Investing.com - Although President Donald Trump’s trade policies have been largely subject to change since the start of his second term in office, his latest round of tariffs this week could be closer to where levies will settle over a longer period, according to analysts at Bernstein.

Ahead of a much-anticipated August 1 deadline for his "reciprocal" duties to come into effect, Trump signed an executive order on Thursday night lifting tariffs to as much as 50% on dozens of countries, as he steps up his drive to upend a global trading system he has described as unfair to U.S. interests. The levies are now set to activate at 12:01 am on August 7.

Major industrialized economies such as the European Union, Japan and South Korea will face duties of 15%, while other countries who run a trade surplus with the U.S. will be hit with tariffs of 10%.

Even higher tariffs are set to be slapped on other nations, including 50% levies on Brazil. Trump increased tariffs on Canada to 35% for goods that do not comply with the U.S.-Mexico-Canada Agreement, a trade deal signed during Trump’s first term.

Meanwhile, Trump and Mexican counterpart Claudia Sheinbaum said Mexico was granted another 90-day reprieve to forge an agreement with Washington.

In a note, the Bernstein analysts argued that while it remains to be seen whether Trump will ultimately decide to maintain the scope and timeline of his executive order, "some of the new rates are now increasingly the results of actual agreements [...] so this may be getting closer to what the actual picture will look like."

They added that companies would likely welcome more certainty around the tariff picture, as this could make planning around them easier. Investors will also be better able to assess the impact of the levies, the analysts said.

"[T]hough the market has clearly been getting trained to mostly ignore Trump’s tariff pronouncements [...] this feels like we may be getting closer to having a tariff plan stick," the brokerage said.

Observers are now keeping tabs on specific sectors, with the White House potentially rolling out tariffs on industries like semiconductors and pharmaceuticals. For chipmakers, in particular, duties may be slapped on "relevant end devices" and "potentially include the implementation of component-level tariffs," the Bernstein analysts said.

"Just given recent comments out of Trump and the administration we would anticipate hearing news on this soon, likely within weeks," the strategists said.

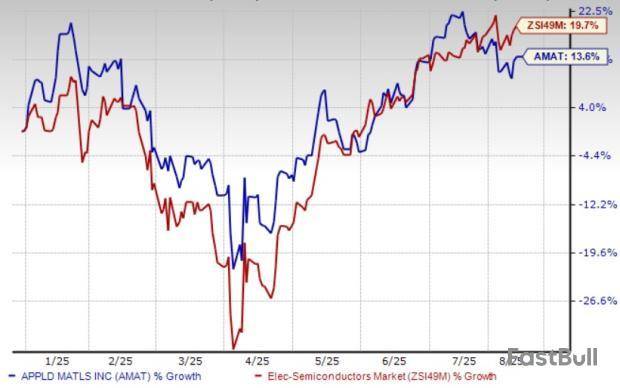

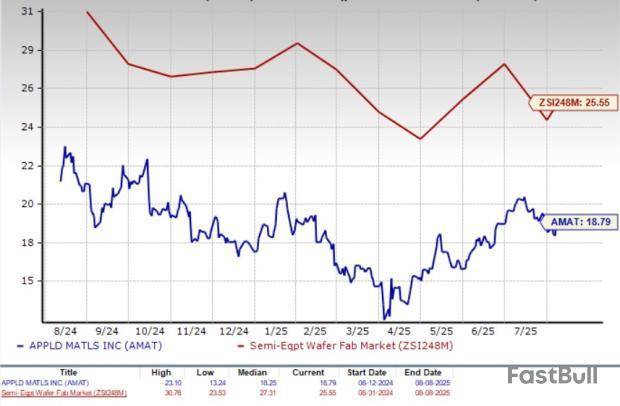

Against this backdrop, they made no changes to their estimates, price targets or ratings for the chip stocks they cover. Nvidia (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO), Qualcomm (NASDAQ:QCOM), Applied Materials (NASDAQ:AMAT) and Lam Research (NASDAQ:LRCX) are all rated at "outperform," while Advanced Micro Devices (NASDAQ:AMD), Analog Devices (NASDAQ:ADI), Intel (NASDAQ:INTC), NXP Semiconductors (NASDAQ:NXPI) and Texas Instruments (NASDAQ:TXN) are all rated at "market perform."