Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

By George Glover

Cryptocurrencies were sliding on Thursday after yet another development surrounding President Donald Trump's tariff plans put investors in a risk-off mood.

Bitcoin was down 0.7% to $87,311 over the past 24 hours, according to data from the crypto exchange Kraken. It's now trading 26% below the record high it hit in January.

That wasn't the only token falling. XRP dropped 3.7%, Ethereum slid 1.9%, Solana tumbled 4.1%, and Cardano was down 3.7%.

Trump imposing 25% tariffs on automotive imports into the U.S. appeared to be what had cryptos trading in the red. While the president's trade policies aren't directly linked to digital-asset prices, forecasters worry that his levies could spark a flare-up in inflation and drag down growth. When the economy is weaker, investors tend to pivot away from risk-on assets like stocks and cryptocurrencies into safer havens like bonds and gold.

Write to George Glover at george.glover@dowjones.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

By Dow Jones Newswires Staff

Shares in automakers across Asia and Europe slumped after President Trump announced a 25% tariff on global automotive imports into the U.S., dampening hopes for relief on the trade front.

The knock on also hit major stock indexes generally, and the dollar fell.

Write to Barcelona Editors at barcelonaeditors@dowjones.com

Richard Teng, the CEO of Binance, recently reaffirmed the company’s commitment to transparency, security and compliance, but his timing has raised eyebrows as the statement collides with growing speculation that the black-and-yellow crypto behemoth played a role in an attack on Hyperliquid, a decentralized exchange that many believe threatens the dominance of centralized platforms like Binance itself.

The irony of Teng’s words is not lost on the crypto community, as Binance finds itself at the center of yet another controversy.

The series of events fueling these suspicions is alarming and intricate. An unidentified attacker initiated a calculated strategy involving shorting JELLY futures while purchasing the meme coin on-chain at the same time, artificially inflating its price.

This was followed by an intentional self-liquidation, forcing Hyperliquid’s liquidity provider to absorb a $4.5 million loss.

Lookonchain@lookonchainMar 26, 2025A massive whale with 124.6M $JELLY($4.85M) is manipulating the price of $JELLY(jellyjelly) to make Hyperliquidity Provider (HLP) face a loss of $12M!

He first dumped $JELLY, crashing the price and leaving HLP with a passive short position of 398M $JELLY($15.3M).

Then he bought… pic.twitter.com/kYcKshV4rl

As the price of JELLY continued to climb due to spot purchases, a second wallet took a long position, reaping significant profits, while Hyperliquid struggled to contain its exposure. The exchange ultimately suffered more than $10 million in losses.

Binance and Hyperliquid drama

The controversy, however, lies in the origin of the attack funds. Blockchain analysis traced the capital used to execute the operation back to OKX and Binance, fueling speculation that centralized exchanges orchestrated the attack to destabilize Hyperliquid. This theory gained traction when both exchanges announced the listing of JELLY perpetual futures right during the attack.

Richard Teng@_RichardTengMar 27, 2025User trust is paramount in the blockchain industry.

We're committed to transparency, security, and compliance to ensure that this technology delivers on its immense potential.

Thus, Teng’s words about transparency and compliance now sit uncomfortably in the midst of this situation.

It is worth pointing out that Hyperliquid responded by delisting JELLY and activating its Auto-Deleveraging (ADL) mechanism, which forcibly closed all positions at a fixed price of $0.0095. Some users accused the platform of unfairly determining this settlement price.

The disappointing technical rejection that XRP just experienced could postpone or even halt its trajectory toward a $3 breakout. The 26-day EMA is a critical resistance level that has now strengthened bears' short-term control, and despite recent sessions' indications of bullish momentum, the asset was unable to break above it.

XRP is currently trading at about $2.36. It has tried to rise above the descending trendline that has capped its movement since January, but the short-term bearish setup has been created by the rejection near the $2.42 level, which coincides with the 26 EMA. This failure is especially detrimental because XRP is still below the 50-day EMA, indicating that there has not been a confirmed reversal and that investor confidence in a long-term uptrend is waning. Chart by TradingView">

Unfortunately, trading volume has been low during the attempted breakout, indicating that there was insufficient market activity to support a significant spike. Bulls find it more difficult to maintain upward movements as a result of this lack of conviction, which also increases bearish pressure.

XRP is currently trapped in a narrowing range, as seen from the chart between the horizontal support and descending resistance around $2.20-$2.30. A zone that might serve as the last line of defense before a steeper decline in the 200-day moving average (about $1.93) is the next reasonable target if this support breaks.

The Relative Strength Index (RSI), which is positioned close to 50, indicates market indecision but is leaning slightly bearish due to the failure at important EMAs and the decline in volume. Although XRP is still technically trading inside the larger descending triangle, the $3 scenario is becoming less and less likely in the near future due to the inability to take advantage of bullish setups and break above dynamic resistance levels.

Now bulls need to reorganize to protect the $2.20 level and hold off on pushing again until there is more volume and momentum. As of right now, XRP's recovery path has become more difficult, as the worst-case technical scenario has occurred.

A South Korean court temporarily lifted the partial business suspension on crypto exchange Upbit that had prohibited the trading platform from servicing new clients for three months.

On Feb. 25, South Korea’s Financial Intelligence Unit (FIU) sanctioned the exchange, imposing a three-month ban on deposits and withdrawals for new clients. The FIU previously said the suspension was in response to Upbit’s violations of policies that prohibit exchanges from transacting with unregistered virtual asset service providers (VASPs).

In response to the FIU’s sanction, Upbit’s parent company, Dunamu, filed a lawsuit against the FIU, seeking to overturn the partial suspension order. In addition, Dunamu requested an injunction to temporarily lift the suspension order.

On March 27, local media Newsis reported that the court granted the injunction, moving the suspension order 30 days after a court judgment is reached. This allows Upbit to service new clients while the legal battle continues.

Upbit investigations led to a 3-month suspension order

Founded in 2017, Upbit is South Korea’s largest crypto exchange. On Oct. 10, the country’s Financial Services Commission (FSC) initiated an investigation into Upbit for potential breaches of the country’s anti-monopoly laws.

In addition to anti-monopoly breaches, the exchange is suspected of violating Know Your Customer (KYC) rules. On Nov. 15, the FIU identified up at least 500,000 to 600,000 potential KYC violations of the exchange. The regulator spotted alleged breaches while reviewing the exchange’s business license renewal.

In 2018, South Korean regulators ended anonymous crypto trading for its citizens. With the new development, users must pass KYC procedures before being allowed to trade digital assets on crypto trading platforms like Upbit.

Apart from these allegations, the FIU accused Upbit of facilitating 45,000 transactions with unregistered foreign crypto exchanges. This violates the country’s Act on Reporting and Using Specified Financial Transaction Information.

South Korea cracks down on overseas exchanges

On Oct. 25, 2024, South Korea strengthened its oversight of cross-border crypto asset transactions. The country’s finance minister, Choi Sang-Mok, said the government will introduce a reporting mandate for businesses that handle cross-border transactions with digital assets.

This aims to promote preemptive monitoring of crypto transactions “used for tax evasion and currency manipulation.”

In line with the rules, South Korea’s Google Play blocked the applications of 17 crypto exchanges at the request of the FIU. The FIU said it’s also working to restrict exchange access using the internet and Apple’s App Store.

Sui Network’s native token, SUI, has reclaimed a crucial level after its 10% price breakout. The token has shown bullish momentum over the past few days, climbing to weekly highs on Wednesday. Various market watchers suggested the momentum could send the cryptocurrency to new highs in Q2.

SUI Reclaims Key Breakout Level

Today, SUI, one of the cycle’s leading tokens, retested the $2.60 resistance for the first time in nearly three weeks after reclaiming a key support zone on Tuesday. The cryptocurrency has lost several crucial levels during the Q1 2025 retraces, falling over 50% from its January all-time high (ATH) to a four-month low of $1.96.

However, it has regained momentum amid institutional adoption, including its partnership with World Liberty Financial (WLFI), US President Donald Trump’s crypto venture, and Canary Capital’s recent filing of a Form S-1 for an SUI spot exchange-traded fund (ETF) with the US Securities and Exchange Commission (SEC).

The cryptocurrency moved toward the $2.45 mark in the following days, suggesting that holding this level could send SUI to the next crucial barrier. After pulling back to $2.20, the token’s momentum resumed on Saturday, rising 13% in the past week after printing five consecutive green candles.

Amid its performance, some analysts noted that SUI reclaimed the key $2.40 support, which served as a significant resistance during the post-US elections breakout and a bounce zone during the February retraces.

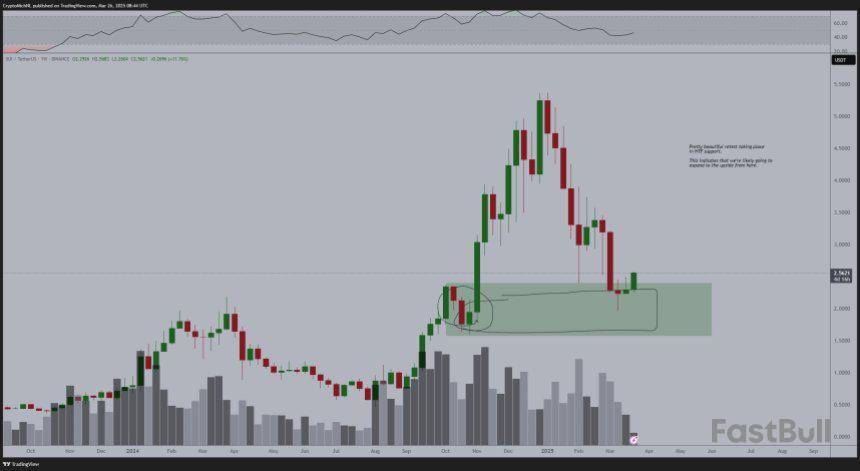

Analyst Michäel van de Poppe suggested that the token is “one to keep an eye on,” highlighting that the “tremendous” retest of the high timeframe support “indicates that we’re likely going to expand to the upside from here.”

Is It Ready For New Highs?

In the past 24 hours, SUI surged 10% to the $2.60 resistance, hitting a 20-day high of $2.65 on Wednesday before retracing. As various market watchers pointed out, this price action has seen the token break out of a multi-month falling wedge pattern.

A retest and confirmation of the breakout level could propel the token to attempt to reclaim its two-month downtrend. Analyst Sjuul from AltCryptoGems considers that the cryptocurrency should be “ready to go” to the $2.80 mark, based on its “bullish market structure and nice strength.”

Previously, Ali Martinez suggested that after reclaiming the $2.45 level, SUI would be poised for a 15% move to this area.

Moreover, the token could also surge toward a new high if history repeats itself. Since 2023, SUI has broken out of a multi-month falling wedge twice, in October 2023 and August 2024, which propelled the cryptocurrency to new ATHs in the coming months.

Meanwhile, trader Crypto Bullet noted that the cryptocurrency has recently reclaimed the 365-day Exponential Moving Average (EMA) after trading below it over the past few weeks. According to the trader, holding this level as support could impulse the token’s rally toward its January high of $5.37.

As of this writing, SUI trades at $2.58, a 5.5% increase in the daily timeframe.

As the new month nears its close, the cryptocurrency market has begun to recover, and the leading crypto asset, Bitcoin, has made a slow but progressive upward run, briefly tapping $88,350.

The bullish uptrend reflects stability in momentum. Two weeks prior, Bitcoin traded at $77,500 as the global cryptocurrency market continued to record losses. Bulls quickly pulled the asset back up after the local bottom was recorded while buyers dominated the market.

Notably, data from Santiment shows a spike in the total number of wallets holding 100 to 10,000 BTC. This new development coincides with Bitcoin’s upward movement, indicating that whale accumulation might reflect renewed demand and an uptick in positive sentiment.

Similarly, Bitcoin miners, another key demographic in the market, have clung tight to their holdings. Over the past 48 hours, no significant selling activity has been recorded. Since February 26th, 2025, the Bitcoin miners’ reserve has grown exponentially, from less than $84,000 on March 6th to $98,000 on March 26th. Until whales begin selling, the current accumulation rate is an attractive indicator for Bitcoin trades and investors.

In the near term, the outlook for Bitcoin amongst key proponents is bullish, with crypto pundits eyeing $90,000 as a potential price target for the big bull.

With key resistance at $89,500 and main resistance around $90,000, a breakout might prolong the upward rally, further serving as an entry point for new buyers. With immediate support at $85,500, a break below the $83,800 key support level could pull Bitcoin to the $82,500 support area. After successfully clearing weekly losses, Bitcoin now trades at a press-time price of $87,398.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up