Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

In an August 10 video titled “My End Of 2025 ETH Price Prediction (Using AI) — You’re Not Bullish Enough!”, crypto analyst Miles Deutscher said Ethereum’s latest breakout above the “very key level in the $4,000 zone” has shifted the market into what he views as a confirmed, structurally stronger advance toward new all-time highs. “We actually did get a daily close,” he noted, adding that the weekly close above the same region—something Ethereum “hasn’t closed above on the weekly since November 2021”— underscores the significance of the move. In Deutscher’s framework, that close is “confirmation for a much bigger run.”

How High Can Ethereum Go?

Deutscher centered the analysis on a simple question—how high can Ethereum go—and answered it with a blend of technical context and model-driven probabilities. Before invoking AI, he sketched an “eye test” path in which price discovery unfolds “well into this range here between $6,000 to $8,000,” arguing that Ethereum is effectively “playing catch-up” after lagging other top assets that already printed new highs.

He even floated a directional benchmark—“I think the price prediction is going to be $7,000”—before deferring to probability distributions as a more disciplined way to size the upside. To that end, he ran two large-language models on a shared set of inputs, asking for odds of specific price bands by the end of 2025 and then by the end of 2026.

On his telling, the first model’s 2025 peak probabilities favored continuation: roughly a three-in-four chance to revisit the prior high near $4.7k, about sixty-plus percent to clear $5k, around thirty percent to reach $6k, high-single-digits to breach $7.5k, and roughly one percent to tag $10k this year.

Expanding the window through 2026 raised those odds materially, to what he summarized as high confidence in $4.7k–$5k, better-than-even odds for $6k, and about forty percent for $7.5k, with a non-trivial tail—“even here 10k plus it’s giving an 18% probability to.”

Running the same exercise on Grok produced a more aggressive contour. As Deutscher relayed it, Grok’s “base case could very well be $10,000,” with an $8,000–$15,000 band as a plausible cycle-top range.

He quoted the model’s technical guardrails explicitly: “A break above $4,800 signals new all-time high pursuit. Drop below $3,800 could invalidate the bullish thesis.” By contrast, his own trading invalidation skews tighter to trend, cautioning that “if Ethereum drops below the money noodle on the daily, which right now is around like $3,400, I think structurally this could start to invalidate the bullish move at least in the short term,” while “as long as we maintain above $4,000, we are in the pursuit of that prior all-time high.”

Headwinds For Ether

The projection stack rests on a macro-to-micro chain of tailwinds that Deutscher argued now favors Ethereum more directly than in prior cycles. He cited consistently positive ETF flows—“around $17 billion of net inflows into the crypto ETFs over the last 60 days, $11 billion coming in the month of July alone,” with particular traction on the ether side—alongside anticipated retirement-account access to crypto that could unlock what he called a “massive pool of new buyers.”

He framed recent US policy steps as a near-term accelerant for on-chain finance, saying the GENIUS Act clarified treatment for a set of crypto assets and “regulates some of the key stable coins,” thereby widening the aperture for institutional yield strategies and tokenization. In his view, those are specifically Ethereum-centric growth funnels because “Ethereum is the biggest blockchain facilitating asset tokenization and DeFi,” which makes ETH “the number one proxy for anyone looking to get exposure to this narrative.”

Deutscher also paired the flows argument with market-structure observations: stablecoins at fresh highs, price resilience marked by “sell-offs… relatively short-lived,” and a turn in bitcoin dominance that, if it persists, historically precedes broader alt rotation with ETH at the fulcrum.

None of this, he stressed, implies a straight line. Deutscher expects the cycle to oscillate through rotations—bitcoin strength, an ether catch-up, then a higher-beta alt expansion—rather than a single monolithic “altseason.”

He even penciled in a likely second-leg window into 2026, aligning with political and monetary calendar points, while cautioning that “you never know what’s going to happen” and emphasizing the need for clear invalidations.

Still, the directional conclusion is unambiguous: the combination of structural inflows, regulatory clarity around on-chain finance, and Ethereum’s technical regime shift leaves him biasing to the upside. “This would be hard momentum to slow down in the short to mid-term,” he said, adding that the true “FOMO” phase probably begins only once ETH is in price discovery above its $4,800 peak.

At press time, ETH traded at $4,303.

BNC, a subsidiary of CEA Industries, announced Sunday that it purchased 200,000 BNB for $160 million, effectively becoming the largest publicly listed holder of the cryptocurrency. The company purchased through its treasury management subsidiary, BNB Network Company.

Last month, the Nasdaq-listed company announced that it is shifting its primary focus from nicotine vapes to building a BNB treasury, changing its ticker symbol from VAPE to BNC. It recently closed a $500 million private placement to support the treasury strategy, led by 10X Capital and Changpeng Zhao's YZi Labs.

"Deflationary token burns, increasing on-chain activity, and potential catalysts such as a BNB spot ETF make the asset a compelling long-term play," BNC wrote in its press release.

The company said it aims to bring more institutional presence to the BNB ecosystem, which is currently underrepresented in the U.S.

BNC said it will continue buying BNB until the initial treasury capital is depleted, and may opt for additional capital worth $750 million via its warrant structure, potentially acquiring $1.25 billion worth of BNB in total.

The trend of corporate crypto treasuries has expanded beyond Bitcoin and Ether, with companies establishing treasuries based on altcoins such as BNB, XRP, and Solana. Other companies, Nano Labs and Windtree, have recently committed around $500 million to their respective BNB treasuries.

BNB is currently the fourth largest cryptocurrency by market capitalization, and is the native token of BNB Chain, which is the third largest chain by total value locked. The cryptocurrency is up 1% in the past day to trade at $820.5, according to The Block's BNB price page.

According to Google Finance data, CEA Industries closed up 3.7% at $17.10 on the Nasdaq last Friday, up more than 92% since it announced its BNB strategy.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

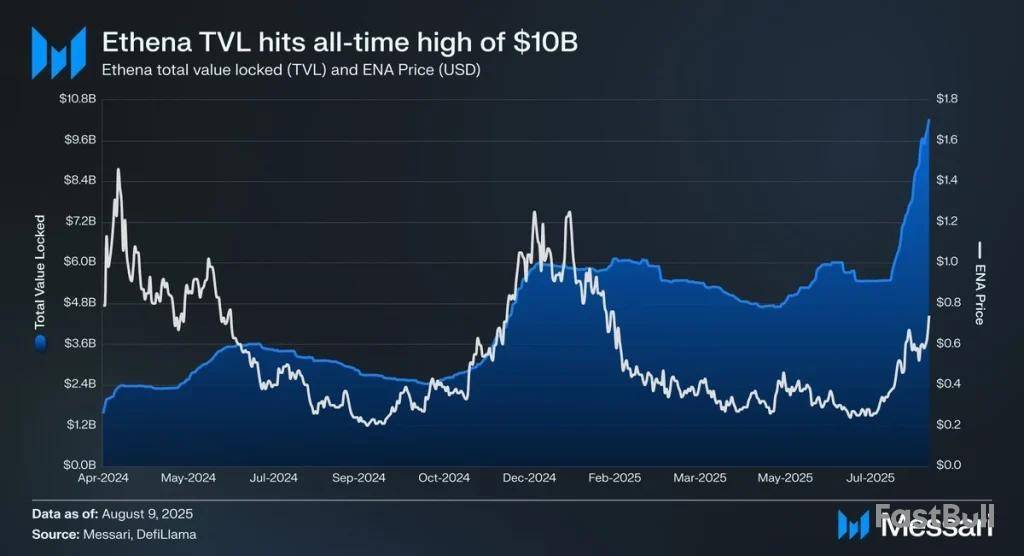

Ethena price has staged a strong 40.03% rally this week, and 11.59% in the last 24 hours, trading at $0.8406. The moonish surge aligns with Ethena’s TVL hitting a record $10 billion, alongside a major milestone for its synthetic dollar, USDe. Which recently became the 3rd largest stablecoin by market capitalization.

Successively, $5M daily ENA buybacks are reducing circulating supply, creating scarcity. Plus, whale addresses holding 100k-1M ENA grew 12% in July, now controlling ~30% of supply. Wondering where the ENA price could head next? Join me as I decode the same in this analysis.

On-Chain Analysis

Ethena’s TVL has reached an all-time high, surpassing $10B as of August 9, 2025, according to Messari. This marks a significant influx of capital into the protocol, reflecting growing investor confidence and adoption of its DeFi products. The TVL rise has tracked closely with ENA’s price recovery from multi-month lows, suggesting that capital inflows may be leading price action.

ENA Price Analysis

ENA’s recent price breakout came on August 10th, when it surged 13.7% from $0.64 to $0.7277, breaking out of a bullish flag pattern. The rally has since extended toward $0.8493, today’s high, with the price currently consolidating around $0.84.

Technical indicators point to strong momentum, the RSI-14 at 74.76 suggests the market is nearing overbought levels, though not yet extreme. This is while the shorter-term RSI-7 at 81.81 indicates high short-term enthusiasm. MACD, on the other hand, has confirmed a bullish crossover with the histogram turning positive at +0.010557.

Talking about price targets, the key upside targets are at $0.8741 at Fibonacci 127.2% and one at $1.02. However, $29.8M worth of ENA moved to exchanges on August 9–10, which could introduce near-term volatility. On the downside, a close below $0.7046 could trigger profit-taking toward lower supports at $0.5638 and $0.4764.

FAQs

Why is the ENA price surging now?Strong TVL growth, USDe’s stablecoin milestone, buybacks, and whale accumulation have boosted ENA’s price.

What are the key levels to watch for the Ethena price?Upside targets are $0.8741 and $1.02; support sits at $0.7046, $0.5638, and $0.4764.

Is ENA overbought?RSI shows it’s approaching overbought territory but still has room for short-term continuation.

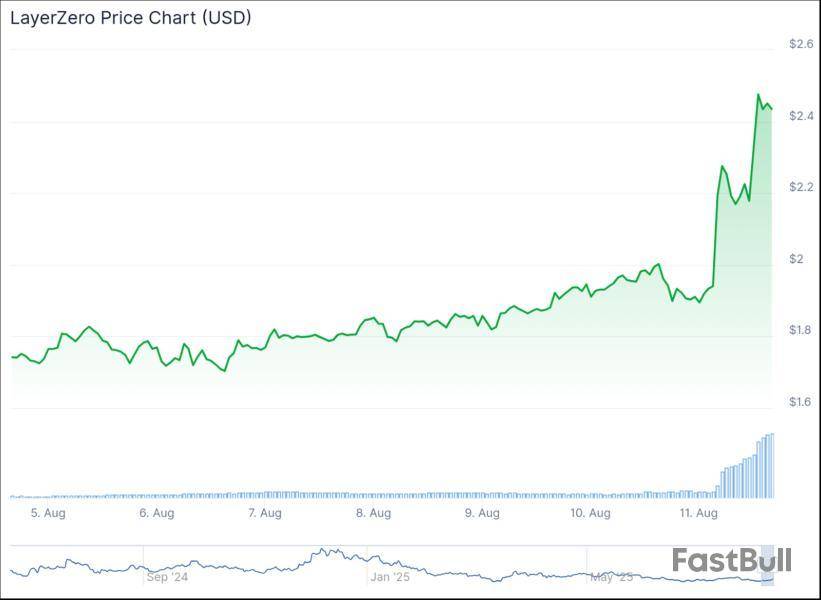

The LayerZero Foundation, which backs the cross-blockchain messaging protocol LayerZero, has put forward a proposal to acquire the crypto protocol Stargate for $110 million, which has boosted the tokens tied to both projects.

LayerZero laid out the plan in a post to Stargate’s forum on Sunday, pitching the offer as “designed to accelerate both Stargate and LayerZero, giving Stargate the resources to ship on an aggressive roadmap that expands its prerogative outside of bridging.”

LayerZero would swap the platform’s token, Stargate Finance (STG), for its self-titled token LayerZero (ZRO) at a rate of 1 STG to 0.08634 ZRO, it explained.

Stargate was developed and launched by LayerZero in 2022, and the deal — if approved by Stargate’s community — would see the platform come back under its umbrella.

Stargate allows users to transfer digital assets across blockchains using liquidity pools, which the platform pitches as allowing assets to be transferred natively instead of relying on blockchain bridges — which have a history of being hacked.

STG, ZRO tokens rise on plan

The tokens tied to the platforms both gained double-digit percentage points on the day on LayerZero’s proposal.

LayerZero’s token has gained over 23% in the past 24 hours to trade at $2.44, making it one of the biggest gainers in the crypto market in the past day, per CoinGecko.

Stargate’s token, meanwhile, saw 24-hour gains of around 16.5% to just over 19 cents, extending its rally over the past week.

Both tokens are down significantly from their peaks, with ZRO down 67% from its December high of $7.47, while STG has fallen over 95% from its mid-2022 peak of $4.14.

LayerZero boss hails plan as “unified direction”

LayerZero co-founder and CEO Bryan Pellegrino posted on X that he wants “to move faster, ship faster.”

He said the proposal would “help Stargate execute on its ambitious roadmap while creating a single stack that anybody integrating within the [LayerZero] ecosystem can adopt.”

He added it would also give STG holders “a more liquid token” and would give the Stargate community “a clear path forward with significantly more resources and a single unified direction.”

STG tokenholders say plan “not attractive at all”

However, the deal saw generally negative feedback from holders of Stargate’s token, with some saying they understand the need for a swap, but the deal pitched is unfair and won’t allow for staking.

“The offers are not attractive at all. They do not offer any advantages to STG holders, and STG’s revenue-sharing system is not available on ZRO. We will only be able to hold on to our tokens,” one Stargate user wrote.

The user added that LayerZero “needs to raise its offer significantly,” while others said the offer was “fundamentally flawed” and agreed the offer should be higher, possibly a 1:1 token swap, due to “the amount of revenue Stargate makes and the potential for the protocol.”

Another user said they saw the need for the swap as “managing two tokens is a pain and causes more distractions than necessary,” while another said it “makes sense to merge” the tokens, but agreed the deal was unfair as it meant STG holders would no longer be able to stake their tokens for rewards.

Stargate said the proposal will be available for comment for the next seven days. The platform’s decentralized autonomous organization, made up of tokenholders, is then set to vote on the deal.

The crypto market kicked off the week with fireworks after President Trump signed an executive order directing regulators to explore allowing cryptocurrencies, private equity, and other alternative assets in 401(k) retirement plans. Analysts say this move could unleash a fresh wave of institutional buying, tapping into millions of U.S. retirement accounts and injecting massive liquidity into the market.

Bitcoin and Ethereum Price Surge to New Heights

Bitcoin climbed past $121,000, up 3.33% in 24 hours, while Ethereum hit $4,300, its highest level since December 2021. The rally came not only from Trump’s policy move but also from strong spot ETF inflows, with Bitcoin ETFs drawing in $253 million this week despite price consolidation after last month’s all-time high. Ethereum ETFs stole the spotlight, pulling in $461 million, surpassing Bitcoin’s inflows and fueling institutional demand that analysts believe could push ETH toward its $4,878 all-time high.

The market momentum isn’t just about ETFs. Corporate treasuries are quietly accumulating crypto, with SharpLink Gaming reportedly acquiring over 52,800 ETH over the weekend. Presto Research’s Min Jung believes this trend is a powerful driver for price action, suggesting treasuries will remain a “key player” in the next phase of the bull run.

Mr. Himanshu Maradiya, Founder and Chairman of CIFDAQ, told Coinpedia, “Bitcoin’s surge to $121,000 and Ethereum’s rise to $4,300 reflect strong institutional accumulation, further boosted by Trump’s executive order opening the $12.5 trillion 401(k) market to crypto. With banks advancing digital asset services and infrastructure buildout accelerating, the market is poised for deeper integration into retirement portfolios and broader capital markets.”

Macro Events Could Test the Rally

While sentiment is red-hot, analysts warn that upcoming macro data could test the market’s resilience. With CPI data due Tuesday and PPI on Thursday, traders are eyeing inflation numbers that could sway the Federal Reserve’s September rate decision. Although CME FedWatch shows an 88% probability of a 25bps rate cut, Fed Chair Jerome Powell recently hinted that such a move is “less likely” without favorable economic data.

ETH’s Edge Over BTC?

BTC Markets analyst Rachael Lucas notes that ETH’s recent surge has even returned Vitalik Buterin to billionaire status, with short liquidations adding fuel to the rally. If institutional inflows continue at the current pace, Ethereum could outpace Bitcoin in the short term, a shift that might redefine the leaderboard in this bullish cycle.

FAQs

How did Trump’s executive order impact crypto?Trump’s 401(k) crypto order could unlock institutional demand from millions of retirement accounts, fueling Bitcoin’s surge to $121K (+3.3%) and Ethereum to $4,300.

What macro risks could disrupt the rally?Upcoming CPI/PPI data may challenge Fed rate cut odds (currently 88% for 25bps), with Powell signaling cuts require stronger economic softening.

What’s next for Bitcoin and Ethereum prices?BTC eyes $130K resistance while ETH tests $4,878 ATH – both supported by 401(k) potential, ETF flows, and corporate treasury accumulation.

The Ethereum community is in shock after one of its well-known developers, Fede’s Intern, was detained in Izmir, Turkey, over the weekend. The accusation? Turkish authorities say he helped people “misuse” the Ethereum network, a charge many in the crypto community are calling vague, unfair, and potentially dangerous for blockchain innovation.

So, what’s next, now?

“We’re Just Infra Builders”

This incident came into the spotlight when an ETH dev Fede’s Intern, an Argentinian crypto researcher, posted a tweet stating that he had been detained in Turkey, after Turkey’s Minister of Internal Affairs personally accused him of this so-called “misuse.”

But no one — not even legal experts—seems to know what actions fall under that term.

Fede’s Intern insists he has done nothing wrong. In his own words, the developer insists he and his team are “just infrastructure builders,” creating technology, not committing crimes.

Fede’s intern 🥊@fede_internAug 10, 2025I’m in Turkey, Izmir. They are telling my lawyer that I helped people to misuse @ethereum and I might have a charge. You can imagine what it means. It’s obviously wrong, we are just infra builders.

I can’t say much because I don’t have information and I don’t know if I will…

He says he is open to cooperating fully with the authorities and has already brought in a legal team.

The Fight to Leave Turkey

While still in Turkey, the developer revealed he was moved to a private room, given food, and told he may be able to fly to Europe, possibly by private jet, to contest the allegations from abroad.

He claims he has contacted influential connections across Europe, the US, Asia, and the UAE to push for his release.

Crypto Community Support and Skepticism

Messages of support have reportedly come from figures in the Ethereum and Solana communities, with some offering legal help. At the same time, skepticism has emerged.

Some believe the detention might stem from translation errors or misunderstandings about how blockchain works. One of the Turkish crypto commentators has argued there is “zero legal basis” for detaining someone over such an allegation.

Turkey, like many countries, applies existing commercial and criminal laws to crypto cases, which often leads to unclear or unusual charges.

What Now For ETH Developer?

For now, he remains in Turkey but is exploring options to leave, possibly flying to Europe to fight the allegations from abroad. His legal team is actively working on the case, while influential contacts across the globe are stepping in to assist.

It remains unclear whether the accusations target Fede’s Intern personally or his business operations.

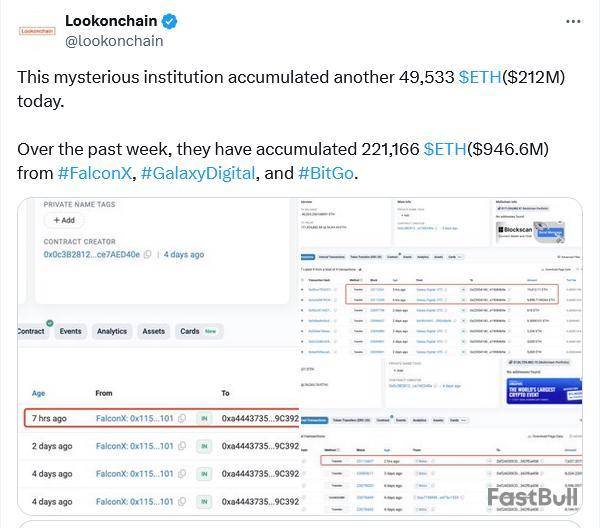

An unidentified entity has been accumulating Ether aggressively over the past week — buying 221,166 ETH as the asset rallied by 21% over the same timeframe.

In the past 24 hours alone, the “mysterious institution” bought $212 million of Ether (ETH), according to data analytics platform Lookonchain.

The whale tracker said the entity is using six different wallets to store its Ether, which it acquired from Galaxy Digital, FalconX and BitGo. The wallet with the most Ether has $181 million worth, while the wallet with the least Ether still has $128 million worth.

The buying comes as Ether addresses with over 10,000 ETH in holdings reached 868,886 on Saturday, the highest it’s been in a year, according to Glassnode.

Ethereum market cap overtakes Mastercard

It also comes as Ethereum’s market capitalization soared to $523 billion on Monday, boosted by a 21% rally in Ether over the past 7 days to cross the $4,000 milestone. It is currently trading at $4,332.

Ether’s market cap also overtakes payments giant Mastercard, which currently has a market capitalization of $519 billion, according to CompaniesMarketCap.

More than 304,000 ETH, worth over $1.3 billion, was added by publicly traded companies that have Ether treasuries in the past week, CoinGecko reported on Saturday.

BitMine Immersion Technologies bought the lion’s share of ETH, as the company bought more than 208,000 ETH, worth more than $900 million, in the past week, which was followed by SharpLink Gaming buying $303 million worth of Ether.

Analysts bullish on ETH’s price action

Technical analysts have also turned bullish on Ether, with some predicting that the asset might reach as high as the $20,000 mark for the first time in the coming months.

Analyst Nilesh Verma stated that ETH can hit the $20,000 milestone in the next six to eight months based on historical price fractals.

Meanwhile, Merlijn The Trader, a popular technical analyst, has predicted that the asset might surpass the $20,000 and may even go beyond that mark.

On the flip side, some industry experts are cautioning investors.

Notably, Ethereum co-founder Vitalik Buterin supported companies that are buying Ether to hold in their respective treasuries; however, Buterin cautioned that it should not turn into an “overleveraged game,” which could lead to the downfall of the asset.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up