Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Bank of Canada released the following statement on Wednesday:"The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%.

The Bank of Canada released the following statement on Wednesday:

"The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%.

"The major shift in direction of US trade policy and the unpredictability of tariffs have increased uncertainty, diminished prospects for economic growth, and raised inflation expectations. Pervasive uncertainty makes it unusually challenging to project GDP growth and inflation in Canada and globally. Instead, the April Monetary Policy Report (MPR) presents two scenarios that explore different paths for US trade policy. In the first scenario, uncertainty is high but tariffs are limited in scope. Canadian growth weakens temporarily and inflation remains around the 2% target. In the second scenario, a protracted trade war causes Canada’s economy to fall into recession this year and inflation rises temporarily above 3% next year. Many other trade policy scenarios are possible. There is also an unusual degree of uncertainty about the economic

outcomes within any scenario, since the magnitude and speed of the shift in US trade policy are unprecedented.

"Global economic growth was solid in late 2024 and inflation has been easing towards central bank targets. However, tariffs and uncertainty have weakened the outlook. In the United States,

the economy is showing signs of slowing amid rising policy uncertainty and rapidly deteriorating sentiment, while inflation expectations have risen. In the euro area, growth has been modest in early 2025, with continued weakness in the manufacturing sector. China’s economy was strong at the end of 2024 but more recent data shows it slowing modestly.

"Financial markets have been roiled by serial tariff announcements, postponements and continued threats of escalation. This extreme market volatility is adding to uncertainty. Oil prices have declined substantially since January, mainly reflecting weaker prospects for global growth.

Canada’s exchange rate has recently appreciated as a result of broad US dollar weakness.

"In Canada, the economy is slowing as tariff announcements and uncertainty pull down consumer and business confidence. Consumption, residential investment and business spending all look to have weakened in the first quarter. Trade tensions are also disrupting recovery in the labour market. Employment declined in March and businesses are reporting plans to slow their hiring. Wage growth continues to show signs of moderation.

U.S. retail sales surged in March as households boosted purchases of motor vehicles ahead of tariffs, though concerns about the economic outlook are hurting discretionary spending.

Retail sales increased 1.4% last month after an unrevised 0.2% rise in February, the Commerce Department's Census Bureau said on Wednesday. Economists polled by Reuters had forecast retail sales, which are mostly goods and are not adjusted for inflation, accelerating 1.3%.

President Donald Trump's 25% global car and truck tariffs came into effect in early April, with industry analysts and manufacturers warning that the duties would significantly raise motor vehicle prices.

Motor vehicle manufacturers reported a big jump in auto sales in March, attributed by some to a rush by buyers "to try and beat the tariffs."

Consumers are also stocking up on other imported goods. Bank credit and debit card data suggest spending continues to be driven by high-income households with low-income consumers struggling. There is less discretionary spending, which is mostly on services, the main engine of the economy.

With the stock market selling off as the import duties stoke fears of inflation and stagnation in economic growth or even a recession, there are concerns high-income households could start retrenching if the values of their investment portfolios continue to shrink.

Consumer sentiment is near three-year lows, with 12-month inflation expectations the highest since 1981. Mass layoffs of public workers as part of an unprecedented campaign by the Trump administration to downsize the federal government are also weighing on morale and could be a potential drag on spending.

"Bank of America card data indicates that 'nice-to-have' discretionary services spending eased in March, while more inflation-driven spending on necessities such as insurance, rent and utilities continues to rise," Bank of America Institute said in a note.

Retail sales excluding automobiles, gasoline, building materials and food services rose 0.4% in March after an upwardly revised 1.3% advance in February. These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product.

Economists had forecast core retail sales rising 0.6% after a previously reported 1.0% jump in February.

Despite the strength in core retail sales in the last two months, economists expect consumer spending slowed considerably in the first quarter because of sluggish outlays on services.

Consumer spending, which accounts for more than two-thirds of the economy, grew at a 4.0% annualized rate in the October-December quarter.

Economic growth estimates for the first quarter are mostly below a 0.5% rate. The Atlanta Federal Reserve is currently forecasting GDP contracting at a 0.3% pace after adjusting for imports and exports of gold. The economy grew at a 2.4% pace in the fourth quarter.

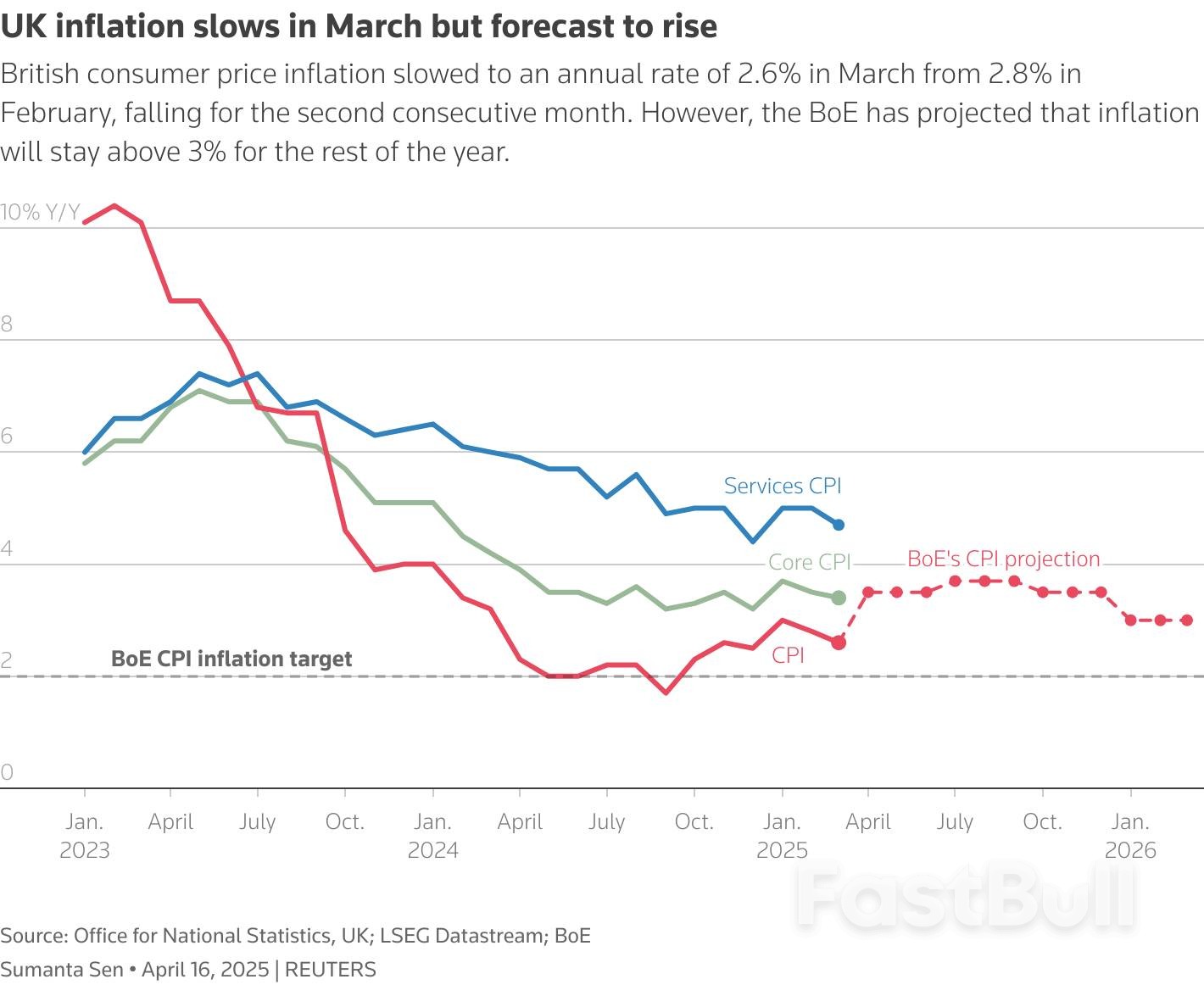

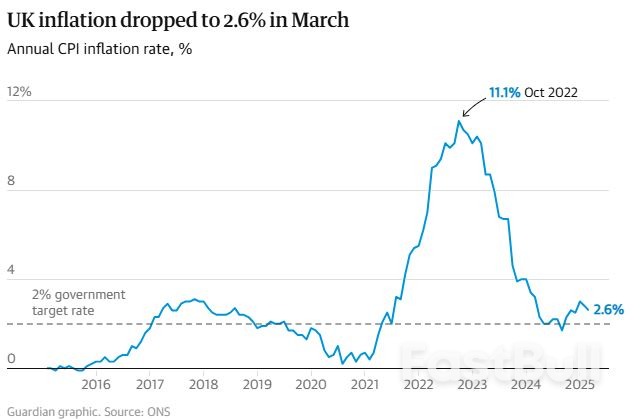

The line chart shows inflation, core inflation and services inflation in Britain from January 2023 to March 2025.

The line chart shows inflation, core inflation and services inflation in Britain from January 2023 to March 2025. Above: GBP/EUR at 15-minute intervals with ICE US Dollar Index. Click for closer inspection.

Above: GBP/EUR at 15-minute intervals with ICE US Dollar Index. Click for closer inspection.

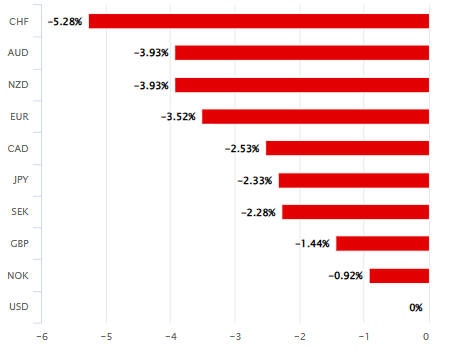

Above: US Dollar performance relative to G10 currencies for the week to Friday, 11 April.

Above: US Dollar performance relative to G10 currencies for the week to Friday, 11 April.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up