Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin falls as investors shun risky assets amid U.S.-China trade tensions and ahead of a speech from Federal Reserve Chair Jerome Powell. The U.S. and China will start charging new port fees on each other's ships Tuesday in the wake of President Trump's fresh tariff threats against China. Powell will speak at the National Association for Business Economics meeting at 1620 GMT. Markets will be monitoring any hints on the pace of future interest-rate cuts. Recent sharp falls in cryptocurrencies highlight the "rapid unwinding of risk in a market still dominated by automatic margin calls and fragmented liquidity," Tickmill Group's Patrick Munnelly says in a note. Bitcoin falls 3.4% to $111,883, LSEG data show. (renae.dyer@wsj.com)

According to analyst Eric Balchunas, Crypto ETFs are on track to surpass $1 trillion in assets this week, fueled by $30 billion in weekly ETF inflows.

October 2025 has already seen record ETF inflows of $180 billion, a monthly figure that would break historical records if measured on a calendar basis.

Analysts note that these inflows signal more than just money movement; they reflect a major shift in investor behavior toward passive investment strategies.

Eric Balchunas@EricBalchunasOct 13, 2025ETFs are going to hit $1T by the end of the week prob given their $30b a week pace lately, and virtual lock to break last year's $1.1T haul. Also check out the $180b in 1M.. if it were calendar month would be all-time record. Just a torrent of cash. pic.twitter.com/kBRQTLTRsv

Record ETF Inflows October 2025 Show Shift from Active Management to Algorithm-Driven ETFs

Shanaka Anslem Perera explains that the surge in ETF inflows highlights a migration from actively managed funds to passive investment vehicles like ETFs. Both retail and institutional investors are increasingly delegating decisions to algorithm-driven ETFs, creating a feedback loop where inflows push prices higher, attracting even more capital.

Perera calls this the “autopilotification of financial markets”, where ETFs absorb routine volatility and price discovery is increasingly determined by automated algorithms. The $180 billion ETF inflows in October 2025 exemplify how passive funds are shaping market dynamics rather than merely reflecting them.

BlackRock Bitcoin ETF Redemptions Highlight Routine ETF Mechanics Amid Algorithm-Driven Market Flows

The trend was recently tested when viral posts claimed BlackRock’s iShares Bitcoin Trust (IBIT) sold 8,670 BTC (~$1 billion) before Fed Chair Powell’s speech. Coby Vu from FVM Research clarified that these were standard ETF redemption operations, not discretionary sales.

IBIT still holds over 800,000 BTC (~$98 billion), with net inflows of $970 million last week. Analysts emphasize that these movements reflect normal ETF operations, balancing ETF premiums with spot market prices. Misreading these flows as a “dump” highlights the challenge of analyzing markets increasingly dominated by passive ETF instruments and algorithm-driven trading.

Why Investors Must Track ETF Flows to Navigate the Algorithm-Driven Market

The record ETF inflows and resilient fund structures indicate a market that is both stable and increasingly dominated by algorithm-driven ETFs. Passive investment strategies now play a central role in market liquidity and price discovery.

Analysts warn that retail investors must understand ETF mechanics, as viral wallet screenshots can easily mislead sentiment. With more capital moving into passive ETFs and algorithm-driven investment vehicles, these funds are becoming a dominant force in financial markets, creating a self-reinforcing cycle that amplifies gains, stabilizes liquidity, and transforms price formation.

Coby Vu | FVM Research@Cobyvu8820Oct 14, 2025🔥 BlackRock’s “Sell-Off” Myth: Wallet Whispers vs. ETF Reality

October 14, 2025 — Crypto X erupted over the weekend with claims that BlackRock’s iShares Bitcoin Trust (IBIT) “dumped” 8,670 BTC (~$1 B) ahead of Fed Chair Powell’s speech. Screenshots of 10+ outgoing transactions… pic.twitter.com/9P2L6BNaqj

In today’s algorithm-driven investment market, tracking ETF inflows is essential to understanding overall market behavior and passive fund dominance.

FAQs

What are ETF inflows and why are they important?ETF inflows are new money entering Exchange-Traded Funds. High inflows signal strong investor demand and can drive market prices, making them a key indicator of market sentiment and trends.

What does the shift to passive investing mean for markets?It means markets are becoming more driven by automated, algorithmic fund flows. This can increase stability and liquidity but also amplifies trends, making ETF flow data crucial for analysis.

Why should I track ETF flow data?Tracking ETF flows helps you understand where capital is moving. In today’s algorithm-influenced market, these flows are a primary force behind price movements and overall market direction.

With the BNB coin price claiming fresh all-time highs, it’s clear that the Binance Chain ecosystem is alive with potential and volatility. Traders and investors are casting a wider net, seeking the next breakout candidates among BNB’s native tokens.

That being said, 3 standouts, namely PancakeSwap, Aster, and FOUR.meme showcase how market catalysts, technical breakout patterns, and ecosystem moves are shaping price action. As I survey recent developments, these projects could be primed for significant surges in the days ahead.

PancakeSwap Price Analysis

PancakeSwap has been riding a wave of renewed optimism after the BNB Chain’s $45 million Relief Airdrop. In just one day, CAKE price rallied 3.27% to $1.05, recovering from a multi-week slump and reversing a -10.37% 7-day decline. Supporting the momentum is a noticeable rebound off the 200-day EMA at $2.56. Further punctuated by a breakout above a 3-month descending trendline, suggests sellers are capitulating.

Supply reduction is also working in the bulls’ favor, with 28.8 million CAKE burned in September. Technical indicators paint a mixed picture, the 7-day RSI sits at a neutral 56.78, and the MACD line has seen a bearish crossover, yet is narrowing. The critical battleground is the $3.54 pivot, if CAKE can close above this mark, technical traders may set sights on $3.91.

Aster Price Analysis

Aster’s price journey over the past week has been turbulent, dropping 4.62% in a day and 31.64% across 7 days, with a price now near $1.40. Nevertheless, the market cap has swelled to $2.82 billion. The primary headwinds are airdrop delays and unlock preparation.

Compounding those concerns, DeFiLlama delisted ASTER in early October due to suspected wash trading. While the RSI doesn’t show extreme overselling, all eyes are on the $1.47 pivot. If ASTER loses this level, a swift move to retest $1.25 is possible.

FOUR.meme Price Analysis

The recent 3.27% price jump in FOUR, following a week of -10.37% losses, highlights the token’s agility as GameFi projects surge across Binance Chain. A sector-wide gain of 5.75% has lifted FORM by 8%. Technically, FOUR’s RSI has climbed out of oversold territory. While the MACD histogram jumping positive to +0.056 signals a bullish divergence after a steep -72% drop over the past 60 days.

For short-term players, the $1.05 pivot support is crucial, but with resistance at the 7-day SMA ($1.09) and lackluster volume, caution is warranted. Despite a dominant -55% 30-day trend, the dynamics suggest that nimble traders may spot low-risk entry points for sharp upside swings.

FAQs

Why are BNB Chain tokens showing such price swings lately?BNB Chain’s record highs have pushed the entire ecosystem, spurring airdrops, technical breakouts, and supply shifts that create opportunities for select tokens.

Is it safe to buy CAKE, ASTER, or FOUR right now?CAKE offers technical breakout potential, but the MACD urges caution. ASTER faces dilution fears and listing drama, while FOUR sees a bullish divergence but is fighting volume. Short-term traders should watch key pivot levels for all three.

What’s the biggest risk to these Binance Chain tokens?The top risks are airdrop-related volatility, potential delistings, and weak trading volume.

House of Doge, the trading arm of the Dogecoin Foundation, has announced a significant merger agreement with Brag House Holdings (TBH), a platform focused on engaging Gen Z at the crossroads of gaming, to list on the Nasdaq.

This reverse takeover transaction will see Brag House acquire House of Doge, a move that has received unanimous approval from both companies’ Boards of Directors, also expected to propel Dogecoin’s mainstream adoption.

House Of Doge Shares Now Available

With this latest move announced on Monday, Dogecoin is now accessible not only to institutional investors but also to retail investors, allowing them to engage in Dogecoin’s projects and future developments.

Individuals now have the opportunity to become shareholders in House of Doge, granting them a stake in the organization’s operations and decision-making processes.

In the press release, both entities asserted that the establishment of a 20-year partnership between House of Doge and the Dogecoin Foundation ensures the financial backing necessary for continued development of Dogecoin for years to come.

Notably, this comes on the heels of DogeOS smart contract Layer 2, and the impending launch of the Dogecoin Fractal side-chain for the tokenization of real-world assets (RWAs), further enhancing Dogecoin’s development and utility. Marco Margiotta, CEO of House of Doge, stated:

Since launching House of Doge, we’ve built momentum across every layer of the Dogecoin ecosystem, from establishing the Official Dogecoin Treasury with ZONE to forming alliances with Robinhood for developing new yield-bearing products, as well as our exclusive ETP/ETF partnership with 21Shares. Now, we’re bringing what we’ve built to the public markets.

Expert Unveils 4 Bullish Targets For DOGE

Earlier this year, House of Doge collaborated with 21Shares, alongside the Dogecoin Foundation to launch Europe’s first Dogecoin ETP. The product’s performance has led to an expanded partnership with 21Shares, including the filing for a US Dogecoin Spot ETF and a Dogecoin 2X Levered ETF, both currently under review.

In parallel, House of Doge established the Official Dogecoin Treasury in partnership with CleanCore Solutions (NYSE: ZONE), which was founded on September 5, 2025. This Treasury currently holds over 730 million Dogecoin, serving as a foundational element of House of Doge’s financial infrastructure.

Following this announcement, the price of DOGE reacted positively, experiencing nearly a 3% surge over the past 24 hours, moving toward $0.21.

Market expert Jonathan Carter noted on the social media platform X (formerly Twitter) that new bullish targets for Dogecoin have emerged following Friday’s market downturn.

He indicated that the memecoin has successfully tested the symmetrical triangle support on its daily chart, signaling a potential rebound. According to Carter’s analysis, consolidation combined with divergence signals suggests a setup for a bounce, with price targets set at $0.25, $0.31, $0.37, and $0.47.

Featured image from DALL-E, chart from TradingView.com

France's financial regulator approved operating rules for what will become the country's first stock exchange built entirely on blockchain technology, clearing the path for small and mid-sized companies to list tokenized shares for direct retail investor trading.

France Clears First Tokenized Stock Exchange for SME Trading

The Autorité des Marchés Financiers (AMF) signed off on LISE SA's 72-page rulebook on October 13. The approval allows LISE to operate as both a multilateral trading facility and settlement system using distributed ledger technology once it receives final authorization from French banking regulators.

LISE will function under the European Union's Pilot Regime, an experimental regulatory sandbox launched in 2022 that lets market operators test blockchain-based trading infrastructure with certain exemptions from traditional securities rules. The platform targets French companies valued below €500 million offering them an alternative to conventional exchanges like Euronext.

"The Pilot Regime is an experimental regulation that allows the creation of market infrastructures on which individual investors can trade directly," the document states.

Traditional stock exchanges are late to join the tokenized stocks trend, which has been gaining momentum since 2024. Until now, the market has been dominated by cryptocurrency and CFD platforms, but the industry, projected to be worth $2 trillion within five years, is starting to attract interest from old-school bourses as well. Among the recent entrants is Boerse Stuttgart, while New Zealand’s exchange is also considering a similar move.

Trading Without Traditional Intermediaries

The platform breaks from standard market structure by letting individual investors trade tokenized stocks (Titres Tokénisés) directly without going through brokerage accounts. Each user receives a digital wallet that records share ownership on the blockchain, cutting out the custody and settlement layers that typically sit between investors and their holdings.

LISE's rules require that retail participants pass a knowledge test covering blockchain technology and associated risks before gaining trading access.

The platform will only accept French joint-stock companies and limited partnerships by shares. At least half of all listed issuers must qualify as small or medium enterprises (or SMEs) with market capitalizations under €200 million. Total value of all tokenized securities admitted to the platform cannot exceed €6 billion, a cap set by the EU's experimental framework.

One of the biggest advocates of tokenized shares at the moment is Robinhood, whose CEO, Vlad Tenev, calls this form of trading the future.

Settlement Happens in Real Time

LISE combines trading and settlement functions on a single infrastructure, collapsing the typical two-day gap between trade execution and final ownership transfer. The system operates continuously, processing transactions and recording ownership changes on the blockchain within seconds of order matching.

Companies listing on LISE must convert all outstanding shares into tokenized form recorded on the platform's distributed ledger. Shareholders wanting to hold shares in traditional registered form would need to remove them from the blockchain system, though LISE can maintain a separate registry for those holdings under a mandate from the issuer.

Companies going public on LISE can raise capital through either public offerings or private placements exempt from prospectus requirements. The platform will handle subscriptions for new share issuances while simultaneously running secondary market trading for already-listed securities.

Regulatory Limits on Experimental Platform

France's implementation of the EU Pilot Regime restricts who can access DLT-based markets and what can trade on them. LISE's rules prohibit high-frequency algorithmic trading and ban participants from offering direct electronic access to third parties.

The platform operates under a three-year experimental window that can extend to six years, after which it must either transition to standard regulatory treatment or shut down. Companies going public on LISE can raise capital through either public offerings or private placements exempt from prospectus requirements.

The rapid rise in the popularity of tokenized stocks over the past several months has prompted regulators worldwide to respond. For example, the U.S. SEC has shown a supportive approach, with Commissioner Hester Peirce stating that she is ready to engage in dialogue with the industry. China, on the other hand, aims to curb asset tokenization, according to Reuters, while ESMA has suggested that transferring shares onto the blockchain could mislead investors.

The final authorization allowing LISE to begin operations has not yet been granted. The rules approved October 13 will take effect once that clearance comes through.

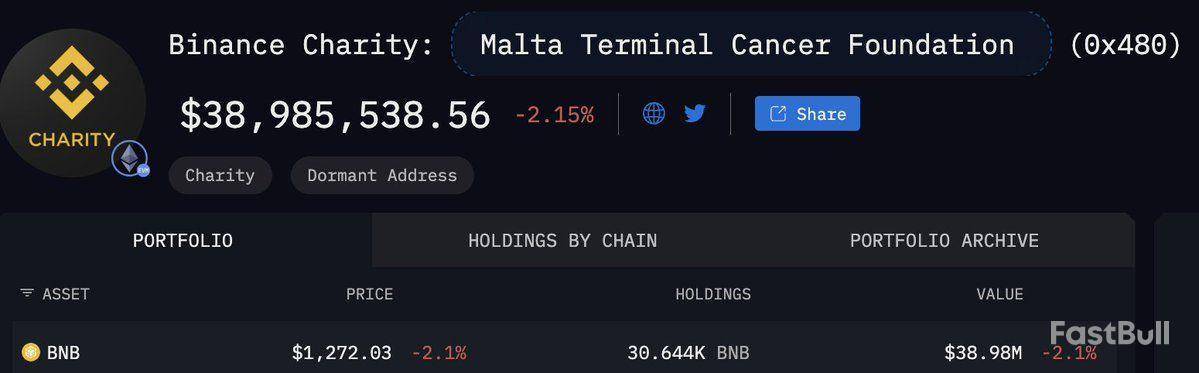

A crypto donation, originally worth $200,000 in 2018, has grown to an astonishing $39 million, yet the BNB remains untouched in a wallet for Malta’s terminal cancer fund.

The sharp increase in BNB’s value has turned the gift into a transformative sum, but what is its status since its transfer six years ago?

A $200,000 Crypto Donation Becomes a Fortune

In 2018, Binance and its users contributed about $200,000 worth of BNB to a wallet for Malta’s terminal cancer fund. Since then, BNB’s value has soared. The wallet balance now approaches $39 million, according to on-chain data cited by blockchain analysts.

Blockchain records confirm that 30,644 BNB remain untouched in the wallet. Despite attention from the crypto community, including messages to Maltese authorities, the funds have stayed dormant and unused for the intended medical cause.

While the growth in value is striking, the funds’ inactivity stands out. The transparency afforded by blockchain technology means the situation is visible to all. Yet, unclear procedures for access or claims can leave charitable gifts untouched.

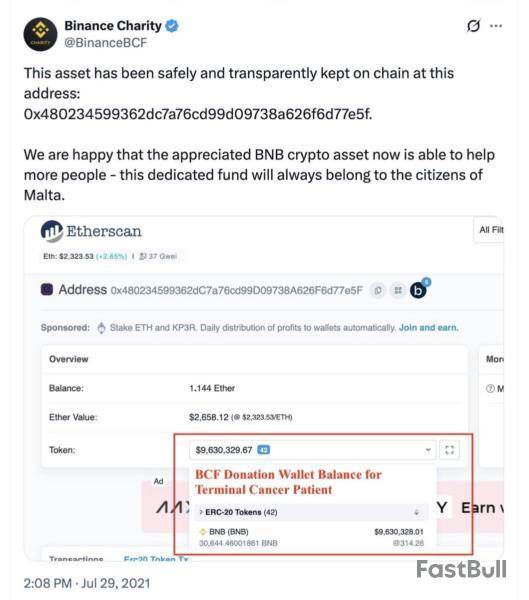

Access Confirmed, Lawsuit Dropped — But the Money Remains Idle

There was speculation that access to the funds might be lost. However, records and social media updates confirm that the donation remains in the original wallet. In 2021, a lawsuit regarding Binance’s responsibility was dropped. This confirmed that the BNB is accessible and still untapped.

This confirmation prompts a key question: Why has the fund not been used for medical needs? Regulatory caution, administrative hurdles, or lack of awareness may contribute.

But as the value grows, so does public scrutiny. Each year, the fund’s purchasing power in healthcare increases.

Potential Impact: Medical Specialists and National Healthcare

Meanwhile, Malta continues to face a critical shortage of palliative care specialists, with just two serving the country, well short of the 12 needed.

Coinbase executive Conor Grogan suggests that selling the BNB and using the proceeds could bridge this gap by funding medical staff and improving care for terminal cancer patients nationwide.

Binance co-founder and customer service manager Yi He agrees, supporting Conor’s proposition that the funds could be put toward the noble cause.

As cryptocurrency donations become more widespread, this case shows both their tremendous promise and how bureaucratic delays can prevent much-needed benefits from reaching those in urgent need.

U.S. spot bitcoin and ether exchange traded funds saw a combined net outflow of $755 million on the first day after the historic crypto liquidations event over the weekend.

According to SoSoValue data, spot bitcoin ETFs recorded $326.5 million in negative flows yesterday.

Grayscale's GBTC had $145.4 million worth of outflows and Bitwise's BITB had $115.64 million in outflows. While funds from Fidelity, Ark & 21Shares and VanEck also recorded outflows, BlackRock's IBIT reported a positive flow of $60.36 million.

Spot Ethereum ETFs saw a heavier $428.5 million net outflow, with funds moving out from seven ether ETFs with no inflows on the day. BlackRock's ETHA saw $310 million net outflows, which marks its second worst performance since debut.

"Monday’s outflows reflect post-liquidation caution," said Vincent Liu, CIO at Kronos Research. "Investors are pausing, clearly waiting for clearer macro signals before putting more capital to work. Sentiment is driving activity more than fundamentals now."

Crypto saw one of its largest liquidation events in history last weekend, wiping out over $500 billion from the market that pushed down entire crypto prices by 10%. This was triggered by U.S. President Donald Trump's confirmation that he would impose a 100% tariff on Chinese imports.

Despite the major decline, market prices quickly recovered as Trump softened his tone on the trade conflict. The Kronos Research analyst predicted that ETF flows will see a "measured return" as traders seek clearer macro signals.

"The outflows appear to reflect short-term institutional risk management rather than a structural shift in sentiment," Min Jung, Research Associate at Presto Research, also told The Block. "Looking ahead, ETF flows should begin to stabilize as markets absorb the weekend’s volatility and broader macro uncertainty."

Jung added that the market will remain sensitive to U.S.-China trade headlines, which may continue to drive short-term volatility across crypto and other risk assets.

Earlier on Tuesday, China reportedly said that it is ready to "fight to the end" in the trade war with the U.S., suggesting that tension between the two largest economies in the world will persist in the near term.

Crypto prices have already reacted negatively to the news, with bitcoin falling 2.54% to $112,283 while ether dropped 3.39% to $4,030, according to The Block's crypto price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up