 100 EMAs respectively.

If these levels were to fall it would indicate waning bullish momentum and potential further decline. Compared to July's explosive move volume is still low for the time being indicating that momentum may not be strong enough to support a significant breakout just yet. Near 54 the RSI is in a largely neutral zone that allows for potential upside but provides no indication of strength.

Bitcoin Gets Ready

Bitcoin has officially breached the crucial resistance level of $115,000 indicating a technically confirmed breakout however prudence is advised. Although the breakout appears bullish on paper the asset is once again getting close to the technically and psychologically dense resistance level of $120,000 which has served as a ceiling on several occasions in recent months.

All three of the major moving averages, the 26 EMA, 50 EMA and 100 EMA–slope upward and are stacked in a bullish formation indicating a clear upward structure on the chart. But since early July Bitcoin has struggled to maintain momentum above $120,000 even with this structurally sound setup.

At that level several rejection wicks show that sellers are trying to push through. On this most recent leg up, volume has not increased much, which may indicate that buyers are hesitating as the asset approaches overbought conditions. On its own the RSI's neutral 52 position provides little conviction but allows for potential movement in either direction. Until a powerful catalyst appears, range-bound movement between $112,000 and $120,000 is the most likely short-term scenario given the current structure of the market.

At $110,000 the 50 EMA served as support during earlier pulldowns and bears might try to drive the price back down toward it. The next stronghold is at $102,500, close to the 100 EMA if that level breaks.

Solana Squeezed Too Hard

Solana is exhibiting compression that may be a precursor to another surge in volatility perhaps akin to the October 2024 rally of 84%. The cluster of exponential moving averages (26 EMA, 50 EMA and 100 EMA) that all converge closely around the $162-$165 region has caused SOL to bounce off and is currently trading at about $172.

The late October 2024 setup in which SOL coiled above the 50 EMA and exploded to the upside gaining over 84 percent in a brief period of time before reversing is similar to this tight EMA compression. As the price tries to recover its prior support trendline which is currently serving as resistance after dropping below it during the most recent correction from the $200+ level momentum is currently regaining.

The RSI indicates that there is still potential for upward momentum without immediately causing selling pressure because it is currently trading just below the overbought zone. The volume profile has been muted during the recent bounce indicating accumulation rather than distribution which adds interest to this setup.

A sharp increase in trading volume once the breakout starts could occur if this pattern recurs. It is imperative to remember that past performance does not necessarily indicate future actions. Although historically the EMA squeeze has resulted in volatility breakouts, direction is important and if the $180 level is not regained a retest of $162 or lower may occur.

Last Friday’s US July Employment Situation release has delivered the kind of statistical jolt that rarely shows up outside crises, forcing traders to re-evaluate both the macro outlook and Bitcoin’s near-term path. Payrolls grew by just 73,000, but the shock lay in the record-large negative revisions: May and June were marked down by a combined 258,000 jobs, slicing the three-month hiring average to 35,000 and erasing nearly all of the second-quarter’s reported momentum. The Bureau of Labor Statistics notes that revisions of that magnitude have been seen only during the Covid collapse.

Is Bitcoin Really Facing A Black Swan Event?

Bloomberg Economics chief US economist Anna Wong wrote: “The downward revisions to May and June payrolls in the July jobs report constitute a black swan event – a three-standard-deviation move with less than a 0.2% chance of occurrence in the last 30 years. Adjusted for our estimate of the job overstatement from the Bureau of Labor Statistics’ birth-death model, the three-month hiring pace turns outright negative.” The data, she wrote in a terminal note circulated Friday, “flipped the labor-market script” from re-acceleration to abrupt cooling.

Related Reading: Bitcoin Could See Another Crash To Fill This Imbalance Before Rally To $120,000

The market’s crypto voice on the issue has been Bitwise Europe’s head of research, André Dragosch, who spent the morning posting a string of warnings on X. First came the news, ”According to Bloomberg chief economist Anna Wong, the most recent payroll revisions were a ‘black swan event’.Will probably get even worse before it gets better…”, then the maxim, “Yes – bad for payrolls = good for bitcoin, at least over the medium to long term.”

Minutes later he argued that deeper revisions could force emergency easing: “NOTE: There is a strong case for a negative June jobs print after further downside revisions which could lead to a 50 bps rate cut in September… Plan accordingly. #Bitcoin”

By mid-afternoon he pushed the point to its logical extreme: “ATTENTION: We are probably just a single negative NFP print away from a significant repricing in Fed rate cut expectations. US labor market & inflation data surprises are still as bad as during Covid but traders only price in 2 cuts until Dec 2025… Printer is coming… ”

Interest-rate futures moved sharply in Dragosch’s direction. On Wednesdays, the CME FedWatch Tool showed a 91 percent probability of at least one cut at the 17–18 September FOMC meeting. Minneapolis Fed President Neel Kashkari acknowledged that “the real underlying economy is slowing,” while Governor Lisa Cook called the size of the revisions “concerning.”

Bitcoin’s price action captured the tug-of-war between recession fear and liquidity hope. The flagship cryptocurrency slumped to $111,920 on 2 August, its lowest print since early July, immediately after the payroll release and President Donald Trump’s subsequent firing of BLS Commissioner Erika McEntarfer. A tentative rebound toward $111,500 followed as rate-cut odds ballooned this week. Yet, Bitcoin remained tethered to macro headlines rather than its own cycle.

Still, the first clear sign of positioning for easier policy has emerged in fund flows. Spot Bitcoin ETFs recorded a net $91.6 million inflow on 7 August, snapping a four-day outflow streak that had drained more than $380 million from the vehicles.

Whether Bloomberg’s and Dragosch’s black-swan framing proves prescient will depend on the next few data prints and the Fed’s tolerance for risk. For now the market is caught between those poles: one bad jobs number away from a full-blown policy response, but one more shock away from a broader risk-off spiral. The only certainty, as Wong’s probability math and Dragosch’s full-throated alerts both imply, is that the margin for error has evaporated.

At press time, BTC traded at $116,359.

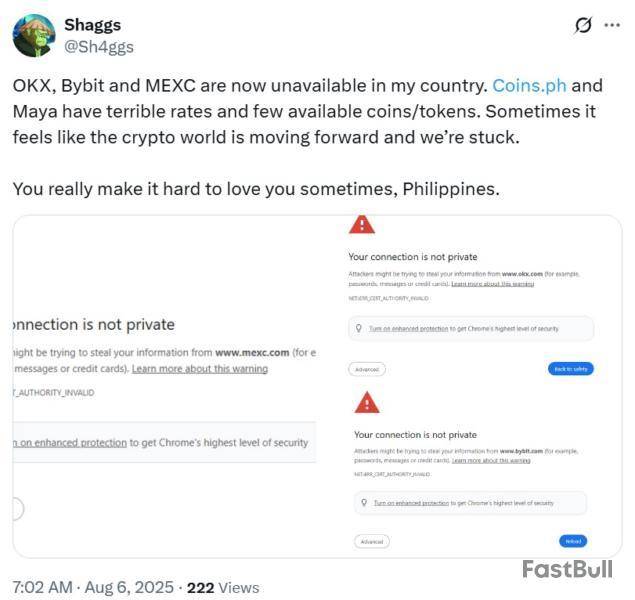

The Philippines internet firms block top crypto exchanges

Members of the crypto community in the Philippines say local internet service providers have begun blocking access to several unlicensed cryptocurrency exchanges.

The move follows a warning issued Monday by the Securities and Exchange Commission (SEC), which flagged 10 exchanges, including OKX, Bybit and Bitget, for operating without a license.

Several users report they can no longer access these exchanges websites, though mobile apps remain functional for now. However, previous enforcement history suggests that app access may also be restricted soon.

The SEC took similar action against Binance in early 2024, first requesting the National Telecommunications Commission to block the website in March, then urging Google and Apple to remove the platforms apps from local app stores in April.

Despite the crackdown, crypto trading remains legal in the Philippines. Licensed platforms are still available, though some users complain they lack the range of tokens and competitive pricing offered by the now-blocked platforms.

India goes after Coinbase scammers hidden stash

Indias Enforcement Directorate (ED) has provisionally attached (frozen) assets worth 428 million rupees (about $5 million) belonging to convicted Coinbase Pro phishing scammer Chirag Tomar.

In Indias legal system, attachment refers to the restriction of asset transfers and use under the Prevention of Money Laundering Act. The provisional attachment can be held up to 180 days. India tagged Tomars 18 properties located in Delhi, along with funds held in several bank accounts.

He is currently serving a five-year prison sentence in the US after pleading guilty to wire fraud conspiracy. He and his associates ran spoofed websites mimicking Coinbase Pro and tricked users into handing over their login credentials. In some cases, victims were lured into calling fake customer support numbers and giving the scammers remote access to their devices.

The stolen funds were funneled into crypto wallets controlled by Tomar and were later sold on peer-to-peer platforms, converted to Indian rupees and deposited into personal and family accounts.

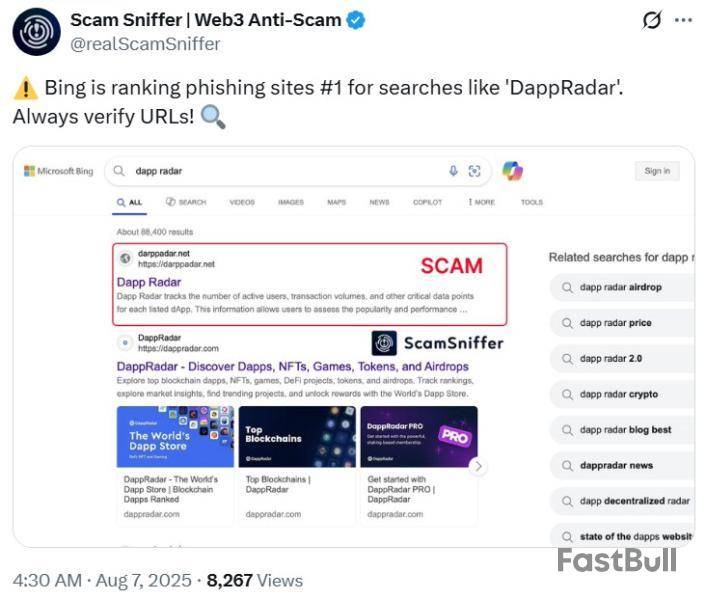

The ED launched its probe based on reports of Tomars arrest in the US and found that search engine optimization was used to push the fraudulent Coinbase clone sites to the top of search results.

Though Tomars operation was busted in the US, phishing tactics that manipulate search engines continue to thrive. As recently as August 7, a top-ranked site on Bing mimicking DappRadar was found to be a phishing site, according to Scam Sniffer.

Read also Features The real risks to Ethenas stablecoin model (are not the ones you think) Features Investing in Blockchain Gaming: Why VCs Are Betting BigTokenize Xchanges Singapore license botch leads to lawsuit

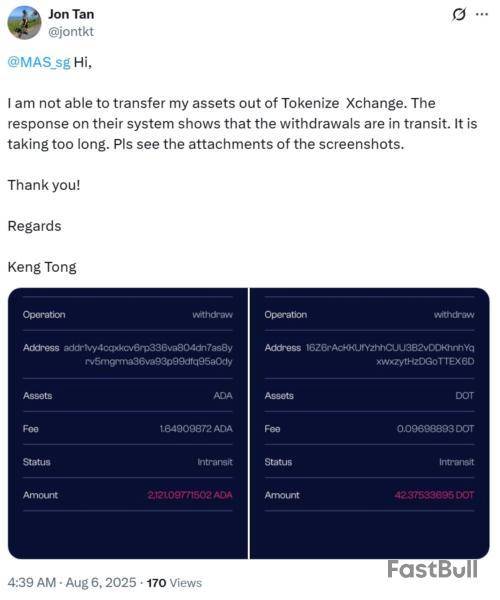

Seven cryptocurrency investors have reportedly filed a court application to place AmazingTech, the operator of Tokenize Xchange, under interim judicial management after being unable to withdraw more than 4 million Singapore dollars (about $3.1 million).

According to local media outlet The Straits Times, a separate law firm Dauntless Law Chambers is preparing a class action lawsuit involving over 100 investors who claim they are owed around 40 million Singapore dollars, with plans to sue founder Hong Qi Yu for fraud.

Tokenize Xchange suspended trading after a regulatory crackdown that forced unlicensed crypto exchanges to cease operations in Singapore. In July, the platform announced it would shut down and relocate to the United Arab Emirates after the Monetary Authority of Singapore (MAS) denied its application for a crypto license.

At the time, the reasons for the license denial were unclear. However, on August 1, the MAS said it had found indications that Tokenize failed to segregate customer assets from corporate funds and may have misrepresented this in its license application. The central bank also revealed that Hong was charged on July 31 with fraudulent trading, an offense that carries a sentence of up to seven years in prison.

The MAS added that it had received multiple complaints in mid-July about delayed withdrawals of both cash and crypto. Despite Tokenizes claims that customers could transfer their crypto to other exchanges for withdrawal, many users said they are still unable to access their funds.

Read also Features Working with the Hydra: Providing Services to Decentralized Organizations Features Insiders guide to real-life crypto OGs: Part 1Coinone to sell $3.1 million in crypto under new South Korean disclosure rules

Cryptocurrency exchange Coinone became the first South Korean cryptocurrency exchange to announce the sale of its crypto holdings under new trading guidelines introduced in June.

There was a de facto ban on institutional cryptocurrency trading in South Korea until recently. In February, the Financial Services Commission (FSC) announced the phased entry of institutional capital into the crypto market, with government agencies, nonprofits, universities and crypto exchanges first to be let in throughout the first half of the year.

The guideline for exchanges to sell cryptocurrencies went into effect in June. According to the guidelines, exchanges are not permitted to sell on their own platforms and must use at least two fiat-to-crypto exchanges (there are only five in the country, including Coinone). Only assets in the top 20 by market capitalization can be sold by exchanges.

Coinone said in a Tuesday announcement that it plans to sell 4.1 billion Korean won (about $3 million) worth of crypto through rival exchanges Upbit and Korbit.

In this second half of the year, the FSC plans to pilot institutional crypto trading for investment and financial purposes, targeting approximately 3,500 entities, including publicly traded companies and registered professional investors.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

The United States Securities and Exchange Commission (SEC) has filed a joint dismissal of the appeals in the Court of Appeals for the Second Circuit. The joint dismissal dated August 7 marked the end of the Ripple vs SEC case, with no more escalation from both sides.

According to the court filing, both parties are expected to bear their costs and legal fees. Ripple’s Chief Legal Officer Stuart Alderoty noted that the company can now focus on its core business model, which includes enabling seamless cross-border payments through blockchain technology.

Stuart Alderoty@s_alderotyAug 07, 2025Following the Commission's vote today, the SEC and Ripple formally filed directly with the Second Circuit to dismiss their appeals.

The end…and now back to business. https://t.co/nVqthNcFOt

Is XRP Price Ready for the Moon?

The closure of the Ripple vs SEC case marks a major milestone for the mainstream adoption of XRP and the XRPL products. Following the announcement, XRP price surged over 8 percent to trade above $3.27 on Thursday, August 7 during the late North American session.

The large-cap altcoin, with a fully diluted valuation of about $327 billion, rebounded from the 50-day Moving Average Simple. With the renewed demand for XRP, as shown by the sharp uptick in its transaction volume, an upsurge towards a new all-time high is imminent in the near future.

According to crypto analyst Ali Martinez, the XRP price has just broken out of a recent consolidation, with a midterm target of $3.34.

Ripple Records Robust Fundamentals for the XRPL Network

Ripple has been anticipating an imminent closure to the long-standing lawsuit under the Donald Trump administration. As a result, the blockchain payment company has focused on building the XRPL network to compete with other layer one chains led by Ethereum (ETH), and Solana (SOL).

For instance, Ripple announced on Thursday a strategic acquisition of Rail, a stablecoin-powered platform for global payments, for $200 million. The acquisition of Rail will play a crucial role in the mainstream adoption of Ripple USD (RLUSD), which helps in the on-chain burns of XRP.

Dubai has officially cemented its position at the forefront of global crypto regulation. This bold regulatory step positions Dubai as a global trailblazer in shaping the future of institutional crypto markets and blending innovation with compliance. As jurisdictions around the world debate how to handle digital assets, Dubai is already laying the groundwork for the financial infrastructure of tomorrow.

Why This Approval Matters For Global Financial Markets

The Virtual Assets Regulatory Authority (VARA) has officially approved the first-ever cryptocurrency options license, marking it a breakthrough moment for the emirate region’s rapidly evolving digital asset ecosystem.

As highlighted in the press release, the permit was granted to a Nomura-backed digital assets firm, Laser Digital. This permit has authorized the firm to offer over-the-counter (OTC) crypto options trading to institutional investors under VARA’s regulatory framework.

This development solidifies Dubai’s status as a premier global hub for cryptocurrency and blockchain innovation. With VARA granting Dubai its first crypto options license, it provides a clear regulatory pathway for firms seeking to offer complex instruments and crypto derivatives. By doing so, Dubai is setting the bar for how governments can blend innovation with compliance.

The approval of Laser Digital under VARA’s framework reflects a commitment to fostering a business-friendly environment with robust regulatory standards, including Anti-Money Laundering (AML) and know-your-customer (KYC) requirements. This gives institutional investors confidence that the space is both progressive and secure.

Why Listed Spot Trading Launched Matters For US Crypto Markets

While the first-ever cryptocurrency options license has been approved, the US Commodity Futures Trading Commission (CFTC), under Caroline D. Pham, has launched a listed spot crypto trading initiative. According to the release, this license opens the door for regulated exchanges such as the Chicago Mercantile Exchange (CME) to offer direct trading of real crypto tokens, not just for futures contracts, but under official United States oversight.

It is important to note that spot trading is where you buy and sell the actual asset itself, such as Bitcoin or Ethereum, for immediate settlement, which hasn’t been regulated at the federal level. It’s different from trading futures or derivatives, where traders speculate on price without owning the asset. “Under President Trump’s strong leadership and vision, the CFTC is full speed ahead on enabling immediate trading of digital assets at the Federal level in coordination with the SEC’s Project Crypto,” Acting Chairman Pham stated.

If this goes through, it would bring spot and futures trading under the same regulatory rulebook, making the crypto market simpler, clearer, and more secure for everyone involved, which is a step forward for the crypto industry. It will also pave the way for retail and institutional investors to engage in crypto markets with a higher level of trust, knowing that trading is taking place on federally regulated exchanges.

The long-running legal battle between Ripple Labs and the US Securities and Exchange Commission (SEC) is officially over.

On August 7, both parties filed a Joint Stipulation of Dismissal with the US Court of Appeals for the Second Circuit, confirming the withdrawal of their respective appeals.

SEC Dismisses Appeals Against Ripple

According to court documents, the SEC has dismissed its appeal (Case No. 24-2648), and Ripple has dismissed its cross-appeal (Case No. 24-2705).

The joint filing states that both parties “stipulate to the dismissal” of the cases, with each side bearing its own legal costs and fees.

The filing brings to a close one of the most high-profile enforcement actions in crypto history.

It also marks the final step in the aftermath of Judge Analisa Torres’ 2023 ruling. The ruling found that Ripple’s institutional XRP sales violated securities laws, while programmatic sales and secondary market transactions did not.

Background on the Appeal Process

Ripple and the SEC had both appealed portions of that ruling. The SEC sought to challenge parts of the judgment that did not favor it, while Ripple contested the injunction and $125 million civil penalty imposed for institutional sales.

Earlier this year, the two sides attempted to resolve the dispute through a negotiated settlement that would reduce Ripple’s penalties and vacate the injunction.

Judge Torres rejected that request in June, forcing both parties back into the formal appeal process.

Today’s filing ends that effort and confirms that no changes will be made to the original remedies. The $125 million penalty, currently held in escrow, will now be transferred to the US Treasury.

XRP Market Reaction

Following the filing, XRP surged 5% within the past hour, as traders reacted to the official end of the multi-year legal battle. The altcoin reached an all-time high in late July, but faced significant corrections afterwards.

So, what does this mean for Ripple and XRP going forward? Ripple remains barred from conducting unregistered institutional sales of XRP.Meanwhile, the SEC will not pursue any further action on this case. The precedent set by Judge Torres’ ruling stands as a partial victory for both sides.

With the appeals dismissed and the case closed, Ripple can now move forward under a clearer regulatory framework, though it remains subject to the court-imposed restrictions.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up