Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Arizona Governor Katie Hobbs has signed a bill into law allowing the US state to keep unclaimed crypto and establish a “Bitcoin Reserve Fund” that won’t use any taxpayer money or state funds.

Hobbs signed House Bill 2749 into law on May 7, which allows Arizona to claim ownership of abandoned digital assets if the owner fails to respond to communications within three years.

The state’s custodians can stake the crypto to earn rewards or receive airdrops, which can then be deposited into what Arizona has called a Bitcoin and Digital Asset Reserve Fund.

“This law ensures Arizona doesn’t leave value sitting on the table and puts us in a position to lead the country in how we secure, manage, and ultimately benefit from abandoned digital currency,” the bill’s sponsor, Jeff Weninger, said in a May 7 statement.

“We’ve built a structure that protects property rights, respects ownership, and gives the state tools to account for a new category of value in the economy,” Weninger added.

On May 3, Hobbs vetoed a similar Bitcoin reserve bill, Senate Bill 1025, which would have allowed the state to invest seized funds into Bitcoin, citing concerns over using public funds for "untested assets.”

Hobbs’ move gives hope for future crypto bills

Bitcoin Laws founder Julian Fahrer said on X that Hobbs’ signing of HB 2749 offers more hope that she may also sign Senate Bill 1373, which is currently on her desk.

SB 1373 would authorize Arizona’s treasurer, currently Kimberly Yee, to allocate up to 10% of Arizona’s Budget Stabilization Fund into Bitcoin.

The bill’s passage in Arizona follows New Hampshire Governor Kelly Ayotte on May 6 signing House Bill 302 into law, allowing her state’s treasury to use funds to invest in cryptocurrencies with a market capitalization of more than $500 billion.

Bitcoin is currently the only cryptocurrency that meets that threshold.

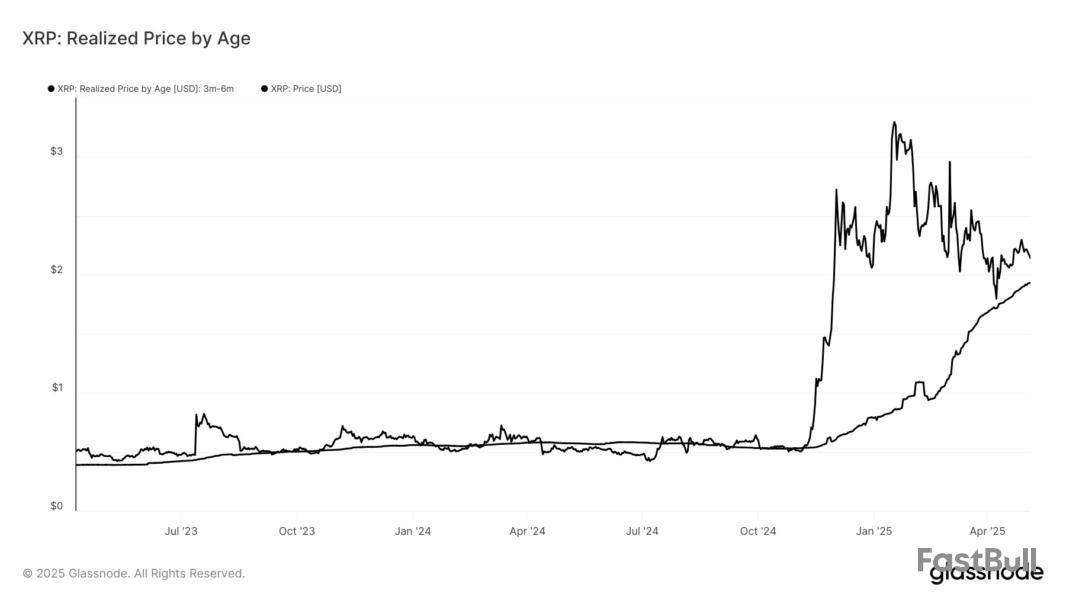

On-chain data shows the top buyers of XRP are still in an 11% net profit today. Here’s how other top coins like Bitcoin and Solana compare.

XRP Top Buyers Are The Only Ones In The Green Right Now

In a new post on X, the on-chain analytics firm Glassnode has talked about how the situation of the top buyers has been looking for different top digital assets.

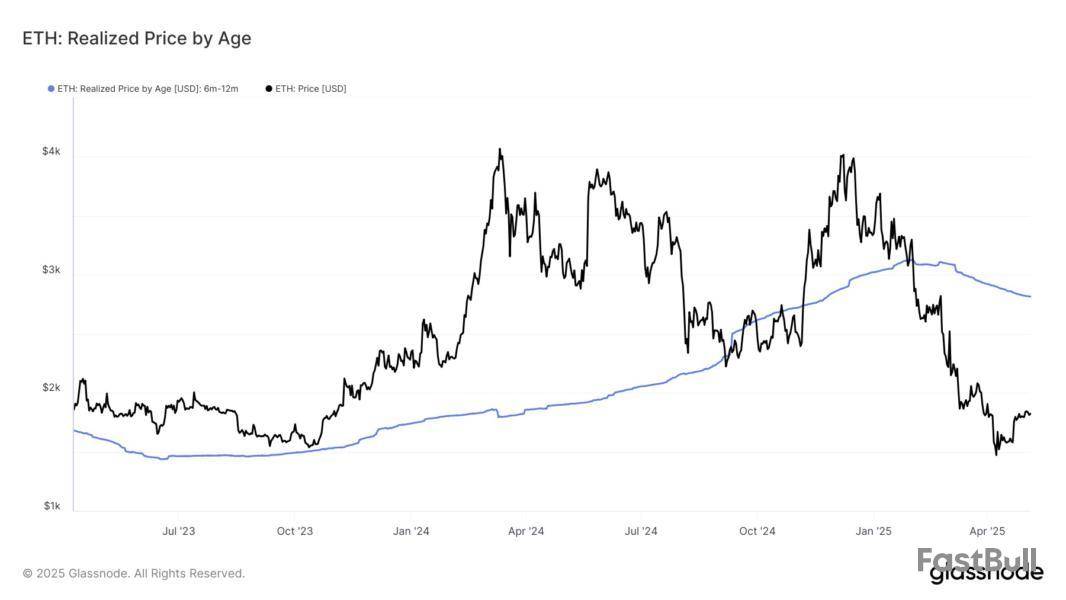

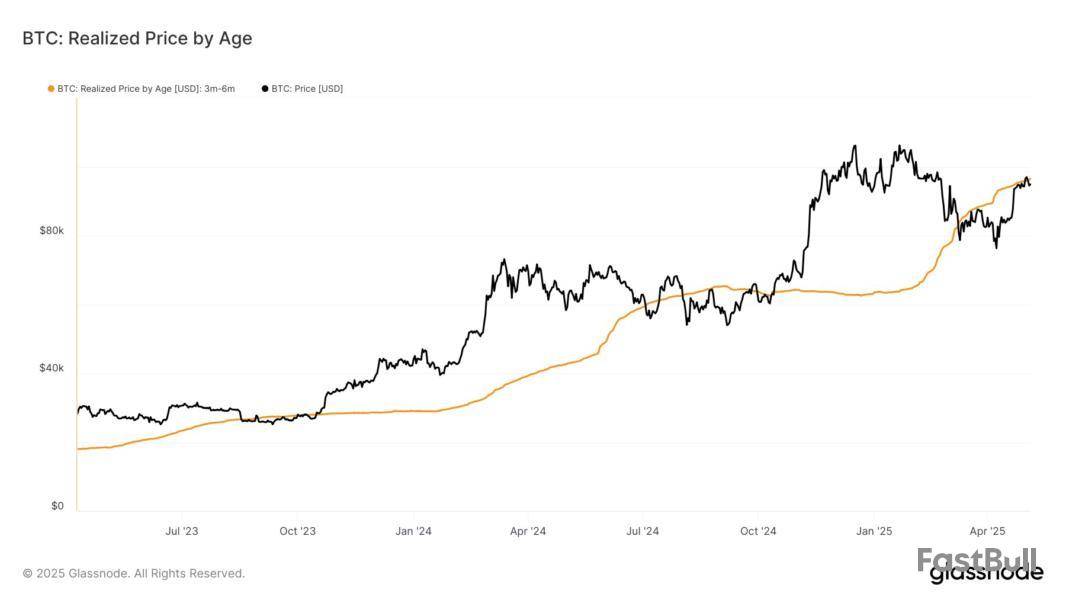

The indicator of interest here is the “Realized Price,” which keeps track of the cost basis or acquisition level of the average investor on a given cryptocurrency network.When the value of the metric is above the spot price of the asset, the holders as a whole can be assumed to be in a state of net unrealized loss. On the other hand, it being under the token’s price implies the dominance of profit on the network.

In the context of the current discussion, the Realized Price of the entire userbase isn’t of relevance, but rather that of only a specific portion of it: the investors who got in during the earlier euphoria phase of December 2024 to January 2025.

From today, this period lines up with the 3 months to 6 months old range, so Glassnode has referenced the average cost basis of these mid-term holders. First, here is a chart showing the Realized Price of this cohort for XRP:

As is visible in the above graph, the Realized Price of the 3 months to 6 months old XRP investors is currently trading a notable distance under the cryptocurrency’s spot price. Naturally, at least some of the top buyers of the asset would have capitulated by this time, but it would appear that those that still continue to hold are sitting relatively comfortably at a profit margin of 11%.

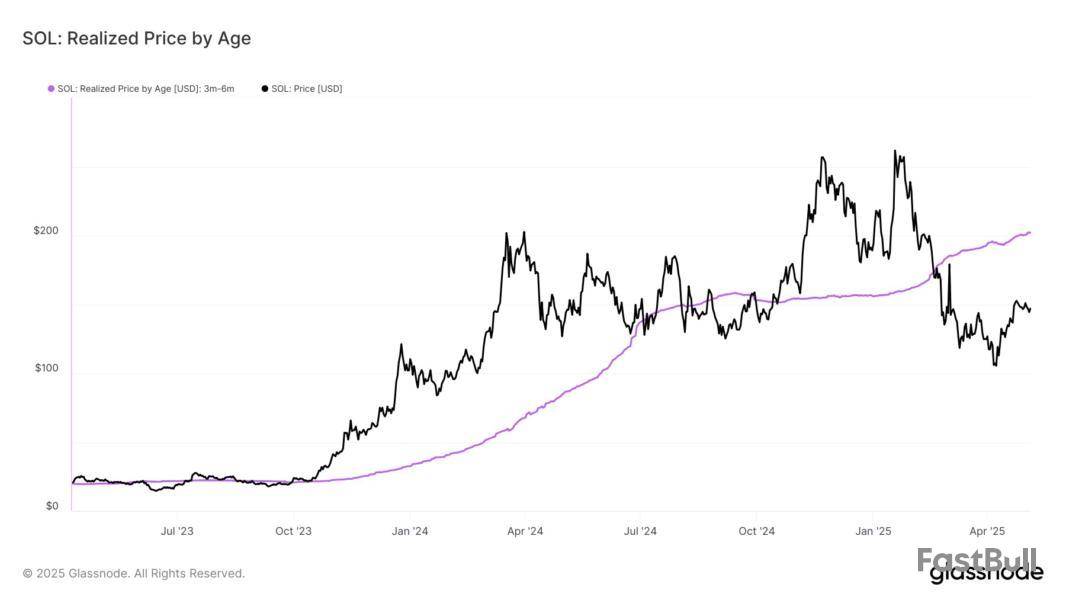

While this may be so for the mid-term holders of XRP, the trend is different for those present on the other major networks. As the below chart shows, Solana’s 3 months to 6 months old hands currently have their cost basis above the spot price.

More specifically, SOL’s mid-term investors are holding a net unrealized loss of around 28%. The situation is even worse when it comes to Ethereum, with the cohort sitting about 36% underwater on the blockchain.

Even Bitcoin has this group carrying a loss, although the margin is just 1% in the case of the number one cryptocurrency.

As for what this trend of the top buyers being underwater could mean, the analytics firm has noted, “price stabilizing below the 3m–6m holders’ cost basis is a clear sign of market weakness.”

XRP Price

At the time of writing, XRP is floating around $2.13, down almost 4% in the last seven days.

Bitcoin is finally showing signs of strength as it attempts to push above the $98,000 level, signaling a potential end to months of volatility and selling pressure. For the first time in weeks, bulls appear firmly in control, reclaiming momentum and building a case for a sustained uptrend. After a prolonged period of uncertainty, BTC is now trading within a pivotal range that could shape its next major move.

A drop below the $90,000 support zone would threaten the current structure and potentially confirm bearish momentum. On the other hand, a clean breakout and daily close above $100,000 would likely open the door to a powerful rally and renewed market confidence. This makes the coming sessions especially critical for traders and investors alike.

Top analyst Big Cheds recently highlighted Bitcoin’s strong technical setup, pointing to the 4-hour chart where BTC is showing “beautiful strength” as it tests the upper bounds of its trading range. This could be the beginning of a breakout phase if bulls can maintain pressure and flip resistance into support.

Bitcoin Triggers Investor Frustration As $100K Breakout Remains Elusive

Bitcoin is testing investors’ patience once again as it continues to struggle below the key psychological level of $100,000. Despite strong price action in recent weeks, BTC has failed to reclaim this milestone, leaving the market divided over what comes next. While some analysts maintain that the bull run is far from over and expect Bitcoin to break its previous all-time high at $109K, others argue that this current rally is nothing more than a relief bounce within a broader bear market structure.

Following months of heavy selling pressure and macro uncertainty, Bitcoin has shown renewed strength, reclaiming key support levels and climbing back above $97K. This move has reignited bullish hopes, especially as price action forms higher lows and approaches the top of a multi-week range.

Cheds has weighed in with a more optimistic take, highlighting Bitcoin’s “beautiful 4H strength” as the price continues to press against range highs. Cheds noted that BTC is showing more resilience than he initially expected, a sign that bulls still have control, at least for now.

However, the $100K level remains a major resistance zone. A confirmed breakout above it could validate a full-scale continuation of the bull market. Until then, the market remains at a standstill, caught between anticipation and doubt. Traders are watching closely for either a breakout above $100K to trigger new upside momentum, or a breakdown below $92K–$90K to confirm a deeper correction.

In short, Bitcoin’s structure is promising, but indecision dominates. Whether this is a setup for new highs or the calm before renewed downside remains to be seen, the next move could define sentiment for the months ahead.

Technical Details: BTC Testing Critical Supply

Bitcoin is trading at $96,959 after bouncing strongly from support near $94,000 and reclaiming short-term momentum. The 4-hour chart shows a clear attempt by bulls to retest the $98,000 level, a key resistance zone just below the psychological $100K barrier. Price is trending well above both the 200-period simple moving average (SMA) at $88,387 and the 200-period exponential moving average (EMA) at $90,723, reinforcing the bullish structure that has been developing since mid-April.

The recent move confirms higher lows and a sustained bullish trend, as BTC continues to build upward pressure against range highs. Volume has picked up slightly during the latest breakout attempt, suggesting fresh demand entering the market. However, the $98K–$100K area has historically triggered selling interest, so a decisive break and close above $100K will be essential to confirm a true breakout.

If bulls manage to reclaim $100K, Bitcoin could quickly extend toward its previous all-time high near $109K. On the downside, holding above the $94K–$95K zone will be critical to preserving bullish momentum. For now, Bitcoin appears to be setting the stage for a breakout, but traders should watch closely as price compresses just under resistance. The next move will likely set the tone for the broader market.

Featured image from Dall-E, chart from TradingView

Binance founder and convicted felon Changpeng Zhao says that he applied for a pardon from US President Donald Trump shortly after denying reports that he was seeking one.

Zhao, also known as CZ, said on a Farokh Radio podcast episode aired May 6 that he “wouldn’t mind” a pardon and that his lawyers have already filed the paperwork on his behalf

“I got lawyers applying,” Zhao said, adding that he submitted the request after Bloomberg and The Wall Street Journal reported in March that he was seeking a pardon from Trump amid discussions of a business deal between the Trump family and Binance.US.

Zhao denied the reports at the time, but said on the podcast that he thought “if they’re writing this article, I may as well just officially apply.”

He added that Trump’s pardon of three BitMEX founders, including Arthur Hayes, also motivated him to submit an application.

Zhao said the application was submitted about two weeks ago.

Zhao said at the time of the Bloomberg and Wall Street Journal reports that “no felon would mind a pardon,” and claimed he is the only person in US history to serve prison time for a Bank Secrecy Act charge.

Zhao pleaded guilty to a money laundering charge in November 2023 as part of a deal Binance reached with US authorities, which saw it pay a $4.3 billion fine, to which Zhao contributed $50 million. He was also forced to step down as CEO.

Zhao was later sentenced to four months in prison and was prohibited from working at Binance as part of his plea deal.

According to the US Department of Justice, a pardon would not erase Zhao’s money laundering conviction; however, it could potentially allow him to assume a management or operational role at Binance.US.

Zhao has no plans to return as Binance CEO

While Zhao remains a Binance shareholder, he said in November at Binance Blockchain Week that he has “no plans to return to the CEO position.”

“I feel the team is doing well and doesn't need me back,” Zhao said.

Since leaving prison, Zhao has commenced advisory roles in Pakistan and Kyrgyzstan, assisting on matters related to crypto regulation and implementing blockchain solutions.

Bitcoin finds itself in a state. Following a robust recovery rally, the asset is currently getting close to a significant resistance level at $96,885, which is a line in the sand that will probably determine whether or not Bitcoin has what it takes to push toward the psychological $100,000 threshold.

With Bitcoin trading well above its major moving averages (the 50, 100 and 200 EMA) the current structure on the daily chart clearly demonstrates bullish momentum. In theory, this places Bitcoin in a sound upward trend. But the momentum appears to be waning. A classic sign of a possible reversal, or at the very least the formation of a local top, is an obvious decline in the volume supporting the recent leg up. Chart by TradingView">

This puts Bitcoin in a position where it either rejects and falls back below the $92,000 support range or breaks through the $96,885 resistance with convincing volume. There is little chance of reaching $100,000 in the near future if that breakdown occurs. Markets are fueled by momentum, and without outside stimuli, Bitcoin just does not currently have enough to take off.

There is a likelihood of a cool-down or consolidation because the Relative Strength Index (RSI) is circling overbought levels. If resistance is not overcome, there may be a correction back toward the $89,000-$92,000 range, which is not what bulls are hoping for in the near term but is still healthy in the larger trend.

Ultimately, at this resistance, Bitcoin is in a now or never situation. In order to rekindle significant bullish sentiment, it must break and hold above $96,885. If not, anticipate a retracement and profit-taking that could postpone the long-awaited six-figure milestone once more.

Shiba Inu gets ready

After a protracted period of consolidation, Shiba Inu is finally exhibiting signs of life as the meme asset is moving closer to a crucial technical breakout. Historically, the 26 EMA has served as a pivot between short-term downtrends and bullish reversals, and SHIB is testing this level on the daily chart.

A move toward the $0.00001400 zone, where the 100 EMA is currently located, may be possible if SHIB is able to close above the 26 EMA with confidence. A successful test or breakout above this level that serves as a significant resistance threshold may indicate a more general bullish change in SHIB's midterm trend.

A crucial indicator that traders are beginning to position themselves for a breakout is the steadily rising volume in the current market setup. From a technical perspective, SHIB has maintained its position above the $0.00001270 support, which has repeatedly resisted selling pressure. This level has served as a launchpad before and seems to be doing so once more.

A retest of the $0.00001270 support and a potential decline back toward $0.00001170, which has functioned as the lower bound of the current range, could result from SHIB being rejected at the 26 EMA. There is currently a bullish trend in momentum. As SHIB seeks to resume a short-term uptrend, a clear move above the 26 EMA and the 100 EMA would probably set off a chain reaction of buy signals across technical setups, potentially reinvigorating the meme coin narrative.

Solana needs help

Once again, Solana is drawing attention to itself not for its upward surge but rather for its frustrating failure to overcome a level of resistance that should be a relatively simple obstacle with greater momentum. SOL is currently trading at about $147 and is having difficulty breaking above the 100 EMA, which is located close to $151.

Despite numerous bullish attempts, this resistance has now turned into a psychological barrier that repeatedly rejects the asset. The trend is becoming too dependable to overlook. The larger picture is not helpful. The lack of volume behind the move and the inability to break the 100 EMA point to underlying weakness despite SOL's remarkable recovery from its March lows. Because traders are not confident in the asset's continuation, they may be taking profits, or worse, choosing not to pursue it at these levels.

Once more, there is no indication of breakout momentum, but the RSI (Relative Strength Index) is positioned at 59, suggesting a neutral-to-bullish bias. This supports the idea that there is local top pressure, or at the very least, a stall in buying power. The 200 EMA is hovering over the market at $161, another crucial level that has historically produced powerful reactions that further complicates things.

A move toward the 200 EMA currently appears overly optimistic if SOL is unable to even break the 100 EMA. Additionally, the chart suggests a fading bullish pennant or wedge which, should SOL fall below $142 once more, could render the uptrend invalid. A retreat toward the $133 support level and possibly lower is to be expected if that breakdown takes place.

As the XRP price takes center stage, bold predictions about its future outlook persist across online forums and social media. Among the most ambitious claims is the idea that the XRP price could skyrocket to $1,000 or even beyond. In response to these projections, a crypto analyst has outlined several key factors that would need to align for XRP to reach such a target.

Factors Needed To Take The XRP Price To $1,000

While it’s tempting to imagine XRP hitting a four-digit price target, X (formerly Twitter) crypto analyst Jasmin argues that the numbers don’t support such a prediction. For the XRP price to reach $1,000, it would need to climb as high as 46,848%, accompanied by key factors like a significant rise in global adoption, especially by financial institutions.

Although Ripple, a blockchain company, has made progress in partnering with global banks and fintech firms for cross-border payments, that level of adoption is still nowhere near enough to support a $1,000 XRP price tag. To even approach this level, XRP would need to become a fundamental part of the global financial structure across different sectors, particularly in banking, remittance, and investment.

But beyond simple adoption, XRP would have to be deeply integrated into major economies in such a way that it becomes an indispensable currency for daily transactions. For this to happen, Jasmin reveals that the cryptocurrency would need widespread regulatory clarity to ensure that it can be used in multiple jurisdictions without any legal barriers.

The ongoing legal battle between Ripple and the US SEC has already created years’ worth of uncertainty around XRP’s legal status. Until this issue is resolved favorably, the cryptocurrency’s potential for mainstream adoption remains limited.

Jasmin has also highlighted that XRP would have to incorporate mechanisms that would drastically reduce its circulating supply. While the cryptocurrency’s price could grow with more aggressive token burns, a jump to $1,000 still seems unlikely. Such a high valuation would also need massive speculative trading activities, which are usually seen during bull markets.

How Market Cap Influences A $1,000 Projection

Based on Jasmin’s analysis, the most significant factor that makes a $1,000 XRP price projection unrealistic is its market capitalization. Currently, XRP has a market cap of about $125.15 billion, and for its price to hit a four-digit level, its total market valuation would need to reach $50 trillion.

To put this in perspective, the global crypto market capitalization today is $3.09 trillion, according to CoinGecko data. This would mean that XRP alone would need a market cap over 15x higher than the entire crypto market.

Furthermore, Bitcoin, the largest cryptocurrency, has never even come close to reaching a $10 trillion market cap. BTC’s market valuation currently sits at $1.92 trillion, meaning XRP would have to surpass it by over 25x to get a $50 trillion market cap.

Due to these extreme market cap requirements, Jasmin argues that a $1,000 or even $10,000 target is highly unrealistic. However, she acknowledges that a price surge to $5 or even $10 is a far more attainable goal.

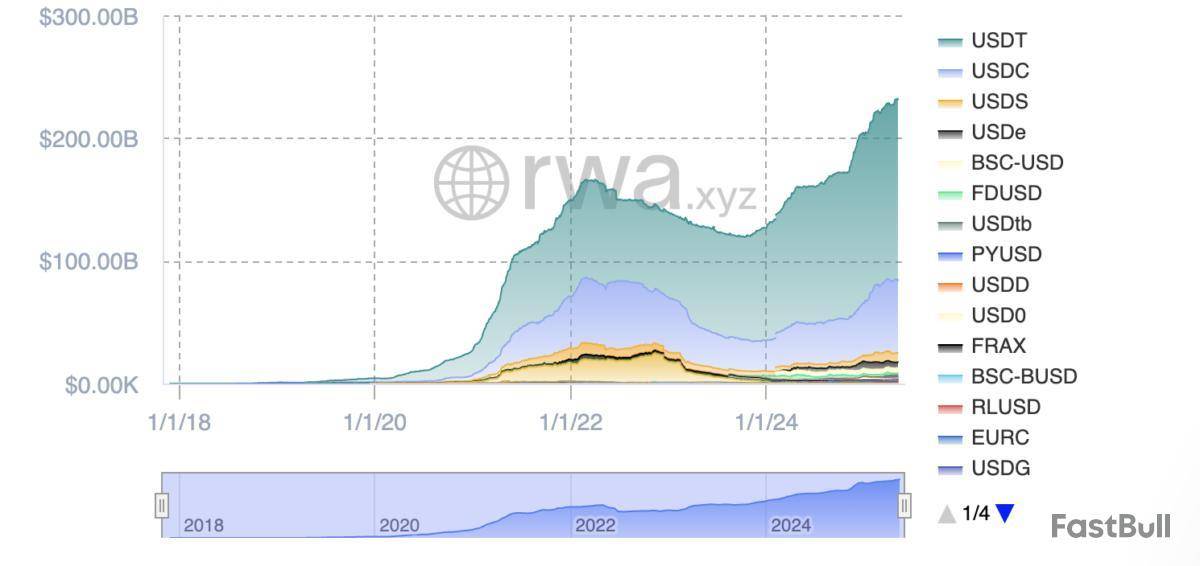

Stripe, a global payments platform, has introduced stablecoin-based accounts to clients in over 100 countries.

According to a May 7 announcement, the new feature will allow the platform's clients "to send, receive, and hold US-dollar stablecoin account balances, similar to how a traditional fiat bank account works."

The product's technical page shows that the new account feature will support Circle's USDC and Bridge's USDB (USDB) stablecoins. Stripe acquired the Bridge platform in October 2024.

The product will be available to clients in more than 100 countries, including Argentina, Chilé, Turkey, Colombia, and Peru, among others.

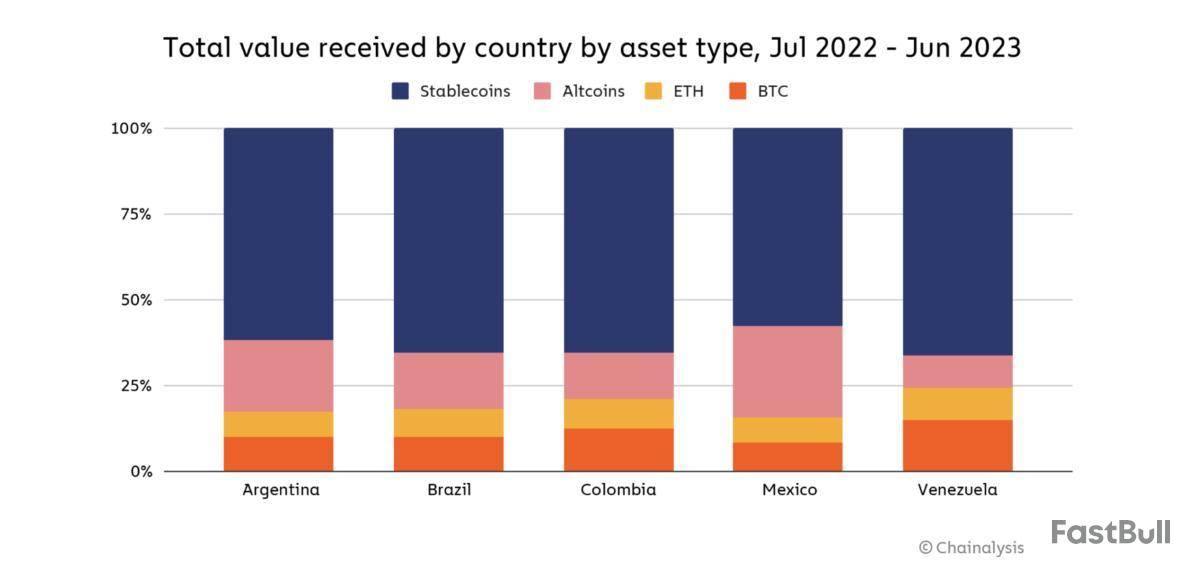

Stripe's newly launched product comes at a time when stablecoins are increasingly seen as stores of value in developing economies struggling with high inflation, capital controls, and a lack of financial infrastructure.

Stablecoins are banking the unbanked and are increasingly used as a store of value

Stablecoins and blockchain payment rails are helping to bank the unbanked in developing regions of the world without critical financial and communication infrastructure.

Blockchain systems can reduce the cost and verification of cross-border transfers, allowing anyone with a cellphone, a crypto wallet, and access to an internet connection to send, receive, and store value in a relatively stable fiat currency.

Stripe integrated USD stablecoin payments, allowing users to pay online merchants in fiat tokens, in October 2024. The integration was met with demand for the stablecoin payment option in 70 countries, the company said.

According to the crypto platform Bitso, residents of Latin American countries are increasingly using stablecoins as a store of value and a medium of exchange used for online purchases.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up