Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

As the XRP price takes center stage, bold predictions about its future outlook persist across online forums and social media. Among the most ambitious claims is the idea that the XRP price could skyrocket to $1,000 or even beyond. In response to these projections, a crypto analyst has outlined several key factors that would need to align for XRP to reach such a target.

Factors Needed To Take The XRP Price To $1,000

While it’s tempting to imagine XRP hitting a four-digit price target, X (formerly Twitter) crypto analyst Jasmin argues that the numbers don’t support such a prediction. For the XRP price to reach $1,000, it would need to climb as high as 46,848%, accompanied by key factors like a significant rise in global adoption, especially by financial institutions.

Although Ripple, a blockchain company, has made progress in partnering with global banks and fintech firms for cross-border payments, that level of adoption is still nowhere near enough to support a $1,000 XRP price tag. To even approach this level, XRP would need to become a fundamental part of the global financial structure across different sectors, particularly in banking, remittance, and investment.

But beyond simple adoption, XRP would have to be deeply integrated into major economies in such a way that it becomes an indispensable currency for daily transactions. For this to happen, Jasmin reveals that the cryptocurrency would need widespread regulatory clarity to ensure that it can be used in multiple jurisdictions without any legal barriers.

The ongoing legal battle between Ripple and the US SEC has already created years’ worth of uncertainty around XRP’s legal status. Until this issue is resolved favorably, the cryptocurrency’s potential for mainstream adoption remains limited.

Jasmin has also highlighted that XRP would have to incorporate mechanisms that would drastically reduce its circulating supply. While the cryptocurrency’s price could grow with more aggressive token burns, a jump to $1,000 still seems unlikely. Such a high valuation would also need massive speculative trading activities, which are usually seen during bull markets.

How Market Cap Influences A $1,000 Projection

Based on Jasmin’s analysis, the most significant factor that makes a $1,000 XRP price projection unrealistic is its market capitalization. Currently, XRP has a market cap of about $125.15 billion, and for its price to hit a four-digit level, its total market valuation would need to reach $50 trillion.

To put this in perspective, the global crypto market capitalization today is $3.09 trillion, according to CoinGecko data. This would mean that XRP alone would need a market cap over 15x higher than the entire crypto market.

Furthermore, Bitcoin, the largest cryptocurrency, has never even come close to reaching a $10 trillion market cap. BTC’s market valuation currently sits at $1.92 trillion, meaning XRP would have to surpass it by over 25x to get a $50 trillion market cap.

Due to these extreme market cap requirements, Jasmin argues that a $1,000 or even $10,000 target is highly unrealistic. However, she acknowledges that a price surge to $5 or even $10 is a far more attainable goal.

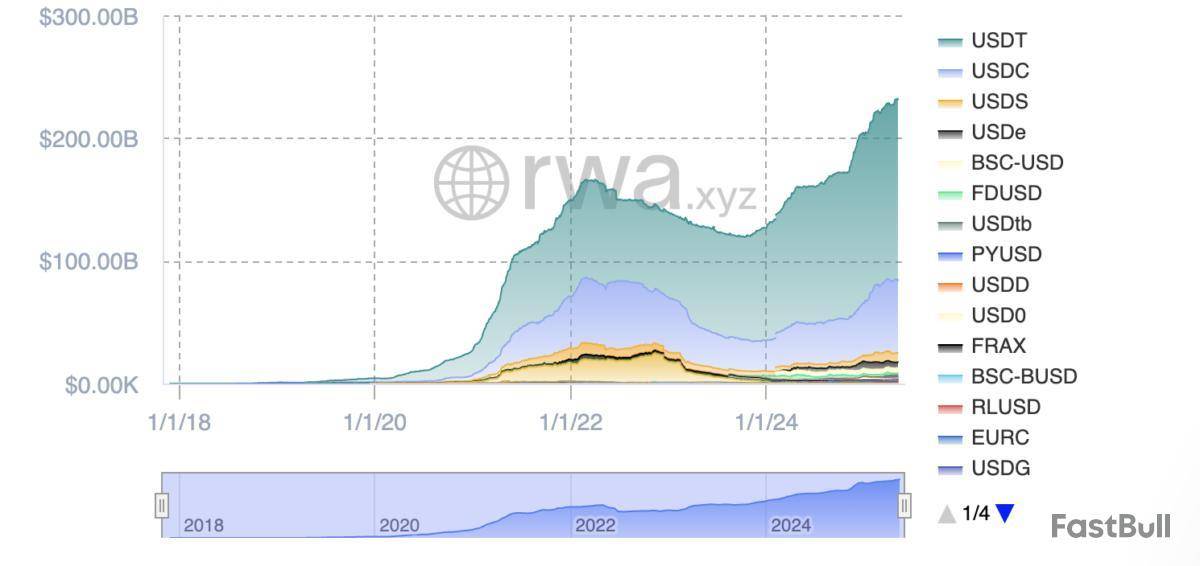

Stripe, a global payments platform, has introduced stablecoin-based accounts to clients in over 100 countries.

According to a May 7 announcement, the new feature will allow the platform's clients "to send, receive, and hold US-dollar stablecoin account balances, similar to how a traditional fiat bank account works."

The product's technical page shows that the new account feature will support Circle's USDC and Bridge's USDB (USDB) stablecoins. Stripe acquired the Bridge platform in October 2024.

The product will be available to clients in more than 100 countries, including Argentina, Chilé, Turkey, Colombia, and Peru, among others.

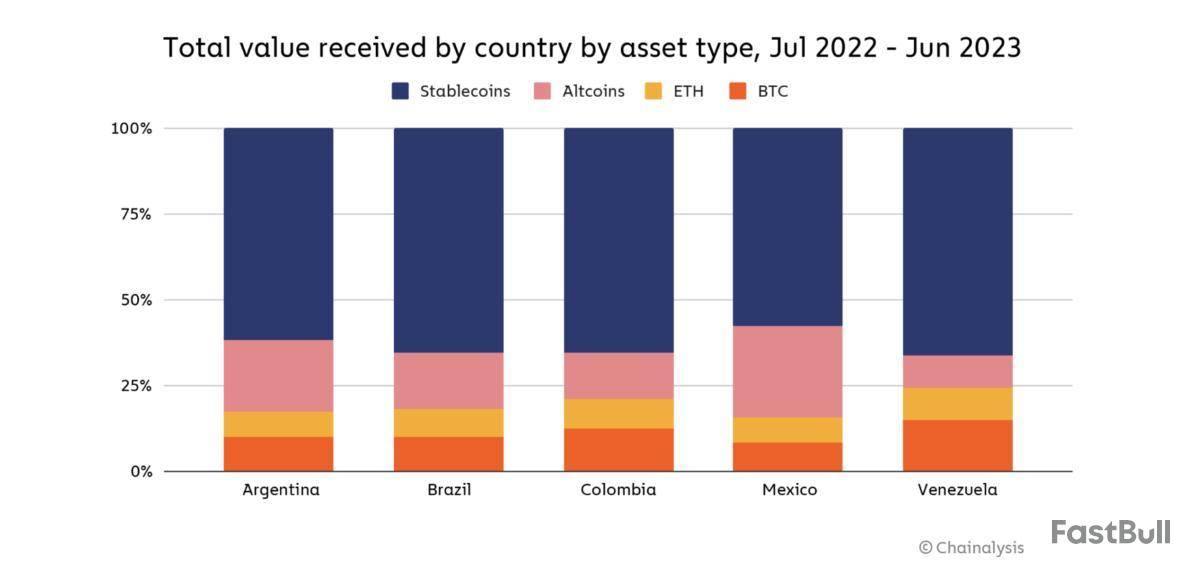

Stripe's newly launched product comes at a time when stablecoins are increasingly seen as stores of value in developing economies struggling with high inflation, capital controls, and a lack of financial infrastructure.

Stablecoins are banking the unbanked and are increasingly used as a store of value

Stablecoins and blockchain payment rails are helping to bank the unbanked in developing regions of the world without critical financial and communication infrastructure.

Blockchain systems can reduce the cost and verification of cross-border transfers, allowing anyone with a cellphone, a crypto wallet, and access to an internet connection to send, receive, and store value in a relatively stable fiat currency.

Stripe integrated USD stablecoin payments, allowing users to pay online merchants in fiat tokens, in October 2024. The integration was met with demand for the stablecoin payment option in 70 countries, the company said.

According to the crypto platform Bitso, residents of Latin American countries are increasingly using stablecoins as a store of value and a medium of exchange used for online purchases.

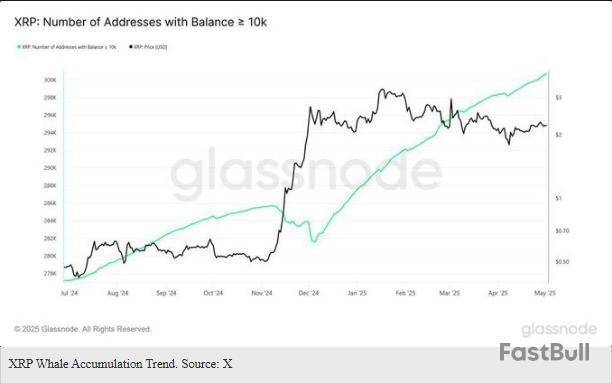

XRP has been resting at the $2 level, but indications of movement are increasing. One crypto analyst by the name of “J4b1” recently stated that purchasing XRP at $2.20 is not too late. In fact, he thinks that it may be the perfect time, just before things change dramatically. His assertions are founded on historical price action, Ripple’s current strategy, and what institutions may do next.

XRP Price Kept Stable By Ripple’s Monthly Activity

Ripple’s dominance over XRP’s supply is an important aspect of J4b1’s argument. Every month, the firm releases 1 billion XRP from escrow but sells only a fraction of it. The remaining amount is put back into escrow. These sales tend to occur via over-the-counter (OTC) channels rather than open markets. In the analyst’s view, this practice prevents Ripple from experiencing sharp price fluctuations.

J4b1@XRPJ4b1May 04, 2025Is XRP about to explode or already overpriced?

Is buying at $2.20 smart or is it too late? Let’s break it down with data, historical context, and Ripple’s price control strategy. pic.twitter.com/UHvbYD4GJl

He used an example: if Ripple wants to transfer $200 million using 100 million XRP, every coin will have to be worth $2. If the price rises too rapidly, Ripple can sell more. If it falls too far, they may buy some back. This strategy could be one of the reasons why XRP has not broken through the $2.20 barrier.

Institutional Demand Could Change Everything

J4b1 mentioned a few things that could drive XRP up. He cited possible regulatory clarity from a new US administration that could be more crypto-friendly. He also talked about the possibility of an XRP spot ETF and the growth of tokenized assets on the XRP Ledger.

The analyst believes that if institutions begin accumulating in large quantities, Ripple’s current approach may not be sufficient to contain the price. If demand outstrips the supply Ripple has, the price may surge.

XRP’s History Holds Clues

XRP’s journey began in 2012, when it was worth less than a penny. It picked up pace over the years as Ripple sold it to banks as a means of making cross-border payments faster and cheaper. That momentum took XRP to a high of $3.80 in the 2017 bull run.

But everything changed when regulators stepped in. In 2015, Ripple was fined by FinCEN. Then, in 2020, the SEC lawsuit struck, slowing down XRP’s adoption and keeping the price under control. Nevertheless, Ripple continued to build, acquiring companies like Metaco and obtaining licenses across the globe.

Meanwhile, as XRP’s price remains stagnant, the large holders are filling up. According to recent statistics, there are now more than 300,000 addresses holding a minimum of 10,000 XRP. That’s an increase from around 281,000 as of December 2024. Whale wallets continue to rise even though the price remains largely flat around $2.20.

That type of buildup tends to indicate a sense that prices may rise further in the future. It’s occurring as global uncertainty increases, which may be encouraging investors to get ready for the next major move.

For the time being, XRP traders are paying close attention. A quick move on the upside may not be far away.

Featured image from Gemini Imagen, chart from TradingView

ViennaUP 2025, lasting from May 8 to 16, is a key event for the Bitpanda Ecosystem. This festival celebrates entrepreneurship and innovation, potentially driving attention to related crypto assets. If Bitpanda announces partnerships or tech advancements, it could boost investor confidence and prices. Market volatility often follows such announcements. However, if no significant news is shared or no traction is gained, the event may not impact asset prices noticeably. Regular updates during the week-long festival could shift momentum. For more information, visit:source.

Solana Name Service's 'The Kitchen' event on May 8 could be a catalyst for price change. The event promises new information on $SNS, presented by their CEO. Such announcements can affect price if they include significant product updates or strategic moves. Investors often react to unexpected and positive alpha, driving demand for the asset. However, if no major news is revealed, the event might not impact the price. It's important to tune in to find out what could unfold. For more, see the event details:source.

sns.sol@snsMay 07, 2025Cooking up a special edition of The Kitchen tomorrow

Catch us live on 8 May, 5PM UTC. $SNS alpha is on the table & our CEO @aomdotsol is joining the talk to dish it out.

Don’t be the one asking what happened.https://t.co/jqaDkdZYja

The 'Trendsetting AI & Web3' event at 4 PM UTC could spark interest in the Artificial Superintelligence Alliance and GT Protocol. It focuses on important updates from TOKEN2049 and the Fetch.ai Global Hackathon. Events like these can move prices if they reveal noteworthy advancements or partnerships in AI and blockchain. As sectors like AI and Web3 grow, any positive news could bring increased adoption and investor interest. However, if updates do not deliver as expected, the price may not change much. More details on the discussion:source.

Fetch.ai@Fetch_aiMay 07, 2025Join us for tomorrow for an AMA with @sinthive & @GT_Protocol as we unpack TOKEN2049 highlights, @ASI_Alliance ecosystem updates, and innovations from the https://t.co/kJ9URVpOul Global Hackathon. https://t.co/zbL9S3pVbV

Brokerage fintech Robinhood is reportedly developing a blockchain network that will enable retail investors in Europe to trade US securities.

According to a May 7 Bloomberg report citing sources familiar with the matter, the move seeks to expand the company's local presence by offering trading of tokenized securities, such as stocks.

Two crypto firms, Arbitrum and the Solana Foundation, are reportedly vying to become partners in the project. Tokenization is the process of turning real-world assets, like stocks, real estate, or commodities, into digital tokens that can be traded on a blockchain.

Tokenizing securities instead of providing direct exposure can offer several advantages: reduced costs by eliminating traditional financial infrastructure, enhanced accessibility, faster settlement times, and quicker transactions. More brokerages and investment firms are exploring asset tokenization.

Robinhood has been preparing to enter the European market. In April 2025, it acquired a brokerage license in Lithuania that allows the firm to offer investment services throughout the European Union. Robinhood has also inked a deal in 2024 to purchase crypto exchange Bitstamp.

“You can sit down in front of some software, create a coin and have it be trading in 5 minutes [...] That’s a scary thing,” Robinhood CEO Vladimir Tenev said in a recent interview. “It’s also an incredibly powerful thing if you juxtapose it with how cumbersome the IPO process is.”

Robinhood shares rose 2.7% on the Nasdaq on May 7, according to Google Finance. The company’s revenue fell 8.6% in the first quarter of 2025, though it still beat Wall Street’s estimates.

Bloomberg reports that no agreement has been finalized between the brokerage and either Arbitrum or Solana regarding the project, with all three parties declining to comment.

More traditional financial firms are exploring blockchain-based solutions. In May 2018, Banco Santander became the first company to use a blockchain for investor voting, while US giant JP Morgan has created its blockchain platform called Onyx.

Magazine: Ethereum is destroying the competition in the $16.1T TradFi tokenization race

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up