Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

DeFi protocol Balancer has published its preliminary incident report on the Nov. 3 exploit that drained tens of millions from its Composable Stable Pools (CSPs) across multiple networks, including Ethereum, Base, Avalanche, Arbitrum, Optimism, Gnosis, Polygon, Berachain, and Sonic.

As The Block previously reported, the decentralized automated market maker (AMM) and liquidity platform suffered massive outflows from its vault. Initial estimates of the loss quickly rose from around $70 million to over $128 million within a few hours, blockchain analytics providers like Nansen and Peckshield reported.

According to Balancer, its security partner Hypernative first detected the suspicious activity early Monday. Several contributors and whitehat responders, such as SEAL 911, BitFinding, and StakeWise, were then contacted to help stem the bleed.

Root cause: rounding flaw in swap logic

In its preliminary report, Balancer attributed the exploit to a rounding error in the upscale function for EXACT_OUT swaps within the v2 vault’s batchSwap feature. This function allows users to combine multiple swap operations into a single transaction to save gas.

Attackers exploited how deferred settlement was implemented in composable pools, which allowed liquidity to fall below minimum thresholds, the team explained. Specifically, the bug occurred when non-integer scaling factors caused the system to round down during specific calculations, creating small discrepancies that the attacker leveraged to manipulate balances and drain value.

In many instances, funds were first redirected into the Balancer Vault’s internal balances before being withdrawn through follow-up transactions. The bug primarily affected Composable Stable v5 pools with expired pause windows, while Hypernative’s emergency automation automatically paused v6 pools.

“The incident was limited to Composable Stable Pools on Balancer v2 and its forks on other chains such as BEX and Beets,” Balancer wrote. “Balancer v3 and all other pool types remain unaffected.”

Meanwhile, CSPv6 pools were automatically transitioned into recovery mode under emergency controls.

Multi-chain impact and recovery

Balancer said the attack spanned several networks and forks, including BEX on Berachain, Beets on Sonic, and Gnosis-based deployments. However, ecosystem partners initiated emergency actions to contain the fallout. StakeWise DAO recovered approximately $19 million in osETH and $1.7 million in osGNO, roughly 73.5% of the stolen osETH. Berachain validators halted the network to perform an emergency hard fork addressing BEX’s v2 exposure, which was completed on Nov. 4.

Also, Sonic Labs froze suspected attacker addresses, restricting fund movements tied to its Balancer fork. Gnosis temporarily restricted bridge activity to prevent cross-chain propagation, while Monerium froze 1.3 million EURe in the affected vault.

Additionally, BitFinding and Base MEV bots recovered smaller sums — about $750,000 in total — and returned them to the Balancer DAO. The team added that a portion of the affected assets has been recovered or frozen and that a final verified accounting will be published once all partners complete on-chain reconciliation.

Balancer claims that any circulating loss figures are unconfirmed until independent verification is concluded.

Mitigations and next steps

As part of its response, Balancer has disabled the CSPv6 factory to prevent the creation of new vulnerable pools and halted liquidity gauges for affected pools to stop further emissions.

Furthermore, the team has enabled liquidity pool exits from paused pools to allow safe withdrawals.

The protocol’s Safe Harbor legal framework (BIP-726), adopted last year, allowed whitehat teams to intervene immediately without legal risk, a structure Balancer said “materially improved response speed and coordination.”

A final report, including confirmed loss and recovery figures, is expected “once all partner validations are complete,” according to Balancer’s latest update.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Samson Mow, the CEO of JAN3 and a prominent Bitcoin maximalist, is pushing back against a common misinterpretation in crypto analysis. Mow explained that coins moving on-chain are not necessarily sales.

Big take on on-chain coin movement

Typically, when crypto assets move from one wallet to another, many analysts and even media outlets automatically label it as a sales distribution. However, Mow shared a different opinion.

He noted that coins moving to exchange addresses are not necessarily sales. Mow mocked panic-driven retail investors and analysts who react to on-chain coin movement without context.

According to Mow, they lack the conviction needed to hold Bitcoin long-term if they are scared by every wallet transfer.

Mow find it hilarious that people still fall for this narrative, especially after years of proof that on-chain moves are often misleading.

Samson Mow@ExcellionNov 06, 2025Coins moving on-chain aren’t necessarily sales.

Coins moving to exchange addresses aren’t necessarily sales.

If you believe the analysts that equate any move to a sale, then you really should sell too because you don’t deserve to hold Bitcoin.

Hilarious.

In reality, coins can move for many reasons, such as security rotation from cold storage to a hot wallet. Users can also move coins to exchanges for staking, lending or yield. Furthermore, exchange transfers may be part of a structured product or ETF rebalancing.

Overall, Mow is calling out fear, uncertainty and doubt (FUD) fueled by the misinterpretation of data. In his opinion, real Bitcoiners do not flinch at wallet movement but understand that context matters.

Samson Mow's Bitcoin predictions

Mow has consistently issued bold predictions for the leading coin over the years. In one of his popular predictions, Mow suggested Bitcoin reaching the $1 million milestone.

However, amid a recent gold market sell-off, Mow noted that the $1 million BTC target cannot happen quickly. He explained that post-gold dips may spur retail panic-selling to chase crypto gains.

Mow agreed in principle about the gold flows to BTC, but he has cautioned against expecting an immediate rally.

Nonetheless, he recently put out his next BTC target at $10 million per coin. He made it sound less like a long-term dream and more like a checkpoint that will come faster than most expect.

While many think this target is overwhelming, and that is understandable, Mow has always dismissed any skepticism toward BTC.

The JAN3 CEO recently warned investors that time is running out to buy BTC below $200,000. His remarks align with BTC tightening supply. Notably, the circulating supply equates to 19.92 million BTC. This is close to the 21 million hard cap, leaving 1.1 million coins to be mined.

While crypto companies are racing to list on Wall Street, Ripple is sitting this one out. Speaking at the firm’s Swell conference in New York, Ripple President Monica Long made it clear the company has no immediate plans for an IPO.

“We do not have an IPO timeline,” Long told Bloomberg. “No plan, no timeline.”

Her words come at a time when the crypto industry is in the middle of an IPO boom. Firms like Circle, Gemini, Bullish, and Figure Technologies have already gone public this year, while Kraken and Consensys are preparing to follow.

A $40 Billion Valuation and No Rush for an IPO

Ripple is avoiding an IPO because it doesn’t need one. The company recently raised $500 million in fresh funding, putting its valuation at $40 billion. The round was led by Fortress Investment Group and Citadel Securities, with backing from Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

“We’re in a fortunate position where we’ve been able to be very well capitalized and fund all of our organic growth, inorganic growth, strategic partnerships – anything we want to do,” Long said.

That financial strength is also reflected in Ripple’s internal confidence. The company reportedly tried to buy back $1 billion worth of shares from investors but found few sellers, which is a sign that existing shareholders are holding on tight.

Ripple’s Growth Driven by Stablecoins and Partnerships

Ripple’s growth story is picking up pace. Long said the company’s customer base has doubled quarter-over-quarter, powered by the growing adoption of stablecoin payments and stronger regulatory clarity following the U.S. Genius Act.

Ripple’s RLUSD stablecoin is already making waves, crossing $1 billion in circulation within a year of launch. The company has teamed up with Mastercard, WebBank, and Gemini to test using RLUSD for credit card settlement, which could expand Ripple’s role in the payments ecosystem.

Ripple also strengthened its institutional arm by acquiring Palisade, a digital asset custody provider, to offer secure and scalable crypto services under one platform.

Staying Private in a Public Frenzy

The IPO wave sweeping across crypto is partly driven by a friendlier environment under President Donald Trump’s administration, which has eased regulatory pressure and revived investor interest.

Yet Ripple’s decision to stay private shows a confidence built on cash reserves, steady growth, and control over its own direction.

As rivals race toward public listings, Ripple seems content to focus on building.

VICTORIA, Seychelles, Nov. 6, 2025 /PRNewswire/ -- Bitget, the world's largest Universal Exchange (UEX), has seen its US Stock Futures trading volume rocket past $1 billion, doubling its momentum in just two weeks. The milestone reflects strong market adoption of Bitget's stock-linked derivatives and the growing demand for tokenized exposure to traditional financial assets.

The surge coincides with a historic rally in US equities driven by artificial intelligence advancements and a robust Q3 earnings season. Traders on Bitget have shown particular interest in AI and technology leaders, with Tesla (TSLA), Strategy (MSTR), Apple (APPL) emerging as the top three most traded assets, recording cumulative volumes of $380 million, $262 million, and $87 million, respectively.

Launched back in September, Bitget's USDT-margined perpetual futures allow traders to access derivatives on 25 leading US stocks, including Apple, Amazon, Meta, and NVIDIA, with up to 25x leverage and competitive fees at or below 0.06%. The listings offer exposure to some of the world's most influential companies across technology, finance, consumer goods, and industrial sectors, all within a crypto-native trading environment.

Building on this success, Bitget expanded its stock-linked product suite with the addition of NFLXUSDT, FUTUUSDT, JDUSDT, RDDTUSDT, and QQQUSDT stock index perpetual futures, further strengthening its portfolio of Real World Asset (RWA) products for global traders.

The introduction of Stock Futures complements Bitget's broader UEX framework, which integrates centralized, decentralized, and tokenized markets within a single platform. This approach allows users to express equity views, hedge positions, and deploy strategies within a capital-efficient, 24/7 derivatives infrastructure that retains full crypto-native execution and transparency.

As tokenization and around-the-clock trading models gain global traction, Bitget's rapid momentum underscores its leadership in shaping the future of multi-asset trading. One where stocks, digital assets, and on-chain instruments coexist seamlessly.

About Bitget

Established in 2018, Bitget is the world's largest Universal Exchange (UEX), serving over 120 million users with access to millions of crypto tokens, tokenized stocks, ETFs, and other real-world assets on a single platform. The ecosystem is committed to helping users trade smarter with its AI-powered trading tools, interoperability across tokens on Bitcoin, Ethereum, Solana, and BNB Chain, and wider access to real-world assets. On the decentralized side, Bitget Wallet runs as the leading non-custodial crypto wallet supporting 130+ blockchains and millions of tokens. It offers multi-chain trading, staking, payments, and direct access to 20,000+ DApps, with advanced swaps and market insights built-in the platform.

Bitget is driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World's Top Football League, LALIGA, in EASTERN, SEA and LATAM markets. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. In the world of motorsports, Bitget is the exclusive cryptocurrency exchange partner of MotoGP™, one of the world's most thrilling championships.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

PROVIDENCIALES, Turks and Caicos Islands, Nov. 6, 2025 /PRNewswire/ -- KuCoin, a leading global crypto platform built on trust, today announced that Shelton Qiu, former Marketing Director and Business Development Lead at SparkPool, has joined the KuPool team as Chief Operation Officer. This strategic addition further strengthens KuPool's leadership in mining capability and KuCoin's position as a comprehensive hashrate production and allocation hub.

With nearly a decade of experience in blockchain and mining, Qiu played a pivotal role in helping SparkPool become the world's largest Ethereum mining pool and maintain its industry-leading position. During his tenure, he actively contributed to technological innovation and community development, advancing the Ethereum PoW ecosystem and promoting industry knowledge sharing. At KuPool, he will leverage his deep engineering insight and operational expertise to scale Litecoin (LTC) mining hashrate, enhance system stability, and drive sustainable profitability for professional miners and institutional clients.

Qiu is also expected to play a key role in expanding KuPool's global reach, forming technical and ecosystem partnerships, and advancing product innovation across multi-currency mining—including LTC, DOGE, PEPE, Lucky, and BELLS. His leadership will accelerate KuPool's vision of building a trusted, transparent, and high-performance mining infrastructure that embodies the decentralized principles of Proof of Work (PoW).

KuPool's total mining hashrate continues to grow, with its LTC/DOGE pool consistently ranking fourth globally — a testament to its strong market reputation and robust product capabilities.

About KuPool

KuPool is a new mining pool service within the KuCoin ecosystem, dedicated to building transparent, secure, and verifiable mining infrastructure. Leveraging KuCoin's advantages in security, compliance, and asset management, KuPool offers miners a fair and trusted experience through efficient, traceable profit-sharing mechanisms and support for major and merged mining cryptocurrencies such as LTC, DOGE, PEPE, Lucky, and BELLS. With "Verified Hashing, Trusted Mining" at its core, KuPool promotes the sustainable growth of the blockchain hashrate economy.

Learn More: https://www.kupool.com/

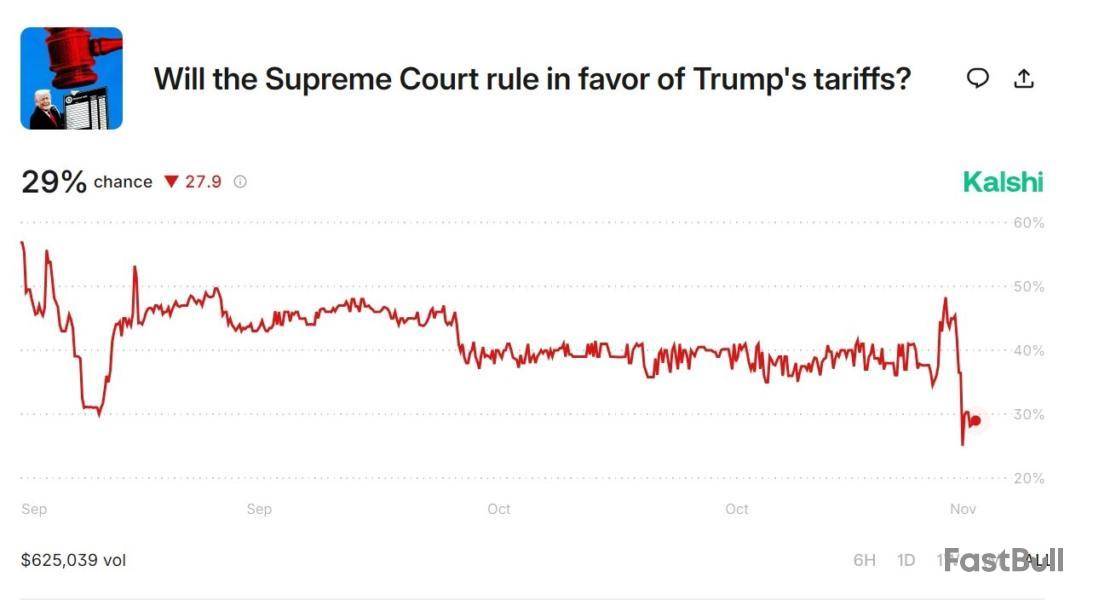

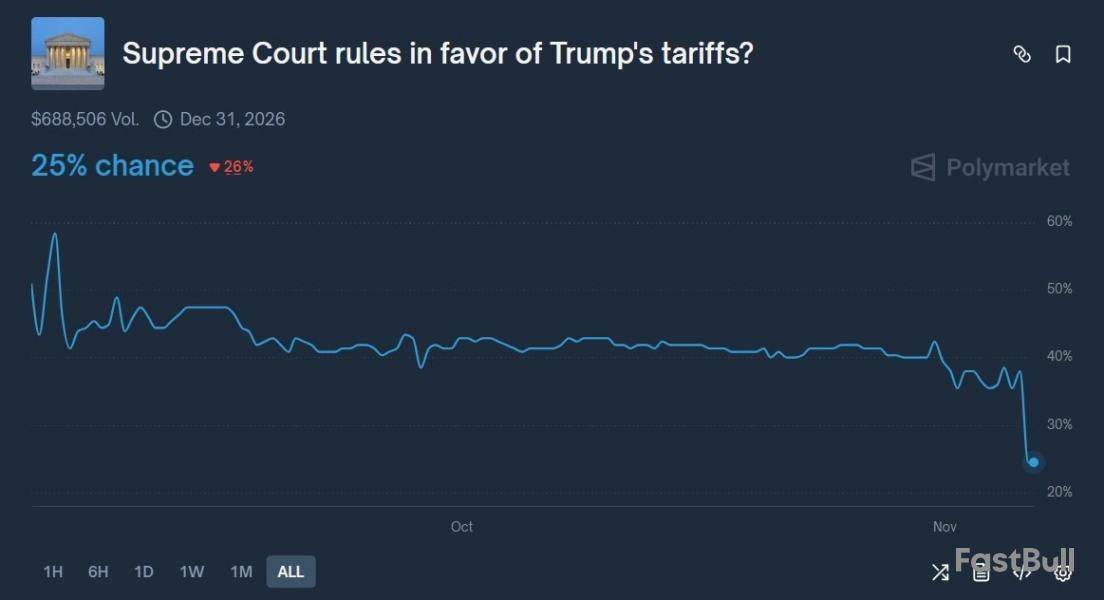

Prediction markets are signaling declining confidence that the US Supreme Court will rule in favor of President Donald Trump’s sweeping tariff powers, with traders on regulated and crypto-native platforms reducing their exposure following the week’s developments.

US-regulated event-market platform Kalshi showed Thursday that traders now assign a 29% chance that the Supreme Court will side with Trump, a 28-point drop in a single day.

On Polymarket, Kalshi’s onchain competitor, where contracts are settled in USDC (USDC), the odds fell to 25%, reflecting a similar collapse in sentiment.

The combined trading volume across both platforms surpassed $1.3 million, showing that traders participating in prediction markets can provide early indicators of sentiment linked to political and judicial outcomes.

Traders expect the court to limit Trump’s authority to impose tariffs

Both markets have been volatile since the Supreme Court agreed to hear the case in September. However, on Wednesday, the market showed the largest single-day decline since going live.

The price swing implies that traders are increasingly expecting the Supreme Court to limit the scope of presidential authority to impose tariffs under the emergency-powers law. This decision could reshape how US presidents approach fiscal leverage and trade policy.

The alignment between Kalshi and Polymarket odds highlights a growing convergence between traditional and decentralized forecasting markets, where fiat-based and blockchain-based traders interpret political risks through similar lenses of liquidity and probability.

Supreme Court justices question Trump’s tariff powers

The sell-offs followed reports that several conservative justices appeared skeptical of Trump’s claim to unilaterally impose broad import duties using emergency powers.

On Wednesday, the Supreme Court held hours of oral arguments on one of the most consequential cases of the presidential term. The case challenges whether the president can rely on a 1977 emergency law to impose tariffs without the approval of Congress.

An Associated Press report noted that even among Trump-appointed justices, concerns surfaced about the separation of powers and the risk of concentrating fiscal authority in the executive branch.

Chief Justice John Roberts, Justice Neil Gorsuch and Justice Amy Coney Barrett reportedly pressed the US government on whether the 1977 International Emergency Economic Powers Act grants such an expansive authority.

Barrett questioned why countries like Spain and France needed to be targeted, while Roberts emphasized that tariffs, as taxes, have always been the core power of Congress. Meanwhile, Gorsuch warned that allowing the executive branch such leeway could create a “one-way ratchet” toward unchecked presidential power.

Trump’s trade policies have historically influenced crypto markets. Earlier tariffs fueled inflation fears and prompted traders to treat Bitcoin (BTC) as a hedge against fiscal instability. But at times, tariff-driven uncertainty also triggered risk-off sentiment, leading to short-term sell-offs as investors rotated into safer assets.

HONG KONG, Nov. 6, 2025 /PRNewswire/ -- Cango Inc. today released a letter to shareholders at the one-year milestone of its bold transformation to a robust Bitcoin mining operation. CEO Paul Yu reflected on this milestone, emphasizing Cango's vision to deliver energy-secured HPC services. The journey began in November 2024 with Bitcoin mining as a practical entry point to secure energy access, build operational expertise, and create flexible sites for long-term goals.

In just eight months, Cango scaled to a 50 EH/s global platform by acquiring 32 EH/s of on-rack mining machines in November 2024, followed by 18 EH/s in June 2025. The company divested its China-based assets by May 2025, redirecting resources to its mining operations. A new Board and management team with expertise in digital assets, finance, and energy was onboarded to guide this ambitious transition.

The financial impact was swift. In Q2 2025, Cango reported US$139.8 million in revenue, US$99.1 million in adjusted EBITDA , and US$117.8 million in cash equivalents, driven by an asset-light model focused on operational efficiency. Cango established a new, highly competitive core business, and a scaled global footprint across the U.S., Oman, Ethiopia, and Paraguay.

This year's momentum continued with key milestones. In August 2025, Cango acquired a 50 MW facility in Georgia for US$19.5 million, strengthening operational control and securing better power terms. Hashrate efficiency surpassed 90%, and Bitcoin holdings grew to over 6,400 BTC by October 31, 2025, through a disciplined HODL strategy. To enhance capital structure, Cango will transition to a direct NYSE listing on November 17, 2025.

Looking ahead, Paul shared that Cango's Bitcoin mining foundation will fuel a dual-track expansion into energy and HPC. The company plans disciplined, phased pilots, a targeted entry into the AI HPC market, and dual-purpose energy infrastructure development, while optimizing mining operations through improved uptime, lower energy costs, and refreshing 6 EH/s of capacity.

View original content: https://ir-image.cangoonline.com/ir-documents/Cango%20Shareholder%20Letter%20202511.pdf

Investor Relations Contact

Juliet YE, Head of Communications

Cango Inc.

Email: ir@cangoonline.com

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up