Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Road Town, British Virgin Islands--(Newsfile Corp. - March 31, 2025) - In a significant move for cryptocurrency enthusiasts, LBank Exchange, a premier global digital asset trading platform, has announced the listing of APTM (Apertum) on March 30, 2025. The APTM/USDT trading pair (https://www.lbank.com/trade/aptm_usdt) is now available to users of LBank Exchange.

APTM (Apertum) Listing Banner

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8831/246704_9834dc4724a579a3_001full.jpg

The cryptocurrency space has long been marked by challenges surrounding security, scalability, and transparency. With the rise of decentralized finance (DeFi), these issues have become more pronounced, often hindering mass adoption and seamless integration into everyday financial systems. As blockchain technologies evolve, the need for more secure, scalable, and transparent solutions becomes increasingly critical. Apertum (APTM) is stepping in to address these issues, creating a decentralized cryptocurrency built on cutting-edge technology to provide an efficient, scalable, and secure platform for digital finance.

Apertum: A Revolutionary Blockchain Solution for Secure, Scalable, and Transparent Digital Finance

Apertum is a decentralized cryptocurrency designed to revolutionize digital finance by offering security, scalability, transparency, and inclusivity. Built as a subnet of the Avalanche blockchain, Apertum leverages Avalanche's technology for high-speed, secure, and scalable transactions. The platform incorporates innovative features such as deflationary tokenomics and decentralized governance, allowing for a fair and inclusive financial ecosystem. APTM holders have the power to vote on protocol changes, resource distribution, and ecosystem development, ensuring that the community plays a central role in shaping the project's future.

Apertum stands out in the cryptocurrency space for its advanced security features and innovative mechanisms. The platform utilizes cutting-edge cryptographic techniques to ensure the integrity of transactions and the confidentiality of assets. Its decentralized consensus mechanism, based on a proof-of-stake (PoS) model, provides rapid transaction validation and scalability while ensuring robust security against malicious activities. With these features, Apertum offers a scalable solution that is well-suited for both individual and business applications in the ever-evolving digital landscape.

The Apertum ecosystem is powered by the Apertum Foundation, which oversees governance, protocol upgrades, and ecosystem development. The Foundation's role is critical in ensuring the sustainability and growth of the platform, fostering continuous innovation, and driving partnerships that enhance the ecosystem. Governance is decentralized, allowing APTM token holders to vote on key decisions such as protocol changes, resource allocation, and dispute resolution. This ensures that the community has a voice in the evolution of the platform, promoting fairness and inclusivity. Additionally, the Foundation is responsible for funding marketing, advertising, and research activities, with 100 million pre-minted APTM allocated for these purposes, representing 4.76% of the total token supply.

APTM Tokenomics

Apertum's tokenomics are designed to encourage long-term growth and sustainability. The total supply of APTM is capped at 2.1 billion tokens, with 2 billion tokens mined through halvings and 100 million pre-minted for the Apertum Foundation. Today, more than 25,000 wallet addresses hold $APTM, demonstrating growing adoption of the ecosystem.

A unique deflationary mechanism is built into the protocol, whereby up to 50% of all transaction fees are permanently burned, reducing the circulating supply and increasing the token's value over time. This deflationary approach ensures that the ecosystem remains dynamic and aligned with long-term growth objectives. The efficient and eco-friendly consensus mechanism further strengthens the value proposition of Apertum, setting the stage for its leadership in the digital finance sector.

Learn More about Apertum:

Website: https://apertum.io/

About LBank

Founded in 2015, LBank is a top crypto exchange offering financial derivatives, asset management, and secure trading. With over 15 million users across 210+ regions, LBank ranks in the top 20 for spot trading and top 15 for derivatives trading globally, ensuring fund integrity and supporting global crypto adoption.

Start Trading Now: lbank.com

Community & Social Media:

Telegram

YouTube

Press contact:

press@lbank.com

Business Contact:

LBK Blockchain Co. Limited

LBank Exchange

marketing@lbank.com

business@lbank.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/246704

Non-fungible token (NFT) marketplace X2Y2 announced it is shutting down after three years of operation.

According to a March 31 announcement, X2Y2 will shut down on April 30, with the team switching its focus to an artificial intelligence project. The team shared its enthusiasm for the rapidly growing sector:

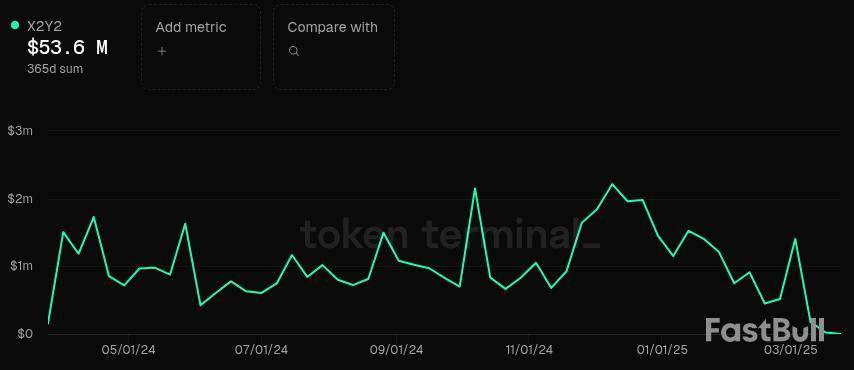

Token Terminal data shows that X2Y2 saw $53.6 million worth of trading volume over the last 365 days. While this is a far cry from market leader Blur with its $3 billion worth of trading volume, it still awards the protocol fourth place behind Blur, OpenSea and Immutable.

Charu Sethi, president at NFT-focused Polkadot and Kusama chain Unique Network, said the decision is not a sign of decline in the NFT market. She told Cointelegraph:

Real-world implementation is key

Sethi highlighted initiatives such as Mythical Games issuing large numbers of NFTs on Polkadot meant for in-game integration following a $75 million fundraise in 2021. She also pointed out a DappRadar report showing that the blockchain gaming sector reached 7.4 million daily unique active wallets in 2024.

According to Sethi, “X2Y2’s experience highlights that NFT platforms cannot rely solely on marketplace network effects.” Instead, companies should focus on building communities and market resilience by building NFTs into real-world applications. She said that the key is in valuing utility over speculation:

“Platforms should pivot toward utility-driven models that incentivize consistent user engagement, whether through gaming, sports fandom or AI-backed applications. Successful platforms will create ecosystems where NFTs are part of an ongoing value cycle, not just speculative trading assets.

A new focus

The announcement was scant on details concerning the project that the X2Y2 team is focusing on. Still, the firm suggested that the readers should imagine “yields in a permissionless way, powered by AI.”

The new platform will reportedly allow users to earn profits throughout bear and bull markets and entire market cycles, in what is presumably a somewhat decentralized variation on AI-powered trading:

The announcement follows early February reports that tokens tied to artificial intelligence agents were down by as much as 90% from 2024 highs. Still, recent reports suggest that the rise of AI-driven crypto agents may be following a familiar trajectory that mirrors the initial boom, bust and resurgence of ICO-era projects.

Crypto inflows hit $226 million last week, signaling a cautiously optimistic investor sentiment amid ongoing market volatility.

According to CoinShares data, altcoins broke a five-week streak of negative flows, recording their first inflows in over a month.

Crypto Inflows Hit $226 Million Last Week

This turnout marks a significant slowdown from the previous week when crypto inflows hit $644 million, ending a five-week outflow streak. Before that, inflows peaked at $1.3 billion, with Ethereum outpacing Bitcoin in investor demand.

“Digital asset investment products saw $226 million of inflows last week suggesting a positive but cautious investor,” read an excerpt in the report.

The pullback to $226 million last week suggests a more measured approach by investors as they assess macroeconomic conditions and regulatory uncertainties.

Specifically, CoinShares’ researcher James Butterfill ascribes Friday’s minor outflows of $74 million to core personal consumption expenditure (PCE) in the US, which came in above expectations.

“The Fed’s preferred measure of inflation (Core PCE) moved up to 2.8% in February & remains well above their 2% target that has yet to be achieved. The market is expecting the Fed to hold rates steady again at their next meeting on May 7 (at 4.25-4.50%),” investor Charlie Bilello noted.

Nevertheless, this turnaround comes after nine consecutive trading days of inflows into crypto ETPs (exchange-traded products).

Despite the slowdown, Bitcoin continued to attract strong inflows of $195 million. Meanwhile, short-Bitcoin products registered outflows of $2.5 million for the fourth consecutive week. This suggests that investors are leaning bullish on Bitcoin, even as altcoins begin to recover.

The CoinShares report shows that altcoins saw $33 million in inflows last week after suffering $1.7 billion in outflows over the past month.

Altcoins Rebound After $1.7 Billion in Outflows

Ethereum led the recovery, attracting $14.5 million, then Solana at $7.8 million, while XRP and Sui recorded $4.8 million and $4.0 million, respectively. Market analysts believe altcoins may be bottoming out, creating potential buying opportunities.

“Altcoins are oversold. The bottom is close. We’re ready for a bounce,” renowned analyst Crypto Rover highlighted.

Other analysts echoed the sentiment, suggesting growing attention toward altcoins. Among them was trader Thomas Kralow, who said, “altcoins are setting up for a comeback.”

Adding credence to this bullish outlook for altcoins, project researcher BitcoinHabebe, known for insightful mid-low cap sniper entries, pointed to technical indicators suggesting a market reversal.

“While bears are trying to spread fear & make you sell your altcoins, the TOTAL3 [Altcoins market cap chart excluding Bitcoin and Ethereum] just bounced off an HTF [higher timeframe] retest,” the analyst stated.

This means most coins have bottomed out and are expected to start reversing soon. Cole Garner noted a key buy signal in market liquidity metrics, further supporting this view.

“Tether Ratio Channel already flashed a double buy signal this month. Now my lower timeframe version is popping off. Fresh capital incoming,” he indicated.

The Tether Ratio Channel is an on-chain analytical tool that helps traders identify potential buy signals. It tracks the ratio of Bitcoin’s market capitalization to that of stablecoins, acting as a leading indicator for short- to medium-term trends.

When the ratio hits certain levels, it can signal shifts in market sentiment, often indicating whether fresh capital is entering or exiting the market.

While overall crypto inflows have slowed compared to previous weeks, the return of capital into altcoins suggests renewed investor confidence. Analysts see signs of an impending altcoin rally, with market metrics indicating that most coins have bottomed out.

As investors weigh macroeconomic uncertainties, the coming weeks could be critical in determining whether the altcoin recovery sustains momentum or if caution prevails.

WISeSat.Space Creates WISeSat España SA Subsidiary to Lead European Space Projects from Andalusia and Build a 100% “Made in Europe” Solution Aligned With the IRIS² Strategy

Madrid / Geneva / La Línea, Cadiz – March 31, 2025 - WISeSat.Space, a pioneer in secure satellite connectivity solutions and part of the WISeKey International Holding Ltd (“WISeKey”) (SIX: WIHN, NASDAQ: WKEY), a leading global cybersecurity, blockchain, and IoT company, today announces the creation of its new subsidiary WISeSat España, headquartered in La Línea de la Concepción (Cádiz, Andalusia). This strategic decision represents a decisive step toward the consolidation of a fully European industrial and technological ecosystem in the space and quantum domains, in line with the digital sovereignty priorities defined by the European Union.

The choice of La Línea de la Concepción as the official headquarters of WISeSat España is no coincidence. This Andalusian city, located at a geostrategic point between Europe and Africa, is positioning itself as an emerging hub for technological innovation, thanks to its institutional will, international openness, and proximity to key logistical infrastructures.

Establishing WISeSat in La Línea makes the company a founding pillar of the project LL4GIR.COM, an ambitious public-private initiative aimed at creating a Center for the Fourth Industrial Revolution in southern Europe. This center will promote high-impact projects in artificial intelligence, quantum computing, blockchain, IoT, and space connectivity, transforming the region into a global benchmark for resilience, sustainability, and economic progress.

A 100% “Made in Europe” solution

The launch of WISeSat España aims to build a 100% European space value chain, combining technological sovereignty, security, sustainability, and autonomous access to space. The proposal is fully aligned with the principles of the IRIS² program (Infrastructure for Resilience, Interconnectivity and Security by Satellite), promoted by the European Commission to establish a satellite constellation ensuring secure connectivity across the continent.

The WISeSat España roadmap includes:

A new paradigm of decentralized innovation

The model proposed by WISeSat España breaks with traditional centralized structures. Its vision is to create a decentralized network of European technological nodes, collaborating under principles of transparency, interoperability, resilience, and sovereign control. The La Línea node will serve as the secure space gateway for European institutions, companies, and citizens.

“At WISeSat, we firmly believe that Europe needs its own secure and resilient infrastructure to avoid dependence on external players in critical areas such as space or cybersecurity. With WISeSat España and our partnerships with FOSSA Systems, PLD Space, QuantixS, and SEALSQ, we demonstrate that a 100% European model is not only possible but necessary,” said Carlos Creus Moreira, Founder and CEO of WISeKey.

The January satellite, currently in orbit:

https://wisesat.wisekey.com/?tags=WISeSat

This launch builds on the previous success of WISeSat in collaboration with FOSSA Systems, which achieved the launch of 17 picosatellites to test the resilience and performance of its core technologies. These tests laid the foundation for the current generation of satellites, which, starting in June, will be equipped with more robust security protocols and post-quantum cryptographic infrastructure developed by SEALSQ.

WISeSat also announced a new strategic partnership with Skyroot Aerospace in India. This collaboration will diversify launch operations by enabling satellites to be deployed on alternative orbital trajectories, optimizing constellation coverage and efficiency. The alliance also includes the possibility of manufacturing satellites on Indian soil, to local specifications, further strengthening WISeSat’s global production and launch capabilities.

By the end of 2025, WISeSat satellites will be able to carry out transactions in SEALCOIN tokens with each other and with connected objects on Earth, forming a secure, autonomous mesh network for machine-to-machine (M2M) transactions. This innovation will create a financial and data exchange infrastructure in space, where connected machines will be digitally certified through a "Know Your Object" (KYO) protocol. The KYO process integrates Wecan technology and WISeKey’s WISeID platform, ensuring reliable identity and accountability throughout the ecosystem.

Each WISeSat satellite is built with:

This technological foundation positions WISeSat as a global leader in secure satellite-based IoT infrastructure.

Invitation to Collaborate

WISeSat España invites governments, universities, R&D centers, investors, and technology companies to join this transformative vision. The goal is to build together a new paradigm of smart economic development by integrating emerging technologies, specialized training, high-quality employment, and international cooperation.

About WISeSat.Space

WISeSat.Space AG is pioneering a transformative approach to IoT connectivity and climate change monitoring through its innovative satellite constellation. By providing cost-effective, secure, and global IoT connectivity, WISeSat is enabling a wide range of applications that support environmental monitoring, disaster management, and sustainable practices. The integration of satellite data with advanced climate models holds great promise for enhancing our understanding of climate change and developing effective strategies to combat its impacts. As the world continues to grapple with the challenges of climate change, initiatives like WISeSat’s IoT satellite constellation are essential for creating a more resilient and sustainable future.

About WISeKey

WISeKey International Holding Ltd (“WISeKey”, SIX: WIHN; Nasdaq: WKEY) is a global leader in cybersecurity, digital identity, and IoT solutions platform. It operates as a Swiss-based holding company through several operational subsidiaries, each dedicated to specific aspects of its technology portfolio. The subsidiaries include (i) SEALSQ Corp , which focuses on semiconductors, PKI, and post-quantum technology products, (ii) WISeKey SA which specializes in RoT and PKI solutions for secure authentication and identification in IoT, Blockchain, and AI, (iii) WISeSat AG which focuses on space technology for secure satellite communication, specifically for IoT applications, (iv) WISe.ART Corp which focuses on trusted blockchain NFTs and operates the WISe.ART marketplace for secure NFT transactions, and (v) SEALCOIN AG which focuses on decentralized physical internet with DePIN technology and house the development of the SEALCOIN platform.

Each subsidiary contributes to WISeKey’s mission of securing the internet while focusing on their respective areas of research and expertise. Their technologies seamlessly integrate into the comprehensive WISeKey platform. WISeKey secures digital identity ecosystems for individuals and objects using Blockchain, AI, and IoT technologies. With over 1.6 billion microchips deployed across various IoT sectors, WISeKey plays a vital role in securing the Internet of Everything. The company’s semiconductors generate valuable Big Data that, when analyzed with AI, enable predictive equipment failure prevention. Trusted by the OISTE/WISeKey cryptographic Root of Trust, WISeKey provides secure authentication and identification for IoT, Blockchain, and AI applications. The WISeKey Root of Trust ensures the integrity of online transactions between objects and people. For more information on WISeKey’s strategic direction and its subsidiary companies, please visit www.wisekey.com.

Disclaimer

This communication expressly or implicitly contains certain forward-looking statements concerning WISeKey International Holding Ltd and its business. Such statements involve certain known and unknown risks, uncertainties and other factors, which could cause the actual results, financial condition, performance or achievements of WISeKey International Holding Ltd to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. WISeKey International Holding Ltd is providing this communication as of this date and does not undertake to update any forward-looking statements contained herein as a result of new information, future events or otherwise.

This press release does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, and it does not constitute an offering prospectus within the meaning of the Swiss Financial Services Act (“FinSA”), the FinSa's predecessor legislation or advertising within the meaning of the FinSA. Investors must rely on their own evaluation of WISeKey and its securities, including the merits and risks involved. Nothing contained herein is, or shall be relied on as, a promise or representation as to the future performance of WISeKey.

Press and Investor Contacts

Bitcoin is on track to end Q1 with its worst performance since 2019. Without an unexpected recovery, BTC could close the quarter with a 25% decline from its all-time high (ATH).

Some analysts have noted that experienced Bitcoin holders are shifting into an accumulation phase, signaling potential price growth in the medium term.

Signs That Veteran Investors Are Accumulating Again

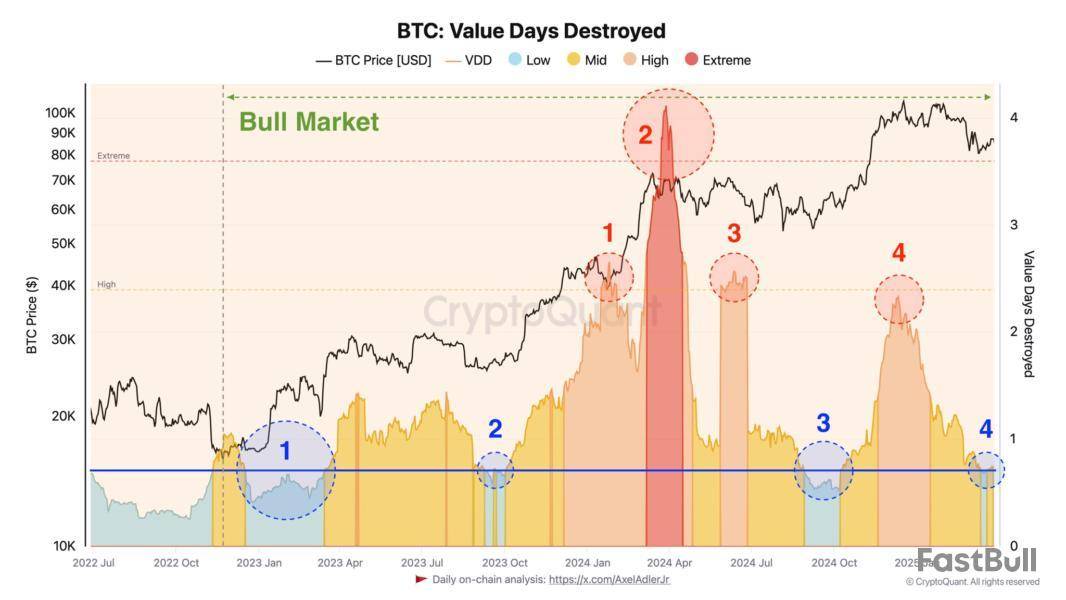

According to AxelAdlerJr, March 2025 marks a transition period where veteran investors move from selling to holding and accumulating. This shift is reflected in the Value Days Destroyed (VDD) metric, which remains low.

VDD is an on-chain indicator that tracks investor behavior by measuring the number of days Bitcoin remains unmoved before being transacted.

A high VDD suggests that older Bitcoin is being moved, which may indicate selling pressure from whales or long-term holders. A low VDD suggests that most transactions involve short-term holders, who have a smaller impact on the market.

Historically, low VDD periods often precede strong price rallies. These phases suggest that investors are accumulating Bitcoin with expectations of future price increases. AxelAdlerJr concludes that this shift signals Bitcoin’s potential for medium-term growth.

“The transition of experienced players into a holding (accumulation) phase signals the potential for further BTC growth in the medium term,” AxelAdlerJr predicted.

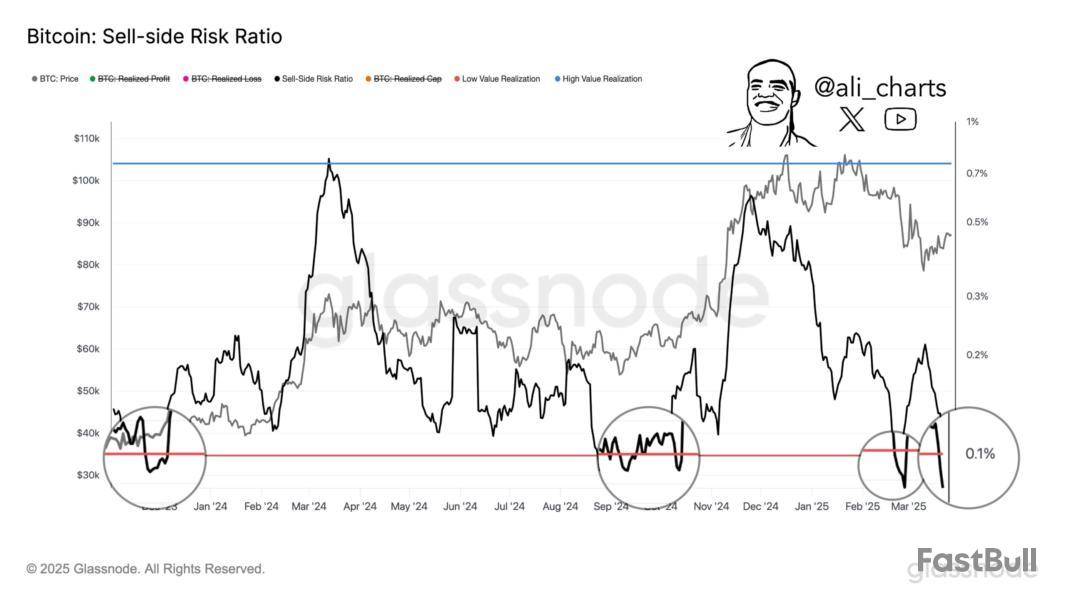

Bitcoin’s Sell-Side Risk Ratio Hits Low

At the same time, analyst Ali highlighted another bullish indicator: Bitcoin’s sell-side risk ratio had dropped to 0.086%.

According to Ali, over the past two years, every time this ratio fell below 0.1%, Bitcoin experienced a strong price rebound. For example, in January 2024, Bitcoin surged to a then-all-time high of $73,800 after the sell-side risk ratio dipped below 0.1%.

Similarly, in September 2024, Bitcoin hit a new peak after this metric reached a low level.

The combination of veteran investors accumulating Bitcoin and a sharp decline in the sell-side risk ratio are positive signals for the market. However, a recent analysis from BeInCrypto warns of concerning technical patterns, with a death cross beginning to form.

Additionally, investors remain cautious about potential market volatility in early April. The uncertainty stems from President Trump’s upcoming announcement regarding a major retaliatory tariff.

Chainlink has been under heavy selling pressure, trading in a downtrend as broader market weakness drags crypto prices lower. The entire crypto market remains on the defensive, with macroeconomic uncertainty and escalating trade war fears continuing to shake investor confidence. With no clear resolution in sight, many analysts believe this high-risk environment could persist for the coming months, placing further pressure on digital assets like Chainlink.

LINK has struggled to maintain upward momentum, and market sentiment remains divided. A growing number of analysts are warning of a possible break below current levels, potentially signaling the start of a prolonged bear market cycle. However, not everyone is bearish.

Top crypto analyst Ali Martinez recently shared a more optimistic take. According to his analysis, all eyes should be on the $13.20 support level — a critical trendline that has held strong through recent volatility. Martinez notes that this level could act as the launchpad for a new rebound in LINK’s price. Whether support holds or breaks will likely define Chainlink’s direction in the weeks ahead.

Chainlink Holds Key Support After 55% Drop

Chainlink is currently down more than 55% from its December high of around $30, struggling to find momentum as broader market conditions remain uncertain. Bulls have yet to reclaim any meaningful resistance levels, and price action has remained underwhelming amid ongoing selling pressure. Still, despite the weakness, bears have been unable to push LINK below the current demand zone — a sign that this area may be acting as a strong support floor.

If this level holds, a significant recovery could be on the horizon. The potential for a rebound is gaining attention, especially as macroeconomic uncertainty clouds the outlook. U.S. President Donald Trump’s latest tariff announcements and geopolitical moves are shaking financial markets, adding pressure to global economies and setting the stage for a potentially volatile era ahead. Crypto markets, often sensitive to global instability, remain caught in the middle.

Amid this backdrop, Martinez has highlighted a key technical level to watch: $13.20. According to Martinez, this support trendline could be the launchpad for the next major rebound in Chainlink’s price. Notably, the TD Sequential indicator has also flashed a buy signal at this level, further strengthening the bullish case for a turnaround.

While risks remain high, a strong defense of the $13.20 zone could trigger renewed momentum and offer bulls the chance to reclaim higher ground. The coming days will be crucial in determining whether LINK can stabilize and rally — or if the current support will finally give way to further downside.

LINK Trades At $13.20 As Price Tests Critical Support

Chainlink (LINK) is trading at $13.20 after enduring several days of intense selling pressure, placing the token in a crucial position. This level now acts as the last strong support before deeper losses, and bulls must hold above it to prevent a breakdown in market structure. A decisive defense here is essential, as slipping below the $13 mark could quickly lead to a drop beneath $12, dragging LINK into lower demand zones.

To shift momentum and spark a recovery rally, bulls need to reclaim higher ground — starting with a move above the $16 level. This zone has acted as a key resistance barrier in recent weeks, and a clean breakout would mark a meaningful shift in sentiment.

More importantly, a sustained push above $17 would bring LINK back above its 200-day moving average (MA) and exponential moving average (EMA), two critical technical indicators that signal broader trend strength. Reclaiming these levels would confirm renewed bullish momentum and could attract fresh demand from sidelined traders and investors.

For now, all eyes remain on the $13 level. Whether bulls defend it or not could determine LINK’s short-term fate — and set the tone for its next major move.

Featured image from Dall-E, chart from TradingView

New York, NY, March 31, 2025 (GLOBE NEWSWIRE) — In response to the growing trend of intelligent digital asset trading worldwide, AIXOR Exchange has officially stepped onto the international stage with its top-tier security system, advanced technological architecture, and the new AI trading system Genesis AI Pro 5.0, promising a more efficient, secure, and intelligent trading experience for global investors.

AIXOR: A New Generation of Intelligent Exchanges Redefining Digital Asset Trading

As a leading cryptocurrency trading platform, AIXOR is committed to becoming the most trusted global digital asset trading center with its core philosophy of "Security, Professionalism, Intelligence." The exchange not only offers a variety of investment options such as spot trading, contracts, ETFs, and leverage trading but also leverages AI technology to give investors an edge in the new era of digital finance.

AIXOR's core advantages include:

- op-tier Security Protection, Asset Safety Guaranteed

AIXOR employs military-grade security systems, integrating multi-signature authentication, cold and hot wallet separation, and AI risk control systems. It strictly adheres to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulatory standards to ensure the safety of user assets and transactions.

- Lightning-Fast Trading Experience, Millisecond Execution

With a super-fast matching engine, AIXOR handles millions of concurrent orders and achieves transaction execution speeds in milliseconds, guaranteeing precise order execution even under extreme market conditions to avoid slippage.

- Diverse Trading Products to Meet Various Needs

The platform supports multiple trading modes such as spot, contracts, leverage, ETFs, liquidity mining, and staking, covering mainstream crypto assets such as BTC, ETH, SOL, XRP, among others, and continually expands to offer new investment products, providing users with diverse asset allocation choices.

- Global Compliance Qualifications, Trustworthy

AIXOR holds multiple financial licenses in various countries, including the US MSB (Number: 31000292188716) and SEC certification, rigorously complying with international regulatory requirements to ensure transparency, safety, and legality in trading.

Genesis AI Pro 5.0: Breaking Traditional Trading Strategies with AI-Driven Intelligent Investment

The core technological advantage of AIXOR Exchange is embodied in its brand-new AI trading system—Genesis AI Pro 5.0. As an industry-leading AI-driven trading technology, Genesis AI Pro 5.0 features three core breakthroughs:

- Adaptive to Market Changes, Smartly Optimizing Trading Strategies

Unlike traditional trading systems with fixed rules, Genesis AI Pro 5.0 can dynamically learn market trends and automatically optimize trading strategies, managing to maintain robust performance even in highly volatile market environments, helping investors reduce risks and enhance returns.

- Cross-Market Compatibility, More Flexible Asset Allocation

Genesis AI Pro 5.0 is not only applicable to the cryptocurrency market, but it also spans multiple markets including stocks, forex, and futures, allowing investors to achieve dynamic allocation across various asset classes through the system, maximizing capital efficiency.

- Millisecond Trading Execution, Accurately Catching Market Opportunities

Based on big data analysis and AI smart decision-making, Genesis AI Pro 5.0 completes market scanning, risk assessment, and trade execution in milliseconds, helping users lock in the best trading opportunities at the first moment of market changes.

AIXOR, Leading a New Era of Cryptocurrency Trading

The inception of AIXOR Exchange is not only a significant breakthrough in the global digital asset trading market but also a model for the integration of AI technology and blockchain finance. Moving forward, AIXOR will continue to promote intelligent trading, providing global users with a more efficient, secure, and transparent investment environment.

Join AIXOR now and embark on a new era of intelligent trading!

About AIXOR

AIXOR is a global leading digital asset exchange dedicated to providing a secure, efficient, and intelligent trading environment through AI technology and blockchain innovation. The platform covers a variety of investment products including spot trading, contracts, ETFs, and leverage trading, and holds global compliance licenses to offer professional digital asset trading services to investors worldwide.

Media Contact

Company Name: AIXOR

Website: https://altafs.com

Contact: Jimmy anne

Email: server(at)altafs.com

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up