Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Crypto financial services firm Anchorage Digital is expanding into the stablecoin trade with its acquisition of Mountain Protocol, according to an announcement on Monday. The move coincides with Mountain’s decision to “commence the orderly winddown of USDM.”

Anchorage CEO Nathan McCauley noted that the acquisition will enable the firm to provide institutional-grade stablecoin services. The terms of the deal were not disclosed.

“By acquiring Mountain Protocol, we are taking a significant step forward in supporting institutional stablecoin adoption and advancing a new era of safety, security, and regulatory compliance in the global digital asset ecosystem,” McCauley said in a statement.

Notably, Anchorage operates the first federally chartered crypto bank. While stablecoin regulation in the U.S. appears to be temporarily stalled following a failed cloture vote last week, the general push of the two bills under congressional consideration would give the banking industry a larger role in managing fiat-backed digital assets.

“Stablecoins are becoming the backbone of the digital economy. With recent regulatory progress and new institutional use cases, our long-term vision is clear: every business will be a stablecoin business,” McCauley added.

The move comes as stablecoin experimentation and adoption accelerate, in part due to a more permissive regulatory regime.

Mountain, launched in 2023, offers an Ethereum-based, yield-bearing token pegged to the U.S. dollar called USDM. The stablecoin, which uses a “rebasing” mechanism and is backed in full by short-term U.S. Treasurys held in bankruptcy-remote accounts, offers about 5% in annual percentage returns through daily rewards.

The startup, founded by Martin Carrica and Matias Caricato, has raised $12 million in total funding. Anchorage will absorb the Mountain Protocol team, technology, and licensing framework into its operations.

According to a post on X, Mountain is will sunset USDM, which has seen its supply shrink from a high of $150 million to around $50 million, according to rwa.xzy.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Over the past three days, Bitcoin has hovered between $103,000 and $104,500, creating a narrow channel after a notable rally that saw it break above $100,000 last week. Technical analysis of the daily candlestick chart shows the formation of a minor impulsive wave from $103,000, which may mark the final end of the recent consolidation and the beginning of a fresh rally towards new highs.

Notably, recent price action in the past 12 hours or so has seen the gradual end of the consolidation, and attention is now turning to the next psychological level at $110,000.

Analyst Sees Breakout As Signal For Upside Continuation

In a post shared on the social media platform X, crypto analyst CrediBULL explained the logic behind his current long trade setup, pointing out that Bitcoin has broken away from its three-day consolidation zone with an early impulse that started at the $103,000 level. His analysis predicted that this movement could be the start of a much larger leg upward, especially if the current price structure holds without falling back into a local demand zone between $101,000 and $102,000.

According to CrediBULL, the current trade has a clean invalidation level just below the impulse origin, allowing for a tight stop loss. This setup yields a high reward-to-risk ratio exceeding 5:1, with an upside target of $110,660, as illustrated in the chart. If this breakout is genuine, it could be a signal that Bitcoin is preparing for an aggressive push toward new all-time highs.

On the other hand, CrediBULL cautioned that if the current move proves to be a deviation and price falls below the impulse origin, focus should shift to the local demand zone around $101,800. The chart supports this with a clearly marked green area labeled “local demand.” This is the next major support if Bitcoin bulls fail to hold the current price levels.

$110,000 Bitcoin Target In Sight With Increasing Market Momentum

According to the crypto analyst, his prediction of the next move to $110,000 has at least a 20% chance of playing out. These odds are quite nice, considering the unpredictable nature of the crypto market.

Notably, price action in the past 24 hours has seen the leading cryptocurrency break above $105,000 again, peaking at an intraday high of $105,503 before easing slightly. This move strengthens the case that the recent consolidation phase may have concluded, and a successful move above $110,000 before the end of the week is underway.

At the time of writing, Bitcoin is trading at $104,428. A successful rally to the $110,660 target would represent a 6% gain from the current price, while downside risk is capped below the $103,000 level.

Spencer Hakimian, founder of Tolou Capital Management, has estimated that the massive tax-cut bill that was released by the Republicans earlier today is set to add $2.5 trillion to the deficit.

The bill is supposed to cut spending by $1.5 trillion while allowing for a whopping $4 trillion worth of tax cuts.

Hakimian, who has emerged as one of the most authoritative voices within the finance community amid the recent economic turmoil, claims that the massive increase in deficit will be amazing for Bitcoin and gold.

The loose fiscal policy is also expected to positively affect US stocks.

At the same time, the expansion of the deficit will obviously be "terrible" for bonds since the US government will have to issue more of them in order to raise funds.

Earlier today, Fox Business reporter Charles Gasparino stated that the notion that the tariffs could pay down the deficit was "off the table," given that the US and China have reached an agreement.

The Bitcoin price reached a new multi-month peak of $105,503 after the news about the agreement broke out. However, it is now down by more than 2%.

Wyoming Senator Cynthia Lummis previously claimed that Bitcoin could help solve the national debt problem in the US.

Former BitMEX CEO Arthur Hayes recently opined that the U.S. government is unlikely to actually buy Bitcoin due to concerns about fiscal debt.

Key takeaways:

Bitcoin lags as investors shift toward stocks after the US and China strike a deal that could end the current trade war.

Macroeconomic conditions are swinging away from gold investing and back to stocks.

Bitcoin reached its highest price in over three months at $105,720 on May 12, but was unable to maintain its bullish momentum. Interestingly, the drop to $102,000 came after a temporary easing in the US-China tariff conflict. This has left traders puzzled as to why Bitcoin reacted negatively to what seemed like positive developments.

The 90-day truce reduced import tariffs, and US Treasury Secretary Scott Bessent noted that the agreement could be extended, provided there is a genuine effort and constructive dialogue. According to Yahoo Finance, the topics under discussion include “currency manipulation,” “steel price dumping,” and restrictions on semiconductor exports.

Part of Bitcoin’s recent lack of momentum can be attributed to its 24% gains over the previous 30 days, during which S&P 500 futures rose 7% and gold remained flat. Investors see little reason for further divergence between Bitcoin and traditional markets, especially since the 30-day correlation with the stock market remains high at 83%.

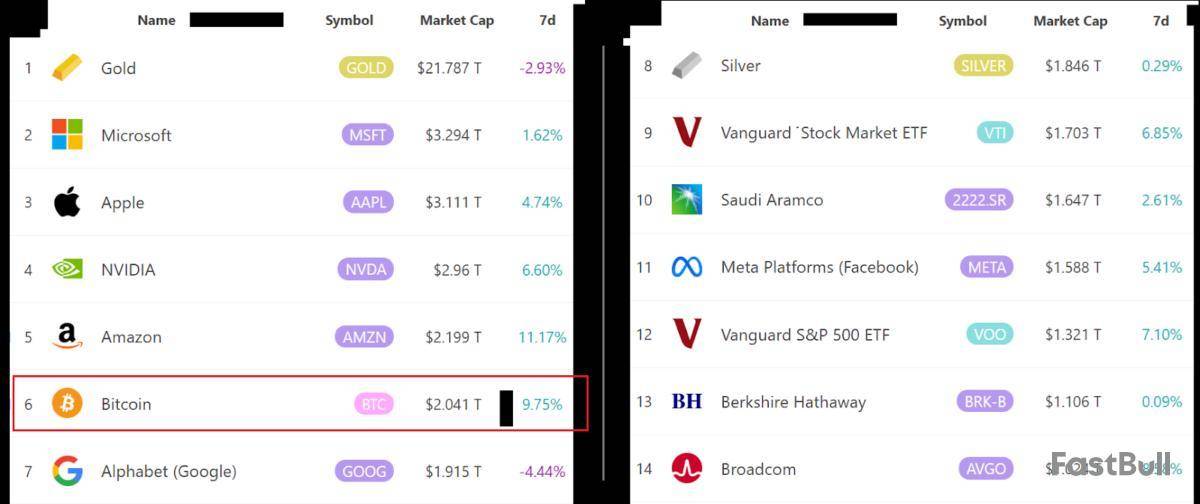

Additionally, Bitcoin has now surpassed the market capitalization of both silver and Google, making it the world’s sixth-largest tradable asset.

News that Strategy acquired another 13,390 BTC between May 5 and May 11 has also raised concerns among investors. With BlackRock and Strategy together holding 1.19 million BTC, about 6% of the circulating supply, some traders worry that Michael Saylor’s company is largely responsible for supporting the price.

Critics, such as Peter Schiff, predict that Strategy’s ever-increasing average purchase price could eventually lead to losses and force the company to sell some of its holdings to cover borrowing costs. However, this scenario seems unlikely, as the company has doubled its capital increase limit by $21 billion in stocks and another $21 billion in debt.

Bitcoin stalls as macroeconomic events favor stocks over gold

While traders often focus on Bitcoin-specific events, the most likely reason for the weakness near $105,000 is broader macroeconomic conditions. Although the pause in tariffs directly benefits the stock market, the effect on scarce assets like Bitcoin is somewhat negative. For example, gold fell 3.4% on May 12 as the demand for safe-haven assets declined.

Gold has typically shown an inverse correlation with the US Dollar Index (DXY), which climbed to its highest level in 30 days on May 12. The strengthening US dollar signals investor confidence, despite a 0.3% decline in US first-quarter Gross Domestic Product and a 6.1% jump in pending home sales in March compared to the previous month.

The lack of conviction among Bitcoin investors when prices traded near $105,000 is at least partly due to reduced demand for scarce assets, as investors view the stock market as a more immediate and direct beneficiary of the US-China trade deal. Lower import duties suggest higher revenues and potentially improved profit margins for companies.

Given the impressive $2 billion in inflows into US spot Bitcoin exchange-traded funds (ETFs) between May 1 and May 9, the likelihood of a price drop below $100,000 remains low. The steady demand for Bitcoin following a 24% monthly gain points to institutional adoption rather than retail-driven FOMO, which is a very positive sign for the price.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Rohun Vora, better known as Frank DeGods, has resigned as CEO of the popular NFT project DeGods, according to an announcement on Monday. Pseudonymous community members @0x_chill and @pastagotsauce were named successors.

“i dedicated 3 years of sleepless nights trying to make DeGods & y00ts a success. i'm proud of the work i did,” Vora said in a message on X. “i'm excited to hand the reigns to the team and watch them cook.”

Frank DeGods has been the public face of the titular DeGods projects since it launched in 2021. He gained prominence as a bold marketer (and rave dancer), including attempts to pitch the NFT series as a quasi-lifestyle brand. He is also the creator of the sister project, y00ts.

Both DeGods and y00ts were initially launched on Solana, but migrated to Ethereum in 2023 following a brief stint on Polygon. Dust Labs, which manages the projects, returned a $3 million grant provided by the Polygon team. The projects were also launched as inscriptions on Bitcoin.

DEGODS currently has a market capitalization of 4,980 ETH, or nearly $12.5 million, with a floor price of 0.554 ETH, according to CoinGecko. y00ts, meanwhile, has a price floor of $5,220 and a total market cap of $64.6 million.

The tokens have been outpacing the broader NFT market over the past week. DEGODS has seen a 567.40% increase in trading activity on Solana and 456.40% on Ethereum over the past day.

Controversial control

Vora’s tenure has been in part marked by controversy, which he hinted at in his resignation announcement on Monday.

“maybe we'll look back at this fixation on ‘frank degods’ as the thing that was holding us back,” Vora said. "at times i felt like the hate was overdone, but i get it. it's funny. it gets clicks and deep down the people doing it feel like they are protecting the industry they love."

“for the record: i'm not ‘on the run’. there are no investigations, because i have never done anything,” he added.

Earlier this year, MisakaTrades accused Vora of abandoning several memecoin projects he promoted as part of the so-called LA Vape Cabal influencer group. In February, Vora responded to criticism, saying he received “insider information,” but subsequently walked back the comments.

At the time, Vora retired his public wallet, which reported profits of $4.4 million, citing accusations of insider trading. Critics alleged Vora leveraged private group chats to gain early access to token launches, including the controversial LIBRA token promoted by Javier Milei, the president of Argentina. He is also rumored to have front-run the disastrous memecoin launched by Hailey Welch, of Hawk Tuah fame.

Additionally, Vora faced backlash after raising 176 BTC for BTC DeGods without a clear roadmap and for his public denouncements of the Solana NFT community.

That said, Vora has gained a reputation as an innovator. For instance, he introduced a 33.3% tax on DeGods sales below the floor price, in an attempt to penalize "paper hand” investors. The collected fees were used to buy and burn low-priced NFTs, reducing supply and boosting value.

“sounds corny, but the best part of the last few years wasn't the money or clout. it was meeting some of you. made some real friends. it's been fun. time to finally hit the gym. thanks for everything. keep trying [rhymes with smit],” Vora said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Emerging technologies, including quantum computing, could potentially render the cryptography securing Bitcoin and other blockchain networks ineffective, asset manager BlackRock said in a regulatory filing.

On May 9, BlackRock updated the registration statement for its iShares Bitcoin ETF (IBIT). The revised version addressed potential risks to the integrity of the Bitcoin network posed by quantum computing, the filing shows.

“[I]f quantum computing technology is able to advance […] it could potentially undermine the viability of many of the cryptographic algorithms used across the world’s information technology infrastructure, including the cryptographic algorithms used for digital assets like bitcoin,” BlackRock said.

It is the first time the asset manager has explicitly flagged this risk in its IBIT disclosures. The IBIT ETF is the largest spot Bitcoin ETF, with approximately $64 billion in net assets, according to its website.

Quantum computing is an emergent field that seeks to use the principles of quantum mechanics to greatly enhance computers’ processing capabilities.

Record-breaking inflows

James Seyffart, an analyst for Bloomberg Intelligence, cautioned that risk disclosures such as IBIT’s are required to highlight every possible risk to an asset, even those that are extremely unlikely.

“They are going to highlight any potential thing that can go wrong with any product they list or underlying asset that’s being invested in,” Seyffart said in a May 9 X post. “It's completely standard. And honestly [it] makes complete sense.”

Since launching in January, Bitcoin ETFs have collectively attracted more than $41 billion in net inflows, according to data from Farside Investors.

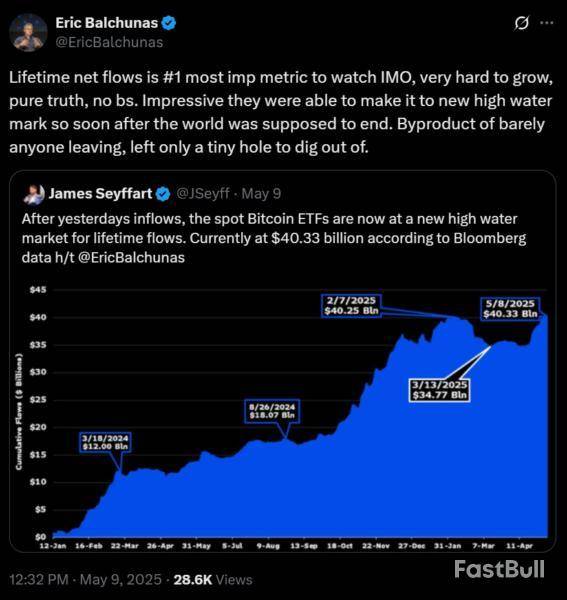

On May 8, Bitcoin ETF net inflows surpassed all-time highs of around $40 billion, according to Bloomberg Intelligence.

“Lifetime net flows is #1 most imp metric to watch IMO, very hard to grow, pure truth, no bs,” Bloomberg Intelligence analyst Eric Balchunas said in a May 9 X post. “Impressive, they were able to make it to a new high water mark so soon after the world was supposed to end.”

In February, Tether CEO Paolo Ardoino predicted that quantum computing would eventually enable hackers to break into inactive Bitcoin wallets and recover the dormant coins.

“Any Bitcoin in lost wallets, including Satoshi (if not alive), will be hacked and put back in circulation,” Ardoino said in a Feb. 8 X post.

After a frenzy of heightened trading volume, XRP overtook USDT to become the third-largest cryptoasset by market cap. It maintained this position for over an hour before USDT reclaimed its spot.

Although data analysis clearly shows where this market cap came from, it’s difficult to ascertain the exact motive for traders. The SEC settled the Ripple case last week, but the XRP’s volume began spiking this morning.

XRP Market Cap Nears $150 Billion

Since the SEC vs Ripple case ended last week, XRP has enjoyed heightened activity. In addition to an impressive price rally, the token has also benefited from growing trade volume.

In the previous 24 hours, XRP’s volume spiked by more than 100%, allowing it to surpass USDT to become the third-largest cryptoasset by market cap.

It’s impressive that XRP sped past USDT’s market cap, especially since the stablecoin sector is booming. However, data analysis shows the outsized influence trade volume can have.

According to analysts, a comparatively small volume boost caused the token’s market cap to skyrocket:

In other words, it’s difficult to assess the exact macroeconomic reason for XRP’s market cap spike. The SEC case was settled last week, but most of this 107% increase in trade volume took place this morning.

It’s very possible that a single trader or small group moved $61 million in XRP, which significantly complicates any narrative about the token’s success.

All that is to say, this volume spike had a significant impact, but it didn’t have much underlying stability. After XRP’s price fell in the early afternoon, USDT reclaimed its position as the third-largest cryptoasset by market cap.

Meanwhile, positive developments continue to drive optimism for the altcoin. In the US, recent reports suggest that Missouri could become the first state to exempt digital assets like Bitcoin and XRP from capital gains tax.

Such developments and continued market optimism could drive more traders to hold ‘Made in USA Coins‘ like XRP.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up