Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

An investor lost 783 BTC, worth about $91.4 million, after a fraudster impersonating a hardware wallet support agent gained access to their wallet, Coindesk reported. The theft, disclosed by blockchain investigator ZachXBT, is one of the largest individual social engineering scams in recent months.

Funds Routed Through Wasabi Wallet

The incident occurred on August 19. The attacker tricked the victim into handing over wallet credentials, allowing them to transfer the Bitcoin. The funds were then moved through Wasabi Wallet, a privacy tool commonly used to hide transaction trails.

The case adds to a series of major crypto scams in 2025. Investors lost $3.1 billion to hacks and fraud in the first half of the year, with social engineering becoming an increasingly common tactic.

The theft also comes exactly one year after the $243 million Genesis creditor hack, which led to multiple arrests in California earlier this year. Both incidents underline how attackers continue to exploit weaknesses beyond technical security.

Security Concerns Persist

The $91 million loss highlights the ongoing risks facing crypto investors, even as firms improve technical safeguards. Analysts warn that impersonation and phishing schemes remain difficult to prevent, with scammers increasingly targeting users through trusted support channels.

North Wales Police has warned cryptocurrency holders to remain vigilant after a victim was defrauded of £2.1 million in Bitcoin. The force described the incident as a “sophisticated” scam and urged the public to be cautious when approached with unexpected requests involving digital assets.

Read more: BTC Remains Under Trendline; North Wales Police Investigate £2.1M Bitcoin Scam

The scam unfolded as criminals impersonated senior UK police officers and fabricated a story about a supposed security breach. The victim was told that an arrested individual’s phone contained personal identification documents linked to them, prompting them to hand over their Bitcoin.

The warning comes as Bitcoin faces selling pressure in the market. BTC/USD has been trending lower along a descending trend line on the hourly chart, with horizontal support observed around 112,800. A drop below this level could add to downside momentum, while a breakout above the trend line may draw in intraday buyers.

Ethereum is down $116.84 today or 2.68% to $4239.59

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

The United States Department of Justice has stepped up its legal clarity for the Web3 and digital assets space. On Thursday, Matthew Galeotti, acting assistant attorney general of the Department of Justice’s Criminal Division, said that Web3 developers will not be prosecuted for any wrongs made by users of their DeFi platforms.

Galeotti, who was speaking at the American Innovation Project Summit in Jackson Wyoming, highlighted that the DoJ will focus on rooting out bad actors while enabling the good players. Moreover, the DoJ admitted that there is an organic demand for web3 protocols and digital assets, thus the need to protect the developers from user misuse.

“Where the evidence shows that software is truly decentralised and solely automates peer-to-peer transactions, and where a third-party does not have custody and control over user assets, new charges against a third party will not be approved,” Galeotti noted.

What Does the DOJ’s Take Mean for Tornado Cash Developers?

The DoJ’s comments follow the recent conviction of Tornado Cash co-founder Roma Storm on charges of conspiracy to operate an unlicensed money transmitting business. Roman, who is preparing to proceed to the Court of Appeals, is being prosecuted for enabling bad actors to launder money intentionally.

However, pro-crypto leaders have argued that privacy is normal and writing code is not a crime. The DoJ’s clarification will play a crucial role in the mainstream development of web3 protocols, especially fully decentralized platforms.

Most importantly, the DoJ’s clarification marks the end of the Justice Department being used to regulate the crypto industry.

“For too long, crypto and open source developers in the US have been living under a cloud of doubt. That uncertainty ends today, with an emphatic statement from the DOJ that shipping code is not a crime,” Katie Biber, CLO Paradigm, noted.

The following article is adapted from The Block’s newsletter, The Daily, which comes out on weekday afternoons.

Happy Thursday, and welcome to The Daily. Kanye West launched a Solana-based token called “YZY” — it surged, then plunged nearly 70% in hours.MetaMask is entering the stablecoin arena, preparing to launch mUSD on Ethereum and Linea, with issuance handled by Stripe-owned Bridge.

JPMorgan analysts outlined four reasons why Ethereum has been outperforming Bitcoin — including growing ETF inflows and corporate treasuries, which now hold over 4 million ETH.

Elsewhere, Nasdaq is delisting BNB treasury firm Windtree for noncompliance, DBS Bank is tokenizing structured notes on Ethereum, and Hong Kong’s Ming Shing Group signed a $483 million deal to buy 4,250 BTC.

P.S. I also write The Funding, a biweekly newsletter covering crypto VC trends. The latest edition explored whether massive treasury deals are hurting early-stage startup funding. Subscribe here.

Let’s get started.

Kanye West’s ‘YZY’ Solana token launches — then plunges 70%

Kanye West appeared to launch a Solana-based cryptocurrency called YZY (Yeezy Money) via a post on X, sparking confusion about its legitimacy after the token’s price soared and then crashed nearly 70%.

The YZY website describes the project as a way to give users control “free from centralized authority,” and includes references to a payments platform (Ye Pay) and a YZY-branded credit card.

Although some users suspected the X account was hacked, YZY is listed as a payment option on Kanye’s official website and online store, suggesting the launch may be real.

The token quickly hit a market cap of around $3 billion, but Lookonchain and Coinbase’s Conor Grogan suggest that insider wallets dominated the supply and traded on non-public info.

One insider wallet is said to have made over $1.5 million in early YZY trades, while Grogan said over 94% of the token’s supply was controlled by insiders at one point.

The YZY website claims the token is not an investment and is meant as an “expression of support,” though some critics view it as a pivot from Kanye’s earlier stance against memecoins.

MetaMask unveils mUSD stablecoin, issued by Stripe-owned Bridge

MetaMask announced its native stablecoin, MetaMask USD (mUSD), is set to launch later this year on Ethereum and the Linea network.

mUSD will be issued by Bridge, a Stripe-owned platform, and minted using decentralized infrastructure built by M0, with 1:1 backing from U.S. cash and short-duration Treasurys.

The stablecoin is designed to be deeply integrated into MetaMask’s wallet ecosystem, enabling users to on-ramp, hold, swap, transfer, and bridge mUSD — and eventually spend it via MetaMask Card at Mastercard-accepting merchants.

MetaMask says mUSD will improve the user experience across DeFi. The move comes amid near-$1 trillion in monthly stablecoin volume and follows the U.S. GENIUS Act.

DBS Bank to tokenize structured notes on Ethereum for institutional clients

Singapore's DBS Bank will tokenize structured notes on Ethereum, offering them to institutional and accredited investors through platforms including ADDX, DigiFT, and HydraX.

The bank’s first tokenized product is a crypto-linked structured note that offers cash payouts when crypto prices rise and includes downside protection if prices fall.

Each tokenized note will represent a $1,000 fungible share of the original instrument, aiming to make these traditionally high-barrier products more flexible for portfolio construction.

Structured notes typically require a minimum investment of $100,000 and are tailored to deliver specific risk-reward profiles tied to underlying assets like equities, credit, or crypto.

DBS plans to expand tokenization beyond crypto-linked products, with future offerings including equity-linked and credit-linked structured notes.

The bank says its clients traded over $1 billion worth of crypto-linked structured notes in H1 2025, and it sees asset tokenization as the next frontier of financial market infrastructure.

JPMorgan outlines four reasons Ethereum is outperforming Bitcoin

Ethereum has outperformed Bitcoin in recent weeks, and JPMorgan analysts attribute this trend to four main reasons.

First, markets expect the U.S. Securities and Exchange Commission to approve staking for spot Ethereum ETFs, unlocking new yield opportunities without requiring users to hold 32 ETH, worth about $135,000 at current prices.

Second, corporate treasuries are beginning to adopt Ethereum, with about 10 public companies now holding ETH — amounting to 2.3% of the circulating supply. Some of these firms may also run validators or pursue DeFi yield strategies.

Third, SEC staff guidance has hinted that liquid staking tokens may not be classified as securities. While not yet formal policy, this has eased institutional concerns and encouraged greater engagement with ETH-related products.

Fourth, the SEC’s recent approval of in-kind redemptions for Bitcoin and Ethereum ETFs reduces operational costs and improves liquidity, allowing institutions to redeem shares directly in crypto rather than through cash conversions.

JPMorgan believes Ethereum has more upside ahead, as its ETF and treasury adoption still lags behind Bitcoin, leaving further room for institutional inflows if current trends continue.

Ethereum treasuries surpass 4 million ETH across 69 entities

Ethereum treasury holdings have climbed past 4.1 million ETH, worth around $17.6 billion, as more institutions add ETH to their balance sheets.

According to StrategicETHReserve data, 69 entities each holding over 100 ETH now collectively hold about 3.39% of Ethereum’s total supply. The data, however, covers not only public companies but also crypto-native organizations and foundations.

BitMine Immersion Technologies leads with 1.5 million ETH in its treasury, valued at approximately $6.6 billion. The company has pivoted away from bitcoin mining toward ether accumulation as a strategic focus.

SharpLink Gaming holds roughly 740,800 ETH, worth $3.2 billion, making it the second-largest ETH treasury. Other major holders include The Ether Machine, with 345,400 ETH, and the Ethereum Foundation, which holds 231,600 ETH.

In the next 24 hours

Fed Chair Jerome Powell will speak at Jackson Hole — investors will watch for clues on interest rates.

In Europe, the ECB will release July data on inflation expectations and wage growth, both key to its next policy move.

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Amid the persisting sell-offs faced by the broad crypto market, BlackRock has also joined the trend.

In a move that has sparked reactions from the crypto community, data from on-chain tracking platform LookOnChain has revealed BlackRock's sale of large portions of its Bitcoin and Ethereum holdings.

According to the data, BlackRock has collectively moved over $366 million in Bitcoin and Ethereum from its exchange-traded funds to a wallet on Coinbase Prime. The move, which is uncommon for the investment giant, happened on August 20 as the crypto market bloodbath continues.

While BlackRock has yet to clear speculations regarding the major transaction today, a leading crypto fund was spotted moving 1,885 BTC worth about $111.66 million and 59,606 ETH worth $254.43 million to the leading crypto trading platform, Coinbase Prime.

Did BlackRock just sell?

The investment giant, which is renowned for consistently recording daily streaks of inflows, has broken the trend today with a massive amount of outflows recorded in both of its ETF products.

Although the nature of the major transaction was not clearly stated, such large-scale transfers to exchanges have often been interpreted as potential sell-offs.

As such, it appears that BlackRock may be taking profits amid recent market volatility, as the market has continued to record massive price declines led by Bitcoin and Ethereum.

Nonetheless, the transaction has fueled speculation among traders about whether this signals the start of a broader institutional offloading of crypto holdings, as BlackRock is renowned as a leader in crypto institutional engagements.

While the major move was executed at a time when investors have seen their crypto bets suffer notable losses, market participants are watching closely to see whether this sell activity could trigger further downside pressure on BTC and ETH prices.

Oftentimes, large institutional transfers of this size have had noticeable short-term market impacts on the performance of the cryptocurrency involved; however, they can also be part of broader strategic redistribution of the portfolio rather than an attempt to exit the market.

Nonetheless, the prices of BTC and ETH have continued to decrease after the major transaction was noticed, sparking curiosity among investors if there was still hope for a broader market rebound.

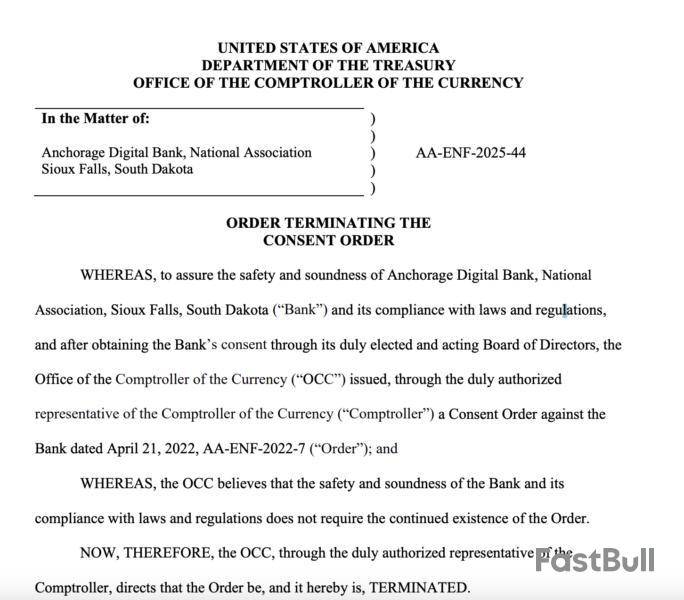

The US Office of the Comptroller of the Currency (OCC) said it had issued an order terminating a consent order made against cryptocurrency custody bank Anchorage Digital in 2022.

In a Thursday notice, the OCC said it had dropped the order “to assure the safety and soundness” of Anchorage. The financial regulator’s April 2022 order was based on Anchorage’s “failure to adopt and implement a compliance program” in accordance with Anti-Money Laundering (AML) standards. However, the OCC said the bank’s “compliance with laws and regulations does not require the continued existence of the order.”

“[W]e received—and have now resolved—feedback from regulators as we set the standard for federally-chartered custody of digital assets,” said Anchorage co-founder and CEO Nathan McCauley in a Thursday blog post, adding:

Anchorage was the first US-based crypto company to receive a national bank charter issued by the OCC in January 2021 under former US President Joe Biden. Under President Donald Trump, the US Senate confirmed Jonathan Gould, the former chief legal officer of Bitfury, to head the regulator in July.

Is politics playing a role in regulating crypto companies?

The dropping of the consent order signaled the US government’s softening on crypto enforcement and regulation under the Trump administration.

The Federal Reserve said in August it would sunset a program launched specifically to monitor banks’ digital asset activities. The OCC, Federal Reserve, and Federal Deposit Insurance Corporation also issued a joint statement in July clarifying the risks to banks holding digital assets for clients.

Other crypto companies seeking national trust bank charters from the OCC included Paxos, Ripple Labs and Circle. Under the GENIUS Act, a bill to regulate payment stablecoins signed into law in July, the OCC and qualifying state regulators will offer a pathway to licensing for crypto companies.

CoinDesk Bitcoin Price Index is down $2132.12 today or 1.87% to $112149.23

Note: CoinDesk Bitcoin Price Index (XBX) at 4 p.m. ET close

Data compiled by Dow Jones Market Data

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up