Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

CME Group, a leading derivatives provider, has announced the launch of cash-settled XRP futures. This cryptocurrency-tied derivative product will be launched on May 19 after necessary regulatory approvals. It’s also worth noting that CME successfully launched Solana futures last month.

Ever since the appointment of Donald Trump as the president, there has been an increase in derivative offerings tied to cryptocurrencies.

Keep reading to learn more about the growing trend of crypto trading products and which is the best crypto to buy now to make the most of this unique opportunity.

The Trend of Crypto Products

CME has seen tremendous growth in derivative trading during the first quarter of 2025.

The company reported an average daily volume of 198K crypto contracts with a notional value of around $11.3B. A large part of this volume consisted of micro Ether features and micro Bitcoin futures.

CME now wants to double down on this demand through its new XRP derivative product.

XRP has also shown stability during the past two months. Although it tested its support at $1.73 during the first week of April, it did not breach it. Since then, it has shown a steady increase of 33% and is currently trading at $2.168.

Increasing Confidence in Bitcoin

Bitcoin has also started showing signs of strength since last week. For the first time in seven weeks, it breached the $95K level and has been able to hold it since. $BTC is now trading around $94K, preparing to reclaim its high.

The king crypto is showing a picture-perfect bounce from the 50% Fibonacci level, which is also a major support zone. What’s more, the price is now above the 50, 20, and 10 EMAs, showing massive bullish momentum.

Plus, there’s a huge pile of crypto-pegged ETF applications pending with the SEC. Ever since the first Bitcoin ETF was approved in January 2025, the SEC has seen applications for Solana ETFs, Litecoin ETFs, XRP ETFs, and more.

Trump also announced the formation of a US Bitcoin reserve, which triggered a global race among countries to hoard the asset. These macro- and microeconomic factors are surely a big positive for the crypto market as a whole. A favorable administration will ease out the regulations around crypto and help it become mainstream in the next few years.

All this means that this is the right time to invest in crypto. To help you get started, here are three of the best altcoins right now.

1. BTC Bull Token ($BTCBULL) – Best Crypto to Buy In 2025

BTC Bull Token ($BTCBULL) is probably the best crypto to invest in if you want to maximize your earnings from the upcoming Bitcoin (and crypto) bull run.

That’s because it’s the ONLY crypto to offer free (and real) $BTC airdrops to its token holders. The airdrops will take place every time Bitcoin reaches a new landmark number, such as $150K, $200K, and $250K.

So, if you believe in Bitcoin’s lofty price predictions, you’d want to hold onto your $BTCBULL tokens – and remember to store them in Best Wallet to be eligible for free $BTC.

We read through BTC Bull Token’s whitepaper and found that the developers have decided upon a deflationary approach, which, too, is based on Bitcoin’s price. Every time $BTC rises by $25K (so $125K, $150K, $175K, and so on), a part of the total supply of $BTCBULL tokens will be wiped off.

Because there will be fewer tokens in circulation, especially if Bitcoin climbs quickly, it will crank up $BTCBULL’s demand and, therefore, its price.

The best part is that you can grab this one-of-a-kind Bitcoin-themed altcoin for just $0.00248. That’s because the project is in presale, where it has so far raised over $5M. Here’s how to buy $BTCBULL.

2. Solaxy ($SOLX) – Top New Altcoin Revolutionizing the Solana Blockchain

Solaxy ($SOLX) is right at the heart of Solana’s potentially bright future. After all, this new cryptocurrency is going to build the first-ever Layer 2 scaling solution on the network.

Albeit successful, the launch of $TRUMP and $MELANIA earlier this year overloaded Solana.

As a result, the blockchain has been struggling to process transactions in a timely fashion. There’s congestion on the network and, of course, scalability issues.

However, with Solaxy being a multi-chain token, it will blend Solana’s high speed and low fees with Ethereum’s vast liquidity pool.

Solaxy’s main plan of action, though, is offloading a bunch of transactions from Solana’s mainnet onto a sidechain to reduce the burden on the network as a whole. Furthermore, Solaxy will also process its share of the transactions in batches – rather than one by one. This will further improve Solana’s affordability.

With nearly $32M in early investor funding, Solaxy is easily the best crypto presale on the market right now. Join the bandwagon for just $0.001706 per token. For more help, check out our guide on how to buy Solaxy.

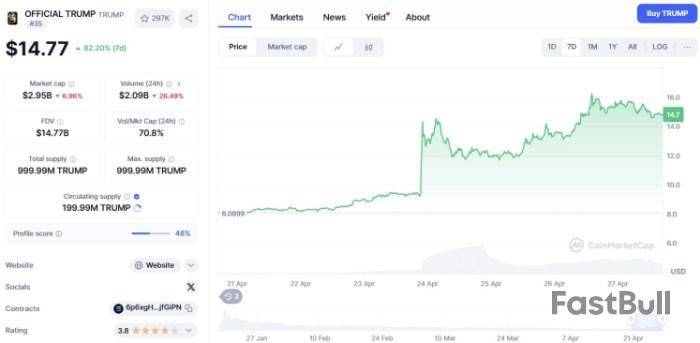

3. OFFICIAL TRUMP ($TRUMP) – One of the Hottest Cryptos Right Now

OFFICIAL TRUMP ($TRUMP) is back among the top trending cryptos thanks to a mind-blowing announcement last week.

It said that the top 220 $TRUMP holders will be invited to dinner with none other than Donald Trump himself.

$TRUMP is up over 80% in the last seven days. Its newfound momentum could easily see it break the next major resistance zone of around $23-$24.

If that happens, it would result in a gain of over 160% from its current price of $14.77.

It’s worth noting that with nearly $3B in market capitalization, $TRUMP is not just the best PolitiFi crypto going around, but it’s also the fourth biggest meme coin. It’s behind only $DOGE, $SHIB, and $PEPE.

Even the Best Crypto to Buy Now Rely on the Market’s Favor

The crypto market’s expansion, thanks to friendly regulations and new trading products, is certainly positive news if you’re an investor.

However, bear in mind that this market is highly volatile, meaning it can switch trends quicker than you realize.

Therefore, we recommend only investing an amount that’s small enough for you. Also, you must do your own research before investing – this article isn’t a substitute for financial advice.

In an Apr. 20 post on X, Kiyosaki wrote, “BITCOIN is $84k today. Strongly believe Bitcoin will reach $180k to $200k in 2025.” Five days later, BTC was trading above $93,600.

BITCOIN is $84k today. Strongly believe Bitcoin will reach $180k to $200k in 2025.

What do you think?

— Robert Kiyosaki (@theRealKiyosaki) April 20, 2025

Earlier, on Apr. 18, the “Rich Dad, Poor Dad” author predicted thatBitcoin’s pricewill eventually skyrocket to $1 million. His related price predictions spelled doom for the dollar’s buying power:

“I strongly believe, by 2035, that one Bitcoin will be over $ 1 million dollars. Gold will be $30k and silver $3,000 a coin.”

“People who heeded my warnings are doing well today. I am concerned for those who did not,” wrote Kiyosaki in the long-form X update. He warned, “This coming Great Depression will cause millions to be poor… and a few who take action may enjoy great wealth and freedom.”Dire Economic Straits and Enterprising Bitcoin Investors

Kiyosaki isn’t a contrarian voice to warn of a difficult economic downturn ahead. Federal Reserve Chair Jerome Powellwarned inApril that the US could soon be mired in a stagflationary period of low growth and rising prices.

Kiyosaki is also not the only financial expert who has predicted that Bitcoin’s price will reach $1 million.

In fact, his timeframe for it is conservative compared to Twitter founder Jack Dorsey’s, whopredicted a$1 million BTC price by 2030 in May last year.

But, Kiyosaki is firmly in the high-conviction column for Bitcoin’s potential upside prices five and ten years from now. Here’s how some of his classic investment advice applies to BTC.1. Kiyosaki on Income vs. Wealth

“The rich focus on their asset columns while everyone else focuses on their income statements.”

In his New York Times bestseller on personal finances and building wealth, Kiyosaki makes an important distinction between wealth and income. He points out that income takes most of your time and effort to sustain, but that wealth sustains your income automatically.

This means even high-income individuals can struggle under equally big spending routines and borrow money at substantial interest rates to maintain a certain way of living.

Thus, not long ago, PYMNTS and the Lending Club found in a survey that about 50% of Americans with six-figure incomes may be living paycheck to paycheck.

In April, the Philadelphia Federal Reserve said that late credit card payments and minimum payments are at the highest level since 2012.

Individuals and households with these spending routines are swimming in the opposite direction of the macro financial currents of the past ten years, as the voracious Bitcoin hoarders.

Managing finances this way is bargaining a harder tomorrow for an easier today. But the way frugal and thrifty saver/investors budget is bargaining a harder today for an easier tomorrow.2. ‘Rich Dad, Poor Dad’ on Investing

“You must know the difference between an asset and a liability and buy assets. An asset puts money in your pocket. A liability takes money out of your pocket.”

Kiyosaki also discerns between assets and liabilities in an individual or household’s financial balance book. In his opinion, houses should not be considered assets because they cost money to maintain and finance.

During the US housing market boom that preceded the 2008 financial crisis and the great recession, conventional financial wisdom said to buy a house because its value would continue going up forever.

But starting in 2007, a mass wave of defaults and foreclosures crashed house prices. Bitcoin launched soon after that to create a space in the financial ecosystem based on settlement instead of lending.

Instead of paying future obligations to consume more today, as with housing loans, Bitcoin is like collecting future rewards by consuming more efficiently today and buying BTC with the savings.

If it continues to appreciate in value due to its scarcity and global popular demand, it will remain an asset rather than a liability like a mortgage, credit card balance, or college loan.3. Bitcoin and Financial Literacy

“Illiteracy, both in words and numbers, is the foundation of financial struggle.”

Another key point of Kiyosaki’s message in “Rich Dad, Poor Dad” was that families, schools, and the government have mostly failed to educate Americans about the basics of finance and investing.

He says that many people don’t really understand the disadvantages of borrowing money and paying interest instead of saving money and collecting returns on investments.

That kind of bad financial math doesn’t just keep many Americans out of investing in Bitcoin and cryptocurrencies. It keeps them from saving any money using any method.

Last December, a Schroders US retirement survey found that half of Gen Xers, Americans aged 44 to 59, have not done any retirement planning at all.

In the cryptocurrency social media community, users like to post, “Do your own research.” Bitcoin aficionados especially like to post, “Do the math.”

One benefit of learning about investing and doing financial math is that it can help to counteract the often more convincing pull of immediate gratification and result in healthier financial behavior.4. Household Finance, Consumer Debt, and Bitcoin

“A person can be highly educated, professionally successful, and financially illiterate. Many financial problems are caused by trying to keep up with the Joneses.”

In fact, the main thrust of Kiyosaki’s book is that he found it remarkable in the course of his life’s experiences, how blatantly neglected financial and investment thinking is among even people of high intelligence, career success, and social status.

The basics of accounting, budgeting, investing, and tax law are not learned or practiced by a shocking swath of the populace, he contends, despite the importance of these modalities to beneficial outcomes that people desire.

If most people cannot be bothered to devote two to three hours a week to learning and eventually mastering these reliably rewarding and basic areas of competency, then it’s no mystery why Bitcoin remains inaccessible to many because it sits well enough beyond their threshold for healthy curiosity.

The Bitcoin price has been in a red-hot form over the past two weeks, leading to talks of the premier cryptocurrency reclaiming the significant $100,000 mark. Interestingly, the latest on-chain data suggests that the price of BTC could fly past this level and forge a new all-time high over the coming weeks.

What Will Happen If Bitcoin Price Falls Beneath $93,145?

In an April 26 post on X, popular crypto analyst Ali Martinez shared an exciting analysis and projection for the Bitcoin price over the next few weeks. According to the online pundit, the flagship cryptocurrency could be on its way to as high as $131,800 so long as it stays above a critical support level.

This projection is based on the Short-Term Holder (STH) Cost Basis, which measures the average price at which recent investors — typically defined as wallets holding Bitcoin for less than 155 days — acquired their coins. This metric often offers insight into the sentiment of short-term investors and can act as a relevant psychological support or resistance level.

When the Bitcoin price is above the STH Cost Basis, it typically signals bullish momentum among short-term market participants. On the other hand, a sustained break beneath this metric could trigger increased selling pressure, as short-term holders are known for their speculative and reactive nature.

According to data from Glassnode, the Short-Term Holder Cost Basis currently stands around $93,145, which represents a crucial support level for the Bitcoin price. Martinez noted that the premier cryptocurrency needs to hold above this support to make a run to a new all-time high price of $131,800.

However, Martinez warned that if the Bitcoin price fails to defend the $93,145 support cushion, this could open the door to a broader correction. In this case, the market leader may suffer a deep price pullback toward the next major support level around $71,150 — an almost 25% decline from the current price point.

As of this writing, the price of Bitcoin stands around $94,410, reflecting a 0.6% decline in the past 24 hours. According to data from CoinGecko, the premier cryptocurrency is up by more than 10% on the weekly timeframe.

Could BTC Whales Provide The Needed Bullish Impetus?

In a separate post on X, Martinez revealed that the Bitcoin whales have been getting busy in the market, loading up their bags following the recent price rally. Whales are significant market participants due to their substantial holdings and also their often informed trading decisions and positions.

Data from Santiment shows that Bitcoin whales (holding between 1,000 – 10,000 coins) bought over 20,000 BTC in the last 48 hours. With this increased buying activity from large investors, the Bitcoin price might get the needed momentum to attempt a run at a new all-time high.

Shiba Inu has encountered a significant obstacle, and its holders could not have timed it worse. According to recent on-chain data, SHIB is currently up against an incredible resistance wall of 533 trillion tokens. SHIB's momentum is already suffering greatly as a result of the selling pressure from both whales and ordinary holders at this crucial level, which is around the $0.000015 mark.

SHIB made a bold attempt to break through the 200 EMA, a crucial indicator that traders use to identify significant trend changes based on the most recent price action. However, as sellers flooded the market, the rally was abruptly put on hold. Indicating that bullish efforts might be short-term exhausted, the asset fell back from its peak. It is similar to what the on-chain volume analysis shows. Chart by TradingView">

The Global In/Out of the Money metric indicates that a sizable group of addresses purchased SHIB tokens at or close to the $0.000017 level. The token is under tremendous downward pressure as a result of many holders hurrying to sell and leave their positions as prices approach those breakeven points. SHIB's capacity to continue its recovery may be seriously hampered by this enormous resistance.

Currently over 81% of SHIB holders are out of the money — that is holding at a depreciation. In this case, selling pressure usually increases as soon as they have a chance to reduce their losses due to even a small rally. The asset is likely to continue to be under a lot of pressure unless SHIB can find a way to break through this massive wall of sell orders, which would call for an unexpected surge in purchasing power.

SHIB might return to earlier support levels around $0.000013 or even lower if it is unable to make a clear break above $0.000015. Both whales and ordinary investors are currently up against a difficult opponent. The outlook for SHIB appears bleak unless there is a significant shift in the market.

Bitwise CEO Hunter Horsley is adding new fuel to the conversation with a headline-grabbing projection: a $50 trillion valuation for Bitcoin , if the leading cryptocurrency steps fully into the role of a digital alternative to the U.S. dollar.

The essence of Horsley's message is that he sees Bitcoin not just as digital gold — a comparison that caps its market potential around $23 trillion — but also as a contender against global instruments like the U.S. Treasuries and the dollar itself, markets that combined hover around $50 trillion.

That’s the scale Bitcoin could be playing at, if the world continues to move toward digital value storage, the fund's head thinks.

It’s not the first time Horsley has painted a bullish picture for Bitcoin’s future, and it fits neatly with Bitwise’s positioning. Under his leadership, the company’s flagship Bitcoin ETF (BITB) holds over 39,000 BTC, currently valued at roughly $3.67 billion.

Hunter Horsley@HHorsleyApr 26, 2025Bitcoin is an apolitical, digital monetary asset.

The right comparison may be not just Gold (~$23T) —

But also Treasuries and USD (~$50T).

When people want to digitally store value, the latter is often the way.

The confidence, it seems, is not just rhetorical — it’s on the balance sheet. What’s interesting is how this prediction syncs with recent market behavior. Bitcoin’s price action has been increasingly tied to movements in global M2 liquidity.

Investors expecting a classic Bitcoin boom cycle based on halvings and hype got something more complex instead: the cryptocurrency behaving like a macroeconomic asset, riding global money supply shifts.

If the cryptocurrency is starting to move in tandem with global liquidity trends, it doesn’t just tell a story of crypto enthusiasm — it hints at Bitcoin’s gradual absorption into the mainstream financial system.

Whether or not the $50 trillion scenario materializes, one thing is clear — BTC is no longer just competing with gold or chasing tech stock returns. It’s positioning itself inside the heart of global finance. The real question now: How many investors are ready to bet on that?

AscendEX hosts an AMA with AB DAO, providing a platform to discuss project updates and gain insights. This event includes a giveaway of 50,000 AB tokens to 20 participants, which could stimulate short-term interest and trading activity. While the impact on long-term prices might be limited, increased attention and potential new investors could temporarily drive up demand. Observers should listen in on the AMA for any important announcements that could significantly affect the token's future value. source

AscendEX@AscendEX_Apr 27, 2025Set Your Reminder!

Don't miss out on our upcoming AMA with @ABDAO_Global! We’re giving away 50,000 $AB to 20 lucky winners!

Join us on 28th April at 11:00 AM UTC https://t.co/syHI0RrXsP

Ankr is featuring Story in their Partner Spotlight event, focusing on AI and intellectual property. Such events can highlight the unique value proposition of Story, attracting potential investors interested in the merging fields of AI and blockchain. However, the direct price impact will depend on the viewer's reception of the concepts discussed. Positive sentiment and engagement during and after the event could lead to a rise in trading and possibly the token's price. Staying updated on the event's outcomes is recommended. source

Ankr@ankrApr 25, 2025️ On this episode, @devrelius will joining @Sergioankr and delving into delving into AI X IP, and we're very excited to hear what nuggets of wisdom he has to share on the subject.

May 1, 2025 at 6 PM CET

Set your reminder here: https://t.co/F29tHnDSVr

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up