Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin and crypto ETPs continue their impressive performance just a week into the new year. According to a CoinShares report filed by James Butterfill, crypto ETPs saw massive $585 million inflows in the first few days of the year. Analysts say this early strong performance of the crypto ETPs continues the impressive run of the assets from last year.

In the same CoinShares report, crypto ETPs achieved over $44 billion outflows in 2024, with Bitcoin as the most-traded digital asset. Bitcoin saw $38 billion in inflows, representing nearly 30% of all Assets in Management (AUM), while Ethereum picked up pace in the latter half of the year, with net inflows of more than $4.8 billion.

Bitcoin ETPs Lead The Pack

CoinShare’s James Butterfill shared these findings on the performance of crypto ETPs on the company’s official site and social media pages. The report explained that Bitcoin ETPs were the preferred digital investment product, cornering $38 billion of all Bitcoin AUMs of global ETPs.

James Butterfill@jbutterfillJan 06, 20252024 saw US$44bn inflows in to crypto ETPs, 2025 off to a good start with US$585m inflows so farhttps://t.co/OczGDBUdph

Ethereum ETPs ranked second, receiving roughly $4.8 billion in inflows in 2024, representing 26% of all ETH AUMs of global ETPs. The ETP’s inflows this past year are 2.4 times bigger than what was recorded in 2021 and 60 times bigger than in 2023.

Ethereum beats Solana regarding inflows in 2024, with just $69 million, representing only 4% of all assets under management. While Solana’s numbers are small relative to Bitcoin and Ethereum, it still leads all other altcoins.

Approval Of Spot ETFs Helps Increase Inflows

The industry saw record-breaking inflows in 2024, which is better than what the bull market experienced in 2021. In 2021, cryptocurrency investment products recorded more than $10 billion in net inflows. In short, last year’s inflows were 4x bigger than the recorded amount in 2021.

According to Bufferfill, the surge in global crypto investment products benefited from the US’ approval of spot ETFs for Bitcoin in January 2024. In January 2024, the US Securities and Exchange Commission approved 11 applications for spot Bitcoin ETFs, which were followed by eight spot ETFs for Ether on May 22nd.

According to recent data, these spot Bitcoin ETFs are the main reasons for the inflows in Bitcoin-related investments. Butterfill also explained that these ETFs will redefine the inflows for crypto investments in the future.Better Days Ahead For US Bitcoin Spot ETPs

Aside from CoinShares, Galaxy Digital also offered a rosy picture of the future of the crypto investments industry. In a report shared last December 31st, 2024, the company boldly predicted that the US spot ETPs market will continue to soar in 2025. The report indicated that this niche will reach $250 billion in AUMs this year.

Meanwhile, Alex Thorne of Firmwide Research said Bitcoin ETPs are closing in on US gold ETPs in total value of assets under management.

Thorne added that Bitcoin will continue to become one of the top-performing assets on its risk-adjusted basis. Other analysts shared that Ether’s spot ETPs will also surge this year. The Ethereum blockchain will benefit from a Trump presidency and favorable regulatory changes.

Featured image from OneSafe, chart from TradingView

You've certainly heard that Bitcoin (BTC) miners require a lot of energy to operate, but they also give off a lot of heat. Wall Street crypto miner Canaan (NASDAQ: CAN) decided to take advantage of this by introducing a combination of miners with… home heaters!

The same device that keeps your toes toasty could now be secretly hustling to fill your crypto wallet. Talk about a warm welcome to the future!

Heat Your Home While Mining Bitcoin

Bitcoin mining firm from Wall Street Canaan unveils dual-purpose mining heaters at CES 2025, marking a significant shift in home cryptocurrency mining technology. The company introduced two new devices - the Avalon Mini 3 and Nano 3S - that combine Bitcoin mining capabilities with practical home heating functionality.

The Avalon Mini 3 delivers 37.5Th/s hashrate while functioning as a home heating system, featuring app-controlled operation and quiet performance. Its companion product, the Avalon Nano 3S, offers 6Th/s hashrate in a portable, energy-efficient design.

Canaan Inc.@canaanioJan 08, 2025📣 Live from CES 2025! Witness history as our Chairman and CEO, Mr. NG Zhang, officially unveils the Avalon Mini 3 to the world. 🔗 https://t.co/zwFPrYXH0R

Compact, powerful, and accessible, this device is designed to revolutionize #Bitcoin mining for everyone.

✨ Step into… pic.twitter.com/U3YxjiiA6Z

"We are committed to making Bitcoin mining accessible to everyone," said NG Zhang, CEO and founder of Canaan. "The Avalon Mini 3 and Avalon 3S represent our vision of user-friendly, practical mining solutions for the modern individual. We're reimagining how technology can create value while minimizing environmental waste. The Avalon Mini 3's ability to generate cryptocurrency while heating your home is a perfect example of our vision for sustainable, multi-purpose technology."

The devices are available for preorder until February 2025, with the Nano 3S priced at $249 and the Mini 3 at $899. The flagship Avalon Mini 3 delivers 37.5 TH/s hashrate while consuming 800W of power. The unit measures 760 x 104 x 214mm without packaging and operates within a temperature range of -5 to 40°C. Operating noise levels are maintained at 55dB, and the device supports universal voltage input of 110-240V.

The entry-level Nano 3S provides 6 TH/s hashrate, representing an upgrade from its predecessor. It features a compact form factor designed for portability and individual users.

Canaan Raises $30 Million

The move comes two months after the China-based computing solutions provider entered into a securities purchase agreement to sell up to 30,000 Series A-1 Preferred Shares at $1,000 each to an institutional investor. The deal is expected to raise $30 million to support the expansion of digital mining sites and equipment in North America.

This development follows a Series A financing round completed in September 2024, during which Canaan sold up to 125,000 Series A Convertible Preferred Shares. The company has also made progress in product development, with strong demand for its Avalon A15-194T miners. Additionally, Canaan signed a follow-on purchase agreement with HIVE Digital Technologies to supply 5,000 Avalon A15 miners in the first quarter of 2025.

Bitcoin plunged below $95,000 on Wednesday after shedding almost 8% over the past day. Amidst heightened volatility, investors appear to have positioned themselves cautiously.

But prominent entrepreneur and investor Robert Kiyosaki believes the latest “crash” is great. Here’s why:Opportunity in Crisis

Kiyosaki took to X to express his optimism about Bitcoin despite its recent price decline. Best known as the author of the best-selling personal finance book Rich Dad Poor Dad, Kiyosaki referred to the cryptocurrency’s downturn as “great news,” describing it as an opportunity to purchase it at a lower price and portraying it as being “on sale.”

He reiterated his belief in the investment strategy of “buying low and holding” long-term. Highlighting Bitcoin’s limited supply, Kiyosaki noted that fewer than two million BTC remain to be mined.

Kiyosaki has been a vocal proponent of Bitcoin and frequently advises investors to consider it an effective inflation hedge. In a recent New Year forecast, the financial guru predicted that Bitcoin could soar to $175,000-$350,000 by 2025. This optimistic outlook isn’t out of place, as it closely matches the rangeforecastedby several other financial experts.

Bernstein analysts, for one, set a price target of $200,000 for Bitcoin by late 2025, restating a previousstatement. Their projection is part of a larger perspective on the crypto industry, which they believe is transitioning into an “Infinity Age” defined by mainstream acceptance and integration with the global financial system.“Temporary Pause”

Weighing on the latest price action, QCP Capital stated that Bitcoin has retreated towards the $95,000 support level following unexpectedly strong US labor market data. The JOLTS job openings report revealed 8.1 million vacancies, which exceeded the forecast of 7.74 million.

This labor market resilience triggered risk-off sentiment, which, in turn, drove a sell-off in risky assets as long-term bond yields surged. The sharp decline in Bitcoin’s price led to liquidations totaling $206 million in just one hour.

The ripple effects of the sell-off extended to equities, with the Nasdaq and S&P 500 reflecting broader market weakness, trading near 21,200 and 5,900, respectively. Meanwhile, Bitcoin ETF inflows have dwindled by 94%, falling to $52.9 million from a previous $987 million.

As markets await the Federal Open Market Committee (FOMC) and Non-Farm Payroll (NFP) reports later this week, these developments are expected to shape Bitcoin’s next moves. Despite the pullback, QCP Capital added that it anticipates this dip to be a temporary pause, with optimism building for a bullish rally ahead.

Ethereum Layer 2 project Starknet now enables developers to launch appchains using its software offering, SN Stack, marking a move towards increased modularity within its ecosystem. Appchains are independent blockchains tailored to specific applications.

Starknet noted that its appchain stack incorporates essential components like Starknet OS for blockchain operations, CairoVM for smart contract execution, Blockifier for block construction, and cryptographic provers and verifiers.

SN Stack is offered in three distinct variants to cater to different developmental needs: Madara, which provides a flexible, open-source modular framework; Dojo, a platform optimized for gaming and advanced on-chain applications; and finally, StarkWare Sequencer, which delivers Starknet’s entire infrastructure for dapps requiring high performance.

“From now on, projects will be able to build appchains using the gold-standard ZK-STARK cryptography with the ease and low cost that has only been possible with optimistic rollups,” said Eli Ben-Sasson, co-founder and CEO of Starknet’s core developer StarkWare.

An appchain called Paradex has been running as a design partner for the current SN Stack introduction.

2024 marked a significant year for Ethereum’s Layer 2 ecosystem. Building on the momentum from previous years, the number of rollups, or Layer 2 chains, surpassed 100, a threefold increase from the end of 2023. This exponential growth has been driven by increasing demand for scalable solutions and the availability of many development tools.

The emergence of modular Layer 2s is supported by developers increasingly using software stacks offered by popular projects such as Optimism, Arbitrum, ZKsync, Linea, and now Starknet.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Appchains are launching on Starknet, the layer-2 blockchain on Ethereum known for its embrace of zero-knowledge (ZK) cryptography. StarkWare, the primary developer of Starknet, shared the news on Wednesday, telling CoinDesk that its "SN Stack" will let developers easily build blockchains tailored to specific crypto use cases.

StarkWare originally announced in July 2023 that it was building a customizable stack for developers to create their own blockchains. The announcement followed similar releases from several of StarkWare's competitors—other layer-2 blockchains that scale Ethereum's capacity by offering users side lanes to transact quickly and cheaply.

StarkWare, founded in 2018, was one of the first layer-2 scaling solutions to adopt ZK cryptography — an encryption technique that's rapidly become one of the core technologies undergirding many next-generation blockchains. Compared to "optimistic" layer-2 networks — the rollup technology used by most Ethereum scaling chains — ZK-based chains like StarkWare are viewed as more advanced and secure, albeit more difficult to build, more expensive and harder to scale to generalized use cases.

“From now on, projects will be able to build app-chains using the gold-standard ZK-STARK cryptography with the ease and low cost that has only been possible with optimistic rollups,” StarkWare co-founder and CEO Eli Ben-Sasson said in a statement shared with CoinDesk.

The SN stack has various options meant to cater to different kinds of developers. According to a press release shared with CoinDesk, “developers can choose between Madara, an open-source and modular framework built for flexibility, Dojo, optimized for gaming and on-chain applications, or the StarkWare Sequencer, which provides the full, high-performance infrastructure of public Starknet.”

Read more: StarkWare’s ‘Starknet Stacks’ Could Add to Growing Field of Blockchain-in-a-Box Offerings

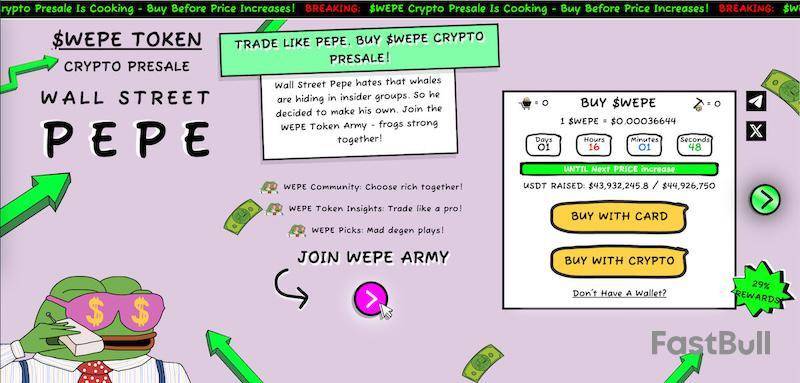

2025 is shaping up to be the year of the Frog, if presales for Wall Street Pepe ($WEPE) are anything to go by. They’re just dollars away from hitting the $45M mark, which suggests that this is the meme coin that could outperform all others this year.

Obviously, we can’t predict anything for sure. If we could, we’d be sitting at our beach resort in Cancun with our cocktails with the little umbrellas in it. But our expert opinion, after careful analysis, is that Wall Street Pepe is in pole position to hit 100x in 2025.

Why Has Wall Street Pepe Done So Well So Far?

Ever since its presale launch back in early December, Wall Street Pepe ($WEPE) has seemingly been on cocaine-fuelled backflips. In a month, it has hit $45M in presales, its token price has shot up to $0.00036644, and its staking APY is 29%.

Add to that, the promise by $WEPE’s developers to provide financial insights and insider information normally only seen by the big whales, seems to have lit a rocket under the fledgling crypto meme coin. Which begs the question – where is the ceiling for $WEPE? Is there even one? Suddenly, 100x ROI doesn’t seem such a stretch.

If things weren’t going swimmingly enough, Elon Musk seems to have been infected with some frog juice. He’s started tweeting (or X’ing?) about it and talking it up. He also briefly changed his X moniker to Kekius Maximus and changed his avatar picture to a frog.

Whatever your opinions are about Musk, you can’t deny that he has some serious influencer beans. When he tweets/X’s about something, people sit up and take notice. WEPE got an Elon boost of almost 20%.

Other crypto meme coins offering governance rights, or cat slapping games, kind of pale into comparison when the world’s richest man is promoting your competitor.

A Populist Message Adds To The Appeal

Wall Street Pepe is also benefiting from the current political and social climate at the moment. A crypto-friendly US President about to take office in less than two weeks, which is giving huge amounts of confidence to the big investors with the deep pockets.

But at a time when corporate greed seems to be on the rise, $WEPE suggests a neat solution. Its whitepaper proposes to share the trading and financial insights with the little people, and share in the profits. Kind of like Robin Hood marching into Wall Street with his bow and arrow to demand a fair share of the meme coin profit pie.

Buy Your Frog Meme Coins Quickly To Take Advantage of Favourable Rates

The next price hike (and presumably reduction in the staking APY is in less than two days from now. This makes today the perfect opportunity to grab some Wall Street Pepe coins for your crypto portfolio.

Being a prelaunch, $WEPE isn’t on exchanges yet. It is expected to launch in March, and will be on exchanges then. So for the next couple of months, the only way to buy it is through their website. It’s your lucky day because we’ve made an in-depth guide on how to buy Wall Street Pepe meme coins.

A word of caution though – and this is why we emphasize that we can’t make guarantees. If you look at the chart above, you’ll see $WEPE’s daddy, PEPE ($PEPE)’s valuation suddenly drop in December. It’s still a good coin to invest in, and the price is slowly picking up again.

But it’s a prime example of how you can never predict anything with absolute certainty, and why you should never invest what you can’t afford to lose.

$WEPE is PEPE’s natural successor – the one to take the Pepe family legacy and run with it. It’s definitely running right now, but be prepared for a few possible stumbles along the way.

Do Your Own Research And Keep Your Shirt

As we stated before though – and it bears repeating – we’re not guaranteeing riches and success. It’s impossible to know for sure what will happen to Wall Street Pepe in the future. We can only cast our meme coin expert eye over its current performance and make confident price predictions.

Like our lawyers always tell us to say, do your own independent research. Take no one person’s word as gospel (including the self-proclaimed crypto expert sitting at the bar). Come to your own conclusions. And never, ever invest money you can’t afford to lose. Like your kid’s college fund or your 401K pension.

Ripple president Monica Long expects its Ripple USD (RLUSD) stablecoin to be listed on major crypto exchanges “imminently.”

In a Jan. 7 interview with Bloomberg, Long confirmed that Ripple is actively pursuing additional exchange listings for RLUSD.

“We are continuing to expand distribution and availability of Ripple dollars on other exchanges. So I think you can expect to see more availability, more announcements coming soon… imminently,” Long said. She declined to provide specifics when asked about RLUSD listings on major platforms like Coinbase.

Currently, RLUSD is available on Bitso, MoonPay, CoinMina, Bullish, Mercado Bitcoin B2C2, Keyrock, Archax, Independent Reserve and JST Digital, according to the Ripple website.

Ripple launched RLUSD on Dec. 17 as a stablecoin pegged 1:1 to the United States dollar. At the time of publication, the stablecoin boasts a market cap of $71.8 million, according to CoinGecko.

Most RLUSD trading volume — over 76% — is concentrated on Bullish crypto exchange, split across two primary trading pairs, R Coin and XRP /RLUSD.

Meanwhile, decentralized exchange Sologenic handles a smaller portion of the market. The XRP/RLUSD pair on Sologenic recorded $3.4 million in 24-hour trading volume, representing 3.56% of the total.

“Business doubled,” says Ripple president

Demand for RLUSD is primarily driven by Ripple’s payments business, which Long noted has doubled in the past year.

“Our business doubled within payments last year, and so we see a really strong growth trajectory for our payment solution. And with that, Ripple US dollar will have a premium role,” she said.

Long anticipates strong growth for stablecoins.

“We think that this year is going to be a big year for crypto overall, and so demand for stablecoins will grow along with that. It’s really the way to on-ramp and off-ramp,” she explained.

The stablecoin market has grown 55% since last year to $206.17 billion, according to data from DefiLlama. USDt remains the largest stablecoin, holding 66% of the market share.

XRP ETF “very soon”

Long indicated that XRP could be next in line for its own exchange-traded fund (ETF):

Several companies have already taken steps to launch an XRP ETF, including WisdomTree, which filed for approval with the US Securities and Exchange Commission on Dec. 2, 2024. Bitwise, Canary Capital and 21Shares have all filed for similar products.

Long believes with the administration change, the approvals of ETF filings will “accelerate.”

Ripple partners with Chainlink

To bolster RLUSD’s utility, Ripple partnered with Chainlink on Jan. 7 to integrate price feeds for RLUSD on Ethereum and the XRP Ledger.

The collaboration aims to provide tamper-proof, accurate pricing data, support DeFi applications and reduce risks like price manipulation or downtime.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up