Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key Takeaways:

88% of Bitcoin’s supply is in profit below $95,000, indicating a reset in investor expectations.

The current price range of $75,000–$95,000 may represent a structural bottom, aligning with market conditions from Q3 2024.

The Market Value to Realized Value (MVRV) Ratio at 1.74 acts as a historical support zone, signaling cooling unrealized gains and potential for future growth.

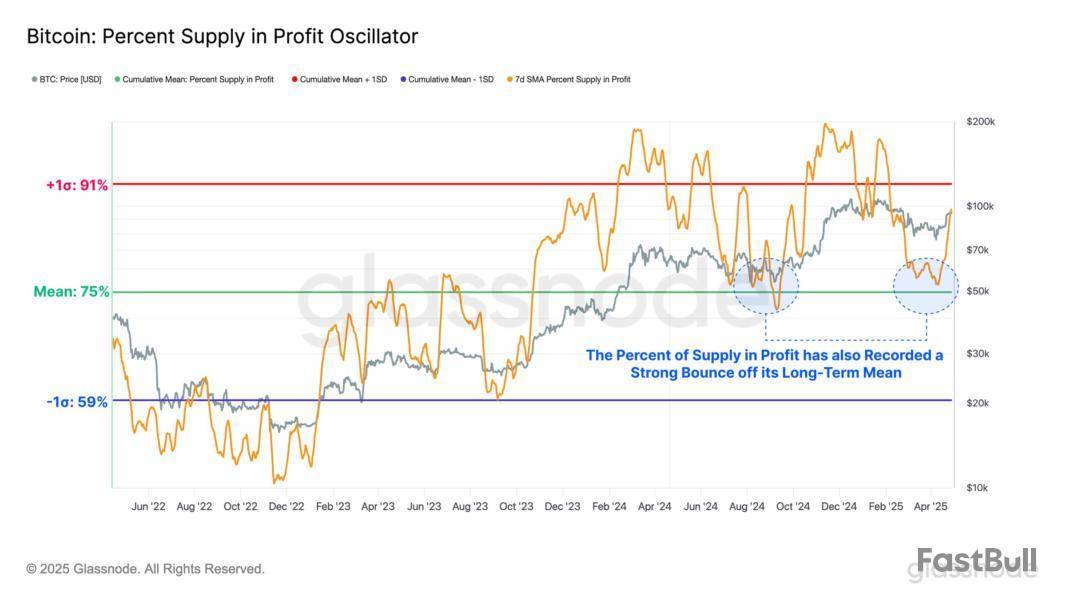

Bitcoin’s (BTC) market dynamics are shifting, as Glassnode data reveals that 88% of the supply is currently in profit, with losses concentrated among buyers in the $95,000-$100,000 range. This high profitability, rebounding from a long-term mean of 75%, indicates a reset in investor expectations.

Bitcoin's price staged a recovery from its long-term cumulative mean percentage in profit, marking a notable shift. Previously, in August 2024, Bitcoin retested the 75% mean at around $60,000. This suggests that the price range of $75,000–$95,000 may represent the bottom, aligning with the structural market conditions observed in Q3 2024.

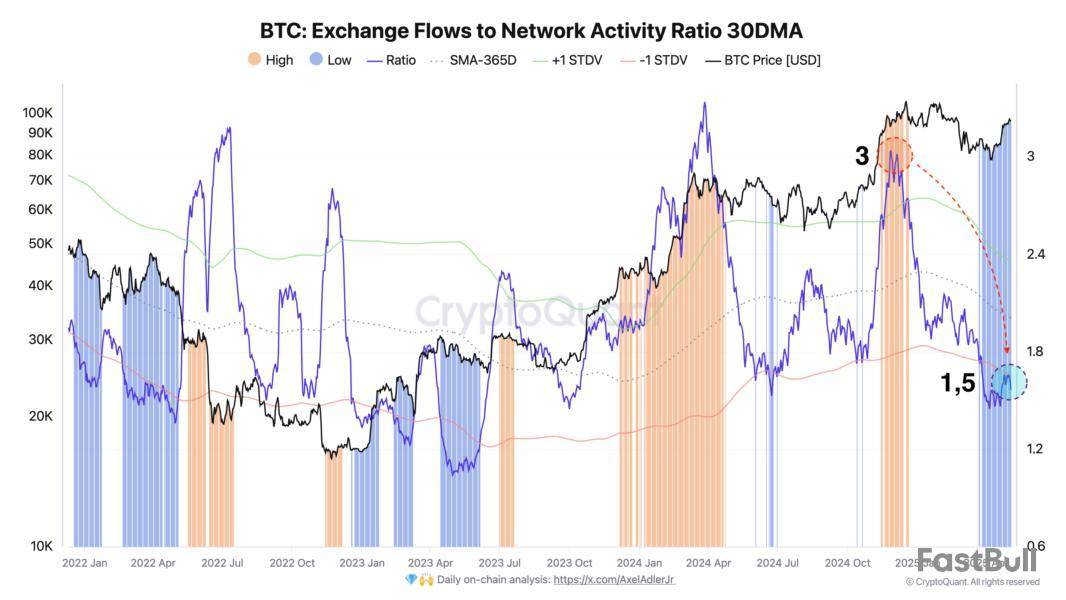

Confirming the decrease in holder sales through exchanges, the total exchange flow (inflow + outflow) to network activity ratio provides further insight. Bitcoin researcher Axel Adler Jr. explained that the chart shows a 1.5x decrease in ratio following Bitcoin’s all-time high, directly confirming that the current growth is more organic.

The analyst explained that, unlike previous price peaks, where a high ratio (marked by orange bars) signaled heavy selling, current levels show no such urgency, reinforcing a more stable market environment.

High profitability and reduced exchange inflows indicate diminished selling pressure from holders, enabling an improved holder’s mindset between $75,000 and $95,000. This suggests that investors viewed BTC as undervalued and not as an exit opportunity, which aligned with the broader bullish sentiment.

Related: Watch these Bitcoin price levels as BTC meets ‘decision point’

BTC data hint at cooling unrealized gains under $95K

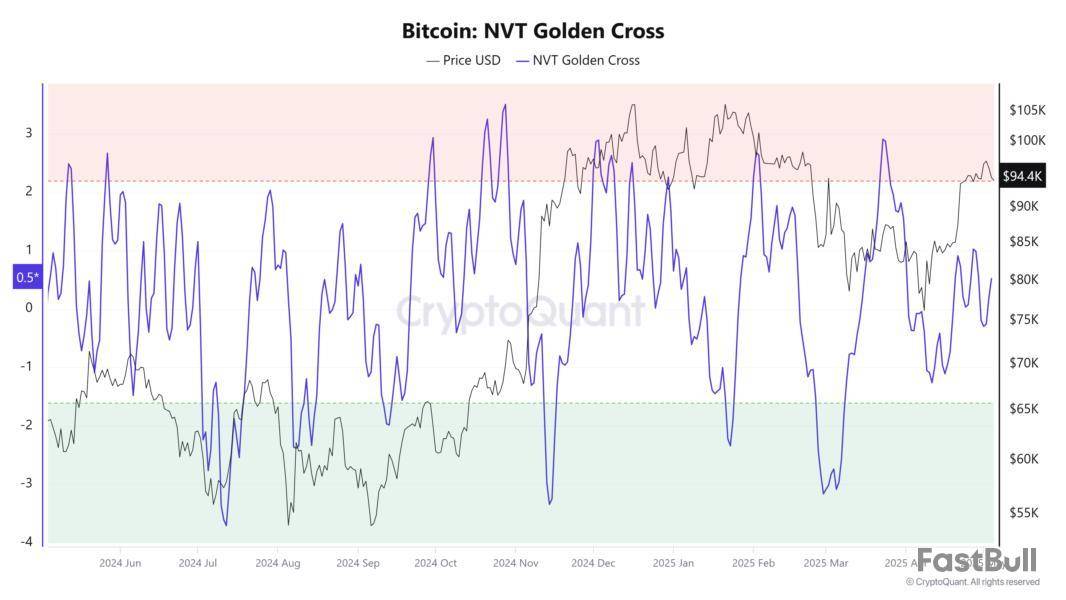

Glassnode noted that the Market Value to Realized Value (MVRV) Ratio, a key market sentiment indicator, has returned to its long-term mean of 1.74. Historically, this level has been a support zone (since January 2024) during consolidation phases, signaling a cooling of unrealized gains and a potential base for future growth.

Similarly, the Network Value to Transactions (NVT) ratio is neutral at 0.5 with Bitcoin priced at $94,400, in contrast to its overbought signal when BTC was previously at this level in February 2025.

This shift in market dynamics and evolving holder behavior indicates that the current cohort of profitable investors may be less inclined to sell at these levels. This could further strengthen the bullish case of the present market structure.

Related: BTC dominance due ‘collapse’ at 71%: 5 things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Goldfinch and Fidu are set to announce their biggest partner integration yet, making investors excited about the potential impact on price. Partnerships usually bring new resources, increased adoption, and added credibility. These can lead to higher demand and price increases. However, the true impact depends on the partner’s identity and the specifics of the collaboration. If the partner is a major player, this could be a big boost for both FIDU and GFI. Keep an eye on the announcement for more details. source

Space and Time (SXT) will be listed on Binance Alpha, a major step for any cryptocurrency because Binance is one of the largest exchanges. This listing can significantly boost SXT’s visibility and liquidity, potentially driving its price higher. Early access and promotions linked to Binance Alpha Points could further enhance demand. However, price impact will also depend on wider market conditions and early investor reactions. A listing often brings an initial price spike, so keeping watch on trading patterns could be important for traders. source

Binance@binanceMay 05, 2025Get ready! Binance Alpha will be the first platform to feature Space and Time (SXT)! Trading will open on May 8th, with the exact time to be announced.

Users who meet the Alpha Points threshold will receive their airdrop within 10 minutes after trading starts. The threshold… pic.twitter.com/x0KfLPq029

CopXToken (COPX) is getting listed on CoinUp.io, bringing it to a broader audience. Listings can drive new interest and purchases of the token due to increased accessibility and trading ease. CoinUp.io might not be as large as Binance, but it still can attract traders seeking new opportunities. If the token catches traders' interest, its price might rise. However, if demand doesn’t pick up or is overwhelmed by sellers taking profits, any price increase could be short-lived. Traders should monitor trading volumes and market sentiment post-listing. source

COPX.AI@Copx_AIMay 03, 2025https://t.co/XcKbik3XhQ (CopXToKen)

Global Debut is Here

Official Launch on May 15, 2025

Simultaneously listed on https://t.co/ku0HZNGwqk @CoinUpOfficials and https://t.co/nHUqHQ6AD2 @XTexchange — two major exchanges!

Empowered by AI. Shaping the future, winning the now!… pic.twitter.com/juzX75rYJU

House Republicans unveiled a discussion draft of a bill to regulate the digital asset industry, expanding on work done over the years.

Top Republicans on the House Financial Services Committee — Reps. French Hill and Bryan Steil — along with their counterparts on the House Agriculture Committee — Reps. Glenn "GT" Thompson and Dusty Johnson released the draft on Monday.

"We made historic progress in the 118th Congress to build bipartisan, bicameral consensus in crafting a functional regulatory framework for digital assets," Hill said in a statement. "Our discussion draft builds upon that work and provides much-needed regulatory clarity for the digital asset ecosystem by protecting consumers and safeguarding the long-term integrity of digital asset markets in the United States."

The Block earlier reported that lawmakers planned to release the discussion draft ahead of a hearing on Tuesday titled “American Innovation and the Future of Digital Assets: A Blueprint for the 21st Century." The draft was expected to resemble last year’s Financial Innovation and Technology for the 21st Century Act (FIT21), which passed the House.

FIT21 set out to clarify when a digital asset would be regulated by the Securities and Exchange Commission, the Commodity Futures Trading Commission, or both. It would have ultimately granted more power and funding to the CFTC to oversee crypto spot markets and "digital commodities," particularly bitcoin, and set parameters for the U.S. Securities and Exchange Commission.

The discussion draft released on Monday includes language around the SEC and CFTC's authority while also looking to create a "pathway to raise funds under the SEC’s jurisdiction" and "clear process to register with the CFTC for digital commodity trading," according to a one-pager.

The discussion draft also includes requirements around disclosures and lays out how "digital commodity exchanges" would be registered.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Mackenzie Tatananni

MicroStrategy snapped up even more Bitcoin and exhausted its 2024 at-the-market common stock offering.

The company, which does business as Strategy, bought 1,895 Bitcoins for a total purchase price of $180.3 million, or around $95,167 per Bitcoin, from April 28 through May 4. Strategy disclosed the transactions in a form filed with the Securities and Exchange Commission on Monday.

The latest purchase brought the company's total holdings to 555,450 Bitcoins purchased for a total of $38.08 billion, or around $68,550 each.

The world's largest corporate holder of Bitcoin also noted the completion of its common equity at-the-market offering, an initial $21 billion program established in October 2024.

Strategy sells equity, debt, and preferred stock to fund Bitcoin purchases and is planning more sales through a new $21 billion 2025 ATM offering of common shares.

Strategy unveiled its "42/42 Plan" last week, saying it aims to secure a total of $84 billion of capital over the next two years to support its Bitcoin treasury operations.

The announcement came just six months after Strategy introduced a so-called 21/21 Plan with the goal of raising $21 billion through equity offerings and another $21 through fixed-income securities.

The latest $42 billion increase leaves $56.7 billion to raise by December 2027. TD Cowen analysts said Monday that they expect Strategy to "move expeditiously" in the coming weeks. "We expect usage will commence in the near term," the analysts wrote.

They noted that issuance on the company's other at-the-market offering, its STRK convertible preferred equity ATM, accelerated over the past week to $51.8 million, representing "a new high-water mark for the company."

Shares of the software company tumbled 4% to $378.58 on Monday. The S&P 500 and tech-heavy Nasdaq Composite were down 0.4% and 0.6%, respectively.

Also falling was the price of Bitcoin, which was down 1.6% over the past 24 hours to $94,068, according to CoinDesk data.

Write to Mackenzie Tatananni at mackenzie.tatananni@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

Take a closer look at the weekend's top three news stories with U.Today.

Cardano's surprising "problem" highlighted by top exec: What is it?

In a recent X thread, Tim Harrison, Input Output EVP Community & Ecosystem, shared his personal thoughts on Cardano's so-called "marketing problem." As clarified by the executive, this problem lies in the project's inability to effectively communicate its value to the wider audience despite having built a solid foundation. "We’ve built something real here, something principled. But if no one knows what we’ve built or why it matters, we’ve got a problem," Harrison wrote. He believes that Cardano does not need what is usually understood by "marketing" in crypto, i.e., hype, or the promises of massive price gains; however, it does require amplification, as "even great builders need visibility." Harrison also believes in the "Growth First, Marketing Second" approach, citing a statement from a DRep Forum, according to which the goal is growth, not marketing. Among other ideas, the exec highlighted a need for a smarter strategy, simplification of the project's message, empowering the community and more.

Coinbase names five cryptocurrencies to be delisted: Details

On Friday, May 2, Coinbase's X account, Coinbase Assets, addressed its followers with a delisting announcement. Following the exchange's recent review, it was decided that five cryptocurrencies will be removed from the platform. Starting from May 16, 2025, on or around 2:00 p.m. ET, Coinbase will suspend trading for Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN) and PARSIQ (PRQ). As explained by Coinbase, the tokens are being delisted because of the release of their new versions. As a result, the original versions of these tokens no longer meet the exchange's listing criteria. Consequently, trading for the tokens GAL, LIT, DAR, ORN and PRQ will be suspended on Coinbase (Simple and Advanced Trade), Coinbase exchange and Coinbase Prime. Ahead of the delisting action, the order books for these tokens have been switched to limit-only mode, allowing users to place and cancel limit orders, and matches may occur.

1,000,000,000 XRP unlocked by Ripple as it sets new rules

As reported by Whale Alert blockchain tracker, on Saturday, May 3, three massive XRP transactions took place, carrying one billion XRP cumulatively. The three transfers moved 200 million XRP, 300 million XRP and 500 million XRP, with the largest transaction initiated by Ripple itself. However, according to XRPscan, the other two XRP lumps were released from escrow by the same entity. Meanwhile, Ripple has changed its approach to releasing XRP. Unlike previous months, where Ripple released one billion XRP on the first day, this time the release occurred on the third day of the month. Additionally, Ripple now locks 700 million XRP in escrow before releasing one billion XRP, not after, as before. With the help of releasing these large amounts of XRP every month, Ripple aims to maintain liquidity on the market while using part of the proceeds for operational expenses and supporting its Ripple Payments network.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up