Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Web3 company Animoca Brands has launched a new marketplace for investors to access tokenized real-world assets (RWAs), fixing what its CEO calls a “fragmented” tokenization marketplace at a time of growing institutional interest in the technology.

The new platform, called NUVA, was developed in partnership with ProvLabs, the organization behind the Provenance Blockchain, according to a joint announcement on Thursday.

The NUVA marketplace will leverage Provenance Blockchain’s existing ecosystem of RWAs, which currently holds assets valued at approximately $15.7 billion.

At launch, NUVA will offer exposure to two tokenized products from Figure Technologies: YLDS, the first yield-bearing stablecoin security approved in the US, and HELOC, a pool of fixed-rate home equity lines of credit.

These assets will be offered through “vaults,” a structure that enables easier and more efficient investor access to tokenized products.

Vault-based marketplaces are increasingly recognized for expanding accessibility, particularly for investors who are traditionally underserved or lack access to conventional financial platforms.

“The vault tokens are liquid claims to the yielding real-world assets stored in each vault,” ProvLabs CEO Anthony Moro told Cointelegraph in a written statement, adding:

These so-called nuAssets bring liquidity to traditionally illiquid RWAs, giving investors the option to trade and transfer them across chains and decentralized finance exchanges.

Animoca Brands’ co-founder and executive chairman, Yat Siu, said NUVA is intended to tap into a growing RWA market that remains “fragmented across chains and marketplaces, [which] limits their reach and impact.”

NUVA intends to fix this gap by making “institutional-quality assets radically more accessible across a unified, multichain ecosystem,” said Siu.

Tokenization boom expected to accelerate with supportive regulations

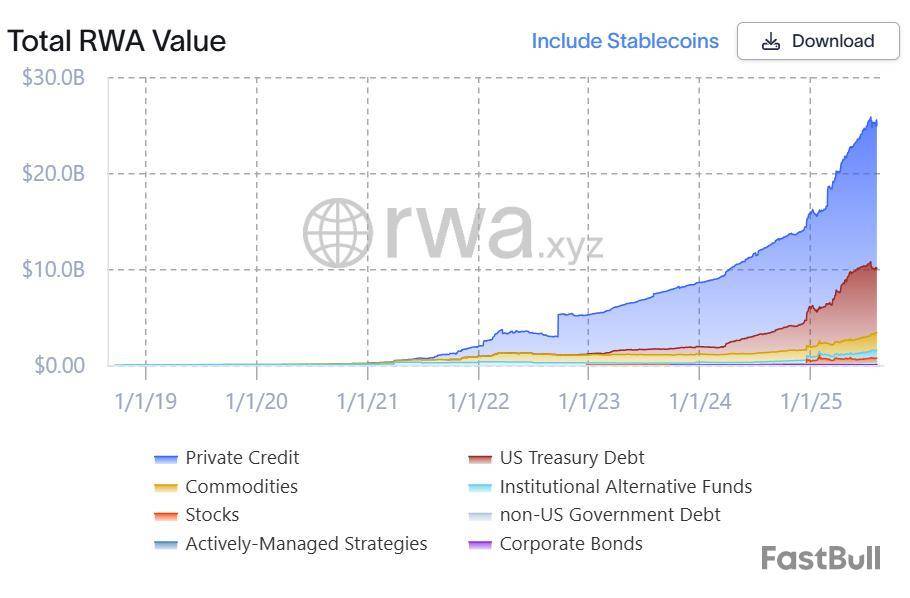

Tokenized finance is emerging as one of the most influential trends shaping the crypto industry in 2025, with the rise of RWA tokenization driven by growing demand for products like private credit and US Treasury bonds.

As Cointelegraph reported, the tokenized RWA market — excluding stablecoins — has surged by as much as 380% since 2022.

Tokenized stocks are also gaining momentum, reaching a total market capitalization of $370 million by the end of July, representing a 220% increase in just one month, according to Binance Research.

Industry experts told Cointelegraph that recent regulatory developments in the US, particularly those surrounding stablecoins, could create a more favorable environment for the continued expansion of RWA tokenization in the years ahead.

Major institutions are also taking notice. JPMorgan recently highlighted the role of tokenized money market funds as a way to preserve the appeal of cash in digital ecosystems.

“Instead of posting cash, or posting Treasurys, you can post money-market shares and not lose interest along the way,” said JPMorgan strategist Tereso Ho said, referring to the operational benefits of tokenized money market funds

Paul Brody, EY’s global blockchain leader, added that tokenized deposits and tokenized money market funds “could find a significant new opportunity onchain,” signaling strong institutional confidence in the sector’s future.

The following article is adapted from The Block’s newsletter, The Daily, which comes out on weekday afternoons.

Happy Thursday! President Trump is reportedly set to sign an executive order today opening a path for crypto in 401(k) plans, and another one threatening penalties for crypto debanking could be on the cards too.

Also in today's newsletter, Ethereum daily transactions reach a new record high, Ripple agrees to acquire Galaxy-backed stablecoin firm Rail for $200 million, Paxos settles with the NYDFS for $48.5 million, and more.

Meanwhile, short-term holder confidence is being tested as the price of bitcoin enters an "air-gap" zone following its July peak, according to analysts at Glassnode.

Let's get started.

Trump to sign executive order for crypto in 401(k) plans

President Trump will sign an executive order today directing the Labor Department to allow crypto, private equity, and other alternative assets in 401(k) plans, Bloomberg reported, citing a person familiar.

Ethereum daily transactions reach new high, surpassing 2021 peak

Ethereum hit a new all-time high of 1.74 million daily transactions on Wednesday, surpassing its previous record peak during May 2021.

Ripple to acquire Galaxy-backed stablecoin firm Rail for $200 million

Ripple has agreed to acquire Galaxy-backed Rail for $200 million to scale its RLUSD stablecoin payments and cross-border settlement as new U.S. regulations take shape.

Paxos settles with NYDFS for $48.5 million over Binance BUSD partnership

Paxos Trust Company has agreed to pay $26.5 million in fines and invest $22 million in compliance upgrades after the New York State Department of Financial Services found it failed to vet Binance properly during their BUSD stablecoin partnership.

Chainlink launches strategic LINK reserve

Chainlink has launched a strategic LINK reserve funded by both onchain service revenue and offchain enterprise payments, designed to support the long-term growth of the decentralized oracle network.

In the next 24 hours

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: This article was produced with the assistance of OpenAI’s ChatGPT 3.5/4 and reviewed and edited by our editorial team.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

US President Donald Trump is set to sign an executive order on Thursday instructing federal bank regulators to identify and fine financial institutions that engaged in “debanking.”

According to Bloomberg on Thursday, citing a senior White House official, regulators will be required to review complaint data, while financial institutions under the purview of the Small Business Administration will be asked to make efforts to reinstate clients who were unlawfully denied banking services.

Debanking has been a key concern among some political groups, who argue that businesses such as gun manufacturers and fossil fuel companies have been denied banking services for idealogical reasons.

It was also a common complaint among crypto companies. During the administration of former President Joe Biden, allegations emerged of a new initiative called “Operation ChokePoint 2.0,” which some believed was an attempt to drive the crypto businesses offshore during the 2022 bear market.

Despite the change in tone under the Trump administration, allegations of debanking have persisted.

According to Bloomberg, the executive order will instruct regulators to eliminate the “reputational risk” category from guidance and training materials. Critics say that category was used to unfairly target crypto companies.

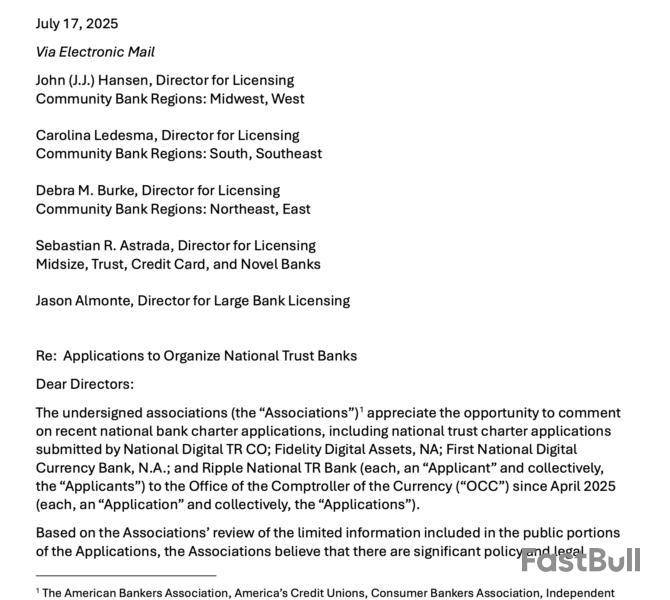

Group of banks attempts to block crypto bank applications

As the Trump administration makes an effort to end debanking, a group of powerful bank associations is attempting to block various crypto companies, including Ripple, from obtaining banking licenses.

According to a letter to the Office of the Comptroller of the Currency (OCC) dated July 17, the American Banking Association, Consumer Bankers Association, National Bankers Association, America’s Credit Unions and Independent Community Bankers of America seek to block banking applications from four digital asset providers, including Ripple and Fidelity.

In their letter, the associations argue that “there are significant policy and legal questions as to whether the Applicants’ proposed business plans involve the types of fiduciary activities performed by national trust banks.” In addition, the associations claim that the “public portions of the Applications do not allow for meaningful public scrutiny.”

Ripple, the creators of cryptocurrency XRP (XRP), applied for a banking license on July 2. The application came days after Circle, the creator of stablecoin USDC (USDC), filed to create a national trust bank to manage its stablecoin reserves.

The applications highlight the growing overlap between traditional financial institutions and native crypto firms, intensifying competition across the financial services industry.

Stablecoin companies, in particular, have introduced new forms of payments, which may clash with the infrastructure provided by traditional banks and credit card companies. The GENIUS Act, a US bill to regulate stablecoins and their issuers, was signed into law on July 18.

TL;DR

The Bullish Targets

Cardano’s native token was at the forefront of gains in mid-July, soaring to as high as $0.93. Since then, though, it has been on a downtrend and currently trades at around $0.74 (per CoinGecko’s data).

The popular X user Ali Martinez recently argued that ADA could witness another major uptick and rally to an eight-month peak of $1.30. According to the analyst, however, the necessary condition for this potential explosion is a breakout above $0.84.

CryptoBullet – an X user with over 170,000 followers on the social media platform – is also bullish, envisioning a possible spike beyond $1.60.

For their part, TapTools noted a resemblance between the current ADA/BTC chart and the one witnessed before the bull cycle in 2021. That said, they expect a major rally in the following months.

Other popular figures who have touched upon the matter recently include Hardy and Smith. The formerbelievesthat those who hold ADA are “golden” because the bull run has not yet started.

Last week, Smith spotted the formation of a “monstrous cup and handle” on the asset’s price chart, which could be a precursor of a massive pump. The analyst thinks the valuation could hit a new all-time high above $4 once it surpasses the breakout target of $0.92.The Multi-Million Approval

Just a few days ago, Input Output Global, the core development team behind the Cardano blockchain,receiveda funding green light for its protocol roadmap proposal. The sum equals around $71 million worth of ADA and will be taken from the Cardano treasury.

The initiative gained significant approval, with 74% casting a “yes” vote. Tim Harrison, EVP Community & Ecosystem at Input Output, described this as “a milestone moment” for the blockchain protocol and noted that this is the first time such a development will be funded directly by the community.

“This vote of confidence empowers us to move forward with full transparency, shared responsibility, and a renewed commitment to building an open, resilient ecosystem,” Harrison added.

The capital will be used to support the implementation of major upgrades, including boosting network throughput without compromising security or decentralization, enhancing the Hydra layer-2 solution, laying the technical groundwork for more advanced smart contracts, and other improvements.

Франция переходит на новый этап внедрения криптовалют, поскольку партия крайнего правого крыла Rassemblement National (RN) готовит законопроект, разрешающий использовать неиспользуемую ядерную энергию для майнинга Биткоина. По информации французской газеты Le Monde, лидер партии и трижды выдвигавшийся в президенты Марин Ле Пен продвигала этот план во время визита на АЭС Фламанвиль 11 марта, заявив, что это разумный способ превратить упущенное электричество в “надежные и крайне прибыльные” цифровые активы.

План Франции: майнить Биткоин с помощью ядерной энергии

Предложение Rassemblement National стало одной из самых обсуждаемых криптоинициатив во Франции. Партия утверждает, что поскольку Франция часто производит больше электроэнергии, чем потребляет, излишки не должны пропадать впустую. Законодатель от RN Орелиен Лопес-Лигуори подготовил законопроект о размещении оборудования для майнинга Биткоина на ядерных объектах компании Électricité de France (EDF), государственной энергетической компании.Идея состоит в том, чтобы направить неиспользуемую ядерную энергию (до одного гигаватта избытков) прямо на майнинговые фермы. Поскольку более 70% французской электроэнергии производится на АЭС, избыточные объемы электроэнергии продаются с убытком или даже за счет Франции передаются соседним странам.Вместо того чтобы продавать лишнюю энергию в убыток, Франция будет использовать ее для более выгодного дела – майнинга Биткоина и сохранения прибыли. Законопроект, поданный в Национальное собрание Франции 11 июля 2025 года, предусматривает пятилетнюю пилотную программу, которая позволит энергетическим компаниям создавать майнинговые предприятия непосредственно на АЭС. По внутренним оценкам, это может приносить от 100 до 150 миллионов долларов дохода в год.

Политический поворот: от скептиков к сторонникам криптовалют

Поддержка майнинга Биткоина со стороны Rassemblement National обозначает резкий поворот в отношении партии к криптовалюте. В 2016 году Марин Ле Пен была категорически против криптовалют, считая, что они лишат граждан контроля над финансами и увеличат власть глобальных банков, выступая за полный запрет их использования во Франции.Однако к 2022 году Ле Пен смягчила свою позицию, начав поддерживать регулируемое использование криптовалют в финансовой сфере. А к 2025 году она открыто выступает за майнинг Биткоина как часть национальной стратегии, что отражает значительные изменения как внутри её партии, так и в общественном политическом дискурсе по теме крипто.После неудачи подобного предложения в июне 2025 года депутат Лопес-Лигуори переработал законопроект, сделав акцент на национальную инфраструктуру и экономическое восстановление, утверждая, что план поможет сделать Францию более экономически независимой и решить давнюю проблему с избыточной энергией.В случае принятия Франция станет первой страной в Европе, официально связавшей майнинг Биткоина, поддерживаемый государством, с ядерной энергией, задавая пример другим странам, стремящимся заработать на избыточной возобновляемой или ядерной энергии.

Быки стремятся превратить уровень $114 000 в поддержку. Источник: BTCUSD on TradingView.com

Токен Maxi Doge (MAXI) собирает $400 тыс. на предпродаже, поскольку трейдеры проявляют интерес

Maxi Doge (MAXI) – это новый смелый мем-коин, построенный вокруг культуры “только вверх”, которая определяет крипто-бычьи рынки.

Токен дает сообществу шанс “выйти из душной комнаты”, уйти от ограничений и получить доступ к потенциальным сделкам x1000 через Maxi Fund. 25% общей эмиссии направлены на поиск самых взрывных токенов цикла, без стоп-лоссов, без страха и с одним правилом: если цена падает – удваивай ставку! Такие инвестиции с высоким риском и высокой уверенностью для тех, кто хочет либо поучить максимальную прибыль, либо уйти с рынка с пустыми руками. Maxi Doge создан для настоящих криптоэкстремалов!Предпродажа еще актуальна: неавно бло собрано целых $400 000. Чтобы купить токен $MAXI прямо сейчас, достаточно зайти на официальный сайт Maxi Doge и подключить свой криптокошелек (например, Best Wallet). Вы можете обменять USDT или ETH на токен, либо инвестировать в проект с помощью банковской карты.

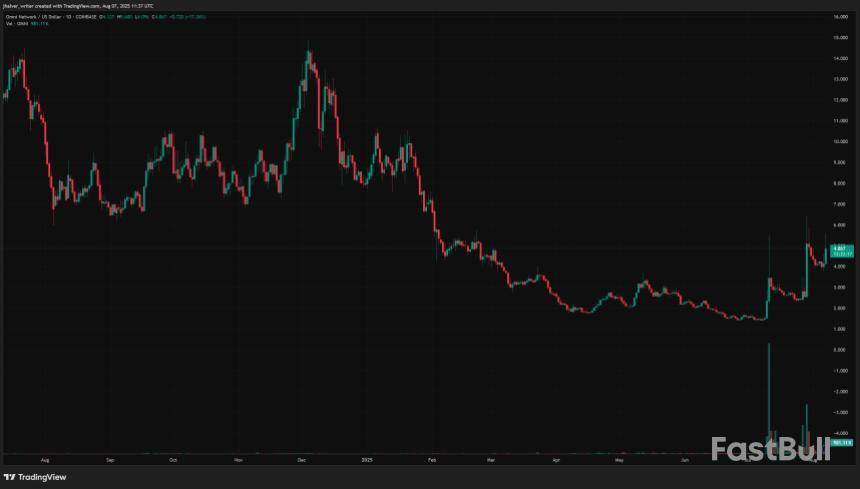

Omni Network (OMNI) continues to ride a powerful bullish wave one week after its debut on South Korea’s top exchange, Upbit.

As of now, the token trades at approximately $5, marking a 276% surge over the past 30 days, with the listing acting as a major catalyst in drawing global investor attention.

Launched to tackle fragmentation in Ethereum’s growing rollup ecosystem, Omni Network is fast becoming a favorite among both retail and institutional investors. The network’s promise of seamless interoperability between Ethereum rollups, powered by OMNI as a universal gas token, has boosted its bullish momentum.

Why OMNI Is Outperforming the Market

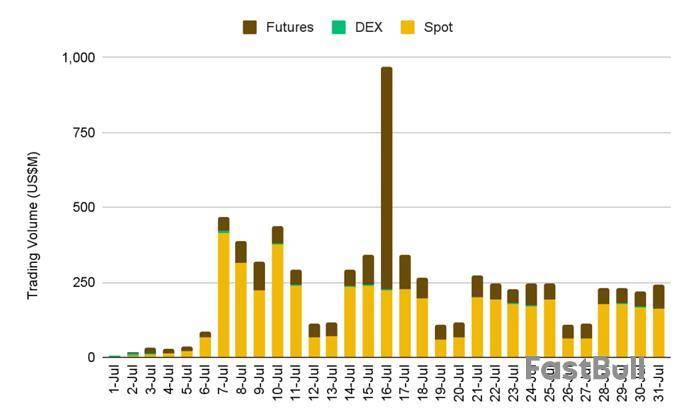

OMNI’s remarkable ascent began with its July 29 listing on Upbit. Within hours, the token surged from $2.50 to over $7.80, before stabilizing around $5. High trading volumes exceeding $580 million supported the magnitude of investor demand.

Technical indicators remain bullish. The MACD line continues to trend above the signal line, while RSI levels, though overbought, suggest sustained momentum.

Analysts view $4.36 as a crucial support level, with $5.98 and $6.94 serving as key resistance points. A breakout above these could pave the way to $10 and beyond in the coming months.

Beyond speculative interest, the token’s utility adds long-term value. Its dual staking model, which includes both the token and restaked ETH, combined with its universal gas marketplace, makes it a foundational infrastructure layer in Ethereum’s modular future.

Omni Network’s design aligns well with the Ethereum roadmap, and its market performance reflects strong confidence in its value proposition. With just over 10 million OMNI tokens currently in circulation, and most allocations under long-term vesting, supply remains constrained, adding to upward price pressure.

If adoption among Ethereum rollups continues and trading volumes hold, the token could hit $10–$30 within the next 12–24 months, according to mid-to-long-term forecasts.

For now, the Omni Network story is one of strong fundamentals, positive technicals, and a market narrative centered on blockchain support, place OMNI as one of 2025’s most promising Layer 1 tokens.

Cover image from ChatGPT, OMNIUSD chart from Tradingview

The Commune AI community call will talk about new ModChain tokenomics and a new app launch. Changes in tokenomics can affect the value of the COMAI token, since they may make the token more useful or rare. The app could also bring more users, which may help the price. However, the real price impact depends on how strong and positive these changes are. If the community likes what they hear, the price may go up. If there is doubt or confusion, price might stay the same or fall. Learn more at this source.

commune@communeaidotorgAug 07, 2025We will be having our community call on Friday at 1 PM EST on the Discord. Our main speakers are Fam and Huck. Huck will be presenting the new tokenomics for the ModChain. This presentation will cover the strategic considerations, key features, and potential impacts of the new…

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up