Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

White House Official - President Trump Not Indicating USA Would Decertify Canadian Built Airplanes In Operation

The White House Announced That President Trump Will Attend A Policy Meeting At 2 P.m. ET On Friday (3 A.m. Beijing Time The Following Day) And Sign An Executive Order At 11 A.m. ET On Friday (midnight Saturday Beijing Time)

According To The Japan Exchange Website, From 10:21:49 To 10:31:59 Beijing Time On January 30, 2026, The Osaka Exchange Activated Its Circuit Breaker Mechanism For Platinum Futures, Temporarily Suspending Trading. This Was Due To A Sharp Drop In Global Platinum Prices, With The Decline Reaching The 10% Limit Set By The Previous Day. The Circuit Breaker Mechanism Is A Measure Taken By Exchanges To Cope With Severe Market Volatility, Aiming To Temporarily Restrict Or Suspend Trading To Encourage Investors To Remain Calm. This Was The First Time The Circuit Breaker Mechanism For Platinum Futures Had Been Activated Since December 30, 2025, Starting At 10:21 AM Beijing Time And Lasting For 10 Minutes

Hsi Down 498 Pts, Hsti Down 105 Pts, Cspc Pharma Down Over 12%, Shk Ppt, Huabao Intl Hit New Highs

Citi Predicts Cn Allocation To Push Copper To Usd15-16K/ Ton In Coming Weeks, But Rather Unlikely To Sustain

Bombardier - Have Taken Note Of Post From President Of United States To Social Media And Are In Contact With Canadian Government

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

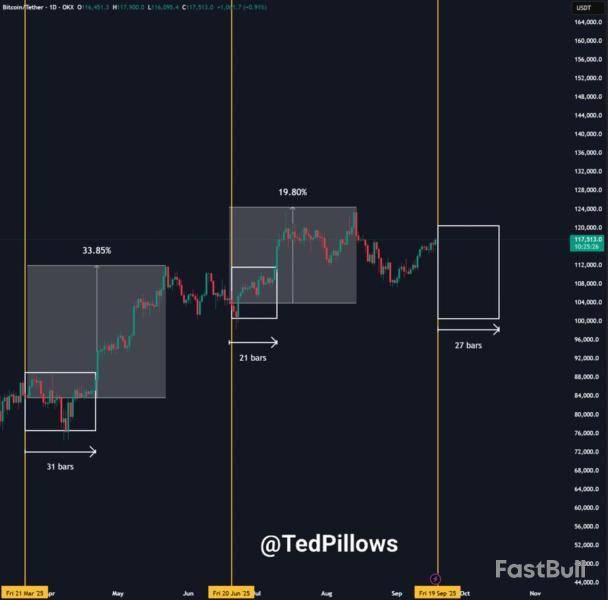

Bitcoin has once again grabbed attention after breaking above $117,600, reaching its highest point in a month. But behind the bullish rally, a big warning is flashing. Popular analyst Crypto Ted says the market may face a storm as $4.9 trillion in stock and ETF options are set to expire today.

For traders, the next few days could bring wild swings.

$4.9 Trillion Option Expiry Threat

In his recent tweet post, Ted pointed out that $4.9 trillion worth of stock and ETF options will expire today. For context, that amount is nearly 1.2 times bigger than the entire crypto market which is $4 trillion as of now.

He further reminded that such large expiries have previously triggered sharp volatility across both equities and cryptocurrencies.

For example, in March 2025, a similar expiry was followed by a crash within two to three weeks. In June 2025, Bitcoin moved sideways for a while and then slipped below $100,000.

Now, with traders loading up on heavy leverage again, Ted believes the same pattern could play out once more.

$4.3B Bitcoin & Ethereum Options Expiring Today

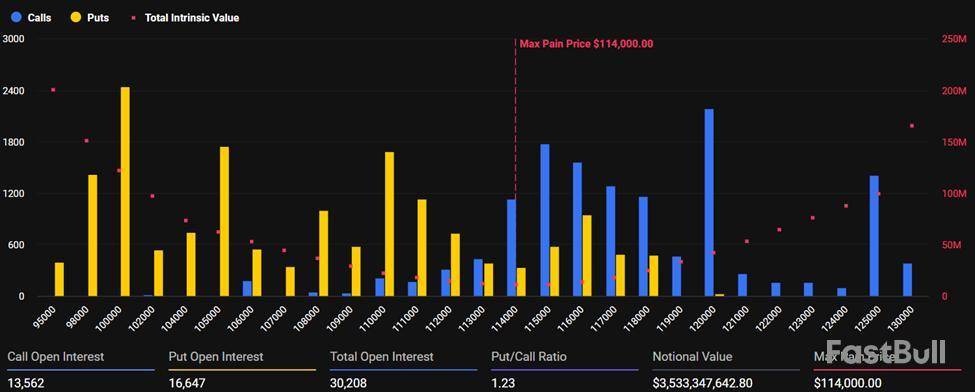

On the crypto front, data from Deribit shows that more than $4.3 billion in Bitcoin and Ethereum options are expiring today. For Bitcoin, the expiring options have a notional value of $3.5 billion, with a put-to-call ratio of 1.23 and a maximum pain level at $114,000.

Meanwhile, Ethereum options account for about $806 million, with a put-to-call ratio of 0.99 and a maximum pain level at $4,500.

These expiry levels often act as magnets for price movement, meaning traders could see sharp swings in the short term.

BTC To Drop Before Hitting ATH

According to Ted, the build-up of leverage almost always ends the same way, a quick flush out. This means short dips may come as weak positions get cleared. But this also sets up the next rally.

In March, Bitcoin jumped 33% before pulling back. In June, the rise was smaller at 20%, and the drop came faster. Now in September, Bitcoin is near $117,000 with traders once again taking big risks.

If history repeats, this volatility could be the push that takes BTC to new highs, helped by the Fed’s recent rate cut and more cuts expected this year.

Solana co-founder Anatoly Yakovenko has urged the Bitcoin community to accelerate its efforts to guard against quantum attacks, arguing that a major breakthrough in quantum computing could come much sooner than expected.

“I feel 50/50 within 5 years, there is a quantum breakthrough,” Yakovenko said at the All-In Summit 2025, which was published to YouTube on Friday. “We should migrate Bitcoin to a quantum-resistant signature scheme,” he added.

Yakovenko based his prediction on the fact that with so many technologies converging, and how fast AI is accelerating from a research paper to an implementation. “It is astounding,” he said. “I would try to encourage folks to speed things up,” he added.

Cybersecurity experts say the threat may emerge quicker

It is commonly forecasted that quantum computers will eventually be able to crack present-day encryption, making security a concern for users in the blockchain industry. Though many Bitcoin (BTC) advocates still think the threat is a long way off.

Bitcoin wallets are secured by ECDSA to generate a pair of private-public keys.

Its security relies on the hard-to-solve elliptic curve discrete logarithm problem (ECDLP), which is impossible to resolve with classical computers, but may not be for quantum computers.

David Carvalho, founder and chief scientist of Naoris Protocol, recently said in June that quantum computers have become so advanced that they could “plausibly rip” through Bitcoin’s cryptography within even less than five years’ time.

However, upgrading a blockchain from legacy cryptography to post-quantum security would be challenging because it would require a hard fork, something many crypto communities are against.

Bitcoiners aren’t as concerned about the threat

Other Bitcoiners don’t see the threat as imminent.

Blockstream CEO Adam Back said that current quantum computers do not pose a credible threat to Bitcoin’s cryptography but will likely threaten it in the future.

Back estimated that quantum computers may evolve to that extent in “maybe 20 years.”

Meanwhile, Jan3 founder Samson Mow told Magazine in June that he isn’t too worried about the threat quantum computing poses.

“I think it is a real risk, but the timeline is probably still a decade away, and I would say everything else will fail before Bitcoin fails,” Mow says.

September 19, 2025 05:59:50 UTC

Polygon Secures $21M Net Flows, Ranks 3rd Among Chains

In the past 24 hours, Polygon attracted $21 million in net flows, ranking third overall. It trailed BNB Chain with $47 million and Hyperliquid at $242 million. Despite new narratives shaping the market, Polygon continues to capture strong inflows. While prediction markets contribute, its growing role as a payments layer is proving to be a key driver, keeping Polygon in focus among leading blockchain networks.

September 19, 2025 05:58:23 UTC

Bitcoin News: Massive Moment for BTC Price , “Change Course of History” Coming Next Week

Dennis Porter has teased something “massive” for Bitcoin coming next week. He claims there’s an opportunity to change the course of Bitcoin’s history in the USA — and it’s that big. Porter says this could be a pivotal moment for Bitcoin policy, adoption, or regulation stateside. What’s unclear is exactly what this “massive” event entails — proposed laws, regulatory shifts, or large institutional movement. All eyes will be watching closely.

Dennis Porter@Dennis_Porter_Sep 18, 2025Something massive is coming for Bitcoin next week. We have an opportunity to change the course of history for Bitcoin in the USA. It’s that big. 🇺🇸

September 19, 2025 05:56:35 UTC

XRP’s Path to Decoupling from Bitcoin

XRP is expected to decouple from Bitcoin once institutional adoption and settlement demand begin driving its value independently. The shift will be gradual, fueled by growing usage of XRP in cross-border payments and banking networks. As settlement demand increases, XRP’s price will be anchored more to real-world utility rather than broader crypto market sentiment, signaling a fundamental divergence from Bitcoin’s dominance in the digital asset space.

September 19, 2025 05:35:41 UTC

Ethereum and Bitcoin Spot ETFs See Strong Net Inflows

On September 18 (ET), Ethereum spot ETFs recorded a combined net inflow of $213 million, with all nine funds avoiding outflows. Bitcoin spot ETFs also showed strength, attracting $163 million in net inflows across all twelve products, each reporting zero outflows. The synchronized gains highlight growing institutional demand for both BTC and ETH, reinforcing market confidence amid ongoing momentum in crypto ETFs.

September 19, 2025 05:35:41 UTC

Aster Crypto Records Explosive Growth, Binance Alpha Launches Today

In just 24 hours since its Token Generation Event (TGE), Aster (ASTER) skyrocketed 1,650%, hitting $310M in trading volume and $1.5B in total platform activity. The network saw 330,000 new wallets created, while net inflows boosted TVL by $660M to surpass $1B. Riding this momentum, Binance Alpha is set to go live today, September 18, at 16:00 UTC+8, further energizing market interest in the Aster ecosystem.

Despite Bitcoin showing strength over the last few days, traders and investors should expect some volatility during the early hours of the European session on Friday amid the anticipation of options expiry.

However, the impact could be short-lived, given that markets quickly adjust to new trading environments shortly after.

What Traders Should Know About Today’s Options Expiry

Data on Deribit shows that over $4.3 billion in Bitcoin and Ethereum options will expire today. For Bitcoin, the expiring options have a notional value of $3.5 billion and a total open interest of 30,208.

With a Put-to-Call ratio 1.23, the maximum pain level for today’s expiring Bitcoin options is $114,000.

For their Ethereum counterparts, the notional value for today’s expiring ETH options is $806.75 million, with total open interest of 177,398.

Unlike Bitcoin, however, today’s expiring Ethereum options have a Put-to-Call Ratio (PCR) below 1, with Deribit data showing 0.99 as of this writing. Meanwhile, the maximum pain level, or strike price, is $4,500.

The maximum pain point is a crucial metric in crypto options trading. It represents the price level at which most options contracts expire worthless. This scenario inflicts the maximum financial loss, or “pain,” on traders holding these options.

Notably, today’s expiring Bitcoin and Ethereum options are slightly higher than last week’s. On September 12, BeInCrypto reported nearly $4.3 billion expiring options, highlighting 29,651 BTC and 189,700 ETH contracts, with notional values of $3.42 billion and $858.2 million, respectively.

However, the main difference between this week’s expiring options and those seen last week is that this time, Ethereum expiring options have a PCR below 1.

A PCR below 1 indicates that more Call (Purchase) options are traded than Put (Sale) options. Therefore, this suggests a bullish market sentiment for Ethereum, and bearish sentiment for Bitcoin, which has more Puts than Calls.

Nevertheless, Bitcoin’s PCR at 1.23 and Ethereum’s at 0.99 suggest an almost balanced bet among traders between sale and purchase orders.

This balanced outlook comes as investors speculate whether the market will move higher or are hedging their portfolios in case of a sell-off.

Options Market Signals Caution After Fed Cut as Record Expiry Looms

In hindsight, it is worth noting that options had repriced ahead of the Federal Reserve’s interest rate decision on Wednesday.

With this, implied volatility for options contracts rose while trading volume declined, suggesting market caution.

“Options are repricing ahead of the Federal Reserve’s interest rate meeting, with implied volatility on options expiring tomorrow rising significantly. Recent actual volatility has also been substantial, showing a marked increase compared to last month, yet actual trading volume has declined instead,” analysts at Greeks.live had noted.

Glassnode highlights a post-rate-cut patience in the market, with Bitcoin trading above 115,200 and 95% of supply in profit after the FOMC rally.

“Futures show short squeezes, and options open interest hit a record 500,000 BTC ahead of the September 26 expiry. Holding above 115,200 is key while a drop risks a move back toward 105,500,” wrote Glassnode analysts.

Meanwhile, it is worth noting that next Friday, September 26, the largest weekly Bitcoin options expiry in history will be seen. On that day, over $18 billion in notional value will expire.

At the $118,000 Bitcoin price level, over $2.4 billion is in the money, with a maximum pain of $110,000. The Put open interest is minimal until $110,000.

Therefore, next week could be interesting. The margin usually drives short-term price action, so markets should not be surprised to see a flush despite the sentiment.

In the meantime, however, traders should brace for volatility because the max pain concept often influences market behavior.

According to the Max Pain theory, the asset’s price tends to gravitate toward this level as options near expiration.

As the options near their expiry time, 8:00 UTC on Deribit, the Bitcoin price, trading for $117,147 as of this writing, could pull toward its max pain at $114,000. Meanwhile, Ethereum, which was trading for $4,590, could drop toward $4,500.

Nevertheless, markets usually stabilize soon after traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing market trends into the weekend.

Bitcoin advocates are jumping up and down again after reports that Vietnam has closed 86 million bank accounts that failed to comply with a facial biometric authentication mandate.

Several Vietnamese media outlets — including Vietnam+ — reported in July that over 86 million bank accounts started being closed on Sept. 1, while the remaining 113 million bank accounts were verified under the new biometric laws, the aim being to prevent fraud and money laundering.

A Reddit user known as “Yukzor,” a former foreign contractor in Vietnam, said the new law’s implementation has required him to fly back into the country to prevent his HSBC bank account from closing, with no remote solution.

“Does that sound crazy to anyone else in 2025, you cannot transfer your money and have to fly into a country in person to resolve an issue? On top of it all, they said they will close my account this month if i don't fly in and update the biometrics,” he wrote eariler this month.

Bitcoin advocates have long supported the idea that people should have access to their own funds, free of government or external interference.

“If users don't comply by the 30th [of September] they'll lose their money. This is why we Bitcoin,” Bitcoin industry commentator Marty Bent said on Thursday. Cointelegraph couldn’t verify whether customer funds would be unrecoverable after Sept. 30.

However, punitive capital controls of this nature have taken place in Lebanon, Turkey, Venezuela, Cyprus, Nigeria, India and many other countries since Bitcoin launched, and it would be “naive to think that Vietnam will be the last,” Bent said in a separate article for the TFTC on Thursday.

The strict measure — which Bitcoin environmentalist Daniel Batten said would give Vietnam’s central bank “next-gen financial surveillance ability” — shows why permissionless monetary protocols like Bitcoin are necessary to safeguard against state overreach.

“Once you use Bitcoin as your bank, and do it correctly, there is no need to worry about your country’s government or central bank deciding on a whim to thrust biometric verification requirements on you,” Bent said.

Banking biometrics said to fight fraud

Vietnam introduced the measures after seeing a rise in generative AI and sophisticated spoofing techniques to bypass security measures like liveness detection in recent years.

In May, local police busted an AI-powered money laundering ring that used fake facial scans and laundered an estimated 1 trillion Vietnamese dong ($39 million).

To comply, bank customers need to complete a first-time facial biometric authentication, and again for online transfers over 10 million Vietnamese dong ($379), the State Bank of Vietnam said in late June.

However, a crypto executive based in Vietnam told Cointelegraph the news may be overblown and that most locals haven’t been affected, stating that the changes have mainly impacted foreign residents with inactive accounts.

“It doesn’t seem to be a local outcry by any means,” they said.

AICEAN chief marketing officer Herbert Sim, who is currently in Vietnam, told Cointelegraph that the problem especially affects foreigners who have left the country or for casual or inactive accounts, or accounts people have forgotten about.

“The [One-Time Password] and phone‐bindings, needing in-person biometric verification, are big hurdles,” said Sim, also known as the “Bitcoin Man.”

BNB price today is hovering just under the $1,000 milestone, trading around $985 after briefly touching a new all-time high of $1,004. The token climbed 4.5% in the past 24 hours, rising from $956 before stabilizing near $998. With its market cap now close to $140 billion, BNB has overtaken Solana to reclaim its spot as the fifth-largest cryptocurrency.

Binance founder Changpeng Zhao (CZ) weighed in on the rally, explaining the mix of political, technical, and regulatory factors fueling BNB’s surge.

CZ 🔶 BNB@cz_binanceSep 18, 2025Why BNB reach $1000?

Good question. No one knows for sure. Correlation does not prove causation. But here is a incomplete list of possible reasons.

People tend to give me too much credit. I didn't do much. I am not technically involved like Vitalik. I am at best a mascot, but… https://t.co/rvhFA0yxYP

Pro-Crypto Policies Boost Investor Confidence

According to CZ, political shifts have created a supportive backdrop for digital assets. He credited the new U.S. administration for taking a friendlier stance toward crypto — one that other countries are now beginning to follow.

“The global environment is finally aligning with crypto. This kind of support is a key driver behind BNB’s rise,” said Zhao.

This policy shift has energized the market, creating optimism around BNB’s potential to break past $1,000 and beyond.

BNB Chain Upgrades Slash Costs and Speed Up Transactions

BNB’s rally isn’t just about politics — technical upgrades to BNB Chain have been transformative. Block times were reduced from 3 seconds to just 0.75 seconds, while gas fees fell by 90%.

These improvements made BNB Chain one of the fastest and cheapest blockchains, leading to a surge in activity. Transaction volumes soared, cementing BNB Chain’s position as the highest-volume network.

“BNB Chain is now among the fastest blockchains in operation, and this efficiency is drawing projects at scale,” CZ emphasized.

Ecosystem Growth and Venture Capital Inflows

The BNB ecosystem continues to expand rapidly. Stablecoins like WLF’s USD1 filled the gap left by BUSD, while AI, DeFi, and real-world asset projects are thriving on the network.

Trading platforms like PancakeSwap have seen rising volumes, while lending protocols such as Lista and Venus are competing for dominance. Venture capital firms, including YZiLabs, are pouring funds into BNB-based projects.

“The growth of the ecosystem shows investors’ confidence in BNB’s long-term future,” Zhao noted.

Binance’s Token Burn Fuels Scarcity

BNB’s quarterly token burn program is another bullish catalyst. In the last quarter alone, Binance removed $1.6 billion worth of BNB from circulation, tightening supply and boosting price momentum.

Many investors view these burns as a strong long-term value driver, ensuring BNB remains deflationary.

Regulatory Relief Restores Market Confidence

Earlier this year, the SEC dropped its lawsuit against Binance, lifting fears that BNB might be classified as a security. Reports also suggest Binance could soon strike a deal with the U.S. Department of Justice to end its court-appointed monitor, a condition tied to its $4.3 billion 2023 settlement.

Such developments significantly reduce regulatory pressure and restore investor confidence in Binance’s stability.

Speculation Over CZ’s Return Sparks Buzz

Adding fuel to the rally is speculation that CZ could return to a leadership role at Binance. Although no official announcement has been made, investors see his potential comeback as a positive sign for Binance’s vision and brand.

“My focus has always been on building. Whether I return or not, the ecosystem speaks for itself,” Zhao remarked.

BNB Price Today

BNB price action has been explosive. After repeated resistance tests at $995, the token broke $1,000 in a six-minute rally, with trading volumes eight times higher than normal. Analysts now eye resistance at $1,005, with strong support holding just below $1,000.

With political tailwinds, rapid ecosystem expansion, regulatory clarity, and ongoing token burns, BNB’s climb past $1,000 could be the start of its next major chapter.

FAQs

Why is the price of BNB going up?BNB’s surge is driven by pro-crypto political shifts, major technical upgrades to its blockchain, rapid ecosystem growth, and its deflationary token burn mechanism.

Is BNB a good investment?Many view BNB as a strong investment due to its real-world utility, expanding ecosystem, deflationary model, and increased regulatory clarity for the Binance exchange.

What will BNB be worth in 5 years?Long-term BNB valuation depends on overall crypto adoption and Binance’s growth. Its deflationary burn and key utility within a massive ecosystem provide a strong foundation for potential future value growth.

Can BNB reach $1000 USD?Yes, BNB has already briefly reached $1,004. Strong momentum, technical upgrades, and growing ecosystem demand suggest it could sustainably break and hold above $1,000.

Ethereum co-founder and Consensys CEO Joseph Lubin said that MetaMask will be launching its much-anticipated native token in the near future.

"The MASK token is coming — It may come sooner than you would expect right now," Lubin said during an interview on The Block's "The Crypto Beat" podcast. "And it is significantly related to the decentralization of certain aspects of the MetaMask platform."

Lubin explained that Consensys is actively supporting the Ethereum ecosystem's direction of progressive decentralization, and that it is using MetaMask, Infura and Linea to ensure that "rigorous" decentralization remains at the center of the ecosystem.

For years, the crypto community has been closely watching whether the most popular Ethereum wallet will launch its native cryptocurrency, an idea that dates back to at least 2021, when MetaMask engineer Erik Marks suggested the concept of community ownership of the wallet through a token launch.

The Block@TheBlock__Sep 18, 2025Consensys CEO Joe Lubin says the MetaMask token is coming and may arrive 'sooner than you would expect' pic.twitter.com/FQXL6PbS08

In a May interview with The Block, MetaMask co-founder Dan Finlay said the token, if launched, would be advertised directly in the wallet. "You'll be able to find a link directly in the wallet," Finlay said.

While Finlay said at the time the token launch is still a "maybe," Lubin's comments on The Crypto Beat on Thursday indicate that the MASK launch plan is concrete and near.

Earlier this month, Consensys' Ethereum Layer 2, Linea, launched its native asset, LINEA, with a token generation event that distributed over 9.36 billion LINEA to eligible addresses.

"With the token launch, we had the opportunity to do some pretty impactful things," Lubin said, pointing out that Consensys took a modest 15% stake in Linea tokens while the remainder was allocated to support builders, liquidity provision, and incentivized usage for both Linea and Ethereum projects, prioritizing community growth.

mNAV concerns

Meanwhile, Lubin, who is also serving as Chairman of publicly-traded Ethereum treasury company SharpLink Gaming, commented on the company's latest performance.

The company's market net asset value (mNAV) ratio recently fell below 1, indicating the market values the company at a discount to the ETH the firm holds. According to The Block's crypto treasuries page, SharpLink's mNAV currently stands at 0.80x. A similar decline in mNAV is spotted among other crypto treasury companies such as Bitmine and MARA.

This trend can erode investor confidence and has raised concerns about a potential "death spiral," where the company's stock price falls dramatically and limits its ability to raise capital, especially for a company heavily reliant on volatile crypto assets.

"There are cyclical things that are happening in the world. There are secular trends," Lubin commented. "When we see the price of ether surge, we see that reflected in SharpLink as we see their price of ether moving back towards all-time highs … We're going to see animal spirits back in the market."

SharpLink CEO Joseph Chalom, also present at the podcast interview, added that the mNAV decline below 1 is a "temporary dislocation."

"This is a public company vehicle, you own the underlying ETH, you get to stake it and earn three plus percent yields … That staking yield is revenue, and in a public company context in the mid-term to long-term, that should attract a multiple," explained Chalom.

Future of the ETH treasury

In the case the mNAV stays below 1, the SharpLink CEO said the company will opt for further buybacks, while seeking other ways to raise capital in the market, such as issuing common stock.

"There are equity-linked and convertible offerings that have really significant investor interest, where you can raise that capital without diluting the shareholders," Chalom said.

Instead of focusing on mNAV, the two SharpLink leaders put more emphasis on their own metric — ETH per share. Chalom said the ETH per share ratio has grown from 2.0 in early June to 3.95, which is a "super positive" for investors.

"It's about more and more investors waking up to the idea that we are going to be using our ether," Lubin said. "We may borrow against it at some point in the distant future when it's a giant pile of high-powered money. We'll be staking it in important protocols, we'll bring liquidity to new exciting protocols."

When the company reaches a certain inflection point that poses a limit for further Ether purchases, SharpLink plans to "substantially change" its mode from Ethereum accumulation to making use of ETH.

According to The Block's data dashboard, SharpLink is the second-largest corporate holder of Ethereum, with around 836,710 ETH under its belt. Its stock closed up 0.58% to $17.22 on Thursday, according to The Block's SBET price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up