Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A recent decentralized finance attack highlights how vulnerabilities with the standard implementation of certain DeFi vaults can be exploited by a sophisticated threat actor using familiar tools like flash loans to manipulate exchange rates and mislead price oracles.

On February 27, an attacker executed a flash loan-based "donation attack," borrowing approximately $4 million from Aave to exploit the ERC-4626 vault token for Mountain Protocol's wrapped yield-bearing stablecoin, wUSDM, artificially inflating its internal exchange rate. The underlying stablecoin, USDM, is collateralized by short-term U.S. Treasury bills.

As part of the donation attack, the threat actor inflated the exchange rate of wUSDM to from 1.06 to 1.7, then used two accounts to perform a self-liquidation on lending platform Venus Protocol. Though Venus reacted quickly to freeze the market, the attacker managed to profit around $200,000, while Venus suffered a net loss of over $716,000 as a result, according to a detailed post-mortem recently released by risk management firm Chaos Labs.

"Both teams implemented appropriate emergency measures — freezing markets, adjusting risk parameters, and resetting the exchange rate," said Yoni Keselbrener, head of DeFi at Lightblocks Labs, in an interview with The Block. Keselbrener contributes to oracle infrastructure on eOracle, an Ethereum-native oracle network developed on EigenLayer that allows for the integration of real-world data into decentralized applications.

The attacked vault implements the ERC-4626 standard for tokenized vaults originally introduced in May 2022, though the vaults later rose in popularity. However, the vault standard "...does not include safeguards against manipulated exchange rates when used in lending protocols," according to the post-mortem.

Lending platform Euler Finance published a research report on vulnerabilities with ERC-4626 vaults in January of 2024, arguing that most vaults don't explicitly implement safety checks to prevent against exchange rate manipulation. "We expect that in many cases two or more mitigation mechanisms might need to be combined for greater effect," the authors wrote.

Chaos Labs acknowledged in its post-mortem that safety strategies could have prevented the attack. "To mitigate this attack vector, the wUSDM contracts could have used a cross-chain exchange rate oracle, or, following proper disclosure, Venus would have implemented security measures to limit the appreciation of the exchange rate," Chaos Labs wrote. "To further mitigate this attack vector, an upside-capped oracle setup—such as Aave’s CAPO mechanism—will be implemented for all yield-bearing assets, preventing manipulation through artificial yield spikes."

"It applies to any vault [by the way], not only standardized," added the X account of Curve Finance in response to a thread by Keselbrener discussing the vulnerability. "Just a common misstep by lending platforms."

Keselbrener said the CAPO standard is effective, but requires "...additional code complexity and ongoing management to ensure they don't restrict legitimate yield growth while preventing manipulation."

"As DeFi becomes more complex, we need to think beyond simple price feeds to understand the entire risk profile of the assets we're integrating," Keselbrener said. "The need for cross-chain oracle infrastructure isn't a drawback but an additional security layer. Specialized oracle providers can also implement specific safeguards designed to detect and prevent these exact manipulation scenarios."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Tracy Jin, the chief operating officer at the MEXC crypto exchange, warns that tokenizing real-world assets (RWAs) carries a substantial amount of centralized risks that can lead to censorship, liquidity issues, legal uncertainty, cybersecurity problems, and asset confiscation through state or third-party intermediaries.

In an interview with Cointelegraph, the executive said that as long as tokenized assets remain under the purview of state regulators and centralized intermediaries, then "tokenization will simply be a new version of old financial infrastructure and not a financial revolution." Jin added:

"If the property or company behind the token is local, in a country with an unstable legal environment or high political volatility, the risk of confiscation increases," the executive continued.

RWA tokenization is projected to become a multi-trillion sector in the next decade as the world's assets come onchain, which will increase the velocity of money and extend the reach of capital markets worldwide.

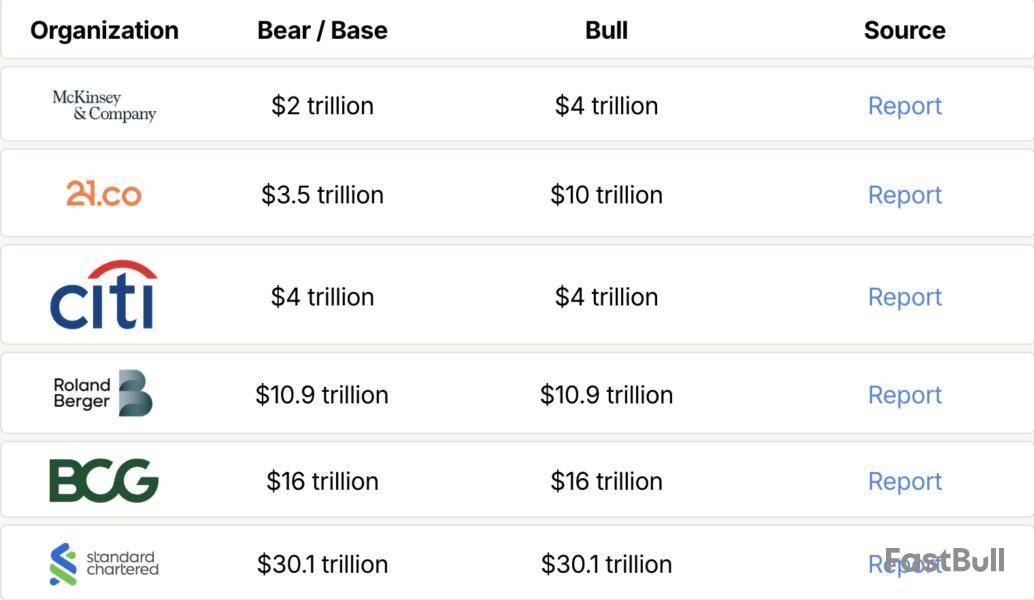

Estimates of the future RWA market differ dramatically

Tokenized real-world assets include stocks, bonds, real estate, intellectual property rights, energy, art, private credit, debt instruments, fiat currency, commodities, and collectibles.

According to RWA.XYZ, there are currently over $19.6 billion in tokenized real-world assets onchain, excluding the stablecoin sector, which surpassed a $200 billion market cap in December 2024.

A research report from Tren Finance polled large financial institutions including Citi, Standard Chartered, and McKinsey & Company; the report found that the participants predicted the RWA market to reach anywhere between $4 trillion to $30 trillion by 2030.

McKinsey & Company predicted the RWA sector will encompass between $2 trillion to $4 trillion by 2030 — a relatively modest assessment compared to other forecasts.

Meanwhile, institutions like Standard Chartered and executives at the blockchain network Polygon say that the RWA market will reach $30 trillion in the next decade.

Bitcoin’s price was rejected this week, showcasing the insufficient bullish momentum in the market.

Nevertheless, the asset faces a substantial support range at the $80K mark, which is expected to hold the price in the short term.Technical Analysis

By ShayanThe Daily Chart

Bitcoin has recently experienced a notable rejection after briefly breaking above the 100-day MA, signaling a false breakout and insufficient bullish momentum. This failure to break through reinforces the prevailing bearish sentiment in the market.

Nevertheless, BTC is approaching a substantial support range, including the psychological $80K level and the 0.5 ($84K) – 0.618 ($78K) Fibonacci retracement zone. This crucial region is expected to act as a support zone, potentially leading to a new consolidation phase around the $80K mark.

Given these conditions, Bitcoin is likely to continue its decline toward $80K in the short term, where price action will determine the next significant move.

On the lower timeframe, Bitcoin encountered increased selling pressure at the upper boundary of its descending channel, leading to a strong rejection. The price is currently testing short-term support at $83K, aligning with a prior swing low. While some buying interest may emerge at this level, overall market conditions lack bullish momentum, and sellers remain dominant.

As a result, BTC is likely to break below $83K and move toward the channel’s mid-boundary at $80K, which is a critical inflection point. While it may support the price and initiate a consolidation phase, a breakdown below this level could trigger a deeper decline toward the $77K threshold.

By Shayan

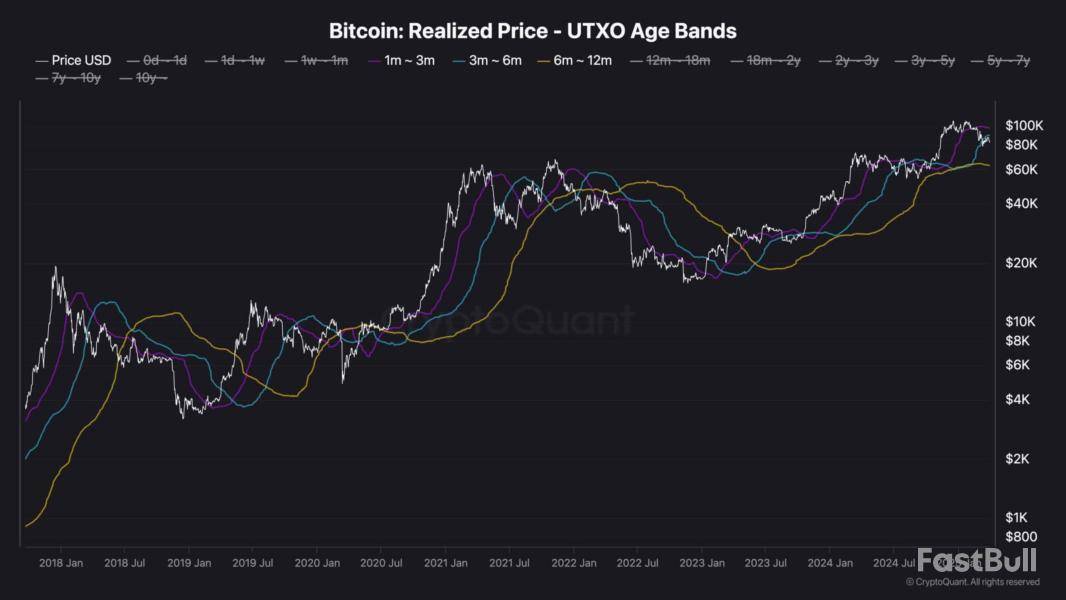

Bitcoin’s interaction with the Realized Price of long-term holders’ UTXOs has historically been a key indicator of market direction, as it represents the average acquisition cost of these holders. Bear markets typically begin when the price drops below the realized price of the 6-12 month cohort, signaling losses and potential distribution by these big investors.

Currently, BTC is trading below the realized price of the 3-6 month cohort at $88K but remains above the 6-12 month cohort’s realized price of $62K. This suggests that while the market is undergoing a deep correction, it is too early to confirm the onset of a bear market.

Bitcoin is likely to continue its corrective retracement within this range until new demand enters the market. The $88K level remains a critical threshold, where a breakout above it could signal the start of a fresh uptrend.

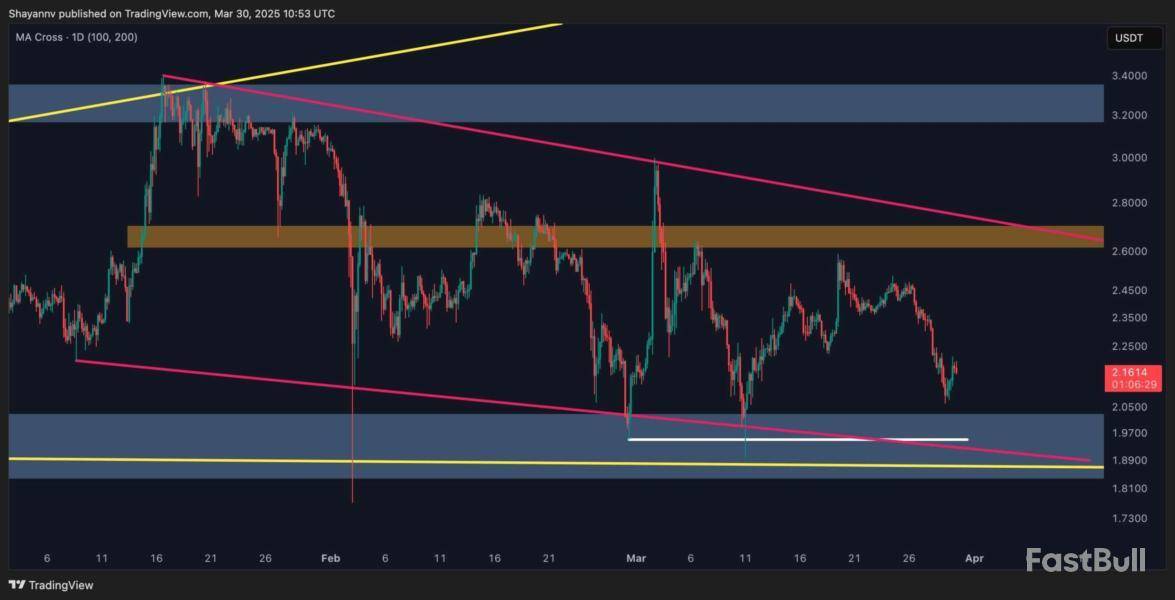

Ripple recently faced rejection at the 100-day MA of $2.5, leading to a substantial decline.

However, the price is now approaching a confluence of key support zones, increasing the likelihood of consolidation in the mid-term.XRP Analysis

By ShayanThe Daily Chart

XRP recently encountered heightened selling pressure at the critical 100-day moving average ($2.5), leading to a rejection and subsequent price retracement. However, the asset has now reached a significant support zone, which includes:

This confluence of key support levels suggests strong demand in this price range, likely preventing further downward movement. Given these conditions, XRP is expected to approach this support range and enter a consolidation phase in the mid-term.

On the lower timeframe, Ripple’s recent upward trend faced strong resistance, highlighting weak bullish momentum and a lack of buying pressure. This led to a notable bearish decline, pushing the asset toward the descending wedge’s lower boundary at $1.9, a key level that has repeatedly supported price action.

If XRP fails to hold above this level, further declines may follow. However, given the broader market conditions, the price is expected to stabilize and consolidate around this support range before its next major move.

F2Pool co-founder Chun Wang will be part of the four-passanger crew that will travel into space on Monday.

The four-day mission, which has been dubbed "Fram2," will be a historic one. This will be the very first human spaceflight to fly over and explore the Earth's poles.

Chun@satofishiMar 30, 2025Rollout and vertical ✅

Dry dress rehearsal ✅

Static fire ✅ pic.twitter.com/Ntzp99twOh

Fram 2 has been funded by Wang, who has accumulated vast wealth because of his early involvement in the cryptocurrency industry. The Chinese-born entrepreneur, who is currently a citizen of Malta, personally mined thousands of Bitcoins within two years during the cryptocurrency's early days. It is not clear how much Wang shelled out for the historic crewed mission.

The four first-time astronauts will travel aboard SpaceX's Crew Dragon capsule that will lift off from Florida at 9:46 p.m. ET. The hardware appeared on the launch pad earlier this week.

The mission is expected to last from three to four days. Its goal is to make it less challenging for humans to engage in long-range space exploration. The crew will conduct some important research, which includes capturing the very first medical X-ray of the human body in space in order to gain a better understanding of how microgravity affects bone density. It will also attempt to grow mushrooms in space for the very first time. Overall, the crew will conduct more than 20 exciting science experiments.

Wang is known as an avid globetrotter who has already visited more than 130 countries. Now, he is set to become the first Maltese astronaut in history.

The listing of AB on Weex, traded against USDT, is a significant step for the cryptoasset, as it increases access to a larger audience of traders and investors. Listings often lead to increased liquidity and can spur price movement as new participants enter the market. The airdrop announcement promising up to 10,000 USDT in $AB further incentivizes trader engagement, potentially leading to volatility. However, as with all new listings, the impact will depend on trader interest and market conditions in the coming weeks. source

AB DAO@ABDAO_GlobalMar 30, 2025$AB has launched on #WELaunch!

Join and claim up to 10,000 USDT airdrops in $AB! https://t.co/QM8TNSQzIT

The Farcaster airdrop of $HUNT to around 1,800 users is an opportunity for broader distribution and increased visibility of the token. Airdrops often create community buzz and can drive the price upwards as recipients might buy additional tokens or push the momentum through discussions. Given this distribution is based on user activity, it encourages engagement, potentially increasing on-chain activity and attention towards $HUNT. Traders might anticipate price movements from the announcement, but long-term impact depends on user retention and the platform's ongoing growth. source

Hunt Town@steemhuntMar 30, 2025The next @farcaster_xyz airdrop will feature $HUNT, with a target date set for Monday!

Approximately 1,800 users will receive the $HUNT airdrop based on their number of followers, frame usage, and on-chain transactions. Basically Based-Users

If you're not familiar with… pic.twitter.com/MyJEf0uNvq

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up