Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Crypto traders are always on the lookout for tokens that are trading below $1 because the one-dollar mark is often seen as an important level for many investors. Once a token starts pushing toward that point, it can build momentum both in the short and long term.

In this article, we take a look at some tokens that are still priced under a dollar but could see a lot more growth in the coming months and even into the next year.

SpacePay (SPY)

SpacePay is the first token on this list because it offers a very low entry price and also brings features that could help it stand out quickly in the crypto market as soon as its presale is completed.

Right now, the SPY token is selling for only $0.003181, and if it ever gets to $1, that would be about a 31,000% increase, which is over 310x from this point.

For anybody who joins early, that kind of move would be life-changing. Someone who puts in just $100 at this price could end up with more than $31,000 if SPY makes it to the one-dollar level.

SpacePay is trying to connect crypto with the traditional fiat system. This has always been one of the biggest gaps in the industry because people hold crypto but cannot easily spend it.

How the System Works

SpacePay works with more than 325 wallets and allows people to pay with different cryptos. It also connects with the payment systems that shops already use, so they do not need to buy new machines or learn anything complicated.

This means a shop can take crypto the same way it takes card payments. Another big feature is that SpacePay protects against price swings. The fiat value is locked at the time of payment, so merchants do not lose money if prices move.

For example, imagine you walk into a small shop and buy something. When it is time to pay, the owner lets you use your crypto wallet. You open it, scan a code, and the payment is done right away.

The owner of the store receives the money in fiat without having to worry about crypto prices changing a few seconds later. That is how simple SpacePay makes the process.

On top of that, everything is fully decentralized, which means no third party has control, and users keep their own funds safe through their wallets. Transactions are also protected by strong security, which reduces the risk of fraud.

Merchants are also attracted to SpacePay because of the cost. The fee is only 0.5% per transaction, which is lower than the industry standard. That means more profit stays with the business.

Why SpacePay Could Change the Game

SpacePay is already gaining attention and has even received industry awards for its innovation. The team has raised strong funding and is planning to expand into different regions across the world. All these moves show that it is aiming for real adoption on a large scale.

The SPY token is the heart of this project, and it comes with its own benefits. Holders can enjoy things like loyalty airdrops, early access to new features, revenue sharing, and even voting rights on platform decisions. That gives the token value beyond just being used for payments.

Because it targets both people who already use crypto and people who mainly use fiat, SpacePay has a ready market. That is why many believe adoption could be fast.

How to Join the Presale

The presale is already live, and many have joined in. At this stage, the price is $0.003181, but it is expected to increase as more stages are completed. To buy SPY tokens, users only need a wallet like MetaMask, Trust Wallet, or Coinbase Wallet.

Payments can be made in ETH, BNB, MATIC, USDT, USDC, AVAX, or even directly with a bank card. Once the presale is over, the price will not be this low again.

JOIN THE SPACEPAY (SPY) PRESALE NOW

Website | (X) Twitter | Telegram

Cardano (ADA)

Cardano has touched the one-dollar level before. The question now is if it can stay there and go higher. At the moment ADA is about $0.86.

Cardano is strong because of how it is built. It uses proof of stake, which makes it use less energy. It is also very secure. The network supports smart contracts in a way that reduces mistakes.

Cardano has a big community and a team that keeps building. That is why it is seen as one of the best coins still under one dollar.

World Liberty Financial (WLFI)

WLFI trades at around $0.2. It is the governance token for the World Liberty Financial project. Holders can vote on changes, stake for rewards, and also take part in how the platform grows.

The project is already getting noticed because it is linked to well-known people. It is also trying to become a bridge between traditional finance with decentralized finance. It is still new, but with attention like this, it could grow fast if more people start using it.

The post Best Cryptos Under $1 To Buy Now That Could See Big Gains in 2026 appeared first on 99Bitcoins.

Ether , the native cryptocurrency of the layer-1 Ethereum blockchain network, is down about 6.7% in the past 24 hours, following Friday’s market crash, showing greater price resilience than many altcoins, which crashed by over 95% in some cases.

The market crash sparked by US President Donald Trump’s tariff announcement took the price of ETH down to a low of about $3,510 on Friday, a decline of over 20% in a single day.

Price tapped the 200-day exponential moving average (EMA), a dynamic support level, before rebounding to over $3,800. The relative strength index (RSI) is also at 35, nearing oversold conditions, signaling a potential reversal to the upside.

The sudden market downturn liquidated nearly 1.6 million crypto traders, according to Coinglass. Following the market carnage, Sassal, a crypto investor, said:

Friday’s market crash represented the most severe crypto liquidation event in history, wiping away up to $20 billion in 24 hours and shaking investor confidence in the markets, as fears of a protracted trade war between the US and China gripped traders.

ETH to $5,500 next or will inbound sell pressure suppress price?

ETH is down over 22% from its all-time high of $4,957 reached in August, according to data from TradingView.

Analysts from investment research firm Fundstrat forecast that ETH could rally to a new all-time high of $5,550 after bottoming out in Friday’s market downturn.

However, potential sell pressure could keep prices down. The Ethereum exchange inflow mean, a metric that tracks the number of coins sent to exchanges for possible selling, reached 79 on Saturday, according to CryptoQuant.

This marks the highest level of ETH exchange inflows recorded in 2025. Higher exchange inflow levels can mean increased selling pressure, while reduced exchange inflows signal that investors are holding for the long term, creating a foundation for price increases.

Withdrawals from Ethereum’s staking queue also hit a record $10 billion in October, which could signal potential sell pressure from validators exiting the queue, but does not necessarily mean they will sell, analysts from market intelligence platform Nansen told Cointelegraph.

Magazine: Alibaba founder’s Ethereum push, whales are 91% of the Korean market: Asia Express

Bitcoin began October on a strong bullish note, gaining by over 12% to establish a new all-time-high price around $126,100. However, the recent days have presented a troubling amount of selling pressure, especially in the last few hours due to tariff threats from the United States’ President Donald Trump. Amidst this highly volatile environment, on-chain data has also surfaced, highlighting market whales’ confidence in the market.

Bitcoin Whales Are Holding Their Ground

In a QuickTake post on the CryptoQuant platform, a market analyst with the username PelinayPA revealed that there is very little exchange activity among the Bitcoin whales despite the recent fall in Bitcoin’s price. The premier cryptocurrency initially fell below $120,000 on Friday to find support around $116,000 before US President Donald Trump’s statement on tariffs forced a flash crash to around $101,000.

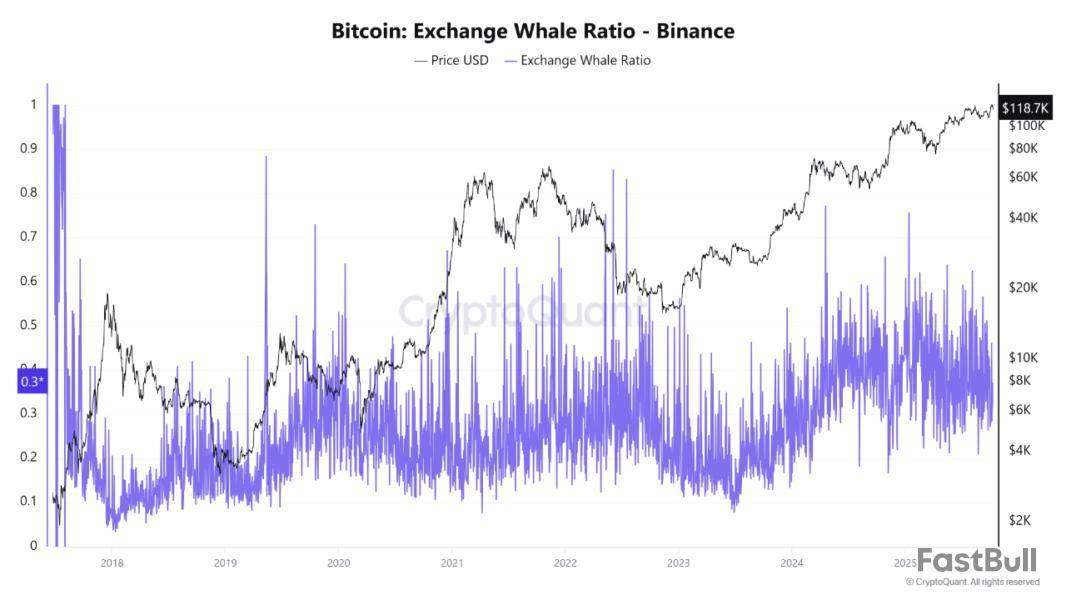

Notably, PelinayPA’s report was based on the Exchange Whale Ratio (EWR), a Binance metric, which tracks the proportion of BTC inflows to the exchanges originating from the top 10 largest addresses. This metric is useful, as it helps analysts assess if large investors are creating increased sell pressure or easing off on the bearish momentum.

A high EWR reading, of values above 0.5, typically indicates high whale inflow to exchanges, either to sell their holdings or exchange for other crypto assets. By extension, increasing exchange activity reflects on price as a boost to its bearish momentum. On the flip side, when the EWR is low, less than 0.3, it usually means that there is low whale activity across exchanges and less of the cryptocurrency is being traded by its top holders.

Interestingly, this conjecture is backed by historical occurrences. Before the 2021 bull market top, PelinayPA notes that EWR spikes were indicating that whales were preparing to sell their holdings. Nearing the end of the 2022 bear market, it is also worth noting that EWR levels were sustained beneath 0.3, showing accumulation and preparation for a bullish run.

The analyst also pointed to the EWR levels from 2024 to 2025. From 2024, “as Bitcoin’s price climbed above $100,000, EWR stabilized around 0.3 and showed fewer sharp surges,” indicating that whales might have been maintaining their positions rather than selling off their holdings. Currently, the EWR levels still stand at 0.3, amidst recent price drops reflecting the Bitcoin whales’ holding a “neutral to supportive” stance with no indication of heavy scale distribution.

What Next For Bitcoin?

Looking ahead, Bitcoin’s next move will likely hinge on how traders respond to shifting macroeconomic conditions and key technical levels. If the EWR rises toward the 0.5 zone, it could indicate growing distribution pressure, meaning that whales may begin transferring holdings to exchanges in anticipation of a market top.

However, if EWR trends lower instead, it would reinforce the current bullish structure, showing that major holders are keeping coins off exchanges and maintaining confidence in the rally. PelinayPA predicts this sustained low EWR would push Bitcoin toward the $163,000 range. Nevertheless, investors may commence profit-taking around $150,000, which represents a psychological resistance.

As of press time, Bitcoin is worth $110,517, with a significant loss of nearly 8.36% in value in just 24 hours.

Indian tax authorities are investigating more than 400 high-net-worth Binance traders suspected of evading India's relatively high crypto taxes while trading on the world's largest cryptocurrency exchange, according to a report from The Economic Times.

The traders are suspected of evading taxes on trades between 2022-23 and 2024-25, the report states, with India's Central Board of Direct Taxes asking departments in different cities to report actions by October 17 in an internal message.

Crypto traders in India face a 1% upfront withholding on each crypto transfer (credited against the final bill), plus a 30% tax on profits, with surcharge and a 4% cess that can lift the effective rate to around 42.7% for top-bracket individuals. India's Union Minister Piyush Goyal recently said the government plans to double down on its efforts to develop a central bank digital currency (CBDC), while continuing to tax non-government-backed cryptocurrencies at a high rate, The Block previously reported.

Binance was blocked from operating in India in late 2023, alongside eight other exchanges, after the country's Financial Intelligence Unit (FIU) accused the sites of operating illegally without complying with provisions of the country's Prevention of Money Laundering Act. The exchange re-entered India in August 2024, after paying a $2.25 million penalty and registering as a "reporting entity" with the FIU.

That registration set the stage for the current probe, according to the report, which argues the registration "paved the way" for Binance to share information on suspected tax evaders with the Indian government. The probe is also examining peer-to-peer payments facilitated by Binance in India but settled using domestic bank accounts, Google Pay, or cash, though the latter option was later discontinued.

Separately, Binance is working to contain the fallout from depegs in several markets, pledging to compensate traders that experienced losses as a result, as the crypto industry reels from record-high liquidations.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

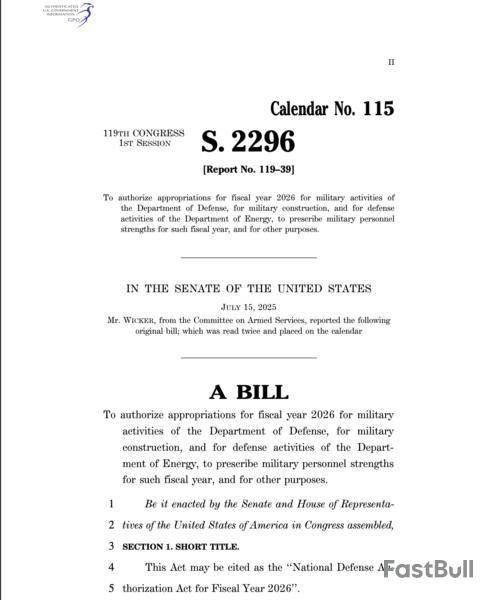

The US Senate has advanced sweeping AI legislation under the National Defense Authorization Act, compelling chipmakers to serve US customers first before exporting advanced processors abroad.

On Thursday, senators passed the Guaranteeing Access and Innovation for National Artificial Intelligence Act of 2026, or GAIN Act, as an amendment to National Defense Authorization Act, requiring AI and high-performance chipmakers to prioritize domestic orders before exporting their products.

The GAIN Act also gives Congress the right to deny export licenses for the most high-end AI processors and mandates export licenses for all products containing an “advanced integrated circuit.”

“Over the past several years, US firms have faced regular backlogs in purchasing chips. In late 2024, Nvidia’s Blackwell line was booked out roughly 12 months ahead,” according to policy advocacy group “Americans for Responsible Innovation.”

Applicants must show that all US orders have been filled before the export license will be granted under the NDAA for fiscal year 2026.

However, the GAIN AI Act is an amendment to the NDAA, and both must still be approved by the House of Representatives and signed by the president before becoming law.

This leaves the final provisions in the NDAA up to Congressional negotiation, with no guarantee that the GAIN Act will become law in its current form, or at all.

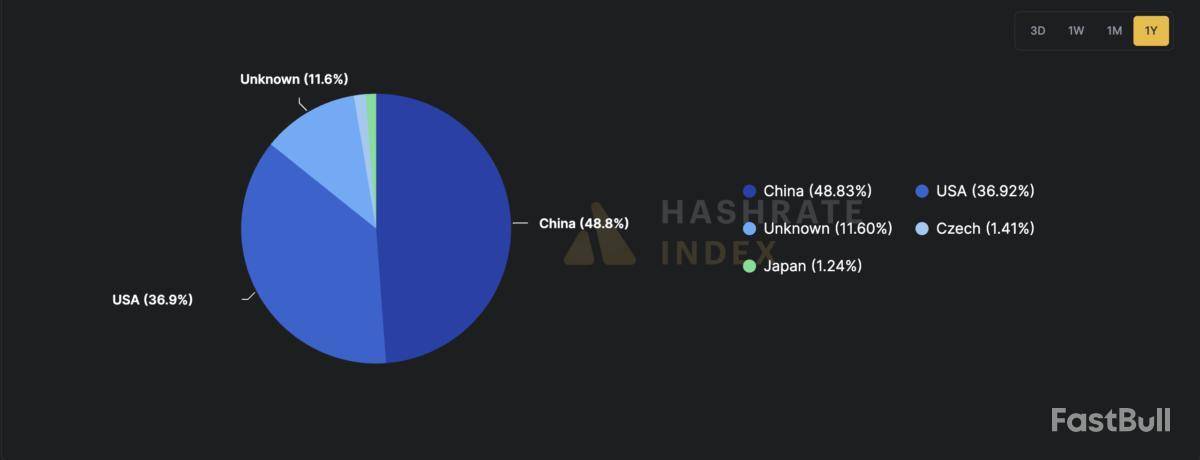

Export restrictions on artificial intelligence and high-performance computer chips could negatively impact the crypto mining industry, which is global in scope and is already feeling the economic pain from trade tensions, by making hardware harder to acquire.

Tariffs and trade wars hit the mining industry hard

The reciprocal trade tariffs announced by US President Donald Trump in April sent crypto prices crashing and created more challenging conditions for the highly competitive mining industry.

Crypto mining hardware manufacturing relies on international supply chains that are now subject to tariffs, which raises the cost of hardware and reduces miner profitability.

CleanSpark, a US-based mining company, faced $185 million in liabilities in July after the US Customs and Border Protection (CBP) claimed some of the mining hardware ordered by the company originated in China.

IREN, another crypto miner in the US, faced a $100 million bill due to claims that the hardware was subject to increased trade duties.

The tariffs could also lower mining hardware prices outside the US, leaving US-based miners at a competitive disadvantage and eroding the United States’ share of global hashrate, the amount of computing power dedicated to securing crypto networks.

Losing hash power would undermine the Trump administration’s stated goal of transforming the US into the crypto capital of the world.

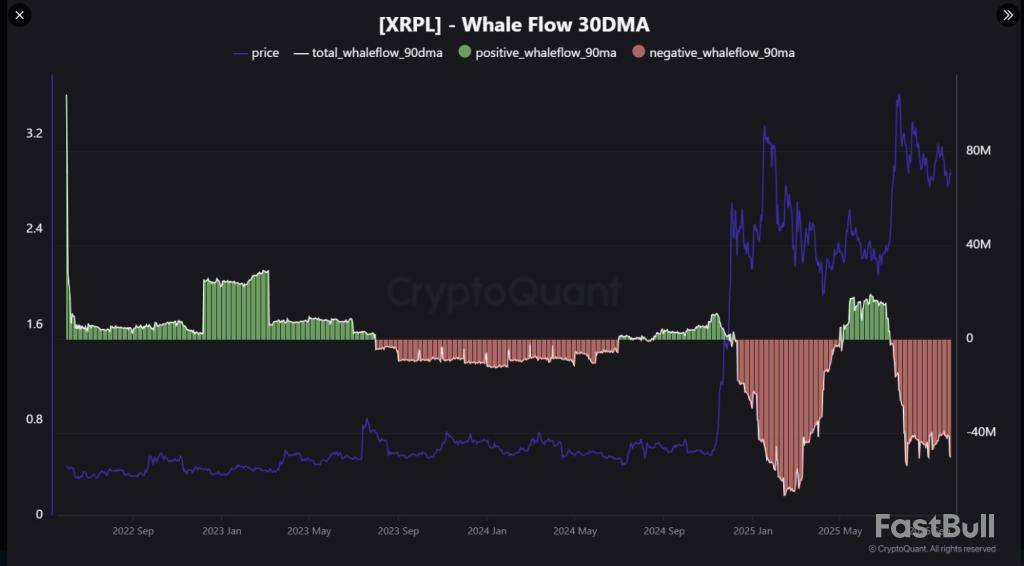

XRP is under renewed selling pressure after data showed big holders are moving large sums out of the market.

According to CryptoQuant analyst Maartunn, on average whales have been net moving about $50 million per day away from XRP holdings. That flow has coincided with renewed price weakness and sharper swings than seen in recent weeks.

Price Slips After Early October Rally

After pushing above $3.00 on October 3, XRP slid back sharply. Reports show the token fell below $2.50 roughly a week later.

Since that dip the highest print has been $2.83, while XRP is trading near $2.40 at the time of reporting. Price action has been mixed over different horizons — XRP is down about 20% over the last seven days but remains in the green on the 14-day chart.

Maartunn@JA_MaartunOct 10, 2025JUST IN: $XRP whales are offloading

Whale Flow (30DMA): -$50M/day.

Sell pressure persists. pic.twitter.com/Hcnys9vCCV

Whale Flows Turned Negative After Accumulation

According to on-chain data shared by Maartunn, whale flow measured on a 30-day moving average swung from positive to negative across the past year.

During 2022 and into early 2023, large transfers suggested accumulation, a period that tracked with relative price calm. Mid-2023 through the first three quarters of 2024 showed a clear negative trend in whale flow, and that pattern returned in force after a later surge in inflows.

Reports have disclosed that the most extreme negative reading on the chart appeared during a price spike in mid-January, when XRP reached as high as $3.4 on January 16, 2025, and large holders took profits. Accumulation On Dips, Profit-Taking On Rallies

The on-chain picture is not uniform. There was a brief window of accumulation in April when XRP slid toward the $2 support level. That buying continued into late June as the token recovered above $2.

Following that recovery, selling pressure resumed as holders locked in gains. The current 30DMA reading sits near negative $50 million per day, a sustained net outflow that signals distribution by some big accounts.

Patrick L Riley@Acquired_SavantOct 10, 2025If we close over $3.1150 by Sunday, it’ll be the most bullish $XRP weekly candle in history.

Market Reaction And Possible Paths

What this means for price is not set in stone. Continued heavy selling into thin bids could push XRP lower toward nearby supports around $2.20 to $2.50. On the other hand, if buyers step in and absorb the outflows, XRP could trade sideways with sharp intraday swings.

Based on reports, veteran investor Patrick L. Riley added a conditional bullish note: a weekly close at $3.11 would produce a very strong weekly candle and could attract fresh demand. That scenario would require meaningful buying to overcome current selling by large holders.

Featured image from Meta, chart from TradingView

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up