Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Today’s recovery attempt by most cryptocurrencies turned out to be a fakeout as the market has turned red once again.

This time, Ethereum has taken the painful main stage, dumping by over 11% since its all-time high registered just over 24 hours ago.

The landscape around the world’s second-largest cryptocurrency changed for the better on Friday evening, after Jerome Powell’s rather promising speech about future key interest rate cuts. ETH reacted with an immediate price surge that drove it from $4,200 to a new all-time high of almost $4,900.

After a much calmer 48-hour period during the weekend, the asset went on the offensive once again on Sunday evening and set another record of over $4,950. That’s where the situation changed for the worse, and ETH, alongside BTC and the rest of the market,tumbledhard.

Bitcoin’s priceplungedto a six-week low, leaving over $300 million in longs liquidated in just one hour before it dumped further to $110,000 today. BTC took yesterday’s correction a lot worse, while ETH, perhaps aided by the continuous big purchases from whales and corporations, performed slightly better.

However, Ethereum has dumped hard now, losing over $550 since yesterday’s peak in a drop to $4,400 marked minutes ago. This price dump is rather surprising given the fact that large entities continue to accumulate the token en masse, including this massive $2.5 billion purchase reported by Arkham Intelligence.

THIS MASSIVE WHALE JUST BOUGHT AND STAKED $2.5 BILLION USD OF ETH

This guy just bought $2.55B USD of ETH from Hyperunit and staked it ALL through the same staking contract.

His last deposit was only 1 HOUR ago. Will he keep buying? pic.twitter.com/YAAPHkfwIM

— Arkham (@arkham) August 25, 2025

The liquidations are once again on the rise. In the past hour alone, the total value has risen to nearly $285 million, with longs representing the majority of that amount. ETH leads the pack, with over $110 million in longs wrecked.

Almost 180,000 traders have been liquidated in the past day, with the single largest wiped out position taking place on Binance. It was worth north of $7 million and involved ETH.

UAE has joined the long list of nations stacking up on Bitcoin, but its Bitcoin accumulation is based on its sophisticated infrastructural capabilities, according to recent data shared by Arkham Intelligence Firm.

The data reveals that the UAE Royal Group’s Citadel Mining has accumulated a massive amount of Bitcoin in an unusual way and now holds over 6,300 BTC worth over $706 million.

UAE stuns with infrastructural BTC bets

While countries holding large amounts of BTC are known to acquire their assets via purchases or legal dealings, the UAE has stirred reactions across the crypto community as reports revealed its massive Bitcoin holdings were primarily accumulated through direct mining operations.

Notably, the UAE Royal Group owns a large share of Citadel Mining, and it has continued to scoop up the world’s leading crypto through block rewards.

With the Bitcoin ecosystem consistently making waves since its halving in 2024, the UAE has seen its Bitcoin stash grow significantly. Following the event, recent daily transfers of around 2 BTC in rewards have been traced to mining pools like Foundry Digital, and the rewards have been sent directly to Citadel’s mining wallets, boosting the country’s BTC holdings.

Nonetheless, with its incredible ability to generate Bitcoin through mining, the UAE has become one of the richest countries with the largest Bitcoin stash without having to spend a dime of its funds to purchase the asset.

UAE joins leading Bitcoin holding countries

Apart from institutions and retailers, the crypto industry has also spotted increasing demand for Bitcoin among countries as the world’s largest cryptocurrency by market capitalization continues to gain mainstream appeal.

Joining the Bitcoin bandwagon is increasingly becoming a global trend since Bitcoin’s explosive growth witnessed in 2024. While the asset has become the center of attention among institutions, governments are increasingly weighing its value as a strategic reserve asset.

While the United States is known as the largest Bitcoin holding country with around 200,000 BTC in its portfolio, the UAE has also joined the list, as its holding is expected to continue doubling as more BTC gets mined.

Following this trend, Bitcoin’s adoption is gradually shifting from retail investors to major corporations amid surging interest from large holders.

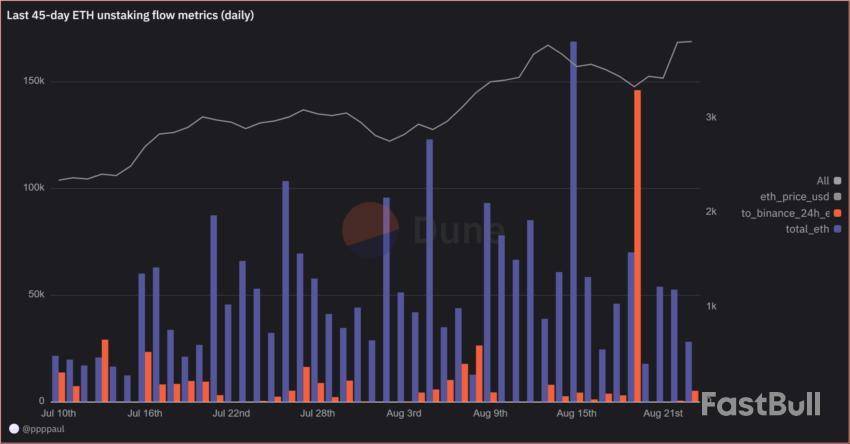

The cryptocurrency market fell nearly 4% Monday, intensifying concerns over a surge in Ethereum unstaking. On-chain data shows 1.18 million ETH are queued for withdrawal, the largest backlog in months.

The delays highlight pressure on the Ethereum network. Normally, unstaking takes three to five days. Current applicants face up to 40 days.

ETH Unstaking Surge ≠ Selling Pressure

Unstaking does not automatically mean selling. Many holders may keep their ETH, waiting for higher prices or DeFi opportunities. Data from Dune Analytics indicates no strong link between unstaking volume and ETH price over the past 45 days.

However, when withdrawn, ETH moves to exchanges, and price drops often follow.

On August 19, large inflows to Binance coincided with a 5% ETH decline. That same day, the Nasdaq fell 1.46% on fears of delayed Federal Reserve rate cuts.

According to on-chain data, roughly 115,000 ETH will exit staking daily this week. At current prices, it is nearly $4,600, which equals $529 million in circulation each day.

The volume adds uncertainty as markets remain sensitive to macroeconomic shifts. A mix of heavy unstaking and negative news could drive sharp price swings.

Several market voices argue that the fears are overstated. Some investors compared the situation to Solana, which faced similar fears after FTX-related unstaking.

Meanwhile, CryptoQuant data highlighted that ETH supply on centralized exchanges has fallen to record lows. Only 18.3 million ETH remain, reducing immediate sell pressure.

Unstaking flows remain large, but the impact depends on exchange transfers and broader economic conditions. Analysts caution that ETH withdrawals alone are unlikely to trigger sustained sell-offs without external market shocks.

Overall, the record Ethereum unstaking backlog underscores growing investor activity, but its market impact remains uncertain.

While billions in ETH are set for release, exchange flows and global economic trends will ultimately determine whether the surge translates into selling pressure or simply reflects a maturing network.

Exchange industry associations and global regulators are joining forces to curb the growth and adoption of tokenized stocks, arguing that these products do not represent actual equities and expose investors to significant risks.

According to Reuters, the European Securities and Markets Authority (ESMA), the International Organization of Securities Commissions (IOSCO), and the World Federation of Exchanges (WFE) have sent a letter to the US Securities and Exchange Commission’s (SEC) Crypto Task Force, urging stricter regulatory oversight of tokenized stocks.

The organizations argue that tokenized stocks “mimic” the equities they are designed to represent but lack the investor protections built into traditional markets.

“We are alarmed at the plethora of brokers and crypto-trading platforms offering or intending to offer so-called tokenized US stocks,” the WFE told Reuters, without naming specific firms or platforms. “These products are marketed as stock tokens or equivalent to the stocks when they are not.”

The push carries weight given the influence of the signatories. EMSA is a European Union agency and one of the bloc’s three main financial supervisory authorities.

IOSCO is an international body that sets standards for securities regulation and investor protection across global markets.

WFE, headquartered in the UK, is an industry group representing exchanges and clearing houses worldwide.

The call for clampdowns comes as tokenized securities gain traction on Wall Street and beyond, driven by the promise of greater efficiency, lower costs and broader market access through blockchain technology.

The value of tokenized assets has already climbed past $26 billion, according to industry data.

Tokenized stocks — digital representations of traditional equities issued on a blockchain — remain a small slice of that market, but their footprint is expected to grow as major platforms such as Coinbase, Kraken and Robinhood move into the space.

Lobby groups ramp up efforts to block crypto takeover

This isn’t the first time traditional industry lobbies have joined forces to slow the growth of blockchain innovation. As US lawmakers mulled over the GENIUS stablecoin bill, banking groups quietly lobbied to exclude yield-bearing stablecoins — a feature that could have directly competed with their service offerings.

They were ultimately successful, with GENIUS explicitly barring stablecoin issuers from paying interest to holders.

While the passage of GENIUS was widely seen as a win for the stablecoin industry, it also came with a trade-off. “By explicitly prohibiting stablecoin issuers from offering yield, the GENIUS Act actually protects a major advantage of money market funds,” Temujin Louie, CEO of crosschain interoperability protocol Wanchain, told Cointelegraph.

Still, the SEC appears open to tokenization at the highest levels. In July, SEC Chair Paul Atkins described tokenization as an “innovation” that should be advanced within the US economy.

That same month, SEC Commissioner Hester Peirce stressed that tokenized securities, including tokenized equities, must nonetheless comply with existing securities laws.

Gemini is expanding its partnership with Ripple, rolling out an XRP rewards credit card for U.S. customers and broadening the use of Ripple USD (RLUSD) as it prepares for a potential public listing.

XRP Credit Card Launch

The crypto exchange introduced a new version of its credit card that provides cashback in XRP. Issued by WebBank, the card offers 4% rewards on fuel, EV charging, and ridesharing, 3% on dining, 2% on groceries, and 1% on all other purchases.

Gemini said select merchants will provide up to 10% back on eligible transactions. “We’re giving customers and the XRP Army new ways to earn XRP and express their passion, loyalty, and excitement,” Gemini co-founder Tyler Winklevoss said.

Ripple@RippleAug 25, 2025Introducing the @Gemini Credit Card XRP Edition

→ $RLUSD now supported for US spot trading

→ Simplified trading, no extra conversion fees

→ Fast and simple access to crypto and stable value

→ Special-edition design for the XRP community https://t.co/gdNJIPWMcq

Gemini also expanded the role of Ripple USD on its U.S. platform. The $680 million stablecoin is now available as a base currency for all spot trading pairs, allowing traders to move between assets without conversion steps.

“Fifty-five million Americans own crypto, and that number is only increasing as more people look for easier ways to access and use it in their daily lives,” Ripple CEO Brad Garlinghouse said. “With Gemini, we’re making everyday spending a chance to earn and connect with both XRP and RLUSD.”

IPO Filing

The moves come as Gemini steps up efforts ahead of a planned IPO. The exchange filed for a listing in June and has since expanded its offerings, including tokenized U.S. stock trading and regulatory approval in Malta under MiCA rules.

According to its IPO paperwork, Gemini reported a $282 million net loss in the first half of the year and secured a $75 million credit facility from Ripple.

Related: Crypto Exchange Gemini's Losses Explode 580% Before Going Public

Meanwhile, Cryptocurrency exchange Gemini has reported a sharp increase in losses for the first half of 2025, disclosing a net loss of $282.5 million compared with $41.4 million in the same period last year. The figures highlighted mounting financial pressures as the firm prepares to enter public markets.

The results mark a setback for Gemini, founded by billionaire twins Tyler and Cameron Winklevoss, who are seeking to position the exchange among a growing list of crypto firms eyeing Wall Street debuts this year.

Revenue for the six months through June slipped to $68.6 million from $74.3 million a year earlier, further weighing on performance. The decline comes even as the broader digital asset sector has benefited from a friendlier policy environment under the Trump administration and rising institutional interest in cryptocurrencies.

B Strategy, a digital asset investment firm founded by former Bitmain executives, plans to launch a $1 billion crypto treasury focused on investing in BNB, the native token of the Binance ecosystem.

According to a Monday announcement, the new BNB (BNB) treasury is backed by YZi Labs, the family office of Binance co-founder Changpeng Zhao.

The new company will be structured similarly to 10X Capital, which recently launched a BNB treasury with YZi Labs’ support, a spokesperson for B Strategy told Cointelegraph.

To fund its crypto treasury, 10X Capital raised $250 million with YZi Labs’ help in July, allocating the capital to accumulate and hold BNB as a long-term reserve asset.

“We plan to collaborate with a US-listed company through a private placement,” the representative said. “Following the capital injection from this placement, the listed company will purchase BNB, transitioning its business model to focus on holding and managing BNB assets as a dedicated treasury entity.

“We aim to serve as a bridge between the US and Asian markets. There is significant demand from Asian investors seeking access to the US stock market, and they trust our team to help manage their investments within this treasury strategy.”

YZi Labs, formerly known as Binance Labs, is led by Ella Zhang and is overseen by Binance's Zhao.

BNB treasury companies rise and fall

According to Cointelegraph indexes, BNB is the fourth-largest crypto token by market capitalization, worth $120.3 billion at this writing. Beyond trading, BNB is used to pay transaction fees, participate in staking and governance, making it central across the Binance’s broader ecosystem.

Companies embracing BNB as a reserve asset have emerged in recent months, with investors sending mixed signals through stock performance.

Shares of CEA Industries surged 550% after the company unveiled plans for a BNB treasury. Similarly, BMB Network Company’s $500 million BNB treasury vehicle was oversubscribed in its latest funding round.

Forbes reported in June 2024 that Zhao controlled about 64% of the entire BNB supply.

Prediction market platform Kalshi has hired digital assets influencer John Wang as its head of crypto in a move the CEO called “betting on slope.”

In a Monday notice, Kalshi CEO Tarek Mansour said the company had hired the 23-year-old New York-based influencer, who dropped out of the University of Pennsylvania “to pursue crypto” in 2024. According to his LinkedIn, Wang worked as a fellow at Paradigm and an intern at Immutable before co-founding blockchain security company Armor Labs in 2022.

“Slope is about high quality thinking, dreaming big, and working mercilessly hard,” said Mansour. “The more time I spent with John, the deeper my conviction grew. I can’t wait for us to tackle the roadmap we are putting together.”

Wang’s position comes while Kalshi is under scrutiny as US lawmakers consider Brian Quintenz’s nomination to chair the Commodity Futures Trading Commission (CFTC), an agency with regulatory authority over the company.

The CFTC filed an enforcement action against Kalshi in September 2024 while under the Biden administration, but filed a motion in May to drop the case while under President Donald Trump.

Political motivation for platform offering election betting?

Wang, as the new head of crypto, suggested that prediction markets could make people more engaged “politically, financially, culturally,” citing his experience monitoring bets over the 2024 US presidential election:

Though launched in 2021, activity on Kalshi surged ahead of the 2024 US elections, for which the platform offered many options for users to bet. Though the CFTC filed for a temporary injunction to block Kalshi from listing political event contracts, a court ruled in October — one month before the federal elections — that the platform could offer such bets.

Kalshi closed a $185 million funding round in June, making the company’s valuation about $2 billion. The funding round and Wang’s hiring followed the platform announcing it would accept Bitcoin (BTC) deposits in April as part of efforts to onboard more crypto-native users.

Magazine: Can privacy survive in US crypto policy after Roman Storm’s conviction?

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up