Investing.com -- Citi analysts are optimistic about Ulta Beauty (NASDAQ:ULTA) Inc. heading into its Q3 earnings report on December 5, saying in a note Friday that they expect the company to exceed consensus EPS estimates.

Citi forecasts earnings of $4.69 per share, compared to the consensus estimate of $4.49.

The bank said the expected outperformance is attributed to stronger-than-anticipated comparable sales and slightly better gross margins.

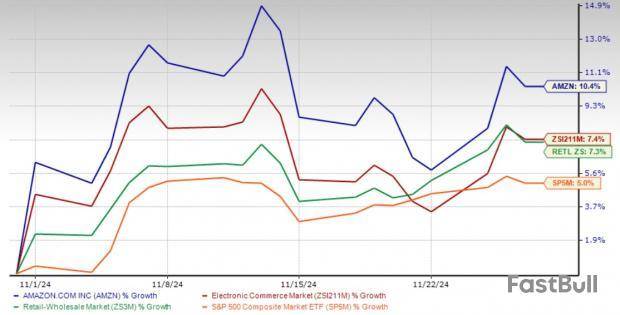

"ULTA is facing headwinds from weakening category trends/increased competition (Sephora in KSS, AMZN, ULTA in TGT) that are making it difficult to drive traffic this year," said Citi.

"However, given our view that trends have not gotten any worse (or better) in 3Q vs 2Q, we anticipate mgmt will narrow their F24 EPS guidance range, taking the worst case scenario off the table, and implying 4Q EPS guidance in-line w/cons."

The current guidance range of $22.60–$23.50 is expected to shift to $22.90–$23.50, implying Q4 earnings in the range of $6.44–$7.04, in line with the consensus of $6.80.

"We view a stabilization of comp trends as a modest positive, as it signals more confidence in achieving their F25 targets," Citi added.

The analysts raised their price target on Ulta to $390 from $345, reflecting higher estimates for fiscal 2024 and 2025. They project FY24 and FY25 EPS at $23.18 and $22.68, respectively, up from prior estimates of $22.95 and $20.75.

The bank also highlights Ulta's trading multiple of 18x FY25 earnings as offering balanced risk/reward, especially with sentiment skewing negative among investors.

"We believe some investors are more willing to own ULTA here given mgmt has already provided preliminary F25 guidance and current trends do not seem to be deteriorating any further," Citi noted.