Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

By Elsa Ohlen

Bitcoin has finally broken into the mainstream after years as the noisy rebel of the financial system. Now, the Trump administration's crypto push could do the same for altcoins — at least some of them.

For years, the world of cryptocurrencies operated as a financial Wild West, characterized by unchecked speculation, regulatory ambiguity, and occasionally spectacular downfalls. Now, just about three years after the collapse of exchange FTX shattered confidence in the sector, lawmakers are actively engaging in shaping rules to govern cryptos, classifying them as either commodities or securities. That, in turn, will remove the ambiguity and overlap over regulation, making investing less of a risk.

"It adds more certainty that [cryptocurrency] is here to stay," Jamie Hopkins, CEO of Bryn Mawr Trust Advisors told Barron's.

For years, it has been unclear just where crypto fits in to the world of financial assets. Despite their name, cryptocurrencies aren't regulated as currencies and there have been legal cases over whether certain tokens should be considered commodities or securities. That ambiguity has had impact on their supervision and regulatory overlap between the Commodity Futures Trading Commission and Securities and Exchange Commission. The lack of a regulatory framework left investors in limbo, while the many attempted cases of litigation and government enforcement have discouraged people wanting to enter the industry.

"It creates a cautionary principle where you don't go to the edge of the cliff," Bitwise Chief Investment Officer Matt Hougan tells Barron's. "You have to stop a hundred yards from the edge of the cliff because you don't know where the cliff is."

A multiyear legal battle between Ripple Labs and the SEC served as a cautionary tale. The regulator charged Ripple in 2020 for selling XRP, which it considered an unregistered security. Ripple denied the accusations, arguing that XRP didn't act like a security and therefore shouldn't be subject to securities control.

A district judge issued a split ruling in 2023 stating that retail XRP sales on public exchanges didn't qualify as securities transactions, however, some institutional sales did. After over four years, Ripple and the SEC finally settled and Ripple agreed to pay a fine of $125 million. In August this year, they jointly filed for dismissal of the case.

The Clarity Act could be key to finally giving the industry the rules and predictability it has craved. It lays out a framework to distinguish whether digital assets are classified as commodities, overseen by the CFTC, or securities, under the jurisdiction of the SEC. Stablecoins, or coins typically pegged to the dollar that act like a crypto version of a money-market fund, have their own category and would fall under joint oversight of the SEC and the CFTC.

The Act's backers say it gives the sector just that, while critics argue it doesn't do enough to ensure effective ways to enforce its rules and provide enough protection.

The act still needs to pass through the Senate, which has published its own discussion draft market structure bill that would likely put most cryptos under SEC jurisdiction, although with exemptions from many aspects of securities laws.

The House bill, would define a commodity as an asset with its value intrinsically linked to the use of a blockchain — that has a decentralized record of transactions maintained across computers. Furthermore that blockchain must be one that isn't controlled by any one person or group. Coins with a central issuer or controlling entity would fall under the SEC as a security. Most will want to avoid the latter, Hougan says. True value, he suggests, lies in the trust and characteristics of a truly decentralized ownership and governance structure. If a coin is too centralized to be classified as a commodity, it's little more than a "a bad database."

Law firm McMillan suggests a reconciliation process is expected that will converge both bills into a final text for passage.

So far Bitcoin and Ether have typically been considered commodities by regulators due to their distinct decentralized nature of a broad ownership and governance structure, but most other coins remain largely undefined. Comparing them to Bitcoin or Ether would be like comparing the world's most valuable company, Nvidia, to a penny stock, Hougan says.

For Bitcoin and Ether, regulatory advancements will be "strictly positive," he adds. It could reduce their notorious volatility as well as remove the reputational risk that surrounds cryptos. Other coins, however, face a potential divide.

The total cryptocurrency market has a value of nearly $4 trillion — around the same as Microsoft — with Bitcoin accounting for about two thirds of that. The rest is altcoins, or alternative coins, of which there are thousands. About 80 tokens have a market capitalization of more than $1 billion, according to CoinDesk data.

The new law could give cryptos tied to a blockchain a leg up on their competitors, according to Professor Sarit Markovich at Kellogg School of Management. She sees cryptos tied to a blockchain like Ether, Solana, and Ripple's XRP as "two-sided markets" — operating systems with app developers on one side and users on the other. Regulatory clarity and legitimacy would bring more users to these ecosystems, increasing their value and the price of the tokens tied to them, she says.

In contrast, the long-term prospects for meme coins such as Dogecoin, Shiba Inu, or $TRUMP, despite potential short-term price bumps, appear more challenging. Meme coins don't typically have their own blockchain but are built on top of other blockchains.

While financial advisors are coming round to making a place for cryptos in portfolios, they are divided on coins besides Bitcoin. Hopkins says he recommends clients interested in cryptos invest between 1% and 3% in via spot ETFs such as those by Fidelity, BlackRock, and Bitwise, leaning toward the lower end of that range, as opposed to investing in the coins themselves.

BlackRock offers the iShares Bitcoin Trust ETF and the iShares Ethereum Trust ETF. Similarly, investors can buy the Fidelity Wise Origin Bitcoin Fund or the Fidelity Ethereum Fund.

Bitwise also offers funds tracking the price of a basket of coins like the Bitwise 10 Crypto Index Fund, which is heavily overweight on Bitcoin but also includes 1% or more of Ethereum, XRP, Solana, and Cardano, as well as minor holdings of Chainlink, Sui, Avalanche, Litecoin, and Polkadot.

If passed, the legislation would remove a key impediment to investing in crypto by providing much-needed regulatory clarity. The Bitwise 10 Crypto Index Fund may be a good place to start.

While many still oppose cryptos altogether, that battle appears to have been fought and lost. Digital assets are here to stay — maybe it's time to embrace them.

Write to Elsa Ohlen at elsa.ohlen@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

While Coinbase CEO Brian Armstrong has become the latest crypto executive to predict Bitcoin to reach $1 million by 2030, one crypto analyst warns investors should not get ahead of themselves after Bitcoin fell to $112,676 this week, retreating 9% from its all-time high.

The US is a “bellwether for the rest of the G20”

“The rough idea I have in my head is that we’ll see a million-dollar Bitcoin by 2030,” Armstrong told John Collison on the “Cheeky Pint” podcast on Wednesday.

Armstrong pointed to a few reasons to back up his Bitcoin (BTC) prediction, including clearer regulations starting to take shape in the United States, which he called a “bellwether for the rest of the G20.”

He highlighted the recently passed Genius Act for stablecoins and the market structure bill that is now “being debated” in the Senate.

“Fingers crossed something could happen by the end of this year, that would be a huge milestone,” Armstrong said.

He also cited the US Strategic Bitcoin Reserve. “If you asked me five years ago, that would have been like a vision board. Someone would have said you’re crazy, the United States government is not going to officially hold Bitcoin.”

It comes the same day Eric Trump said at the Wyoming Blockchain Symposium, “You go out a couple of years, there’s no question Bitcoin hits a million bucks.”

Crypto analyst suggests one step at a time

However, McKay Research researcher James McKay suggests Bitcoiners should not get ahead of themselves over the asset’s future price.

“Let’s try and hold 124K first guys,” McKay said in an X post on Tuesday, a week after Bitcoin hit a new all-time high of $124,128 but shed its gains in the days following.

McKay, however, said Armstrong’s prediction is “not out of left field,” considering Standard Chartered predicts $500,000 by 2028.

Factors supporting a continued Bitcoin rally include crypto treasury firm and nation-state Bitcoin buying, continued institutional interest in Bitcoin and rising demand for spot Bitcoin ETFs.

However, some near-term headwinds could include the US Federal Reserve delaying rate cuts, while longer-term risks include a potentially less crypto-friendly stance from the next US presidential administration.

Several other execs forecast $1M Bitcoin by 2030

McKay’s comments came just hours after he said, “Only time will tell whether the 4-year cycle is dead or not.”

In February, ARK Invest CEO Cathie Wood said Bitcoin could reach $1.5 million by 2030 in her firm’s “Bull Case” forecast. Going even further back, in May 2024, Twitter co-founder Jack Dorsey forecasted that the price of a single BTC would be $1 million by 2030 and could appreciate further.

However, others warn that if the price tag comes any sooner, it may set off warning signs.

Galaxy Digital CEO Mike Novogratz says a million-dollar Bitcoin next year wouldn’t be a victory but rather a sign that the US economy is in serious trouble.

“People who cheer for the million-dollar Bitcoin price next year, I was like, Guys, it only gets there if we’re in such a shitty place domestically,” Novogratz told Natalie Brunell on the Coin Stories podcast on Wednesday.

U.S. hiphop artist Ye, better known by his previous name Kanye West, has apparently launched his own Solana cryptocurrency named Yeezy Money (YZY).

"Yeezy Money is here … A new economy, built on chain," said a Wednesday post on West's X.

His social media post also attached an image showing what appears to be the address for his cryptocurrency, and a link to a website that allows people to buy, sell and send the cryptocurrency. According to data from the GMGN.Ai analytics platform, the token's market capitalization currently stands at around $2 billion.

"YZY Money is a concept to put you in control, free from centralized authority," the website said. It also said the YZY ecosystem includes Ye Pay, a crypto payments processor that allows merchants to accept credit and crypto payments at a lower fee, and a YZY credit card.

Meanwhile, in its disclosure, the website states that YZY is intended to function as an "expression of support for and engagement with" the ideals embodied by the symbol, and is not intended to be an investment opportunity.

If confirmed to be legitimate, this marks a pivot from West's previous stance on memecoins. In February, West said he is not launching a coin as they "prey on the fans with hype," after seemingly teasing the idea a couple days prior. West also said he was approached to scam the social media community to promote a fake Ye cryptocurrency for $2 million. These posts came amid multiple erratic social media posts that hiphop artist has been publishing on X at the time.

Following the announcement, X users quickly grew suspicious of the new crypto venture, speculating that Kanye West's account had been compromised. However, West's official website and his online store list YZY as a potential payment option, which suggests the venture might be legitimate.

The Block has reached out to West to confirm if YZY was indeed launched by West himself.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Cross-blockchain bridge Wormhole is looking to bid against LayerZero’s $110 million bid to acquire crypto protocol Stargate, arguing LayerZero’s bid doesn’t “create a compelling offer.”

The Wormhole Foundation said in a post on Stargate’s forum on Wednesday that it deserves “a more competitive process” after the LayerZero Foundation’s initial $110 million bid earlier in August to buy the platform failed to resonate with the community. LayerZero updated its offer on Sunday to a greater reception.

“It doesn’t create a compelling offer, which values Stargate’s ongoing business at an unreasonably low number,” Wormhole wrote of LayerZero’s bid. “We are prepared to submit a meaningfully higher bid.”

The impending bid could set up a bidding war for Stargate, which LayerZero developed and launched in 2022. LayerZero’s deal would see the platform come back under its umbrella, but many Stargate Finance (STG) tokenholders slammed its initial offer as unfair.

Wormhole asks for vote pause on LayerZero’s bid

Wormhole asked the Stargate community to suspend the vote on LayerZero’s bid for five business days to allow it time to finalize its offer.

It added that it “would appreciate additional time to conduct research and to speak with the Stargate team,” and it could “improve upon the current offer if more time is allowed to conduct a proper process.”

It asked for a list of assets, its financials since its launch, user and traffic metrics, its liabilities and if it’s facing any ongoing lawsuits or regulatory actions.

Wormhole pitched its potential acquisition of Stargate as forming a “market-dominant ecosystem.”

“Stargate brings deep, unified liquidity pools and proven user demand, while Wormhole commands broad ecosystem integration across dozens of blockchains and protocols, as well as key growth areas in crypto, like RWAs [real world assets],” it wrote.

Wormhole did not immediately respond to a request for comment. The LayerZero Foundation could not be reached for comment.

Stargate community backs LayerZero’s updated bid

LayerZero updated its proposal to acquire Stargate on Sunday to include a revenue-sharing period for those who had staked their Stargate tokens, which has seen wide support from Stargate’s community.

LayerZero’s final proposal said it would give staked Stargate tokenholders half of all top-line Stargate revenue for six months, with the remaining half used to buy back its LayerZero (ZRO) token.

In comparison, its initial proposal pitched using Stargate’s excess revenue for a ZRO buyback program.

LayerZero said all circulating STG would be swapped for ZRO at a ratio of 1 STG to 0.08634 ZRO — aligning with its original proposal.

The new proposal has seen 88.6% of STG holders vote in favor, accounting for 6.6 million tokens.

Some Stargate community members had called LayerZero’s original pitch “not attractive at all” as it didn’t give advantages to STG holders, while others said the token swap should be upped to a 1:1 basis.

Wormhole, Stargate, LayerZero tokens gain

The tokens tied to all three platforms all saw gains on the day alongside a modest lift in the wider crypto market.

The Wormhole (W) token is up 6.3% in the past 24 hours to just over 8 cents, having seen a boost around the time of its post to Stargate’s forum, according to CoinGecko.

Stargate’s token has gained 6% on the day, also climbing around the time of Wormhole’s forum post to a 24-hour high of over 18 cents, which has since cooled to just over 17 cents.

LayerZero’s token has also seen gains, a modest 3.6% on the day to $2, joining gains in the wider crypto market as Bitcoin (BTC) and Ether (ETH) are up 1% and 5.2%, respectively.

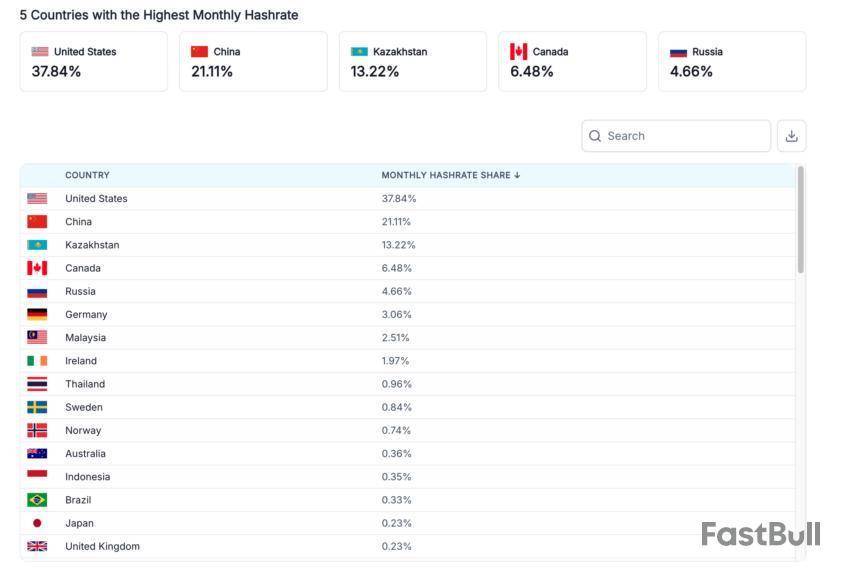

Bitcoin mining remains the backbone of the crypto economy. In the Asia-Pacific (APAC) region, abundant hydropower, gas reserves, and surplus electricity create opportunities and friction.

The region offers “green hash” potential yet faces high electricity costs and fragmented rules. For global investors, APAC bitcoin miners now sit at the center of debates over energy use, transparency, and capital access.

APAC Bitcoin Mining Overview

Latest Update – In July 2025, Bitdeer expanded hydropower mining capacity in Bhutan to more than 1,200MW, positioning the country as a renewable mining hub. Marathon Digital and Zero Two began operating a 200MW immersion-cooled site in Abu Dhabi, showing how advanced cooling and flare-gas integration sustain operations in extreme climates. Meanwhile, Iris Energy in Australia reported 50EH/s, signaling how APAC miners scale alongside Western peers.

Background Context – The Cambridge Bitcoin Mining Map shows that after China’s 2021 crackdown, bitcoin mining shifted across Asia-Pacific economies while underground activity in China persists. Energy data, published by Asia-Pacific Economic Cooperation, projects rising renewable penetration, creating conditions where bitcoin mining can align with decarbonization goals if policy supports it.

Deeper Analysis – China remains opaque. Despite the ban, seasonal hydropower in Sichuan and underground clusters persist. The Cambridge Digital Mining Industry Report 2025 warns of underreported activity in China, complicating global hash power and concentration risk assessments.

In fact, despite the 2021 ban on crypto mining, the country still accounts for more than 21% of global hashrate. This persistence is driven by underground hydropower operations in regions like Sichuan, dispersed small-scale farms that avoid detection, and local utilities quietly selling surplus electricity. While Beijing maintains a prohibition on paper, in practice, it appears to tolerate a shadow bitcoin mining industry, adding significant opacity and transparency risks to global assessments.

Japan’s high electricity prices limit domestic farms. However, firms such as SBI Crypto and GMO operate overseas, at renewable-powered sites. Domestically, SoftBank’s 300MW data center in Hokkaido illustrates how AI infrastructure overlaps with mining-scale energy loads. PTS signed agreements to supply telecom-grade hashrate over three years in Japan’s enterprise segment, indicating steady demand for stable capacity.

South Korea is exploring power-system integration. A May 2025 arXiv study suggests that monetizing surplus electricity through bitcoin mining could help KEPCO reduce debt while lowering grid losses. This model reframes mining as a grid-balancing tool rather than a burden.

Green Hash in Asia: Hydropower, Flare Gas, and Renewable Expansion

Bhutan’s hydropower expansion with Bitdeer signals how Asia can brand bitcoin mining as environmentally sustainable and attract ESG-minded capital. Abu Dhabi’s immersion-cooled site shows how flare gas and advanced infrastructure redefine efficiency in hot climates. Australia’s Iris Energy demonstrates a hybrid model by combining renewable-powered mining with AI computing, positioning itself across digital and energy markets. These cases show that Asia-Pacific bitcoin mining is growing more flexible, diversified, and sustainability-driven.

Behind the Scenes – APAC miners balance local politics and global scrutiny. Japan and Korea focus on energy integration rather than pure scale. Bhutan markets sustainability, while China’s hidden activity raises transparency concerns. The UAE and Australia leverage their energy mixes to attract institutional capital and lower marginal costs.

Broader Impact – Institutional investors demand high disclosure standards. US-listed miners win trust with SEC filings and market liquidity, while APAC firms must bridge fragmented frameworks. However, if Asian miners deliver ESG-backed transparency, capital flows could diversify more evenly between East and West.

Looking Forward – By 2026, more APAC miners could approach parity with Western peers if they combine efficiency with credible disclosure. Competitiveness will depend on rapid upgrades to next-generation ASICs, integration with renewable grids, and establishment of regional reporting standards that reduce perceived risk for global investors.

Policy Costs and Regional Risks

Data Breakdown—The CCAF 2025 report highlights hardware efficiency gains and geographic reshuffling of mining capacity. The region’s intergovernmental forum’s Energy Outlook shows how regional energy trajectories can reshape bitcoin mining’s cost base and carbon profile.

Possible Risks –

Expert Opinion –

“The most significant risk for Asian miners remains regulatory unpredictability. Without long-term clarity, capital costs rise and global investors hesitate.”— Cambridge Centre for Alternative Finance, Digital Mining Industry Report 2025

“Our facility in Abu Dhabi demonstrates how immersion cooling and flare gas integration can redefine mining economics in challenging climates.”— Marathon Digital Holdings, press release

“By monetizing surplus power through mining, utilities could improve their financial health while stabilizing electricity networks.”— ArXiv research, Bitcoin Mining and Grid Efficiency in Korea (May 2025)

Ming Shing Group Holdings Limited, a Nasdaq-listed construction service provider specializing in wet trades, announced Wednesday that it has entered a bitcoin purchase agreement to buy 4,250 BTC.

The Hong Kong-based company's agreement involves a $482.9 million transaction with Winning Mission Group, a company registered in the British Virgin Islands, which will sell the 4,250 BTC at an average price of $113,638 per bitcoin.

The deal, which is expected to close by the year-end, will not be paid for in cash. Instead, Ming Shing will issue convertible promissory notes and stock warrants to the seller, the announcement said.

The transaction extends to a third party, Rich Plenty Investment Limited, which will receive half the value of the deal. Both the original seller and the new assignee will each get a convertible note worth over $241 million and a warrant to purchase more than 200 million of Ming Shing's shares, according to the press release.

“We believe the Bitcoin market is highly liquid and the investment can capture the potential appreciation of Bitcoin and increase the Company’s assets," said Wenjin Li, CEO of Ming Shing. "We are devoted to creating additional value for our shareholders and actively exploring options for the Company to grow further.”

The company's stock MSW momentarily jumped 29% on the news on Wednesday. It closed the day 11.5% higher to trade at $1.65.

Ming Shing's pivot adds to the long list of public companies that have incorporated bitcoin into their treasury strategy. Led by Michael Saylor's Strategy, public bitcoin treasury companies hold 3.93% of bitcoin's entire supply, according to The Block's data dashboard.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Core Foundation and Hex Trust have expanded their partnership to offer institutional Bitcoin staking services across the Asia-Pacific and MENA regions.

The collaboration combines Core’s Dual Staking technology with Hex Trust’s regulated custody platform. Core provides Bitcoin staking services, and Hext Trust is an institutional crypto custody service in Hong Kong.

Institutional Appeal: Yield with Compliance

Banks, family offices, and institutional investors can timelock Bitcoin to support the Core network. At the same time, they can maintain full custody and earn protocol rewards. By integrating Core’s staking technology within Hex Trust accounts, clients can stake BTC, CORE, or both without transferring assets to unregulated platforms.

The value is clear for institutions: earn yield on idle Bitcoin while staying compliant and keeping custody secure. Rewards are issued from blockchain activity, not opaque off-chain programs.

Core is positioning itself as a leading Bitcoin-focused DeFi ecosystem. It bridges Bitcoin security with EVM-compatible programmability. Recent data shows that over $500 million in total DeFi value is locked, over 7,000 timelocked BTC is securing the network, and roughly 75% of Bitcoin mining hash power is backing it. These figures highlight why custodians and institutions are paying attention.

With its regulatory footing in APAC and MENA, Hex Trust says the integration could drive larger, compliant flows into BTCFi, or decentralized finance built on Bitcoin security. Asset managers can use time-locked Bitcoin as a regulated source of yield while preserving custody relationships.

Analysts say the key challenge will be scale and operational controls. Institutions demand predictable rewards, clear custody separation, and strong accounting before allocating significant Bitcoin. By combining Core’s yield layer with Hex Trust’s compliance infrastructure, this partnership may shift institutional Bitcoin engagement from passive holding to active, yield-focused strategies. Security and regulatory comfort remain central to adoption.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up