Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin (BTC) showed resilience over the last weekend as it defended the crucial $108,000 support level amid heightened whale selling on leading crypto exchanges around the world, including Binance.

Bitcoin Survives September Whale Selling Pressure

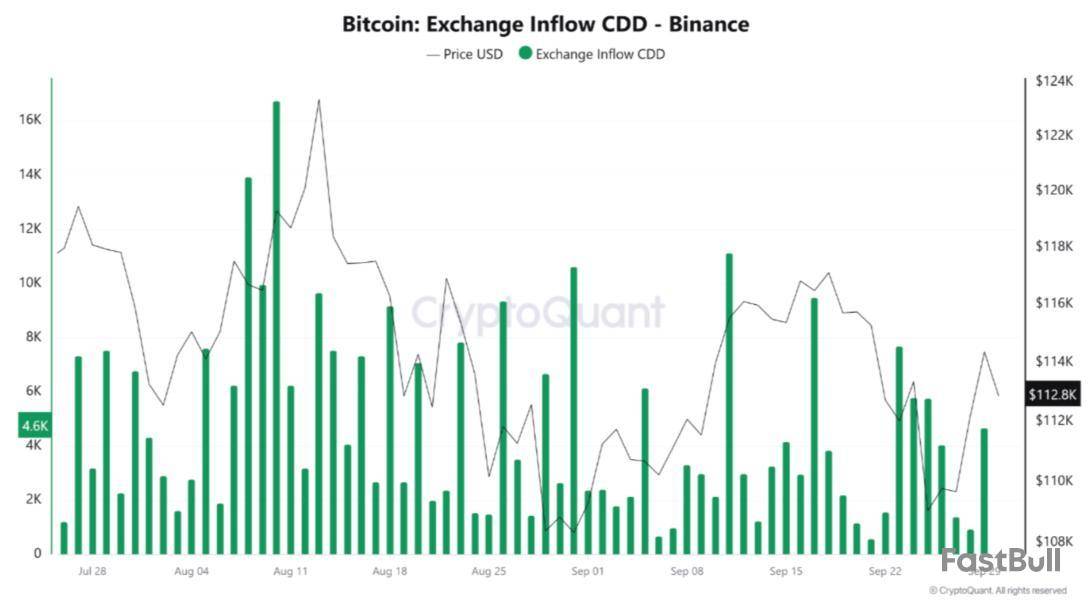

According to a CryptoQuant Quicktake post by contributor Arab Chain, September was marked by clear fluctuations between Bitcoin’s attempts to rally and exposure to selling pressure by whales and long-term holders. Binance trading volume data confirms this.

Arab Chain highlighted Binance’s Exchange Inflow Coins Days Destroyed (CDD) indicator, which showed significant volatility throughout September. The indicator recorded multiple peaks at various points during the month, especially during mid-September.

For the uninitiated, the Exchange CDD indicator tracks the movement of older, long-held Bitcoin when it flows into exchanges, weighting transactions by the age of the coins being spent. Spikes in this indicator signal that long-term holders or whales are moving coins with the intent to sell, which can create selling pressure.

It is worth noting that despite the high peaks hit in September, the Exchange CDD indicator did not reach the extreme levels that it did in the previous months. However, the repeated spikes seen in September indicate inflows from older wallets into Binance.

The CryptoQuant analyst stated that the multiple spikes in the Exchange CDD indicator reflect a state of caution among long-term investors. Some of these investors tried to test the market by moving their BTC to the exchange, without turning it into a mass sell-off event.

Another point worth emphasizing is that the Exchange CDD spikes often coincided with price pullbacks in BTC, reinforcing the hypothesis that these flows likely represent short-term selling pressure. The analyst added:

However, these pressures did not lead to a breakdown of key support levels around $108K, indicating the presence of corresponding buying liquidity that absorbed these moves.

In conclusion, although some long-term investors showed willingness to take some profits, the absence of large waves of sell-offs shows that they have not fully lost confidence in the market yet.

Similarly, Bitcoin’s price remaining above $108,000 despite repeated selling pressure shows that the market still possesses the capacity to absorb BTC inflows, confirming the robust underlying demand for the top digital asset.

What Does October Hold For BTC?

In a separate CryptoQuant post, analyst crypto sunmoon remarked that past data suggests that a surge in taker buy orders has often preceded major Bitcoin bull runs. However, currently, there are no signs of any increase in taker buy orders.

The analyst added that even if BTC witnesses some price increase, it is unlikely to record the same magnitude of gains as before. That said, improving Bitcoin network fundamentals offers some hope to the bulls.

For instance, Bitcoin network transactions are once again approaching the important 600,000 transactions threshold, which could spark bullish momentum for the digital asset. At press time, BTC trades at $113,200, down 0.6% in the past 24 hours.

The crypto market is entering a decisive phase as major assets consolidate following weeks of heightened volatility. Bitcoin has recently pulled back from its highs near $115K, stabilizing around the $110K zone while showing resilience despite selling pressure. Ethereum, meanwhile, has been fluctuating in the $4,000–$4,200 range, maintaining relative strength as traders eye upcoming network updates and institutional flows. Broader altcoins have mirrored this consolidation, with select projects showing stronger accumulation trends as capital rotates from large caps. This environment is setting the stage for potential momentum shifts, making accumulation strategies increasingly relevant ahead of the next market expansion.

Here are a few altcoins that are expected to trigger a strong upswing once the BTC price resumes moving higher.

Solana’s price structure remains supported by consistent accumulation as liquidity rotates into its DeFi and NFT ecosystems. SOL has shown strong resilience after holding above the $200 support level, and technical momentum suggests a possible push toward the $230–$250 range in October. Its network activity continues to strengthen, reinforcing market confidence. If bullish sentiment accelerates, Solana could outpace other Layer-1s in short-term gains.

Cardano price‘s current consolidation between $0.42 and $0.45 indicates the formation of a solid base pattern. This range has served as a critical support area, and a breakout from this zone may open the way toward the $0.55–$0.60 target range in October. ADA’s upcoming ecosystem upgrades focusing on scaling and interoperability could provide the necessary fuel for momentum. Technical stability makes it a steady accumulation play for the month.

XRP

XRP continues to display relative stability within its current trading band, consistently finding demand around $0.58. A decisive break above the $0.65 resistance level could spark a run toward $0.75–$0.80 in October, especially as institutional interest and regulatory clarity strengthen investor sentiment. Its technical structure shows resilience, and capital rotation into XRP price could intensify if broader market momentum accelerates.

Avalanche is showing technical signs of renewed strength, with recent inflows supporting its attempt to reclaim higher trading ranges. If AVAX sustains above the $42 support, October could see price expansion toward $50–$55. The ecosystem’s growth in gaming and subnets continues to generate traction, aligning with this technical setup. A failure to hold $42, however, could trigger a retest of the $38 zone.

Little Pepe (LILPEPE)

As a speculative meme coin, Little Pepe trades with high volatility but has attracted significant attention through its presale success and Layer-2 narrative. Technical setups point toward a possible rally into the $0.00045–$0.00050 range during October, while $0.00030 remains the key support level. Its short-term movements are likely to be liquidity-driven, offering high-risk yet potentially high-reward opportunities for aggressive traders this month.

Sei Network has been steadily attracting capital, with its accumulation zone suggesting a potential breakout. Holding above the $0.40 support could set the stage for upside toward $0.48–$0.52 in October. Its growing Layer-1 adoption narrative aligns with improving liquidity flows, giving traders confidence in its short-term prospects. If activity continues to rise, Sei may surprise as one of the stronger performers of Q4.

Floki Inu remains highly volatile but has sustained strong community backing, which supports its trading base. Technicals indicate that holding above $0.00018 could provide a launchpad for upside toward $0.00025–$0.00028 in October. FLOKI’s expanding ecosystem, particularly in branding and NFTs, adds to the speculative momentum. While risky, its persistence on trending lists signals continued investor attention this month.

Ethereum remains central to market rotations, maintaining its pivotal role despite consolidation. Trading near the $4,000 level, the ETH price has formed a strong accumulation base, with upside targets around $4,400–$4,600 for October. Its network upgrades, staking demand, and DeFi dominance continue to reinforce confidence among traders. A breakdown below $3,800 remains the key risk, but ETH’s structural stability suggests potential strength as the altcoin market heats up.

Final Thoughts

From a technical perspective, October 2025 presents opportunities for both accumulation and breakout plays. Solana, Cardano, and XRP demonstrate steady structures with defined support and resistance, while speculative plays like LILPEPE, SEI, and FLOKI carry higher volatility but notable upside potential. Monitoring breakout levels, liquidity inflows, and market rotations will be crucial to identifying the strongest performers as the next bullish phase develops.

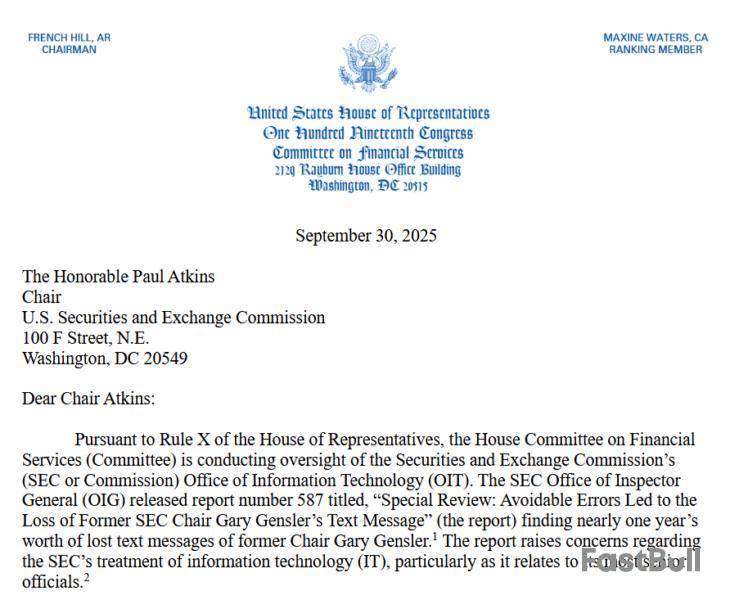

US House Republicans have told Securities and Exchange Commission Chair Paul Atkins that they are investigating the loss of text messages from former SEC Chair Gary Gensler from when he led the agency.

The SEC’s Office of Inspector General’s findings in early September cast doubt on whether the Gensler-led SEC acted with transparency and integrity while serving between 2021 and 2025, House Financial Services Committee Chairman French Hill said in a letter to Atkins on Tuesday.

Hill said the House Financial Services Committee said “is engaging with the OIG to learn more about their report, seek clarity on outstanding questions, and discuss additional areas that require further oversight and investigation.”

Many in the crypto industry accuse Gensler of being key to a theorized Biden administration plan to pressure banks into refusing or limiting services to crypto businesses and argue his SEC stifled the industry with multiple lawsuits against crypto companies during his tenure.

Republicans accuse Gensler of double standards

The letter, also signed by House Ranking Members Ann Wagner, Dan Meuser, and Bryan Steil, said that Gensler sued several financial firms for “widespread record-keeping failures,” collecting more than $400 million worth of fines to settle charges alone in 2023.

The deleted text messages highlight a clear double standard, the House Republicans claimed.

SEC IT department blamed for deleted texts

The OIG said the SEC IT department implemented a poorly understood automated policy that triggered a full wipe of Genler’s government-issued mobile phone, which also deleted text messages between October 2022 and September 2023.

The loss was worsened by poor change management, lack of proper backup devices, ignored system alerts, and unaddressed vendor software flaws, the OIG found.

Conversations with crypto enforcement actions were lost

The OIG found that some of Gensler’s deleted texts involved SEC enforcement actions against crypto companies and their founders, meaning that key communications about how and when the SEC pursued cases may never be fully known.

The SEC also experienced a security blunder in January 2024, when a hacker compromised its X account to post false news that it approved the spot Bitcoin (BTC) exchange-traded funds.

X attributed the security breach to the SEC not having two-factor authentication enabled.

The global cryptocurrency market cap stands at $3.9 trillion, down 0.41% in the last 24 hours. Bitcoin trades around $114,477, showing little change but struggling to build momentum. Ethereum is at $4,148, down slightly, while XRP trades at $2.83. Most of the top altcoins are in the red, with Solana, BNB, and Dogecoin posting small declines.

The U.S. Government Shutdown Factor

The main pressure point today comes from Washington. The U.S. government faces a potential shutdown with betting markets giving it an 86% probability. Political gridlock over budget approvals has unsettled investors, creating risk-off behavior across financial markets, including crypto.

Historically, shutdowns have limited direct economic impact. Essential services like the military and air traffic control continue, but uncertainty often drives short-term volatility. Analysts expect headlines to dominate the next 48 hours, pushing both Bitcoin and altcoins into sharp intraday swings.

End of Month and Quarter Closes

The timing adds further stress. Markets are closing out both the monthly and quarterly cycles, which often brings increased volatility. September has a history of weakness for Bitcoin and crypto markets, and this year has followed the same pattern.

Still, seasonal data shows that October and November are usually stronger months. Bitcoin has averaged a 19% gain in October and a 43% gain in November in past cycles. Bulls argue that today’s pullback could set the stage for a Q4 rebound if seasonal trends hold.

Liquidations and Trading Flows

Data shows nearly $300–400 million in liquidations in the last two days, mostly from leveraged short positions. Exchange volumes remain lower than earlier in the year, a sign that big buyers are sitting on the sidelines until political risk clears.

Altcoins are mixed. Solana and BNB have seen some inflows tied to activity on decentralized exchanges, while XRP remains heavily traded following ETF speculation earlier this month.

Former Binance CEO Changpeng Zhao has issued a major security warning about the official X account of BNB Chain, which appears to have been compromised by hackers.

CZ 🔶 BNB@cz_binanceOct 01, 2025ALERT 🚨: The @BNBCHAIN X account may have been compromised.

Please do not click on any links recently posted from this account.

The teams are investigating and will share updates as soon as possible. 🙏

Several minutes ago, the account posted "$4" alongside a phrase "FOR THE MEME."This was accompanied by a wallet address and a picture of CZ.

The obviously fraudulent social media post has been pinned by the attackers to gain more exposure.

CZ has warned against clicking any suspicious links posted from the account, adding that the team is currently investigating the issue.

Binance's Chinese account has also warned that the official English-language account of the BNB Chain has been hacked.

For several agonizing hours in August 2022, white hat hackers watched anxiously as evil-doers, known as “black hats,” stole $190 million from the Nomad bridge — the fourth biggest crypto hack just that year alone.

While some white hats eventually took it upon themselves to steal the funds for temporary safekeeping, many more hesitated over fears that getting involved could land them in prison.

This exact incident is what led crypto security nonprofit Security Alliance, or SEAL, to find a way to give white hats the freedom and, more importantly, legal safety, to fight against the bad guys.

This later became the Safe Harbor Agreement — a framework for white hats and projects to abide by during an active exploit, according to the SEAL Safe Harbor initiative’s co-leads Dickson Wu and Robert MacWha.

SEAL recognizes 29 companies supporting crypto’s ethical hackers

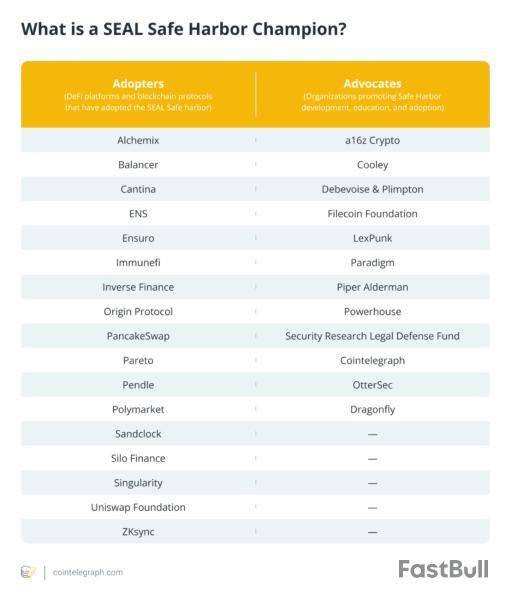

Three years later, SEAL is now recognizing 29 crypto companies for adopting and supporting its Safe Harbor Agreement as part of its very first Safe Harbor Champions 2025 awards.

“By rallying around standards like Safe Harbor, we’re signaling a coordinated defense strategy rather than remaining fragmented,” Wu and MacWha said.

The nominees, split into “adopters” and “advocates,” include Polymarket, Uniswap, a16z Crypto, Paradigm, Piper Alderman, and many more, including Cointelegraph.

Another nominee, Web3 security platform Immunefi, told Cointelegraph last month that its adoption of the Safe Harbor initiative has helped 30 of its white hat security researchers reach millionaire status, contributing to more than $25 billion in customer funds saved from attempted thefts.

So far, Immunefi has facilitated more than $120 million in payouts across thousands of reports, with SEAL’s Safe Harbor framework serving as one of its powerful tools to protect crypto protocols from bad actors.

Notable white hat hacks that saved millions in crypto

SEAL currently has 79 volunteer white hat hackers who can respond during active exploits. One of the more famous white hats is the pseudonymous c0ffeebabe.eth, who has run in and saved crypto projects on more than a few occasions.

In April, they ran a Maximal Extractable Value bot to frontrun a malicious transaction and intercept $2.6 million stolen from the Morpho App.

In July 2023, c0ffeebabe.eth returned $5.4 million worth of Ether (ETH) to Curve users through the same MEV strategy, and a few months earlier, they also recovered 300 ETH from a smart contract exploit on SushiSwap.

banteg@bantgJul 31, 2023thank you c0ffeebabe.eth for returning the funds ❤️https://t.co/DoBoh5QEaR pic.twitter.com/ltEKSvZo80

Good-faith white hat actors also withdrew and returned $12 million worth of Ether and USDC (USDC) from the Ronin bridge in August 2024, receiving praise from its team for their actions.

More recently, several SEAL volunteers coordinated to warn crypto protocols of the NPM supply chain attack that compromised JavaScript software libraries in September.

Despite early fears of a potential black swan event, the industry’s collective defense limited the total damage to less than $50 across the first 24 hours.

“I'm very proud of the fact that SEAL worked quickly to triage and remediate the crypto aspects of the attack while GitHub and other developers worked quickly to flag and neutralize the infection from a Web2 perspective,” SEAL’s pseudonymous founder and CEO, Samczsun, said.

SEAL’s Safe Harbor Champions 2025 open for voting

Winners of SEAL’s Safe Harbor Champions 2025 awards will be determined by the total number of likes, retweets, quote tweets, and replies on posts from nominees using the @_SEAL_Org tag from Oct. 1 until Nov. 1.

The winners will be announced on Nov. 3. They will earn a commemorative SEAL nonfungible token and ongoing recognition as a 2025 Safe Harbor Champion.

The awards are part of SEAL’s wider initiative to encourage more crypto companies to adopt the Safe Harbor Agreement to strengthen the protection of customer assets.

How SEAL’s Safe Harbor framework works

To adopt the Safe Harbor framework, crypto protocols must join SEAL’s onboarding waitlist. If approved, they will receive a step-by-step guide on how to comply with the framework.

During an active exploit where a white hat steps in to take the funds for temporary safekeeping, the Safe Harbor rules state that funds must be returned within 72 hours, with the bounty set at 10% of recovered funds (capped at $1 million).

Payment is made only after verification, and to ensure accountability, white hats must complete a Know Your Customer and OFAC check before receiving rewards.

On the other hand, membership as a SEAL volunteer is granted through certain badges, which are earned by contributing time or money to support the operations and initiatives run by SEAL.

The crypto industry is taking accountability

Adoption of the Safe Harbor initiative shows “the outside world that crypto has evolved beyond the wild west into a mature ecosystem capable of collective action,” Wu and MacWha said.

Related: Crypto.com says report of undisclosed user data leak ‘unfounded’

Ayham Jaabari, a founding contributor of DeFi platform and Safe Harbor nominee Silo Finance, told Cointelegraph that the SEAL agreement being enforced on-chain and tied to updated user terms, reflects the type of accountability expected by banks and regulators.

Part of Silo Finance’s implementation of Safe Harbor has involved publishing recovery addresses on Ethereum, Avalanche, Sonic, Arbitrum, Base and Optimism to remove any doubt about where white hats should return rescued assets.

Continued adoption of white hat frameworks like Safe Harbor should serve as a warning sign to bad actors, Jaabari added:

White hats now have legal protection

Another Safe Harbor nominee is the Security Research Legal Defense Fund, a nonprofit that is prepared to fund the legal defense for any white hat who faces legal issues, provided the hack was carried out in good faith.

SRLDF President and Senior Attorney Kurt Opsahl told Cointelegraph that while they haven’t had to use the fund yet, it gives white hats more confidence to step in to safeguard protocols during active attacks:

Despite the progress, work remains. Hackers are becoming increasingly sophisticated, siphoning $3.1 billion in the first half of 2025 — already surpassing the $2.85 billion lost in all of 2024.

The $1.4 billion Bybit hack, along with rising crypto prices, have been the biggest contributors to losses in 2025, already exceeding those seen last year.

XRP is once again at the center of price speculation, but this time the targets are higher than most have seen before. Analysts following recent market data now believe XRP could enter a supercycle that lifts the price into the $20 to $30 range by 2026.

The argument by Zach Rector is built on comparisons with Bitcoin. Spot Bitcoin ETFs have attracted more than $57 billion in inflows since their launch in early 2024. That capital helped Bitcoin set new price records well before its halving cycle. Supporters of XRP say a similar pattern is forming now that spot XRP ETFs are beginning to roll out.

Why ETFs Matter

Until recently, XRP lacked the regulated investment products that have fueled Bitcoin’s rise. That gap is closing. The first spot XRP ETF has already launched, and more are set to follow. Banks and research firms are weighing in with early estimates:

At XRP’s current circulating supply of about 60 billion tokens, these inflows alone could justify a base case of $20 to $30 per coin.

Current Market Conditions

XRP trades below $3 after a recent pullback tied to U.S. political uncertainty. Analysts describe this as a short-term event rather than a change in long-term momentum. The asset has already shown the ability to recover quickly, climbing more than 600% since late 2024 despite ongoing debates about regulation.

Beyond ETFs

The supercycle outlook is not only about ETFs. Broader changes in global markets are underway. Regulators and exchanges are exploring tokenization of stocks and private equity, which could move parts of traditional finance onto blockchains. If XRP and its ledger play a role in that transition, demand could expand far beyond current expectations.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up