Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Apple’s latest iPhone 17 introduces a new layer of defense for crypto users with hardware-level memory protections that aim to prevent common attack vectors used to hijack signing operations.

At the core of this upgrade is Memory Integrity Enforcement (MIE), a feature enabled by default that uses Enhanced Memory Tagging Extension (EMTE)-style memory tagging to detect and block dangerous memory access types like out-of-bounds and use-after-free errors.

According to cybersecurity firm Hacken, the new MIE system “meaningfully” reduces the risk of attackers using memory-corruption zero-days to take control of signing code. “It’s a real plus for crypto users, especially high-net-worth or frequent signers,” Hacken told Cointelegraph.

These vulnerabilities reportedly account for nearly 70% of software flaws and are often exploited in zero-day attacks targeting wallets and Passkey approvals.

Apple boosts iPhone 17 defenses

Hacken explained that MIE actively detects and blocks dangerous memory access patterns like out-of-bounds and use-after-free errors, preventing many common exploit chains. It’s always-on across both kernel and user-level processes, making spyware development more difficult and expensive.

“It raises the bar for attackers and makes targeted spyware/exploit development much harder and more expensive,” Hacken said. “That directly benefits wallet apps and Passkey flows that rely on in-process operations,” the blockchain security firm added.

However, MIE is not a silver bullet. It does not protect against phishing, social engineering, malicious web content, or compromised apps. Furthermore, it does not replace secure hardware wallets or eliminate the need for user vigilance.

“Security improvements reduce overall risk but don’t make devices invulnerable,” Hacken said, asking users to be vigilant and expect new vulnerabilities.

Apple crypto users face security threats

Apple’s crypto users have been facing serious security threats. Last month, it was revealed that a zero-click vulnerability allows attackers to compromise iPhones, iPads and Macs without user interaction. Apple released security patches across multiple OS versions to fix the flaw.

Earlier this year, Kaspersky warned that malicious software development kits used in apps on Google’s Play Store and Apple’s App Store are scanning users’ photo galleries for crypto wallet recovery phrases.

Last year, Trust Wallet also warned Apple users to disable iMessage due to “credible intel” of a high-risk zero-day exploit circulating on the Dark Web that could let hackers take control of iPhones without user interaction.

The U.S. crypto market is preparing for a landmark week as Rex-Osprey’s highly anticipated exchange-traded funds (ETFs) are scheduled to launch this Friday. The lineup includes ETFs linked to Bitcoin, XRP, Dogecoin , BONK, and TRUMP tokens, all of which have cleared the Securities and Exchange Commission’s (SEC) 75-day review window without objection.

SEC Clears the Path for Crypto ETFs

The SEC’s decision not to object during the 75-day review period effectively gives Rex-Osprey the green light. These funds fall under the “40 Act” category, meaning they won’t hold spot crypto directly but will still provide regulated exposure to major tokens.

Chad Steingraber@ChadSteingraberSep 11, 2025The Rex-Osprey ETF’s are set to launch on Friday without SEC objection, clearing the 75 day review window.

Bloomberg analyst Eric Balchunas noted:

“Unless the SEC steps in at the last minute, these ETFs will begin trading on U.S. markets before the week is over.”

XRP ETF Could Set Records

Among the lineup, the XRP ETF is generating the most buzz. Market analyst Dom Kwok predicted:

“The XRP ETF could see the largest inflows in crypto history.”

With deadlines for other ETF applications arriving in October, many experts believe billions of dollars could enter the market if investor demand matches expectations.

Dogecoin ETF Makes History

The Dogecoin ETF (ticker: DOJE) is another milestone. It would be the first regulated U.S. product giving investors direct exposure to Dogecoin. Both retail traders and institutions are expected to pay attention, given DOGE’s popularity and cultural presence in crypto.

SEC’s Mixed Signals

While Rex-Osprey’s ETFs are moving forward, other applications face delays. The SEC recently extended its review of Franklin’s Solana and XRP ETFs until November 14, 2025. Similarly, Bitwise’s Dogecoin ETF has been pushed back to November 12. Meanwhile, BlackRock’s request to add staking to its Ethereum ETF awaits a final ruling on October 30.

These delays show the SEC’s cautious approach to more experimental crypto products, even as it allows others to advance.

What It Means for U.S. Markets

The launch of Rex-Osprey’s ETFs marks another step in the integration of digital assets into regulated financial markets. While these funds don’t provide direct spot exposure, they make it easier for both institutions and everyday investors to participate.

With XRP and DOGE leading the charge, this week could be a turning point for crypto ETFs in the United States.

FAQs

When do the new Rex-Osprey crypto ETFs launch?The Rex-Osprey ETFs, including funds for Bitcoin, XRP, and Dogecoin, are scheduled to launch this Friday.

What is the significance of the SEC’s 75-day review?The SEC did not object during its 75-day review window, effectively giving the Rex-Osprey ETFs the green light to begin trading.

Will these ETFs hold the actual cryptocurrencies?No. These are “40 Act” funds, meaning they provide regulated exposure to the tokens but will not hold the spot assets directly.

Are other crypto ETFs facing delays?Yes, the SEC has delayed decisions on Franklin’s Solana/XRP ETFs and Bitwise’s Dogecoin ETF until November, showing a cautious approach.

Hyperliquid has quickly become one of the hottest names in decentralized finance, and now it’s drawing serious attention from Wall Street. VanEck, a global asset manager VanEck is gearing up to file for a Hyperliquid spot-staking ETF in the U.S., while also preparing a parallel ETP in Europe.

Adding fuel to the excitement, VanEck executives hint that such a launch could even pave the way for Coinbase to list HYPE.

VanEck To Launch Hyperliquid Spot-Staking ETF

VanEck is preparing to launch an ETF focused on Hyperliquid, one of the fastest-growing decentralized exchanges. What makes this product different is that it won’t just track the price of HYPE, Hyperliquid’s token, but also include staking rewards, giving investors a chance to earn yield inside a regulated fund.

This is more than just another ETF filing. VanEck is attempting to merge two powerful features of crypto, a rare move in the ETF industry that could increase demand for the token.

If approved, the Hyperliquid spot-staking ETF would be a major milestone. It shows growing trust in new blockchain projects beyond Bitcoin and Ethereum, while providing traditional investors with an easier way to access decentralized finance.

HYPE to Get Listed on Coinbase Soon?

VanEck’s push for a Hyperliquid staking ETF could be the key to HYPE landing on Coinbase. Launched in 2023, Hyperliquid has already built strong momentum, topping DeFi revenue charts for four straight weeks.

VanEck’s Kyle Dacruz explained that demand for a HYPE staking ETF is clear, and such a product could make it easier for U.S. investors to gain exposure while boosting the token’s visibility.

At its core, the move shows Wall Street’s growing interest in blending DeFi innovation with traditional finance structures.

HYPE Token Price Outlook

Hyperliquid has hit a fresh all-time high this week, jumping 22% to reach $55.34.

For weeks, the token was stuck in a tight range between $44 and $47. But in early September, it finally broke out, moving strongly above two key levels, the 50-day EMA at $48.15 and the 100-day EMA at $46.74.

Looking ahead, support now sits around $55, with stronger backup near the $60–$65 zone. As long as trading volume stays high, the bulls seem firmly in control, and HYPE could continue its upward run.

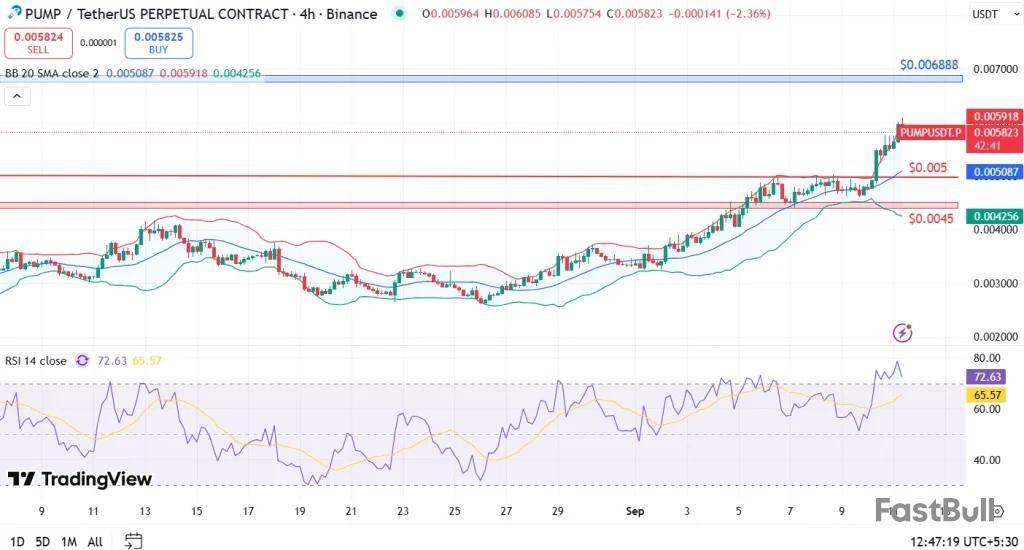

Pump.fun has been one of the most talked-about tokens this week, and for good reason. The memecoin launchpad is not only helping new tokens gain traction but also making a strong case for its own native token, PUMP. At press time, PUMP is changing hands at $0.005814, with a daily premium of 10.52%, and an impressive 42.34% weekly jump. With a market cap of $2.06 billion and intraday trading volume soaring 89% to $500.47 million, momentum around the project is building fast.

The price action also highlights renewed investor confidence, bolstered by recent buybacks, fresh listings, and growing protocol revenues. The question that now haunts traders is whether PUMP can sustain this bullish momentum or if a correction is around the corner. And this analysis is here to address all those queries.

Onchain Metrics

Revenue is one of the signals of Pump.fun’s current strength. According to DeFiLlama, Pump.fun generated $2.57 million in the last 24 hours, placing it right behind Hyperliquid among the top protocols. This revenue primarily comes from trading and token launch fees, which the platform keeps at a rather slim 0.05%, making it attractive for new projects.

What’s pushing adoption further is the growing ecosystem impact. On September 8, MEXC listed TBCN, a Solana-based memecoin born out of Pump.fun’s platform. This listing came shortly after Pump.fun launched the Glass Full Foundation in August, a liquidity injection initiative designed to support fresh projects. These moves highlight the platform’s growing role as a memecoin incubator.

On the tokenomics side, Pump.fun has aggressively reduced supply through buybacks. Since July, the protocol has bought back over $30.65 million worth of PUMP, including $705,000 in a single day last month. This reduced the circulating supply by 0.76%, directly easing selling pressure from early investors and fueling the latest rally.

PUMP Price Analysis

From a technical perspective, PUMP has been showing strength. The token reclaimed the 23.6% Fibonacci retracement level at $0.005, a critical support zone that now underpins bullish sentiment. As long as the price stays above this level, the path of least resistance points higher.

Immediate resistance sits at $0.006888, a level traders are eyeing for the next breakout attempt. If PUMP clears this hurdle, bulls could push toward the $0.0075 zone, setting the stage for a run back to its all-time high of $0.01214.

Conversely, a close below $0.005 could see PUMP retest support at $0.0045. The RSI is currently at 72, suggesting the market is flirting with overbought territory, so short-term pullbacks cannot be ruled out. Still, with buybacks, listings, and revenue momentum backing the move, dips are likely to attract fresh buyers.

FAQs

Why is PUMP rallying right now?The rally is driven by MEXC’s listing of a Pump.fun-generated memecoin, aggressive buybacks reducing supply, and Binance listing boosting exposure.

What are the key levels to watch?Resistance stands at $0.006888, while $0.005 and $0.0045 serve as critical support levels.

How does Pump.fun generate revenue?The protocol earns from trading and token launch fees, which have made it the second-highest revenue generator in DeFi over the past 24 hours.

Bitcoin’s price jumped by a few grand yesterday and has maintained around $114,000 ahead of the highly anticipated US CPI data, which will be announced later today.

Most larger-cap altcoins are in the green as well, with DOGE and XLM surging by up to 3%. AVAX has risen by over 6%.BTC Rises Before US CPI Data

The primary cryptocurrency tried to take down the crucial $113,000 support on a couple of occasions in the past week, but each attempt was met with an immediate rejection. The subsequent decline drove it south by a few grand, as it happened on September 6 and September 10.

The bullsinitiated another leg upin the past 24 hours that also saw BTC challenge that level. This time, though, the asset wasa lot more successfulas it finally breached that level. Moreover, it kept climbing and tapped a 17-day peak of $114,500 earlier this morning.

Although it has retraced slightly since then, it still trades around $114,000. More volatility is expected later today when the US CPI numbers are set to be announced. The past few such occasions led to immediate price declines before bitcoin managed to recover the lost ground.

For now, though, BTC’s market cap has risen to $2.270 trillion, while its dominance over the alts has calmed at 56% on CG.MNT New ATH

Mantle’s native token is today’s top performer, having surged by double-digits to mark a new all-time high at $1.65. AVAX is next in line from the larger caps, as a 7% increase has pushed the asset to almost $30.

DOGE, XLM, LTC, and TAO are also well in the green. Ethereum has risen past $4,400 after a 2.3% jump over the past 24 hours. In contrast, WLD has dropped by almost 8% after the recent rally that drove it north to well over $2.

The total crypto market cap has reclaimed the $4 trillion mark and has grown to $4.060 trillion on CG.

John Lennon’s younger son, Sean Ono Lennon, has addressed his X followers with a message that criticizes the current monetary policy of the US and praises Bitcoin.

Sean Lennon is known for his interest in crypto, both in Bitcoin and some altcoins. The first time he began talking about BTC was in 2020, when the pandemic rolled around the world, causing numerous lockdowns and money printing. It seems that Lennon the junior believes that Bitcoin is capable of curing “most of the ills of our society.”

card

Sean Lennon defines Bitcoin as the cure for society's problems

Sean Lennon’s recent X post questions the current US monetary policy, slamming it as a possible “true root cause of most of the ills of our society.” Elaborating on it, the musician specifies that this policy is “runaway money printing.”

He believes that the world’s largest cryptocurrency, Bitcoin, may solve this problem and, perhaps even, rid society of the problems it has been causing – Lennon added a Bitcoin hashtag to his tweet.

Seán Ono Lennon@seanonolennonSep 10, 2025Runaway money printing ie, monetary policy, could be the true root cause of most of the ills of our society. #bitcoin

In 2020, Sean Lennon stated that Bitcoin gave him more optimism than any other thing in the world – he said that at Max Keiser’s podcast, Orange Pill. This statement was to do with Bitcoin’s scarcity due to the capped supply of 21 million coins. This fact triggered Lennon’s positive appraisal as in 2020 the US government began to give away supportive Trump’s cheques to support American households.

In 2023, the son of the music legend proclaimed himself a Bitcoiner.

Bitcoin rises to a two-and-half-week high after the S&P 500 and Nasdaq reached record highs overnight. U.S. stocks were boosted by a rally in Oracle's shares after the database-software giant said that it won several billion-dollar artificial intelligence deals in its latest quarter. Lower-than-expected U.S. wholesale price data also lifted shares as it strengthened the case for the Federal Reserve to cut interest rates at the September 17 meeting. Attention now turns to U.S. inflation data at 1230 GMT for further clues on the likely pace of future rate cuts. Bitcoin rises to a high of $114,452, LSEG data show. (renae.dyer@wsj.com)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up