Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US Department of Homeland Security's El Dorado Task Force has reportedly launched an investigation into Anchorage Digital Bank, a Wall Street-backed cryptocurrency firm.

According to an April 14 Barron's report, members of the task force have contacted former employees of the company over the past weeks to examine its practices and policies. Citing unidentified sources, the report claims the probe looks at potential financial crimes within Anchorage.

The reported Homeland task force probe hints at cross-national financial activities. Established in 1992, the El Dorado Task Force focuses on “transnational money laundering” activities and financial crimes carried out by organizations.

Anchorage is co-founded by Portuguese-American entrepreneur Diogo Mónica and Nathan McCauley, according to its website. Along with its US businesses, Anchorage has operations in Singapore and Portugal. Its investors include Andreessen Horowitz, Goldman Sachs and Visa, among others.

Anchorage Digital is the only federally chartered crypto bank in the United States. It received its national trust bank charter from the Office of the Comptroller of the Currency (OCC) in January 2021.

Despite its advanced regulatory position, Anchorage Digital has faced regulatory challenges in the US. In April 2022, the OCC issued a consent order against the bank for deficiencies in its Bank Secrecy Act and Anti-Money Laundering compliance programs. At the time, the company was ordered to establish a committee to address the alleged issues under the oversight of the OCC.

Cointelegraph reached out to Anchorage for comment but had not received a response at the time of publication.

Anchorage's crypto footprint

Anchorage was founded in 2017, and since then has been expanding its crypto footprint with services for institutional clients. The company is a custodian of BlackRock's Bitcoin exchange-traded funds (ETFs) alongside Coinbase and BitGo. BlackRock's BTC funds have attracted over $35.5 billion in cumulative inflows since its launch in January 2024.

Another of Anchorage's clients is Cantor Fitzgerald. The company has offered custody and collateral management for Cantor's Bitcoin holdings since March 2025. Anchorage reported over $50 billion in assets under management in 2024.

Among Anchorage's custody competitors are players such as Ripple, Kraken, Taurus and Fireblocks, but the storage of digital assets has also attracted traditional financial institutions to the crypto field. HSBC, Citi and BNY Mellon — America's oldest bank — are also competing to safeguard crypto assets for institutional clients.

According to Fireblocks’ Adam Levine, senior vice president of corporate development, the US market lacks qualified custodians for digital assets. "[...] there are limited options for certain market participants to keep their digital assets in safe keeping via a qualified custodian,” Levine told Cointelegraph in a previous interview.

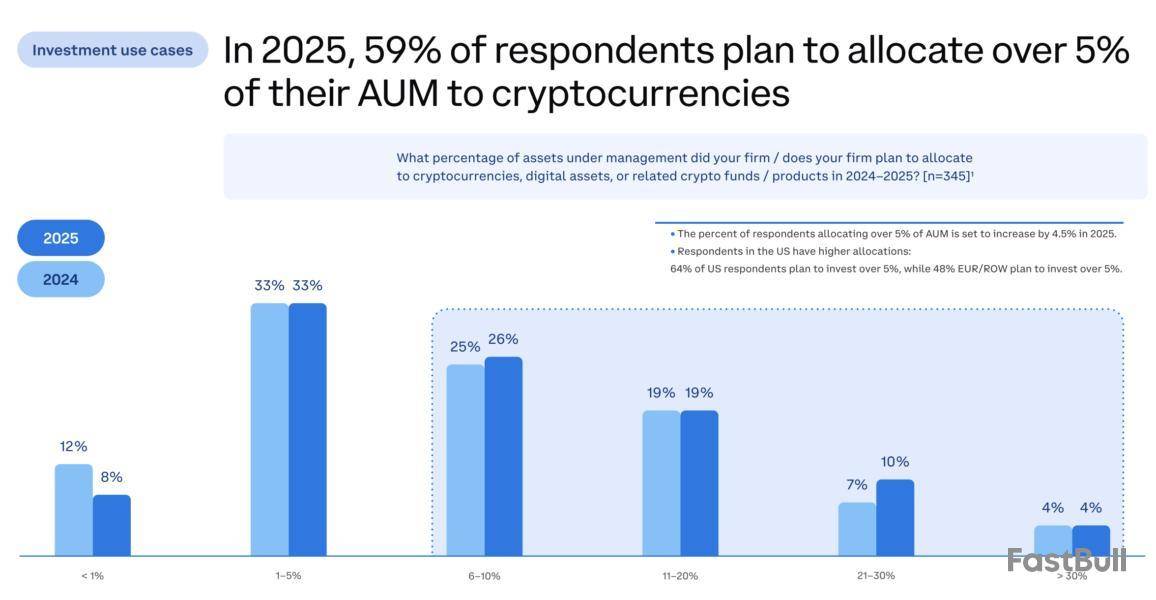

A 2025 survey by EY reveals that 59% of institutional investors plan to allocate over 5% of their assets under management to cryptocurrencies, indicating a growing demand for institutional-grade custody services.

Magazine: SEC’s U-turn on crypto leaves key questions unanswered

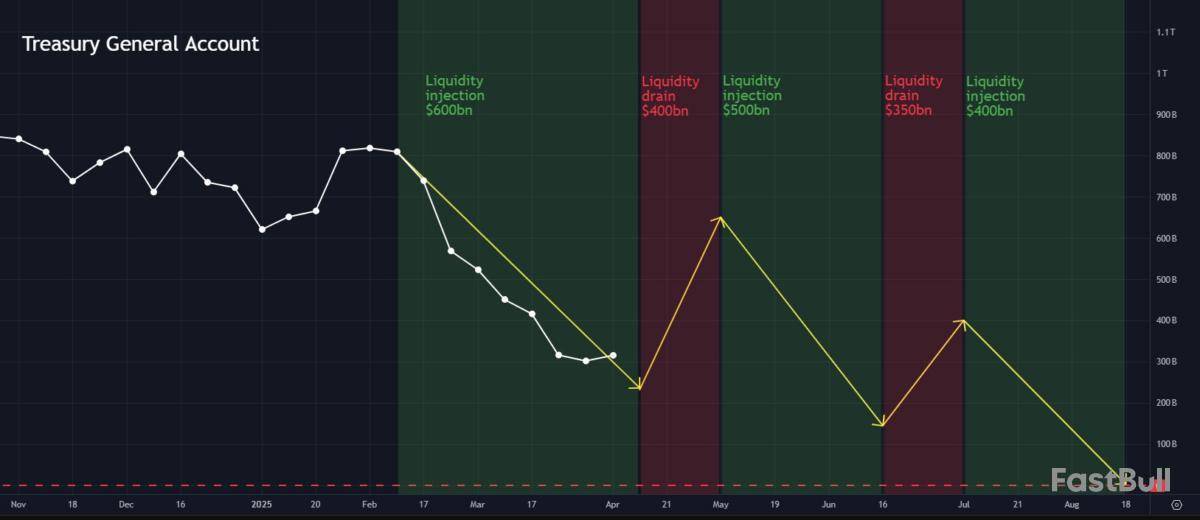

The US Treasury has injected $500 billion into financial markets since February by drawing liquidity from its Treasury General Account (TGA), funding government operations after a $36 trillion debt ceiling was hit on Jan. 2, 2025.

Macroeconomic financial analyst Tomas said that this liquidity surge boosted the net Federal Reserve liquidity to $6.3 trillion, and it may support Bitcoin’s (BTC) price in the future, even though risk assets have reflected minimal growth so far.

The TGA represents the government’s checking account at the Federal Reserve, holding capital for daily operations like paying bills or collecting taxes. A decrease in TGA capital means the balance has been deployed into the broader economy, boosting available cash in the markets.

Tomas explained that The TGA drawdown commenced on Feb. 12, following the exhaustion of "extraordinary measures" after the debt ceiling was reached. The TGA balance has dropped from $842 to roughly $342 billion, releasing liquidity into the system, and the targeted liquidity is expected to rise up to $600 billion by the end of April.

The analyst added that the current tax season will temporarily drain liquidity, but the drawdown is expected to resume in May. If debt ceiling talks extend to August, net liquidity could hit a multi-year high of $6.6 trillion, which could cause a bullish tailwind for Bitcoin.

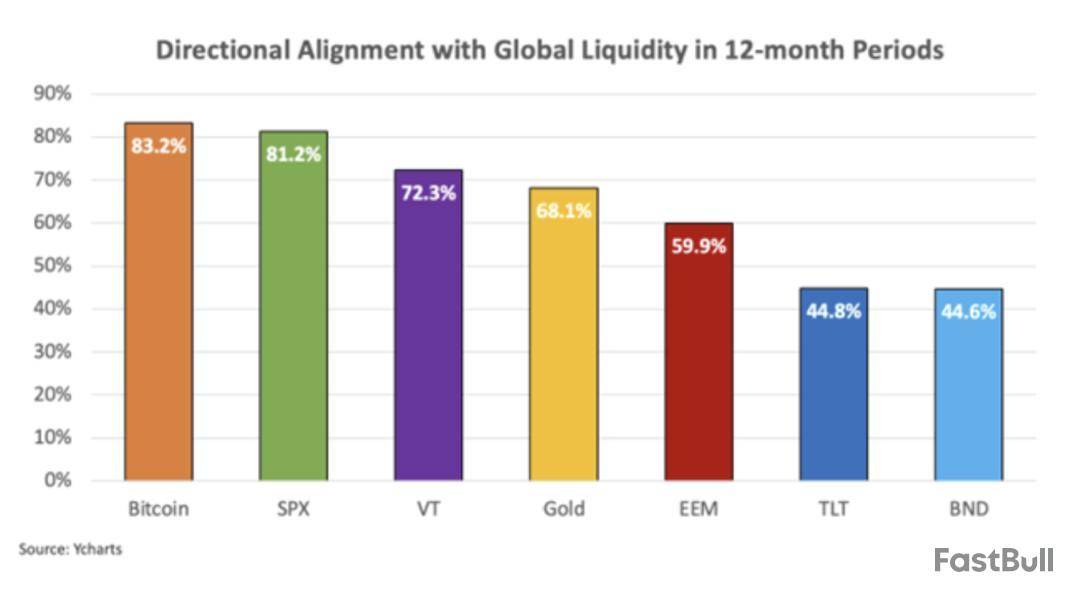

According to a study by financial analyst Lyn Alden, Bitcoin has historically moved 83% of the time in line with global liquidity in a given 12-month period. The research termed “Bitcoin a Global Liquidity Barometer” compared Bitcoin to other major asset classes such as SPX, gold and VT, and BTC topped the correlation index with respect to global liquidity.

Past TGA drawdowns in 2022 and 2023 have fueled speculative assets like Bitcoin. Thus, a $600 billion boost, plus billions more added over Q2-Q3, could lift BTC’s value if market conditions remain stable.

Related: Bitcoin traders target $90K as apparent tariff exemptions ease US Treasury yields

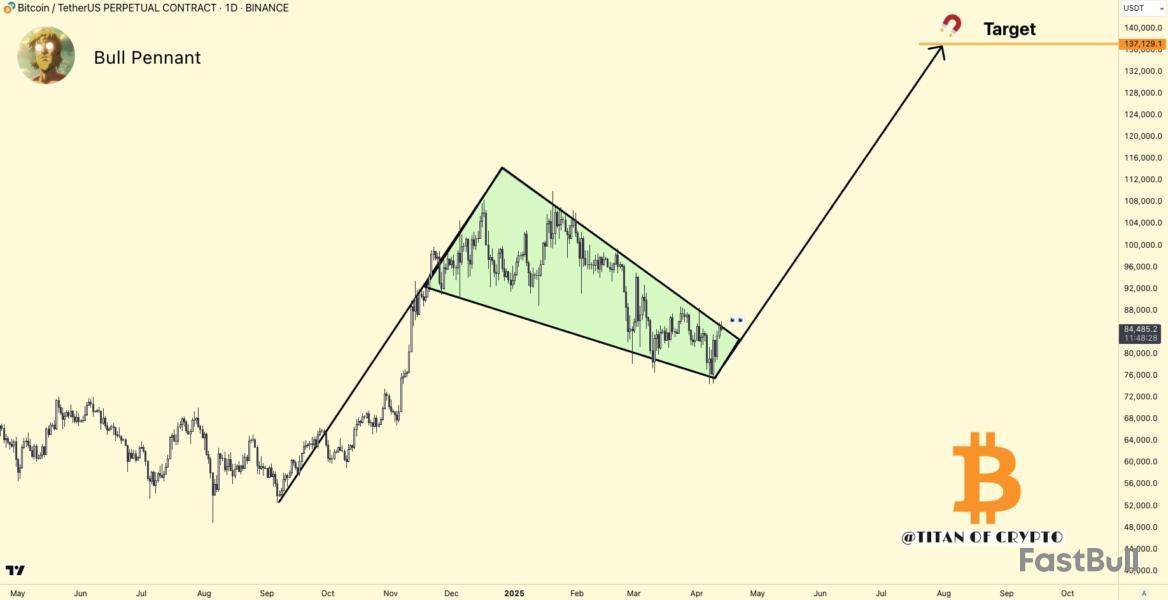

Bitcoin eyes $137,000 by Q2-Q3, says analyst

Anonymous crypto trader Titan of Crypto shared a bullish outlook for Bitcoin, predicting that BTC could surge to a new all-time high of $137,000 by July-August 2025. In a recent X post, the analyst pointed out a bullish pennant pattern on the daily chart, with the price potentially heading toward a positive breakout.

However, before pushing chips into a long conviction play, BTC must break and retain a position above its 200-day exponential moving average (EMA). As illustrated in the chart, Bitcoin faces resistance from all three key EMAs, namely, the 50-day, 100-day and 200-day indicators.

A collective reclaim above each moving average on a higher time frame chart could further strengthen the bullish case, allowing the crypto to retest its six-figure targets.

Related: Bybit integrates Avalon through CeFi to DeFi bridge for Bitcoin yield

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Ethereum might be on track to facing renewed pressure, according to an interesting technical outlook. Despite short bursts of recovery attempts, the broader market structure is still trying to flip in favor of bulls, but price movement shows that the bears are still in control. Notably, a recent technical analysis posted by crypto analyst Youriverse on the TradingView platform highlights a potential sharp drop in the price of Ethereum towards $1,400 if the current downward trend continues.

Strong Rejection From Key Fibonacci Zone Hints At Persistent Resistance

Technical analysis shows that the Ethereum price chart is currently characterized by a noticeable Fair Value Gap (FVG) on the 4-hour timeframe. This interesting gap was left behind after a steep 10% drop last Sunday, marking a strong area of seller dominance.

This gap represents a zone of clear imbalance where selling activity outweighs buying pressure and has influenced Ethereum’s price action throughout the past seven days. Earlier last week, Ethereum retraced into this gap, reaching the midpoint, but was met with swift rejection. This swift rejection showed the intense selling pressure present within this Fair Value Gap.

Interestingly, the Ethereum price has returned to this Fair Value Gap again, and another rejection here could send it back to a bottom below $1,400. Furthermore, Ethereum is trading within an area identified as the “golden pocket” of the Fibonacci extension indicator, which is drawn from the $1,383 bottom on April 9. Unless price action breaks decisively above this level and heads toward the next Fib level of 0.786 at $1,724, there is still a risk of a significant rejection that could lead to further downside below $1,400.

Stochastic RSI Weakness Suggests Possible Downturn Ahead For Ethereum

In addition to the Fair Value Gap and Ethereum’s struggle within the golden pocket of the Fibonacci retracement zone, the Stochastic RSI is now introducing another layer of bearish pressure to the current outlook. This momentum oscillator, which measures the relative strength of recent price movements, is approaching the overbought region on the daily timeframe.

Ethereum’s approach of overbought zone with the Stochastic RSI is due to inflows that have pushed the crypto’s price from the $1,383 bottom on April 9. Now that the Stochastic RSI is moving into the overbought zone, it adds to the bearish outlook that it could reject at the Fair Value Gap and start a new downside correction very soon.

So far, the Ethereum price was rejected at $1,650 in the past 24 hours, which further supports the bearish continuation thesis. If the selling pressure builds again, as suggested by both the weakening RSI and persistent resistance at the Fair Value Gap, the analyst warns of a breakdown that could drag the price to as low as $1,400, or even lower.

At the time of writing, Ethereum is trading at $1,627.

Prominent on-chain analyst James Check has stated that the $70,000-$75,000 range is critical for Bitcoin bulls.

Making sure that Bitcoin does not drop below the $70,000 level is crucial for the bulls. If the cryptocurrency drops to $65,000, your average Bitcoin holder will become "sensitive," according to Check.

The flagship cryptocurrency has just reclaimed the $75,000 level, according to CoinGecko data.

Things can change fast

At the same time, he cannot definitely say whether or not the cryptocurrency is already in a bear market since macro stories are dominating the headlines.

"I would recommend people just put aside the notion of bulls, bears, and cycles for…Things can change on a dime," he said.

Bitcoin has been significantly influenced by the most recent developments surrounding the ongoing tariff disputes due to its correlation with the S&P 500.

Bitcoin is different now

The analyst has noted that Bitcoin has been trading differently since 2023. Check has described the period lasting up to 2017 as the "adoption cycle."

The 2018-2022 period was the cycle of maturation and development. "Derivatives come onboard, stablecoins come alive. The market changes," he noted.

In 2023, the leading cryptocurrency kicked off its "institutional" cycle. "We have a different type of marginal buyer now," he said.

FERNANDINA BEACH, Fla., April 14, 2025 (GLOBE NEWSWIRE) — BDTCOIN, a pioneering digital currency focused on financial inclusion and cross-border transactions, has officially been listed on MEXC, one of the world’s leading cryptocurrency exchanges. This milestone marks a significant leap forward in BDTCOIN’s mission to revolutionize the financial landscape, making it more accessible, efficient, and inclusive for underserved communities worldwide.

Launched with the vision to bridge the gap between traditional assets and decentralized finance, BDTCOIN is a gold-backed cryptocurrency that combines the enduring stability of physical gold with the transparency and efficiency of blockchain technology. Each BDTCOIN is backed by tangible gold reserves, giving it a unique edge in today’s volatile digital asset market. By integrating cutting-edge features like quantum-resistant cryptography and lightning-fast transactions, the currency is built not only for stability but also for scalability and real-world utility.

The listing on MEXC Global makes BDTCOIN accessible to millions of users worldwide, unlocking new opportunities for trading, investing, and utilizing BDTCOIN in everyday financial activities. MEXC’s expansive global presence and strong reputation for listing high-potential, credible projects will provide BDTCOIN with enhanced visibility and adoption in both institutional and retail markets.

BDTCOIN is built on a secure and scalable blockchain protocol incorporating quantum-resistant encryption, lightning-fast transactions, and smart contract functionality. These features ensure that BDTCOIN remains not only a store of value but also a practical, usable currency in today’s fast-moving digital economy. The technology has been developed with long-term resilience in mind, offering security against future threats such as quantum computing while supporting decentralized applications and integrations.

“We’ve always believed that technology can empower the unbanked and underbanked. Listing on MEXC is not just a technical milestone—it’s a meaningful step toward delivering financial access to those who’ve been excluded from the system for far too long.”

— BDTCOIN creator

“BDTCOIN was built with purpose—real asset backing, technological integrity, and a user-first approach. Being listed on a global exchange like MEXC validates that purpose and sets the stage for us to scale our impact across borders.”

— BDTCOIN creator

Kickstarter Voting Details:

Snapshot Time: April 13, 2025, 16:00 UTC (minimum 25 MX required)

Voting Period: April 14, 2025, 10:00 UTC – April 15, 2025, 09:50 UTC

Airdrop Pool: 50,000 USDT

Trading Starts: April 15, 2025, 12:00 UTC

Withdrawal Opens: April 16, 2025, 12:00 UTC

Participants can commit between 25 to 500,000 MX tokens, with reward multipliers available for users who invite new valid users to the MEXC platform.

https://x.com/MEXC_Listings/status/1911713357289189772 (embed)

With a growing ecosystem of users, developers, and advocates, BDTCOIN is positioning itself as a frontrunner in the emerging class of asset-backed cryptocurrencies. Its focus on transparency, decentralization, and inclusivity resonates with global investors and consumers alike who are looking for secure and meaningful ways to engage with digital finance.

The listing on MEXC also comes at a time when gold-backed digital assets are gaining momentum because they offer both the benefits of crypto and the stability of physical assets. BDTCOIN is poised to be at the forefront of this movement, creating new pathways for economic empowerment, especially in emerging markets.

For more information, visit https://bdtcoin.co and follow BDTCOIN’s official channels for updates, partnerships, and community initiatives.

About BDTCOIN

BDTCOIN is a next-generation cryptocurrency focused on financial inclusion and seamless cross-border transactions. Built on a secure and decentralized blockchain, BDTCOIN empowers individuals and businesses by providing efficient, low-cost financial services worldwide.

Company Details:

Website: https://bdtcoin.co/

Explorer: https://bdtcoin.info

Development: https://bdtcoin.org

Contact:

Sultan

Email: Admin@bdtcoin.co

Disclaimer: This press release is provided by the BDTCOIN. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.

Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed.

Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6ad786ea-b501-46a8-b0d6-0dd959ec171b

https://www.globenewswire.com/NewsRoom/AttachmentNg/2d634702-5f58-4a9a-9b48-6dc587f531a9

BDT Coin

BDT Coin

BDT Coin

BDT Coin

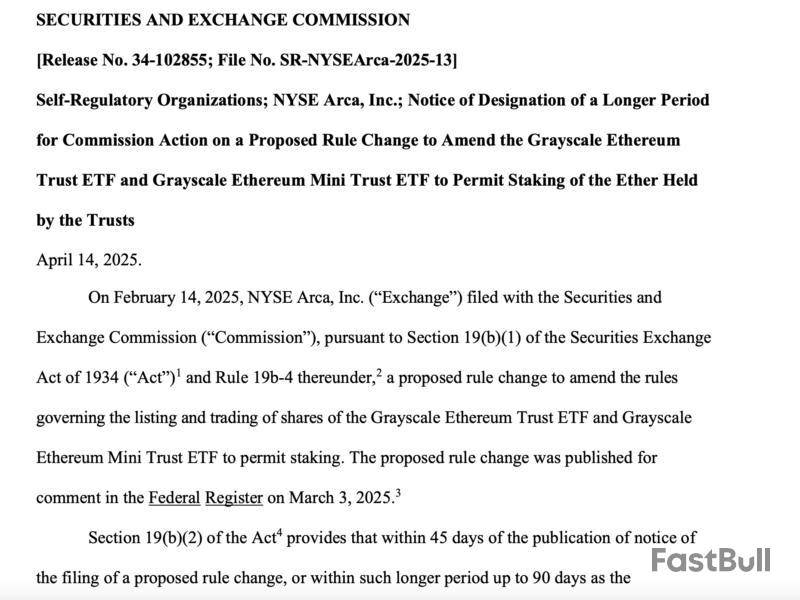

The United States Securities and Exchange Commission (SEC) has delayed a decision on whether to approve Ether staking in two Grayscale funds.

The decision on Grayscale Ethereum Trust ETF and Grayscale Ethereum Mini Trust ETF has been postponed until June 1, according to an April 14 announcement from the SEC. The deadline for a decision is the end of October.

On Feb. 14, the New York Stock Exchange (NYSE) filed a proposed rule change on behalf of Grayscale that would permit investors in the company’s Ether (ETH) ETFs to stake their holdings.

Staking is the process of locking up cryptocurrency in a wallet to support the operations and security of a blockchain network, offering stakers rewards in return. The feature is considered a potentially integral part of Ether ETFs, as it could generate yield to investors, increasing the attractiveness of the funds.

Annual yield on staked Ether is estimated at 2.4% on Coinbase, while on Kraken, another US-based exchange, it ranges from 2% to 7%. According to Sosovalue, Ether ETFs have had a cumulative net inflow of $2.28 billion since their launch in 2024.

The race for staking on Ether ETFs includes other asset managers, including BlackRock's 21Shares iShares Ethereum Trust. The company sought permission to offer staking services in February and is currently waiting for the agency approval.

SEC approves options for multiple spot Ether ETFs

Despite the delay on staking filings, the SEC is moving forward with regulatory requests surrounding crypto ETFs.

On April 9, the agency approved options trading for multiple spot Ether ETFs, allowing the derivates feature on funds from BlackRock’, Bitwise and Grayscale's ETFs.

Options trading involves the right to buy and sell contracts that give the investors the right but not the obligation to buy an asset at a certain price. The approval broadens the funds utility for institutional investors.

The efforts to expand the appeal of Ether ETFs reflect the lack of adoption in contrast with Bitcoin (BTC) ETFs launched in January 2024. While the Ether ETFs amassed a net cumulative inflow of $2.2 billion as of April 11, Bitcoin funds flows topped $35.4 billion according to Sosovalue.

Ether has also had a rough time during this bull market compared to other assets like XRP (XRP) and Solana (SOL). The asset’s 52-week high of $4,112 did not surpass its November 2021 peak all-time-high value of $4,866. The token is trading below the $2,000 mark on April 14.

Magazine: What are native rollups? Full guide to Ethereum’s latest innovation

ZURICH, Switzerland, April 14, 2025 (GLOBE NEWSWIRE) — The pressure is on as XploraDEX, the groundbreaking AI-powered trading platform on the XRP Ledger, enters its final 8-day countdown before closing its $XPL presale. With excitement intensifying across the XRP communities, investors are rushing to secure their allocation before the window slams shut.

Join $XPL Presale Now

The $XPL presale has already passed the 85% milestone, signaling overwhelming interest from early adopters, whale wallets, and strategic traders who understand what’s coming. As the first AI-powered decentralized exchange built natively on XRPL, XploraDEX is poised to redefine smart trading and early investors know the opportunity to enter at presale pricing is about to vanish.

Unlike any traditional DEX, XploraDEX integrates real-time artificial intelligence, giving users access to smart trading dashboards, predictive market analytics, automated execution engines, and adaptive risk alerts. The platform is built for precision and performance, designed to help traders outperform by making decisions rooted in data, not emotion.

Buy $XPL Tokens

$XPL Token Utility

The utility of $XPL extends far beyond trading discounts. Token holders unlock access to premium AI tools, early staking and yield opportunities, governance voting rights, and exclusive allocations through the platform’s integrated launchpad. In short, $XPL isn’t just a token—it’s the backbone of the XploraDEX ecosystem.

Investors who join during the $XPL Presale will benefit from early-bird rewards, VIP access to beta features, and ground-floor positioning before the token is listed on XRPL-based exchanges. Once the presale ends, the price will increase—and the first phase of staking, AI activation, and partner integrations will begin.

With 8 days remaining, FOMO is reaching new highs. Social media engagement is exploding, whale accumulation is intensifying, and more than 10,000 wallets have interacted with the platform’s sale portal. The clock is ticking, and the final allocations are moving fast.

Participate in $XPL Presale

XploraDEX has been called the most intelligent trading product to ever launch on XRPL. If you missed out on early plays like GMX, DYDX, or SUI, this might be your second chance—but only if you act now.

There are 8 days left. After that, $XPL will enter the open market, and the early phase will be gone forever.

Join the $XPL Presale Now: https://sale.xploradex.io

Stay connected and Join the XploraDEX AI Revolution

Website | $XPL Token Presale | X | Telegram

Contact:

Oliver Muller

oliver@xploradex.io

contact@xploradex.io

Disclaimer: This press release is provided by the XploraDEX. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.

Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed.

Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7ca2d656-18ac-4669-b82b-4ab04dd023b9

XploraDEX

XploraDEX

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up