Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Crypto analysts speculate that the massive weekend leverage flushout, which wiped billions of dollars from the crypto markets, may have just paved the path for “altseason 3.0”

“Every major expansion in crypto has included sharp 30% to 60% resets along the way,” observed analyst and researcher ‘Bull Theory’ on Monday.

March 2020 saw almost 70% wiped off markets in the pandemic-induced black swan event, and May 2021 saw more than 50% wiped out. There were at least five other 30% to 40% altcoin slumps during the last bull market cycle.

The market crash in April this year had many calling it the beginning of the bear market. Yet “each of those wipes looked like the end [and] each was followed by the strongest rallies of the cycle,” the analyst added.

Altcoins will bounce back

Altcoins are usually hit hardest during these epic market resets, and this was the case over the weekend with XRP (XRP) dumping at least 18%, Solana (SOL) 22%, Dogecoin (DOGE) 28%, Cardano (ADA) 25%, and Chainlink (LINK) 26% in just a day.

After the March 2020 flash crash, “we had a huge altseason where altcoins pumped 25x to 100x,” said analyst Ash Crypto before adding, “I think it will happen again.”

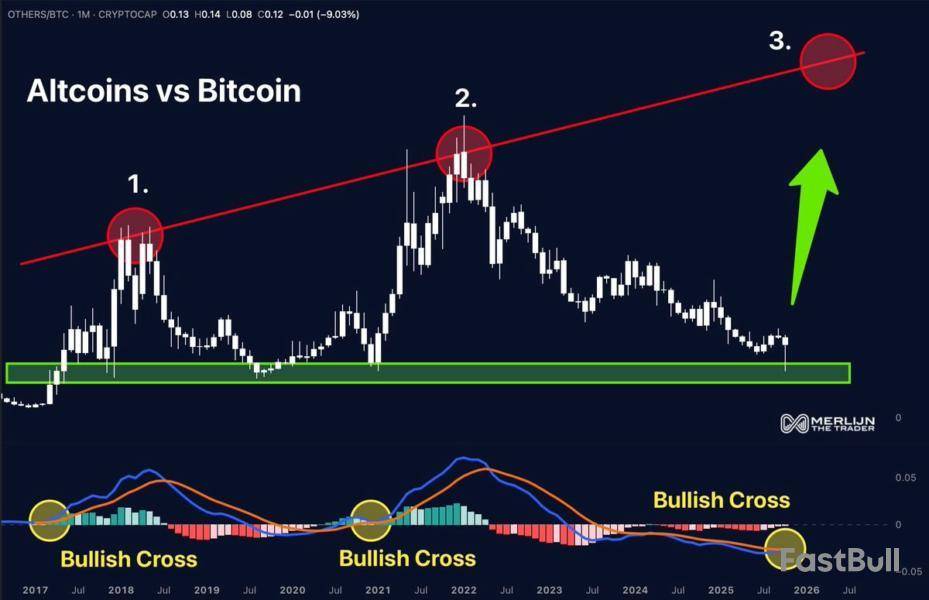

Meanwhile, analyst ‘Merlijn The Trader’ identified a setup for “altseason 3.0” with a monthly bullish MACD cross on the BTC/altcoins chart, the same pattern that occurred in 2017 and 2021.

Total crypto cap falls back below $4T

The total crypto market capitalization dipped back below the psychological $4 trillion mark on Tuesday, despite the bullish sentiment regarding the recovery and a potential altseason.

Bitcoin (BTC) is leading losses with a 1.4% decline on the day as it fell below $113,500 on Tuesday morning. This comes at the same time as several altcoins were posting daily gains.

Additionally, Bitcoin dominance, another key indicator of altcoin performance, is forming its first red weekly candle in five weeks as it fell below 59% on Tuesday, according to TradingView.

Solana started a fresh increase above the $188 zone. SOL price is now consolidating above $200 and might aim for more gains above the $208 zone.

Solana Price Jumps Further Above $200

Solana price started a decent increase after it settled above the $172 zone, beating Bitcoin and Ethereum. SOL climbed above the $180 level to enter a short-term positive zone.

The price even smashed the $188 resistance. The bulls were able to push the price above the 61.8% Fib retracement level of the main drop from the $225 swing high to the $155 low. Besides, there is a bullish trend line forming with support at $199 on the hourly chart of the SOL/USD pair.

Solana is now trading above $202 and the 100-hourly simple moving average. On the upside, the price is facing resistance near the $208 level and the 76.4% Fib retracement level of the main drop from the $225 swing high to the $155 low. The next major resistance is near the $218 level.

The main resistance could be $225. A successful close above the $225 resistance zone could set the pace for another steady increase. The next key resistance is $242. Any more gains might send the price toward the $250 level.

Another Pullback In SOL?

If SOL fails to rise above the $208 resistance, it could start another decline. Initial support on the downside is near the $199 zone and the trend line. The first major support is near the $195 level.

A break below the $195 level might send the price toward the $190 support zone. If there is a close below the $190 support, the price could decline toward the $180 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $199 and $190.

Major Resistance Levels – $208 and $218.

MiniDoge is now live on X Layer, a move that means the token can be used on more chains with stronger liquidity and faster performance. This event shows growth for the project and could bring new users or traders. Expanding to other networks sometimes leads to higher demand and price increases, as more people can use or buy the token. However, the real price impact will depend on if users see true value and if the token’s ecosystem grows. Read more in the team’s announcement source.

The RP-6 vote for Renzo is about a buyback and burn plan, which could remove 10% of the tokens from supply across six months. This type of event usually helps the price, because less supply often means higher value. If the community supports this plan, it might build more positive feeling, leading to buying. However, the vote must still be approved first, and big changes depend on the size of market interest. If people want to hold for the long-term, the impact could be stronger. Learn more from the team’s announcement source.

Renzo@RenzoProtocolOct 13, 2025REMINDER: Discussions are still ongoing for RP-6!

Renzo Buyback & Burn - 10% Over 6 Months

All community members are encouraged to share their feedback and participate in the discussion. Voting begins in 2 days. https://t.co/uZhYx5w2oR

WhiteBridge Network (WBAI) will list on Gate.io, with trading in the WBAI/USDT pair starting soon. Listings on big exchanges often create more interest and higher liquidity, because more people can buy or sell the token easily. Usually, the price could move up after the listing, at least for a short time. But sometimes, there is selling after the early excitement, which might push the price back down. Long-term effects depend on project developments and trading volume. Watch for volatility when trading begins. Read more information here source.

Gate@GateOct 14, 2025Gate Initial Listing: $WBAI @AiWhitebridge

Trading Starts: 12:00 PM, October 15th (UTC)

Trade: https://t.co/AC6PySIWrR

More details: https://t.co/pvg3UxKY3K pic.twitter.com/AmfjuycpaX

In a market shaken by liquidations and fear, one chart pattern on Dogecoin’s higher time frame continues to whisper a story most traders seem to be missing. According to crypto analyst Cantonese Cat, the monthly DOGE structure still forms the handle of a larger cup-and-handle formation that has been developing since 2021.

Dogecoin Cup and Handle Still Targets $2

Despite Friday’s sharp crash across altcoins, the analyst argues there’s “no technical damage.” His chart shows that the handle wick retraced as far as the 0.382 logarithmic Fibonacci level before rebounding to hold the 0.618 retracement as support, preserving the symmetry of the broader bullish setup that points toward the long-discussed $2 extension zone.

“This is a handle to the cup that wicked as far down as the 0.382 log fib but is currently holding 0.618 back as support. There is no technical damage in the greater scheme of things. Only emotional damage,” Cantonese Cat wrote via X.

The chart maps a rounded base from the 2021–2023 decline into a mid-2023–2024 upswing that peaked at the 1.000 Fibonacci marker at $0.48442 in December 202, thereby completing the “cup.”

Price has since carved the “handle,” with Friday’s crash extending below the 0.382 retracement at $0.11771 before recovering above the 0.618 at $0.20205. At the time of the snapshot, DOGE traded at $0.20568 on the monthly candle, down 11.74% for the period, with open, high, and low printed at $0.23304, $0.27043, and $0.10305, respectively.

The immediate inflection remains the 0.618 pivot near $0.20205; sustained acceptance above that shelf keeps the handle constructive. Overhead, the 0.707 and 0.786 retracements—$0.24770 and $0.29681—frame the next resistance band. A close through those levels would re-expose the prior swing zone around the 0.886 at $0.37315 and the 1.000 at $0.48442.

Cantonese Cat’s roadmap also includes standard Fibonacci extensions derived from the completed cup. The 1.272, 1.414, and 1.618 projections sit at $0.90288, $1.24968, and $1.99344, respectively. The latter aligns with the widely cited “$2” objective and is the technical anchor behind the analyst’s headline claim.

On the downside, the 0.500 at $0.15422 and 0.382 at $0.11771 mark the key retracement supports already stress-tested by the month’s wick; a decisive monthly close below 0.382 would compromise the handle symmetry, but that condition has not been met on the current candle.

Altcoin Momentum Also Still Intact

To contextualize last week’s washout across altcoins, the analyst published a second monthly chart of the “OTHERS” market-cap index (total crypto market cap excluding the top 10). The panel overlays 20-period Bollinger Bands and shows a classic squeeze preceding an abrupt spike in realized volatility.

According to the readout, the index opened the month near $300.19 billion, posting a high at $332.18 billion and a capitulation low at $156.59 billion before rebounding to $270.35 billion. Notably, that recovery carried back above the 20-month moving average—the Bollinger middle band—currently at $264.88 billion, after wicking to the lower band at $167.44 billion.

The upper band resides at $362.31 billion. Arrows on the chart highlight a near-identical pattern during the March 2020 COVID deleveraging: a monthly lower-band wick within a band squeeze that preceded a sustained upside cycle once the candle reclaimed the mid-band.

In commentary accompanying the charts, Cantonese Cat likened the weekend’s crypto drawdown to a“COVID-like deleveraging.” He wrote: “What happened this past weekend with altcoins is very similar to the deleveraging that happened in COVID based on technicals, with monthly Bollinger band squeeze and wicking down to lower Bollinger band. These moves are necessary for us to move up if the bull market is not over yet.”

He also pointed to US small-cap equities—via the Russell 2000 ETF (IWM)—as evidence of broader risk appetite, arguing that small caps’ V-shaped rebound from their own lower Bollinger Band and approach toward all-time highs helps explain why Bitcoin miners are outperforming spot cryptocurrencies. In his view, market-wide liquidity exists, but clearing excess leverage in altcoins was a precondition for the next leg higher.

At press time, DOGE traded at $0.21124.

South Korean authorities have resumed their review of Binance's acquisition of local crypto exchange Gopax after a delay of over two years, local news agency Newsis reported Tuesday.

This indicates that Binance, the world's largest crypto exchange, could soon re-enter the South Korean market, after initially shutting down local operations in 2021.

According to Newsis, South Korea's Financial Intelligence Unit (FIU) is currently assessing the formal report from Gopax on changing its key executives and is reviewing it favorably, with approval of the Binance-Gopax change expected as early as the end of 2025.

Under the current South Korean legal framework, there is no distinct suitability review for major shareholders of crypto exchanges. Consequently, this executive change report is viewed as essentially a review of Binance’s major shareholder qualification.

Binance and Gopax first submitted the executive change report in March 2023, after Binance became the largest shareholder of Gopax by acquiring 67% of its shares. Local authorities stalled the approval process since then, citing potential anti-money laundering risks.

In June 2023, the U.S. Securities and Exchange Commission sued Binance for illegally offering services in the U.S., while the Department of Justice accused the exchange of money laundering violations, resulting in the exchange paying $4.3 billion in penalties.

FIU's latest move appears to be influenced by the resolution of those compliance issues in the U.S., Newsis noted.

The Block has reached out to the FIU and Binance for comment.

What is Gopax?

Gopax is one of the five South Korean cryptocurrency exchanges authorized to handle cash-to-crypto transactions, a privilege granted only to platforms that meet rigorous know-your-customer and AML requirements.

Gopax faced a serious withdrawal crisis in 2023 when its DeFi partner, Genesis Global Capital (GGC), froze customer funds tied to Gopax's GoFi deposit product.

This issue was triggered by GGC halting withdrawals and subsequently filing for Chapter 11 bankruptcy in January 2023 following the collapse of FTX. This resulted in an estimated $47 million (around 56.6 billion Korean won) in GoFi customer funds being frozen.

The crisis directly led Binance to step in, acquiring a majority stake in Gopax in February 2023 with the stated intention of injecting capital to help repay the affected GoFi users.

As the takeover process stalled, Binance sought to sell a large portion of its Gopax shares to local cloud service provider Megazone, in an aim to become the second-largest shareholder. However, that deal fell through as of late 2024, according to local news outlet The Bell, indicating that Binance remains Gopax's largest shareholder.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up