Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Cathie Wood-led ARK Invest has bought more than 160,000 shares in the crypto exchange Bullish in the asset manager’s latest scoop of crypto-related stocks.

In a filing on Tuesday, the company revealed it bought around $8.21 million worth of Bullish shares across two of its funds, the ARK Innovation ETF (ARKK) and the ARK Next Generation Internet ETF (ARKW), with the funds buying up 120,609 shares and 40,574 shares, respectively.

The firm now holds over $129 million worth of Bullish stock across ARKK, ARKW, and its ARK Fintech Innovation ETF (ARKF).

ARK has backed Bullish since its debut on the New York Stock Exchange mid last month, when it acquired 2.53 million shares, worth $172 million at the time.

ARK’s latest buy aims to rebuild Bullish position

The investment firm bought $7.5 million shares in Bullish earlier this month, and had acquired $21 million worth of Bullish stock on Aug. 20.

Despite the recent buys, Ark’s total Bullish holdings across all three of its ETFs currently stand at 2.52 million shares, indicating that the firm has booked some partial profits and is now reacquiring the stock after it fell heavily since its debut.

Bullish stock declines post-IPO

Shares in Bullish (BLSH) soared on its listing day, as the stock touched an intraday high of $118, registering a gain of 218% from its IPO price of $37.

However, since its debut on Aug. 13, the stock has shed most of its gains and closed trading on Tuesday flat at $51.36, down nearly 57% from its all-time high, according to Google Finance.

The firm reported its revenue dropped 0.2% year-over-year as of the quarter ending March, while its operating income was down 270% during the same period.

Bullish is set to release its second-quarter results on Thursday, its first since its debut.

Analysts are mixed on the exchange, with some neutral while others are optimistic that it can outperform.

Last week, Jefferies initiated a “hold” rating on Bullish, while JP Morgan and Bernstein assigned a “neutral” rating, according to Yahoo Finance.

Conversely, Cantor Fitzgerald had an “overweight” rating, meaning it thinks Bullish will outperform.

Ark has been accumulating other crypto-related stocks in recent months.

It acquired a $4.4 million in BitMine on Sept. 9, which increased its total stack to 6.7 million BitMine shares worth $284 million.

The firm also bought shares of Jack Dorsey-backed financial services company Block, and held $193 million worth of Block shares on Aug. 12.

Shares of GD Culture Group plunged 28% on Tuesday following news that the company is acquiring 7,500 Bitcoin through a share-based deal with Pallas Capital Holding.

Key Takeaways:

The livestreaming and e-commerce firm in exchange for Pallas Capital’s assets, including approximately $875 million worth of Bitcoin.

The transaction, completed last Wednesday, marks a significant shift in GD Culture’s strategic direction.GD Culture CEO Says Bitcoin Deal Aims to Build Diversified Crypto Reserve

CEO Xiaojian Wang said the acquisition supports the company’s goal of building a diversified crypto asset reserve, citing Bitcoin’s increasing institutional adoption as a key driver.

Despite the bullish tone, the market responded with skepticism. GD Culture Group (GDC) stock dropped to $6.99, its steepest single-day decline in over a year, according to Google Finance.

Shares rebounded slightly in after-hours trading but remain down 97% from their February 2021 high of $235.80. The company’s market cap now sits at just $117.4 million.

Investors appear concerned about the dilution caused by the issuance of new shares. Such moves often raise red flags, particularly when linked to speculative strategies like Bitcoin accumulation.

VanEck previously warned that companies financing crypto purchases via stock offerings may erode shareholder value if their market price falls below the value of their assets.

GD Culture’s move aligns it with a growing list of “Bitcoin treasury” firms, public companies that hold BTC on their balance sheets.

JUST IN: Publicly traded GD Culture Group ($GDC) to acquire Pallas Capital Holding along with its 7,500 , positioning GDC to become one of the biggest players in BTC treasury strategy. — BitcoinTreasuries.NET (@BTCtreasuries)

This trend accelerated in 2025, with over 190 public firms now holding Bitcoin, up from fewer than 100 at the beginning of the year. The market is still dominated by MicroStrategy, which controls nearly 70% of the total.

GD Culture first revealed its crypto ambitions in May, stating plans to raise $300 million to invest in digital assets, including Bitcoin and the Trump-themed memecoin TRUMP.

The announcement came just weeks after the firm received a Nasdaq warning for falling below the $2.5 million minimum equity requirement.Strategy Tops Corporate Bitcoin Holdings with 636,505 BTC

Michael Saylor’s Strategy now holds 636,505 BTC, making it the largest corporate holder by a wide margin.

Bitcoin mining firm MARA Holdings remains in second with 52,477 BTC, after adding 705 BTC in August.

But new entrants are gaining ground. XXI, founded by Strike CEO Jack Mallers, has amassed 43,514 BTC, while the Bitcoin Standard Treasury Company holds 30,021 BTC.

Other major players include crypto exchange Bullish (24,000 BTC), Metaplanet (20,000 BTC), and publicly listed names like Riot Platforms, Trump Media & Technology Group, CleanSpark, and Coinbase.

This wave of accumulation has fueled speculation around a supply shock. With just 5.2% of Bitcoin’s fixed 21 million supply left to be mined, continued corporate demand could drive prices even higher.

Some firms are aiming much higher. Japan’s Metaplanet and U.S.-based Semler Scientific have set targets of 210,000 BTC and 105,000 BTC by 2027, ten to twenty times their current holdings.

Outside the US, 120 public companies now hold Bitcoin. Canada, the UK, Hong Kong, Mexico, South Africa, and Bahrain are among the countries where corporate BTC ownership is growing.

Ethereum treasury firm The Ether Machine announced Tuesday that it has submitted a draft registration on Form S-4 to the Securities and Exchange Commission to advance its goal to go public in the U.S.

"We're shifting into the next gear, and officially on its path to full public form," the company wrote in a post on social media platform X.

An S-4 filing is used to register securities issued in business combinations, mergers, or acquisitions. For The Ether Machine, the draft registration relates to the proposed business combination with special-purpose acquisition company Dynamix Corporation, which is trading on the Nasdaq under ticker symbol ETHM.

The Ether Machine announced the plan to go public via business merger back in July, where it stated that it expects to close the deal in the fourth quarter.

The deal, subject to customary closing conditions including Dynamix shareholder approval, will be voted on at the upcoming extraordinary general meeting, the company announced.

Meanwhile, The Ether Machine announced earlier this month that it raised 150,000 ETH for its corporate treasury in August, bringing its total holdings to 495,362 ETH. According to data from SER, The Ether Machine is currently the third largest corporate holder of ETH, behind Bitmine Immersion Tech and SharpLink Gaming.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

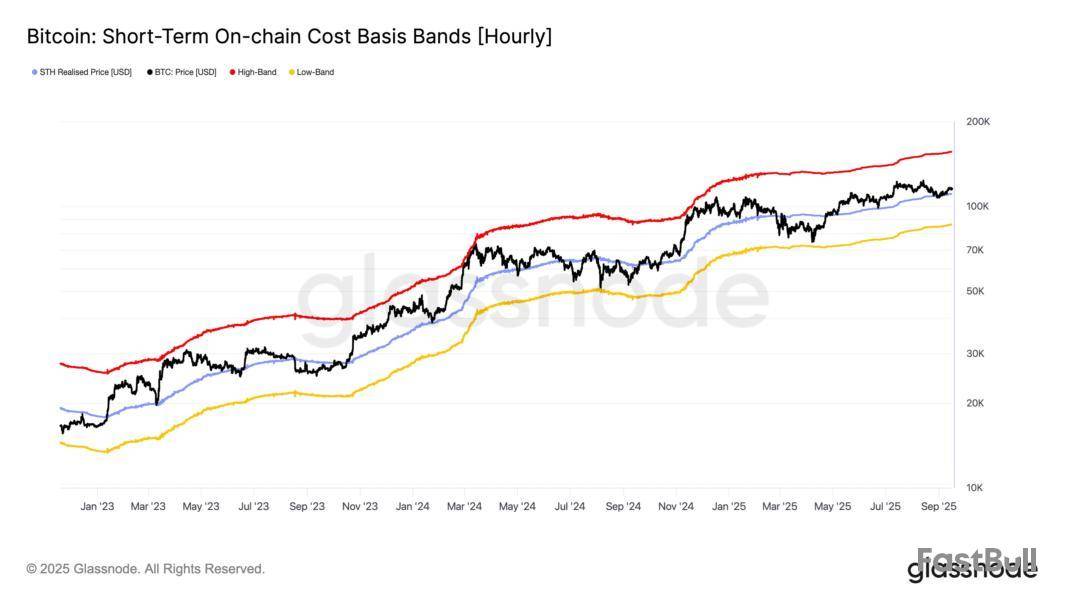

On-chain analytics firm Glassnode has explained how the Bitcoin price trend remains constructive as long as the asset trades above the short-term holder cost basis.

Bitcoin Is Still Maintaining Above Short-Term Holder Realized Price

In a new post on X, Glassnode has discussed about the Realized Price of the Bitcoin short-term holders. The “Realized Price” here refers to an indicator that keeps track of the cost basis of the average investor or address on the BTC network.

When the value of the metric is greater than BTC’s spot price, it means the investors as a whole are sitting on some net unrealized profit. On the other hand, it being under the asset’s value implies the overall market is in a state of net loss.

In the context of the current topic, the Realized Price of a specific segment of the userbase is of interest: the short-term holders (STHs). This cohort includes the investors who purchased their tokens within the past 155 days.

Now, here is the chart shared by Glassnode that shows the trend in the Bitcoin Realized Price for the STHs over the last few years:

As displayed in the above graph, Bitcoin retested the STH Realized Price at the start of the month and found support at it. Since then, the coin’s price has seen some recovery.

This pattern of the STH Realized Price acting as a support barrier has actually been seen many times through this bull market. The reason behind the pattern may lie in investor psychology.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell them in the future. Since the STHs have a relatively low holding time, however, they don’t tend to be resolute, and thus, easily make panic moves when shifts occur in the market.

The STHs can particularly be susceptible to panic when the cryptocurrency retests their break-even level. When the market mood is bullish, the reaction comes in the form of buying. This is because the STHs look at drawdowns to their cost basis as dip-buying opportunities.

Similarly, STHs react to surges to their Realized Price by selling during bearish periods instead, fearing that the asset would decline again in the near future and send them back into a state of loss.

For now, Bitcoin is maintaining above the STH Realized Price. “As long as the price respects this level, the trend remains constructive,” notes the analytics firm. “Losing this support has coincided with phases of contraction or pullbacks.”

BTC Price

At the time of writing, Bitcoin is floating around $116,200, up almost 5% over the last seven days.

The U.S. and the UK are preparing to work more closely on cryptocurrency regulations, a move that could reshape the future of global digital finance.

According to the Financial Times, UK Chancellor Rachel Reeves and U.S. Treasury Secretary Scott Bessent discussed a joint framework for crypto rules during a high-level meeting in London.

This signals that two of the world’s biggest financial powers are ready to set the tone for international policy. Official details are still pending.

Rachel Reeves@RachelReevesMPSep 16, 2025Together we are delivering investment and opportunity for both our countries.

It was a pleasure to welcome @SecScottBessent to Downing Street today. pic.twitter.com/rvI435Jz0O

A Meeting of Power Players in Crypto and Banking

The talks weren’t just between regulators. Bank of America, Barclays, Citi, Coinbase, Circle, and Ripple were present, showing how deeply crypto is now tied to mainstream finance.

Ripple’s Cassie Craddock said the cooperation could become a “template for international collaboration,” adding that stronger ties could “unlock the full economic potential of blockchain for both economies.”

The UK aims to position itself as a global hub for digital assets, building on its strength as a traditional financial powerhouse. Working with the U.S. could give London an edge while the EU and Asia are also moving quickly on regulatory frameworks.

Stablecoins and Tokenization in Focus

Last week, crypto industry groups urged the UK government to include stablecoins and tokenization in the U.S.-UK Tech Bridge. This initiative already covers AI, cybersecurity, and quantum computing. Leaving out digital finance could put Britain at risk of falling behind.

Including stablecoins, in particular, would help the UK keep up with global adoption. SEC Commissioner Hester Peirce has also suggested the idea of a “cross-border sandbox”, where crypto firms could operate under joint U.S.-UK oversight for a trial period. Such steps could provide clarity for companies and reduce regulatory friction.

Public Sentiment Shows Strong Crypto Interest

A recent survey by Aviva shows that public interest in crypto remains high. Around 27% of adults said they would consider adding crypto to their retirement funds. One in five respondents, about 11.6 million people, have owned crypto at some point. Many view it as a means to pursue higher returns despite the associated risks.

Why This U.S.-UK Crypto Collaboration Matters

For the crypto market, this move signals growing political will to integrate digital assets into mainstream finance. With the U.S. still facing regulatory uncertainty and the UK aiming to attract innovation, closer cooperation could lay the foundation for consistent global crypto rules.

The timing is also significant. The meeting took place during U.S. President Donald Trump’s visit to the UK, showing the political weight behind the talks.

If the collaboration gains traction, it could accelerate adoption, boost institutional confidence, and cement the U.S. and UK as leaders in shaping the future of blockchain-based finance.

FAQs

What is the U.S.-UK crypto regulatory collaboration?The U.S. and UK are developing a joint framework for cryptocurrency regulation, aiming to create consistent rules and foster innovation in digital finance through closer cooperation.

Why is U.S.-UK cooperation important for crypto?As two major financial powers, their collaboration could set a global standard for crypto regulation, reducing uncertainty and encouraging institutional adoption worldwide.

Could this collaboration make crypto more mainstream?Yes. Clearer cross-border rules would boost institutional confidence, accelerate adoption, and integrate cryptocurrencies more deeply into the global financial system.

U.S. Securities and Exchange Commission Hester Peirce has denied endorsing private cryptocurrency projects or cryptocurrency firms.

This comes after OpenVPP, a cryptocurrency project that is meant to streamline the electric utility sector with blockchain, announced that it was working "alongside" Peirce on the tokenization of energy.

The project also attached a photo of Peirce and OpenVPP CEO Parth Kapadia, which was ostensibly meant to signal some sort of endorsement. The social media post clearly has a promotional spin.

Hester Peirce@HesterPeirceSep 17, 2025I welcome the chance to meet with crypto projects to hear from them about their regulatory challenges, but I do not "work alongside" or endorse private crypto projects or firms.

Crypto task force roundtables

Peirce, who has been dubbed "Crypto Mom" due to her cryptocurrency-friendly views, is spearheading the agency's cryptocurrency task force that is meant to foster engagement with early-stage cryptocurrency startups that have just 10 or fewer employees. The goal of the task force is to make sure that the voices of smaller cryptocurrency firms are taken into account when developing regulations for the industry.

The agency is in the process of conducting a series of roundtable discussions across the U.S. New York City is set to be the next stop for the SEC, according to the schedule that was unveiled earlier this year. The tour will also include such cities as Los Angeles, Cleveland, Scottsdale, Atlanta, and Ann Arbor.

However, the effort to hear underrepresented voices within the industry might also lead to some awkward encounters like the one described above.

Newly unsealed court filings and state records reveal details about a massive data breach at Coinbase, one of the world’s largest cryptocurrency exchanges. The incident, traced to an employee of Coinbase’s customer service contractor TaskUs, exposed sensitive data of more than 69,000 customers and led to losses estimated as high as $400 million.

Insider Breach and Criminal Scheme

According to the filings, TaskUs employee Ashita Mishra stole Coinbase user data starting in December 2024. Using her personal phone, she allegedly photographed Social Security numbers, bank account details, and government IDs from Coinbase accounts. She then sold these images to hackers for $200 each.

Hackers used the stolen information to impersonate Coinbase staff in calls and emails, tricking users into transferring funds. Some customers lost their entire retirement savings, the documents say.

The breach was discovered on May 11, 2025, but Coinbase did not notify affected users until May 30, 2025. By then, attackers had already drained many accounts.

State Breach Notification Filing

Coinbase confirmed the scope of the incident in a Data Breach Notification filed with Maine regulators:

The filing was submitted by Michael Rubin, an attorney at Latham & Watkins LLP, acting as outside counsel for Coinbase.

Alleged Cover-Up by TaskUs

The lawsuit claims TaskUs learned of the misconduct in January 2025 but sought to contain the damage by firing more than 300 employees and dissolving its internal investigation team instead of disclosing the breach. Plaintiffs accuse TaskUs of negligence, fraud, and breach of contract.

While TaskUs initially downplayed the breach as the work of “two individuals,” investigators allege the scheme involved a wider network of employees and supervisors.

Coinbase Response

Coinbase has cut ties with the implicated TaskUs staff and said that “rogue overseas support agents” were to blame. The exchange has offered free identity protection services to all affected customers and pledged to tighten internal controls.

Still, victims remain at risk. The lawsuit also said that fraud attempts continue, and some customers fear physical harm now that home addresses and bank details have been exposed.

FAQs

What happened in the Coinbase data breach?An employee at Coinbase’s contractor TaskUs stole data for 69,000+ users, selling it to hackers who impersonated support staff and stole up to $400 million from victim accounts.

What should I do if my Coinbase data was stolen?Enable two-factor authentication, monitor accounts for suspicious activity, and use the free IDX credit monitoring offered by Coinbase, which includes $1M insurance.

Is Coinbase safe to use after the data breach?Coinbase has strengthened internal controls, but users should always enable robust security features like 2FA and be wary of unsolicited support calls or emails requesting transfers.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up