Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

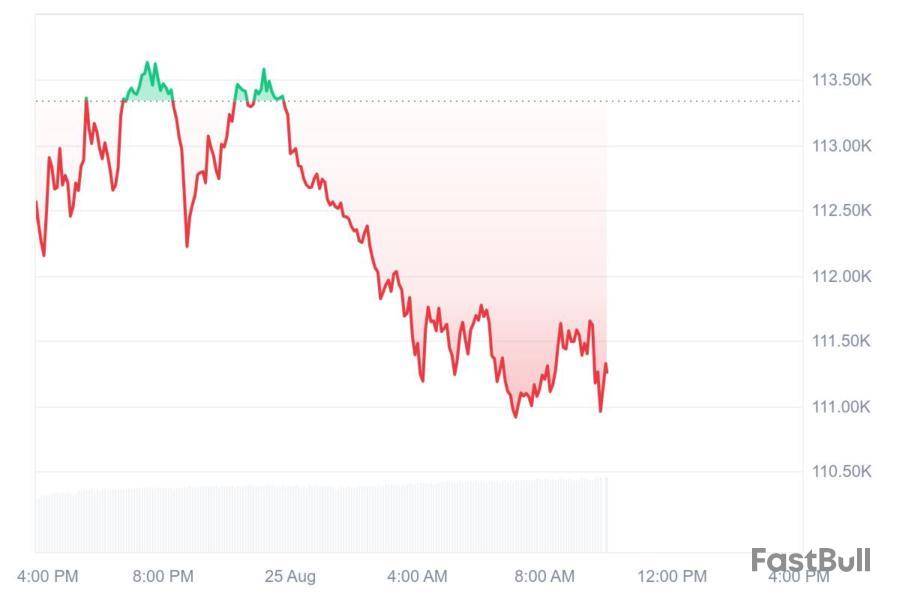

After weeks of price swings, Bitcoin buyers are showing fresh strength. In the past few hours, key on-chain signals have turned positive as Bitcoin found support around $110K. This has pushed buying activity higher, increasing the chance of new weekly highs. On top of that, rising interest from institutional investors is adding even more stability to Bitcoin’s support levels.

Bitcoin’s Open Interest Turns Positive

Bitcoin’s buying demand is rising as recent dip-buying has built strong support levels. This has turned several on-chain indicators positive. Data from Coinglass shows that in the past 24 hours, Bitcoin saw over $280 million in liquidations, with buyers accounting for around $264 million of those positions being closed.

According to on-chain data from CryptoQuant, there are still signs that Bitcoin bulls can stay hopeful about a rebound. The platform noted that large-scale selling, or distribution, hasn’t fully taken over the market yet.

After hitting an all-time high of $124K, Bitcoin is now in a pullback phase that could last a bit longer. Interestingly, while big whales are holding back, smaller holders with up to 10 BTC are still steadily accumulating.

Some traders see little reason to expect Bitcoin’s bull market to fully return. Those with a cautious outlook on future price movements have only grown more certain after BTC/USD dropped to its lowest level since early July.

Also read: Why Bitcoin, ETH, and XRP Price Are Down Today

Bitcoin’s open interest has climbed in recent days. According to Coinglass, it rose by 0.97% to $85.5 billion. This increase signals higher trading activity and growing volatility, which could open the door for Bitcoin to break above nearby resistance levels.

Last week, Fed Chair Jerome Powell unexpectedly shifted from his earlier hawkish tone, boosting hopes for a potential rate cut. Risk assets like Bitcoin jumped right away, but since then, the excitement has faded as investors wait for more inflation data ahead of the mid-September rate decision.

What’s Next for Bitcoin Price?

Bitcoin dropped below the EMA trend lines recently as buyers failed to meet demand around resistance channels. However, Bitcoin has built a strong support around the $110K level. As of writing, BTC price trades at $112,434, declining over 1.65% in the last 24 hours.

Buyers are expected to defend the zone between $110,000 and $112,000. If the price bounces from this support, BTC/USDT could easily rise toward the 20-day EMA ($113,500) on the 4-hour chart. A daily close above this level would suggest Bitcoin might trade sideways between $110,000 and $118,000 for a while.

On the other hand, if Bitcoin fails to break above the 20-day EMA and instead falls below $110K, it would show sellers are in control. In that case, the price could drop quickly to $105,000 and possibly even to the key psychological level of $100,000.

Currently, the RSI is trying to recover above the midline as it trades at level 42. If buyers face any further resistance, we might see a steep decline on the chart.

While the crypto market was shaky this past week, the coming week could improve, provided the macro financial market conditions shift to bullish. This could push some crucial altcoins on the path to a new ATH.

BeInCrypto has analysed three altcoins that could potentially reach a new all-time high in the coming days.

BNB

BNB is currently trading at $854, just below the $855 support level. The altcoin has declined from its all-time high (ATH) of $900, currently standing 5.4% below that peak. Despite the pullback, there is potential for a recovery if certain support levels hold firm.

For BNB to regain its momentum and possibly reach its ATH, the key support level at $855 must hold. If BNB holders choose not to sell, the price could secure this floor and start pushing higher. This would provide a solid base for the altcoin to target the $900 range once again.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, if investors decide to sell and take profits, BNB risks slipping through its current support at $823. A drop below this level would likely invalidate the bullish thesis, leading to further downside potential and a shift toward more bearish market sentiment for BNB.

XRP

XRP is currently priced at $2.94, just below the critical support of $2.95. The past week has been volatile, with XRP failing to breach the $3.07 resistance, leading to a price decline. This setback has left the altcoin struggling to gain upward momentum amidst broader market turbulence.

The recent drop has pushed XRP below the 50-day EMA, indicating potential short-term weakness. This bearish trend suggests that XRP could face further declines, possibly falling to the $2.74 support level. Traders are cautious, watching for signs of stabilization before considering potential recovery opportunities for the token.

However, if XRP can successfully secure the $2.95 support level, a bullish reversal could be in play. A sustained hold above this zone may enable XRP to break through $3.07, aiming for a rise above $3.12. This is necessary for XRP to eventually post a 24.49% rise towards the ATH of $3.66.

BUILDon (B)

BUILDON is currently trading at $0.560, approximately 20.4% below its all-time high (ATH) of $0.675. The altcoin is facing resistance at $0.574, but it has managed to stay afloat despite recent declines. Investors are closely watching for signs of a potential breakout or further consolidation.

Despite the recent drop, BUILDON has managed to hold above the $0.514 support and the 50-day EMA, indicating that the short-term outlook isn’t overly negative. With favorable market conditions, if BUILDON flips the $0.574 resistance into support, it could surge towards $0.646, potentially reaching the $0.675 ATH again.

However, if selling pressure increases, BUILDON could struggle to maintain suApport at $0.514. A failure to hold this level may lead to further declines, possibly reaching $0.478. Such a move would invalidate the current bullish outlook, signaling a bearish shift in market sentiment.

The U.S. Securities and Exchange Commission is seeking public input on whether to approve a staked Injective (INJ) exchange-traded fund, setting the stage for its next steps on the proposal.

The securities watchdog asked for comments on the proposed Canary Staked INJ ETF to be filed within the next 21 days, according to a filing on Monday. The agency has up to 90 days to decide on the next steps.

Canary filed its proposal for the staked INJ fund last month, which if approved by the SEC, would track the native asset of the Injective blockchain. If it's allowed to list and trade, the ETF would trade on the Cboe BZX Exchange.

In an Aug. 11 filing, the exchange said that INJ's growth to a market cap of more than $1.4 billion reduces the "susceptibility to manipulation."

"The geographically diverse and continuous nature of INJ trading makes it difficult and prohibitively costly to manipulate the price of INJ and, in many instances, the INJ market can be less susceptible to manipulation than the equity, fixed income, and commodity futures markets," the exchange said.

Amid a friendlier regulatory environment during President Donald Trump's second administration, several firms have proposed a slew of crypto ETFs tracking assets from Dogecoin to Solana. More recently firms have been vying for crypto ETFs that involve staking.

Last week, VanEck filed a registration statement proposing a JitoSOL ETF aimed at tracking the price of the liquid staking token. The Jito Foundation said the fund would be "the first spot Solana ETF 100% backed by a liquid staking token (LST): the Jito Network’s JitoSOL," in an earlier statement.

REX-Osprey's Solana staking ETF has also integrated staking rewards through a partnership with JitoSOL, according to an announcement made in July.

In recent months, the SEC has set out to clarify its stance on staking. In May, the agency said that most proof-of-stake features do not fall under its remit, and later clarified that certain liquid staking activities do not involve securities.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

By Dean Seal

Shares of DDC Enterprise jumped after the company said it just made its fourth bitcoin purchase of August, picking up 200 more coins.

The stock was up 8.9% at $13.88 in midday trading. Shares have more than tripled since the start of the year.

The bitcoin-treasury company said the latest acquisition brings its total holdings up to 888 bitcoin, which is more than double the 368 it had at the beginning of the month.

"Doubling our BTC holdings in a matter of weeks despite Bitcoin market volatility demonstrates our commitment to being a leading Bitcoin treasury company," Chief Executive Norma Chu said.

Write to Dean Seal at dean.seal@wsj.com

Ether treasury company ETHZilla, which recently pivoted from its biotechnology roots to cryptocurrency, has approved a $250 million share repurchase program — signaling that some firms may increasingly tap digital-asset gains as a source of liquidity.

ETHZilla’s board of directors authorized the buyback of up to $250 million worth of its outstanding common shares, the company disclosed Monday. The company currently has 165.4 million shares outstanding.

The move comes less than a month after the firm rebranded from 180 Life Sciences and made Ether its core strategy — a pivot that helped revive its beaten-down stock.

ETHZilla has since acquired 102,237 ETH at an average price of $3,948.72, spending just over $403 million. At current market levels, those holdings are worth about $489 million. The company said its most recent ETH purchases will be staked with Electric Capital.

Management’s language around the repurchase echoed classic triggers, citing “market conditions,” “management discretion,” and “alternative uses of capital.”

ETHZilla’s new strategy comes against a backdrop of weak fundamentals. As a public company, it has struggled with limited revenues, persistent losses and shareholder dilution. Last year alone, it reported an accumulated deficit of over $141.5 million.

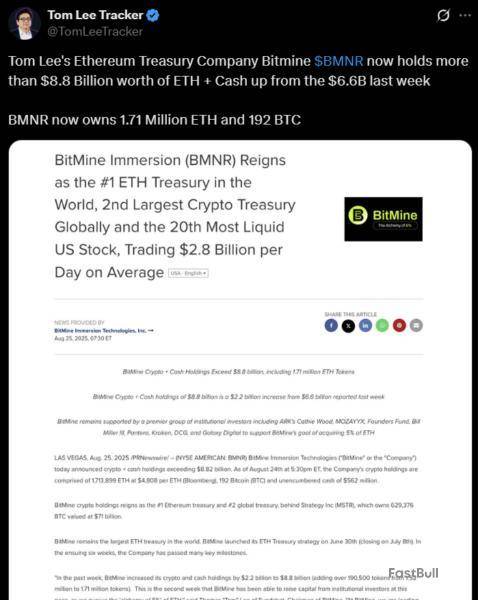

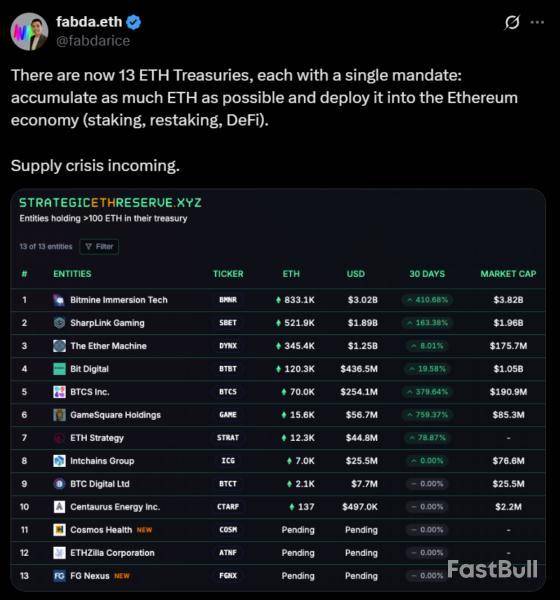

ETHZilla is not alone in embracing crypto as a balance-sheet asset. Companies both inside and outside the digital-asset sector — including BitMine Immersion Technologies, The Ether Machine, SharpLink Gaming, Bit Digital and Ether Capital Corp. — have all made strategic Ether acquisitions.

Leverage and concentration risks

Analysts see parallels between today’s “crypto treasury” plays and earlier waves of corporate gold adoption, but warn that leverage-fueled balance sheet builds remain a major risk. Companies that borrow heavily to accumulate crypto could face worsening financials if — or when — another bear market hits.

Mike Foy, chief financial officer at Amina Bank, told Cointelegraph that it’s still too early to tell whether crypto-treasury strategies are sustainable in the long run. In the meantime, he said it’s important to determine whether companies are pursuing the approach for speculative gains, signaling purposes or as part of a broader strategic plan.

“If any of these [purchases] seem strange or out of the ordinary, then this is possibly a sign that this isn’t a long-term plan but rather a short-term share price play,” Foy said.

Kadan Stadelmann, chief technology officer at Komodo Platform, drew parallels between ETH-treasury firms and spot exchange-traded funds (ETFs), noting that the former can offer benefits that ETFs cannot. “Spot ETFs cannot legally offer staking and DeFi,” he said. “Ethereum treasury firms offer higher yields.”

Still, Stadelmann cautioned that the model carries significant risks. “ETH treasury firms have risks, such as overleveraging,” he said. In a bear market, this could trigger forced liquidations, potentially creating cascading effects on Ether’s price.

Falling ETH prices could undermine debt-financed strategies at companies that acquired their holdings through loans, convertible notes or equity dilution.

Of the current digital asset treasury strategies, Ether is the most exposed, with roughly 3.4% of its total supply held by such entities, according to Anthony DeMartino, founder and CEO of Sentora Research.

The mixed price actions seen across the crypto market in the past few days have raised curiosities as to whether the 2025 bull market has been concluded.

While hopes of Bitcoin achieving a new all-time high appear to be fading, recent data from Glassnode suggests that it is still possible in 2025.

The data shows that Bitcoin is forming a critical cycle that is closely similar to previous bull cycles following its recent market movements.

Bitcoin May cross $124,457 this year

The analyst cited two bullish patterns formed by the world’s leading cryptocurrency by market capitalization in 2017 and 2021. During these periods, Bitcoin moved in similar directions, achieving separate all-time highs in two to three months earlier in the mimicked cycles.

Although it is not common that history repeats itself in crypto market trends, investors often weigh on the crucial time context they provide to help them observe the market closely. This allows investors to make predictions on potential price actions amid uncertainties as to whether the currently formed pattern will also mimic the major price breakouts projected by the former cycles.

This could also help them make decisions on necessary cautions to take to avoid possible losses.

The analysis comes at a time when the market continues to trend downward amid rising profit-taking activities and a notable increase in speculative trading, a trend observed in the cited market conditions.

Nonetheless, if history repeats, Bitcoin might achieve a new all-time high in 2025 as data provided by CoinMarketCap shows that it is only 10.55% away from hitting a new all-time high above its previous $124,457 record achieved on August 13.

Furthermore, the data shows that the asset is trading negatively today, showing a price decrease of 2.07% over the last day. Following this slow price action, Bitcoin is trading at $112,035 as of press time.

CoinMarketCap">

While Bitcoin is showing an intraday high of $114,853 in the last 24 hours, it has also fallen as low as $110,604 on the same day. The rapid decline in its price in a matter of hours points to a massive profit-taking activity from holders.

Notably, this is more evident in the massive surge of over 69% in Bitcoin’s trading volume, accompanied by a 2.1% decline in its market capitalization during the same period.

Usually, increases in an asset’s trading volume coupled with a reversed trend in its market value and capitalization are pointers to increased selling activities, which are often triggered by speculative trading (e.g., FOMO) or attempts to take profits.

Nonetheless, large investors like Strategy have shown resilience with a continuous buying spree regardless of what the market is saying.

Small-cap medical device firm Sharps Technology Inc. (ticker STSS), said on Monday its aiming to raise over $400 million to stockpile Solana. Its private placement is expected to close on Aug. 28.

The company aims to become the "largest Solana digital asset treasury," according to a statement.

"The offering consists of an over $400 million private investment in public equity transaction (PIPE) for the purchase and sale of common stock," the company said. Sharps Technology listed several participating investors including ParaFi Capital and Pantera Capital.

Sharp Technology's pivot to become a digital asset treasury (DAT) focused on Solana's native token puts it alongside firms like Upexi and DeFi Development Corp, which hold $370 million and $199 million worth for SOL, respectively, as of Monday, according to The Block Data Dashboard. The company also joins the ranks of several other small-cap Nasdaq stocks shifting to a DAT strategy.

The company's shares rose nearly 70% on Monday, according to Yahoo Finance.

Solana ecosystem

"Global adoption of Solana's ecosystem is accelerating as it continues to receive institutional support for its vision of a single global market for every tradeable asset, making now the right time to establish a digital asset treasury strategy with SOL," Sharp Technology's newly-appointed Chief Investment Officer Alice Zhang said. "We will have a team with deep ties to the Solana ecosystem and proven founder-level experience in scaling institutional digital asset platforms, which we believe will set the Company up for success."

Zhang previously co-founded Avalon Capital, which specializes in digital assets and technology. She is also the co-founder of Jambo, "the first web3 phone with a built-in decentralized app store," according to a statement.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up